1. Top Event of the Week

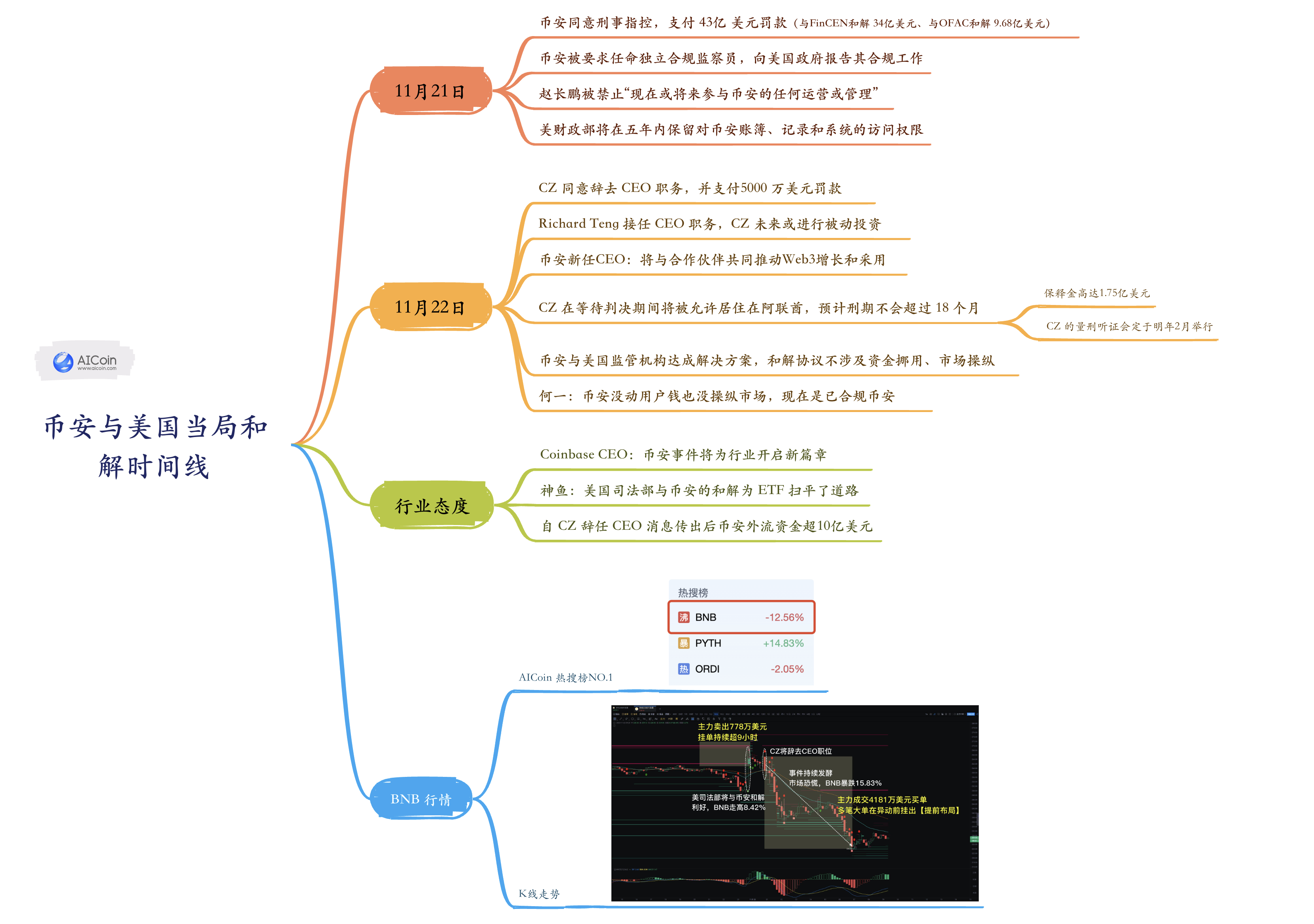

Binance fined $4.3 billion, CZ resigns as CEO.

- On November 22, the US Department of Justice announced that Binance was fined over $4 billion, and CEO Zhao Changpeng resigned, with Richard Teng taking over as CEO.

-

2. Cryptocurrencies and Exchanges

- On November 20, OKX submitted a virtual asset trading platform license application to the Hong Kong Securities and Futures Commission.

- On November 23, Bitstamp denied Glassnode's explanation of a 38% loss in its Bitcoin reserves.

- On November 21, Bittrex Global announced that all trading will be disabled after ceasing operations.

- On November 21, cryptocurrency exchange Bitbest plans to enter the South Korean market and is scheduled to launch in 2024.

- On November 18, BlockFi reminded users to submit withdrawal requests before the wallet withdrawal window closes on January 1 next year.

- On November 21, Celsius's plan to establish a new company is facing obstacles at the SEC, requiring more information for evaluation.

- On November 18, Astar founder: The construction work of the ASTR token economic model 2.0 is two-thirds complete.

3. Regulatory Updates

- On November 21, regulatory authorities in Canada seek feedback on disclosure rules for bank cryptocurrency risks.

- On November 22, BNY Mellon in New York was appointed as the transfer agent for the Grayscale Bitcoin ETF after its conversion from a trust.

- On November 22, the US SEC will hold a closed-door meeting on November 30 to discuss topics related to ongoing litigation.

- On November 23, Singapore will ban margin leveraged trading in 2024 to curb retail cryptocurrency speculation.

4. Cryptocurrency Market Updates

- On November 18, the SEC postponed the filing of Hashdex's Ethereum spot and futures ETF.

- On November 18, the US Securities and Exchange Commission (SEC) postponed the application for a spot Bitcoin ETF from Franklin Templeton.

- On November 18, Fidelity has applied for a spot Ethereum ETF.

- On November 20, the President of the European Central Bank proposed establishing a regulatory agency in Europe equivalent to the SEC in the US.

- On November 20, ARK updated its application for a Bitcoin spot ETF once again.

- On November 21, court documents: Celsius plans to transition into a Bitcoin mining enterprise.

- On November 21, the US SEC reaffirmed in the Kraken lawsuit that SOL and ADA, among 11 other tokens, are considered "securities".

- On November 23, Grayscale submitted a new S-3/prospectus for its GBTC conversion application.

- On November 23, the US court rejected the latest release request from SBF.

5. Statements from Individuals/Institutions

- On November 19, a Wall Street investor: Ripple may launch an IPO in mid-May next year.

- On November 19, CEO of BitGo: Approval for a Bitcoin ETF is imminent, but preparations for more setbacks are still needed.

- On November 19, a US presidential candidate: If elected president, will ensure that Bitcoin is not subject to government intervention.

- On November 20, Chief Legal Officer of Ripple: The SEC Chairman made a prejudgment on crypto and filed lawsuits against others without investigation.

- On November 21, Policy Director at Paradigm: The absence of the SEC in DOJ enforcement actions may indicate that the SEC did not participate in the settlement.

- On November 22, Chief Legal Officer of Coinbase: Has responded to the petition for updating SEC rulemaking.

- On November 23, CEO of EOS Foundation: Governments around the world see the potential of RWA.

- On November 23, SEC Commissioner: We have no reason to hinder a Bitcoin spot ETF.

- On November 24, JPMorgan: Once GBTC is converted into a Bitcoin spot ETF, at least $2.7 billion in funds will flow out.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。