This article outlines the blueprint for the future monetary system, which utilizes the transformative potential of tokenization to improve existing structures and open up new possibilities.

Authors: Diane Cheung, Will Awang, Spinach Spinach

Today, the global monetary system is at a historic turning point after digitization, and tokenization (the digital representation of asset rights on programmable platforms) is key to making this leap. Tokenization changes the way intermediaries serve users, bridging the gap in information transmission, reconciliation, and settlement, greatly enhancing the capabilities of the monetary and financial system. Tokenization will create new economic activities that are difficult to achieve within the current monetary system.

Cryptocurrencies or decentralized finance (as recently seen with DeFi greedily devouring RWA assets) only reveal one aspect of tokenization. They still have limitations, not only because of the difficulty in connecting with the real world, but also due to the lack of endorsement from central banks, even stablecoins are not stable.

In our previously compiled report, "Citi RWA Report: Money, Tokens, and Games (The Next Billion Users and Trillion-Dollar Value of Blockchain)", it opened up a brand new trillion-dollar tokenization market. So before embarking on the vast voyage, we still need to go back to the basics and look at tokenization, RWA, and even token payments from the first principles of blockchain, just as we carefully studied the Bitcoin whitepaper at the beginning.

Therefore, we have compiled the section on tokenization from the Bank for International Settlements (BIS) 2023 Annual Economic Report for industry professionals to further understand the underlying logic of tokenization.

BIS deconstructs tokenization from the perspective of the monetary and banking system, presenting a future blueprint for the global monetary system. The key elements of building the future blueprint are CBDC, tokenized deposits, and other tokenized rights to financial and physical assets. The blueprint envisions integrating these elements into a new financial market infrastructure called the "Unified Ledger," to fully realize the advantages of tokenization and to improve old systems and build new ones.

Key Points

Tokens and the tokenization of assets have enormous potential, but the endorsement of central bank currency and its ability to connect to the financial system are key to the success of tokenization.

The "Unified Ledger," a new type of financial market infrastructure, can combine CBDC, tokenized deposits, and tokenized assets on a programmable platform to maximize the advantages of tokenization.

CBDC and tokenized deposits have certain advantages in maintaining the singleness of money, settlement finality, providing liquidity, and risk mitigation.

The application of tokenization and the Unified Ledger can not only improve existing financial market infrastructure by seamlessly integrating multiple systems, but also create entirely new economic arrangements using programmable platforms, with significant commercial value.

Multiple specific-use ledgers can coexist, interconnected through application programming interfaces to ensure interoperability, while promoting financial inclusion and fair competition.

Governance arrangements are important factors driving the application of the Unified Ledger and tokenization of new technologies, and reasonable incentives are key to attracting participants to join new references and ultimately form network effects.

Glossary

Token – A digital representation of a right or asset on a blockchain or distributed unified ledger.

Tokenisation – The process of recording rights to physical or financial assets from traditional ledgers onto a programmable platform.

Private Tokenised Monies – Tokens issued by the private sector (non-central banks).

Singleness of Money – In a specific monetary system, there is only one primary currency, and different forms of currency or assets can be exchanged for this primary currency at an equivalent value, unaffected by the different forms of currency, whether they are issued by the private sector (such as deposits) or by the public sector (such as cash).

Settlement Finality – After funds are transferred from one account to another, they become the legitimate property of the receiving party and cannot be revoked.

Unified Ledger – A new type of financial market infrastructure (FMI) that integrates multiple data sources, platforms, or system information (financial transactions, data records, contracts, digital assets, etc.) for recording all transactions and data without the intervention of centralized institutions.

Programmable Platform – A platform not limited by specific technologies, including an execution environment, ledger, and governance rules of a Turing machine.

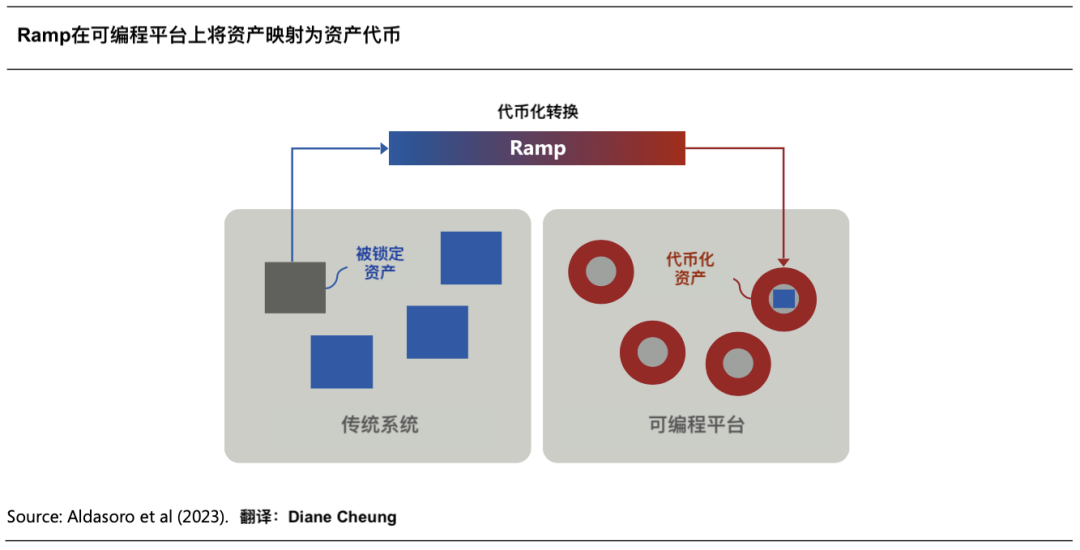

Ramp – A smart contract that connects non-programmable platforms with programmable platforms, locking assets on their original platform as collateral for tokens issued on the programmable platform.

Atomic Settlement – Linking the transfer of two assets to ensure that the transfer of one asset only occurs if the transfer of the other asset also occurs, making T+0 settlement possible.

Payment-versus-payment (PvP) – A settlement mechanism that ensures one currency must be transferred synchronously with another (or multiple) currency, making the final and irrevocable settlement at the same time.

Delivery-versus-payment (DvP) – A settlement mechanism that associates the transfer of assets with the transfer of funds to ensure that delivery only occurs when the corresponding payment occurs.

I. Tokens and Tokenization

1.1 Definition of Tokens and Tokenization

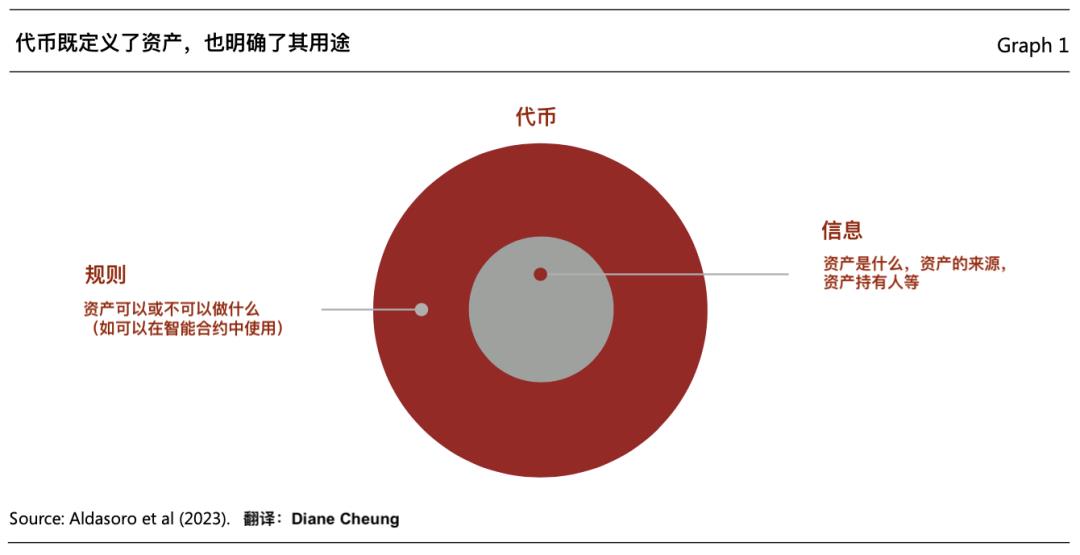

A token refers to a digital certificate of ownership available for trading on a programmable platform [1]. Tokens are not just single digital certificates; they typically combine the rules and logic governing the transfer of underlying assets in traditional ledgers (see the figure below). Therefore, tokens are programmable and customizable to meet personalized scenarios and regulatory compliance requirements.

Tokenization is the process of recording ownership of financial or real assets from traditional ledgers onto a programmable platform [2]. The tokenization process is facilitated by Ramp contracts (see the figure below), which map assets from traditional databases (such as financial securities, commodities, or real estate) into tokenized forms on a programmable platform. Assets in traditional databases are frozen or "locked" to serve as collateral for tokens issued on the programmable platform. This locking of assets ensures that the underlying assets are transferred simultaneously with the transfer of the mapped tokens, meaning ownership changes synchronously.

Tokenization introduces two important features: decentralized execution and contingent performance of smart contracts.

Decentralized Execution – Unlike traditional systems that require intermediary account managers to update and maintain ownership records of assets, in a tokenized environment, tokens or assets become "executable objects" maintained on the programmable platform, and platform participants can transfer assets by issuing programming instructions without the need for intermediary account managers to keep records. This approach expands the scope of composability, allowing multiple operations to be bundled into a single execution package. While this does not necessarily eliminate the role of intermediaries in tokenized transactions, the nature of the intermediary role shifts from "updating and maintaining ownership records of assets" to "managing the rules of the programmable platform," thus eliminating the need for dedicated individuals to update the ledger.

Contingent Performance of Smart Contracts – Programmable platforms can achieve conditional execution through the use of logical statements in smart contracts, such as "if, then, or else."

By combining the composability and contingent execution features of tokenization, complex transactions requiring contingent execution can be simplified.

1.2 CBDC and Private Tokens

Tokenization requires a unit of account for pricing transactions and its means of payment to be fully applicable. Compared to using stablecoins as a means of payment in decentralized finance scenarios to achieve tokenization, CBDC has a better foundation due to its settlement finality and central bank endorsement. Programmable platforms can directly utilize embedded fiat currency settlements as a necessary component of tokenization arrangements, making CBDC the optimal choice for tokenization applications.

The development of wholesale CBDC is crucial for tokenization applications. As a settlement method for tokenization, wholesale CBDC can serve as a function similar to current reserve requirements in the monetary system, and it can also be endowed with new functions through tokenization. For example, transactions conducted using wholesale CBDC can incorporate the composability and contingent execution features mentioned above. This enhanced form of CBDC can also become a retail variant for use by residents and businesses, allowing central banks to further support the singleness of money by providing the public with direct access to digital cash linked to the digital form of the sovereign unit of account.

The role of CBDC in a tokenized environment is already quite clear, but there is still room for discussion on how private tokens complement CBDC in an appropriate form. Currently, there are two mainstream forms of tokenization: tokenized deposits and asset-backed stablecoins. Both represent liabilities of the issuer, with the issuer committing to redeem the rights of customers at face value in the sovereign unit of account. The difference between the two lies in the transfer method and their roles in the financial system, which affects their attributes as private tokens complementing CBDC.

Tokenized Deposits

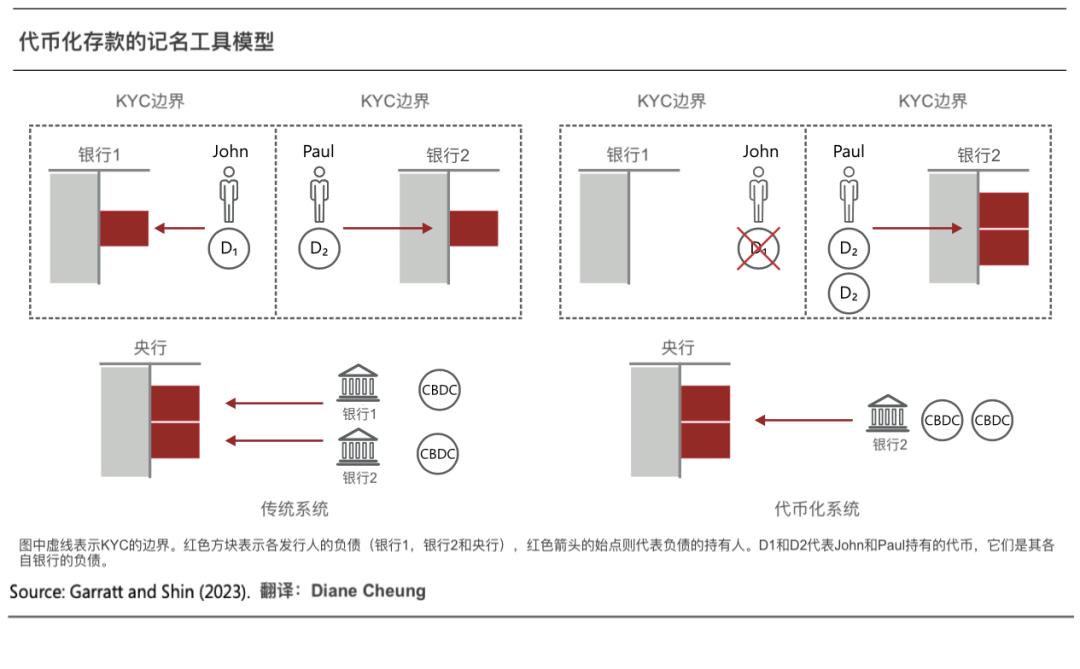

Tokenized deposits can be designed to operate similarly to conventional bank deposits in the existing system. Banks can issue tokenized deposits to represent liabilities of the issuer. Similar to conventional deposits, tokenized deposits cannot be transferred directly, and the liquidity provided by central banks will continue to ensure the normal functioning of payment functions.

The following example illustrates the similarity between tokenized deposits and traditional deposits. In the traditional system, when John pays 100 pounds to Paul, Paul does not receive a deposit of 100 pounds at John's bank. Instead, the balance in John's bank account decreases by 100 pounds, while the balance in Paul's bank account increases by the same amount. At the same time, the adjustment of the individual accounts of the two banks is achieved through the transfer of central bank reserves between the two banks.

In a tokenized environment, the same payment result can be achieved by reducing the tokenized deposit held by John's bank and increasing the tokenized deposit held by Paul's bank, while simultaneously settling the payment through the concurrent transfer of wholesale CBDC. Paul still only has a claim against his bank, as a verified customer, and has no claim against John's bank or John.

Tokenized deposits can preserve and enhance some key advantages of the current two-tier monetary system.

First, tokenized deposits will help maintain the singleness of money. The existing system operates settlement infrastructure through central banks, ensuring that payments in the sovereign currency achieve final transfer, maintaining the singleness of bank deposit payments. Tokenized deposits preserve this mechanism, and because settlement using wholesale CBDC is completed through smart contracts, it improves timeliness, reduces payment time lags, and can lower risks.

Second, tokenized deposits settled using wholesale CBDC can ensure settlement finality. The central bank deducts the corresponding amount from the payer's account and credits it to the payee's account, achieving final settlement by updating the balance sheet, confirming that the payment is final and irrevocable. In the example above, settlement finality ensures that Paul has no claim against John (or John's bank), but only against his own bank.

Finally, tokenized deposits will ensure that banks can still flexibly provide credit and liquidity. In the existing two-tier monetary system, banks provide loans to residents and businesses as well as on-demand liquidity support (such as credit lines). Most of the currency in circulation in the existing monetary system is created through this process, as loans issued by banks directly create deposits in the accounts of borrowers, achieving money creation. This flexible approach allows banks to meet the funding needs of residents and businesses based on changes in economic or financial conditions. However, this model also requires effective regulation to prevent excessive credit growth and high-risk behavior.

Stablecoins

Stablecoins represent another form of private tokens and have certain drawbacks. Compared to tokenized deposits, stablecoins represent transferable claims issued by the issuer, similar to digital bearer bonds. Using stablecoins for payment is equivalent to transferring the issuer's liability between users.

Using the example of John and Paul's transfer, when John pays one unit of stablecoin issued by the stablecoin issuer to Paul, John's claim is transferred to Paul. Before the transfer, Paul does not hold any claims against the issuer. In this scenario, Paul may passively hold a claim against the issuer that he does not trust. The question then arises: does Paul trust the stablecoin issuer?

This is because stablecoins have the characteristics of anonymous bearer bonds. The stablecoin issuer does not need to update its balance sheet at the time of the transfer, and because stablecoins are private tokens, the central bank's balance sheet does not settle the transaction. The stablecoin itself serves as evidence of the issuer's liability, and the transfer of this evidence does not require the issuer's consent or involvement.

Compared to tokenized deposits, stablecoins mainly have the following disadvantages:

First, stablecoins may disrupt the singleness of money, meaning the inconsistency of the value of money. This is because stablecoins are tradable, and when there are differences in liquidity between stablecoins or differences in the credibility of issuers, their prices may deviate from face value, or even experience more severe uncertainty. For example, in the case of Silicon Valley Bank, users' concerns about the bank's liquidity affecting stablecoin prices led to a massive sell-off of stablecoins, causing a sharp drop in stablecoin prices, disrupting singleness. The lack of clear regulation and central bank credit endorsement is a significant factor contributing to these issues.

Second, unlike tokenized deposits, the operation of asset-backed stablecoins is more similar to narrow banking. This is because, in principle, all the dollars corresponding to stablecoin issuance should be invested in highly liquid assets, which reduces the supply of liquid assets available for other purposes, thus limiting the flexibility of providing liquidity.

Furthermore, compared to tokenized deposits, stablecoins lack regulation in areas such as KYC, AML, and CFT, posing certain risks. In the example mentioned earlier, when John transfers stablecoins to Paul, the issuer does not verify or conduct compliance checks on Paul's identity, leading to the risk of fraud. Tokenized deposits, on the other hand, can operate within existing regulatory frameworks by mimicking the transfer process of traditional deposits.

II. Tokenization and Unified Ledger

The full application of tokenization depends on the ability to combine the trading and operations of currency and a range of assets on a programmable platform. Tokenization provides a necessary means of payment that can map underlying asset transactions, with the central bank currency in tokenized form at its core, to facilitate settlement finality. The unified ledger is a "public space" that brings together CBDC, private tokens, and other tokenized assets on the same programmable platform, ultimately achieving seamless integration of a new economic arrangement.

2.1 Creation of a Unified Ledger

The concept of a unified ledger does not mean "one ledger to rule them all." The form it takes depends largely on the balance between short-term and long-term interests, mainly because the establishment of a unified ledger requires the introduction of new financial market infrastructure (FMI) and consideration of the specific needs of various jurisdictions.

Using APIs to connect multiple ledgers and existing systems to form a unified ledger is a form with lower initial costs in the short term and easier coordination of stakeholders, and it can also meet the specific needs of different jurisdictions. Connecting existing systems through APIs can achieve automatic data exchange processes similar to those in a tokenized environment, allowing multiple ledgers to coexist. Over time, new features can be continuously integrated, and the scope of the unified ledger will determine the involvement of each party in the governance arrangement of each ledger. However, this progressive approach also has limitations, as it is constrained by the need for forward-looking and compatibility with existing systems during construction, and as it expands, the constraints will become more stringent, ultimately hindering innovation.

Directly introducing new financial market infrastructure for a unified ledger, while resulting in higher initial investment costs and costs associated with switching to new standards in the short term, allows for a comprehensive assessment of the benefits that new technology applications can bring. Tokenization presents an opportunity for innovation, and the long-term value generated by programmable platforms will far exceed the short-term investment.

It should be noted that neither implementation method is absolutely good or bad, and the specific implementation method depends to a large extent on the technological foundation and the specific needs of jurisdictions.

2.2 Composition of a Unified Ledger

A unified ledger enables tokens on a common platform to fully leverage their advantages. In this secure environment of encrypted storage and shared data, new transactions can be created, and the execution of contracts can be optimized. The design of a unified ledger has two key factors: all components required for transactions must be stored on the same platform, and tokens or tokenized assets must be executable objects, allowing them to be safely transferred without relying on external messages and identity verification.

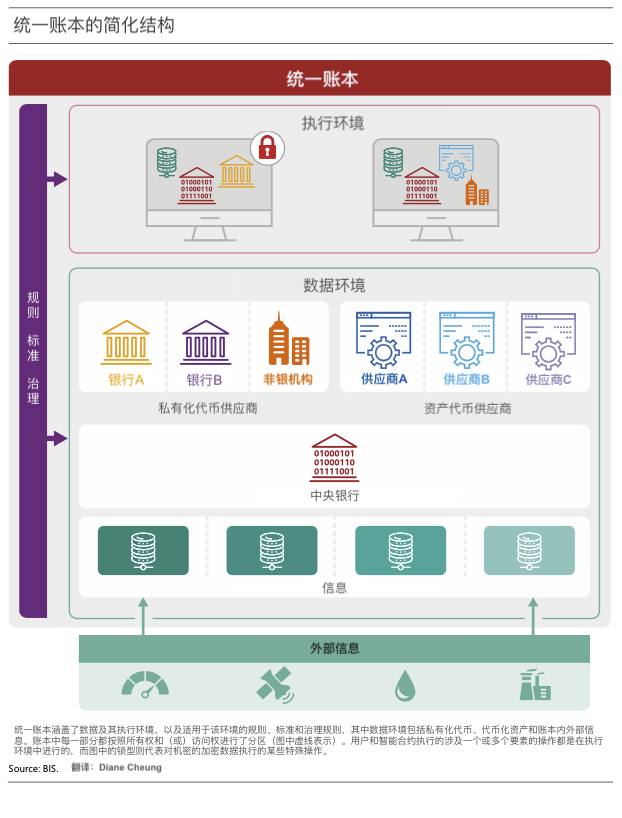

The figure below shows the simplified structure of a unified ledger, consisting of data environment and execution environment modules, both of which are subject to a common governance framework.

Data Environment: The data environment mainly includes three parts: private tokens and tokenized assets, necessary information for ledger operation (such as data required for the secure and legal transfer of funds and assets), and all real-world information required for operations (which can be transaction results within the ledger or obtained from the external environment). Private tokens and tokenized assets are independently partitioned and owned and operated by the corresponding qualified operating entities.

Execution Environment: This is used to execute various operations, which can be directly executed by users or smart contracts. It only combines the institutions and assets required for business based on specific applications. For example, when two individuals transfer funds through a smart contract, the payment from the user's bank (the supplier of tokenized deposits) and the central bank (the supplier of CBDC) are combined for execution. If external conditional information is required, it is also included.

Common Governance Framework: This is used to specify how different components should interact and apply in the execution environment, ensuring strict confidentiality. Data partitioning and encryption are the main methods for achieving confidentiality and data control. Data partitioning isolates different areas, allowing only authorized entities to access data within their respective areas, while data encryption ensures that data is encrypted during transmission and storage, and only authorized parties can decrypt and access the data. Together, they ensure the security and trustworthiness of financial transactions and operations.

III. Use Cases

As mentioned above, tokenization and a unified ledger can provide new economic arrangements for existing financial businesses, leading to improvements in existing business models and the innovation of new business models.

3.1 Improvement of Existing Business Models

The application of tokenization can improve existing payment and securities settlement businesses.

3.1.1 Payment Settlement

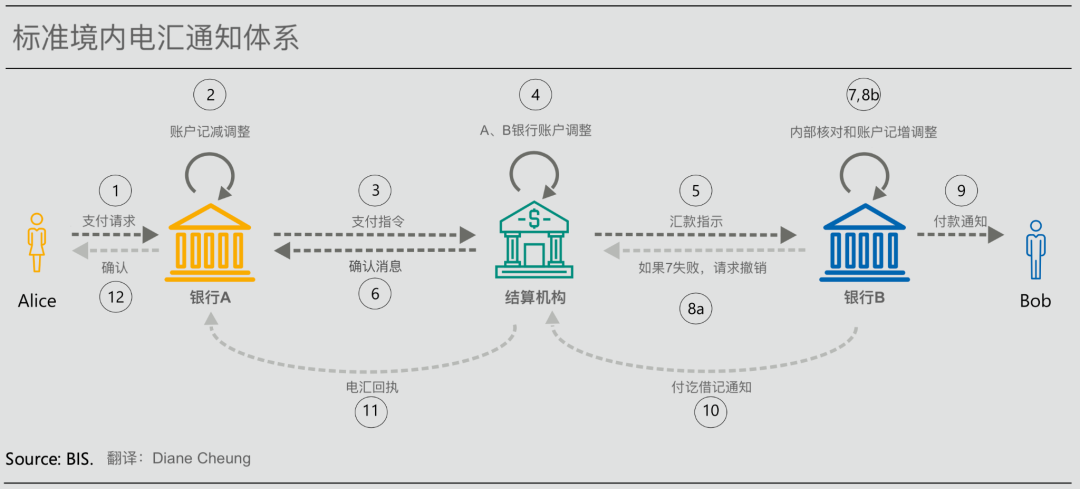

The current payment system meets the basic needs of users, but there are still issues with high costs, slow speed, and low transparency in the payment process. This is mainly because digital currencies are currently on the edge of communication networks and must be coordinated by external messaging systems to connect banks and non-bank proprietary databases. The separation of messaging, reconciliation, and settlement leads to delays, and participants cannot fully understand the progress. In the event of errors, this can lead to high error correction costs and operational risks.

The figure below shows a simplified domestic telegraphic transfer notification process, involving a complex series of message notifications, internal checks, and account adjustments for the transfer of funds from the payer, Alice, to the payee, Bob. Participants find it difficult to track payment progress, and payees and payers can only passively learn about payment status. In actual business, cross-border transaction payment processes are even more complex, involving a series of factors such as cross-border messaging, time differences and holiday disparities, and foreign exchange settlement, further hindering timeliness and increasing payment risks.

A unified ledger can improve these issues in payments. Private tokens and CBDC on the same programmable platform no longer need to send messages between various proprietary databases. The unified ledger uses atomic settlement (i.e., simultaneous exchange of two assets), so when one asset is transferred, the other asset is also transferred, combining wholesale payment settlement from one bank to another and concurrent wholesale CBDC settlement, eliminating delays and reducing risks. At the same time, with data partitioning and access control, the unified ledger provides better payment experiences for participants while ensuring data privacy and transaction transparency.

3.1.2 Securities Settlement

Securities settlement[7] is also a typical scenario where a unified ledger empowers existing businesses.

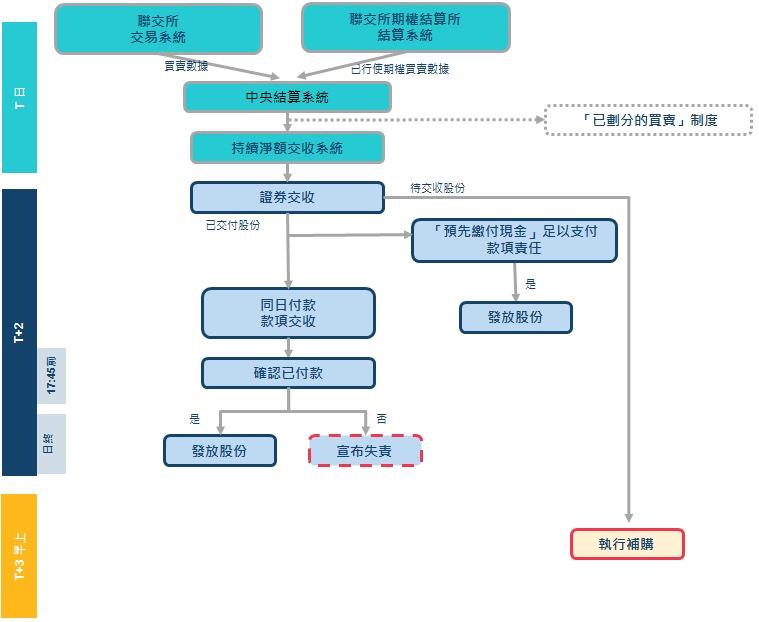

The existing securities settlement process involves multiple participants, such as brokers, custodians, central securities depositories, clearinghouses, and registrars, among others. The complex messaging instructions, fund flows, and reconciliation procedures involved in transaction settlement make the overall process lengthy and costly, leading to the risk of reset cost and principal risk.

In traditional securities settlement, central securities depositories (CSDs) directly or indirectly manage securities for the beneficial owners. Buyers or sellers of securities initiate the trading process by instructing their brokers or custodians, and final settlement may take up to 2 working days to complete (see the securities settlement process of the Hong Kong Stock Exchange in the figure below), exposing the parties to reset cost risk (the risk of having to re-trade at a less favorable price if the transaction fails to settle). Additionally, due to the asynchrony of fund payment and securities delivery, there is also the risk of sellers not receiving funds or buyers not receiving securities, known as principal risk.

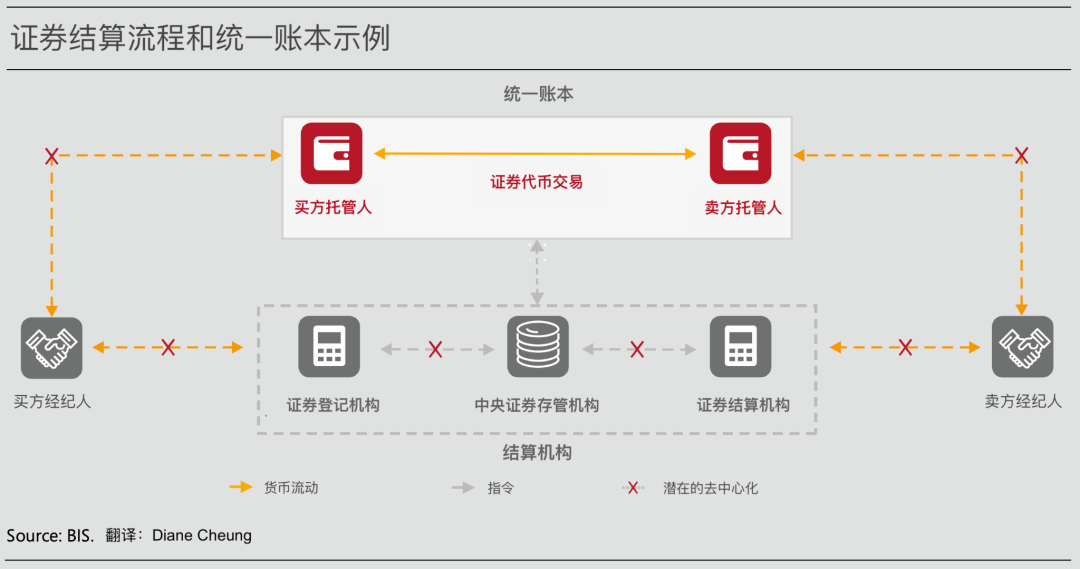

Unified ledger and tokenization can improve securities settlement. As shown in the figure below, by combining tokenized currency and securities on a programmable platform, settlement delays can be reduced, eliminating the need for messaging and reconciliation, thereby lowering reset cost risk. Synchronized fund payment and securities delivery can expand the scope of delivery versus payment (DvP) to further reduce principal risk. Implementing this new securities settlement method requires corresponding liquidity-saving mechanisms[8], as atomic settlement in the system requires higher liquidity, similar to the transition from deferred net settlement (DNS) to real-time gross settlement (RTGS).

The Evergreen project initiated by the Hong Kong Monetary Authority in 2022 is a typical application of how a unified ledger empowers securities settlement, as detailed in the Green Finance section below.

3.1.3 Foreign Exchange Settlement

Unified ledger and tokenization can also effectively reduce settlement risk in the trillion-dollar foreign exchange market.

The existing simultaneous settlement (PvP) mechanism in foreign exchange trading helps reduce settlement risk, but the risk still exists, and the PvP system may not be available or suitable for certain transactions, with market participants also considering it to be costly.

24/7 atomic settlement can eliminate settlement delays and further reduce risk. Smart contracts combining foreign exchange and authorized foreign exchange providers can expand the scope of PvP settlement, reducing transaction costs.

3.2 Creating New Business Scenarios

The unified ledger not only improves existing businesses but also expands the scope of collaboration and creates new types of business arrangements and trading models through the joint use of smart contracts, secure and confidential information storage and sharing environments, and tokenized transaction execution.

3.2.1 Alleviating Bank Run Risk

The application of smart contracts can effectively broaden the scope of collective coordination, overcoming individual "free-riding" behaviors and effectively reducing the risk of bank runs.

Term deposit contracts are bilateral agreements between banks and depositors, and the value of deposits may be affected when banks or the banking industry face liquidity pressure. In such cases, the value of deposits will depend on the collective decisions of all depositors. As banks primarily invest depositor funds in illiquid assets, when facing short-term liquidity pressure, under the principle of first come, first served, depositors who withdraw their deposits first are guaranteed the value of their deposits, leading to bank runs.

The application of smart contract deposit contracts can mitigate this risk by enforcing collective coordination among all depositors (i.e., the value of deposits does not differ due to the order of withdrawals), eliminating the motivation for depositors to withdraw early due to concerns about others withdrawing first. While this approach may not prevent all bank runs, it can alleviate the typical advantages of early withdrawal and collective failure.

3.2.2 New Supply Chain Finance

By integrating real-time information into smart contracts, supply chain finance can be improved using a unified ledger.

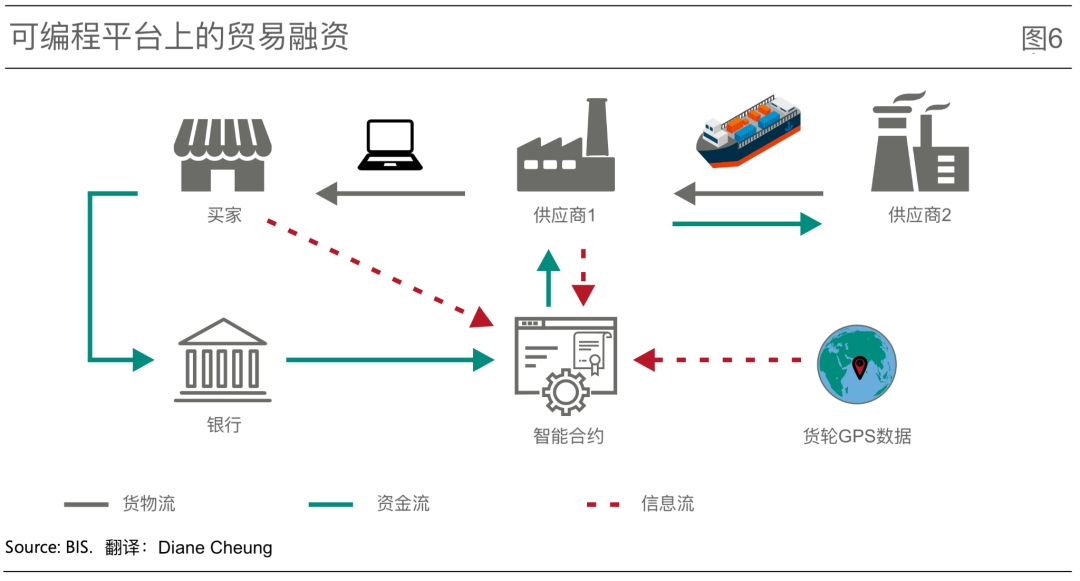

The figure below depicts a simple supply chain. The buyer (usually a large company) purchases goods from Supplier 1 (usually a small and medium-sized enterprise, SME), who needs to purchase raw materials from Supplier 2 for production. The buyer typically pays Supplier 1 after the goods arrive, while Supplier 1 needs to pay wages and raw material costs before receiving payment, requiring financing and repayment upon receipt of payment.

Due to the possibility of the buyer not paying after delivery, the financing form for suppliers is mainly collateralized trade loans. For example, an Italian SME purchases semi-finished products from an Indian supplier, and the semi-finished products are delivered by cargo ship after one month. To start production, the SME uses these in-transit goods as collateral to obtain a loan from a bank or the supplier. If the SME defaults, the creditor has the right to reclaim the collateral. Due to the risk of collateral damage or devaluation (e.g., encountering pirates or storms), creditors may only provide insufficient credit or increase borrowing costs. Additionally, SMEs may engage in fraudulent activities, such as pledging the same collateral to multiple lenders. These common financing issues limit suppliers to relying on their own funds to meet operational needs.

The unified ledger can mitigate trade finance problems by integrating different components of the supply chain relationship and financing process into one place. Smart contracts between the buyer and supplier can specify automatic payment by the buyer upon delivery of goods or partial payment at a certain intermediate stage, reducing the risk of the buyer not fulfilling payment obligations upon delivery. Smart contract loans between banks and suppliers can automatically execute loan terms at different stages of transportation based on real-time data provided by IoT devices, such as automatically reducing interest rates or adding additional credit when the ship passes through a high-risk area. This allows suppliers to meet early operational capital needs, and because the collateral is recorded in the unified ledger and cannot be re-pledged, it reduces the risk for fund providers and further increases their willingness to provide credit.

3.2.3 Loan Service Optimization

Through its secure and confidential information storage and sharing environment, the unified ledger can also leverage the advantages of data to reduce the cost and difficulty of obtaining credit.

First, the integrated data in the unified ledger allows lenders to incorporate more diverse data into borrower credit risk assessment systems, reducing borrowing costs and reliance on collateral.

Second, the application of data encryption technology in the unified ledger allows users to retain control over their data, improving the high borrowing costs caused by network effects. While network effects aggregate a large amount of user data, providing convenient borrowing channels for borrowers, as these services attract more users, the increase in data volume leads to more users creating data, forming a Data-Network-Activities (DNA) loop. This increased market concentration generates excess profits or monopolistic profits, leading to high borrowing costs. The unified ledger preserves the user's control over their data, allowing users to decide whether lenders can share or use their data, reducing the profits generated by market concentration for lenders, ultimately lowering borrowing costs and benefiting residents and businesses.

Additionally, the unified ledger can enhance financial inclusion by improving data sharing arrangements, allowing data from disadvantaged groups such as ethnic minorities and low-income families, who have "limited credit history," to be included in the credit system. These applicants will benefit from non-traditional data screening, as traditional credit scoring by banks interferes more with their default risk indicators than other groups. The more comprehensive data provided in the unified ledger improves the quality of credit assessment, thereby reducing borrowing costs for these groups.

3.2.4 Anti-Money Laundering

Through the use of encryption technology, the unified ledger can also introduce new methods to strengthen anti-money laundering (AML) and combatting the financing of terrorism (CFT).

Financial institutions need to protect highly sensitive and proprietary data in accordance with the law, and the inability to share this sensitive data without exposing confidential information hinders the implementation of AML and CFT. The unified ledger can provide transparent and auditable records of transactions, transfers, and changes in ownership, while encryption methods allow financial institutions to share this information across borders in a confidential manner, enabling the detection of fraud and money laundering activities in compliance with local data regulations.

By utilizing tokenization and the dual attributes of tokens containing identification information and specifying transfer rules, its advantages can be further highlighted. For example, in payment transactions, regulatory compliance requirements such as the geographic attributes of the parties involved and the type of transfer can be directly embedded into the tokens. The BIS Innovation Hub's Aurora project is exploring how enhanced privacy technology and advanced analytics can combat cross-institution and cross-border money laundering activities.

3.2.5 Asset-Backed Securities

The combination of smart contracts, information, and tokenization through the unified ledger can also improve the issuance and investment process of asset securitization and bonds.

Taking mortgage-backed securities (MBS) as an example, MBS involves pooling mortgage loans and layering them into different classes of bonds, which are then sold to investors. Even in the highly liquid MBS market in the United States, with a market size of up to $12 trillion, the securitization process involves the participation of dozens of intermediaries, making the process very complex.

By applying automated smart contracts, the delay in information flow and fund flow can be eliminated, simplifying the securitization process. Tokens can integrate real-time data on borrower repayments, repayment collection methods, and investor allocations, further reducing the reliance on intermediaries.

3.2.6 Green Finance

Green finance is another typical use case for the innovative application of the unified ledger and tokenization.

By creating a digital platform, investors can download an application on the platform and invest any amount in tokenized government bonds to fund green investments. Investors can not only view accrued interest during the bond term but also track real-time information such as the amount of clean energy generated and the reduction in carbon emissions due to the investment. The bond also allows investors to trade on a transparent secondary market.

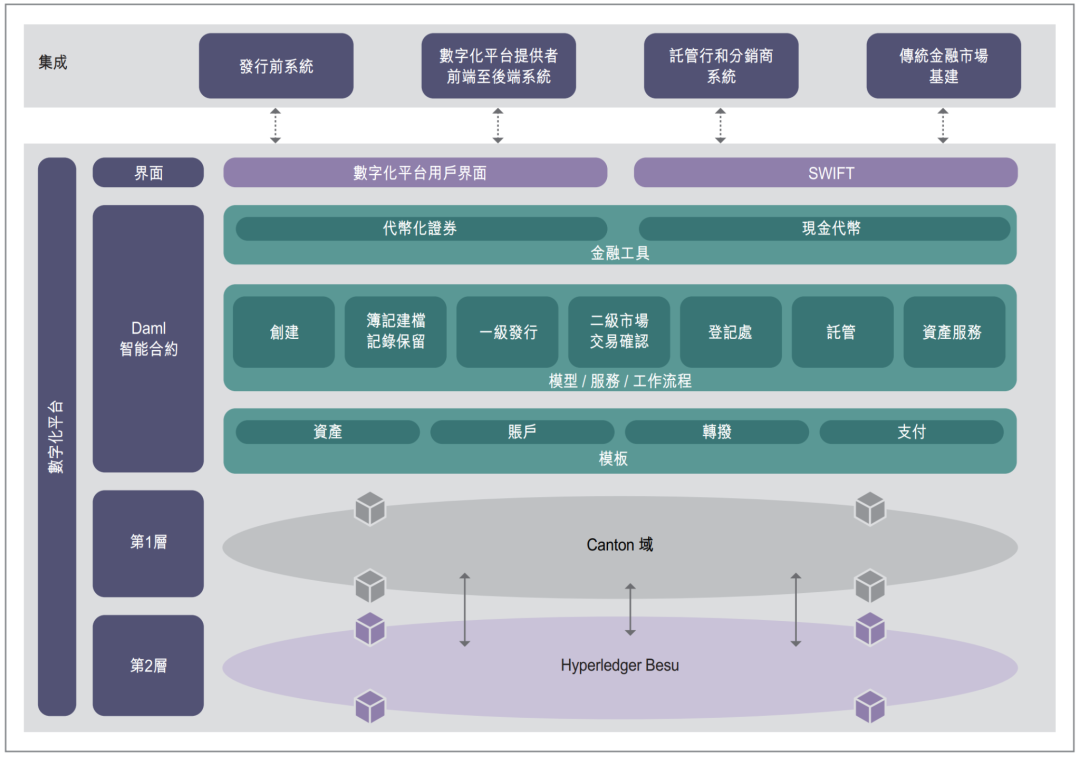

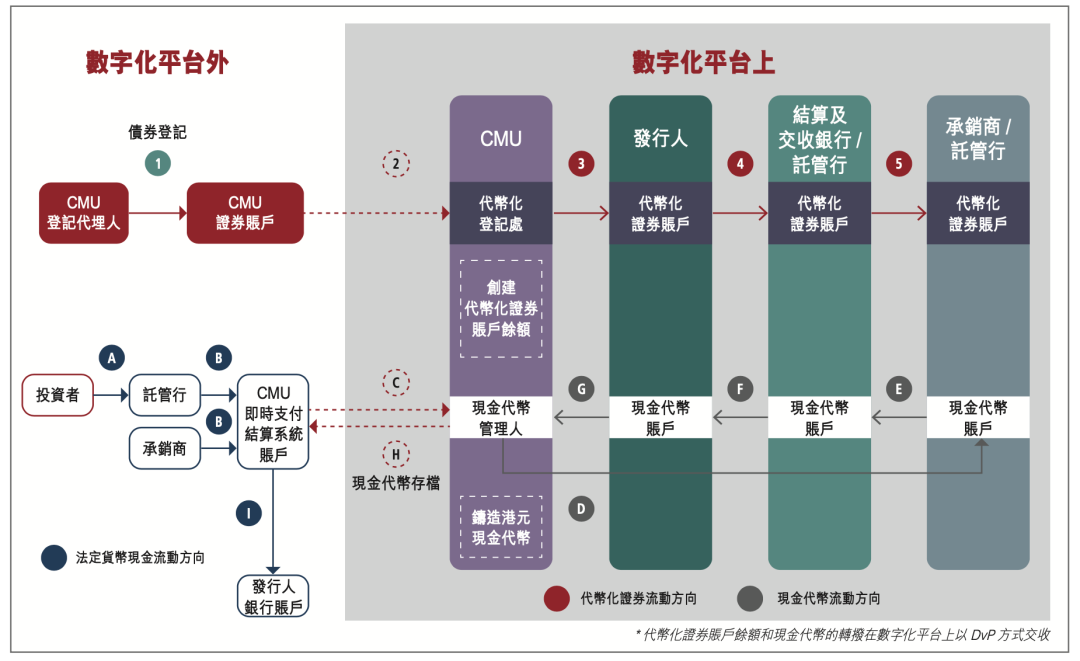

In the BIS Innovation Hub's Genesis project, BIS and the Hong Kong Monetary Authority have been continuously exploring in this area. In 2022, the Evergreen project was launched to issue green bonds using tokenization and the unified ledger. The architecture and primary issuance process of the project are shown in the figure below. The project fully utilizes the distributed unified ledger to integrate the participants involved in bond issuance on the same data platform, supporting multi-party workflows and providing specific participants with authorization, real-time verification, and signing functions, improving transaction processing efficiency. The bond settlement achieves DvP settlement, reducing settlement delays and settlement risk, and the real-time data updates on the platform enhance transaction transparency. While the project still uses API integration to connect traditional systems with the unified ledger platform, it is a meaningful attempt to improve transaction efficiency and reduce risk.

Overall architecture of the Evergreen project

Primary issuance workflow of the Evergreen project with DvP settlement

4. Basic Principles of Unified Ledger Application

When applying the unified ledger and its tokenization, some general guiding principles need to be followed. The primary principle is that any application should be consistent with the dual-layer structure of the monetary system. Based on this, central banks can continue to maintain the singularity of the currency through wholesale CBDC settlement, while the private sector can continue to innovate, benefiting residents and businesses.

In addition, principles related to scope and governance are also crucial, as they can clarify how to best ensure a fair competitive environment and promote competition, as well as safeguard data privacy and operational resilience. The implementation of these principles ultimately depends on the specific needs and preferences of each jurisdiction, as well as the details of their specific applications.

4.1 Scope, Governance, and Competition

4.1.1 Scope of the Unified Ledger

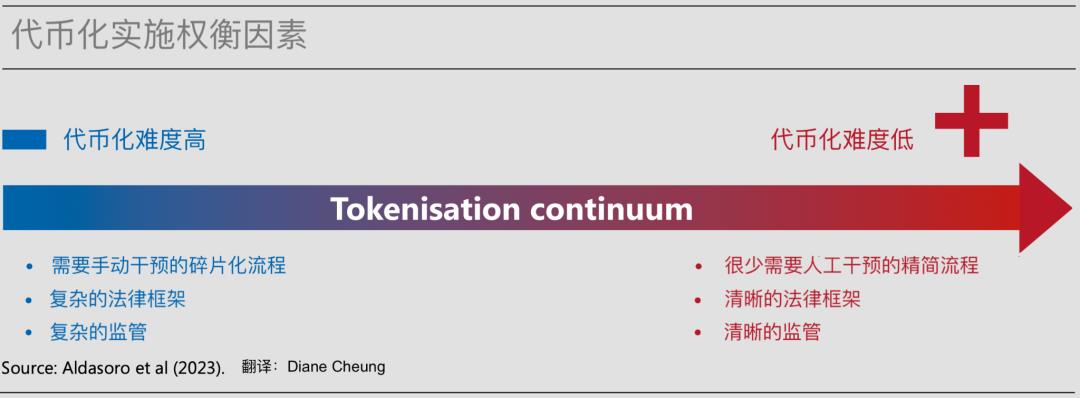

As mentioned earlier, the unified ledger can contain multiple sub-ledgers, each with specific use cases, so the application of the unified ledger can start with specific scenarios where its effects are more pronounced. The figure below shows the scope and characteristics of tokenization applications. When implementing tokenization, the implementation effect should be comprehensively balanced, as applications that are relatively easy to tokenize may not yield significant unit returns, while applications that are relatively difficult to tokenize may yield huge returns after implementation. Therefore, in the short term, tokenization can focus on identifying assets suitable for tokenization and capable of large-scale trading. Starting from specific use cases, the scope of the unified ledger application can expand over time, but its ultimate scope will depend on the specific needs and limitations of each jurisdiction.

The unified ledger is essentially a new type of FMI (or a combination of multiple FMIs). As stated in the "Principles for Financial Market Infrastructures" [10], the most fundamental principle of FMIs is that they should provide final settlement in central bank money in a feasible and available manner, which applies to various infrastructures such as payment systems, central securities depositories, securities settlement systems, central counterparty clearing, and trade repositories.

4.1.2 Governance and Competition

The scope of the unified ledger directly affects its governance arrangements, competitive landscape, and participation incentives.

The governance of the unified ledger can follow existing arrangements, where central banks and regulated private sector participants participate in governance according to established rules. For example, in payment settlement, when the unified ledger involves currency and payments, central banks are still responsible for the final settlement of assets, and to ensure integrity, regulated and supervised private sector participants continue to provide services to users. They should also comply with existing KYC, AML, and CFT regulations and conduct continuous due diligence to ensure privacy compliance.

As the scope of the ledger expands, the requirements for governance arrangements will also increase. For example, a unified ledger for cross-border payments requires seamless interoperability between private payment service providers (PSPs) and central banks in different jurisdictions with different regulatory frameworks, requiring extensive cross-jurisdictional collaboration, whereas a unified ledger for domestic securities settlement requires relatively less coordination.

For competition and financial inclusion, an open and fair environment is crucial. From a regulatory policy perspective, the focus is on considering how the introduction of a general platform will impact the organization of the currency and payment industry and its ultimate impact on the entire financial system. Open platforms can promote healthy competition and innovation among private sector participants, thereby reducing costs for end-users by cutting excessive profits. Regulators should aim for this when designing platforms and corresponding rules, ensuring that network effects serve the interests of consumers and prevent the emergence of monopolistic participants.

Providing appropriate economic incentives for potential participants is key to promoting competition. Without proper incentives, private payment service providers may choose not to participate. If the application of new technology affects the distribution of existing economic incentives, reducing the influence or benefits of incumbents, it may hinder the implementation of new technology by participants. The provision of infrastructure that allows for innovation while mandating participation may be crucial for implementation, allowing all participants to receive economic incentives, and as the number of participants increases, network effects become more prominent, leading to network effects.

4.2 Data Privacy and Operational Resilience

The unified ledger aggregates currency, assets, and information on the same platform, making data privacy and operational resilience particularly important.

4.2.1 Privacy Protection

Different types of data being aggregated in one place can raise concerns about data theft or misuse. To protect user privacy, adequate safeguards need to be implemented, and a conservative approach should be taken to manage data on the unified ledger to achieve privacy protection. The same concerns apply to trade secrets, and businesses are only willing to participate in the unified ledger if their confidential information is adequately protected.

Creating partitions in the data environment of the unified ledger is an important way to protect privacy, allowing each participant to only see and have access to relevant data in their own partition. The application of private keys further strengthens data protection, as data updates, transaction authentication, and authorization within partitions are all done through private keys, ensuring that only authorized accounts can manage partition data.

Encryption technology is another effective way to protect privacy. When different participants interact in transactions, information from different partitions needs to be shared and parsed in the execution environment. Secure data sharing technology allows mathematical calculations to be performed directly on encrypted or anonymous data without exposing sensitive information. This meets the desire of financial institutions and users to share data in a privacy-protected manner, while also promoting competition and innovation due to decentralization. Trade secrets can be protected through the encryption of individual smart contracts, as only the code owner or designated participants can access detailed contract information.

There are various technologies available to achieve information confidentiality and privacy protection in the unified ledger, each with its own advantages and disadvantages, as well as differences in privacy protection, computational burden, and implementation difficulty.

In addition, as institutions that serve the public interest and have no commercial interest in personal data, central banks can ensure privacy protection from the outset when designing the unified ledger, such as embedding privacy laws directly into the tokens of the unified ledger. Data privacy laws give consumers the right to authorize or refuse the use of their data by third parties, such as the EU's General Data Protection Regulation, which requires companies to delete consumers' personal data, and California's Consumer Privacy Act, which gives consumers the right to know the details of information collected by companies. By using the unified ledger, options to prohibit the sale of personal data or delete personal data can be directly embedded into tokens and smart contracts, strengthening the effective implementation of data privacy laws.

4.2.2 Cyber Attacks

In addition to privacy protection, operational resilience is also crucial. In recent years, the losses caused by cyber attacks have increased significantly, and strong protection of operational resilience is needed at both the institutional and legal levels. When FMIs or the unified ledger are subjected to cyber attacks, the potential financial and reputational losses are significant, and the widespread paralysis of the financial system and the resulting societal losses are immeasurable. The broader the scope of the unified ledger, the greater the risk of a single point of failure, and the potential losses are also greater. For these reasons, sufficient investment in operational resilience and security is essential, requiring multi-layered security measures to ensure the integrity and confidentiality of unified ledger data.

V. Conclusion

In order to fully unleash the innovative potential in the fields of currency, payments, and broader financial services, the role of central banks is crucial in building a future currency system that can adapt to real-world needs and innovative developments.

This article outlines the blueprint for the future currency system, which leverages the transformative potential of tokenization to improve existing structures and open up new possibilities. This blueprint proposes a new type of financial market infrastructure, the unified ledger, which integrates CBDC, tokenized deposits, and tokenized rights to other financial and physical assets onto one platform. Its advantages lie in allowing seamless integration and automatic execution of a wider range of financial transactions, achieving synchronous and real-time settlement; and consolidating all information data on the same platform, overcoming information and incentive issues, and serving the public interest.

The concept of tokenization and the unified ledger reveals the development trajectory of the future currency system, but in practical applications, the specific needs and limitations of each jurisdiction determine the scope and sequence of its application. In this development process, multiple ledgers can coexist and interoperate through API integration.

Furthermore, to achieve this vision, it requires joint efforts from the public and private sectors to drive the development of technological solutions, establish a universal digital platform, and ensure appropriate regulation and supervision. Through collaboration, innovation, and continuous integration, it is believed that a trust-based currency system can be established, leading to new economic arrangements, improving the efficiency and accessibility of financial transactions, and meeting the evolving needs of residents and businesses.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。