Title: One Night Bull Market? Bears Suffer Brutal Massacre

Author: Terry | Plain Language Blockchain / Source: https://mp.weixin.qq.com/s/aTQJGhCbjbdtfzy9vDPN5w

Suddenly, like a one-night bull market, last night and this morning (October 23-24), Bitcoin saw a significant surge, reaching nearly $36,000, with a maximum increase of over 15% in 24 hours. Ethereum also briefly surpassed $1,800, setting a recent high.

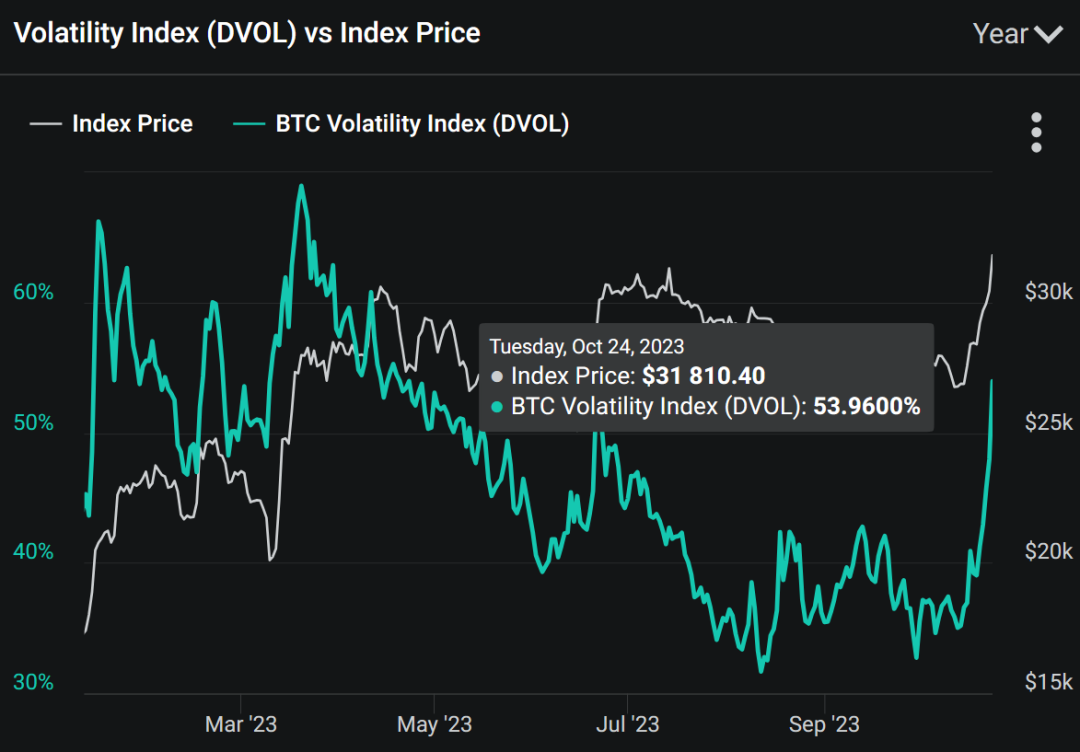

At the same time, the long-hovering volatility suddenly soared. Derbit's BTC volatility index (DVOL) rose from around 39.2% on October 18 to 53.96% this morning, returning to the normal range before June this year.

01

Volatility Hits Bottom and Rebounds

Volatility refers to the rate of price increase or decrease of a specified asset within a certain period, which is an indicator of the degree of price change of the asset.

Historical data shows that Bitcoin has always been a high-volatility asset. However, starting in the second half of this year, the volatility index of the Bitcoin market has continuously converged and decreased, strangely dropping to historical lows:

Since June, the volatility of the entire crypto market has been declining, falling below 40% and lingering at low levels, reaching a new low in mid-August.

On August 12, the daily price range of Bitcoin was less than $100, fluctuating between $29,381.56 and $29,481.35 (BN USDT trading pair data), while Ethereum's daily price range was less than $8, fluctuating between $1,846.08 and $1,854.01.

This is an extremely rare situation in the history of Bitcoin and the entire crypto market, indicating that market liquidity is almost depleted, and users' trading willingness is very passive.

Derbit data shows that on August 12, the BTC index's 15-day historical (annual) volatility dropped to 20.608%, reaching a new low since March 2021 for Derbit's BTC volatility index (DVOL) at 31.32.

On the same day, Derbit's ETH volatility index (DVOL) also dropped to 30.12, reaching a new low since March 2021.

The extremely contracted low volatility also confirms the depletion of liquidity. Subsequently, the market experienced another historically significant plunge on August 18.

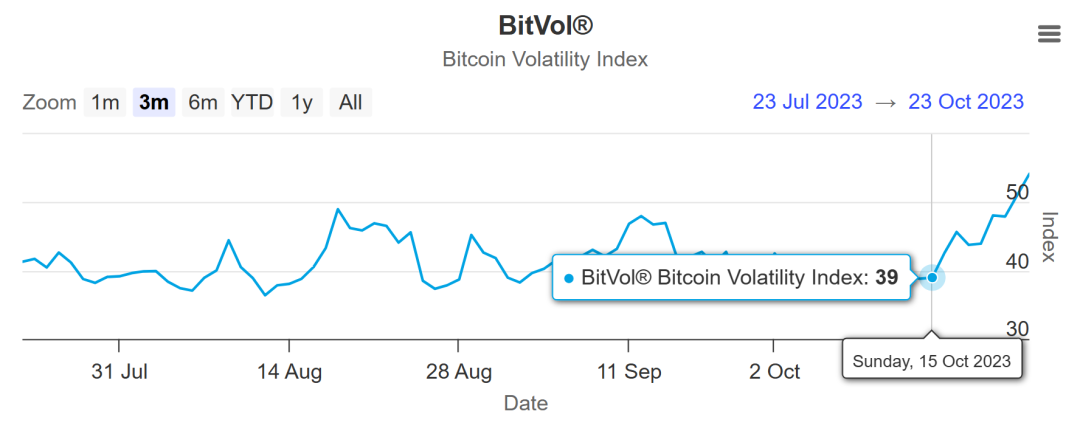

Before this recent surge, Bitcoin's volatility had been lingering at low levels. The BitVol (Bitcoin Volatility) index, jointly launched by financial index company T3 Index and Bitcoin options trading platform LedgerX, dropped to 39 on October 15.

It was then stimulated by false news from Cointelegraph, rising from the low levels and combined with the optimistic news of new spot ETFs in the past two days, leading to the current surge.

Overall, volatility represents market participants' views and expectations of the current and future market. Once it reaches a low level, it is likely to be followed by significant fluctuations. At least, the surges on August 18 and this morning were accompanied by a rebound in volatility.

02

One Night Bull Return? Bears Suffer Brutal Massacre

Starting from yesterday, Bitcoin gradually sounded the horn for an upward trend. This morning, the entire crypto market staged a bloody massacre of bears, especially Bitcoin bears:

Between 6:30 and 7:30 this morning, Bitcoin saw a sudden significant surge, reaching nearly $36,000, with a maximum increase of over 15% in 24 hours. Ethereum also briefly surpassed $1,800, and the altcoin market also saw tokens with increases of 10% and 20% abound.

This led to a liquidation of over $150 million in the entire crypto market in about an hour, with over 80% being bear liquidations, and over two-thirds concentrated in Bitcoin, leaving Bitcoin bears virtually wiped out overnight.

According to CoinGlass statistics, approximately $1 billion in Bitcoin open interest contracts have been liquidated in the past two hours, marking the largest bear liquidation event so far this year.

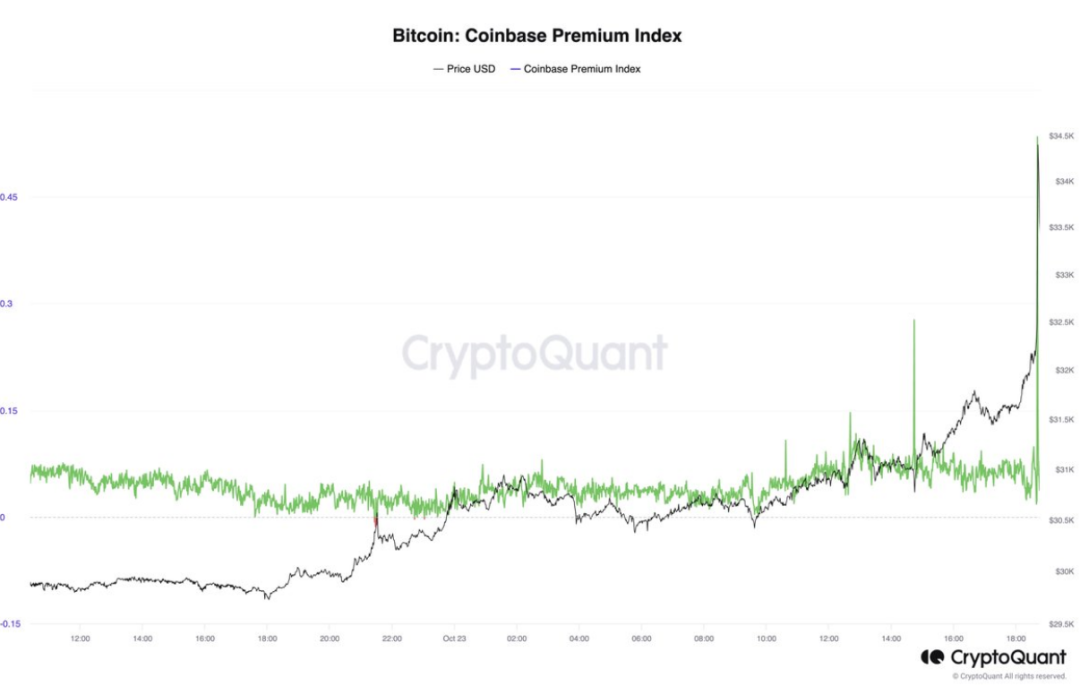

At the same time, behind the price surge, Bitcoin's premium quickly rebounded. CryptoQuant's on-chain analysis showed that Bitcoin's Coinbase premium index surged to over 0.4, reaching a high of 0.5, setting a new high since March 12, 2023.

The Coinbase premium index for Bitcoin refers to the percentage difference between Coinbase's price and Binance's price in USD. The higher the premium, the stronger the buying power of U.S. investors on Coinbase.

03

Where to Go from Here?

The market sentiment seems to have reversed overnight. Overall, the current market's optimism is mainly focused on the expectation of "spot Bitcoin ETF."

However, recent pessimism is not uncommon. If we carefully consider the recent news and funding aspects of the market before this surge, we will find that the market was almost engulfed in a vortex of pessimism:

First, insiders disclosed that Polkadot development organization Parity Technologies laid off over 300 people, which was later denied by Parity Technologies (although at the time of writing, the latest official announcement confirmed layoffs of over 100 people). As a leading project development organization, such large-scale layoffs indicate that the industry is already feeling the chill of winter.

Subsequently, even leading mining company Bitmain was reported to have unpaid wages. In addition, the Hashrate Index released a report on Bitcoin's third-quarter production, mentioning that Bitcoin ASIC production machine prices continued to decline in 2023, with all specifications of surviving machine models hitting historical lows in the third quarter. Meanwhile, Bitcoin's overall hash rate and production difficulty continued to reach new highs, indicating that the internal competition in this field has reached its peak.

With Bitcoin having undergone three halvings, the block reward reduced to 6.25, and the number of mined Bitcoins exceeding 19 million, there is a lot of uncertainty about whether the block producers, who are willing to invest billions of dollars in the Bitcoin production industry, can still emerge unscathed from this gamble.

Before 2020, "Bitcoin ETF" had always been the main channel for "off-exchange incremental funds" to enter the market. Everyone hoped that "Bitcoin ETF" would bring in a massive amount of incremental funds, open up the path for traditional mainstream investors to invest in cryptocurrencies, and push for wider acceptance of crypto asset allocation by Wall Street on a large scale.

However, since institutions, represented by Grayscale, "entered the stage" in 2020, seemingly taking over everyone's expectations for "Bitcoin ETF," ETF has once again taken the lead in the bear market backdrop.

But the current news about ETF is still somewhat elusive, especially considering the caution needed to handle any sudden impact on the market before the dust settles, as evidenced by Cointelegraph's previous experience.

There is no obstacle that cannot be overcome, no mountain that cannot be climbed. The bull market seems faintly audible, while the bear's footsteps are uncertain. Maintaining cautious optimism may be the only thing to do in the current eerie market atmosphere.

END

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。