Authors: Sharon, BlockBeats

Editor: Jack, BlockBeats

With the approach of the fourth Bitcoin halving, a new paradigm shift has emerged in the Bitcoin and its computing power market.

On June 20, Bitcoin mining company HAG Holding Limited (HAG) announced the official issuance of the world's first compliant digital security (STO) based on Bitcoin perpetual computing power, and also provides monthly Bitcoin dividend payouts to investors; September 23, the decentralized computing power routing protocol Lumerin announced the launch of a decentralized Bitcoin computing power market on Arbitrum; on October 2, the Bitcoin RWA project Merlin Protocol announced the completion of testing on the test network.

US dollar stablecoin issuer Tether is also actively expanding its business, announcing the launch of the Real World Ecosystem (RWE) on one hand, and also vigorously engaging in Bitcoin mining operations.

Compared to the profits obtained by traditional centralized Bitcoin mining companies (referred to as mining companies in the following text), Bitcoin computing power and RWA may be becoming the new focus of the Bitcoin mining market.

Centralized Mining Companies: Leveraging Bull Markets, Seeking a Way Out in Bear Markets

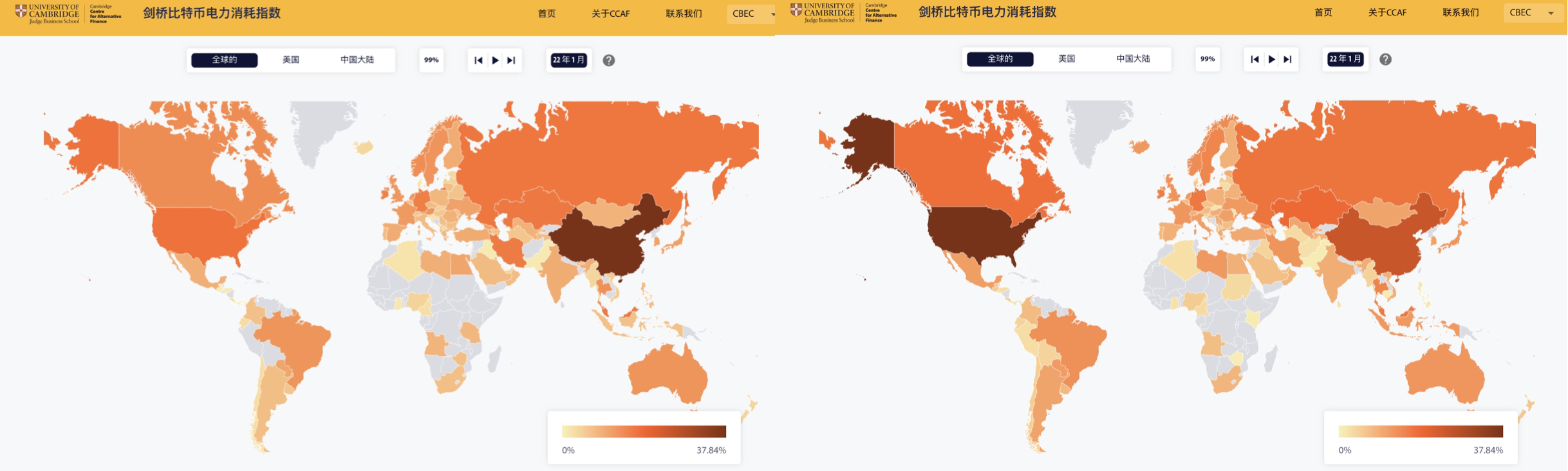

Since the comprehensive ban on Bitcoin mining activities in mainland China in June 2021, the Bitcoin computing power center has shifted from China to North America. In fact, this shift in computing power center began as early as 2020, and by the end of 2021, the change was visible to the naked eye. According to the Bitcoin Mining Map developed by the Cambridge Bitcoin Electricity Consumption Index, if the average monthly hash rate share is used as the standard, the global Bitcoin mining center was still in China in January 2021, but by December 2021, this center had shifted to North America.

Left image: January 2021; Right image: December 2021. Image source: Cambridge Bitcoin Electricity Consumption Index

Behind this change is the continuous rise of mining companies in North America. Since 2020, leading North American mining companies such as Core Scientific (NASDAQ: CORZ), Riot Platform (NASDAQ: RIOT), Bitfarms (NASDAQ: BITF), and Iris Energy (NASDAQ: IREN) have begun to purchase a large number of mining machines and have successively gone public in North America, embarking on a path of compliant operations.

In February 2020, Bit Digital (NASDAQ: BTBT) went public;

In June 2021, Bitfarms, Hut 8 (TSE: HUT), and HIVE Digital (CVE:HIVE) went public;

In November 2021, Iris Energy went public;

In January 2022, Core Scientific went public;

Riot Platform, formerly a biopharmaceutical company, also took off after joining the mining wave.

These mining companies' main business is Bitcoin mining, so their development is highly correlated with the price of Bitcoin. During the bull market period from January 2021 to May 2022, the stock prices of these companies soared. According to Nasdaq data, compared to their initial public offering, the stock prices of Core Scientific, Bitfarms, Hut 8, and HIVE Digital rose by 57%, 707%, 371%, and 228% respectively during the cryptocurrency market bull market period.

Bull market conditions from January 2021 to May 2022. Image source: Coingecko

During this period, most mining companies achieved profitability through a combination of computing power mining and debt/equity financing. Taking Marathon Digital (MARA) as an example, its main business is self-operated Bitcoin mining, and its strategy is to deploy mining farms by purchasing mining machines through financing, paying the cash operating costs of production, and holding Bitcoin as a long-term investment. Data shows that in 2021, Marathon Digital spent $120 million to purchase 30,000 Antminer mining machines from Bitmain, and also obtained a $100 million revolving credit line from Silvergate Bank, and planned to raise $500 million in debt by issuing senior convertible notes to continue purchasing mining machines, making it the largest holder of Bitcoin in North America at one point.

Similarly, Core Scientific was even more exaggerated, operating over 200,000 Bitcoin mining machines in five states in the United States, and producing over 7,000 Bitcoins in June 2022 alone. In addition, Core Scientific had received a $54 million investment from Celsius and signed a $100 million equity investment agreement with investment bank B. Riley.

However, due to the high-leverage nature of their business, the sudden bear market caught these mining companies off guard.

Firstly, Marathon Digital recorded a net loss of $686.7 million for the entire year of 2022; Riot Platform had a net loss of $509.6 million in 2022; Bitfarms had a net loss of $239 million in 2022; and Core Scientific had already incurred a loss of over $1.7 billion in the first 9 months of 2022, to the point where it was on the brink of bankruptcy by the end of 2022.

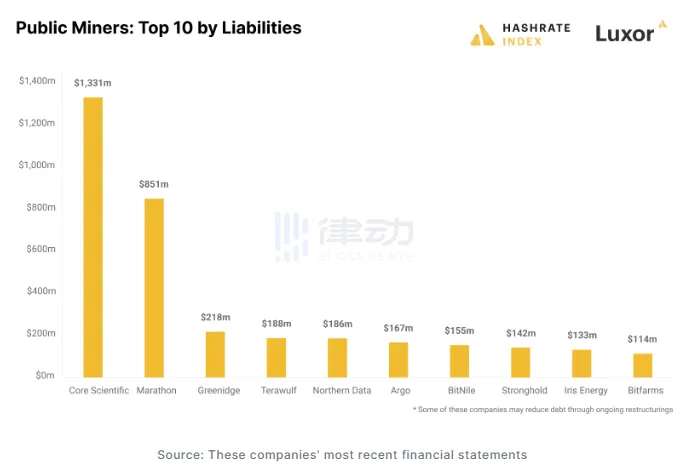

According to a report from Hashrate Index, the collective debt of mainstream centralized mining companies by the end of 2022 exceeded $4 billion, with Core Scientific having the most debt, owing creditors $1.3 billion as of September 30, 2022; Marathon Digital owed approximately $851 million, but most of it was in the form of convertible notes; the third debtor was Greenidge Generation, owing $218 million.

Image source: Hashrate Index

Many institutions believe that the development of centralized mining companies is highly correlated with the price of Bitcoin, so the "business model of financing to purchase Bitcoin mining machines for mining is very challenging for the cash flow management of enterprises in bear markets," and it is also easy to face the risk of insolvency.

Related reading: "Life and Death Speed under the Bitcoin Mining Industry Cold Winter: Marathon Digital Holdings (MARA) Analysis and Investment Insights"

Many Bitcoin mining listed companies borrowed heavily during the bull market in 2021, leading to very negative impacts on their profitability during the subsequent bear market.

The business models of purchasing mining machines for mining and hoarding coins (Mara, Hut 8, Riot) and producing and selling mining machines (Cannan) differ in that they have lower research and development expenses but higher capital expenditures, and their income is not resilient, relying only on increasing BTC mining efficiency and BTC appreciation for profits. They have a high debt ratio and high leverage, so the revenue of mining listed companies is more strongly correlated with the price of Bitcoin, and price fluctuations are more severe, while they also face the potential threat of insolvency in bear markets.

Today, Core Scientific is facing restructuring, Marathon Digital is struggling to survive through selling Bitcoin and private financing, Riot Platform is using a name change as a means to strive for strategic transformation (the company was previously named Riot Blockchain), and Iris Energy is seeking a transformation into the generative AI market. Some centralized mining companies are seeking new ways out in the bear market, while others continue to expand their layout in the Bitcoin mining market, holding on in the darkness before dawn, waiting for the arrival of the bull market.

In addition to the narrative of the development of centralized mining companies, the value of Bitcoin itself is still highly regarded by the entire market. It is for this reason that even in the current bear market, new narratives are still emerging in the market.

Bitcoin RWA: Paradigm Shift to Decentralized Dividends

Centralized mining companies finance their operations through listing on the US stock market, and investors buy their stocks, relying on stock price increases to make profits. This also means that during the bull market, mining company stock prices can soar, but during the bear market, they can plummet. Therefore, many people who hope to profit from mining and the rise in coin prices have turned to a new paradigm outside of centralized mining companies—Bitcoin and its computing power RWA.

RWA (Real-World-Assets) refers to the mapping of traditional market assets onto the blockchain in the form of tokens for Web3 users to buy and sell, and is also seen as a gateway to bring traditional financial markets into the Web3 industry.

BlockBeats has learned that there are two new ways for Bitcoin RWA, one is anchoring Bitcoin computing power, and the other is anchoring Bitcoin price.

Anchoring Computing Power: Tokenizing Mining Dividends, Profiting from Mining Machine Price Fluctuations

As the "world's first STO based on perpetual Bitcoin computing power issued in accordance with US securities laws," HAG Holding Limited's core members come from Goldman Sachs, TSMC, SoftBank, and Bitmain, and they issue STOs (security token offerings) through SEC-compliant means, and then bring Bitcoin computing power income into the Ethereum and DeFi world through a similar "holding dividend" form.

On June 20, HAG Holding Limited issued a total of $500 million worth of HAG tokens on the US digital securities issuance platform INX, with each HAG token anchoring 1TB of Bitcoin computing power for the company's operational mining farms. Of the Bitcoin income generated by the mining farms, 30% is used for project operation and maintenance, and 70% is distributed to HAG token holders in the form of WBTC.

According to the HAG team's statement to BlockBeats, this distribution is paid monthly by INX-compliant transfer agents, and all income and distributions are transparent and public. Joe, a founding member of HAG, revealed to BlockBeats that the team is already negotiating the purchase of new S21 mining machines with Bitmain, and expects more progress by January 2024.

Through this form, the underlying value of HAG is highly positively correlated with mining machines. "We use decentralized crowdfunding to allow more Web2 people to enter the Web3 world, buy and hold Bitcoin in this way, and profit from it," Joe told BlockBeats in an interview.

Traditional mining companies control a large amount of computing power and are highly centralized. Today's Bitcoin RWA will to some extent drive Bitcoin back to the path of decentralization, iterating the narrative of Bitcoin mining.

"The liquidity of web3 is not enough, and efficient economies of scale + effective mining farm operations are core," Joe believes that current Bitcoin mining needs to accommodate more participants from outside the crypto industry to achieve greater scale and development, and mining farm operations need to be sustainable. Therefore, to some extent, the "mining and holding + bond financing" form of certain centralized mining companies cannot achieve sustainable development.

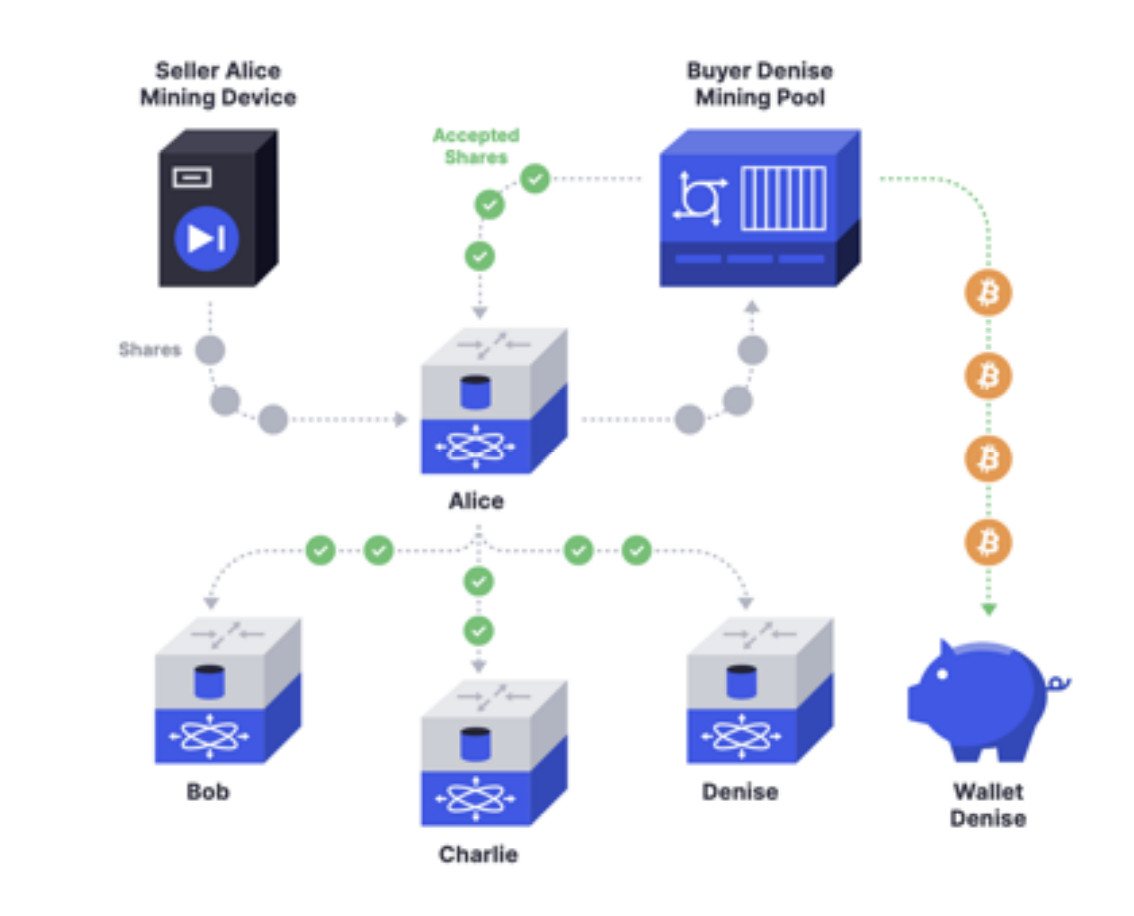

In addition, Lumerin, another Bitcoin computing power RWA project, was officially launched on September 26. Its essence is also a "DEX/DeFi for computing power," commodifying Bitcoin computing power through smart contracts, allowing anyone to trade Bitcoin computing power. Community users have described it as "the world's first P2P exchange for mining Bitcoin on Arbitrum."

Image source: Introduction to the operating mechanism of Lumerin in the white paper

Anchoring BTC: Surpassing WBTC, Leveraging Coin-Based Compounding

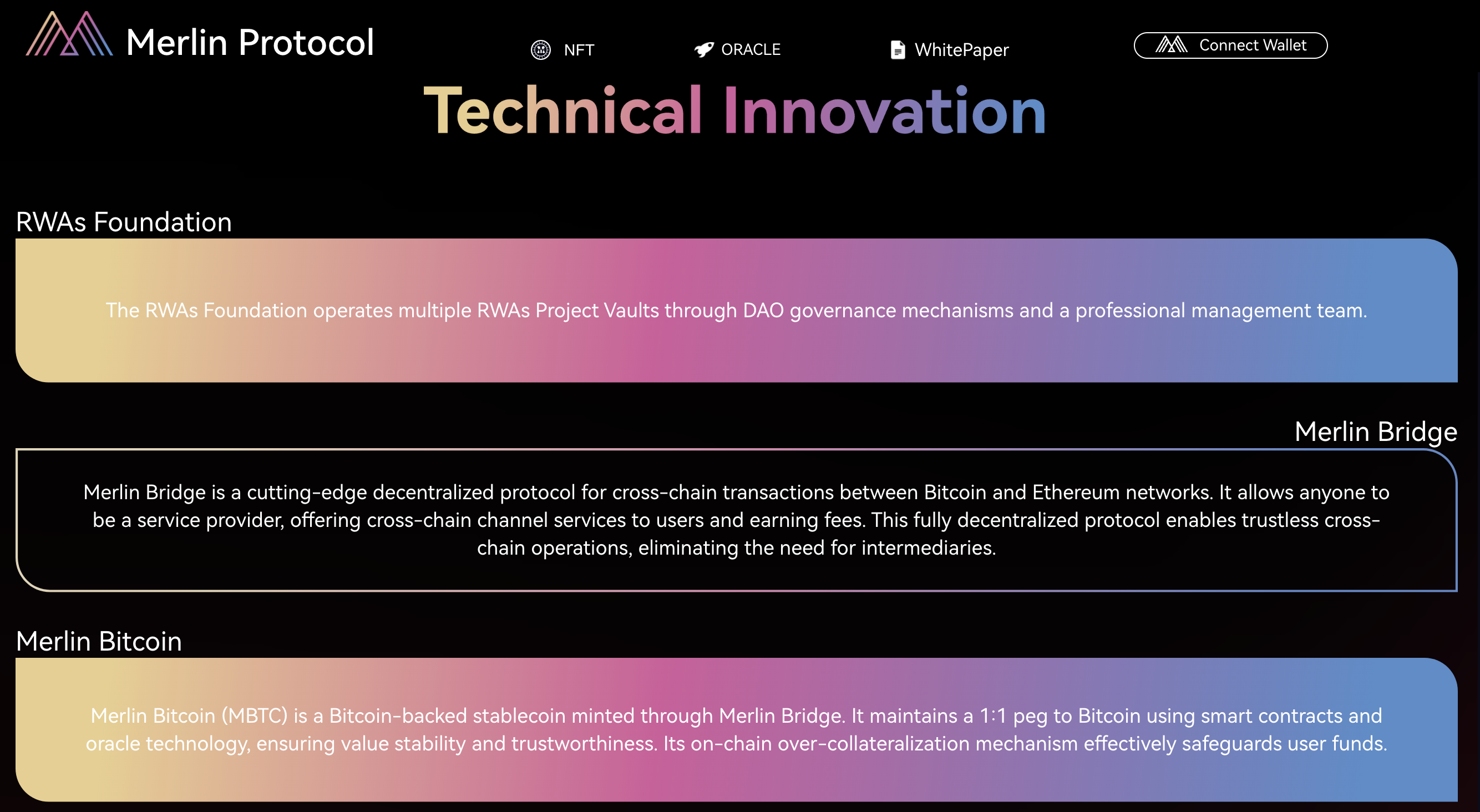

Compared to HAG's focus on protecting investors through compliance, Merlin Protocol's mechanism is similar to MakerDAO and has more native properties of the crypto industry.

Source: Merlin Protocol official website

Merlin Protocol provides space for miner arbitrage on one hand and fund custody and secure transactions for cross-chain traders on the other. Its operating mechanism is that Merlin Protocol issues MBTC anchored to Bitcoin, and miners can forge MBTC by locking the Bitcoin mined, and can also arbitrage through "phantom Bitcoin."

Phantom Bitcoin is a special transaction provided by the cross-chain service channel, which can increase MBTC without the need for real Bitcoin. Phantom Bitcoin transactions require the issuance and destruction of MBTC in a single block, and payment of the corresponding transaction fees.

When there is arbitrage space for MBTC transactions on Ethereum, users can quickly conduct liquidity arbitrage through phantom Bitcoin, without the need for principal. Phantom Bitcoin is a unique technical feature of MBTC, and based on phantom Bitcoin, MBTC will gain more abundant market liquidity.

MBTC hopes to solve the problems and pain points that stablecoin WBTC already has, "first, WBTC is controlled by centralized institutions, and second, WBTC is difficult to help users earn profits."

Users can custody their Bitcoin on Merlin Bridge, and Merlin Bridge will disperse users' Bitcoin across multiple cross-chain channels to ensure the security of their funds. On Merlin Bridge, anyone can become a cross-chain channel service provider through over-collateralization, "the collateral ratio is 150%. For example, if you want to custody 1 Bitcoin, you need to first pledge an equivalent of 1.5 Bitcoin in Ethereum or USDT as collateral to become a service provider," said Eason, co-founder of Merlin Protocol, to BlockBeats. At the same time, service providers can earn a 1% transaction fee for each transaction, and the treasury will also collect an additional 0.5% from the transaction.

"Previously, we raised funds by issuing NFTs on-chain, then gave the funds to miners for mining, and shared the profits with investors. In the future, essentially within our ecosystem, it will be the same. Everyone will use a DAO management system to raise the MBTC we issue, and then after the miners receive this MBTC, they will engage in mining in the real world, obtain more BTC, and share it with the entire ecosystem. Investors can earn more BTC through raising Bitcoin. Essentially, only Bitcoin mining can achieve coin-based compounding."

Image source: Merlin Protocol Whitepaper

Building Factories, Buying Coins, Is Tether Also Layout Bitcoin RWA?

Compared to the above-mentioned projects, Tether seems to be quietly laying out Bitcoin RWA. Currently, Tether not only operates its own Bitcoin mining farms, but also has purchased a large amount of Bitcoin, and sees Bitcoin mining and RWA as the strategic focus for 2024.

On September 22, Tether's Chief Technology Officer Paolo Ardoino stated on his social platform that Tether's new global strategy will be fully implemented in 2024. According to his hint, the new global strategy may include investment cooperation, AI, new energy Bitcoin mining, education, and global business expansion; in October, the CTO announced, "Tether's Real World Ecosystem (RWE) is about to be launched."

In fact, as early as August 26, Paolo posted on social media that Tether's Bitcoin mining farm in Latin America is planned to start operations in a few weeks. And according to a previous report by Bitcoin Magazine, Tether has invested in a renewable energy power plant in El Salvador, which plans to build a 169MW photovoltaic solar energy and 72MW wind energy, and also plans to build a Bitcoin mining farm in the park.

Tether has also partnered with a licensed company in Uruguay to launch sustainable Bitcoin mining operations, and launched the "Tether Energy" plan a few months ago to build renewable energy production and Bitcoin mining farms. Meanwhile, as of August 6, Tether may have become the 11th largest Bitcoin holder in the world, with an estimated holding of 55,022 BTC worth $1.6 billion.

The launch of RWE, investment in building Bitcoin mining farms, and holding a large amount of Bitcoin, all indicate that Tether may make a bigger layout in the Bitcoin RWA market.

Whether it's HAG, Merlin Protocol, Lumerin, or Tether's layout, although their operating mechanisms and revenue models are different, overall, it can be seen that Bitcoin is becoming an important part of the RWA narrative, and many teams are choosing to enter the market at this time for multiple reasons.

The Market Size Far Exceeds $9 Billion, the Imaginative Space of Bitcoin RWA

In fact, it is not difficult to understand why to enter the Bitcoin RWA market at this time. On the one hand, during the bear market, the price of mining machines is at a market low, and entering now can purchase a large number of mining machines at a relatively low price, with lower basic costs. On the other hand, as the concept of RWA gradually heats up, a good underlying asset can help the project achieve stable development and help investors profit with lower risk, and Bitcoin is the "good underlying asset" recognized by most people in the crypto industry.

What's more, the future space and scale of this market may be beyond the imagination of many people.

Mainstreaming of RWA Narratives

In addition to the increasing attention to the value of Bitcoin itself, the concept of RWA, which has been widely mentioned in recent years, is also a major reason for the rise of Bitcoin RWA.

Related reading: ["RWA Discussion: Underlying Assets, Business Structure, and Development Path"]

The crypto market is not currently in a bull market, and even within the native crypto market, there is a lack of sufficient narratives. RWA is one of the few tracks with solid revenue support that is currently seen, and it may achieve explosive business growth.

Joe, a founding member of HAG, pointed out that with the recent resurgence of the RWA narrative, Bitcoin computing power is being revalued, and how to allow ordinary people to participate in computing power while protecting investors is the focus of HAG. Merlin Protocol also acknowledges this, stating, "As the cycle rotates, RWA will, like public chains, DeFi, and GameFi, become a narrative that lasts long after the wave." Merlin co-founder Eason told BlockBeats in an interview.

Eason also mentioned MakerDAO, the most well-known project in the RWA field, and believes that its most successful aspect is empowering its DAI ecosystem with U.S. Treasury bonds: "Finance is about higher utilization of funds and greater productivity. This is actually quite meaningful. It uses its own issued general equivalent to invest in RWA, which most projects do not have. So we also want to develop and expand the RWA industry in the future by issuing an anchoring coin tied to Bitcoin."

Highly Imaginative "Bitcoin Financial World"

"This market is actually very large. There is over $9 billion worth of Bitcoin that needs to be 'processed' every year, and over 70% (200,000 to 300,000 miners) of BTC is traded off-exchange rather than on exchanges. We only account for 10%-20% of this market, and the annual income is quite considerable," said Eason, co-founder of Merlin, to BlockBeats. According to the team's estimates, the annual income of the Merlin Protocol from cross-chain service fees alone can reach $14 million, and node income can reach $30 million.

Furthermore, BlockBeats has learned that the OTC market size for Bitcoin mining is even larger, and there even exists To G business. An informed source revealed to BlockBeats that the scale of these transactions far exceeds the imagination of many people.

Eason pointed out that the future financial market size based on Bitcoin RWA is very considerable. Especially for many miners, as the fourth halving cycle of Bitcoin approaches, miners also need to strategize in advance for 2024, seeking new revenue opportunities, while also finding ways to increase machine efficiency, reduce power costs, or reduce other operating costs.

In addition, there are more and more voices in the industry that believe that Bitcoin may achieve a "revival," which to some extent has also driven the expansion of the Bitcoin RWA market. On October 20, Tether's Chief Technology Officer Paolo Ardoino stated in an interview that the adoption of Bitcoin scaling solutions in the coming years will achieve a "huge leap."

On the same day, Lightning Labs CEO and co-founder Elizabeth Stark also stated in an interview that Taproot Assets can help Bitcoin achieve a "revival," making the Lightning Network a multi-asset network, and possibly consolidating Bitcoin's position as the currency of the internet: "With the next halving approaching, it's time to accelerate Bitcoin development."

According to observations by BlockBeats, behind the topic of "Bitcoin revival," there is not only the development of the Bitcoin network and ecosystem itself, but also the push from the traditional world. Also on October 20, Coinbase's Chief Legal Officer Paul Grewal stated in an interview with CNBC that Coinbase is confident in the approval of a Bitcoin ETF by the U.S. Securities and Exchange Commission. Earlier, JPMorgan analysts also predicted that a Bitcoin ETF would be approved in the coming months.

With the arrival of the halving cycle, if a Bitcoin ETF is officially approved, it may bring more opportunities and positive sentiment to the Bitcoin mining market. In addition, at a time when the mining community is seeking diversified profit opportunities, the price of mining machines is at a market low, and the RWA narrative has become mainstream, the Bitcoin and its computing power market may experience a greater turning point and "revival."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。