Author | Peter

Foreword: Since its establishment, Web3CN has published over 1000 original articles and researched over 300 high-quality blockchain projects. We focus on fundamental infrastructure projects such as public chains, ZK, Layer2, as well as the most explosive potential DeFi, NFTFi, and GameFi applications. If you are interested in investing in the above tracks, welcome to join the Web3CN core user community for discussions. WeChat ID: Web3CN_ (Web3CN Research Assistant). When adding, please indicate the track of interest so that the assistant can add you to the corresponding community. Otherwise, the assistant may not accept your friend request.

Introduction:

When it comes to BTC Layer2, it seems to be a strange and awkward topic, as if working on Layer2 for BTC is very politically incorrect. In fact, the well-known Lightning Network is one of the most famous BTC Layer2 solutions.

The core goal of the Lightning Network is to expand the payment scenarios for Bitcoin, allowing BTC to overcome the constraints of low TPS and high GAS fees on the Bitcoin blockchain, enabling fast and inexpensive BTC payments on the Lightning Network Layer2.

Today, we are going to discuss BEVM, which is a BTC Layer2 compatible with EVM. Its core goal is to expand the smart contract scenarios for Bitcoin, allowing BTC to break free from the constraints of non-Turing complete and lack of smart contract support on the Bitcoin blockchain, enabling BTC to build decentralized applications with BTC as the native GAS on the BEVM Layer2.

Although they take different paths, both aim to expand the application scenarios for Bitcoin, enhancing BTC Layer1 while expanding more application scenarios and possibilities for Bitcoin on Layer2.

BEVM: A BTC Layer2 with BTC as Gas and EVM Compatibility

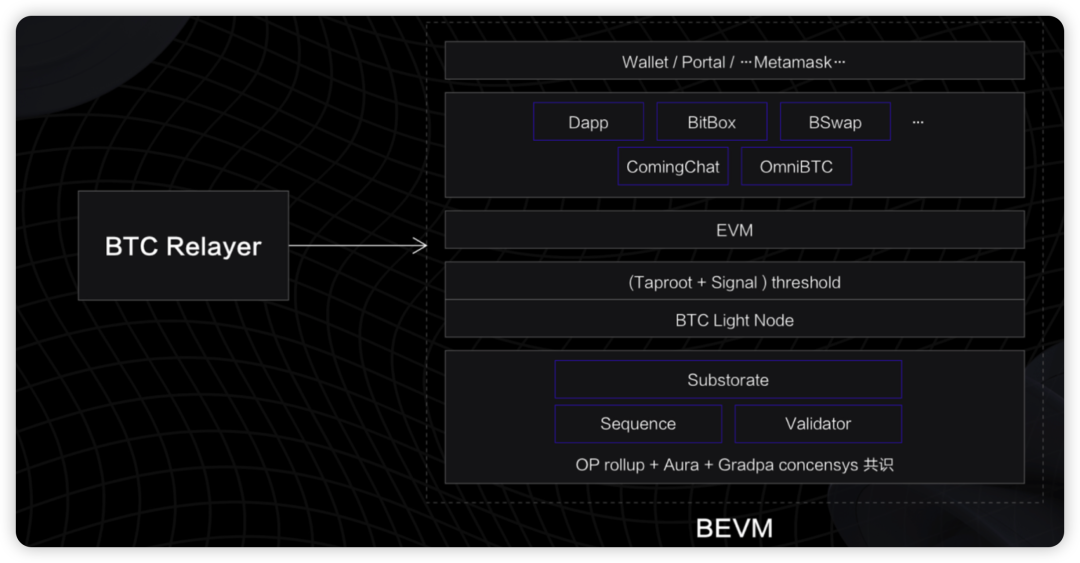

The design concept of BEVM is to directly utilize Bitcoin's native technology to achieve decentralized BTC Layer2 without changing the original Bitcoin technical framework. The specific approach involves Musig2 aggregated multi-signature technology and Bitcoin light nodes to achieve decentralized cross-chain to BTC Layer2. Since Layer2 is fully compatible with EVM, it can easily enable various decentralized applications for BTC.

The design concept of EVM also implies a consensus within the crypto community: attempting to run complex smart contracts on the Bitcoin Layer1 is not feasible and contradicts Satoshi Nakamoto's original design principles for Bitcoin. Therefore, Bitcoin's native technology should be used to decentralize BTC in a secure manner to Layer2, allowing BTC to break free from the constraints of the Bitcoin Layer1 framework and revitalize itself. This is also the design concept for many ETH Layer2 solutions in relation to ETH. Since ETH Layer2 has achieved widespread success, BTC Layer2 can also replicate this success!

So, how does BEVM achieve decentralized BTC Layer2?

To understand this question, we need to start with the 2021 BTC Taproot upgrade.

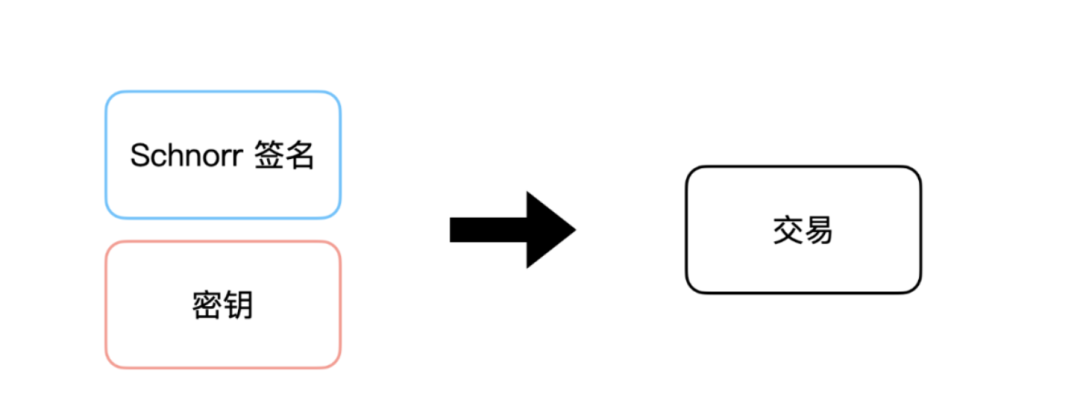

The 2021 BTC Taproot upgrade introduced Schnorr Signature, and the Musig2 aggregated signature technology enabled decentralized multi-signature for BTC, opening up significant applications for decentralized multi-signature on BTC Layer2.

Schnorr Signature is a digital signature algorithm named after the German mathematician and cryptographer Claus-Peter Schnorr. When designing the Bitcoin protocol in 2008, this algorithm was not open-source, so Satoshi Nakamoto did not use this signature algorithm and instead chose the already open-source Elliptic Curve Digital Signature Algorithm (ECDSA).

However, Bitcoin core developers discovered over a decade of practice that Schnorr Signature is the future of Bitcoin due to its cryptographic advantages, providing more secure, convenient, and scalable services for Bitcoin. One of the most prominent advantages is the ability to easily and discreetly construct decentralized multi-signature transactions. These signature addresses can involve hundreds or even thousands of participants without affecting the signing speed. Therefore, after the Taproot upgrade, Schnorr Signature was officially introduced to the Bitcoin network, ushering in a new era for decentralized multi-signature on Bitcoin.

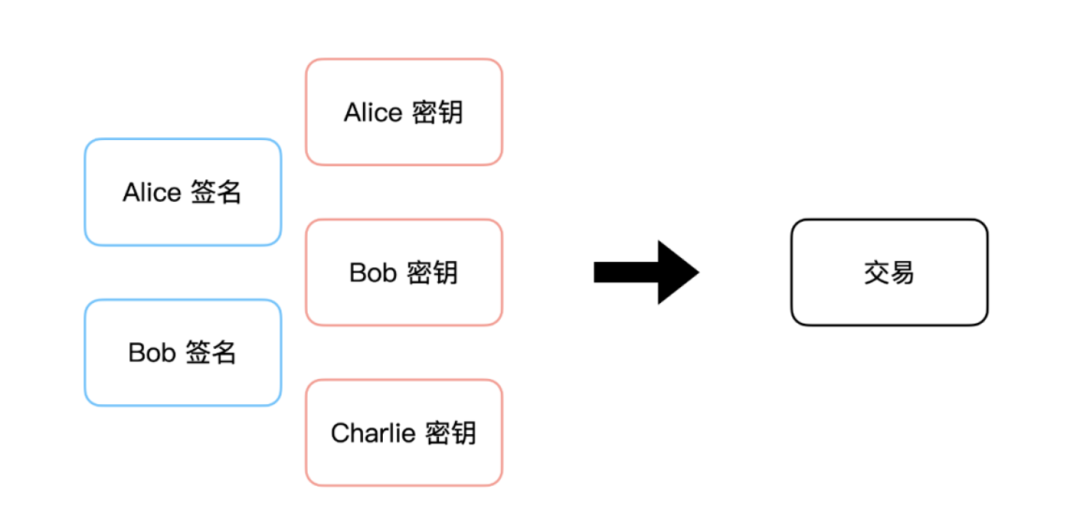

So, what is the difference between the multi-signature implemented by Schnorr Signature and traditional multi-signature?

Essentially, Schnorr Signature does not implement traditional "multi-signature" in the traditional sense, but rather a form of aggregated signature technology. This brings us to the Musig2 aggregated signature technology. For example:

In the Musig2 scheme, if the goal is to collectively manage 100 BTC wallet addresses, creating a multi-signature with 100 addresses, the private keys of these 100 addresses will collectively generate an aggregated public key address. Then, a valid signature is created for this aggregated public key to manage BTC assets (decentralized Bitcoin asset management). When assets need to be transferred, only the aggregated public key and a valid signature are required to transfer the assets. This significantly reduces transaction size, lowers costs, increases speed, and ensures decentralization.

Traditional multi-signature

On the other hand, the traditional multi-signature approach requires 2/3 of the 100 wallet addresses to be individually signed, which is a complex process and generates significant data, leading to block congestion, reduced speed, and increased costs. In theory, traditional multi-signature rarely involves 100 addresses simultaneously, making it difficult to achieve true decentralized BTC asset management. Similar to WBTC, which uses a traditional multi-signature approach and relies on a single company (BitG) to custody the BTC, while RenBTC and TBTC use distributed multi-signature, they still cannot achieve true decentralized multi-signature. Traditional and distributed multi-signature addresses are generally set to 5-7 or 9-11, and having over 11 multi-signatures significantly impacts security and efficiency. In contrast, Musig2 aggregated multi-signature can manage hundreds or even thousands of BTC addresses simultaneously, ensuring decentralization without compromising cost and speed.

Schnorr Signature

BEVM is based on Musig2 decentralized multi-signature to enable BTC to cross to BTCLayer2, completely decentralized. Additionally, BEVM introduces the mature SIgnal privacy network. When the collective public key needs to participate in a transfer, the participating multi-signature addresses directly perform rapid private signatures in the SIgnal network, and the final transaction is uploaded to the Bitcoin blockchain.

So, how does BEVM (Layer2) communicate in real-time with the BTC blockchain (Layer1)?

As mentioned earlier, BEVM uses Musig2 technology to enable BTC to cross to Layer2 in a decentralized manner. Furthermore, BEVM creatively anchors the addresses participating in aggregated multi-signature and the nodes maintaining the Layer2 network one-to-one. In other words, the nodes maintaining the Layer2 network also participate in managing BTC assets, further ensuring the security of Layer2. To ensure communication between Layer1 and Layer2, these participating nodes are all BTC light nodes, capable of reading real-time dynamics on the BTC chain, ensuring real-time communication between L1 and L2.

The technical architecture diagram of BEVM's BTC Layer2 allows for the deployment of DeFi, GameFi, SocialFi, NFTFi, and all other decentralized applications on the ETH EVM, which can also be deployed on BEVM. The only difference is that ETH Layer2 uses ETH as GAS, while BTC Layer2 uses BTC as Gas. Each transaction on BTC Layer2 will be packed into BTC Layer1 in a 10:1 ratio, allowing BTC Layer2 to share the security of BTC Layer1.

How legitimate is BEVM, and will it receive widespread support from the BTC community?

The Bitcoin community highly values legitimacy. A project with strong legitimacy signifies deep roots and will receive support and endorsement from the Bitcoin community. The assessment of legitimacy generally involves three aspects:

1. Whether it changes the original Bitcoin architecture (unless it is a Bitcoin upgrade achieved through community consensus)

2. Whether it shares the security of the Bitcoin blockchain (whether the final accounting exists on the longest Bitcoin chain)

3. Whether users truly control their private keys and their BTC (distrusting any third party and only trusting decentralized networks)

Let's see if BEVM meets these three criteria.

1. As mentioned at the beginning of the article, the design concept of BEVM is to adhere to the original Bitcoin framework without making any changes to the Bitcoin network, and to use the native Musig2 signature of Bitcoin to achieve decentralized cross-chain for Bitcoin.

2. Since BEVM is a Bitcoin Layer2, similar to the principles of Ethereum's Layer2, every transaction on BEVM will be merged and packaged in a 10:1 ratio and uploaded to the Bitcoin blockchain through a sequencer. Therefore, BEVM shares the security of the Bitcoin blockchain and only recognizes the longest Bitcoin chain as the sole secure ledger.

3. Since BEVM uses the native Musig2 signature algorithm of Bitcoin, it can extend the aggregated signature nodes to over 1000, using a decentralized network maintained by BTC light nodes to store and transfer users' BTC assets. This is undoubtedly decentralized, secure, and very much in line with the spirit of Bitcoin. (This also distinguishes BEVM from some Bitcoin sidechain projects, as sidechains often rely on traditional cross-chain solutions to link to Bitcoin, but are fundamentally centralized.)

Therefore, based on the above three points, it is evident that the design of BEVM is in line with the legitimacy advocated by the Bitcoin community and will undoubtedly gain widespread consensus and support from the Bitcoin community.

What are the current use cases of BEVM?

The BEVM testnet has already been launched, allowing developers to build various applications based on BEVM. Since BEVM is fully compatible with EVM, the deployment and migration costs are extremely low for developers familiar with EVM.

Currently, there is a DEX on BEVM that supports BRC20 asset trading, allowing users to deposit BTC+BRC20 assets to become LPs and earn fees from DEX trades. As seen on the official website, the BTC DEX deployed on BEVM—Bswap—currently has the largest pool for btc/sats, allowing users to deposit assets to become LPs and earn fees from DEX trades.

In addition, there is a full-chain DEX—omniBTC—operating on BEVM, supporting BTC trading on over a dozen mainstream chains including ETH, ETH's mainstream L2, SUI, Polkadot, and others.

Conclusion:

BEVM, without changing the original Bitcoin framework, creatively uses BTC's native Musig2 aggregated signature technology and BTC light nodes to enable BTC to build a completely decentralized Layer2, thereby introducing BTC into the world of decentralized applications.

In the long run, the development of BTC Layer2 will be a necessary choice for the long-term stability of the Bitcoin network. Due to the limited supply of Bitcoin and the continuous halving of Bitcoin production, the Bitcoin blockchain will find it difficult to attract miners to sustain network maintenance solely through block rewards. Therefore, the fee income generated from Bitcoin's application scenarios will become one of the most important breakthroughs. While the Lightning Network has chosen the payment scenario, BEVM has chosen the broader smart contract scenario.

In the long run, BTC Layer2 solutions like BEVM, similar to the Lightning Network, are of significant importance for the long-term development of Bitcoin. With the development of the Bitcoin ecosystem, we believe that BTC Layer2 solutions will also become a long-term exploration direction for the Bitcoin community.

As Ethereum founder Vitalik Buterin recently stated on social media: Bitcoin should expand various Layer2 solutions to address Bitcoin's scalability issues while enhancing the Bitcoin base layer.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。