Authored by:MicroStrategy

Compiled by:TaxDAO

MicroStrategy is a well-known enterprise analytics software company that has attracted widespread attention in recent years for its unique approach to managing Bitcoin. The company's financial statements, particularly its 10-Q report, provide valuable information about its strategies and their impact on its financial condition. This article compiles and analyzes the key aspects of MicroStrategy's presentation of Bitcoin assets in its third-quarter financial report.

Asset Classification and Measurement:

MicroStrategy records and measures its digital assets (limited to Bitcoin) in accordance with Accounting Standards Codification ("ASC") 350, the accounting rules for indefinite-lived intangible assets. These digital assets are initially recorded at cost and subsequently measured at fair value based on their net cost since acquisition. Impairment losses are recognized as "digital asset impairment losses" in the company's consolidated statement of income during the period in which the impairment occurs. Gains, if any, are only recognized upon sale, at which point the gains are presented in the company's consolidated statement of income net of any impairment losses. In determining the recognized gains upon sale, the company calculates the difference between the sales price of specific Bitcoin sold immediately prior to the sale and its carrying amount.

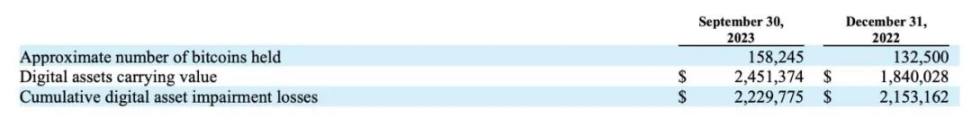

The company's digital asset holdings are shown in the table below (in thousands, except for Bitcoin quantities):

As of:

- December 31, 2022, the company held 132,500 Bitcoins;

- September 30, 2023, the company held approximately 158,245 Bitcoins. The carrying value of Bitcoin was $2,451,374,000, an increase from $1,840,028,000 as of December 31, 2022. Accumulated digital asset impairment losses were $2,229,775,000, slightly up from $2,153,162,000 as of December 31, 2022.

Digital Asset Purchases

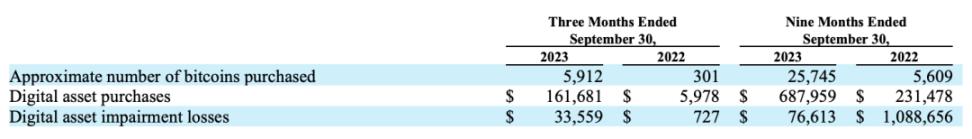

The company's digital asset purchases are shown in the table below (in thousands, except for Bitcoin quantities):

For the specified periods:

- In the third quarter of 2022, the company only purchased 301 Bitcoins, totaling $5,978,000;

- In the same period of 2023, the company purchased 5,912 Bitcoins, totaling $161,681,000.

- In the first nine months of 2022, the company only purchased 5,609 Bitcoins, totaling $231,478,000;

- In the same period of 2023, the company purchased a total of 25,745 Bitcoins, totaling $687,959,000.

In addition, the company may obtain short-term credit lines from Coinbase or other executing partners to pre-purchase Bitcoin before using cash funds. These trade credit lines are to be settled in cash within a few days of being provided. As of September 30, 2023, the company had no outstanding trade credit lines. As of September 30, 2023, the carrying value of approximately 15,731 Bitcoins held by the company was approximately $251.1 million, and these Bitcoins are included in the company's consolidated balance sheet as part of the 6.125% senior secured notes due 2028. All of the company's Bitcoins were previously pledged as collateral for a $205 million term loan issued by MicroStrategy LLC, a wholly-owned subsidiary of MicroStrategy Incorporated, to Silvergate Bank, and were released from collateral after the repayment of the 2025 term loan in the first quarter of 2023. The company's Bitcoin acquisition strategy generally involves using liquid assets in excess of operating working capital requirements to purchase Bitcoin, and at times, raising debt or equity securities or engaging in other capital-raising transactions to use the proceeds to purchase Bitcoin based on market conditions. The company considers its Bitcoin holdings as long-term holdings and expects to continue accumulating Bitcoin. The company has not established specific Bitcoin holding targets and will continue to monitor market conditions to determine whether additional financing should be pursued to acquire more Bitcoin. This overall strategy also includes the company potentially (i) periodically selling Bitcoin for general corporate purposes, including generating cash for financial management or tax-advantaged strategies consistent with applicable laws, (ii) engaging in additional capital-raising transactions with the company's Bitcoin holdings as collateral, and (iii) considering pursuing additional strategies to generate income or otherwise raise funds using the company's Bitcoin holdings.

The company believes that Bitcoin is attractive as a store of value due to its robust and publicly accessible open-source architecture, unaffected by sovereign monetary policies. Additionally, the company believes that due to the limited supply of Bitcoin, it has the potential to appreciate if adopted, while also having the potential to serve as a hedge against inflation. Furthermore, the company believes that its Bitcoin acquisition strategy complements its enterprise analytics software business, as the company believes that its Bitcoin and activities supporting the Bitcoin network contribute to enhancing its brand awareness. The company is also exploring integrating features into its software products to leverage the Lightning Network, a second-layer decentralized payment protocol built on top of the Bitcoin blockchain, aimed at achieving fast and low-cost transactions.

Impairment Losses:

Digital asset impairment losses are a significant component of the company's operating expenses. During the three months ended September 30, 2023, digital asset impairment losses amounted to $336,000, representing 26.2% of the company's operating expenses, whereas during the three months ended September 30, 2022, digital asset impairment losses were $7,000, accounting for 0.8% of operating expenses. For the nine months ended September 30, 2023, digital asset impairment losses were $7.66 million, representing 21.1% of operating expenses, while for the nine months ended September 30, 2022, digital asset impairment losses amounted to $1.089 billion, accounting for 79.3% of operating expenses.

Related Taxation

The company calculates its cumulative income tax liability or benefit by applying the estimated annual effective tax rate to the year-to-date cumulative pre-tax income or loss and adjusts the income tax liability or benefit to reflect discrete tax items recorded in the period.

The estimated effective tax rate fluctuates based on the relative impact of income and loss levels in various tax jurisdictions, differences in foreign tax rates, and the relative impact of permanent book-tax differences. Each quarter, any fluctuations compared to the estimated annual effective tax rate are recorded as cumulative adjustments. Due to these factors and the potential for changes in the company's results during the period, the company's effective tax rate and the corresponding income tax liability or benefit may fluctuate.

For the nine months ended September 30, 2023, the company recorded an income tax benefit of $403.9 million on the basis of a pre-tax loss of $63.9 million, resulting in an effective tax rate of 632.2%. For the nine months ended September 30, 2022, the company recorded an income tax liability of $112 million on the basis of a pre-tax loss of $11.08 billion, resulting in an effective tax rate of (-10.1%). The change in effective tax rate compared to the same period of the previous year is primarily due to (i) the release of a portion of the valuation allowance related to deferred tax assets associated with the impairment of the company's Bitcoin holdings, as the market value of Bitcoin increased as of September 30, 2023, compared to December 31, 2022, and (ii) the establishment of a valuation allowance related to deferred tax assets associated with the impairment of the company's Bitcoin holdings, as the market value of Bitcoin decreased as of September 30, 2022, compared to December 31, 2021.

As of September 30, 2023, the company's valuation allowance was $1.184 billion, primarily related to deferred tax assets associated with the company's Bitcoin holdings, which, based on the company's current estimates, are less likely to be realized. If the market value of Bitcoin declines or the company does not generate profits in future periods, the company may need to increase the valuation allowance for deferred tax assets, which could have a significant adverse impact on net income (loss). If the market value of Bitcoin increases, the company may reduce the valuation allowance for deferred tax assets. The company will continue to periodically assess the realizability of deferred tax assets.

The company records liabilities related to its uncertain tax positions. As of September 30, 2023, and December 31, 2022, the total unrecognized tax benefits, including accrued interest, were $6.3 million and $6.1 million, all of which are recorded in the company's balance sheet as "other long-term liabilities."

Risk Analysis

The various risks associated with Bitcoin that the company faces include, but are not limited to:

1. Bitcoin is a highly volatile asset. Bitcoin is a highly volatile asset, with prices on the Coinbase exchange (the company's primary Bitcoin market) having been below $20,000 per Bitcoin and above $35,000 per Bitcoin in the 12 months preceding the reporting date for this quarter. 2. Bitcoin does not pay interest or dividends. Bitcoin does not pay interest or other returns, and the company can only create cash flow from its Bitcoin holdings by selling Bitcoin or implementing strategies to utilize the company's Bitcoin holdings in other ways. Even if the company pursues such strategies, it may not be able to generate cash flow from its Bitcoin holdings, and any such strategies may expose the company to additional risks. 3. The company's Bitcoin holdings significantly impact the company's financial results and the market price of Class A common stock. The company's Bitcoin holdings have significantly impacted the company's financial results, and if the company continues to increase its total Bitcoin holdings in the future, they will have a greater impact on the company's financial results and the market price of Class A common stock. Refer to "Risks Related to the Company's Bitcoin Acquisition Strategy and Holdings - The historical financial statements of the company do not reflect the potential for changes in earnings that the company may experience in the future due to its Bitcoin holdings." 4. The company's Bitcoin acquisition strategy has not been tested over a long period or under different market conditions. The company is continuously studying the risks and returns of its Bitcoin acquisition strategy. This strategy has not been tested over a long period or under different market conditions. For example, although the company believes that Bitcoin has the potential to serve as a long-term hedge against inflation due to its limited supply, the short-term price of Bitcoin has declined during recent periods of increased inflation. Some investors and other market participants may disagree with the company's Bitcoin acquisition strategy or the actions taken by the company to execute it. If the price of Bitcoin declines or the company's Bitcoin acquisition strategy performs poorly, the company's financial condition, operating results, and the market price of Class A common stock may be significantly adversely affected. 5. The company bears counterparty risk, including risks associated with its custodian. Although the company has taken various measures to mitigate its counterparty risk, including storing almost all of its Bitcoins in custody accounts with institutional-grade custodians in the United States and negotiating contractual arrangements to establish the property rights of the custodian-held Bitcoins free from claims by the custodian's creditors, the bankruptcy law regarding the holding of digital assets in custody accounts has not been fully developed. If in such custodian bankruptcy, receivership, or similar bankruptcy proceedings, the custodian's property rights to the company's Bitcoins are considered the custodian's bankruptcy estate, the company may be treated as a general unsecured creditor of such custodian, limiting the company's exercise of ownership rights related to such Bitcoins, which may ultimately result in a loss of part or all of the value of the Bitcoins. Even if the company is able to prevent its Bitcoins from being considered the custodian's bankruptcy estate during the bankruptcy proceedings, there may be delays or other difficulties in accessing the company's Bitcoins during the affected period. Any such outcome may significantly adversely affect the company's financial condition and the market price of Class A common stock. 6. Changes in the accounting treatment of the company's Bitcoin holdings may have significant accounting impacts, including increased volatility of the company's results. On March 23, 2023, the Financial Accounting Standards Board (FASB) issued a proposed Accounting Standards Update (ASU) requiring the measurement of eligible crypto assets, such as Bitcoin, at fair value with fair value changes recorded in current earnings. On September 6, 2023, the FASB held a meeting to review feedback received on the exposure draft and reconsider other issues. At the end of the meeting, the FASB determined that the expected ASU benefits outweigh the expected costs and directed FASB staff to draft the final ASU for a written ballot. Under the current proposal, the ASU will be effective for fiscal years beginning after December 15, 2024, including interim periods within those fiscal years. The FASB also confirmed that the proposed ASU will allow early adoption. The FASB indicated that they expect to hold a vote in the fourth quarter of 2023 to approve the final ASU. Changes in the accounting treatment of Bitcoin holdings, such as the adoption of a final ASU similar to the exposure draft, may have significant impacts on the company's operating results in future periods, potentially increasing the volatility of the company's reported operating results, affecting the carrying value of Bitcoin on the company's balance sheet, and may result in adverse tax consequences, which may significantly adversely affect the company's financial results and the market price of Class A common stock.免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。