Renowned asset management company VanEck has resubmitted its application for a Bitcoin spot ETF to the U.S. Securities and Exchange Commission (SEC).SEC Chairman Gary Gensler stated last Thursday that the SEC has 8 to 10 potential Bitcoin exchange-traded product filings to consider.

Public information indicates that several companies, including ARK Invest, BlackRock, Bitwise, WisdomTree, Fidelity, and Invesco, have applied for Bitcoin spot ETFs.

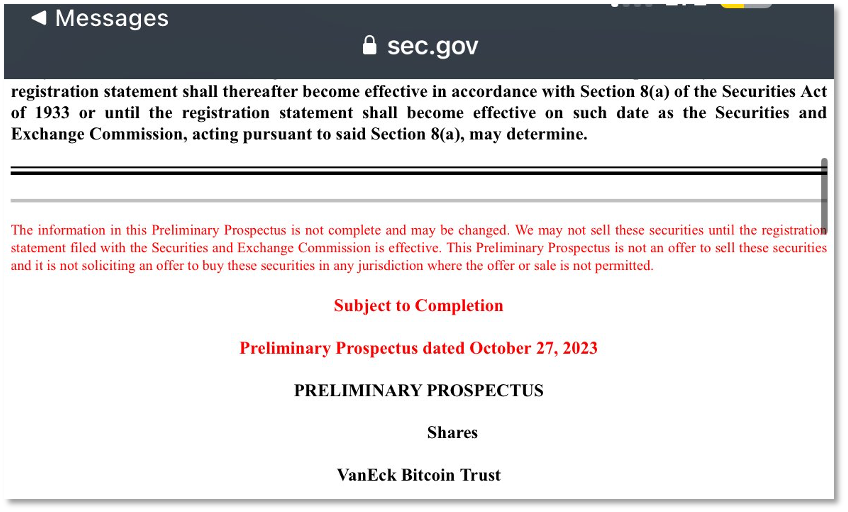

VanEck has resubmitted its application for a Bitcoin spot ETF.

VanEck has resubmitted its application for a Bitcoin spot ETF.

Public information shows that VanEck was one of the earliest applicants for a Bitcoin spot ETF. In 2018, it attempted to launch a Bitcoin ETF in partnership with SolidX — the VanEck SolidX Bitcoin Trust Fund. However, the application was withdrawn in September 2019, and then in December 2020, VanEck submitted the application for the VanEck Bitcoin Trust, whose shares would trade on Cboe BZX.

With the trust fund, VanEck did not give up its efforts to apply for a Bitcoin spot ETF. However, the SEC repeatedly delayed the decision on the company's second application and officially rejected it in November 2021. VanEck then submitted a third application in mid-2022, but the SEC once again stalled, ultimately rejecting it in March of this year.

In the United States, there are several companies, such as BlackRock, Grayscale, Bitwise, ARK Invest, and 21Shares, waiting for the approval of a Bitcoin spot ETF, just like VanEck. Their application process is like a marathon, constantly adjusting their posture to meet the demands of the "referee" SEC. In September, Bitwise Asset Management submitted a modified application in response to the SEC's concerns about its product. In early October, ARK Invest and 21Shares followed suit by providing additional information about their proposed Bitcoin spot ETF, improving their joint application.Wall Street analysts have mentioned that the SEC has previously stated that they would approve a Bitcoin spot ETF if the applying institution could reach an agreement with a large-scale, regulated market to jointly monitor the market and prevent potential market manipulation. Currently, BlackRock's application includes such a "monitoring sharing agreement," allowing Nasdaq to monitor the market to ensure its proper functioning and protection from improper operations. Other applicants have also added similar monitoring clauses to meet the SEC's requirements, which helps to increase the feasibility of issuing Bitcoin ETFs.As various companies continue to refine their documents, Cantor research analysts Josh Siegler and Will Carlson are increasingly confident in the SEC's approval of a Bitcoin spot ETF. They believe that there is a higher chance of the SEC approving the updated and modified proposals from institutions. SEC needs to respond to ARK by January next year. On October 26, Reuters reported that SEC Chairman Gary Gensler is well aware of the status of the applicants for a Bitcoin spot ETF. He stated that there are 8-10 applications for potential Bitcoin exchange-traded products (ETFs) in front of the SEC.In April 2021, SEC Chairman Gary Gensler, who took office, previously taught a course on cryptocurrency at MIT and is an expert in the field of cryptocurrency. He once stated, "Cryptocurrencies have become a catalyst for change. Bitcoin and other cryptocurrencies have brought new inspiration for payments and financial inclusion, and will promote innovation with other commissioners, while also providing protection for investors." The reality is that when he took over as SEC chairman, "investor protection principles" became his new professional creed. Shortly after Gary Gensler took office, he issued a warning to investors about the risks and volatility of the cryptocurrency market. However, the SEC is now facing increasing pressure. In October of this year, the U.S. Court of Appeals for the District of Columbia Circuit criticized the SEC's decision to reject Grayscale's application for a spot ETF. Interestingly, the SEC did not appeal this decision, which the market interpreted as "increasing the likelihood of Grayscale obtaining ETF approval."During this standoff, the SEC has stated that the Bitcoin market lacks sufficient controls to detect fraud and manipulation. However, the appeals court stated that the SEC did not fully explain why it rejected a spot Bitcoin ETF while approving a Bitcoin futures ETF. The SEC's ambiguous attitude towards the Bitcoin spot ETF application is time-limited. According to the public application process, the decision time for the ETF will begin after the applying company publishes the 19b-4b document in the SEC's federal register. The decision time for the SEC regarding the Bitcoin spot ETF application is a total of 240 days. It will go through 3 public responses, with response dates spaced at 45 days, 45 days, 90 days, and 60 days. Before the SEC issues a final decision (approval or rejection), the SEC has 3 opportunities to delay the application result for the ETF. At the same time, the SEC has the authority to approve or reject the application at any time during the decision-making process.At present, the application submitted by ARK Invest led by Cathie Wood is at the forefront of the approval queue. The SEC's 240-day review period for its application will end on January 10, 2024. By then, the regulatory agency must make a decision to approve or reject the application. The SEC's response deadline for the ARK application is scheduled for January 10th next year.Some analysts have expressed very optimistic views. Bloomberg analyst James Seyffart believes that there is a 90% chance of approval for Ark Investment's Bitcoin spot ETF before January 10th as discussions continue. Currently, many institutions and investors are paying attention to the decision that the SEC is about to make. Cryptocurrency investors are hopeful that the approval of a Bitcoin spot ETF will turn the market from bearish to bullish. Since 2023, news of the "Bitcoin spot ETF" has led to several rebounds in Bitcoin, including the resubmission of a spot Bitcoin ETF application by BlackRock and Fidelity Investments in June this year, when the Bitcoin trading price briefly exceeded $30,000.Strict Compliance Notice: The content does not represent any investment advice.免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。