Author: 0x00pluto

Question: What is Maple?

In the process of continuous exploration, I found a large amount of article materials online (special thanks to the authors of these articles), so I organized these materials according to the structure.

On the one hand, I hope it is useful to everyone, and on the other hand, I want to summarize and improve the learning effect.

I'll start with a one-sentence project introduction

Maple Finance is an online lending platform based on blockchain technology that allows users to borrow and lend funds. Its operation is similar to a digital credit cooperative or bank, but it is fully automated and decentralized, meaning there are no intermediaries involved, and all transactions are transparent and secure.

On Maple Finance, the borrowing process is similar to borrowing from a bank in real life. However, it uses blockchain technology for credit assessment and loan management. For example, if you want to borrow money from a bank, you usually need to provide a large amount of personal and financial information, and the entire process may be slow due to manual review. But on Maple Finance, everything is automated, processed through smart contracts (self-executing digital contracts), which greatly speeds up the borrowing process and reduces costs.

Another example is that its operation is somewhat like an automatic, digital lending club. Imagine a club where every member can borrow and lend money, and the rules of the club are open and transparent, and all transactions are automated without any human intervention. This makes the borrowing process fast, simple, and transparent, and because there are no intermediaries, the costs are lower.

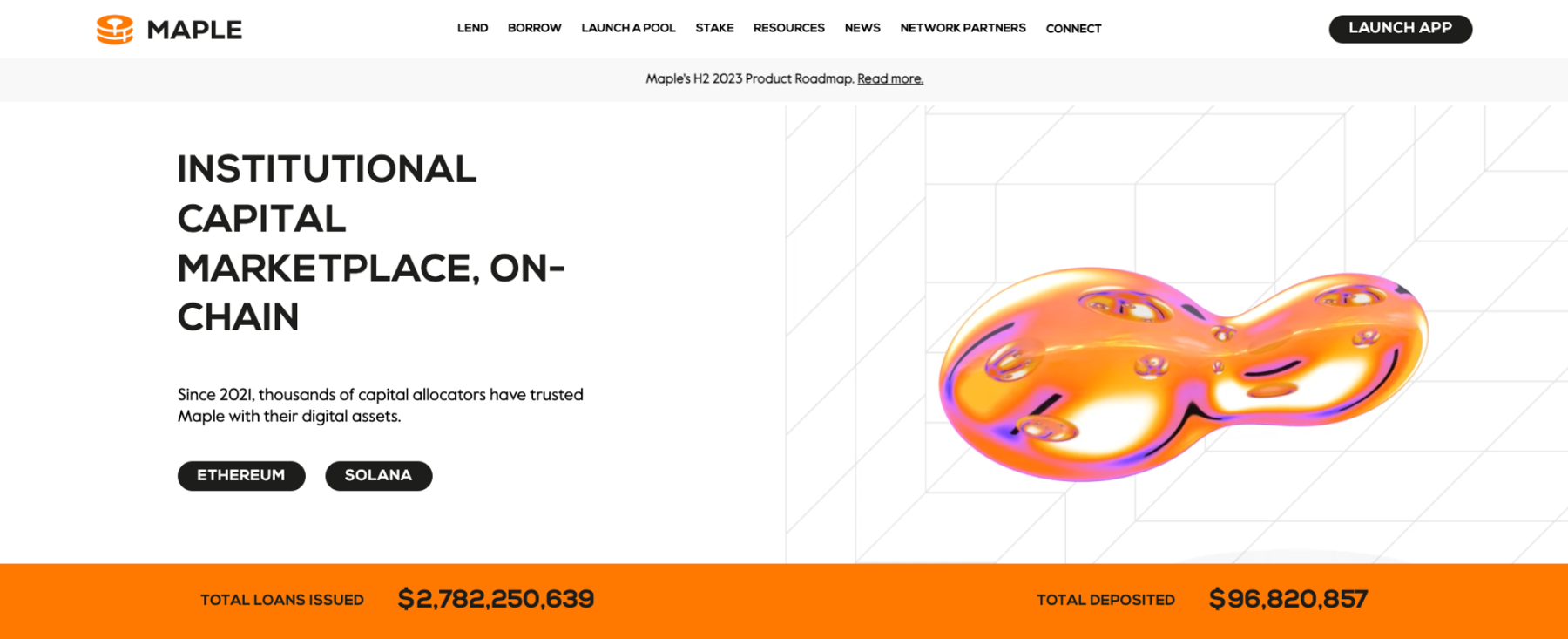

0. Project Overview

Maple Finance is a blockchain-based capital market platform. Since 2021, thousands of capital allocators have entrusted their digital assets to Maple. The core function of Maple Finance is to provide high-quality lending opportunities for institutional and individual qualified investors, helping them meet their liquidity, risk, and return needs. Credit experts on the platform are responsible for managing fast-moving loan businesses, pooling capital, and lending to institutional borrowers to support their business growth and operations.

1. Research Highlights

1.1. Core Investment Logic

Team Aspect

The founders of Maple Finance are Joe Flanagan and Sidney Powell. Sidney Powell is the co-founder and CEO of Maple Finance, with a background mainly in bond capital markets and institutional banking. Joe Flanagan co-hosted the first team meeting of Maple Finance with Sidney Powell and also gave an interview related to the current situation of Maple Finance.

Financing Aspect

Maple Finance has raised funds in different financing rounds. The most recent round of financing took place on August 22, 2023, led by BlockTower Capital and Tioga Capital, raising $5 million. In addition, Maple Finance also raised $1.3 million in seed round financing in 2020.

Technical Aspect

Maple Finance released version 2.0, which comprehensively revamped the protocol to achieve higher flexibility, modularity, and scalability. Major technical updates include periodic and proportional withdrawals, removal of lock-up periods, stable value at initial capital liquidation, immediate declaration of default, automatic compound interest, and adoption of the ERC-4626 standard. The smart contract team of Maple Finance attaches great importance to the integrity of technical documents and has open-sourced all protocol smart contracts and related content for testing and auditing contracts on GitHub to ensure the success and security of the project.

Track Aspect

The market targeted by Maple Finance is mainly the decentralized finance (DeFi) lending market, especially serving institutional borrowers. By solving the problem of over-collateralization and providing low-collateral or even unsecured loans, the platform demonstrates a unique approach to the DeFi lending market.

1.2. Valuation

Regarding the valuation of Maple Finance, the information available online is currently limited, but it can be seen from its financing rounds and the amount of funds raised that the project has gained recognition and support from investors.

1.3. Project Risks

- Market Risk: Maple Finance's market is mainly focused on the decentralized finance (DeFi) lending sector, which is full of uncertainty and volatility, especially in terms of legal regulations.

- Competition Risk: Maple Finance's main competitors include TrueFi, KKR, and Archblock, among others, which may affect Maple Finance's position in the market.

- Technical Risk: Although Maple Finance has rigorously tested and audited its smart contracts, there are still potential technical risks, such as vulnerabilities and security issues in smart contracts.

- Financial Risk: In past cryptocurrency market crashes, Maple Finance's total value locked (TVL) suffered significant losses, indicating that the project may be affected by market fluctuations.

In addition, Maple Finance also faces some challenges and risks in terms of technology and operations, such as technical upgrades, contract security, and market competition. These factors should be fully considered in investment decisions to ensure safety and returns.

2. Project Overview

2.1. Basic Project Information

Maple Finance is an institutional-grade encrypted capital network platform based on blockchain technology, focusing on providing decentralized lending and borrowing solutions through smart contracts and blockchain technology. The platform connects different fund providers and borrowers, providing them with a secure, transparent, and efficient lending environment. The main goal of Maple Finance is to provide innovative lending solutions for the cryptocurrency market and traditional financial markets to meet the needs of different users.

2.2. Team Situation

2.2.1. Overall Situation

The team of Maple Finance consists of members with rich experience and expertise from the fields of banking, technology, and financial management consulting. The number of team members has increased from 20 people in early 2022 to 35 people. Their goal is to build Maple Finance into a leading encrypted capital market platform through continuous product development and operational optimization.

2.2.2. Core Members

Sid Powell: CEO & Co-Founder, with a background in debt capital markets and institutional banking

Joe Flanagan: Co-Founder

Quinn Thompson: Head of Capital Markets & Growth

Ryan O’Shea: Head of Operations.

2.3. Financing Situation

Since its inception, Maple Finance has completed 3 rounds of financing, with a total financing amount of $7.7 million. The most recent round of financing was on August 22, 2023, led by BlockTower Capital and Tioga Capital Partners, with a financing amount of $5 million. The earlier two rounds of financing took place in March 2021 and December 2020, with financing amounts of $1.4 million and $1.3 million, respectively. Major investors include The Spartan Group, Tioga Capital Partners, BlockTower Capital, Framework Ventures, and Polychain, among others.

2.4. Past Development and Roadmap

2.4.1. Past Development

- December 2020: Completed seed round financing with a financing amount of $1.3 million.

- March 2021: Completed a venture capital round with a financing amount of $1.4 million.

- May 2021: Maple Finance officially launched.

- End of 2021: Maple Finance completed a significant amount of loan disbursements, gaining market recognition and user trust.

- First half of 2022: Maple Finance achieved cross-chain functionality, with total loan disbursements reaching $15 million, doubling the team size, and launching xMPL.

2.4.2. Current Progress

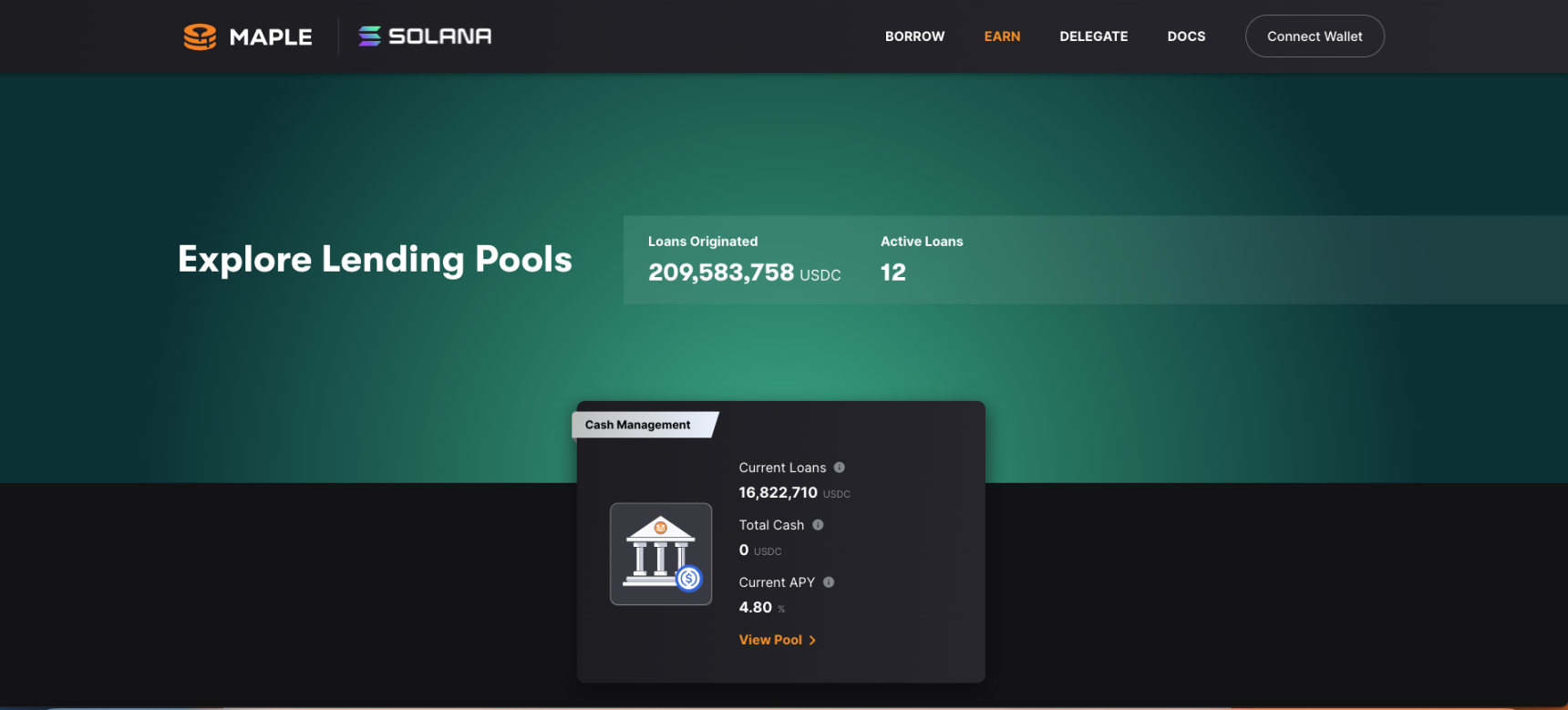

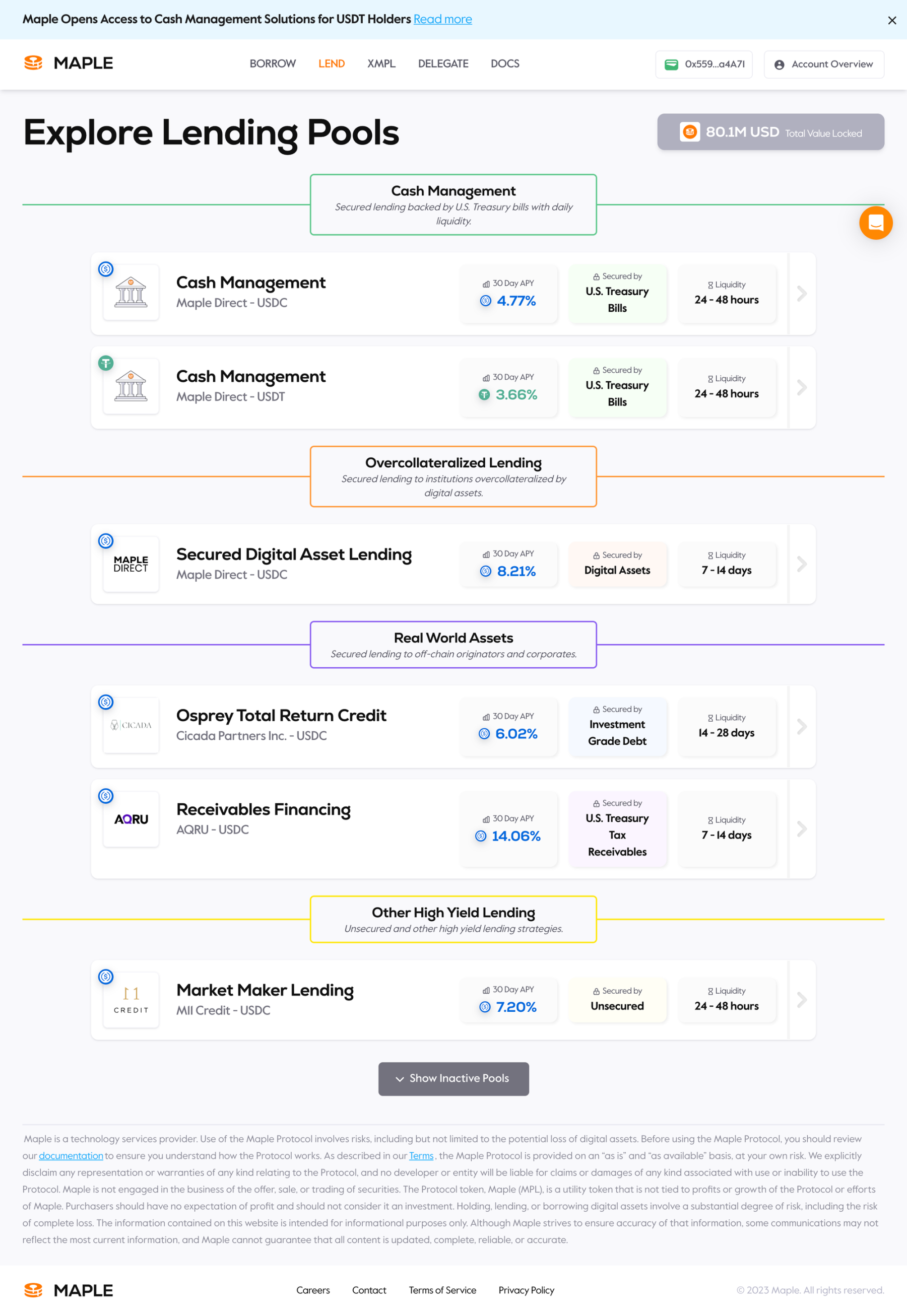

Maple Finance is operational on multiple chains, including Ethereum and Solana, and has disbursed over $150 million in loans. They have successfully listed the MPL token on mainstream exchanges such as Coinbase, Gemini, and Huobi, and continue to introduce new features and products, such as loan refinancing and xMPL.

2.4.3. Development Plan and Roadmap

Maple Finance's long-term goal is to build a leading institutional-grade encrypted capital network by constructing a robust, intuitive, and composable lending infrastructure. They plan to expand their user base and application scenarios in the next six months, especially by developing loan pools for the crypto mining industry and engaging in discussions with potential pool representatives to explore setting up loan pools for FinTech, SaaS, and other sectors. Additionally, they plan to integrate with third-party applications to ensure wider acceptance and use of the Maple protocol. In terms of product, they plan to launch Maple 2.0, a major revision of the current smart contract infrastructure aimed at correcting existing flaws and improving platform scalability. They will also focus on implementing improved reporting, accounting, and compliance tools to make Maple a one-stop solution for financial institutions.

Regarding Maple Solana, they plan to continue momentum and introduce significant product features, such as open period loans and active collateral management, as well as launch the SYRUP token to create and issue their own token for Maple Solana. These plans and measures will help Maple Finance further expand its influence in the cryptocurrency lending market, providing users with more lending options and a better service experience. Additionally, Maple will continue to explore new opportunities within the Solana ecosystem, such as providing financing for Solana infrastructure projects, including node operators, SaaS companies, and startups.

In the future, Maple Finance plans to build its platform into a full-service capital market infrastructure through continuous product innovation and market expansion, providing strong support for cryptocurrency and traditional financial market lending operations. With the launch of Maple 2.0, they expect to expand the platform from the current $150 million to several billion. They will also continue to invest in security and compliance to ensure the safe operation of the platform and user assets.

Overall, Maple Finance has promising market prospects and development potential, and its team's professional capabilities and market execution have been recognized. Through continuous product innovation and market expansion, Maple Finance is expected to become a significant participant and leader in the cryptocurrency lending market.

3. Project Analysis

3.1. Project Background

The birth of Maple Finance is mainly based on addressing some core issues in the traditional lending market. By building a decentralized lending platform, Maple Finance aims to provide a more transparent, efficient, and secure environment for both borrowers and lenders. The project aims to use blockchain technology and smart contracts to transform traditional lending dynamics into a simplified and automated process, addressing trust and efficiency issues in traditional financial systems.

3.1.1. Development Background

Maple Finance was established approximately 9 months after the global experience of the COVID-19 pandemic. At that time, many countries were under lockdown, and Maple DAO (Decentralized Autonomous Organization) had completed a round of fundraising 3 months earlier but was in an awkward organizational stage, not entirely a commercial company but not just a project. Initially, the team consisted of 8 full-time members and some part-time helpers, distributed globally, with almost no formal organizational structure. During the seed round of fundraising, they optimistically stated that they would launch in January or February, but in reality, they did not launch during those two months. Over the next 3 months, they needed to complete the development of smart contracts and web applications, undergo audits, and find initial clients.

3.1.2. Technical Background

The technical background of Maple Finance is primarily based on blockchain technology and smart contracts. The core of the project is to build a decentralized lending platform, allowing both borrowers and lenders to transact in a transparent and secure environment. To ensure the platform's smooth operation, the team spent a significant amount of time developing smart contracts and web applications and underwent rigorous audits to ensure platform security. Additionally, Maple Finance used liquidity mining mechanisms to attract user participation and utilized the Balancer Liquidity Bootstrapping Pool for token sales, providing MPL tokens to community members. In the early stages of the project, the technical team faced various challenges, including network attacks and website downtime, but ultimately they successfully resolved these issues, ensured the security of user funds, and successfully launched the platform.

Through technological innovation and continuous optimization, Maple Finance not only achieved significant breakthroughs in technology but also successfully attracted a large number of users and capital, laying a solid foundation for the project's development.

3.2. Project Principles

The core principles and concepts of Maple Finance mainly revolve around decentralized lending (DeFi lending), providing a secure, transparent, and efficient lending platform for both borrowers and lenders through the use of blockchain technology and smart contracts.

Key Principles:

- Decentralization: The foundation of the project is decentralization, eliminating intermediaries through blockchain technology, thereby reducing transaction costs and increasing transaction efficiency.

- Smart Contracts: Smart contracts form the basis for the automatic execution and automation of transactions, providing a secure and transparent lending environment for both borrowers and lenders.

- Trust Mechanism: Through the transparency and immutability of blockchain technology, a trusted lending environment is created for users.

Key Principles and Core Concepts:

- Asset Pool: Maple Finance adopts the concept of asset pools to provide a centralized lending platform for borrowers by aggregating funds from multiple parties.

- Liquidity Provision: Users can deposit their assets into the asset pool to earn interest and provide lending opportunities for other users.

- Lending Mechanism: Through a simplified lending mechanism, borrowers and lenders can quickly and easily complete transactions.

Core Technological Points:

- Cross-Chain Functionality: By implementing cross-chain functionality, Maple Finance can operate on multiple blockchains, attracting more users.

- Token Economy: Through the MPL token, users are provided with the opportunity to participate in the platform's development and share in its profits.

Key Issues Addressed:

- Trust and Transparency: Addressing trust issues in traditional financial systems by providing users with a reliable lending environment through the transparency and immutability of blockchain technology.

- Efficiency and Cost: By eliminating intermediaries and automating transaction processing, Maple Finance significantly reduces transaction costs and improves transaction efficiency.

Core Business Logic:

- Lending Process: Borrowers and lenders, after registering and verifying on the platform, can quickly complete lending transactions through a simplified process. Borrowers can borrow from the asset pool, while investors can earn interest by depositing their assets into the pool.

- Interest and Fees: The calculation of interest and fees is automated, ensuring accuracy and transparency through smart contracts.

- Token Economy: Through the MPL token, users are provided with an opportunity to participate in the platform's development and share in its profits. Additionally, through liquidity mining and token sales, Maple Finance attracts more users and capital.

Through these principles and core concepts, Maple Finance has built a comprehensive platform integrating lending, investment, and token economics, providing users with a new lending experience.

3.3. Project Technical Features

Maple Finance's technical features primarily revolve around its decentralized lending platform, utilizing blockchain technology and smart contracts for construction and operation.

Key Technical Features:

- Decentralized Technology: Leveraging blockchain technology, Maple Finance achieves decentralization of the lending platform, eliminating intermediaries, reducing transaction costs, and improving transaction efficiency.

- Smart Contracts: Smart contracts are one of Maple Finance's core technologies, automatically executing and processing transactions, ensuring transaction security and transparency.

- Cross-Chain Functionality: Maple Finance has cross-chain functionality, enabling operation on multiple blockchains, enhancing project flexibility and user base.

- Token Economy: By creating the MPL token, Maple Finance establishes a token economic system, incentivizing user participation and contribution to the platform's development.

- Liquidity Mining Mechanism: Through liquidity mining, Maple Finance attracts users to provide liquidity, maintaining the platform's fund liquidity and healthy development.

- Asset Pool Mechanism: Through the asset pool mechanism, aggregating funds from multiple parties, Maple Finance provides a centralized lending platform for borrowers and lenders.

Key Technical Architecture:

- Smart Contract Layer: Responsible for handling all transactions and contract logic, including lending, repayment, interest calculation, etc.

- Application Layer: Provides user interface and interaction experience, enabling users to easily engage in lending and investment activities on the platform.

- Data Layer: Responsible for storing and managing all transaction data and user information, ensuring data security and integrity.

- Interface Layer: Provides APIs and other interfaces to enable interaction with external systems and applications, such as integration with other blockchains and DeFi platforms.

- Security Layer: Responsible for platform security, including data security, transaction security, and system security, ensuring stable operation and user asset security.

These technical features and architecture provide Maple Finance with robust technical support, enabling rapid development and growth in the DeFi lending market. Additionally, through continuous technological innovation and optimization, Maple Finance provides users and investors with a secure, efficient, and user-friendly lending platform.

3.4. Project Ecological Applications

Maple Finance's project ecology primarily revolves around its decentralized lending platform, providing a variety of applications and collaboration opportunities, offering rich lending solutions for users and partners.

Representative Applications:

Lending Platform:

- Maple Finance's core application is its decentralized lending platform, where users can engage in lending activities, and investors can provide funds to earn interest.

- Addresses trust, transparency, and efficiency issues in the traditional lending market.

Liquidity Mining:

- Through liquidity mining, users can deposit assets into designated liquidity pools to earn MPL tokens and interest.

- Attracts more liquidity, maintaining the platform's fund liquidity.

Token Sales Platform:

- Maple Finance also provides a token sales platform, where users can buy and sell MPL tokens.

- Provides a simple, secure, and efficient token trading platform.

Collaboration Opportunities:

- Technical Collaboration: Maple Finance collaborates with other blockchain projects and DeFi platforms through API and other technical interfaces, achieving service interoperability and expansion.

- Capital Collaboration: Through collaboration with investment institutions and capital providers, Maple Finance receives financial support while providing investment and profit opportunities for partners.

- Ecosystem Collaboration: Collaborates with other DeFi projects and blockchain platforms to provide users with more services and products, expanding Maple Finance's service scope and user base.

- Community Collaboration: Through collaboration with multiple blockchain communities, Maple Finance has built an active and large community, providing support for the project's development and promotion.

Through these applications and collaborations, Maple Finance has built a comprehensive and diverse project ecosystem, providing rich services and opportunities for users and partners, while laying a solid foundation for the project's long-term development.

3.5. Project Operation Process

Maple Finance's operation process revolves around its decentralized lending platform. Below is the basic operation process of the project:

1. User Registration and Verification:

Users need to register on the Maple Finance platform, complete basic identity verification, and account setup.

2. Fund Deposits:

- Investors: Investors can deposit their assets into Maple Finance's asset pool, becoming liquidity providers for the pool.

- Borrowers: Borrowers can view different asset pools and lending conditions on the platform, selecting a suitable asset pool.

3. Lending Application:

Borrowers can submit a lending application on the platform, including loan amount, term, and other information.

4. Smart Contract Processing:

Once a lending application is submitted, smart contracts automatically process these requests, including checking the asset pool's funding situation and calculating interest.

5. Lending Execution:

- If the lending application is approved, the borrower will receive the required funds, and investors will begin to receive interest returns.

- Borrowers can repay at any time, and once the repayment is completed, smart contracts will automatically process the related transactions, including returning the principal and interest to the investors.

6. Liquidity Mining and Token Trading:

- Users can participate in liquidity mining by earning MPL tokens by depositing assets into liquidity pools.

- Users can also trade MPL tokens on Maple Finance's token sales platform.

7. Project Progress and Community Engagement:

- Users can engage in the Maple Finance community, provide suggestions, or participate in the further development of the project.

- The Maple Finance team regularly releases project progress and updates, and users can stay informed about the latest project developments through the community or other channels.

Above is the basic operation process of the Maple Finance project, providing users with a simple, secure, and efficient lending platform through a concise and clear process. Additionally, through smart contracts and other blockchain technologies, it ensures transaction security and transparency, providing a reliable lending environment.

3.6. Project Data

3.6.1. Core Business Data

Since its launch, Maple Finance has shown continuous growth and development in its business data. Here are some core business data points:

- As of the end of the second quarter of 2022, Maple Finance's total active liquidity was $755 million. Despite a slight decrease from the previous quarter, it demonstrated strong resilience against market fluctuations, with a 67% decline compared to the overall DeFi liquidity.

- In the second quarter of 2022, Maple Finance continued to generate revenue through its platform, returning $17 million in interest to borrowers, despite facing the largest crypto market contraction in the past five years.

- In the second quarter of 2022, the platform disbursed $414 million in loans, covering 40 new loans, a decrease from the first quarter. However, the platform has cumulatively disbursed over $1.5 billion in loans to date.

- Since its launch in May 2021, Maple's lending pool has provided a stable source of income for lenders, with an average annualized return of 7.82% (excluding MPL rewards). In the second quarter, lenders earned over $17 million in interest income through Maple's lending pool.

- In the latest funding round on August 22, 2023, Maple Finance raised $7.7 million from an undisclosed venture capital round, with 17 investors participating, including The Spartan Group and Tioga Capital Partners.

4. Industry Space and Potential

4.1. Track Analysis

4.1.1. Project Classification

Maple Finance is an institutional-grade encrypted capital network built on Ethereum and Solana, aiming to reshape capital markets through digital assets. It expands the digital economy by providing unsecured loans to institutional borrowers and income opportunities for lenders. Maple Finance has also introduced cash management products based on U.S. Treasury bonds and showcased an upgraded V2 version, exploring the integration of crypto with real-world assets, particularly through the introduction of real-world assets (RWA) to increase the liquidity and stability of its lending platform. Unlike conventional DeFi projects, Maple Finance is committed to changing the digital finance sector and global lending, with its protocol core concept of "low collateral" making the lending process different from conventional DeFi projects.

4.1.2. Market (Track) Size

The decentralized finance (DeFi) market is rapidly growing. According to various reports, the global DeFi market valuation in 2022 varies from $135.8 billion to $555.8 billion. The market size is expected to further grow by 2023, demonstrating significant growth potential. Over the next few years, with continued DeFi technological innovation and broader acceptance, the market size is expected to continue expanding.

4.1.3. Core Competitive Factors

In the DeFi market, core competitive factors include technological innovation, security, user experience, compliance, and community support. Technological innovation is a key driver of DeFi market development, including optimization of smart contracts, cross-chain interoperability, and more efficient consensus mechanisms. Security is a major concern for users and investors, as any security incidents could impact the project's reputation and market value. User experience encompasses usability, interface design, and customer support, directly affecting user satisfaction and the project's user base. Compliance is crucial for DeFi projects to operate and expand in different regions, with compliant projects more likely to gain trust from traditional financial institutions and regulatory bodies. Community support includes developer and user communities, with an active community providing continuous support and innovation for the project.

These core competitive factors are crucial for Maple Finance's competitiveness and market positioning. Maple Finance's unique positioning and technological innovation capabilities are demonstrated through its provision of unsecured loans and integration with real-world assets.

4.2. Competitor Analysis

4.2.1. Competitor Analysis

When comparing Maple Finance with major competitors TrueFi and KKR, several differences and characteristics can be observed:

TrueFi:

- Business Model: TrueFi primarily provides unsecured loan services, offering efficient capital utilization for borrowers and investors. Its lending model is primarily based on credit assessment rather than collateral.

- Target Users: TrueFi seems to be more inclined to serve individual users rather than institutional or corporate users.

KKR:

- Business Model: KKR is a traditional investment management company, offering various investment management services, including private equity, energy, infrastructure, real estate, and credit. Its business model and operating mode are significantly different from decentralized finance (DeFi) platforms.

- Target Users: KKR primarily targets large institutions, enterprises, and high-net-worth individuals.

Maple Finance:

- Business Model: Maple Finance expands the digital economy by providing unsecured loans to institutional borrowers and income opportunities for lenders. It also explores the integration of the crypto world with real-world assets, particularly through the introduction of real-world assets (RWA) to increase the liquidity and stability of its lending platform.

- Target Users: Maple Finance primarily targets institutional investors and enterprises, providing an innovative credit-based lending solution.

4.2.2. Competitive Advantages

Maple Finance has some unique competitive advantages compared to its competitors:

- Credit Model: Maple Finance provides corporate debt financing solutions through lending pools, rather than the typical personal loans, which differs from TrueFi's unsecured loan model.

- Target Users: Maple Finance primarily targets institutional investors and enterprises, rather than individual users, creating a unique positioning in the market.

- Partnerships: Maple Finance has established partnerships with several well-known cryptocurrency companies and investment firms, which may help it gain more trust and recognition in the market.

- Ecosystem: Maple Finance is working to build a healthy ecosystem, including lending, liquidity provision, and risk management, providing users with an all-in-one solution.

From the above analysis, it is evident that Maple Finance has a unique market positioning and competitive advantages, but it also faces challenges from competitors in different tracks. In the future, Maple Finance needs to continuously innovate and optimize its business model to maintain its market leadership.

4.3 Token Economic Model Analysis

4.3.1 Token Total Supply and Distribution

Maple Finance's native token is MPL. The total supply is 10,000,000 MPL, with a current circulating supply of 3,658,989. The original token distribution structure is as follows:

- Liquidity Mining: 30%

- Seed and Advisors: 25%

- Seed: 26%

- Public Sale: 5%

- Treasury: 14%

4.3.2 Token Value Capture

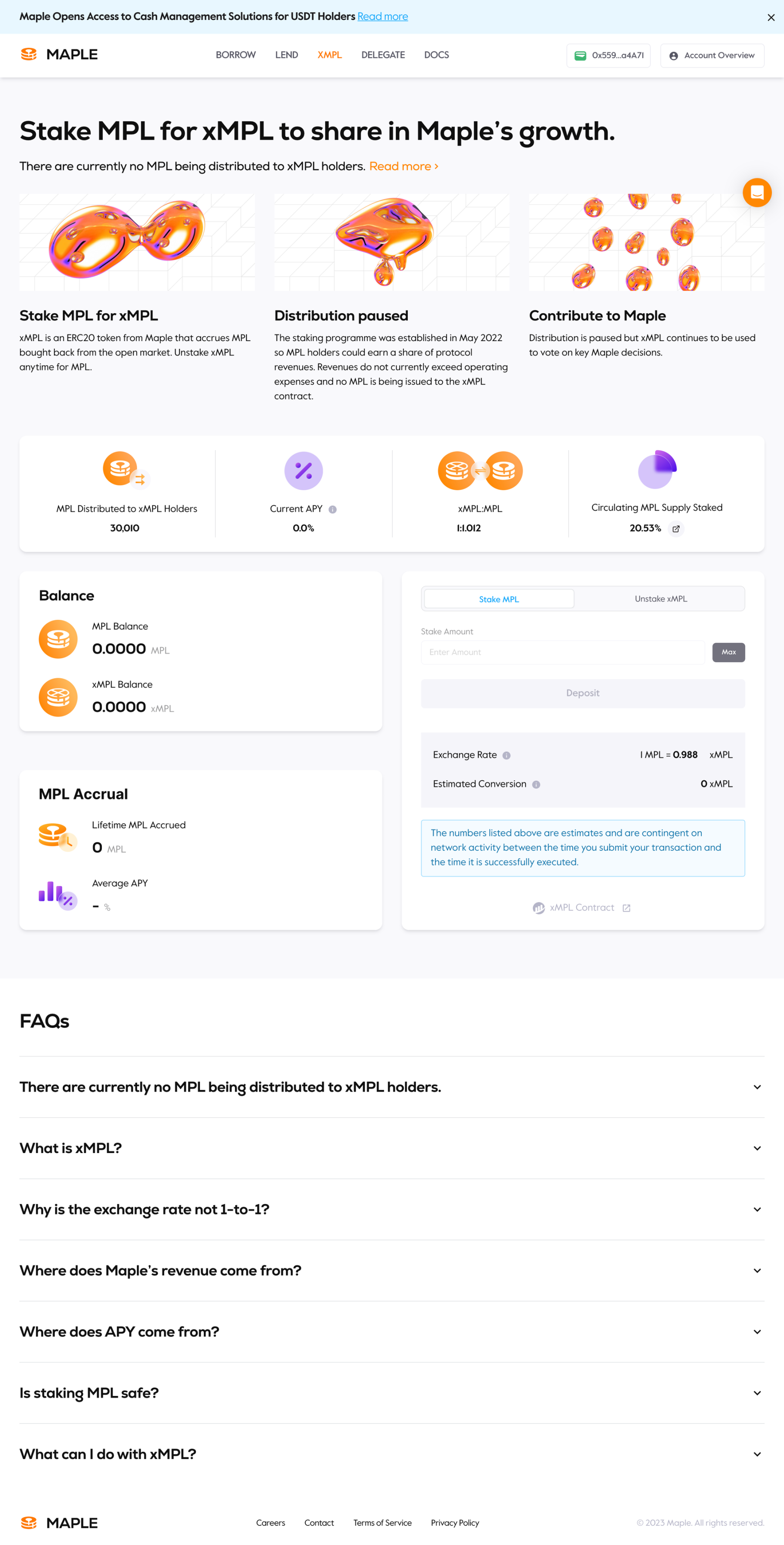

The value of the MPL token is primarily captured through sharing in protocol revenue and equity rewards. MPL holders can stake MPL into smart contracts owned by Maple to receive xMPL, and protocol revenue will accumulate into xMPL. Specifically, Maple will use protocol revenue to buy back MPL from the open market. Initially, as per MIP 008, 50% of the protocol revenue will be used to purchase MPL monthly. These MPL will then be issued to the xMPL smart contract and distributed evenly to xMPL holders over a specified period.

The income of MPL mainly comes from the establishment fee for each loan on the Maple Finance platform, with the establishment fee being 0.99% (annualized), where 2/3 (66%) is paid to the Maple Finance treasury, and the remaining 1/3 (33%) is paid to the pool representative issuing the loan. Maple Finance's business model is simple: the more loans, the more income. As income increases, the cash to buy MPL from the open market will also increase.

4.3.3 Core Token Demand

The core demand for the MPL token mainly includes:

- Stakers: Staking MPL to receive xMPL and earn a share of protocol revenue.

- Borrowers: Need to pay loan establishment fees, with most of this fee becoming protocol revenue, thereby increasing the value of MPL.

- Governance Participants: MPL holders are eligible to participate in the decentralized governance process of the project, influencing the future development direction and decisions through voting.

Through this token economic model, Maple Finance can create a self-incentivizing ecosystem while ensuring the project's continuous development and active community participation. In the future, with the introduction of xMPL, MPL holders will be able to stake MPL to receive xMPL, earn more from protocol revenue, and participate in governance voting and provide other practical functions such as single-sided pool coverage.

5. Preliminary Valuation

5.1 Core Issues

Issue 1: What stage is the project in operationally? Is it mature or in early to mid-stage development?

Maple Finance is currently in the early to mid-stage of development. While it has made some progress and successfully attracted some users and capital, there is still significant room for development. Its business model and technological foundation have been established but are continuously being optimized and expanded to attract more users.

Issue 2: What are the main variable factors in the project's operations? Are these factors easily quantifiable and measurable?

The main variable factors in the project's operations include the total amount of loans, lending interest rates, user growth rate, liquidity provision, and community activity. These factors are relatively easy to quantify and measure through monitoring platform data and community activities.

Issue 3: What is the project's management and governance approach?

Maple Finance adopts a decentralized governance approach through the MPL token. MPL holders can participate in project governance through voting, influencing the project's future development direction and decisions.

Issue 4: Does the project have reliable competitive advantages? Where do these competitive advantages come from?

Maple Finance's competitive advantages come from its unique lending model, partnerships, and technological innovation. By collaborating with several top decentralized finance platforms, Maple Finance can provide unique lending solutions and deliver value to users through its technological platform.

Issue 5: What is xMPL? What is its purpose?

xMPL is a token obtained by staking MPL, representing the holder's equity in the Maple Finance protocol. xMPL holders can earn a share of protocol revenue and participate in governance voting at Maple Finance.

Issue 6: What are the unique aspects of Maple Finance's lending model?

- Fund Pool Aggregation: Maple Finance aggregates funds from multiple parties through fund pool creation, which can improve capital efficiency. Borrowers can borrow from these fund pools, and investors can invest in these fund pools to earn returns. This aggregation method allows Maple Finance to reduce lending rates to some extent, providing better services to users.

- Credit Trustee Model: Maple Finance adopts a unique credit trustee model. Credit trustees are qualified and verified entities responsible for reviewing and managing borrowers' loan applications. This model helps reduce credit risk and accelerate the lending process.

- On-Chain Credit Assessment: Maple Finance also provides an on-chain credit assessment system to evaluate the credit status of borrowers by analyzing their historical transaction data and other relevant information. This on-chain credit assessment system not only improves assessment efficiency but also reduces the cost of credit assessment.

- Decentralized Governance: Maple Finance achieves decentralized governance through the MPL token. MPL token holders can decide on important project matters, including fund pool parameter settings, project updates, and optimizations, through voting. This decentralized governance model allows Maple Finance to better adapt to market changes and increases community activity and cohesion.

Issue 7: What is "low collateral"? How is risk evaluated?

In digital and traditional finance, borrowing typically requires providing assets of equal or higher value as collateral to protect against the risk of default. However, in Maple Finance, the concept of "low collateral" refers to borrowers potentially not needing to provide collateral equal to the loan amount, or having relatively low collateral requirements.

For example, in a traditional lending environment, if you want to borrow $10,000, the bank may require you to provide assets worth $10,000 or more as collateral. But in Maple Finance, you may only need to provide relatively lower-value assets to borrow $10,000, for example, only needing to provide assets worth $5,000 as collateral. This low collateral model can make it easier for more people to access funds, especially those who do not have enough collateral but need funds. Additionally, through Maple Finance's on-chain credit assessment mechanism, the platform can assess the credit risk of borrowers to protect the interests of both borrowers and lenders.6. SWOT Analysis

6.1. Strengths

- Innovative Lending Model: Maple Finance adopts a unique lending model, providing higher capital efficiency and lower lending rates through aggregating funds from multiple parties, thus offering attractive loan products to users.

- Strong Partnerships: Established partnerships with several well-known cryptocurrency and traditional financial institutions provide the project with reliable sources of funding and a large potential user base.

- Technological Innovation: The project has some technological innovation, especially in on-chain assets and credit assessment, providing users with more secure and convenient services.

- Community Governance: Achieving decentralized governance through the MPL token allows community members to participate in project decisions, increasing community activity and cohesion.

6.2. Weaknesses

- Intense Market Competition: The DeFi lending market is highly competitive, with many established large projects and platforms. Maple Finance needs to face these competitors and their potential advantages in resources and user base.

- Regulatory Risks: The regulatory environment for decentralized finance markets is unclear, and potential regulatory changes may impact the project.

- User Acceptance: While Maple Finance excels in providing innovative services, there may be a need to strengthen user outreach and education to increase user acceptance and activity.

6.3. Opportunities

- Market Growth: With the continuous maturation of the DeFi market and increased user awareness, there are more opportunities to attract users and capital from traditional financial markets.

- Technological Advancements: Advancements in blockchain and smart contract technology may provide Maple Finance with more innovation and optimization opportunities to deliver better services.

- Partnerships: Continuing to strengthen partnerships with other DeFi projects and traditional financial institutions may bring new business opportunities and users.

6.4. Threats

- Market Risks: Cryptocurrency markets are highly volatile, which may affect Maple Finance's assets and lending business.

- Security Risks: While the project has implemented a series of security measures, blockchain and smart contracts still pose security risks that may affect the project's operations and user asset security.

- Competitors: New and existing competitors may adopt more competitive strategies and products, posing a threat to Maple Finance.

References

Maple Finance Official Website: https://www.maple.finance/

Maple Finance Documentation: https://docs.maple.finance/

Decrypt Article: https://decrypt.co/99353/maple-finance-defi-loans

Maple Finance Medium Blog: https://medium.com/maple-finance

DeFi Pulse Maple Page: https://defipulse.com/maple

Maple Finance Twitter Page: https://twitter.com/maplefinance

Maple Labs GitHub Page: https://github.com/maple-labs

Crunchbase Maple Finance Page: https://www.crunchbase.com/organization/maple-finance

CoinGecko Maple Token Page: https://www.coingecko.com/en/coins/maple

Nasdaq Article: https://www.nasdaq.com/articles/why-are-defi-loans-becoming-so-popular-in-the-crypto-industry-2022-08-25

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。