Original Author: Chainalysis

Original Compilation: Luffy, Foresight News

This article is excerpted from Chainalysis' 2023 Cryptocurrency Geography Report, which will be released later this month.

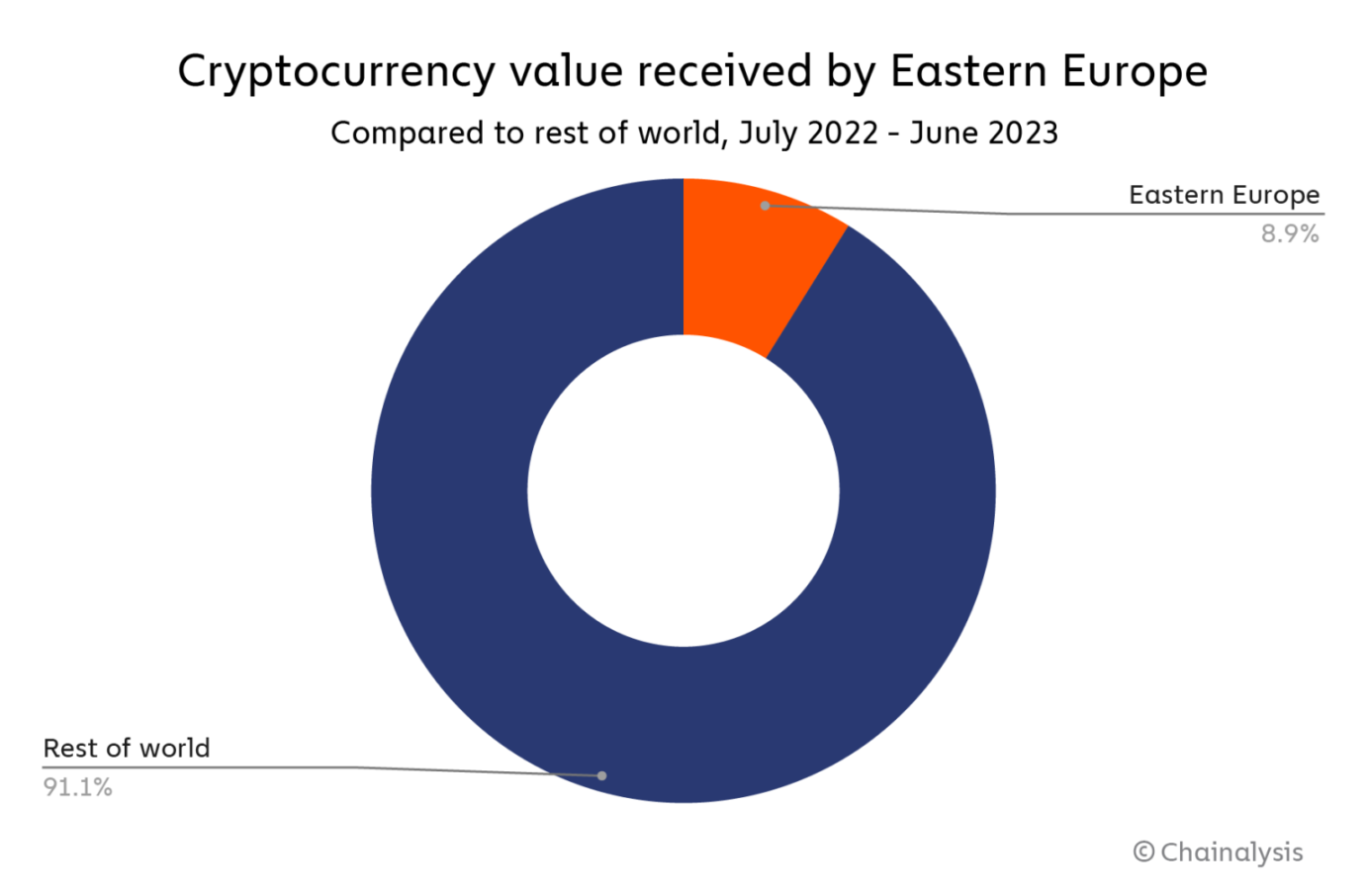

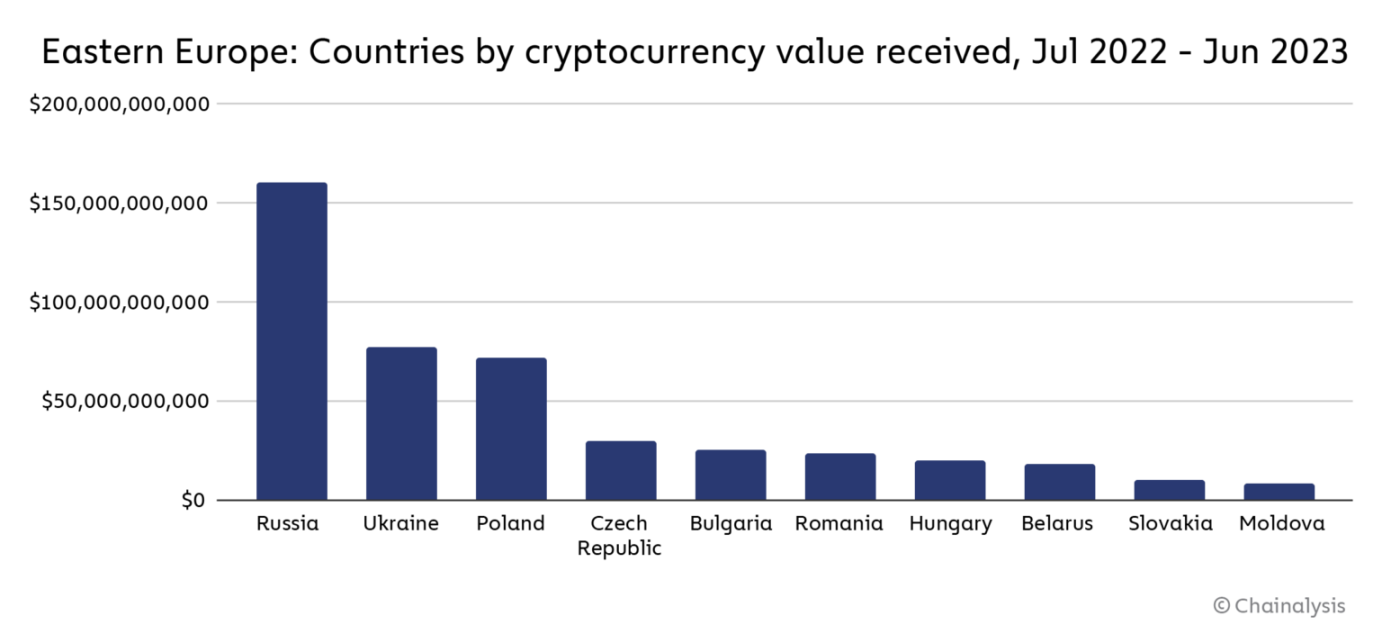

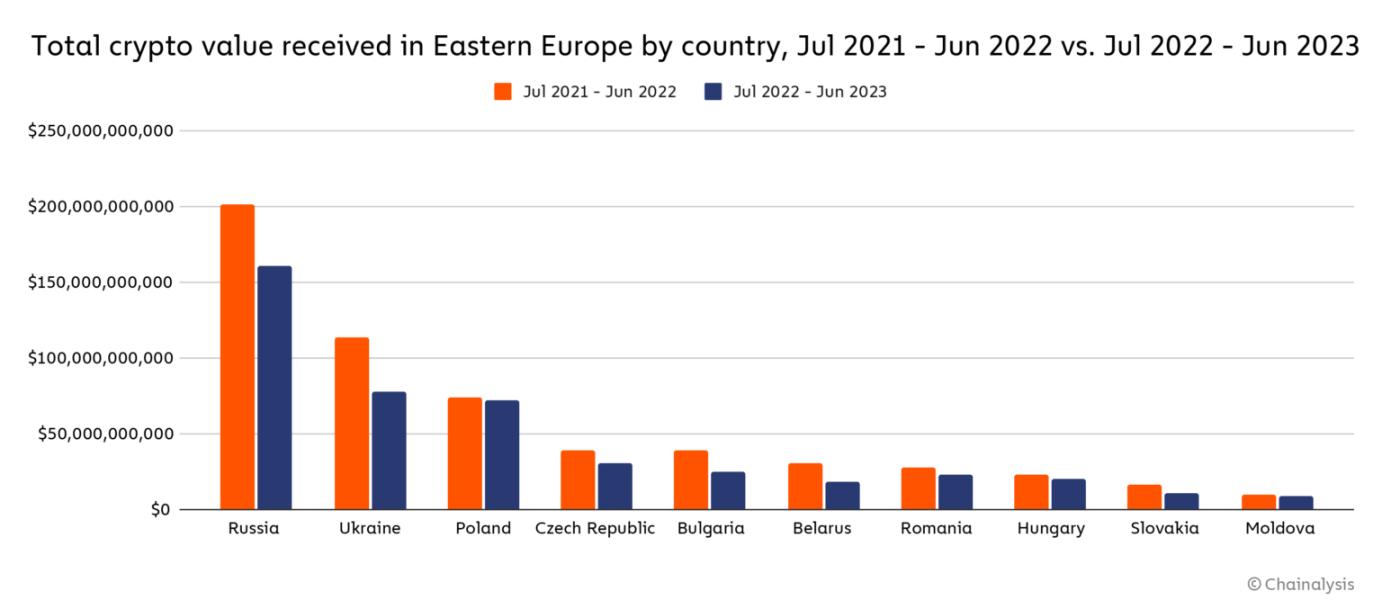

Eastern Europe is the fourth largest cryptocurrency market we studied, with the value of cryptocurrencies received on-chain in the region from July 2022 to June 2023 totaling $445 billion, accounting for 8.9% of global transaction activity during the research period.

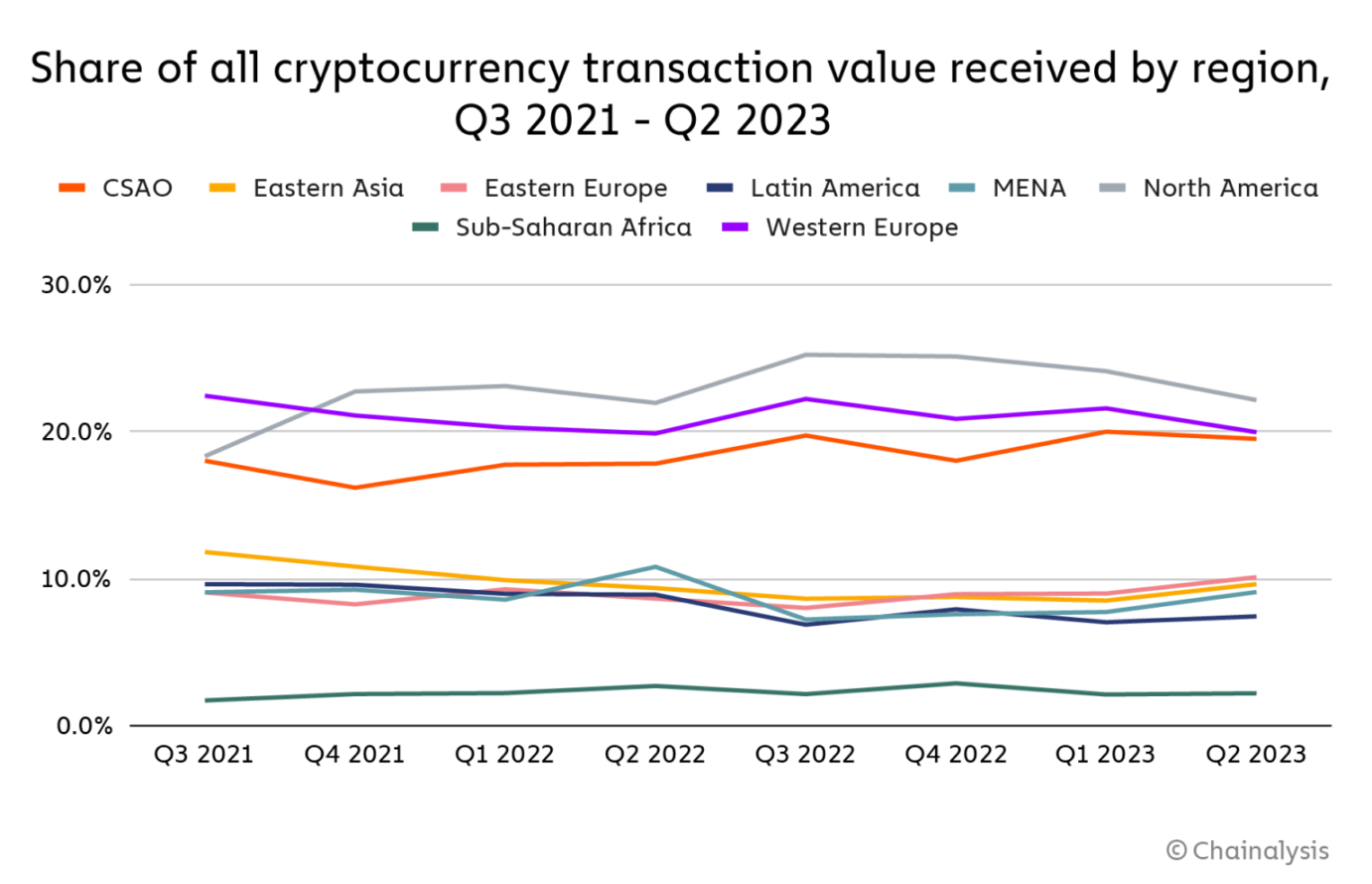

Over the past year, cryptocurrency usage has declined in most regions around the world, and Eastern Europe is no exception. The region's transaction volume decreased by 22%, consistent with the global downward trend during the same period. While other regions show signs of recovery from the cryptocurrency winter, Eastern Europe continues to be affected by the economic impact of the Russia-Ukraine war, which we will discuss in more detail later. Both countries are the largest cryptocurrency participants in the region, whether in terms of transaction value or public adoption rate.

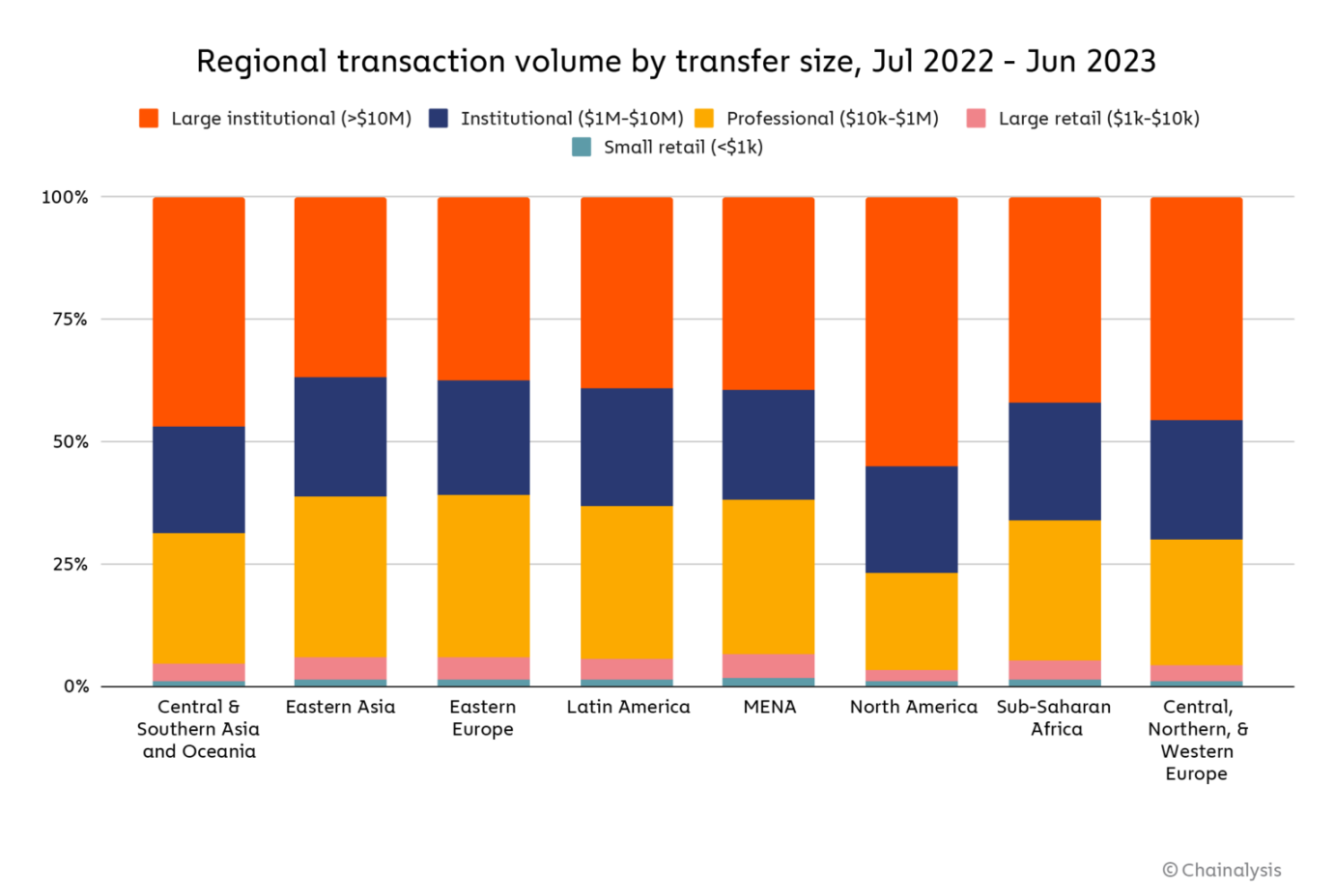

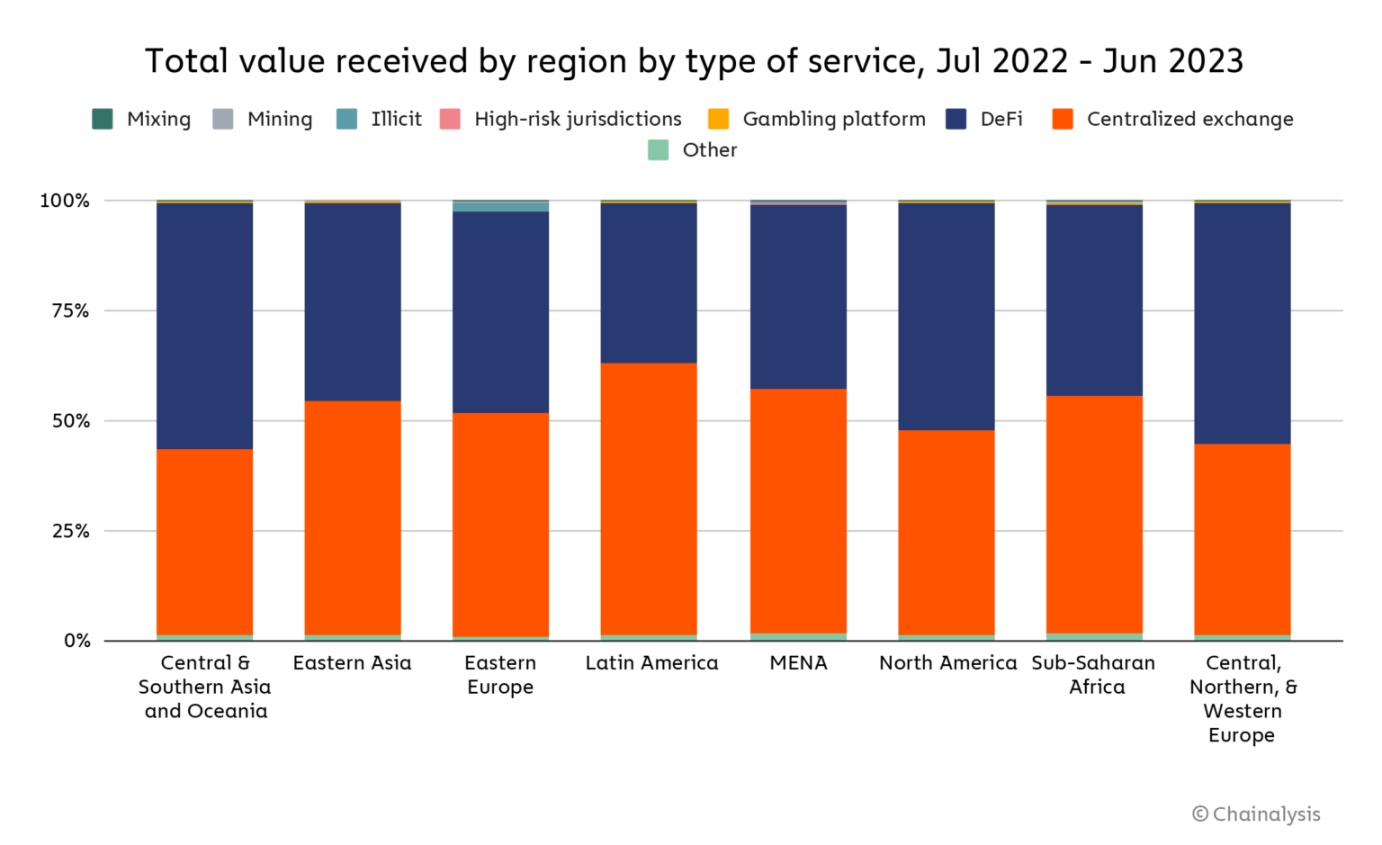

Most of the trading volume in Eastern Europe comes from institutional-sized transfers, and the distribution of on-chain trading volume between centralized exchanges and DeFi protocols in the region is relatively even.

However, interesting trends emerge when we divide cryptocurrency activity in Eastern Europe by transaction size over time. Despite three peaks during the research period, the volume of large institutional transactions has been steadily declining. On the other hand, the volume of smaller institutional transactions has remained relatively stable despite periods of volatility, while professional-sized transaction volume exceeds both. Retail transaction volume has also remained stable. In summary, the data suggests that while the primary cryptocurrency users in the region have reduced their activity during the bear market, others continue to participate in this asset class.

As we have seen in other regions, the largest fluctuations in cryptocurrency activity in Eastern Europe coincide with market turmoil events, such as the FTX collapse at the end of 2022, and the closures of Silicon Valley Bank (SVB), Silvergate Bank, and Signature Bank in March. Transfer volume data shows that institutional investors' behavior changed the most during this period.

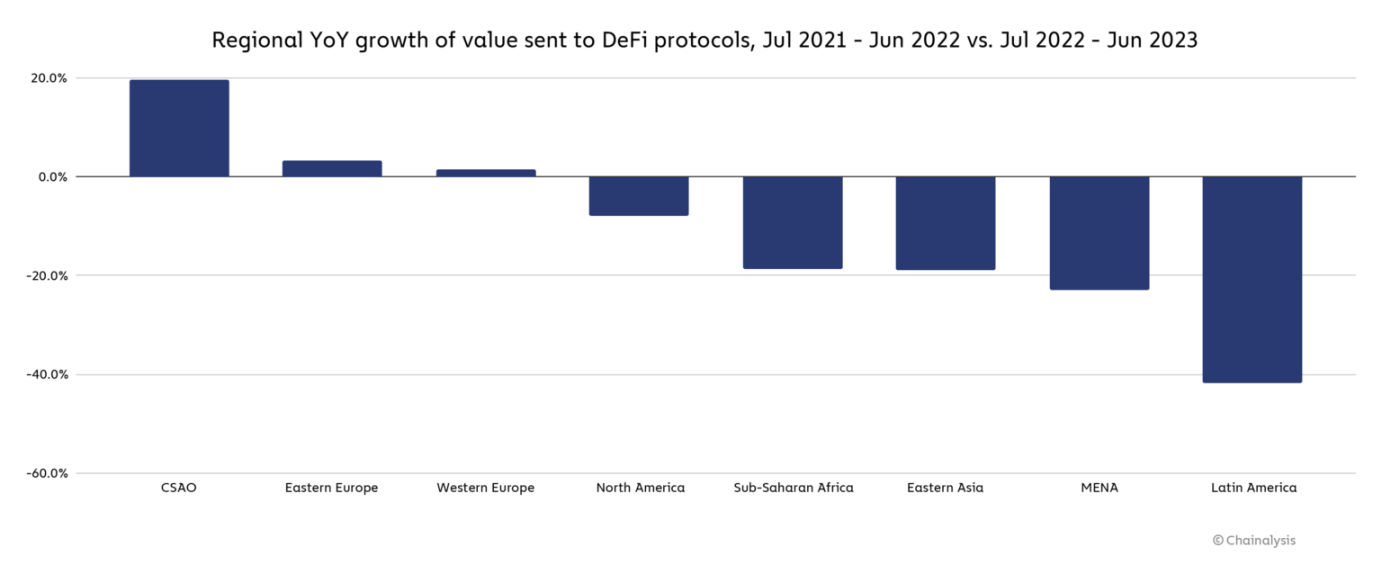

A notable positive trend in the region is DeFi. Eastern Europe is one of only three regions where DeFi activity has grown (by 3%).

The reasons for this increase are complex, but regional regulations and the uncertainty of the cryptocurrency market turmoil may be contributing factors. In the past, we have observed that when centralized exchanges encounter problems or market crises, investors turn to DeFi, possibly because of the non-custodial nature of DeFi, which gives users greater control over their funds.

Even as prices fall, cryptocurrency adoption remains stable

In terms of cryptocurrency adoption, Ukraine and Russia are usually key players on the world stage. While Ukraine and Russia remain leaders in the region in terms of trading volume and public adoption, their year-on-year declines in cryptocurrency trading volume are the largest among Eastern European countries, at $35.8 billion and $41 billion, respectively. Compared to other countries, public adoption rates have also declined, with Ukraine and Russia dropping two and four places, respectively, in our global cryptocurrency adoption index.

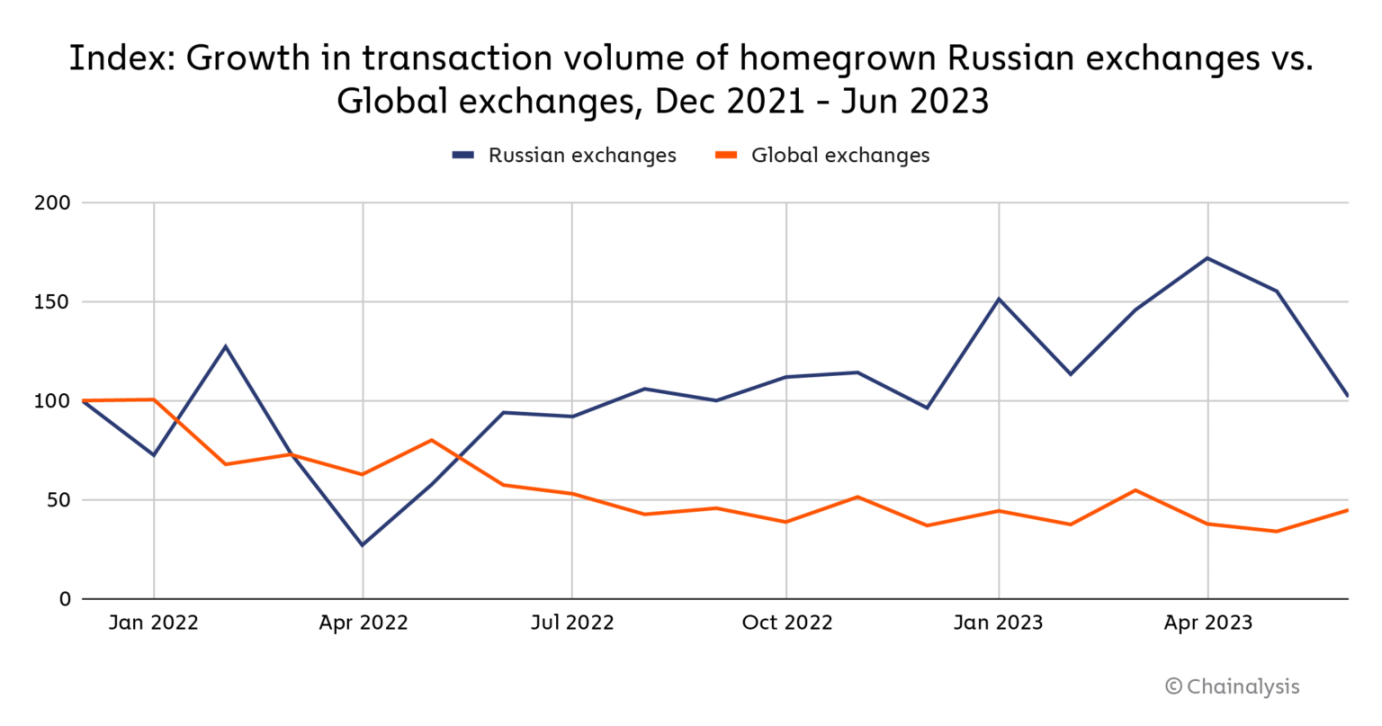

This decline may be driven by the ongoing war between the two countries. Russia's decline may be partly attributed to U.S. economic sanctions, the European Commission's comprehensive encryption ban on Russia last fall, and a general decrease in willingness of businesses to operate in Russia. One piece of evidence is that since the months before the war, the use of Russia on the world's largest international exchanges has decreased by over 50%, as seen in the index below. This may be partly due to restrictions imposed on Russian users and banks by some international exchanges due to the war. Meanwhile, we also see an increase in trading volume on exchanges primarily serving Russia, which have not introduced such restrictions.

While Russia's trading volume on international exchanges remains higher overall than on local exchanges, the opposite adoption trend suggests that at least some Russian users may be turning to local exchanges. However, overall, we believe these restrictions are damaging the Russian market, and the same economic headwinds are also affecting cryptocurrency users in other parts of the world.

On the other hand, in Ukraine, we believe the greater decline in trading volume is more due to the extreme economic difficulties brought about by the war, and the migration of many Ukrainian residents and businesses (including cryptocurrency platforms) to other parts of Europe.

Kuna is one of the Ukrainian cryptocurrency companies that relocated due to the war. This year, the company moved its headquarters to Lithuania and shifted its focus to the European market. The company has multiple bank clients there and has developed Kuna Pay, a solution that provides B2B channels for cryptocurrency payments. Kuna is also developing and obtaining the necessary licenses for staking products and creating cryptocurrency custody solutions, which Ukrainian banks can use once regulations allow. Anna Voievodina, Chief Legal Counsel at Kuna Exchange, commented on these developments, saying, "The war is making us move faster."

She went on to say that the use of cryptocurrencies in Ukraine is complex. On February 17, 2022, the Ukrainian parliament passed cryptocurrency regulations, and the following week, Russia invaded the country. Over the next few months, despite millions of cryptocurrency donations pouring into Ukraine to support resistance to the invasion, some interventions related to the war affected the use of cryptocurrencies. For example, the National Bank of Ukraine (NBU) banned the purchase of cryptocurrencies with Ukrainian hryvnia to "prevent capital from non-productive outflows from the country" and to save the national currency. Subsequent restrictions have been relaxed, and Voievodina stated that Ukrainians are becoming more interested in cryptocurrencies and are exploring the opportunities within them.

Despite the damage caused by the war to Ukraine and its cryptocurrency ecosystem, some positive factors have emerged. Due to the extension of the protection period for refugees fleeing conflict areas to March 3, 2025, by the European Union, these refugees are considered residents of the EU. Utilizing these rights, many are taking new actions, such as using cryptocurrency platforms governed by EU regulations, which are more advanced than those in Ukraine.

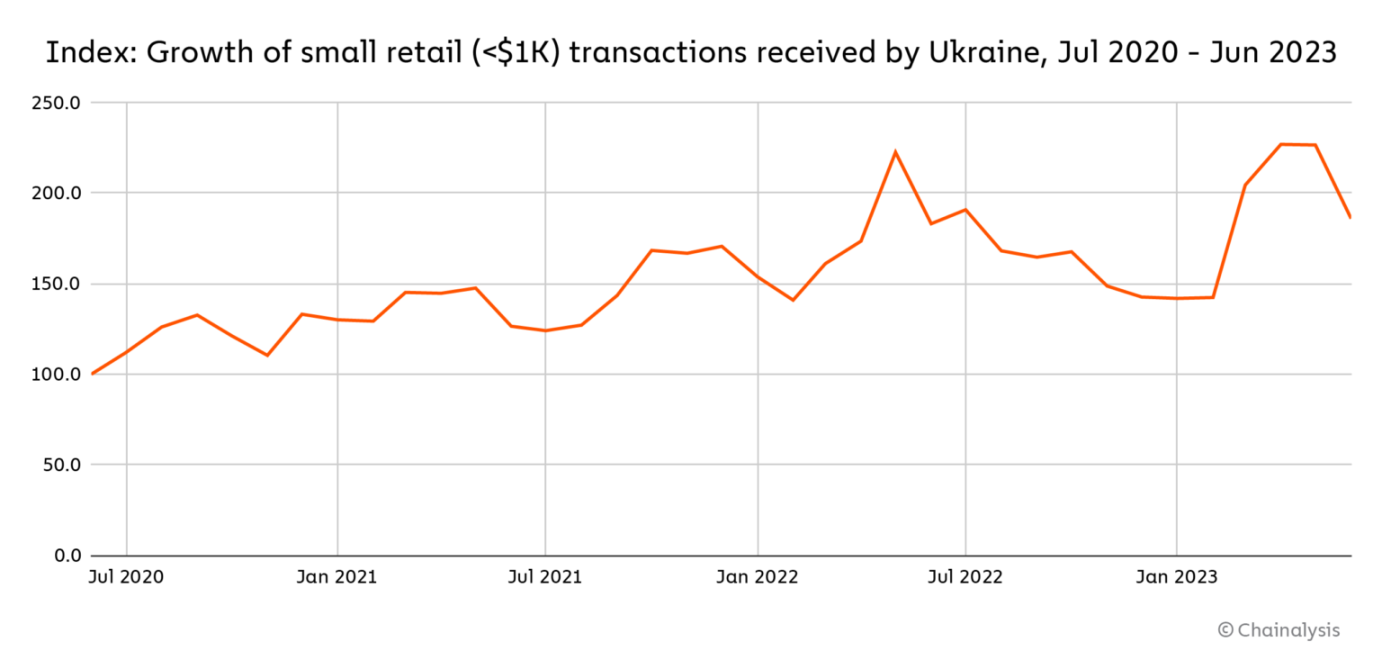

Voievodina said, "Due to the economic decline in Ukraine, the destruction of towns, people are leaving. Now, Ukrainians living under the legal order of Europe are using financial tools they have not used before. People are looking for new options and are no longer as afraid of KYC as before." She explained that these Ukrainians are now using cryptocurrencies for everyday purposes, such as savings, donations, and remittances. In fact, we estimate a significant increase in remittances sent to Ukraine last year. The following graph shows the growth of small transactions, with amounts comparable to those typically used for remittances.

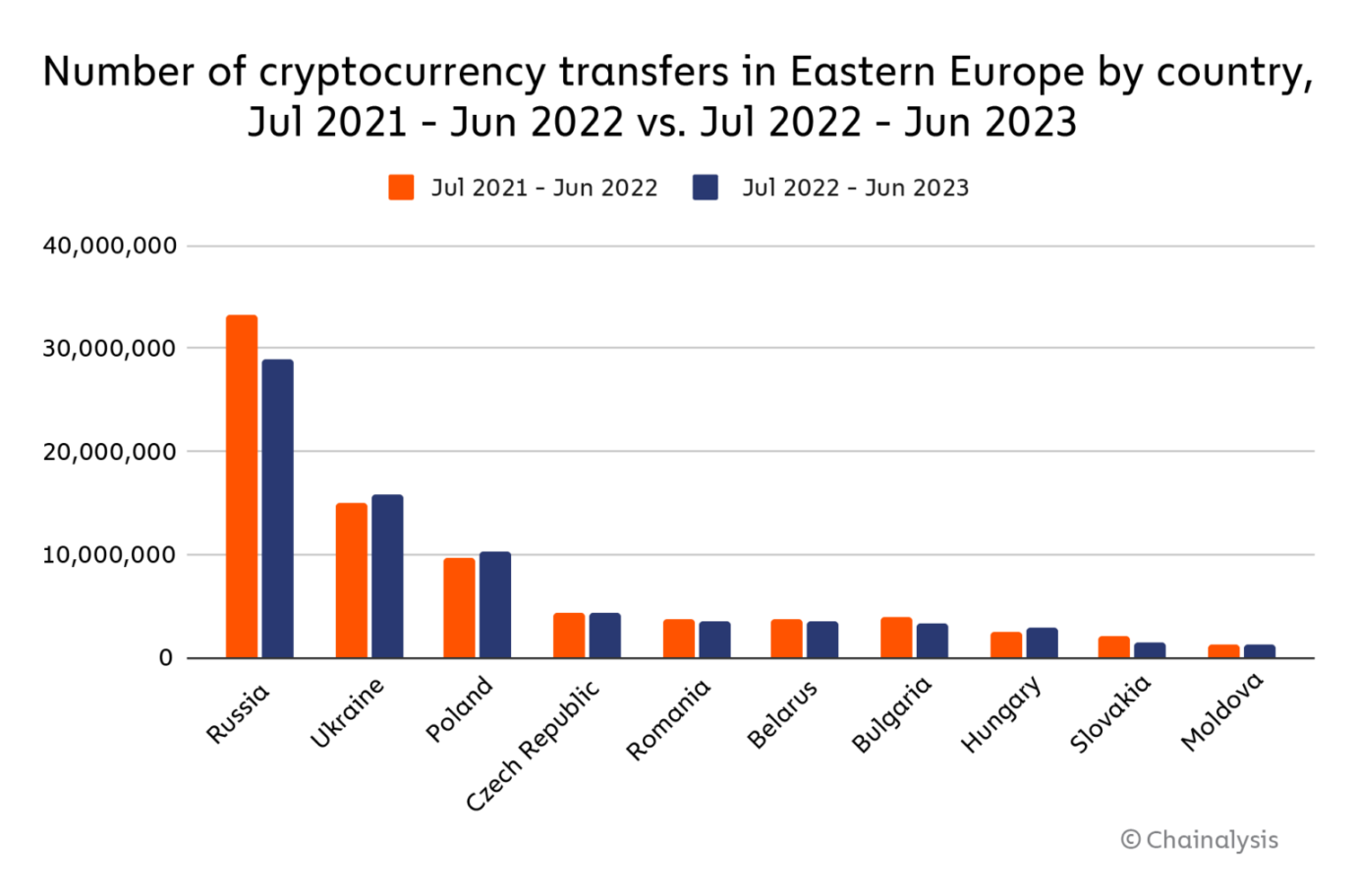

Data on the number of individual cryptocurrency transfers (not just transaction volume) also indicates consistent cryptocurrency usage in Eastern Europe. While transaction volume in Eastern Europe has declined year-on-year, transfer numbers have remained consistent in almost all places except Russia, and have even increased in countries like Ukraine and Poland. This suggests that residents of these countries are still using cryptocurrencies at roughly the same pace.

Even in Russia, where the number of individual transfers has decreased, the decline is proportionally small compared to the decrease in transaction volume, at 12.8% and 20.4% respectively. The above data indicates that people in Eastern Europe are still benefiting from cryptocurrencies and using them at a similar frequency as before, but with less actual funds being invested in cryptocurrencies.

Regarding the future growth of cryptocurrencies in the region, Voievodina believes that the increasing integration of Ukrainians with the EU will drive faster cryptocurrency adoption. She also discussed efforts to draft a new law in line with the Markets in Crypto-Assets Regulation (MiCA) and believes that regulatory measures aimed at protecting consumer markets will be beneficial for Ukraine. "Governments around the world realize that without cryptocurrency regulation, they will be excluded from financial market opportunities."

In Eastern Europe, people are still using cryptocurrencies

Despite the impact of the war, the trends over the past year indicate that cryptocurrency adoption in Eastern Europe is still actively developing and growing. First, there is evidence that opportunities for Russians to use international cryptocurrency platforms are diminishing, which may affect their ability to continue funding the war. Next, the war has led to a faster integration of Ukrainians into the EU, which recently passed the most comprehensive cryptocurrency legislation to date. Despite global market crises, retail usage is still growing, and in many countries where transaction volume has decreased, transfer numbers remain stable or have increased, indicating that the technology continues to provide value to users. DeFi usage in the entire region has also increased. As the impact of the Russia-Ukraine war diminishes, we hope to see more cryptocurrency businesses return to Ukraine, as well as continued development in cryptocurrency regulation, both of which will continue to increase cryptocurrency adoption in Eastern Europe.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。