Author: Xiyu, ChainCatcher

On November 4th, OpenSea was reported to have laid off 50% of its staff, which was later confirmed. However, this personnel change is not the first for OpenSea. As early as July last year, OpenSea had laid off 20% of its staff due to the impact of the crypto winter and macroeconomic instability, leaving about 230 employees. After this 50% layoff, the company now has just over 100 employees.

On November 8th, it was revealed that OpenSea's largest investor, Coatue, had already written down the value of its stake in OpenSea from $120 million to $13 million in the second quarter of 2023, a 90% decrease. This also implies that OpenSea's valuation is now equal to or less than $1.4 billion, nearly 90% lower than its peak valuation of $13.3 billion in early 2022.

In addition, according to DappRadar data, the number of daily active wallets on OpenSea has dropped to below 8,000, with daily trading volume only around $3 million, and even in the past two months, it has been in the millions. During the peak period, the number of daily active wallets exceeded 50,000, with daily trading volume exceeding $100 million. In the past week, OpenSea's market share in the NFT trading market is less than 35%, while the aggregated NFT trading platform Blur's market share in the same category exceeds 50% (about 53.7%).

"Layoffs of over 50%, nearly 90% decrease in valuation, and market share squeezed to less than 35%" and other negative terms related to OpenSea have been filling major crypto communities in recent days. OpenSea, seen as a barometer of the NFT market's development, is capturing the attention of industry professionals with every move it makes.

As the former leader of the NFT trading platform and once seen as a model unicorn enterprise in the crypto world, why has OpenSea fallen to this point? Who or what pushed OpenSea off its pedestal? Faced with the current predicament, how will OpenSea break through?

Who Pushed OpenSea off the Altar?

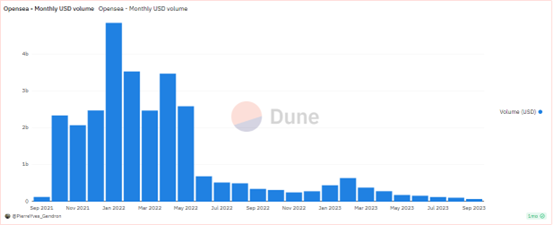

Founded in 2017, OpenSea once dominated the entire NFT trading market with a first-mover advantage. In January 2022, during the metaverse and NFT boom, it achieved a monthly trading volume of $5 billion, with a daily average trading volume exceeding $100 million. It also completed a $300 million Series C financing round led by Paradigm and Coatue at a valuation of $13.3 billion, making it a unicorn in the crypto field. However, the current state of OpenSea is that "the company now has just over 100 employees, with a valuation of $1.4 billion, and a market share of less than 35% in the NFT trading market."

What exactly caused the former NFT trading leader OpenSea to fall from grace?

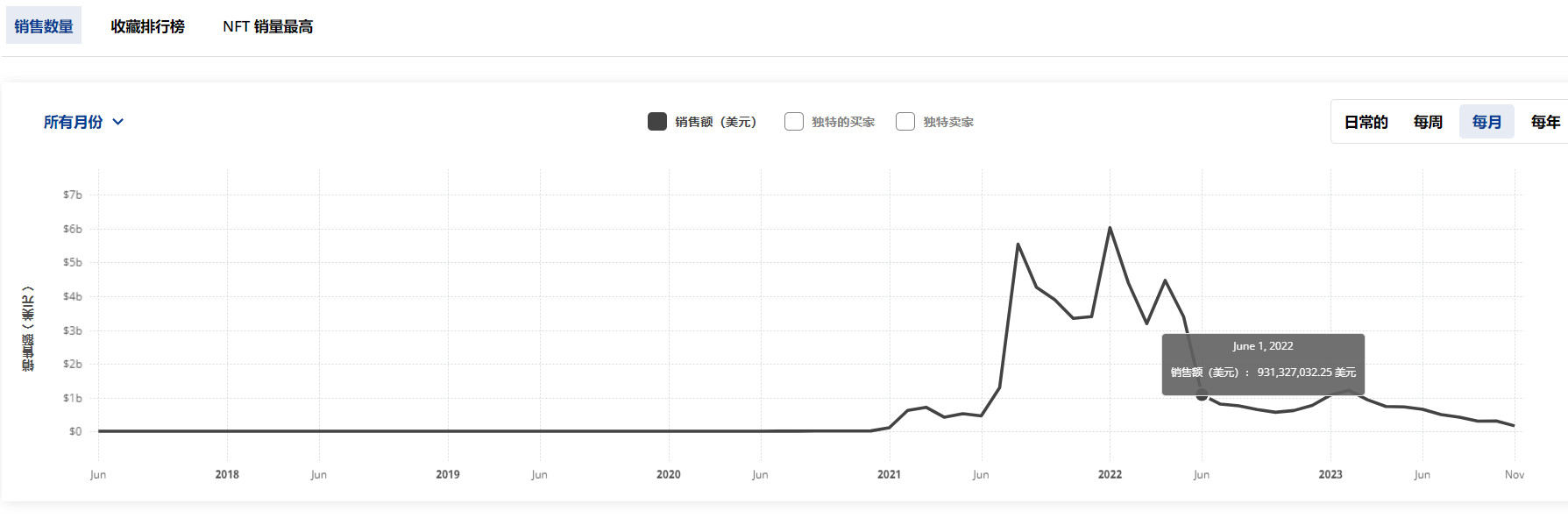

We may be able to find some clues from the changes in its platform trading volume. OpenSea's platform trading volume experienced a cliff-like plunge in June 2022, dropping from over $30 billion per month to less than $10 billion (from $26 billion in May to $7 billion in June).

The main reason behind this is the overall cooling of the crypto market, which has led to a sharp decrease in NFT market trading volume and a bleak market. According to data from The Block, the NFT trading volume in June 2022 was only $1.04 billion, a 74% decrease compared to the $4 billion in May. It is reported that this is the largest decline in the history of the NFT market.

In July, OpenSea announced a 20% reduction in staff. In response, OpenSea co-founder and CEO Devin Finzer stated: "In various potential downturn environments, based on the current trading volume, this round of layoffs will enable OpenSea to maintain normal operations for five years. Just one year after this round of layoffs, OpenSea announced another 50% reduction in staff."

Furthermore, with the prosperity of the NFT market, OpenSea has faced increasing competition, and the NFT trading market has evolved from a monopoly to a state of diversified competition.

At the beginning of 2022, similar competitors known for their trading mining against OpenSea, such as LooksRare and X2Y2, emerged one after another. In addition to Ethereum, mainstream public chains represented by Solana have also launched their native NFT trading platforms (such as Magic Eden) and have seen the emergence of a batch of high-quality NFT projects (such as DeGods). The NFT market has begun to sink, and user traffic has shifted from Ethereum to other public chains, eroding OpenSea's market share. CEXs have also announced the launch of their own NFT platforms, such as Binance NFT by Binance, OKX NFT by OKX, as well as NFT platforms focusing on specific segments, such as Artblocks (art), the crypto art professional curation platform SuperRare, Adius (music), and NFT batch trading aggregation platforms like Gem and Genie.

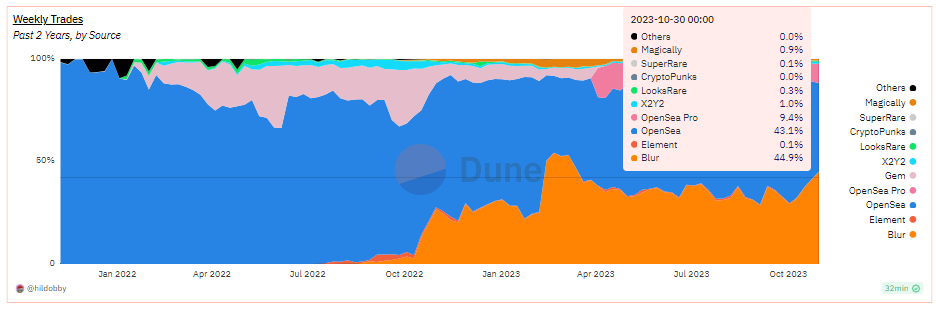

However, these products did not shake OpenSea's leading position in NFT trading until the appearance of the NFT aggregation trading platform Blur in October 2022.

With its token airdrop incentive strategy, zero trading fees, and the ability to set royalties, Blur quickly established itself in the NFT market, with its trading volume surpassing OpenSea at one point, making it the largest NFT trading platform.

According to NFT market transaction data from Dune, since the launch of Blur, OpenSea's market has been severely encroached upon, with its market share remaining below 50% for a long time, and even dropping below 35% on multiple occasions.

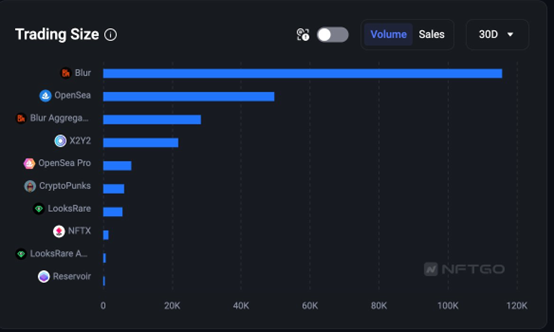

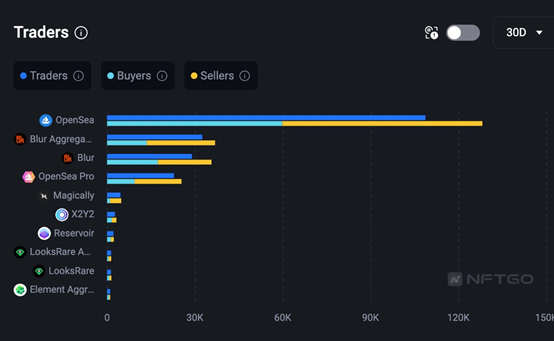

According to the latest statistics released by NFTGO on October 28, the monthly trading volume of Blur was 115,700 ETH in the past 30 days, while OpenSea's trading volume was only 49,600 ETH, with the former being more than twice as high as the latter. In addition, the trading volume of a single address on Blur is also higher, with an average transaction volume of 0.76 ETH per address, while OpenSea's average transaction volume per address is 0.13 ETH. Three months ago, these two numbers were 2.87 ETH and 0.43 ETH, respectively.

Overall, the overall bear market in the crypto market has had more of an impact on the trading volume of NFT platforms, but it is the Blur platform that has truly changed the market share of OpenSea. With Blur's strong presence, OpenSea's market share has been declining from its initial peak of 90% to 50-30%, ultimately pushing OpenSea off the throne of the NFT trading platform king.

OpenSea's Counterattack: Launching Zero-Fee OpenSea Pro to Regain Market Share, Controversy Arises from Changes to Royalty Rules

Faced with the relentless competition from newcomer Blur, OpenSea did not remain indifferent and instead took a series of proactive strategies to respond. Among them, the most representative actions are the "launch of the product OpenSea Pro" and "cancellation of the mandatory royalty policy." However, from the final results and the evaluation of the community users, it seems that the official expectations were not met, and instead, it sparked some controversy.

First, OpenSea added OpenSea Pro to its product line. In April of this year, OpenSea announced the rebranding and upgrade of the previously acquired and independently operated NFT aggregation platform Gem to OpenSea Pro, aiming to attract professional users and compete with its rival Blur on the new platform.

The OpenSea Pro platform features real-time cross-market data, advanced orders, powerful inventory management, instant sales, optimized gas fees, watchlists, real-time minting overviews, batch transfers, and other innovative features. However, in terms of product functionality, it largely borrowed from Blur's approach, adopting a zero-transaction fee model, focusing on NFT trading aggregation business, and introducing trading rewards and airdropping Gemesis NFT to historical Gem users.OpenSea Pro airdropped approximately 95,000 Gemesis NFTs to early Gem users in April of this year, and the current floor price for this NFT is 0.0145 ETH. Although the official statement claims that this NFT is only commemorative and has no actual value, it is still considered by the community as an important basis for future airdrops by OpenSea.

According to the latest data from Dune, OpenSea Pro is currently the third largest NFT trading platform in the NFT market, following only Blur and OpenSea, with a market share of approximately 8%. When the market shares of OpenSea and OpenSea Pro are combined, the total is not significantly different from Blur.

From a data perspective, the launch of OpenSea Pro has helped OpenSea regain some market share.However, on August 18th of this year, OpenSea's decision to "cancel the mandatory creator royalties and change to optional creator fees" has made it a target of criticism, facing protests from multiple parties. Royalties are the fees paid to the original NFT creators, typically ranging from 2.5% to 10% of the secondary sales price.

OpenSea announced that starting from August 31, 2023, they will implement an optional mechanism for creator fees, canceling the mandatory creator royalty tool (Operator Filter). For current NFT series using mandatory royalties, OpenSea will enforce the previously specified creator fees until February 29, 2024, after which the creator fees will become optional. For new series starting from August 31, the creator fees will be optional.

In simple terms, starting from March 2024, NFT sellers can freely decide the split percentage for their NFT's secondary sales. If they set the split percentage to 0, the creators will not receive any revenue from subsequent NFT transactions. Sellers can also choose to pay more fees if they wish.

The adjustment of OpenSea's royalty mechanism may be related to the market challenges it faced at the time. On one hand, the bearish trend in the crypto market led to continuous declines in NFT prices and trading volume, indicating a decline in the trading interest of NFT traders. Lowering royalties may bring in more trading volume. On the other hand, the current trend in the NFT market favors 0% royalties, with platforms like Blur and LooksRare opting for an optional royalty mechanism, and others like SudoSwap adopting 0% royalties. OpenSea is facing a continuous loss of market share and in order to change this situation, it needs to attract more trading users.

OpenSea's implementation of the optional royalty mechanism has sparked controversy, with strong opposition from figures such as Mark Cuban and Yuga Labs against OpenSea's royalty policy change.As an investor in OpenSea, Mark Cuban expressed disappointment in a social media post, stating that OpenSea not charging and paying royalties for NFT sales is a huge mistake, undermining people's trust in the platform and damaging the entire industry.

Yuga Labs (the parent company of BAYC), as a representative of the NFT industry, led the protest and announced that they will gradually stop supporting all upgradeable contracts and any new series on the OpenSea SeaPort, and will completely withdraw from the OpenSea market by February 2024.

However, on the same day as OpenSea's 50% layoff on November 4th, Yuga Labs announced a partnership with the NFT trading platform Magic Eden to jointly launch a new NFT market on Ethereum by the end of this year that allows for the collection of creator royalties.

In fact, there are both supporters and opponents of this royalty reform at OpenSea. Opponents believe that the optional or zero royalty strategy may attract NFT traders in the short term, but it is a short-sighted strategy that will ultimately lead to a lack of creative motivation for creators, hindering the continued innovation and development of NFTs in the long run. Additionally, with OpenSea also shifting to an optional creator royalty model, it means that there are no major trading platforms supporting mandatory royalties in the NFT market. This, coupled with the market downturn, is already leading to a significant reduction in creators' earnings. If NFTs have no royalties, what sets them apart from art in the Web2 or the real world? On the other hand, supporters believe that the current existence of royalties is detrimental to NFT liquidity and will further expose investors facing losses to additional losses.On the second day after OpenSea announced the implementation of optional royalties (August 22nd), OpenSea Pro subsequently stated that, with the adjustment of creator fees, a platform fee of 0.5% will be charged for all OpenSea listings and sales created on OpenSea Pro starting from August 31st. Community users criticized this move, commenting that charging fees for listings means creators get nothing, and the platform gets even more?

From the reactions of creators and users to OpenSea's changes in royalty policies and arbitrary fee settings, it is evident that OpenSea's policies still follow a self-centered approach and do not truly consider the users' perspective, but rather aim to increase the platform's revenue.

### OpenSea 2.0

**Can it Break the Deadlock of OpenSea?**

Currently, the negative evaluations of OpenSea outweigh the positive ones, but as a former leader in NFT trading, it still has the largest number of NFT trading users. According to data from NFTGO, the number of active traders on OpenSea is three times that of Blur. However, the NFT trading track is currently very crowded, with not only rising stars like Blur, challengers like LooksRare and X2Y2, but also centralized exchanges such as Binance NFT, OKX NFT Marketplace, and multi-chain representative Magic Eden. Although OpenSea has the first-mover advantage in terms of users and NFT quantity, if it continues to adhere to a "self-centered, non-user-centric" approach in its product, its advantage will slowly disappear with the emergence of new platforms, and it may even be replaced by new platforms.

Now, with the warming of the crypto market, the NFT market is also showing an upward trend. Can OpenSea regain its dominant position in the upcoming bull market?

In response to the recent layoffs, OpenSea co-founder and CEO Devin Finzer has expressed that the future will involve a repositioning of the team around OpenSea 2.0: changing the way operations are conducted, shifting towards a smaller team, directly engaging with users, and making a major upgrade to the product, including fundamental technology, reliability, speed, and user experience.

However, specific details about the upgrades to OpenSea 2.0 and its future development roadmap have not been disclosed to the public. Nevertheless, many in the community view OpenSea 2.0 as a self-rescue strategy for OpenSea, attributing significant importance to its ability to break free from the current predicament, and even considering it a make-or-break move for the platform.Although the content of OpenSea 2.0's future strategy is unknown, based on OpenSea's recent public actions, it can be inferred that "multi-chain operations" and "how to improve the NFT creator experience" will be part of it. Today (November 10th), OpenSea announced a five-week on-chain creator art competition in collaboration with Optimism, offering a reward of 1 million OP tokens to on-chain creators; in October, OpenSea launched Shipyard, an open-source NFT developer toolset, providing NFT creators with a standardized set of tools to help them build various types of NFT projects.

In addition, with regard to multi-chain layout, many users predict that OpenSea will soon integrate into the Bitcoin ecosystem. Currently, Bitcoin has become the second largest NFT ecosystem, with a trading volume of $76.78 million within the Bitcoin ecosystem in the last 30 days, compared to Ethereum's on-chain NFT trading volume of $227 million. Platforms represented by Binance NFT and OKX NFT Marketplace already support Bitcoin NFT, and recently Binance also launched the BRC20 token representing ORDI, indicating optimism about the future of the Bitcoin ecosystem.

However, OpenSea's layout in the Bitcoin ecosystem seems somewhat slow, as it has not released any information regarding support for Bitcoin NFTs until now.

Some opinions suggest that OpenSea's delay in integrating into the Bitcoin ecosystem can be considered a strategic mistake, as it not only missed the golden development period of the Bitcoin ecosystem (in May and June), but also missed the emerging market that was most likely to bring in new users. In the same multi-chain NFT market track, Magic Eden, after shifting to support the Bitcoin ecosystem this year, not only gained a batch of new users, but also contributed over 60% of its trading volume during the Bitcoin ecosystem's explosive growth in May. However, in October, Magic Eden announced the suspension of BRC20 token trading support.In addition, OpenSea has another major ace up its sleeve that has not yet been revealed, which is related to Token content. Although OpenSea has always operated with the intention of going public and has been rumored to be preparing for an IPO, the move to airdrop NFTs to Gem's historical users when OpenSea Pro went live this year once again gave users hope.

The crypto market's winter will eventually pass, and the NFT market will return to prosperity. However, the question remains whether OpenSea will still be the leader in the NFT market in the next bull market. But for NFT creators, what they are most concerned about is whether OpenSea will continue to prioritize creators and provide sustainable income in terms of royalties to encourage their creative passion. It is obvious that OpenSea's current optional royalty policy does not meet these requirements.

However, the NFT trading track is currently very crowded, with not only rising stars like Blur, challengers like LooksRare and X2Y2, but also centralized exchanges such as Binance NFT, OKX NFT Marketplace, and multi-chain representative Magic Eden. Although OpenSea has the first-mover advantage in terms of users and NFT quantity, if it continues to adhere to a "self-centered, non-user-centric" approach in its product, its advantage will slowly disappear with the emergence of new platforms, and it may even be replaced by new platforms.

Now, with the warming of the crypto market, the NFT market is also showing an upward trend. Can OpenSea regain its dominant position in the upcoming bull market?

In response to the recent layoffs, OpenSea co-founder and CEO Devin Finzer has expressed that the future will involve a repositioning of the team around OpenSea 2.0: changing the way operations are conducted, shifting towards a smaller team, directly engaging with users, and making a major upgrade to the product, including fundamental technology, reliability, speed, and user experience.

However, specific details about the upgrades to OpenSea 2.0 and its future development roadmap have not been disclosed to the public. Nevertheless, many in the community view OpenSea 2.0 as a self-rescue strategy for OpenSea, attributing significant importance to its ability to break free from the current predicament, and even considering it a make-or-break move for the platform.Although the content of OpenSea 2.0's future strategy is unknown, based on OpenSea's recent public actions, it can be inferred that "multi-chain operations" and "how to improve the NFT creator experience" will be part of it. Today (November 10th), OpenSea announced a five-week on-chain creator art competition in collaboration with Optimism, offering a reward of 1 million OP tokens to on-chain creators; in October, OpenSea launched Shipyard, an open-source NFT developer toolset, providing NFT creators with a standardized set of tools to help them build various types of NFT projects.

In addition, with regard to multi-chain layout, many users predict that OpenSea will soon integrate into the Bitcoin ecosystem. Currently, Bitcoin has become the second largest NFT ecosystem, with a trading volume of $76.78 million within the Bitcoin ecosystem in the last 30 days, compared to Ethereum's on-chain NFT trading volume of $227 million. Platforms represented by Binance NFT and OKX NFT Marketplace already support Bitcoin NFT, and recently Binance also launched the BRC20 token representing ORDI, indicating optimism about the future of the Bitcoin ecosystem.

However, OpenSea's layout in the Bitcoin ecosystem seems somewhat slow, as it has not released any information regarding support for Bitcoin NFTs until now.

Some opinions suggest that OpenSea's delay in integrating into the Bitcoin ecosystem can be considered a strategic mistake, as it not only missed the golden development period of the Bitcoin ecosystem (in May and June), but also missed the emerging market that was most likely to bring in new users. In the same multi-chain NFT market track, Magic Eden, after shifting to support the Bitcoin ecosystem this year, not only gained a batch of new users, but also contributed over 60% of its trading volume during the Bitcoin ecosystem's explosive growth in May. However, in October, Magic Eden announced the suspension of BRC20 token trading support.In addition, OpenSea has another major ace up its sleeve that has not yet been revealed, which is related to Token content. Although OpenSea has always operated with the intention of going public and has been rumored to be preparing for an IPO, the move to airdrop NFTs to Gem's historical users when OpenSea Pro went live this year once again gave users hope.

The crypto market's winter will eventually pass, and the NFT market will return to prosperity. However, the question remains whether OpenSea will still be the leader in the NFT market in the next bull market. But for NFT creators, what they are most concerned about is whether OpenSea will continue to prioritize creators and provide sustainable income in terms of royalties to encourage their creative passion. It is obvious that OpenSea's current optional royalty policy does not meet these requirements.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。