Frax v3 will undergo a series of updates, including sFRAX pegged to sDAI, complete external collateral, anchoring to the US dollar fiat currency instead of USDC, and bond token FXBs, among others.

By: Jiang Haibo, PANews

Frax Finance has almost the most comprehensive products in DeFi, including: the dollar stablecoin FRAX, Frax Price Index FPI, ETH liquidity collateral derivatives FraxEther, native AMM Fraxswap, lending market Fraxlend, cross-chain bridge Fraxferry, and more.

The features of Frax v3 have been gradually rolled out since October, with the first to be launched being sFRAX, pegged to sDAI in MakerDAO. However, the updates of Frax v3 are not limited to this, and some features are still under development, which PANews will detail in the following text.

Overview of Frax v3

Frax v3 is described by the official as the "ultimate stablecoin." Overall, FRAX remains a stablecoin, still using the Algorithmic Market Operations (AMO) and internal and external sub-protocols Fraxlend, Fraxswap, and Curve to maintain stability. However, Frax v3 introduces several new mechanisms as detailed below.

Complete external collateral. The protocol will strive to achieve a collateralization ratio (CR) >=100%. It is important to note that when calculating CR, Frax does not include the portion of FXS held in the assets. This means that the protocol will strive to ensure that each FRAX stablecoin is backed by an equivalent collateral without the need to mint additional FXS. This measure may enhance the confidence of FRAX holders after the Terra collapse and make FRAX more stable, potentially making it more regulatory-friendly.

Pegged to the US dollar fiat currency. The price of FRAX will be maintained at $1, rather than being anchored to assets such as USDC, USDT, or DAI. Once the CR reaches 100%, a combination of Chainlink oracles and governance-approved reference interest rates will be used to track the US dollar.

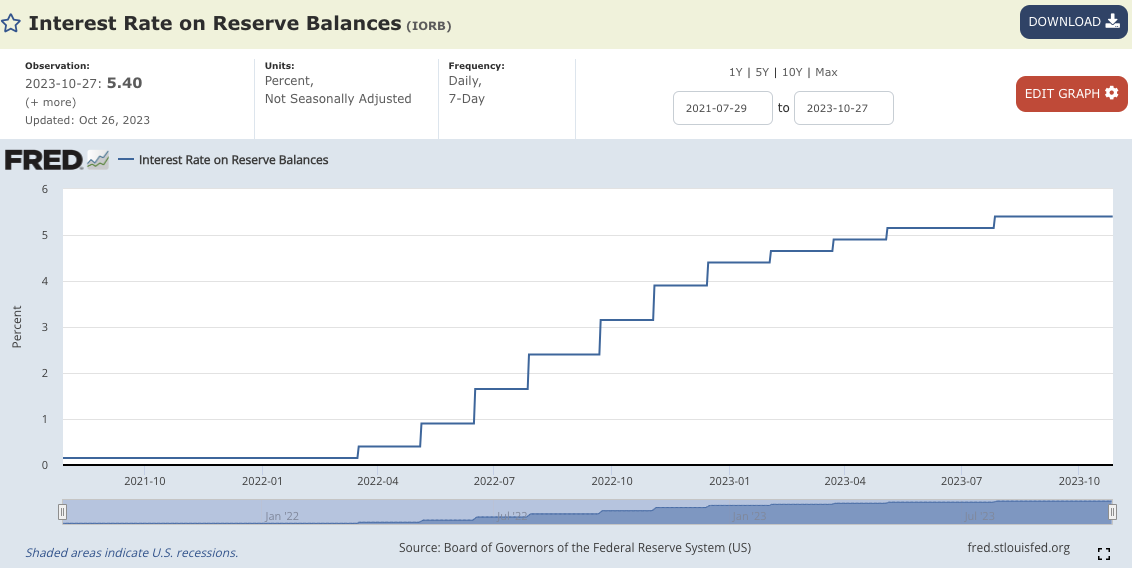

Introduction of the IOBR oracle. The protocol will use the Interest on Reserve Balances (IORB) of the Federal Reserve for certain functions, such as the staking yield of sFRAX. IORB is an interest rate control tool implemented by the Federal Reserve in 2021 to replace the previous statutory reserve ratio and excess reserve ratio, representing the upper limit of the interest rate corridor set by the Federal Reserve for financial institutions.

Elimination of the trust assumption of multi-signature. Smart contracts will operate entirely on-chain, determined by governance, eliminating the previous centralization factors.

No longer redeemable. FRAX does not guarantee redemption for specific financial assets or tokens (such as USDC), but will still maintain stability through the AMO contract. For example, when the price of FRAX falls, the AMO will remove and destroy a portion of the FRAX held by the protocol in the FRAX/USDC pool on Curve, reducing the proportion of FRAX in liquidity and increasing the proportion of USDC, causing the price of FRAX to rise.

These features will ensure that the price of FRAX aligns with the US dollar, enhance the resilience of the protocol, and signify improvements in decentralization, stability, and efficiency for Frax.

Real-world assets in the balance sheet

Frax's balance sheet now allows for the holding of certain real-world assets (RWA) held by partner entities approved by the governance module. Frax has introduced the IORB oracle, and when the IOBR rate is high, Frax will deploy some funds into RWA.

The allowed RWAs include types that are close to the IORB rate and have as low risk as possible, including: short-term US Treasury securities, Federal Reserve overnight repurchase agreements, US dollars held in the main account of the Federal Reserve, and selected shares of certain money market mutual funds.

The first RWA partner approved by Proposal FIP-277 is FinresPBC, which will focus on low-risk RWAs related to "cash equivalents." FinresPBC is a non-profit company registered in Delaware, with the primary purpose of providing access to traditional financial assets for the Frax protocol and providing safe cash equivalents and returns close to the Federal Reserve rate, with all returns distributed to Frax. Its banking partner is Lead Bank, and the operations it can carry out include:

- Holding US dollar deposits in FDIC-insured savings accounts and earning returns.

- Minting/redeeming USDC and USDP stablecoins.

- Holding, buying, and selling US Treasury securities in an independent brokerage account and earning returns.

As of October 30, the balance sheet of Frax's token type already includes "OFFCHAIN_USD," which consists of FDIC-insured bank deposits and short-term US Treasury securities, valued at approximately $2.98 million.

sFRAX pegged to sDAI

sFRAX, or Staked FRAX, is a special staking treasury that distributes a portion of the protocol's earnings to stakers weekly. The annualized yield of sFRAX will attempt to roughly track the IORB rate of the Federal Reserve, which has been 5.4% from the end of July to the present, as shown in the image below.

The yield of the sFRAX treasury is determined by a utilization function, initially set at 10% and decreasing as the staked funds increase. The protocol will deploy staked FRAX to sources of income as close to the IORB rate as possible. Every Thursday at 7:59:59 AM Beijing time, the protocol will mint new FRAX stablecoins based on profits and add them to the sFRAX treasury. sFRAX represents a certain proportion of FRAX deposits in the treasury, meaning that over time, more FRAX can be redeemed.

The protocol only strives to achieve a yield close to IORB, but does not guarantee it, and the yield mainly comes from the RWA strategy of partners. Frax also holds $56.28 million in sDAI, which can also generate returns through MakerDAO's RWA strategy.

Zero-coupon bond token FXBs

Frax also plans to issue a bond-like token called FXBs, which can be converted into FRAX stablecoins at maturity. Specifically, FXBs are debt tokens denominated in FRAX stablecoins, only guaranteed to be converted into FRAX stablecoins at maturity.

FXBs are auctioned off in a Dutch auction manner, with the system setting quantity and price limits to ensure that the auction price of FXBs does not fall below the reserve price. Additionally, due to the characteristics of zero-coupon bonds, they are usually issued at a discount. For example, FXBs with a maturity of one year may be traded at a price of $0.95, and each FXB can be exchanged for 1 FRAX at maturity, resulting in a yield of 0.05/0.95, approximately 5.26%. This helps form a yield curve for FXBs to price the time value of lending FRAX to the protocol itself.

The introduction of FXBs helps Frax bridge traditional financial bonds with decentralized cryptocurrencies, providing users with an innovative way to balance risk and return.

Limitations of Frax RWA strategy compared to MakerDAO

Although sFRAX in Frax offers a higher yield of 6.5% compared to sDAI in MakerDAO at 5%, Frax's RWA strategy still has many limitations compared to MakerDAO.

In comparison to DAI, which mainly relies on over-collateralization or stablecoin swaps, FRAX's CR is still less than 100%, which may raise concerns for some users. According to data as of October 30, CR = (total assets in the balance sheet - locked liquidity) / total debt = (806,442,146 - 120,069,640) / 742,061,132 = 92.5%.

In terms of stablecoin issuance, according to Makerburn and Frax official website data, the supply of DAI is 5.565 billion, with an increase in supply after the implementation of enhanced DAI deposit rates, which stopped growing about half a month ago. The supply of FRAX is approximately 672 million, and the supply has been decreasing over the past year and a half, with no increase after the launch of sFRAX this month.

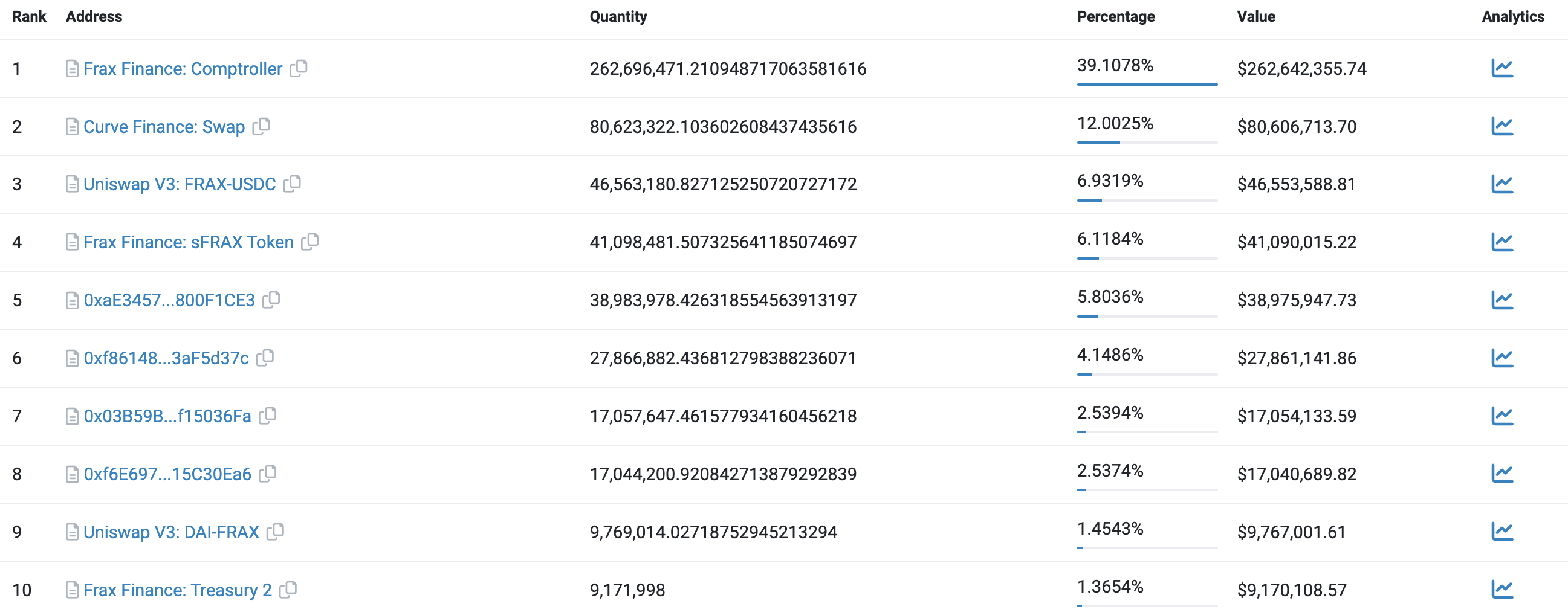

In MakerDAO, stablecoins originally accounted for the vast majority of the collateral for minting DAI, and these funds, after reserving a small amount of stablecoins for liquidity withdrawal, can be used to purchase RWA. So far, RWA collateral has reached 3.378 billion. In Frax, many FRAX is controlled by the protocol itself, such as AMO minting FRAX to provide liquidity in the Curve USDC/FRAX pool, which is shown in the balance sheet as FRAX or liquidity owned by the protocol. Clearly, there is not enough liquidity in the market to exchange all of this FRAX for other stablecoins and then use it to redeem and purchase US Treasury bonds. According to the blockchain explorer, the Frax Finance: Comptroller contract address alone controls 262 million FRAX, accounting for 39.1% of the FRAX supply.

In terms of stablecoin exchange methods, MakerDAO's PSM provides zero-cost 1:1 USDC/DAI swaps; whereas, to purchase FRAX for investment in sFRAX, trading must be conducted on Curve, incurring trading fees and slippage, which is not friendly to large holders.

RWA projects also have network effects and require substantial costs for off-chain compliance work. Only with a sufficient amount of assets can enough profit be generated to achieve sustainable operation and gain trust.

Conclusion

Frax v3 will make Frax more decentralized, stable, and efficient. sFRAX, pegged to sDAI in MakerDAO, has been launched this month, and other products such as bond FXBs will also be introduced.

However, there is still a significant gap between Frax and the well-established MakerDAO. After the launch of sFRAX, the supply of FRAX has not increased, standing at only 670 million, and possibly half of it is held by Frax itself and cannot be sold to purchase RWA.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。