Original Author | Cryptocurrency Researcher Ann

Original Translation | Baize Research Institute

1. Rapid Rise - Really Too Fast

When altcoins began to rise sharply, Bitcoin had not even stabilized in the new price range. It started with high market cap altcoins like Chainlink (LINK) and Solana (SOL). But within a week, we saw rebounds in low market cap and memecoins - which usually happens in the late stage of a bull market. My Binance homepage and DEX filtering list are filled with names like ORDI, MEME, and TIA.

Some say that bull markets are getting shorter. But what I see is pure desperation. It's as if you'll miss out if the tokens don't rise now.

What's driving this? I also see old coins like MBL or FIL rising. I remember a similar market situation at the end of 2019 and the beginning of 2020, before the collapse of the COVID-19 pandemic (3.12 Black Swan). Looking back at that period, we can definitely call it a bull market trap. So is this another bull market trap now? Or is it just bear market PTSD?

2. Ethereum's Poor Performance

Ethereum's performance in terms of price is still disappointing. I'm trying to figure out why this is happening.

From October 1, 2023, to November 14, 2023, the coin returns are as follows.

Bitcoin (BTC): 30%

Solana (SOL): 120%

Cosmos (ATOM): 22%

Avalanche (AVAX): 69%

Fantom (FTM): 50%

Near Protocol (NEAR): 43%

And here are Ethereum's returns.

Ethereum (ETH): 18%

Even compared to the usually lagging ATOM, Ethereum is still at a disadvantage. More importantly, compared to new memecoins or newcomers like Celestia's TIA, ETH also looks very poor.

Why the poor performance? I attribute it to staking. Since the Shanghai upgrade, more ETH has been staked. Of course, staking can prevent ETH from becoming an unstable asset compared to other parts of the cryptocurrency market. However, enthusiasts like to understand staking as a reduction in supply, so the price "might" be higher. However, what is actually happening is quite the opposite.

As people continue to exchange ETH for altcoins that are in a rising market, it means that ETH is being continuously sold off. Besides this selling, there are currently no new buyers. Experienced crypto investors will not bet on ETH during the wild meme season.

During the last bull market, when ETH outperformed BTC, it marked the end of the bull market. Traders no longer bet on other altcoins, they transfer their profits to safer assets like ETH, usually staking and DeFi mining.

3. Beware of Solana VC Holders

As expected, this surge has lured VCs out of their predicament, and they suddenly announced that they never gave up on cryptocurrencies.

Interestingly, not long after, they "marketed" their assets.

Solana is the most famous VC coin to date, with a large portion of the token allocation targeted at internal investors. So it's not surprising that they hope the price will return to hundreds of dollars. I'm pretty sure these VCs still hold these shares.

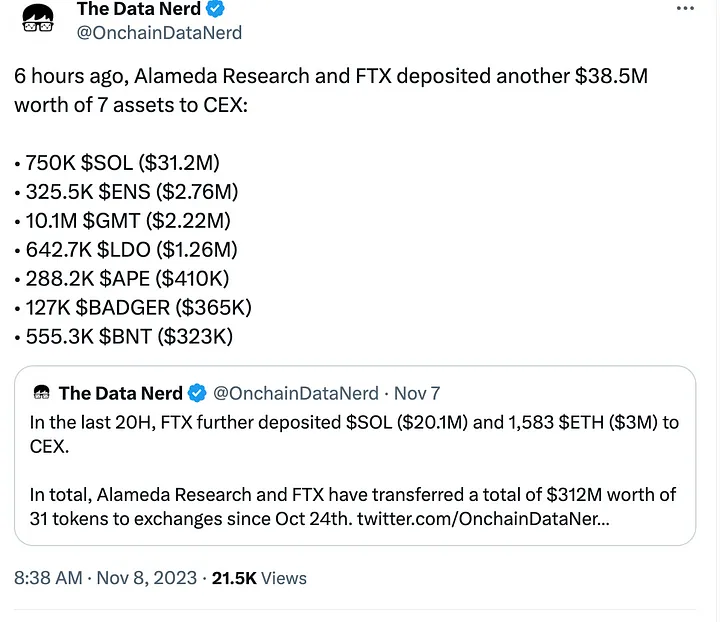

Let's not forget one of the most important holders, FTX/Alameda. According to the Solana Foundation, FTX/Alameda's SOL tokens will be gradually unlocked by 2028.

4. Watch Out for Those "Dumping"

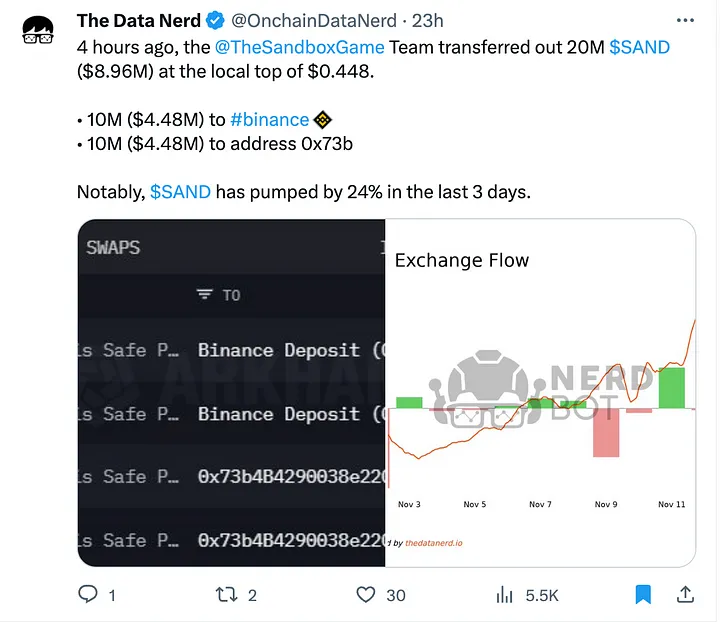

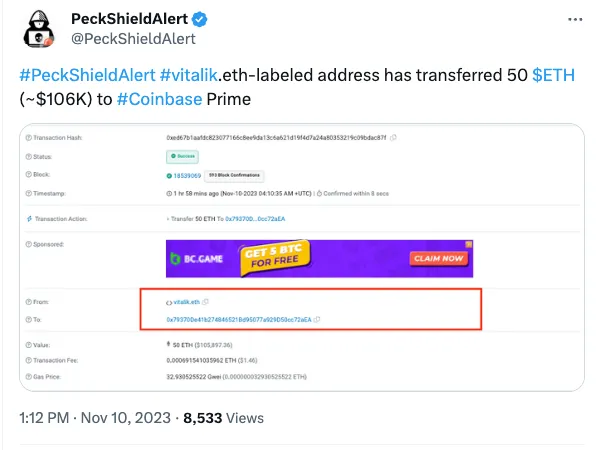

Various parties are taking advantage of this surge to sell off their assets. This includes project development teams, OGs (like Vitalik), and struggling exchanges (like FTX).

The first round of selling in a bull market often ends up being a mistake. But the worst case is that you are forced to buy at a higher price and then get stuck.

However, for some, this is a rational decision, such as for projects that need funds to continue operating. Just be aware: 1. You won't become their exit liquidity, 2. The sale is not because they no longer believe in the project and are seeking a gradual exit.

The second point is important because I have seen tokens of previously famous projects being continuously sold off by the development teams.

When the concept of the metaverse was still hot, SandBox was a very famous project.

Vitalik stated that he has never sold ETH for personal purposes since 2018. However, he often sells ETH at skyrocketing prices, which is quite interesting.

Some token unlocks are controversial, such as dYdX.

5. Inflow of Stablecoins - Will It Sustain the Surge?

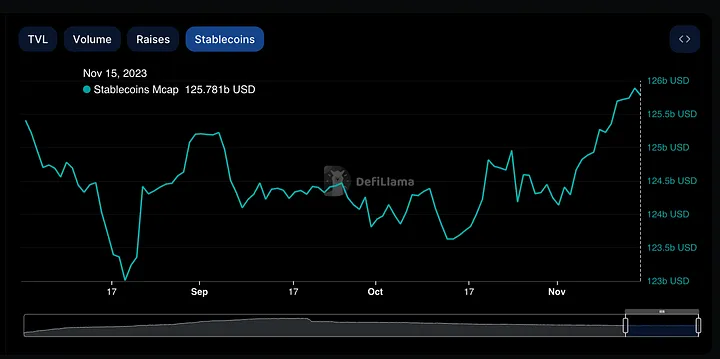

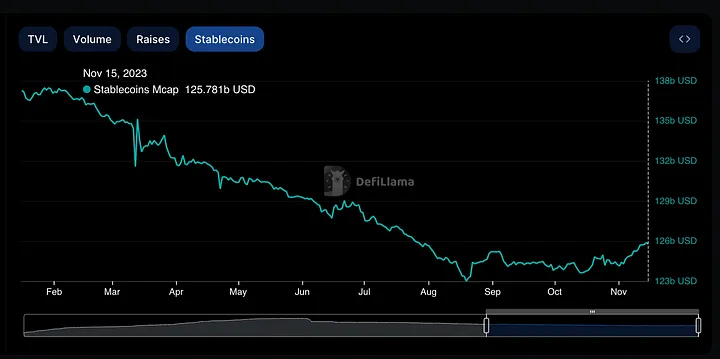

I heard about a large influx of stablecoins on Twitter, so I had to check it out myself to confirm.

The increase in stablecoin market value often serves as an indicator of whether the bull market is officially starting.

Using DeFillama, I did see stablecoin inflows, and it looks like it could be significant, reaching 30 billion. However, if we narrow the scope and compare it to the outflow of funds the market suffered last year, it is still insignificant.

Here is the chart for the past three months.

Here is the zoomed-in view.

Although my conclusion is that I don't believe it, this is still a good start. I hope the chart will continue to move upward (upward trend).

This 30 billion increase in stablecoins is likely to come from existing cryptocurrency enthusiasts - those who have been waiting and deploying funds. This is not enough; what we really need is inflow from outsiders in the crypto market. This is also what people hope a spot Bitcoin ETF will be able to attract.

6. Watch for Bitcoin ETF News

Browsing news about ETFs, such as CNBC's news, can lead to some conclusions.

The ETF is expected to be approved in early 2024, but it may be delayed.

Traditional asset management companies will still advise clients to allocate only 1-5% of their overall investment portfolio to cryptocurrency investments. This means we cannot expect them to buy in a frenzy.

At the same time, advisors will also raise significant warnings about Bitcoin's volatility.

In short, we cannot expect TradFi funds to come rushing in.

As for the end of the crypto market bull run, we all know that people will try to take profits before the ETF announcement, before it is listed. The approval of the ETF is like a sell-off news event. It's a bit like Elon Musk appearing on "Saturday Night Live" with DOGE.

The day of its arrival may still be a few months away. Then comes the news of the SEC delaying the approval of the ETF. Interestingly, some traders prefer the delay, as it keeps the market in a bullish atmosphere.

7. In Conclusion, the Market is Still Confusing

There is a difference of opinion in the entire crypto community about whether this surge will continue. For me, this surge feels like what we experienced in the first half of 2023. People were too excited about the rise, and then immediately felt frustrated when the market pulled back the next day.

The urge to "go all in before the atmosphere deteriorates" is clear evidence of distrust in the market. A few days ago, there was a needle in the altcoins, liquidating almost all long positions.

Imagine spending days building a position, only to be liquidated on a single 1-hour needle.

This kind of liquidation does not guarantee that the market is ready to enter a bull market. This means 1. Liquidity is still too low. 2. Some people are still short-sighted and want to make quick profits.

Another piece of evidence comes from the comparison of spot trading volume and futures trading volume. High spot trading volume usually indicates that long-term investors are entering the market. However, just by browsing Binance, you will find that most of the trading volume is still perpetual contract trading. As long as this situation persists, you can expect the market to experience severe rallies and sell-offs.

The ideal price trend for the "real" start of a bull market is usually gradual. What we get is not a sharp rise, but a small, sustained rise over several months, with long-term investors willing to gradually increase their positions, and most of the time they will not incur losses.

Perhaps this time is different. Who knows.

Note:

The above projects and views should not be construed as investment advice. Do your own research. According to the notice issued by the central bank and other departments on "Further Preventing and Dealing with the Speculative Risks of Virtual Currency Trading," the content of this article is for information sharing only and does not promote or endorse any business and investment activities. Readers are strictly required to comply with local laws and regulations and not participate in any illegal financial activities.

Original Link:

https://medium.com/p/2bbcdfd158ac

Due to the revision of the public account, the article is no longer regularly published.

If "Baize Research Institute" has been helpful to you,

give it a "like" and "share."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。