How long does it take to start a cryptocurrency exchange from scratch? 1 year? 6 months? 1 month? 2 weeks? ChainStar's answer is just 15 minutes.

By Frank, Foresight News

The sound of the bull can be faintly heard. With the expectation of the spot Bitcoin ETF driving the recent market trading enthusiasm, the market has started a general uptrend. At the same time, top exchanges are competing for existing users around concepts like ORDI, and the restart of the market seems to be just a thought away.

This also indicates that the emergence of new trading hotspots at the moment of bear-bull conversion often leads to user migration and reshuffling of the exchange landscape. So, how long does it take to start a cryptocurrency exchange from scratch to quickly seize the opportunity to lay out hot coins?

1 year? 6 months? 1 month? 2 weeks? Just 15 minutes, that's ChainStar's answer.

As a service provider focusing on providing SaaS one-stop solutions for trading platforms, ChainStar aims to enable customers to quickly build a systematic architecture for a cryptocurrency exchange that meets their trading needs without the need for separate development, simply through configuration, covering functions including wallets & liquidity, DEX & CEX, spot & derivatives, etc.

Exchanges, the preferred layout for incremental cryptocurrency markets

In the cryptocurrency industry, exchanges are always the track that most benefits from dividends and gathers wealth, but it is also one of the most fiercely competitive tracks.

It has been a year since the sudden collapse of FTX in early November 2022, and there have been some implicit major changes in the overall landscape of the cryptocurrency industry and the exchange track.

In particular, leading platforms such as Binance, OKEx, and Huobi, as well as numerous small and medium-sized exchanges, have successively introduced proof of reserve assets, further promoting the transparency of exchanges. This has, to some extent, boosted the market's trust in exchanges.

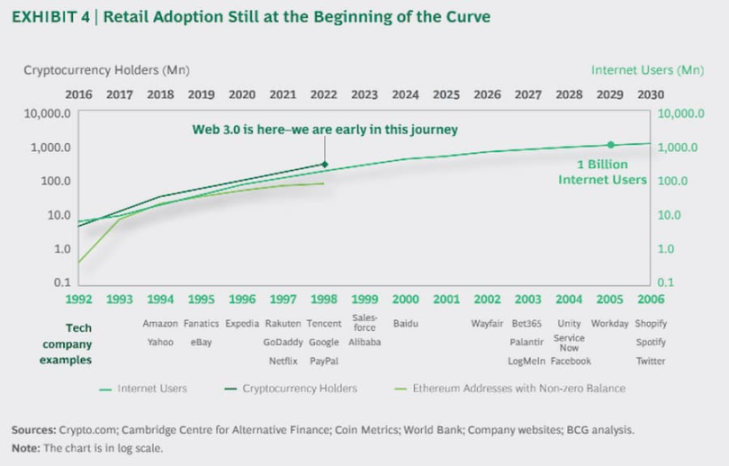

According to a report on the trends and prospects of cryptocurrency exchanges released by the Boston Consulting Group (BCG), cryptocurrency adoption is still in its early stages, with the number of cryptocurrency users expected to reach 1 billion by 2030. It is estimated that the top five exchanges will account for 65% to 75% of spot trading volume and 80% to 90% of derivative trading volume in the future.

Therefore, it is foreseeable that CEX will still be at the core of the cryptocurrency market in the future. With such a large market volume and a constant stream of trading hotspots, there is also an opportunity for emerging exchanges to take off during the incremental explosion period. The trend of the dominance of top exchanges is reaching its peak, and the trend of "one super, many strong" may be the industry's underlying theme in the next wave.

As the first entry point for blockchain traffic, exchanges are essential, high-frequency, and have a long retention time. They can generate revenue through high trading volumes. Therefore, at the end of a bear market and the beginning of a bull market, laying out exchanges is the preferred strategy for tapping into incremental cryptocurrency markets, and the business of "selling water" will naturally become a necessity within the necessity.

However, building an exchange from scratch often requires assembling a complete professional team, including developers, security teams, legal advisors, marketing teams, customer service teams, etc. It also requires a substantial investment to continuously maintain the platform's technical development, security protection, legal compliance review, and market promotion.

From a cost and time perspective, this is extremely unfriendly to exchanges that need to perceive layouts in a timely manner and quickly enter the market. Therefore, one-stop exchange solutions have emerged in the industry, which is not new. Previously, leading exchanges such as Binance, Huobi, and OKEx have provided one-stop solutions for digital asset exchanges.

In theory, trading platforms built on these one-stop solutions from leading exchanges can increase order book depth and liquidity, and share security and guarantee advantages. However, joining the ecosystem of giants has its pros and cons:

The most direct consequence is the loss of autonomy over trading data. The most important user data and trading capabilities of the exchange are left in the ecosystem of the giants. Additionally, the subsequent operation and activities of the exchange will also be highly dependent on the ecosystem of the giants, and emerging exchanges will lose a certain degree of autonomy.

One of ChainStar's greatest competitive advantages is the one-stop efficient solution it brings to enterprise users, allowing new exchanges to be customized and have complete autonomy.

ChainStar's One-Stop Trading Solution

In the eyes of ChainStar, in the ever-changing cryptocurrency market, time means uncertainty. "One step slow, every step slow" means falling far behind.

Therefore, ChainStar's one-stop trading solution directly covers all the functional elements needed to build an exchange from scratch, aiming to take on all the services required to build an exchange, provide the infrastructure needed by users, and modularize elements at all levels, allowing customers with needs to directly get started and act as a "hands-off manager" in terms of technology.

ChainStar's one-stop trading solution specifically includes providing a full-scenario trading solution, full-process service provision, and full-chain packaged services.

Full-Scenario Trading Solution

The demand for trading in today's cryptocurrency market has become very diverse. In addition to spot trading, derivative trading has already accounted for more than 70% of the total trading volume.

ChainStar has built a complete system around cryptocurrency trading, covering services for the entire scenario, including the construction of spot trading, derivative trading (futures contracts, options contracts, etc.), and even DEX trading.

In short, whether customers want to create a new cryptocurrency trading platform or upgrade an existing platform, and whether they want to provide spot trading or include various categories such as derivatives, ChainStar can provide comprehensive support to meet the needs of exchange users to execute various types of cryptocurrency asset trading on the same platform.

Full-Chain Packaged Services

Of course, in addition to trading, exchanges also essentially serve as wallets, payment providers, and liquidity providers, leading to extremely high development complexity and operational capability requirements.

Through packaged services, ChainStar can provide a full-chain service from storing encrypted assets, to providing payments, and to providing liquidity, helping customers quickly obtain all the functional elements of an exchange and securely build and operate a cryptocurrency asset trading platform.

Whether it is building a secure storage wallet for encrypted assets or integrating payment functionality and trading liquidity, ChainStar can provide full-chain service support.

In addition, some enterprises wish to have complete control over their trading platform and deploy it in their private environment to ensure data privacy and security. ChainStar also supports the private deployment of white-label platforms, meaning that customers can have their own trading infrastructure and customize it as needed.

Full-Process Service Provision

Exchanges are a long-term endeavor, so rapid site deployment is just the first step. After seizing the opportunity, subsequent operational support and user services are also enduring tests.

In this regard, ChainStar can also provide a professional customer support team to assist users in solving problems, obtaining market insights, and providing trading advice.

Furthermore, every enterprise has unique needs, and ChainStar can provide highly customized solutions, tailored to the specific requirements of each customer through private configuration.

Service Advantages of ChainStar

So, what specific advantages does ChainStar's lightweight, one-stop, 15-minute lightning-fast site deployment service have compared to traditional one-stop digital asset exchange solutions?

Rapid Site Deployment, Ultra-Fast Launch

Firstly, in terms of deployment cycle, traditional exchange site construction models usually take several months to a year or even longer to complete. Even some SaaS one-stop solutions also require several weeks to complete the deployment, including demand analysis, system design, development, testing, and launch.

By comparison, ChainStar's SaaS exchange deployment cycle only takes 15 minutes, allowing exchange operators to connect to ChainStar's liquidity pool and quickly launch the exchange in less than 5 minutes.

Minimal Configuration and Human Resource Requirements

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。