March 11, 2020, proved to be an intense day in the financial world, with few assets immune to the market’s tumultuous response. It is now enshrined as a black swan event and bears the moniker of “Black Thursday” in the financial history books. This seismic shift was largely triggered by the escalating instability brought about by the Covid-19 pandemic. On that day, the World Health Organization (WHO) officially declared Covid-19 a pandemic, a proclamation that reverberated across various sectors of the global economy.

U.S. equity markets were rocked, as the Dow Jones, S&P 500, and Nasdaq Composite experienced their most significant single-day declines since “Black Monday” in 1987. Wall Street encountered a brief yet pivotal trading halt lasting 15 minutes due to the mandated “circuit-breaker” threshold. Moreover, in the subsequent days, global markets observed significant declines, reaching a critical juncture on March 16, 2020, when worldwide markets collectively plummeted by roughly 13%.

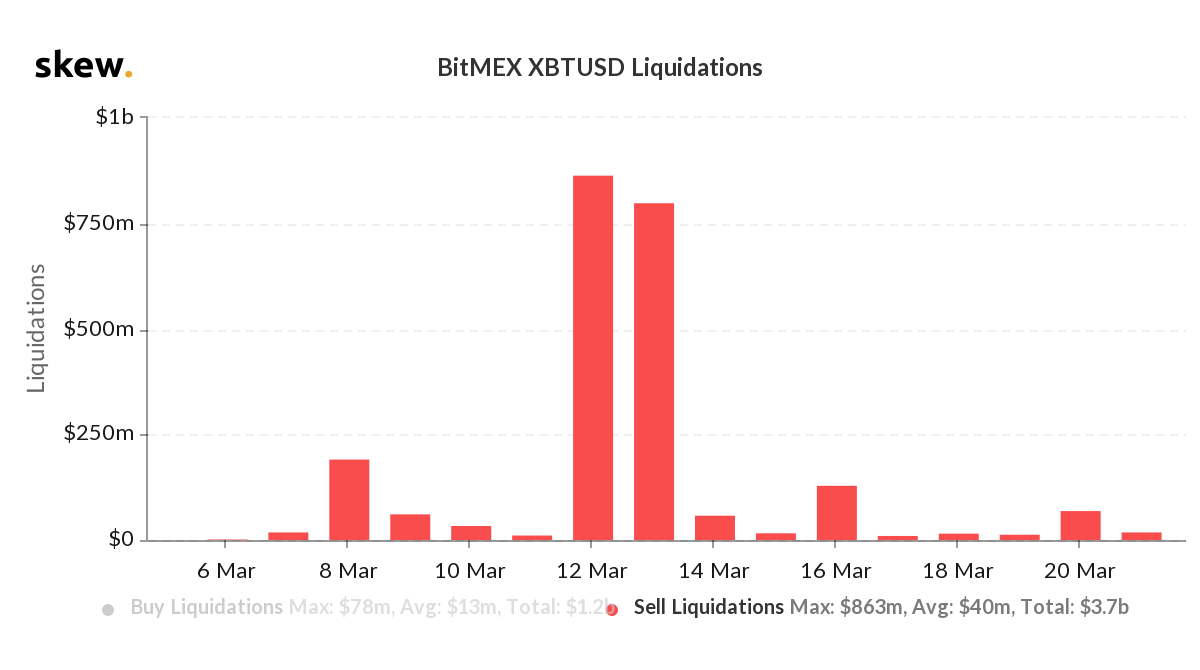

Precious metals experienced substantial depreciation, oil prices plunged to historic depths, and the cryptocurrency market witnessed a sharp decline in valuations. For instance, on March 10, 2020, the closing price of bitcoin (BTC) stood at $7,886 per coin, only to plummet to a low of $3,867 per unit on March 11, 2020. That week, the entire crypto market economy hovered just above $140 billion, in stark contrast to today’s valuation of $1.27 trillion. Although bitcoin endured a more than 50% drop within a 24-hour period, this low price proved short-lived.

The very next day, BTC rebounded to above the $5,000 mark, and by the end of March, it closed at $6,410. Following the events of Black Thursday, whistleblower Edward Snowden remarked that he “felt like buying bitcoin” on that fateful day. Bitcoin and other global financial assets swiftly rebounded, with crypto markets, precious metals, stocks, and commodities showing signs of recovery by April 2020. The revival was attributed to several factors, including the anticipation of a gradual return to normalcy following the pandemic.

However, the most significant factor was the unprecedented government stimulus measures that were implemented, surpassing any in history. This sparked a surge in the real estate market, a meteoric rise in crypto assets, an upswing in the stock market, and quite literally, a bubble in virtually everything. In November 2021, bitcoin achieved a lifetime high of $69,000 per unit, and the crypto economy’s total value surpassed $3 trillion. However, since that time, government stimulus programs have concluded.

Central banks, including the Federal Reserve, have implemented aggressive monetary tightening policies, leading to increases in interest rates. A prolonged and frigid crypto winter has persisted since the onset of the downturn, with stock markets encountering several setbacks following their 2021 peaks. A substantial segment of global markets has witnessed deflationary trends. Nevertheless, in 2023, BTC and other cryptocurrency assets mounted a remarkable resurgence, while the precious metal gold has been nearing its historical high.

However, the shadow of another black swan event, reminiscent of March 11, 2020, hangs over us, enveloped in uncertainty. Today, a tangible sense of unease prevails, driven by the reverberations of significant stimulus efforts, wars and global conflicts, and the specter of inflation. The potential for such an occurrence remains unquestionably plausible, given the current state of global tensions and market volatility. Last week, the social media account on X called “Crypto Nova” wrote that the only circumstance under which bitcoin could significantly drop in value would be a massive black swan event.

The analyst told her 79,000 followers that last year’s market conditions were distinctly different from the present. The market strategist cited numerous negative factors from the previous year, including the absence of upcoming ETF catalysts, no near-term halving event, and the collapse of major crypto entities like FTX, Terra, and Celsius, alongside worsening inflation. The next day one person replied, “I still think it’s a bit too early to post this. A significant black swan event can change everything in an instant.”

“Yeah but making a bet on a black swan event happening is statistically less likely to happen at this point,” Crypto Nova responded.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。