Behind Circle's exposure to the possibility of another IPO, its flagship product USDC is facing regulatory uncertainty and a significant decline in market value, posing many tests. Whether it will restart its listing and achieve success remains a big question mark.

By Nancy, PANews

On November 8, according to Bloomberg, citing anonymous sources, stablecoin USDC issuer Circle is in talks with advisors, considering an IPO in early 2024.

Looking back at Circle's path to listing, it has encountered many setbacks, even pressing the "pause button" at one point. The exposure to the possibility of another IPO is due to the regulatory uncertainty and a significant decline in market value faced by its flagship product USDC. Whether it will restart its listing and achieve success remains a big question mark.

Restarting IPO still uncertain, reverse merger listing delayed multiple times and eventually terminated

Bloomberg reported that Circle is in talks with advisors to prepare for a possible IPO. However, the review is still ongoing, and it is uncertain whether Circle will decide to go public, and it is not clear how much valuation Circle hopes to achieve through the IPO.

However, based on Circle's fundraising of $400 million at a valuation of $7.7 billion from financial institutions such as Goldman Sachs, BlackRock, and Fidelity in 2022, its valuation has significantly shrunk compared to before.

As early as July 2021, Circle announced its merger with SPAC company Concord Acquisition (CND.US) to be listed on the NYSE, with the transaction expected to be completed in the fourth quarter. According to the terms of this merger, Circle's valuation would reach $4.5 billion. After more than half a year, riding on the rapid growth of its main business stablecoin USDC's market share, Circle announced that it had reached new terms with Concord Acquisition, raising the valuation to $9 billion. At the same time, Circle's CFO Jeremy Fox-Geen also stated that regardless of market conditions, Circle would go public through SPAC by the end of 2022.

However, Circle has encountered setbacks on its path to listing, with the acquisition deal being repeatedly delayed. The terms of the transaction, originally scheduled to be completed on June 10, were postponed again for 6 months to December 10. As the agreed-upon transaction time approached, Concord announced in November 2022 that it planned to further postpone the acquisition transaction to the end of January 2023, citing the board's belief that there was not enough time to convene a special shareholder meeting to approve the transaction. However, compared to the first postponement, this delay of nearly seven weeks led the market to speculate that the reason Circle had not completed the transaction might be more procedural than unfavorable current market conditions.

In December 2022, Circle announced the termination of the SPAC merger agreement, which was approved by Concord and Circle's board. For this reason, Circle also admitted in January of this year that it was the U.S. SEC that "sabotaged" its SPAC listing plan, not the turmoil in the crypto market. "Because the SEC has not declared our S-4 registration (S-4 registration refers to the registration document that a company must submit to the SEC to seek permission to issue new shares) effective, we cannot complete the business combination before the expiration of the transaction agreement."

In other words, from the first submission of the SPAC listing application in 2021 to December 2022, Circle did not receive a response from the SEC during the 15-month application review period. In response, insiders said that Circle wasted a long time during this period, but the "regulatory chaos" in the interaction between the United States and crypto companies was prevalent for most of 2021.

However, although Circle was disappointed by the proposed transaction's overtime, its CEO Jeremy Allaire also stated that making Circle a public company is still part of its core strategy to enhance trust and transparency.

USDC's market value almost halved, coupled with regulatory risks, Circle faces numerous obstacles to listing

As the cryptocurrency market has shown signs of recovery, although the news of Circle's potential listing has brought optimistic expectations to the market, Circle faces numerous obstacles to listing.

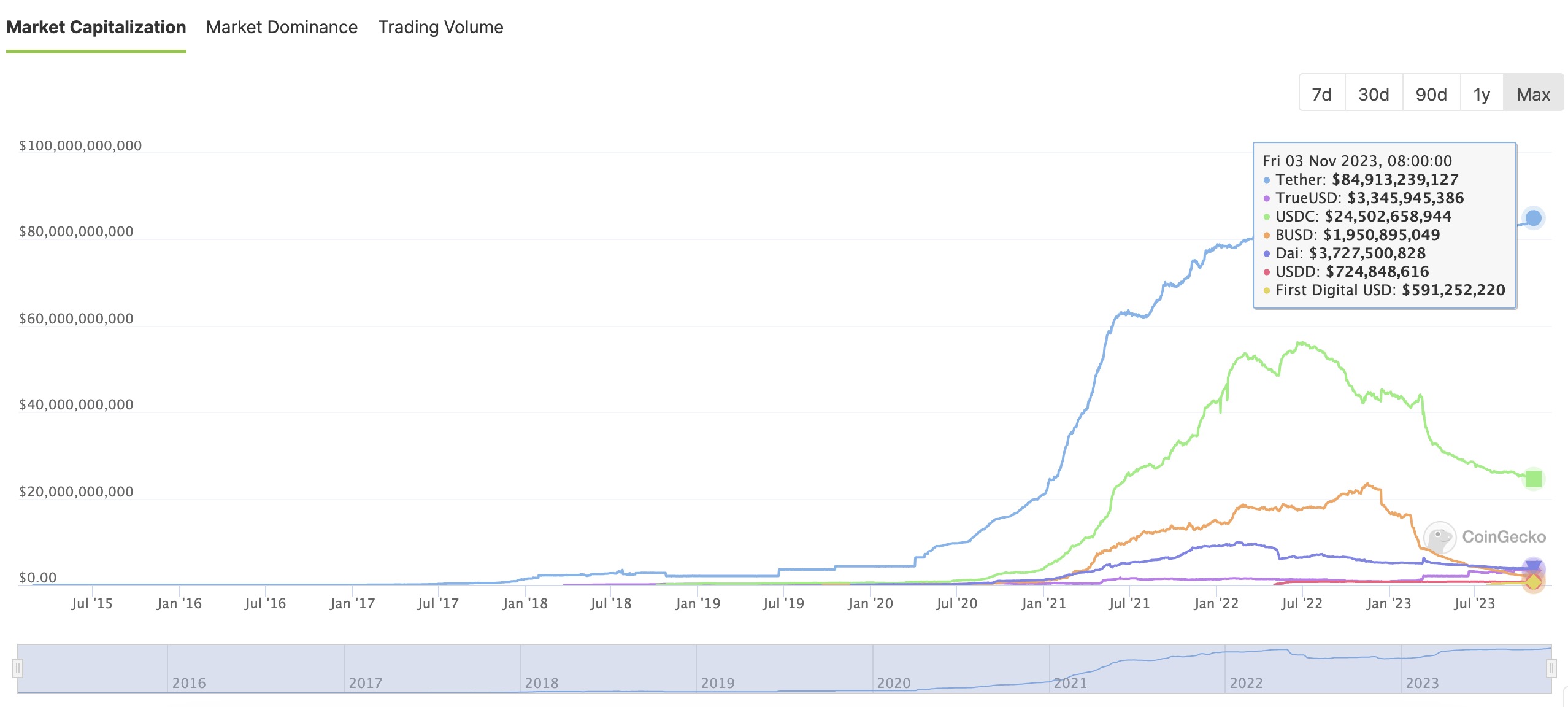

On the one hand, the market share of stablecoin USDC has been continuously shrinking. According to CoinGecko data as of November 8, the total market value of USDC has decreased by about 45.2% since the beginning of this year, almost halving from its historical high, and its market share has also dropped from 33.26% to 19.94%. In contrast, competitors such as USDT and DAI have been expanding their market share, while the entry of traditional payment giants like PayPal has intensified the competition in the stablecoin race. In fact, since the turmoil caused by the run on Silicon Valley Bank earlier this year, there has been a significant outflow of funds, with MakerDAO once initiating an emergency proposal to limit USDC exposure.

The green line in the image represents USDC. Source: CoinGecko

In response, Circle has made several business adjustments. For example, in June of this year, Circle resumed purchasing U.S. Treasury bonds as reserve assets for USDC to protect it from potential impacts of U.S. debt defaults; in July, Circle stated that it had made slight layoffs to maintain a "strong balance sheet" that would allow it to "focus on core business activities and execution," while earlier this year, its CFO Jeremy Fox-Geen had planned to increase the number of employees by 25% for expansion; in August, Coinbase invested in Circle to continue its long-term success in adjusting and investing in stablecoins (especially USDC). At the same time, USDC also plans to deploy USDC on 6 new blockchains including Polygon PoS, Base, Polkadot, NEAR, Optimism, and Cosmos; in the same month, Circle also launched an ecosystem funding program, providing up to $100,000 in USDC funding support, and more.

On the other hand, there is a trend of stricter regulation surrounding stablecoins. Since the beginning of this year, the United States and other countries have increased their regulation of stablecoins, such as the previous elimination of BUSD due to U.S. SEC regulatory crackdown. In response, Circle has begun to expand into markets outside the United States, including obtaining a payment license in Singapore and planning to issue stablecoins in Japan. At the same time, Circle has made significant investments in lobbying legislators. Since the end of 2021, Circle has been working with strategic consulting firm Invariant for lobbying efforts, and has spent at least $560,000, with the company's quarterly lobbying budget currently at $100,000. However, as stablecoin regulation becomes clearer and even implemented in the future, compliant stablecoins may usher in development opportunities, and with the "compliant and transparent" label, Circle is the stablecoin issuer with the most regulatory licenses.

However, in addition to USDC, Circle has disclosed that its core businesses also include equity crowdfunding platform SeedInvest and Trading and Treasury Services (TTS), with TTS accounting for 56% of Circle's revenue, while USDC's revenue has not been disclosed. However, SeedInvest was sold to crowdfunding platform StartEngine in October last year, and Circle hopes to focus on developing stablecoin products. At the same time, Circle's revenue has shown a significant increase compared to last year. According to Circle's latest financial data, its revenue for the first half of 2023 was $7.79 billion, exceeding the full-year revenue of $7.7 billion in 2022. Circle's adjusted EBITDA for the first half of the year was $2.19 billion, also surpassing the full-year revenue of $1.5 billion in 2022.

Overall, although Circle's revenue has improved, it still faces regulatory risks and the dilemma of USDC's continuously shrinking scale, making the road to restarting its IPO uncertain and fraught with obstacles.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。