On Binance's KAS contract, it marks the first time that this "hidden production line" has connected the "PoW exchange" to mainstream trading platforms, creating a "value discovery path."

Authors: Jack, Kaori, BlockBeats

Recently, due to the continuous rise of the Kaspa token KAS, the PoW concept has become another hot topic after the Bitcoin ecosystem concept, and the "mining coin sector" has become a recurring term in many community discussions. However, in addition to the boost from Bitcoin-related concepts and market trends, the sudden rise of the PoW concept seems to be not accidental. Behind the "KAS myth," there seems to be a hidden "mythical mining coin production line" that is not known to the mainstream market.

KAS Flywheel

On November 7, 2021, the Kaspa mainnet, built on the GhostDAG protocol, was officially launched, using the BlockDAG architecture to solve scalability issues related to traditional blockchain operations. The KAS mining algorithm is kHeavyHash, supporting GPU single mining or dual mining with ETHW and ETC, and supporting some FPGA and ASIC mining machines. According to F2Pool data, the current network hashrate of KAS is 60.97PH/s, with a 24-hour output revenue of 1.5267 million USD.

Kaspa's economic model is similar to Bitcoin's issuance mechanism, with no pre-mining or pre-sale, and all tokens can only be obtained through mining. Its total supply of KAS tokens is 28.7 billion, which is expected to be mined in 186 months, and the circulation supply is expected to be released by April 2037.

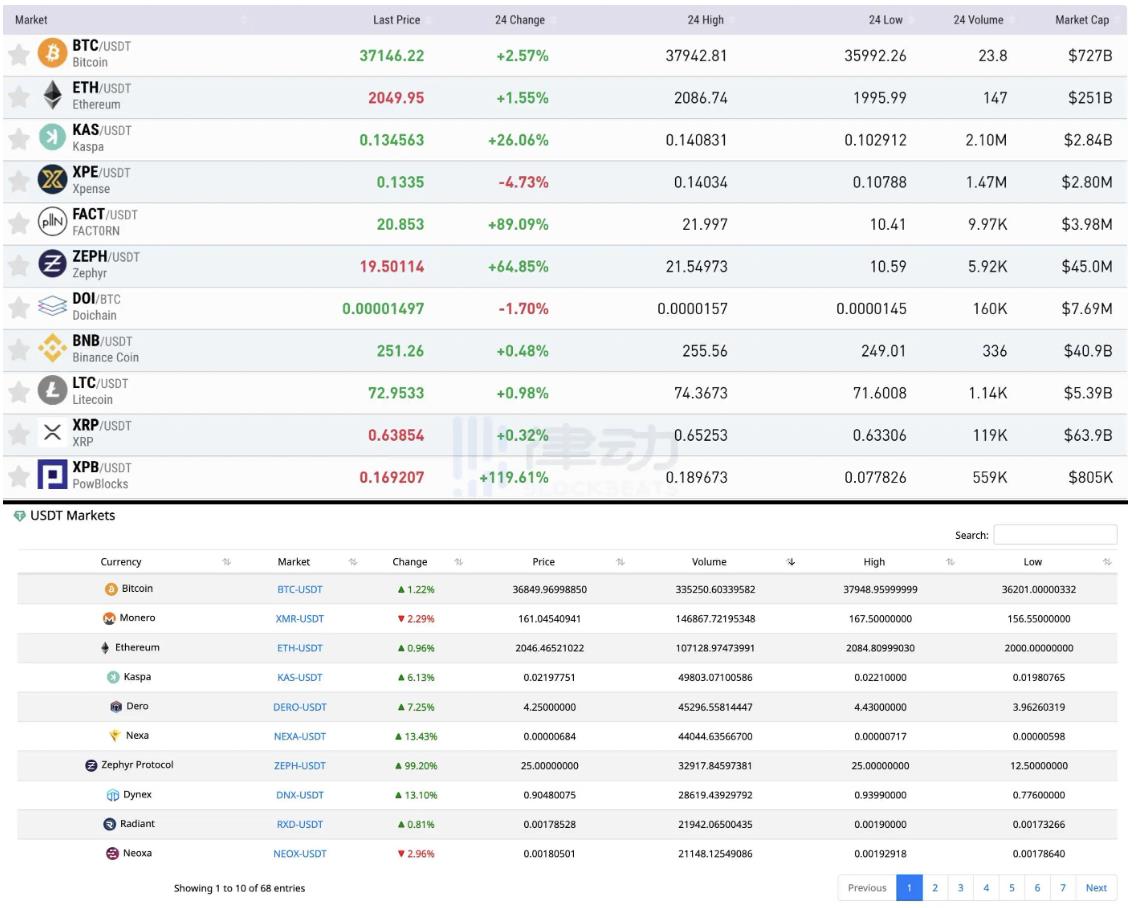

On November 16 of this year, Binance suddenly announced that it would launch KAS 1-50x U perpetual contracts at 10:00 on November 17. According to CoinGecko data, as of the time of writing, the PoW public chain Kaspa token KAS has exceeded 0.13 USD, currently priced at 0.134 USD, with a 24-hour increase of 18.3%, and a price increase of 37.40% in the past 7 days.

KAS price trend; Image source: CoinGecko

The rise in KAS's price can be traced back to the end of May 2022 when it was listed on TxBit, with the lowest price of KAS being 0.0002 USD. In September of the same year, KAS was listed on MEXC, and the price quickly soared to 0.008 USD.

By April 2023, KAS's price reached a historical high of 0.039 USD, with an increase of over 1850% in less than a year. In that month, KAS's trading volume continued to increase, fluctuating between 15 to 40 million USD daily, and even once exceeding 500 million USD. During this period, the largest trading platforms for KAS were MEXC Global, TxBit, Gate.io, and Coinexcom.

In May, Bitmain and BitFuFu successively launched dedicated ASIC mining machines, and mining machine manufacturers rushed into Kaspa.

On May 17, BitFuFu released the first KS3 model Kaspa mining machine. According to F2Pool data, the computing power of the KS3 mining machine is as high as 8.3TH/s, with a power consumption of 3188W and a unit power consumption of 384W/T. Based on the price of KAS at that time, the theoretical daily income per mining machine could reach 2600 USD. However, industry insiders revealed to BlockBeats that due to factors such as mining machine manufacturing and technical wear and tear, the actual income may not reach this standard.

Currently, the mainstream mining machines for KAS mining are from the Antminer and BitFuFu series, with an average power consumption of over 3000W, and the theoretical daily net income can reach 200 to 300 USD.

However, by August of the same year, the price of KAS had dropped by about 50% from its peak, and the sales effect of the new mining machines entering the market was not prominent. Insiders told BlockBeats that this may mean that there are not many high-performance mining machines circulating in the market, and miners have not yet sold off their tokens.

Kaspa mining machine model; Image source: F2Pool

Kaspa mining machine model; Image source: F2Pool

However, BlockBeats found that the Kaspa community has always had strong consensus and "cohesion."

On August 14, TxBit announced that it would close its platform trading on September 14, and Kaspa community users jokingly said that "KAS allowed the founder of TxBit to achieve retirement directly." The community also announced a joint airdrop activity with CoinPal and IceRiver. On November 9, Kaspa community members found that the market value ranking information of the KAS token was displayed incorrectly on CoinMarketCap and strongly demanded that the official website make corrections. The next day, CMC corrected the KAS token information, and KAS's ranking jumped from 207th to 34th.

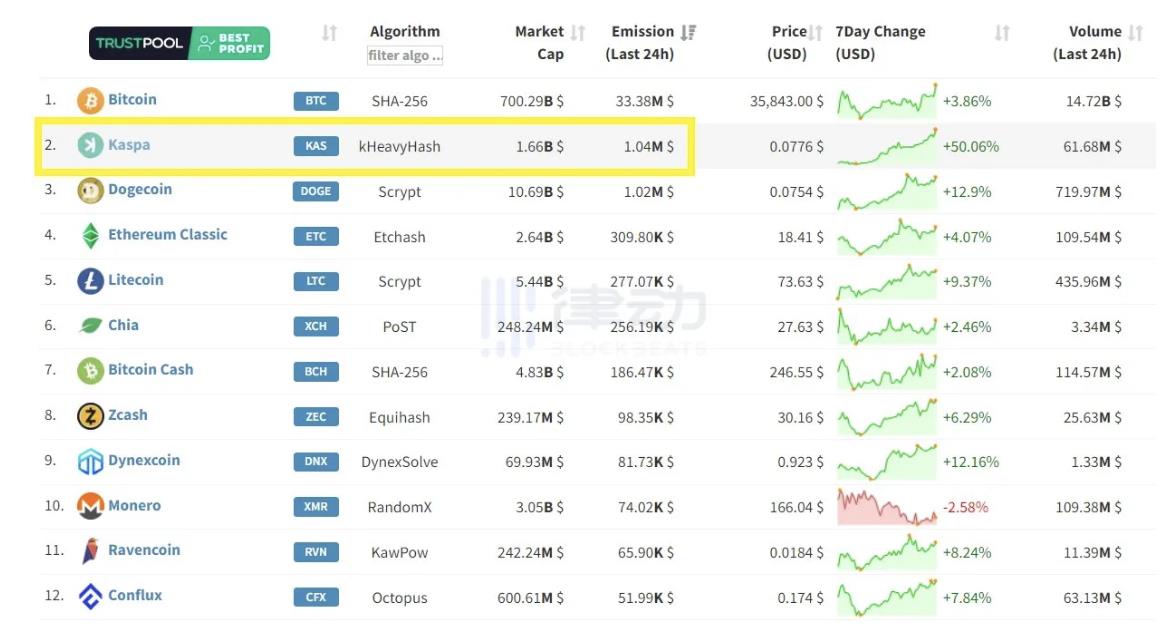

With the continuous rise in the price of KAS, the daily mining rewards of Kaspa reached over 1.6 million USD in November, becoming the second-ranked mining coin.

Network hashrate ranking; Image source: X Community

With the recent bullish trend in the crypto market, the "strong price of KAS" FOMO sentiment has begun to spread in the secondary market. Some community users have noticed that mainstream exchanges also seem to be "eager" for KAS.

On November 3, OKX Web3 wallet integrated with Kaspa Network, and on the 16th, Binance announced the launch of KAS perpetual contracts, causing a short-term price increase of nearly 20%, starting the ecological flywheel.

The mining coin frenzy market, SafeTrade emerges

Driven by the rise in KAS's price, the "mining coin sector" has also reached a high point of sentiment. Among them, mining coins such as Spacemesh (SMH), Zephyr Protocol (ZEPH), and Qubic (QUBIC) have received high attention. BlockBeats found that the name SafeTrade frequently appeared in many community discussions.

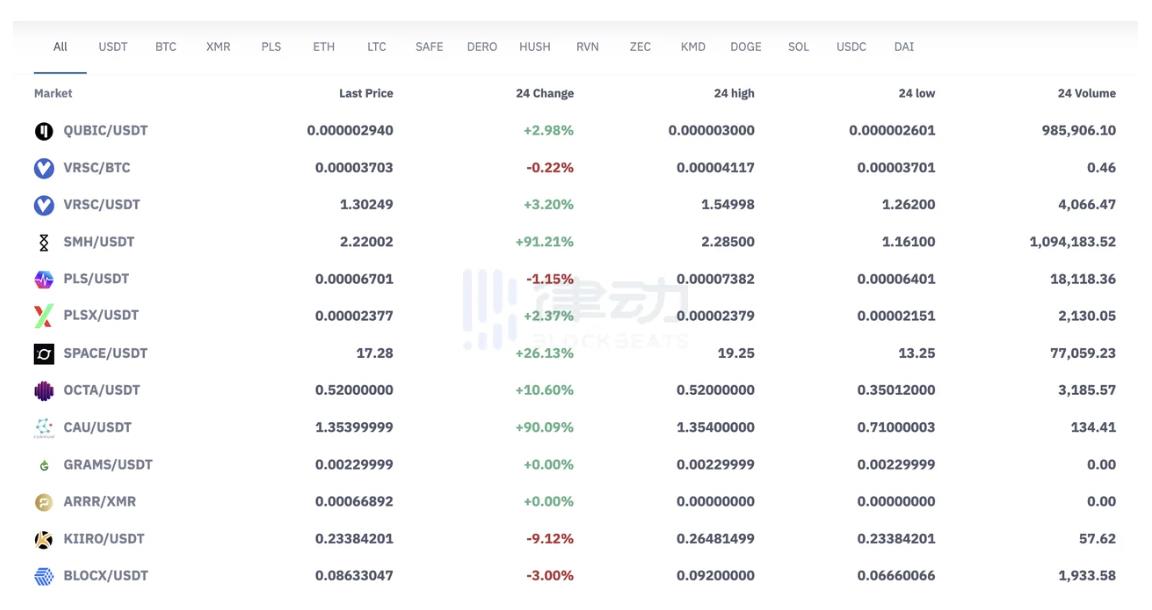

In August of this year, Spacemesh (SMH) was listed on SafeTrade, and its price rose from 0.42 USD to a high of 2.285 USD, an increase of 442%. In the same month, SafeTrade announced the listing of Qubic (QUBIC), and its token price rose to a high of 0.0000039 USD, an increase of 1566% since its listing.

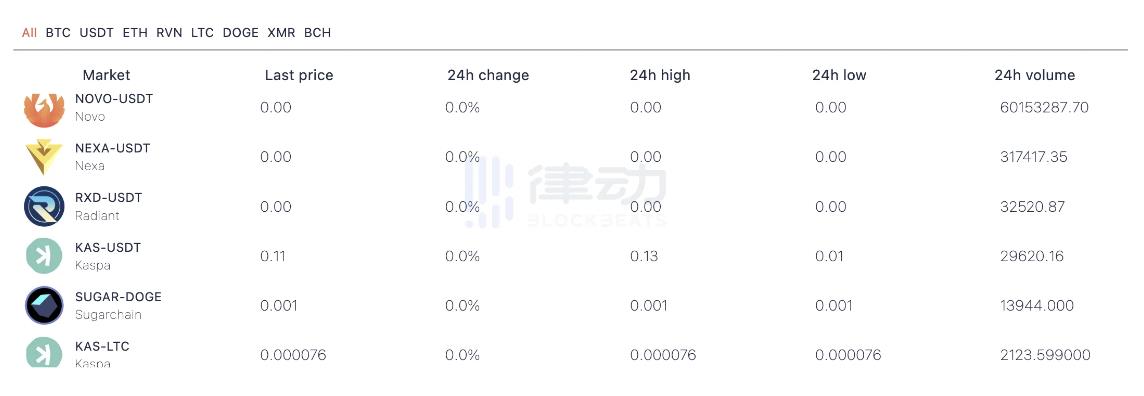

SafeTrade is a centralized cryptocurrency exchange platform founded in 2018. Despite being established for 5 years, according to BitDegree Exchange Tracker, it still ranks 225th among trading platforms. According to Coingecko data, as of the time of writing, SafeTrade's 24-hour trading volume is less than 3 million USD. However, such a platform with severe lack of liquidity has become the preferred liquidity exit for miners.

According to the SafeTrade official website, the platform currently has 53 currencies and 102 trading pairs, most of which are PoW mining coins. Among them are SMH, QUBIC, and other currently hotly discussed PoW coins.

SafeTrade currency interface; Image source: SafeTrade

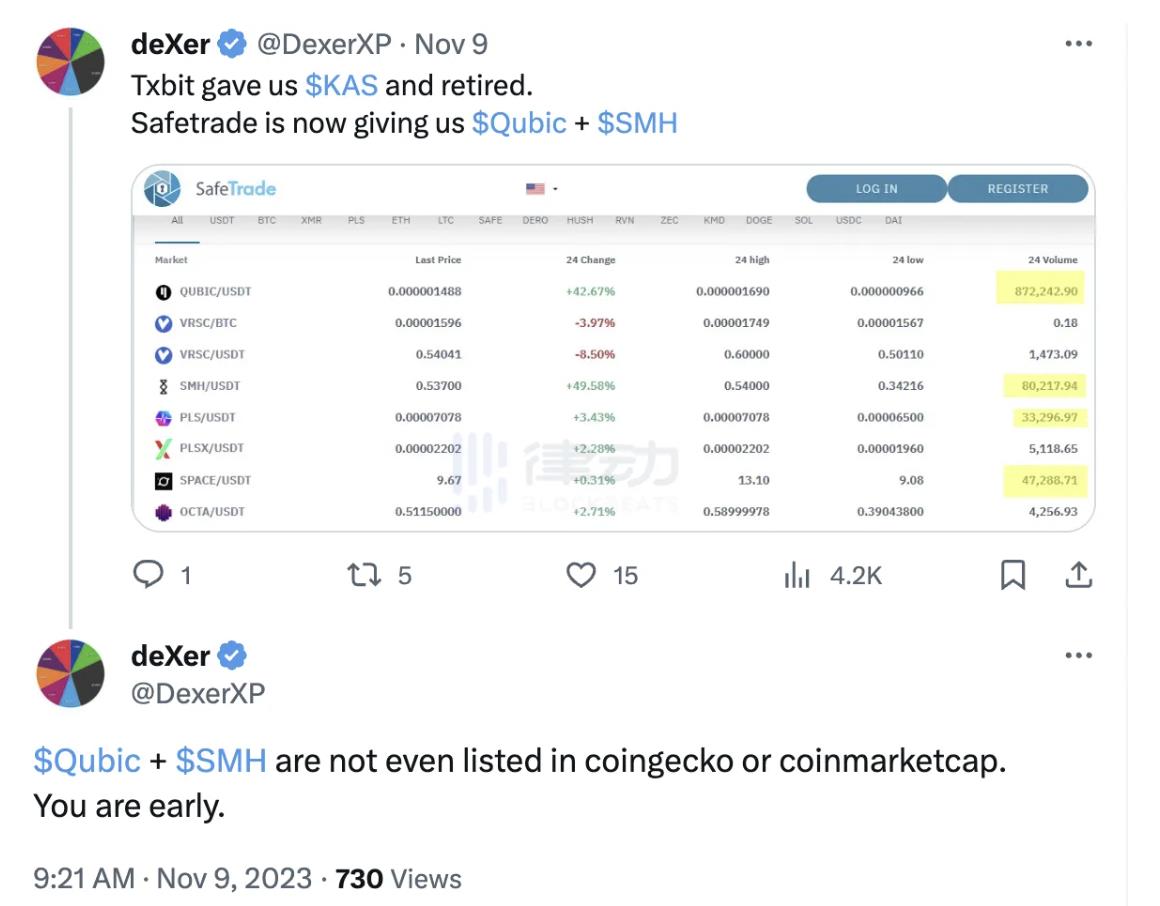

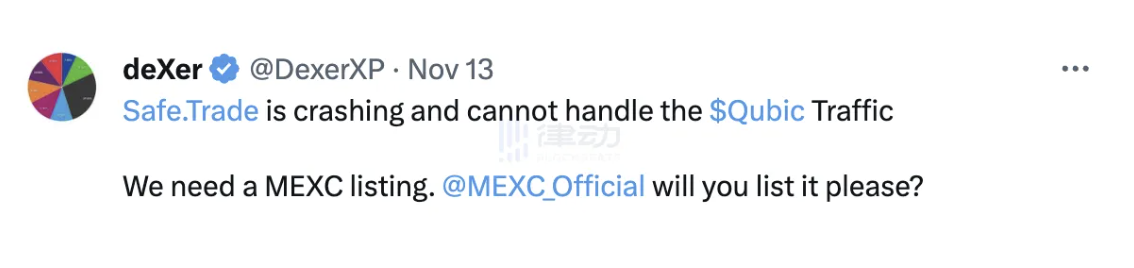

"TxBit brought us KAS and then went offline, and now SafeTrade has brought us QUBIC and SMH," Thrifty SoFi advisor deXer (@DexerXP) tweeted on X (formerly Twitter), saying, "QUBIC and SMH have not yet appeared on the lists of Coingecko and Coinmarketcap, it's still early."

BlockBeats noticed that although most PoW coins on SafeTrade have experienced a "price flywheel," there are also many doubts about the platform in the community. Among them, "the trading platform is too small, it looks very strange" is the main concern of users. Some users in the community openly stated, "I want to buy QUBIC, but I don't trust SafeTrade at all," and said that they would rather trade off the platform than deposit money into the exchange.

On November 12, due to the large number of people buying QUBIC, the server was unable to process it, and SafeTrade closed the trading channel. The next day, when the Qubic official explained how to buy QUBIC, many users in the comments section said that the funds they transferred to the platform did not arrive. On that day, the price of QUBIC dropped from its highest point to 0.0000023 USD, a decrease of 69%. After SafeTrade resumed the entry and exit channels, the token price rose again.

PoW Exchange: The mythical production line of mining coins

BlockBeats investigation found that "PoW exchanges" seem to have a fixed business routine and community groups, but they rarely receive attention from the mainstream crypto market.

In addition to the aforementioned SafeTrade, BlockBeats has also discovered a number of small "PoW exchanges" such as TxBit, Exbitron, XeggeX, and TradeOgre. These exchanges have extremely similar trading interfaces, mostly directly using Trading View's candlestick charts, and they do not have their own trading indicator systems. In addition to the common mainstream currencies, these exchanges focus on ultra-low market cap PoW mining coins and often stage "price myths."

The above image shows the trading currency interface of XeggeX, and the image below shows the trading currency interface of TradeOgre.

Among them, TxBit, the first to list KAS, announced in August that it would permanently shut down a month later. According to official sources, the platform stated that the shutdown was due to the continuously rising compliance costs and the uncertainty of cryptocurrency legal regulation.

In addition to the now-closed TxBit, Exbitron also faded out of the market this year. Exbitron, launched in May 2021, is a centralized exchange platform based in Germany, also focusing on new coin trading. In early February of this year, Exbitron was hit by a hacker attack, with TRX worth 390,000 USD stolen. Since then, its official Twitter account has had few updates, and there have been no price changes on the website's trading pairs.

Exbitron currency interface; Image source: Exbitron

BlockBeats found that "PoW exchanges" like SafeTrade are actually seen by many users as the "baton bearers" of early price discovery.

Cryptocurrency trader Kaduna (@CryptoKaduna) once wrote on X, "People say that diamond projects are all on MEXC and Kucoin, but I think we should go further, such as looking at Txbit, Tradeogre, Xeggex, etc., even though whether these exchanges are safe is another matter." And community members who are already users of "PoW exchanges" often call for these small currencies to be "listed on MEXC and Gate."

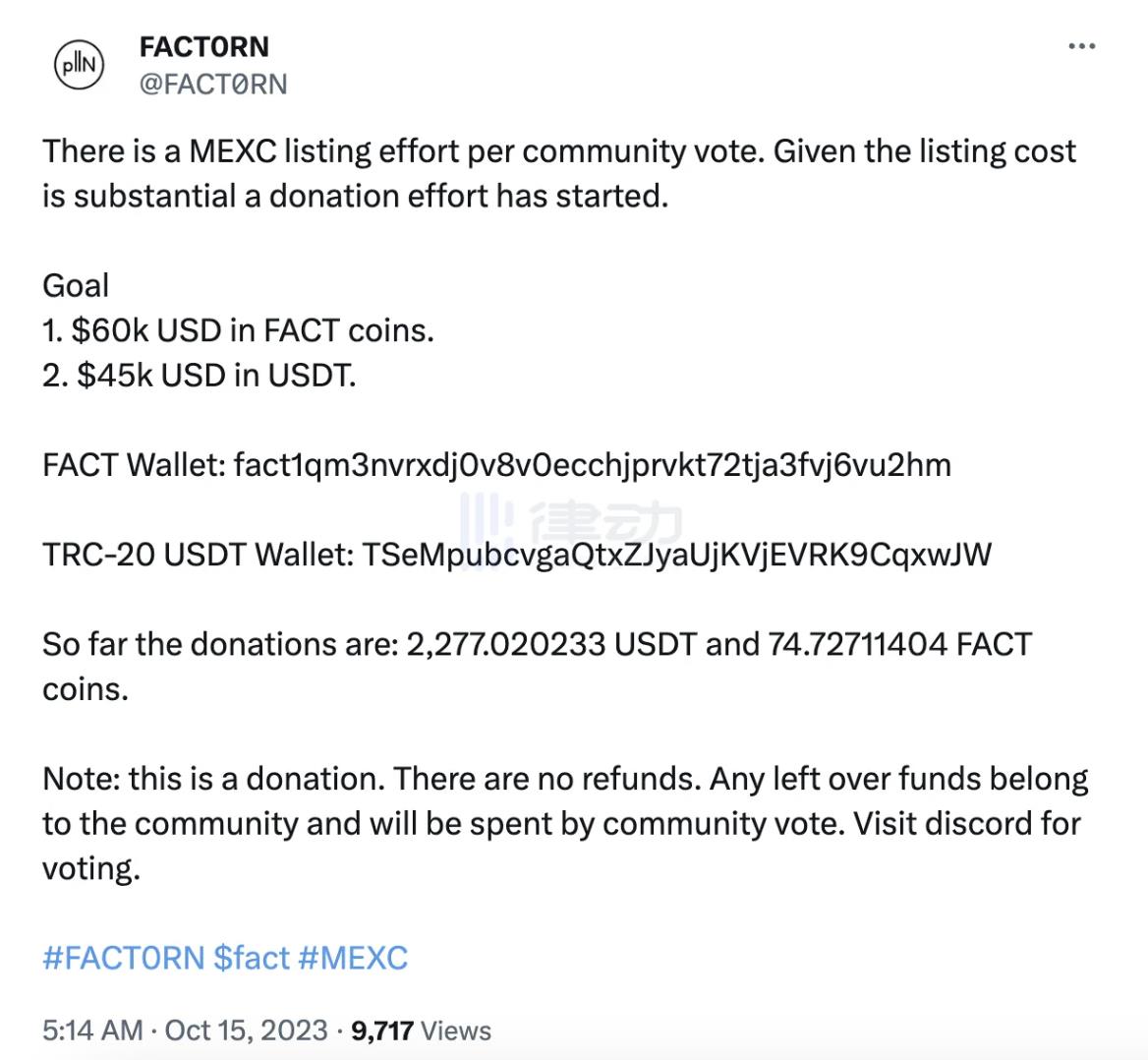

Listing on second-tier exchanges seems to have become the "main consensus" and "fixed expectation" for buying mining coins in the community. In October of this year, FACTORN (FACT), which is listed on XeggeX, officially announced a community donation plan to crowdfund the listing fee on MEXC, with a fundraising target of 60,000 USD worth of FACT tokens and 45,000 USD USDT.

Listing on second-tier exchanges can bring more liquidity to tokens, not only providing an exit window for early entrants, but also helping to push the token's price up again. This path has become particularly evident since the "mining coin sector" entered a high emotional state in November of this year.

OctaSpace (OCTA), which was listed on MEXC from SafeTrade in August, broke through 0.69 USD on November 17, with a price increase of over 36.8% since its listing, during which MEXC contributed 82.09% of the trading volume. Zephyr Protocol (ZEPH), which was listed on MEXC from XeggeX in September, broke through 15 USD on November 1, with a price increase of over 300% since its listing, during which MEXC contributed 96.65% of the trading volume.

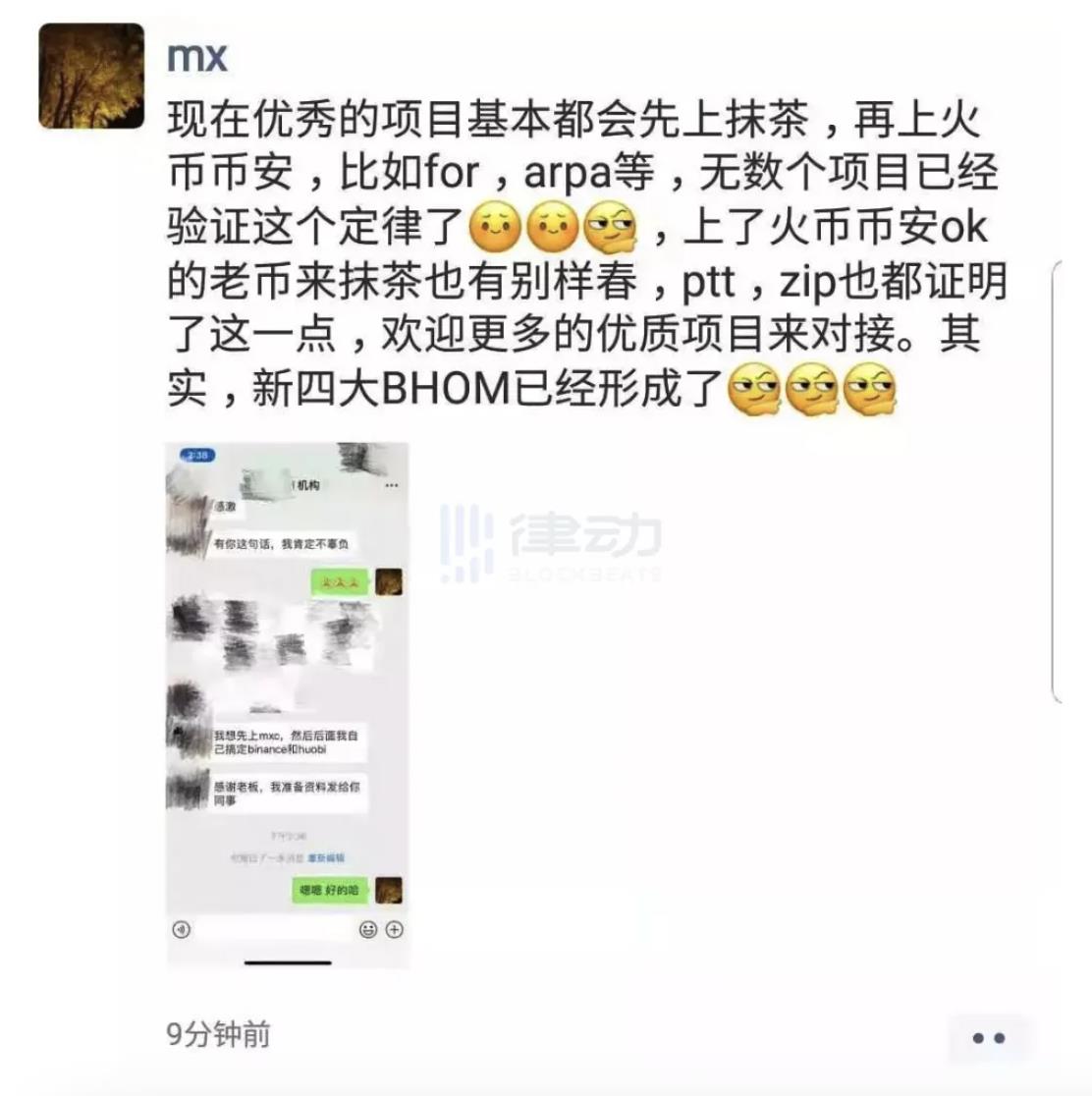

In an article published by BlockBeats in 2019 titled "The Fall of the 'Binance Effect,' the Rise of the 'Matcha Effect'," it mentioned the early role of MEXC as a "mining coin headhunter":

"Some projects see MEXC as a positive, and their goals are surprisingly consistent. First, they go to a small exchange to test the waters, and when the time is right, they start to plan to list on MEXC, and finally consider making a push to Huobi or Binance."

Image source: BlockBeats

Insiders told BlockBeats that behind the simultaneous rise of the "mining coin sector," there is actually a mature and complete chain of interests. BlockBeats summarized it as follows:

- The project is proposed and project promotion begins;

- Some mining machine manufacturers (many of which are the project's own) sell mining machines and recapture early funds;

- Use some of the recaptured funds to receive tokens dumped by miners into the market. Since the income from selling mining machines is much greater than mining income, this can lead to price increases;

- After observing price fluctuations, second-tier exchanges consider listing the tokens on their platform. After listing, the project can sell some tokens to retail investors on the platform;

- Some large mining projects will regularly produce new mining machines with the difficulty of mining, and use the new round of income and other cooperative capital to push up the token price again, attracting the attention of first-tier exchanges such as Binance, with the goal of landing on mainstream platforms and gaining more liquidity.

Compared to Ethereum, EVM, and other public chain ecosystems, or encrypted tracks such as DeFi and NFT, PoW mining and the mining coin market have always been one of the least attention-grabbing areas in the crypto field, and its industry chain and business model are not well known to most people. It is this to some extent "hidden" and "high-risk" threshold that creates space for some participants in the mining field to achieve continuous arbitrage.

Currently, with the continued popularity of the Bitcoin ecosystem, mining coins as a related concept are gradually receiving attention from the mainstream crypto market. The listing of KAS contracts on Binance marks the first time that this "hidden production line" has connected the "PoW exchanges" to mainstream trading platforms, creating a "value discovery path." Will the mining coin community seize the opportunity to bring continuous liquidity increments into the market?

At the same time, BlockBeats reminds readers that several third-tier trading platforms mentioned in the article have no reliable team endorsement, and many token projects have "Ponzi scheme attributes," so it is especially important to consider the risks and invest cautiously.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。