Original Author: Matthew Lee

Recently, there have been reports that BlackRock is seeking potential cooperation with top market makers such as Jane Street and Jump Trading, hoping to assist BlackRock in market making after the approval of a Bitcoin spot ETF. The potential cooperation between market makers and BlackRock has once again sparked confidence in the market's recovery, especially as the market's liquidity has been continuously depleting since the bankruptcy of FTX last year and the collapse of crypto banks Signiture and Silvergate this year.

Since the regulatory investigation into cryptocurrencies started in June, the market has become increasingly fragile. More people are pointing to the gradual withdrawal of market makers such as Jump Trading and Jane Street from the cryptocurrency market due to regulatory uncertainty, leading to liquidity depletion. Industry giant Coinbase also revealed in its latest financial report that the withdrawal of market makers led to a significant loss of trading volume.

Source: Coinbase Q3 Earnings

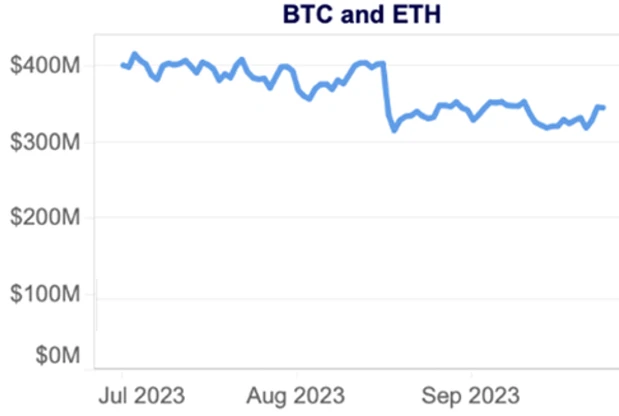

According to data from Kaiko, from early July to mid-August, the market depth decreased by approximately 15%, highlighting the importance of market makers to the market.

*The 1% market depth refers to the amount of trading volume required to increase the asset price by 1%. For example, in early July, it required $400 million to increase the price by 1%, but by mid-August, only $320 million was needed.

Source: Jane Street Research

With the gradual weakening of market depth, any slight movement can cause significant fluctuations in asset prices. For example, in August, the announcement of Evergrande's bankruptcy protection and Tesla's liquidation of a certain amount of Bitcoin in the past quarter caused BTC prices to drop by over 16.7%. In October, fake news about the approval of a Bitcoin spot ETF caused the entire market to surge by nearly 17%. These seemingly irrational surges or plunges are mainly due to the withdrawal of market maker liquidity.

Therefore, not only BlackRock, but every ETF management company will actively hire market makers to help mitigate the impact of large trades or concentrated trading orders on ETF prices. This is especially important for less active ETFs that may not have other investors willing to buy on a given day. Without market makers' intervention, slippage could significantly increase, causing the price at which trades are executed to be around 10% away from the most recent market price, potentially leading to a 90% drop in the ETF's share price.

In addition to providing liquidity, market makers also serve two main purposes:

When asset prices experience significant fluctuations, market makers take counteractive measures to stabilize the ETF.

If a market maker provides $10 million in liquidity for a digital asset, when the asset price rises by 10%, the market maker's long position is worth $8 million. Although the asset may continue to rise to 8%, for risk management reasons, the market maker may start increasing sell orders and decreasing buy orders when the rise reaches 5%. This counteractive measure helps slow down the pace of price fluctuations.

Arbitrage allows the ETF's value to reflect the true price of the underlying assets.

Bitcoin trading is 24/7, while the liquidity of ETFs in the US stock market is limited to certain times. When liquidity is lacking, the NAV of the ETF may not reflect the true asset price of BTC, leading to a price difference between the ETF and the spot market. Market makers' arbitrage activities can significantly reduce this price difference.

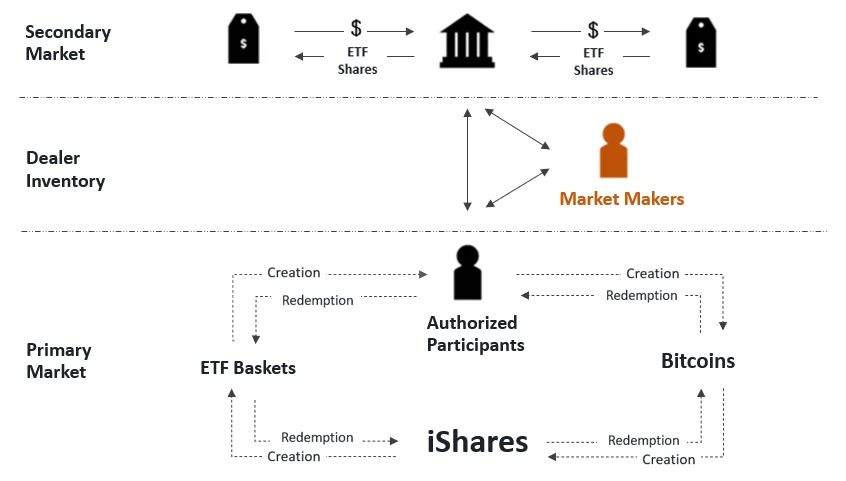

Market makers not only provide crucial liquidity and active supervision for ETFs, but also play a critical role in the creation and redemption process of ETFs, ensuring that the prices investors pay when buying or selling reflect the value of Bitcoin in the ETF.

Similar to stocks, ETFs primarily operate in the primary and secondary markets. In the primary market, BlackRock first issues a large amount of Bitcoin to authorized participants (APs) as an exchange for ETF shares. After receiving the ETF unit assets (Bitcoin), authorized participants also act as market makers and enable ETF units to be traded in the secondary market. Investors can trade ETF units with market makers or other investors on the exchange on a daily basis, just like trading stocks. As shown in the diagram below:

How can ordinary users benefit from market maker participation in ETFs?

As shown in the diagram, the primary market activities of spot ETFs account for the majority of issuances, requiring the participation of numerous institutions in the creation and redemption of ETF shares. For example, custody businesses dominated by institutions such as Coinbase, The Bank of New York Mellon, and Paxos indirectly provide a more secure way for ordinary investors to store and manage digital assets. Through investment custody service providers, ordinary users can generate returns. For example, despite a net loss in the third quarter, Coinbase's stock rose by over 8% on the day of its financial report disclosure.

Alternatively, compliance businesses dominated by on-chain data companies such as OKLink, Chainalysis, and Elliptic help financial institutions and regulatory bodies identify and track the compliance of digital assets. For example, they assist custody companies or fund management companies in verifying the source of digital assets to ensure that funds do not violate anti-money laundering regulations and incur regulatory penalties.

Ordinary users can not only participate in investments in ETFs and other "upstream industries," but can also use tools provided by on-chain data companies, such as the OKLink browser function, to browse and monitor the transactions and fund flows of publicly available ETF-related wallet addresses, better observe the fund dynamics of underlying assets, and ensure a clearer understanding and participation in the digital asset market and blockchain ecosystem, as well as better risk management and improved rational investment decision-making.

Conclusion

Market makers play a crucial role in the cryptocurrency field, contributing to the development and promotion of new projects while reducing trading costs and improving trading efficiency. Improper behavior by some new market makers in the past has led to market resistance, with some believing that market makers disrupt market fairness as "dealers." Therefore, market makers also need to comply with industry and regulatory standards to maintain their reputation and gain support from the market and compliance.

References

Jump Trading 13F annual report,

https://wallmine.com/fund/3mg/jump-trading-llc#google_vignette

Management of ProShares Trust,

Do market makers affect stock prices in the US stock market,

https://www.gelonghui.com/p/46676

Proshare Trust Registration Statement,

https://www.sec.gov/Archives/edgar/data/1174610/000168386321004445/f9424d1.htm

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。