After Social Mining, Port3 has launched a new BQL Mining, introducing the Bonding Curve mechanism, thus upgrading the gameplay of the FT mode in the DeFi field.

Author: Port3

The Decline of Friend.tech Social Craze

The emergence of Friend.tech once sparked everyone's enthusiasm for SocialFi. This is mainly because it cleverly applied Shares to community rights and used a very aggressive Bonding Curve to anchor prices. Its uniqueness lies in the combination of social and purchasing behaviors, triggering a game among user groups. In this process, users achieved a wealth effect. The platform, early KOLs, and users could make decent profits, further spreading and attracting the participation of numerous users.

Although Friend.tech's model is simple and effective, it also has some obvious problems:

- The price curve of Key is too steep, limiting the number of users that a single community can accommodate.

- The application scenarios supporting Key prices are not diverse enough, failing to form a true fan economy.

- Lack of continuous value injection and high fees, leading to a loss of user confidence.

- High and non-transferable fees, hindering the flow of Shares.

However, Friend.tech's "Fi" attributes far exceed its "Social" attributes. Essentially, it is a Ponzi game based on the fan economy, actually a tool for monetizing traffic (influence) for KOLs. This financial model, lacking new user support at a certain stage, ultimately becomes unsustainable, leading to price collapse and a decline in popularity.

Social applications cannot support the Ponzi scheme of cryptocurrencies. After a brief surge in popularity, they face a lack of momentum. Due to rapid price growth and high transaction fees, only the entry of new users can sustain the rise, otherwise it will lead to a decline. In addition, the rise of major cryptocurrencies such as Bitcoin and Ethereum has stimulated overall market activity, shifting everyone's focus from social to larger wealth-generating projects and BRC20.

Who Can Succeed Friend.tech?

Although the social craze has subsided, Friend.tech's model still inspires many projects. Many Friend.tech imitations have emerged on various public chains, including Friend3, TOMO, and Stars Arena. TOMO, by innovating this model, introduced a voting method to attract KOLs, while others continue to focus on social scenes. However, these innovations have failed to sustain the popularity of Friend.tech.

By observing countless past hotspots, we have come to a realization: blockchain is a place suitable for playing finance, not necessarily for socializing. Without exception, all projects that have become hotspots have innovated in financial models, achieving a positive feedback loop. Crypto itself also has a very strong Ponzi property. There are few successful cases of socializing established on the blockchain because users come to the blockchain not for socializing, but for making money!

We have to admit that the blockchain is still in its early stages of development, and the large-scale application of social scenes is still impractical. Friend.tech's model is more suitable for transplantation into DeFi (decentralized finance) rather than social scenes.

Port3 BQL Key —— DeFi Innovation Based on Bonding Curve

Port3 became well-known due to its previous Social mining activities. After Social Mining, Port3 has launched a new BQL Mining, which introduces the Bonding Curve mechanism, thus upgrading the gameplay of the FT mode in the DeFi field. In response to the problems encountered by Friend.tech, Port3 also provides corresponding solutions.

Unlike Friend.tech, Port3 BQL Mining directly corresponds to the ultimate scenario of Crypto—trading. BQL is a chain interaction language created by Port3, which can achieve automated and process-oriented chain interactions, including transactions. BQL Mining contains many trading pairs, and each trading pair can achieve quick token exchange by running BQL easily.

It is important to note that Port3's BQL Mining uses the Port3 Aggregator, which generates fee income. All earned fees will be distributed to all users participating in the swap and holding BQL Key. Each BQL trading pair corresponds to a BQL Key, and users holding BQL Key (similar to Friend.tech's Shares) can receive dividends.

This design has several highlights:

- BQL, as a new interaction method centered on Intent, greatly reduces the threshold for transactions.

- Holding Shares (BQL Key) provides cash dividends, continuously injecting external value into Key.

- The Bonding Curve of BQL Key is flexibly configured, allowing for adjustment of the base when created, accommodating more users.

- BQL Key is implemented in the form of ERC-721, allowing free transfer between wallets.

In terms of participation, after the BQL trading pair is released, Sponsors (such as KOLs) can claim the trading pair and issue the corresponding BQL Key (similar to Friend.tech issuing its own Shares, which can earn a 5% Mint/Burn fee). After issuance, it can be purchased by all users. For users, the most direct way to participate is to Mint BQL Key.

The Mint process of BQL Key is a Fair Launch, with the price rising along the Bonding Curve, allowing for a clear view of price changes.

Users who successfully purchase BQL Key can enjoy the BQL pool dividends for each BQL Mining cycle. Additionally, BQL Key itself can be bought and sold.

The holding annualized return of BQL Key

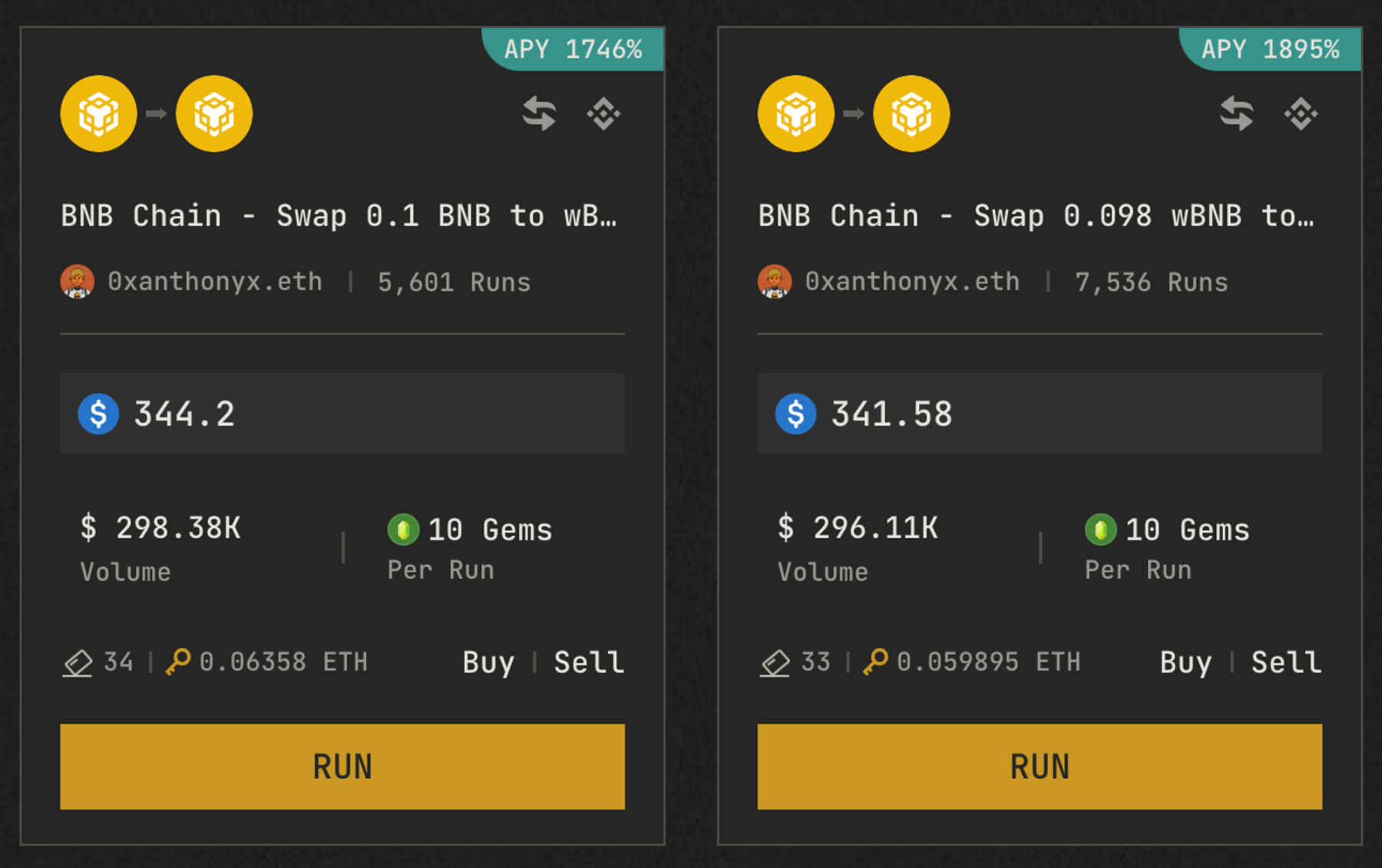

The image above shows two BQL trading pairs. In the direction of BNB → WBNB, a total of 35 Keys were Minted, and the price has risen from 0 to 0.067 ETH. The pool's trading volume for this week is 297.48k, and the current dividable dividends are 359 USDT. Since BQL's earnings accumulate weekly, the final dividend for each Key per week can reach 40 USDT, equivalent to 30% of the cost of 0.067 ETH. If you enter at a price lower than the current price, the actual annualized return will be higher.

The platform will launch new BQL trading pairs in each cycle, and these new trading pairs' BQL Keys will be issued from 0, making it a feasible strategy to purchase BQL Key in advance. Furthermore, increasing the trading volume of this BQL trading pair will also increase the pool's dividends.

Bonding Curve Empowers NFT Liquidity

In the process of designing the BQL Key, we also obtained a by-product—solving the liquidity problem of NFTs through the Bonding Curve. Previously, various NFTs lacked price support and had very poor liquidity, relying on users to trade through auctions on the marketplace. Similar to Sudoswap, it introduced the concept of AMM exchange pools, solving some of the liquidity problems of NFTs, but not completely.

By combining NFTs with the Bonding Curve, we can completely solve the liquidity problem of NFTs. Before this, all NFTs required user participation in Minting, and then the funds were transferred to the issuer, relying on the issuer's subsequent actions to give value to the NFT. However, if we directly attach a Bonding Curve fund pool to the NFT, the NFT's contract itself can provide liquidity for the NFT, enabling basic liquidity.

Implementing the Bonding Curve on NFTs is not complicated, as long as Shares are implemented as NFTs.

This approach has many benefits:

- NFTs can be reflected in the user's wallet, making it convenient for users to manage, and can have more uses in the future.

- NFTs themselves provide a fund pool for liquidity, allowing users to Mint and Burn operations at any time based on the Bonding Curve.

- Due to the significant price fluctuations of the Bonding Curve, users can independently list and trade on the Marketplace to supplement the liquidity of the Bonding Curve.

We recommend that future NFTs should be implemented in this way. On the one hand, this can prevent NFT issuers from "running away," ensuring that users can always sell; on the other hand, issuers can also earn fee income from it. This is a win-win situation, allowing NFT issuers to focus on giving value to NFTs, thereby achieving more trading volume and fee income.

Implications of the Hotspot for BQL Key

Because blockchain contracts can ensure a balance of interests among all parties, it is particularly suitable for playing a role in the financial field. However, so far, various Ponzi schemes and hotspots have swept through the blockchain, and there are actually not many real and solidified application scenarios. For blockchain to gain wider adoption, it must continue to optimize in various scenarios, reduce barriers to use, and solve real problems, in order to achieve mass adoption.

Various blockchain models and infrastructures are gradually developing and evolving in the face of each hotspot issue. Hotspots will always pass, but the insights they provide can drive us to build fairer and more reliable asset issuance methods and better distribution methods. These are the main points of the development of blockchain up to now, and they are also the key points for future integration into a larger narrative (AI + IoT).

The innovation of BQL and BQL Key is largely inspired by hotspots such as Friend.tech, but BQL, as a 0 to 1 innovation, represents a new way of interaction. It is gradually penetrating into the DeFi and NFT fields as a pivot of interaction, and it has the potential to develop and link to AI smart assistants, on-chain strategies, data-driven closed loops, and other areas. This is an exciting and intelligent, automated future, and it is a new opportunity for blockchain to achieve mass adoption.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。