Author: Joy, PANews

On the evening of November 9th, regulatory documents showed that BlackRock registered the iShares Ethereum Trust in Delaware. BlackRock has taken the first step towards applying for an Ethereum spot ETF. Previously, BlackRock had similarly registered the iShares Bitcoin Trust 7 days before submitting the Bitcoin spot ETF application to the SEC.

Upon the news, ETH immediately surged from below $1900 to above $2000.

BlackRock submits application for ETH spot ETF, with Coinbase as custodian

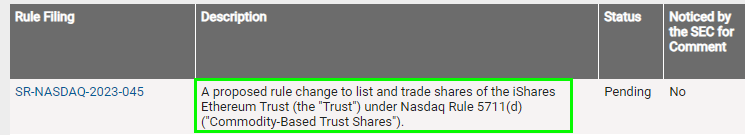

Hours after the filing in Delaware, documents submitted by the U.S. Nasdaq confirmed BlackRock's plan for an Ethereum ETF. The documents revealed that BlackRock, upon regulatory approval, will seek to list the product on a U.S. stock exchange.

According to the documents, BlackRock has chosen the U.S. cryptocurrency exchange Coinbase as the custodian for the ETH held by the product, while an unnamed third party will hold its cash. BlackRock has also signed a market surveillance agreement with Coinbase. Based on the experience of the Bitcoin spot ETF application, such regulatory sharing agreements seem to be crucial for these types of ETFs to obtain approval from the U.S. Securities and Exchange Commission.

To prevent potential objections from the SEC regarding surveillance sharing, BlackRock also pointed out in the application email that the prices of Ethereum futures from the CME Group, which some ETFs already hold, closely match the spot ETH prices. It is believed that either the CME can monitor for market manipulation in the spot market where futures ETFs and spot exchanges trade, or it cannot monitor for any type of product.

BlackRock's application has also boosted confidence in an ETH spot ETF in the market. Bloomberg analyst James Seyffart stated that based on public information, there are currently 5 Ethereum spot ETF applications, including those from Vaneck, ARKInvest/21Shares, Hashdex, Invesco US/Galaxy, and Grayscale's filing to convert ETHE.

It is worth noting that, according to Fox Business Network reporter Charles Gasparino, BlackRock has expressed increasing confidence that the U.S. SEC will approve its spot Bitcoin ETF in January. According to previous reports, the SEC will open an 8-day window during which it may approve all 12 Bitcoin spot ETFs. In theory, from now until January 10, 2024, the SEC can make decisions on 9 of these ETFs at any time.

Crypto market prices "riot," with both long and short positions losing nearly $500 million

Last night, shortly after the sharp rise in ETH, the market suddenly took a turn, experiencing an overall crash. Bitcoin also surged from around $35,000 to slightly below $38,000 on the news, then quickly dropped to around $36,300, and ETH briefly fell below $2000.

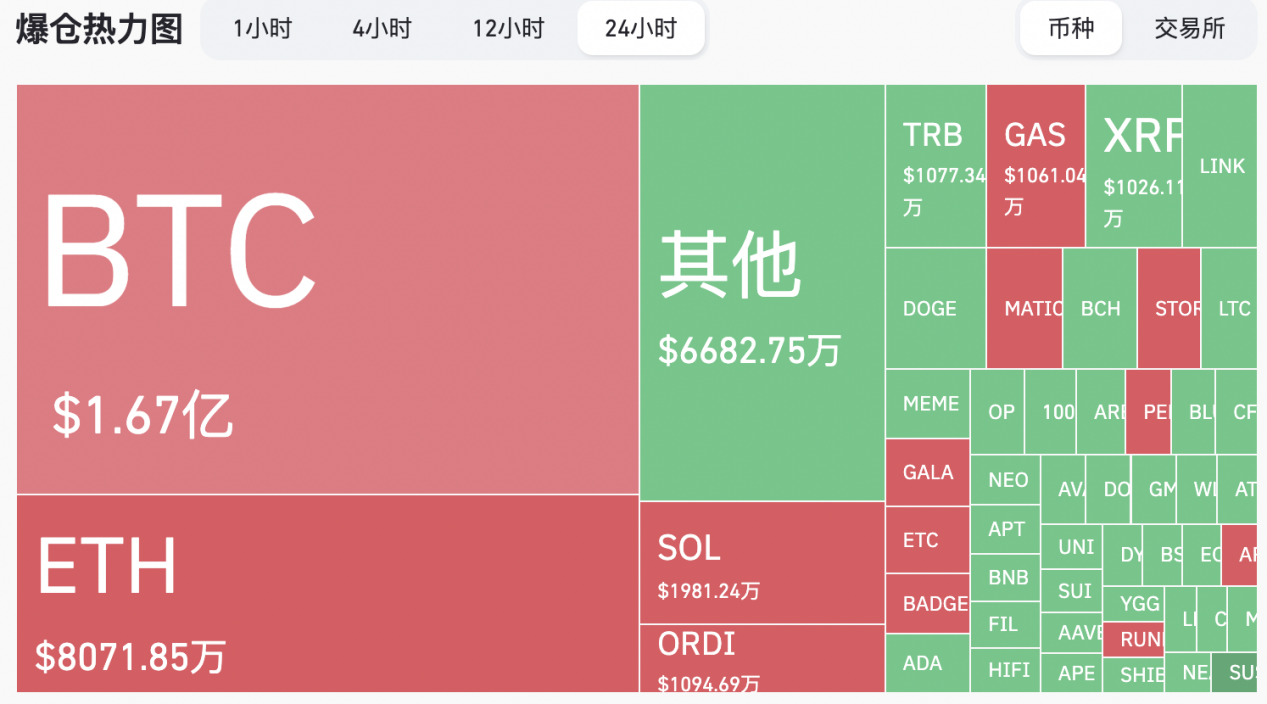

Compared to the decline in mainstream assets, altcoins experienced severe retracements and volatile movements. Projects like TRB, which led the rally in recent days, saw even more dramatic declines. SOL dropped from $48 to $41 during the day, while Ordi fell from $20 to $15. The intense market movements shook leveraged contract traders, causing them to lose their positions.

According to Coinglass data, as of 9 a.m. on November 10th, the cryptocurrency market's total contract liquidations in the past 24 hours amounted to $493 million, with long positions liquidated at $219 million and short positions at $274 million. By currency, BTC liquidations accounted for approximately $167 million, the largest share, while ETH liquidations amounted to approximately $81.95 million. The largest single liquidation occurred on OKX - BTC-USDT-SWAP, worth $14.7616 million.

As of now, the market has stabilized once again, with Ethereum-related concept coins leading the way, such as Staking concept coins like Lido (LDO), Rocket Pool (RPL), and SSV Network (SSV), all showing nearly 20% gains.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。