The demand function for Bitcoin may permanently change.

Author: Dan Morhead, Founder of Pantera Capital

Translation: Golden Finance 0xjs

There is much discussion about the possibility of soon approving a spot Bitcoin ETF.

There is an old saying on Wall Street: "Buy the rumor, sell the news." This theory suggests that if most investors anticipate something happening and buy in, then when the event actually occurs, it is naturally the time for sellers to sell, and many buyers are already exhausted.

The launch of a spot Bitcoin ETF is arguably the worst-kept secret in the blockchain space. So, when this news finally arrives, will it be time to sell?

Before we share our thoughts on the future, let's review the past.

This adage has worked perfectly in the recent two major regulatory events in the crypto field.

Bitcoin Futures Launched on CME in 2017

At one of our investor summits, former CFTC Chairman Chris Giancarlo pointed out a crazy fact that I had never noticed before. Throughout 2017, the market had been on the rise, with the slogan being "When CME lists Bitcoin futures, the price of Bitcoin is going to the MOON!!"

Until the day Bitcoin futures were listed, the price of Bitcoin had indeed risen by 2448% compared to 12 months earlier. That was the top. The day marked the beginning of an 84% bear market decline.

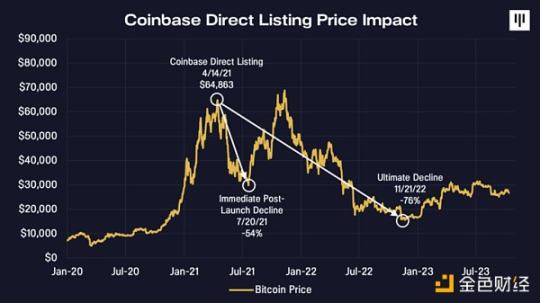

Coinbase Went Public in 2021

Before Coinbase went public, the market repeated the exact same cycle. The entire industry was excited about Coinbase's upcoming direct listing. On the day of the listing, the price of Bitcoin had risen by 848% compared to 12 months earlier. Bitcoin reached a peak of $64,863 on the day of the listing, and a bear market decline of 76% began.

In 2021, we joked, "Can someone remind me the day before the official launch of the Bitcoin ETF? I might want to take some chips off the table."

ETF

I believe that a Bitcoin ETF will be seen as a significant step forward in the adoption of digital assets. Before discussing the product and its impact on the industry, let's take a moment to consider how far the industry has come.

A Brief History of Buying Bitcoin

In the past decade, acquiring Bitcoin has undergone significant changes. In the early days, people would receive free Bitcoin through so-called "Bitcoin faucets." When I first encountered Bitcoin, Gavin Andresen had BitcoinFaucet—just register and receive free Bitcoin. My brother sent me some free Bitcoin at the time.

Soon, people needed a place to trade Bitcoin. A poker card trading site called Magic The Gathering Online eXchange allowed enthusiasts on the site to trade a digital currency called Bitcoin, abbreviated as Mt.Gox.

Bitstamp was launched in August 2011 and is the oldest exchange still in operation. There was also LocalBitcoins – a marketplace that facilitated face-to-face transactions between buyers and sellers. Those were the days.

Now we have hundreds of exchanges. However, many of them are offshore and opaque, with more similarity to FTX than to the New York Stock Exchange. Many institutions are reluctant to trade and custody with these entities. IRA accounts and other types of financial accounts often cannot access cryptocurrency exchanges.

Future from the Past

Futures have not had a significant impact. I have been trading currencies for thirty-five years and know that traditional fiat currencies rarely use futures. The forex market is almost entirely cash / spot.

Although it sounds contradictory, Bitcoin futures are actually a step backward.

Bitcoin futures missed the entire "thematic" of Bitcoin (as my friend Andrew Lawrence put it). The elegance of Bitcoin lies in the fact that Bitcoin trading is "t-minus zero"—the trade is the settlement. When Bitcoin has settled, the hassle of rolling (e.g., from March to June) is unnecessary.

There are no "T+2" settlements, collateral, monthly futures rollovers, or cash settlement market manipulation in the rough-and-tumble exchanges. When we return to monthly cash-settled futures, all the charm of Bitcoin disappears.

Don't get me wrong—I think the existence of futures is a good thing. They have brought in thousands of new traders who could not get Bitcoin through other means. The listing of CME and CBOE and the CFTC's regulation of Bitcoin futures are huge positive steps in the tokenization of assets.

Bitcoin futures market vs. cash / spot market trading volume and relative share data: The average daily trading volume of Bitcoin futures in October 2023 was approximately $38 million, theoretically 13,300 contracts vs. Bitcoin spot trading volume of $6.169 billion, with a relative share of 0.4%.

Impact of ETF

While starting a prediction with "This time is different…" is usually not an auspicious start, I believe this time it really is different.

The previous two Bitcoin price peaks were:

- On the day of the CME futures listing (December 18, 2017), it reached a peak of $20,000, and the price immediately dropped by 65%, eventually declining by 84%.

- On the day of Coinbase's listing in April 14, 2021, the price was $65,000, and the price immediately dropped by 54%, falling to a 76% decline at the eventual low point.

None of these events had any impact on the real-world use of Bitcoin.

It's all "buy the rumor, sell the news."

Bitcoin futures did not open up any significant new investor groups. They only interested a small number of major arbitrageurs. The net new buying volume is not significant.

Coinbase's product was more explicit. Coinbase's website ran well when held privately. The next day, when it went public, the website's performance remained the same. The change in Coinbase stock ownership did not increase people's opportunities to acquire Bitcoin.

A Bitcoin ETF, on the other hand, is very different. The launch of the BNY Mellon ETF fundamentally changes the way Bitcoin is acquired. It will have a huge (positive) impact.

We firmly believe that many spot Bitcoin ETFs will be approved. We also believe this will happen in one to two months, not years.

When they did the Goldman Sachs index, I was at Goldman Sachs. Now everyone sees commodities as an asset class. In the 90s, I was very active in emerging markets. Now, emerging markets are seen as an asset class. Blockchain will be the same. A Bitcoin spot ETF is a very important step in their becoming an asset class. Once a Bitcoin spot ETF exists, if you are not exposed, you are effectively shorting Bitcoin.

"Buy the rumor, sell the news."

Gold ETF: Digital Gold and Traditional Gold

Many market observers believe that the best analogy for the launch of a "digital gold" ETF is the impact of launching a physical gold ETF. The first gold ETF was launched outside the United States in 2003, and the first U.S. ETF GLD was launched in 2004. This analogy may be a good one because in the early 2000s, holding physical gold was challenging for many investors, just as custody of crypto assets is a challenge for many investors today. Additionally, the convenience, low cost, and trustworthiness of the issuers will almost certainly attract new investors who would not have previously participated in the gold market.

We expect the same to happen when a Bitcoin ETF is launched. When investors have this choice, the demand function for Bitcoin may permanently change. The launch of the ETF will also have another important impact on Bitcoin and cryptocurrencies. Twenty years ago, the launch of ETFs had a legitimizing effect on the idea of including commodities in portfolio allocations. We expect the appearance of the most respected brands in consumer finance in the first wave of Bitcoin ETFs to have a similar impact.

We should also expect that a few ETFs will capture the majority of the market share. The larger the ETF, the more efficient its pricing, initiating a virtuous cycle that makes larger ETFs more popular. The SPDR Gold Trust (GLD) ($54.6 billion) and iShares Gold Trust (IAU) ($25.3 billion) account for nearly 90% of the value of U.S. gold ETFs, with no other competitor exceeding $10 billion.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。