Writing: 0x00pluto

In the research of the LSD track, it is necessary to understand the EigenLayer project. After studying this project, I found it very interesting, and I admire the way the experts think?

Question: What exactly is EigenLayer?

In the process of continuous exploration, I found a large amount of article materials online (special thanks to these article authors), so I organized this information into a structure.

On the one hand, I hope it is useful to everyone, and on the other hand, I want to summarize it to improve the learning effect.

First, I will try to explain what EigenLayer is in the simplest terms?

Based on personal understanding, let's take an example~

First, let's talk about ETH mainnet LSD staking

Imagine in the real world, there are express delivery companies responsible for transporting goods. How to make the shipper feel at ease? The express delivery company needs to stake (Staking) a certain amount of money (ETH) as a guarantee deposit (trust) for compensation in case of misconduct. The guarantor (the person who provides the guarantee deposit) may be the express delivery company or an individual… After staking the deposit, the guarantor will receive a guarantee deposit receipt (stETH), and these guarantee deposit receipts can earn corresponding income (LSD) from the business of the express delivery company.

Now, let's talk about restaking

Now, in reality, there is a need for some weather forecasting agencies to predict future weather. Weather may affect the income of the express delivery industry. Obviously, those who can join the weather forecasting organization to predict the weather need to be endorsed with trust. Currently, there are two ways to do this: one is to stake (Staking) a certain amount of money (ETH) for the new business. The other is to restake (restaking) the guarantee deposit receipts (stETH) from the express delivery industry to the weather industry as a guarantee, and receive guarantee deposit receipts (re-stETH). Similarly, these re-staked receipts (re-stETH) can also earn corresponding income from the weather forecasting industry.

0. Project Introduction

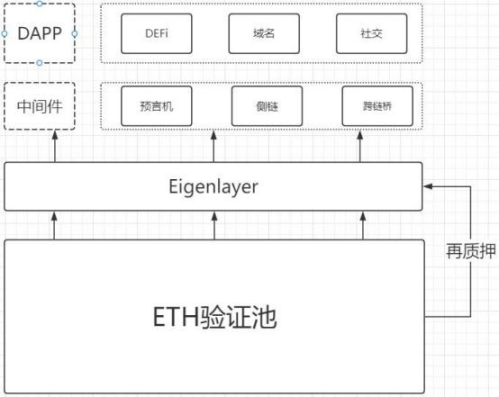

EigenLayer is a middleware protocol based on Ethereum, which introduces the concept of restaking, allowing Ethereum nodes to restake their staked ETH or LSD tokens into other protocols or services that require security and trust, thereby obtaining double income and governance rights. It also allows the utility of the Ethereum consensus layer to be extended to various middleware, data availability layers, sidechains, and other protocols, enabling them to enjoy Ethereum-level security at a lower cost.

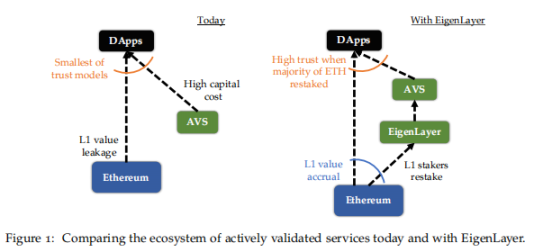

With EigenLayer, Ethereum stakers can re-stake their staked ETH, choose from a variety of services, and provide collective security to help protect the security of multiple services. This not only reduces the capital cost for stakers to participate, but also significantly increases the trust guarantee for individual services.

EigenLayer aims to solve the fragmented security issues of decentralized applications built on Ethereum. It allows any service, regardless of its composition, to leverage the collective security provided by Ethereum stakeholders, creating an environment for permissionless innovation and free market governance.

1. Research Highlights

1.1. Core Investment Logic

Team Aspect

EigenLayer has a blockchain team focused on technical innovation, with 30 members, over 80% of whom are engineers. Although the team is young, they have rich backgrounds in blockchain technology and research experience, making them a dynamic and promising blockchain team worth paying attention to. Looking at the history of blockchain projects, projects built by purely technical teams have mostly been successful.

Financing Aspect

EigenLayer has received high recognition and support from the capital market early in the project. EigenLayer has completed three rounds of financing, with a total amount exceeding 64 million USD, and the latest Series A financing valued at 500 million USD. These data fully demonstrate EigenLayer's leading position and huge potential in blockchain security and scalability. At the same time, sufficient funds provide strong support for its subsequent development, allowing it to better serve the Ethereum ecosystem and other protocols.

Technical Aspect

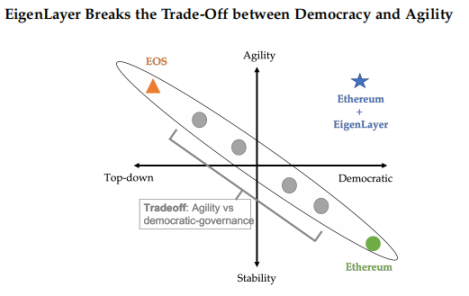

EigenLayer is a disruptive technological innovation protocol that addresses a strong real demand for technical pain points. It lowers the development threshold for other projects, bringing higher security and scalability to the Ethereum ecosystem, while enhancing the trust network of Ethereum, allowing any system to leverage the security of the Ethereum pool, thereby increasing the value and influence of Ethereum.

EigenLayer utilizes Ethereum's consensus layer stakers as validators, providing high decentralization and security, avoiding the trust risks of centralized service providers or proprietary tokens.

Track Aspect

EigenLayer is the first project to propose Restaking. Its restaking track currently has no obvious competitors. As an innovative concept, it has not been completely replicated or imitated by other protocols, and the market is still in its early stages with few participants.

EigenLayer introduces restaking as a new cryptographic economic security primitive, allowing Ethereum's consensus layer stakers to choose to validate other modules and gain additional income and influence. This mechanism is unprecedented in the blockchain field and is the trend and direction for future development.

1.2. Valuation

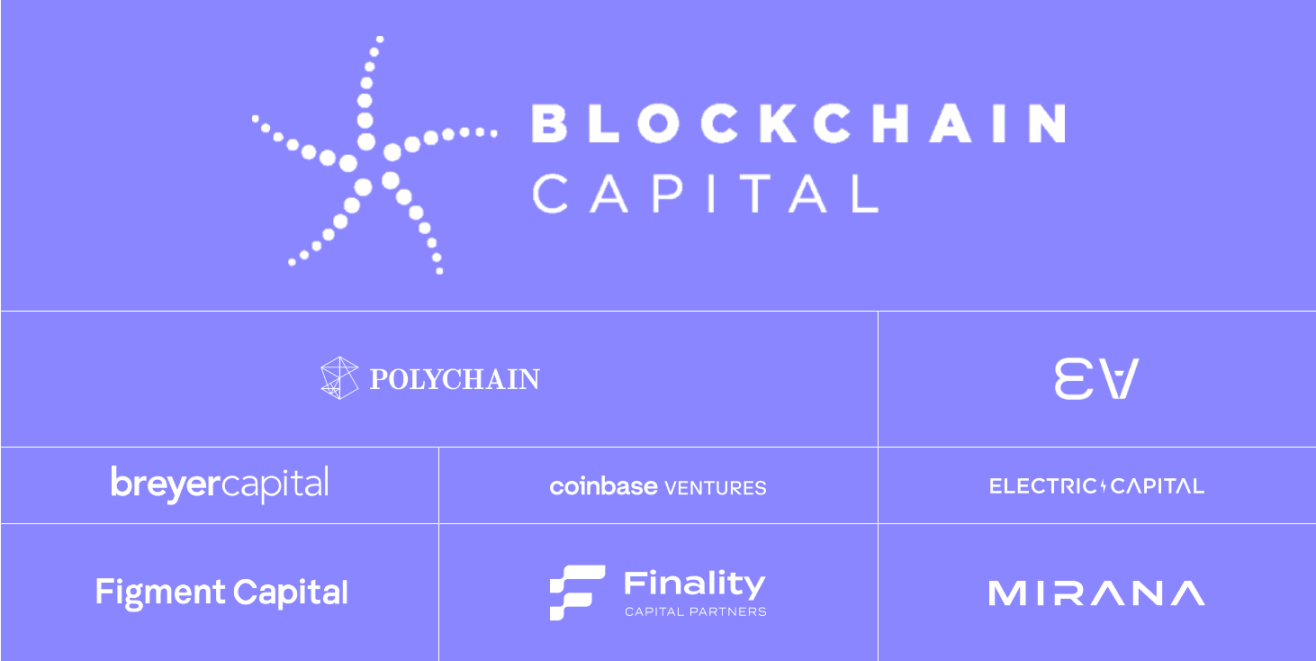

On March 28, 2023, EigenLayer completed a Series A financing of 50 million USD, led by Blockchain Capital, with participation from Coinbase Ventures, Polychain Capital, Bixin Ventures, Hack VC, Electric Capital, IOSG Ventures, and others. The valuation of this financing is 5 billion USD.

2. Project Overview

2.1. Basic Project Information

EigenLayer is a restaking protocol based on the ETH staking market, developed by EigenLabs in 2021. The team is mainly located in the United States. The project has not yet issued tokens, but may do so in the future. EigenLayer is currently in the first phase of the mainnet and has attracted many validators and protocol participants.

EigenLayer's business scope covers two aspects: allowing ETH stakers to restake ETH to provide security and trust for other protocols, and enabling new software modules in the ETH ecosystem to use stakers as validation nodes to improve security and efficiency. EigenLayer supports various modules, such as consensus protocols, data availability layers, virtual machines, guardian networks, oracle networks, cross-chain bridges, threshold encryption schemes (a cryptographic technology that involves splitting a key or data into multiple parts and distributing these parts among multiple participants. Only when a certain number or proportion of participants cooperate can the original key or data be restored.), and trusted execution environments, among others.

Currently, Ethereum's updates are progressing slowly through robust off-chain democratic governance. EigenLayer allows innovations to be rapidly deployed on Ethereum's trusted layer, providing testing and experience for Ethereum's mainnet innovation, similar to a test network, avoiding the trade-off between rapid innovation and democratic governance for Ethereum.

2.2. Team Situation

2.2.1. Overall Situation

EigenLayer is a restaking protocol developed by EigenLabs. EigenLabs is a laboratory focused on blockchain innovation and research, headquartered in Seattle, Washington, USA. Sreeram Kannan, the founder of EigenLabs, is an associate professor in the Department of Electrical and Computer Engineering at the University of Washington and the head of the UW Blockchain Lab. The EigenLabs team consists of 30 experts and enthusiasts from different fields and backgrounds, primarily engineers, as well as product managers, strategic directors, and legal advisors.

2.2.2. Core Members

Sreeram Kannan is the CEO of EigenLayer. He is an associate professor in the Department of Electrical and Computer Engineering at the University of Washington, where he primarily researches information theory and its applications in communication networks, machine learning, and blockchain systems. He holds a Ph.D. in Electrical Engineering and a master's degree in Mathematics from the University of Illinois at Urbana-Champaign, and has conducted postdoctoral research at the University of California, Berkeley, and Stanford University. He has received multiple awards and honors, such as the 2019 UW ECE Outstanding Teaching Award, the 2017 NSF CAREER Award, and the first prize in the Qualcomm Cognitive Radio Contest in 2013. He is also the head of the UW Blockchain Lab.

Robert Raynor is an engineer at EigenLayer. He is a Ph.D. student in the Department of Electrical and Computer Engineering at the University of Washington and a former Air Force officer with a background in applied physics. He is currently researching data-driven artificial intelligence, data economics, and causal reasoning. He is also a member of the UW Blockchain Lab.

Soubhik Deb is an engineer at EigenLayer. He is a third-year Ph.D. student in the Department of Electrical and Computer Engineering at the University of Washington and a member of the UW Blockchain Lab. His goal is to design, develop, and deploy Web3.0-based systems to democratize trust, data, and control in digital platforms. He was previously an industrial researcher at NEC Corporation in Japan, working on 5G technology. He graduated from the Indian Institute of Technology Bombay with dual degrees in Electrical Engineering (Bachelor's and Master's).

Calvin Liu is the Chief Strategy Officer. He previously served as the Head of Strategy at Compound and is also a venture partner and angel investor who has invested in multiple blockchain projects such as Argus Labs, Catalyst, and Liquity. He graduated from Cornell University with majors in Philosophy and Economics.

Bowen Xue: Master of Electronic Engineering at the University of Washington, Assistant Researcher.

Jeffrey Commons: Smart Contract Architect at the University of Washington.

Gautham Anant: Computer Science major at the University of Washington, Developer.

Vyas Krishnan: Full-stack software development at the University of Illinois.

2.3. Financing Situation

According to data from Crunchbase and PitchBook, EigenLayer has completed three rounds of financing as follows:

On May 24, 2022, EigenLayer completed an angel round of financing with undisclosed amount, with investments from dao5, cFund, Coinbase Ventures, and others.

On August 1, 2022, EigenLayer completed a seed round of financing of 14.5 million USD, led by Polychain Capital and Ethereal Ventures.

On March 28, 2023, EigenLayer completed a Series A financing of 50 million USD, led by Blockchain Capital, with participation from Coinbase Ventures, Polychain Capital, Bixin Ventures, Hack VC, Electric Capital, IOSG Ventures, and others. The valuation of this financing was 5 billion USD.

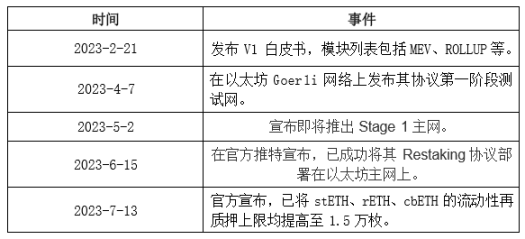

2.4. Past Development and Roadmap

2.4.1. Past Development

In April 2022, EigenLayer began internal testing of the test network and participated in the Ethereum DevConnect developer conference roadshow and the ZK Summit roadshow in May.

2.4.2. Development Plan and Roadmap

EigenLayer plans to launch its second phase protocol in the fourth quarter of 2023, introducing a free market governance mechanism that allows stakers and protocols to negotiate and reach consensus on the terms of restaking, such as fees, rewards, and forfeiture conditions.

Additionally, in the third quarter of 2023, the Operator test network will go live, followed by the launch of the Active Validation Service (AVS) test network in the fourth quarter, with the AVS mainnet expected to go live in the first quarter of 2024.

3. Project Analysis

3.1. Project Background

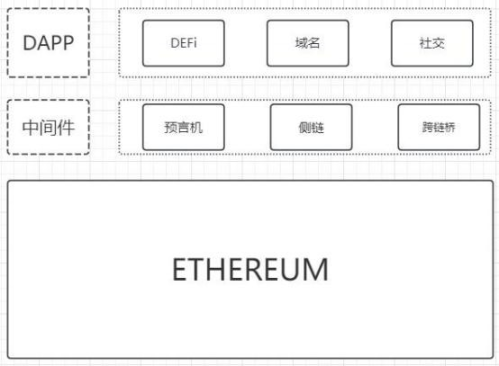

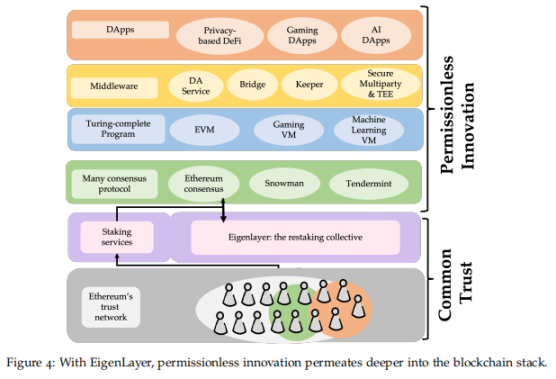

The Ethereum network was the first to introduce modular blockchain technology, with the consensus layer providing trust and the protocol layer providing innovative dApps.

However, this led to a decoupling of trust and innovation, with stakers and validators providing trust to ensure network security, while dApps consume this trust and pay a premium for the trust and security provided by the Ethereum consensus layer.

In 2009, the Bitcoin network introduced the concept of decentralized trust, designed as a peer-to-peer digital currency system using UTXO and script language, but with limitations in building various programs on the network.

In 2015, the Ethereum network allowed the construction of various decentralized applications (dApps), but its performance and programmability were limited, requiring reliance on Layer 2 and other middleware for scalability and innovation.

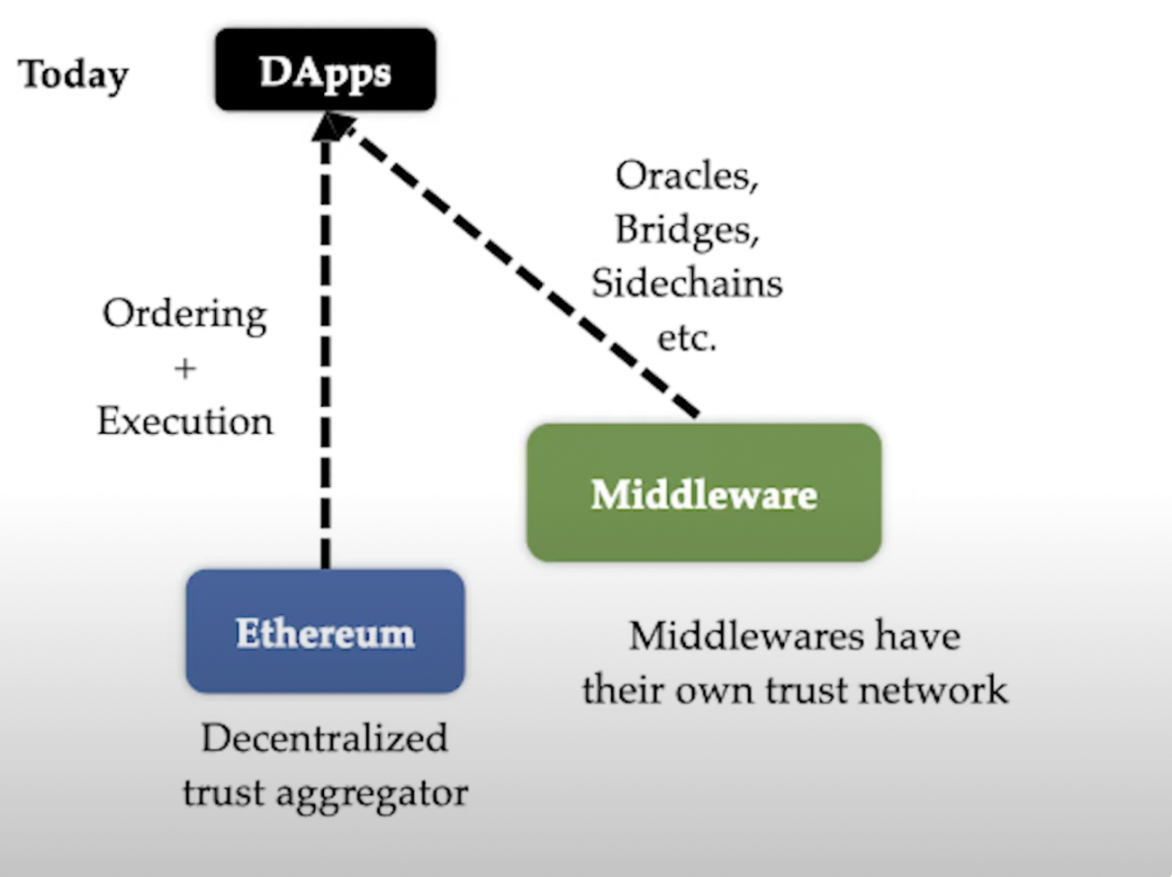

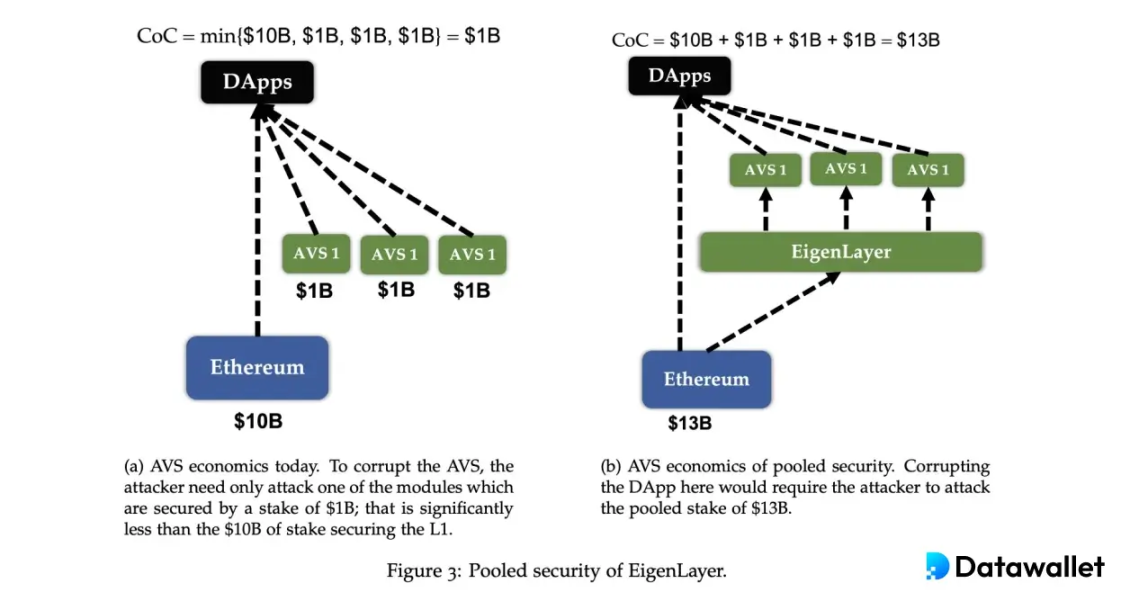

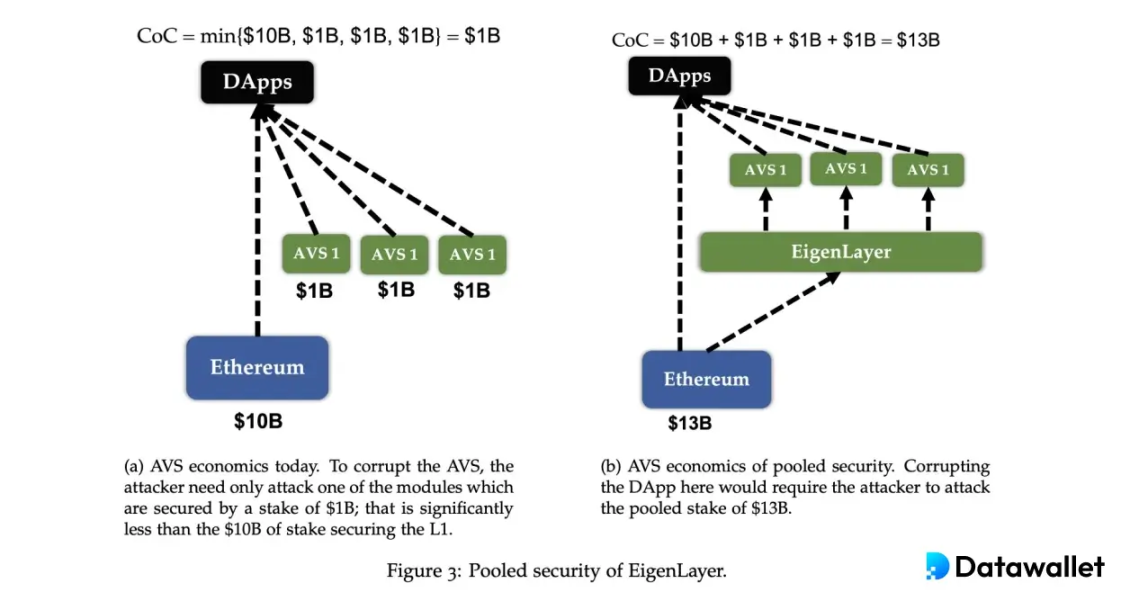

Layer 2 and other middleware, dApps, etc., cannot leverage the security of the Ethereum trusted layer and need to build their own independent Active Validation Service (AVS) to be responsible for the security of their systems, which mainly brings two problems:

- Increased project threshold:

Building a new AVS requires a significant amount of time, cost, and resources, making it difficult to achieve.

A new AVS requires additional fees, leading to value loss and a decrease in user experience.

Middleware validators need to invest funds to guard the network, which incurs a certain marginal cost. Due to the consideration of token value capture, validators are often required to stake native tokens of the middleware, and the fluctuating prices lead to uncertainty in their risk exposure.

Security Issues:

For Middleware: Since it operates independently of Ethereum itself and relies on staking native tokens to run the validator network, the security of the middleware depends on the overall value of the staked tokens. If the token price plummets, the cost of attacking the network also decreases.

For DApps: For some DApps that rely on middleware (such as derivatives requiring oracle price feeds), their security actually depends on the trust assumptions of both Ethereum and the middleware. The trust assumption of the middleware essentially comes from trust in the distributed validator network. We have seen numerous incidents of asset loss due to oracle misfeeds.

This can lead to a serious "barrel effect," where the security of the system depends on its weakest link, and seemingly insignificant weaknesses can trigger systemic risks.

Whenever someone builds a new decentralized network, whether it's Layer-1 or an oracle network, they must establish their own security foundation, or what EigenLayer calls the "trust layer." For example, the security and trust layer of Bitcoin comes from Proof of Work (PoW) mining, where anyone using the network can trust the information and state contained in the Bitcoin blockchain because they can trust that necessary computations have been performed. For Ethereum, this security and trust layer is achieved through Proof of Stake (PoS), where any user or application on the network can trust every transaction because of the security incentives that come with PoS consensus (e.g., slashing). When applications use information from sources different from the Ethereum protocol and data availability (such as a set of oracles), they need to adopt a different set of trust for that specific network.

By running middleware and alternative Layer-1 on different trust networks, this creates a completely new trust and security layer, which slows down potential innovation by increasing capital and labor costs. Additionally, these protocols must accumulate significant value to gain enough security and trust, especially for Proof of Stake (PoS) networks where security is directly related to token value. Finally, there is almost no incentive consistency between different networks, paving the way for negative extraction.

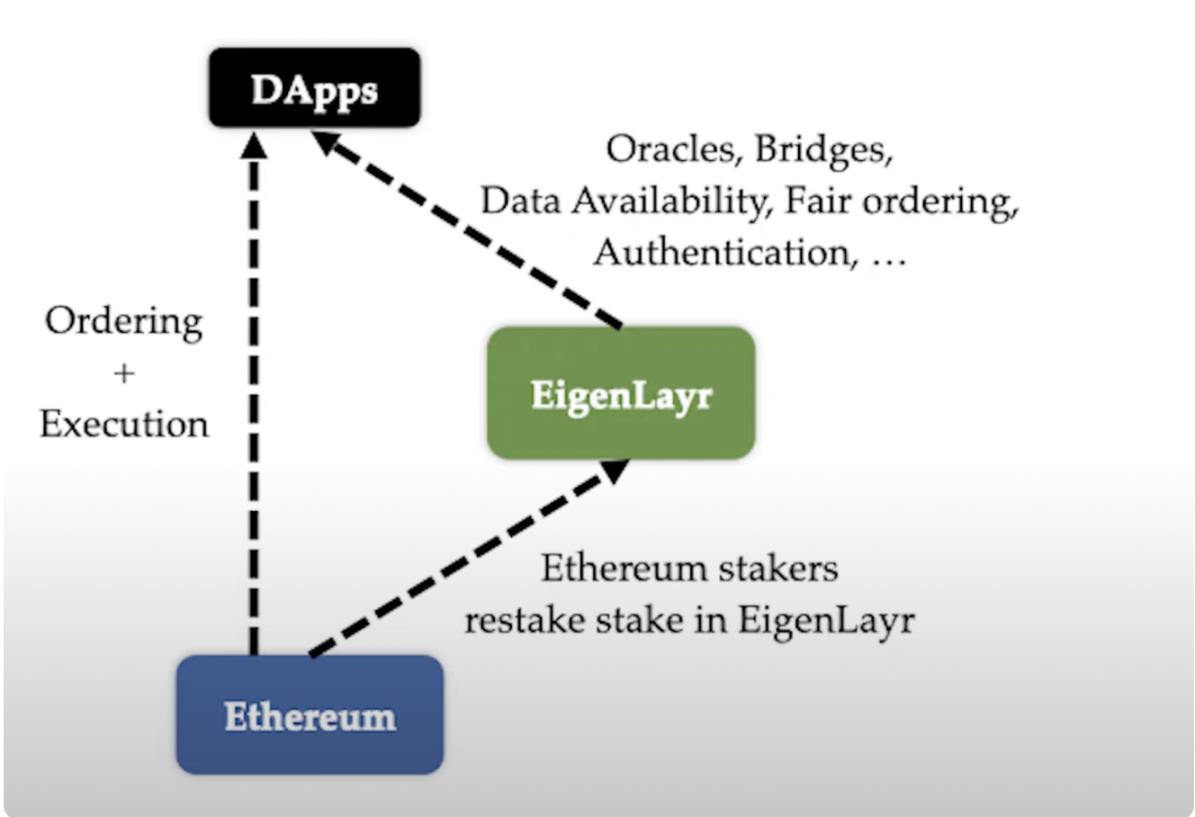

EigenLayer aims to address the problem of decentralized trust networks by providing a service where users who have locked ETH in a staking protocol can "restake" their ETH in a separate smart contract. This essentially means committing the same capital to additional slashing risk. Then, these restaked funds are used to protect any new applications or middleware created using EigenLayer. Stakers will be able to choose the projects they want to restake for and provide security for, giving stakers the opportunity to take on the risk they are willing to bear while providing incentives for these projects to compensate for the security provided by the stakers.

This system results in zero marginal cost of capital, as each of these projects does not need to create new tokens as part of their trust layer; it can build on the already very strong security of ETH. This also creates value consistency between the middleware being created and the Ethereum protocol, as their fates are now linked through shared security. This creates a flywheel where the more valuable the service created through EigenLayer, the higher the return for ETH stakers, bringing higher value to ETH, and in turn, higher security for each EigenLayer project, providing greater incentive for new projects to use EigenLayer. Without the need to bootstrap the security and trust of middleware solutions, this could trigger a significant amount of innovation that was previously only possible at the application layer.

3.2. Project Principles

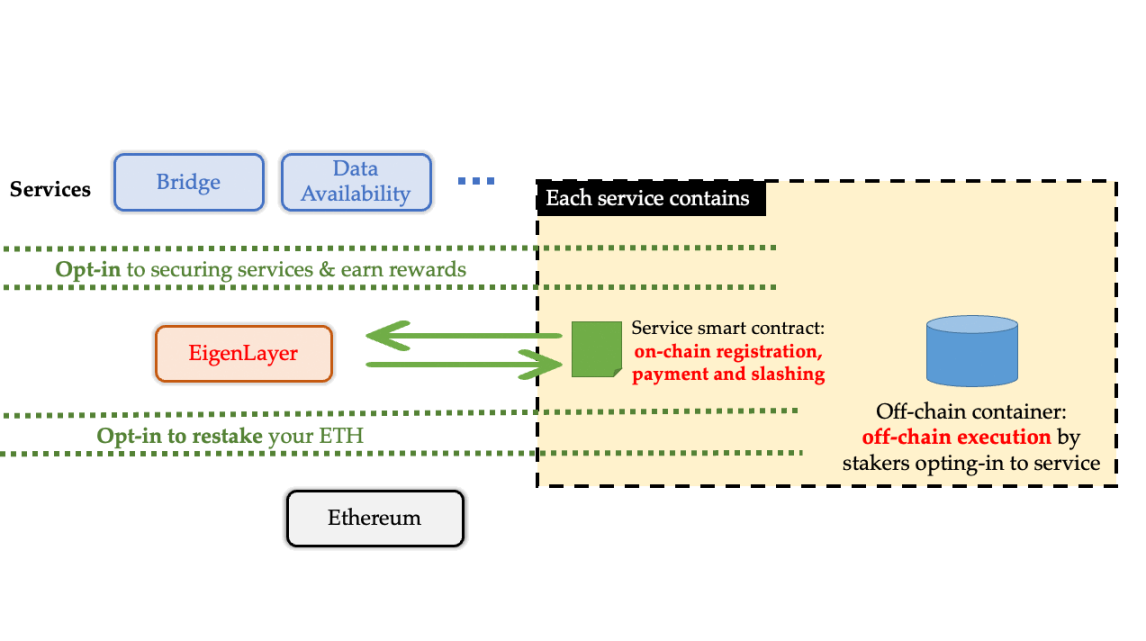

Essentially, EigenLayer allows Ethereum stakers to choose smart contracts and restake their native ETH or Liquidity Staking Tokens (LST) for additional rewards. By contributing to collective security, stakeholders can help protect numerous services on the network, effectively addressing the decentralized security issues that have plagued the industry.

The protocol's initial security design focuses on decentralization and platform trustworthiness, while also emphasizing the protection of user funds through rapid governance response to unforeseen events. Through a multi-signature approach, control over contract upgrades and reductions is handed to the "community multisig," while the "security multisig" has the authority to pause functionality when necessary.

The idea behind EigenLayer is relatively simple, similar to shared security, attempting to elevate the security of middleware to the level of Ethereum.

This is achieved through "Restaking."

By "restaking," the Ethereum trust layer is extended, allowing developers to build their own consensus protocols and execution layers on EigenLayer without needing to build a separate trust layer. Through "trust computation" on EigenLayer, DApps can operate without relying on middleware and directly leverage the strong trust layer of Ethereum.

3.2.1. Slashing Mechanism Design

The security of a cryptographic network depends on the cost of attacking it, also known as the "cost-of-corruption." If the cost of corruption is higher than the attacker's profit, known as "profit-from-corruption," then the network is very secure.

The security of the ETH network's consensus layer is safeguarded by the potential slashing risk of staked funds, which is commonly referred to as a violent means to maintain security.

L2 feeds transaction data back to the mainnet and audits to inherit security, while EigenLayer allows staking "ETH-value assets" to become validator nodes, borrowing the "violent means" of slashing from the mainnet to maintain security.

3.2.2. Restaking

Previously, validators staked on the Ethereum network to earn rewards, and any malicious behavior would result in slashing of their staked assets. Similarly, after restaking, one can earn staking rewards on the middleware network, but if malicious behavior occurs, the original ETH stake will be slashed. In simple terms, if validators on the Ethereum network engage in malicious behavior, they may have half of their staked 32 ETH tokens confiscated, while EigenLayer allows the remaining 50% to be confiscated.

The specific implementation method of Restake is as follows: when an Ethereum validator node participates in validation through EigenLayer, its fund redemption address is set to EigenLayer's smart contract, giving it the power of slashing. If the node violates the rules of the application layer, EigenLayer can confiscate the redeemed ETH through the slashing contract.

This slashing mechanism allows the application layer to confirm the rights and obligations of Ethereum trust layer nodes through smart contracts, making it possible for other applications or middleware to utilize the trust layer of Ethereum. Therefore, EigenLayer's restaking mechanism enhances security by significantly increasing the cost of malicious attacks.

3.2.3. Trust Trading Market

EigenLayer will establish a public trust trading market, allowing Ethereum trust layer nodes and application layer protocols to determine transaction content through a free market mechanism. Nodes can decide whether to participate in the validation work of a specific application to earn additional rewards based on their preferred risk-reward ratio and slashing conditions, avoiding rigid governance structures. Application layer protocols can easily purchase "trust" through market-based prices, allowing them to focus on protocol innovation and operation at the application layer, achieving a balance between their own security and performance.

3.2.4. Support for Multiple Staking Modes

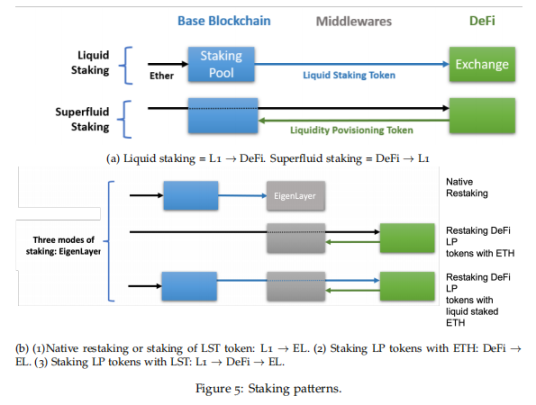

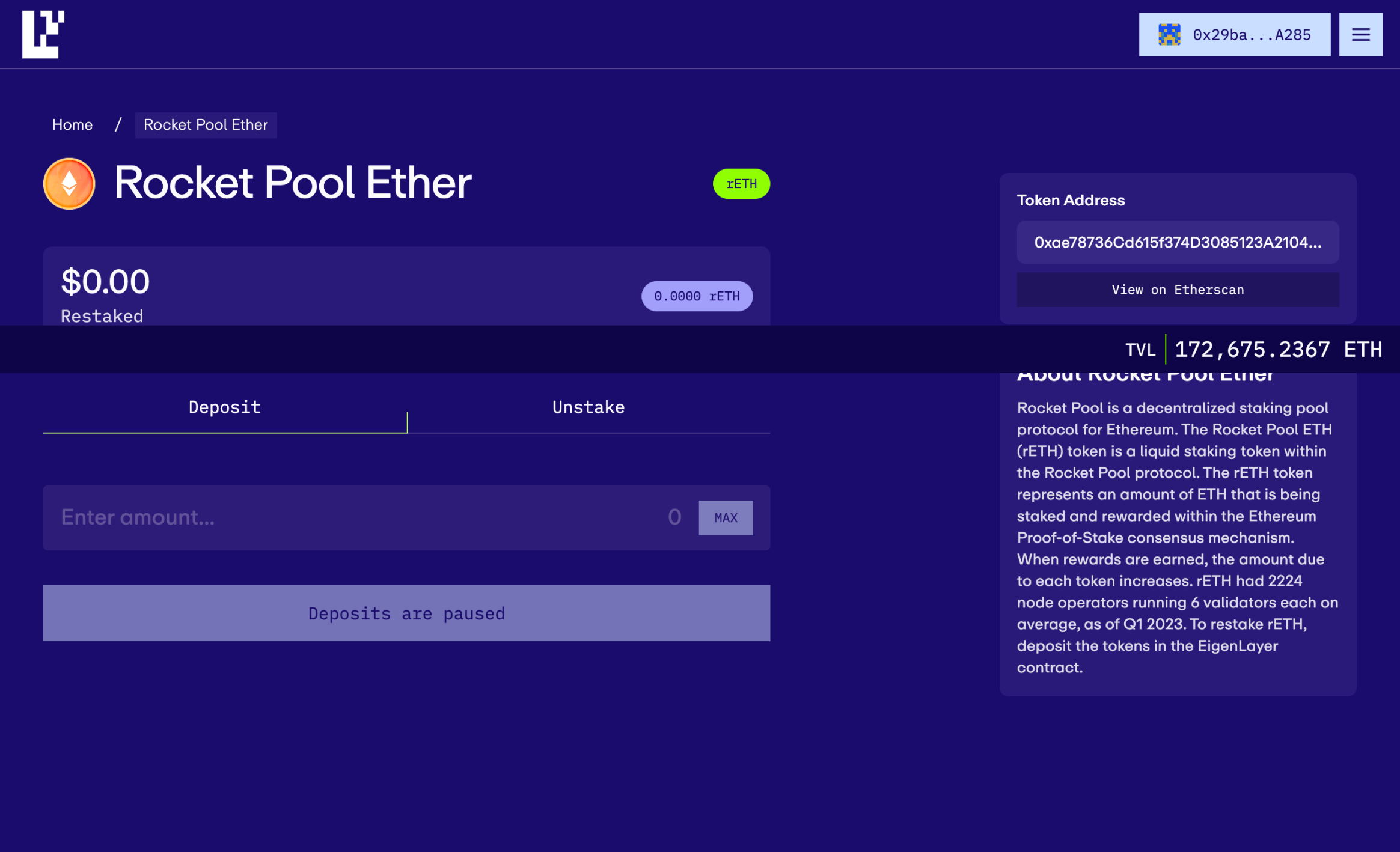

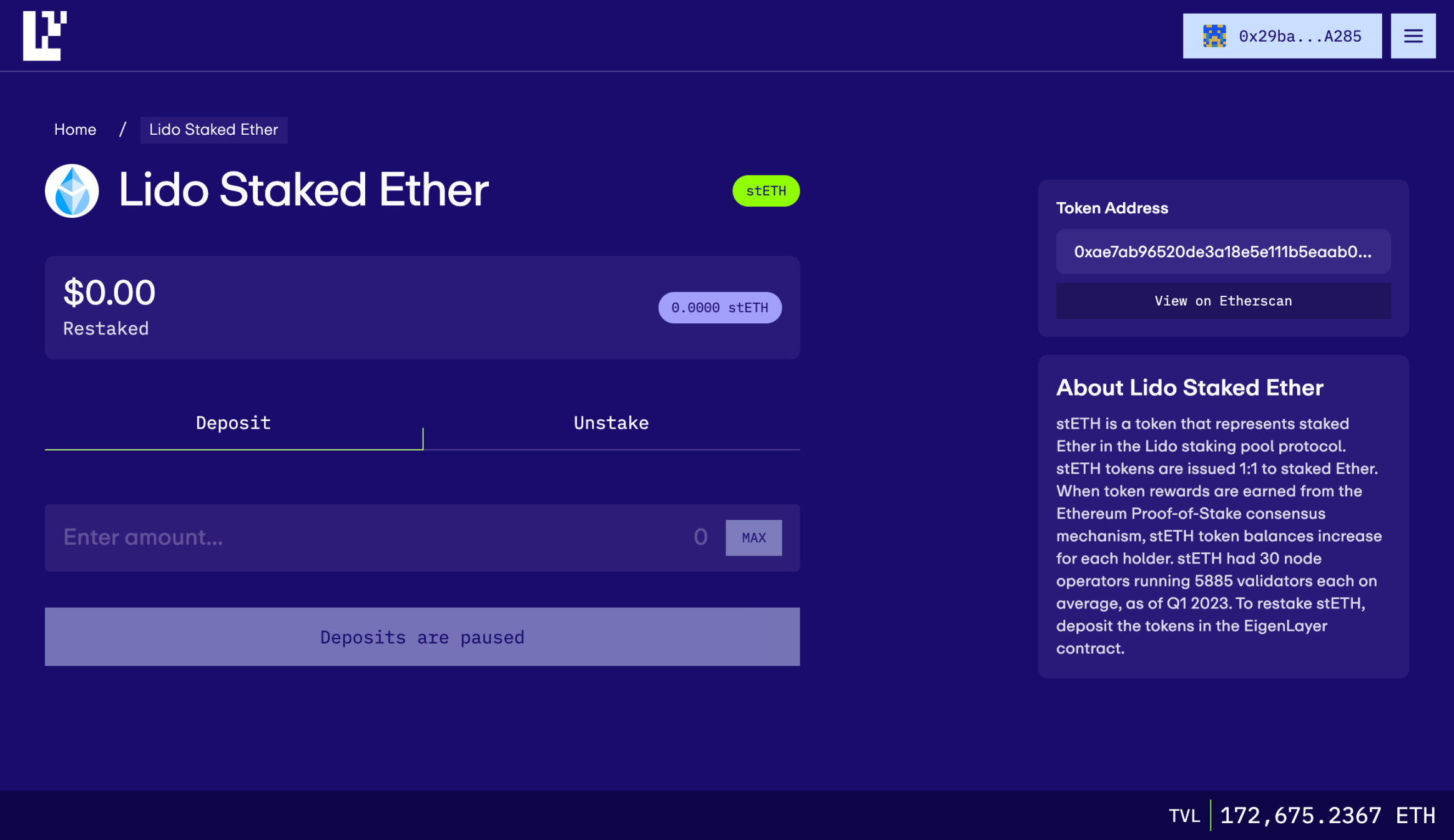

EigenLayer provides multiple staking methods similar to Lido's Liquid Staking and Superfluid Staking, where Superfluid Staking allows for LP staking. Specifically:

- Direct staking, staking ETH directly on EigenLayer from Ethereum

- LSD staking, restaking assets already staked in Lido or Rocket Pool on EigenLayer

- ETH LP staking, restaking LP Tokens from DeFi protocols on EigenLayer

- LSD LP staking, restaking LP Tokens such as Curve's stETH-ETH on EigenLayer

Middleware can choose to retain the staking requirements for its native tokens while introducing EigenLayer, to continue capturing the value of its native tokens, thus avoiding the "death spiral" caused by a single token price drop.

3.2.5. Delegators

For those interested in EigenLayer but do not want to operate as node operators, they can delegate their rights to other node operators, who will then stake tokens in Ethereum and distribute a portion of the earnings to these delegators. EigenLayer offers two modes:

- Solo staking mode: Stakers provide validation services, can directly join the AVS, or delegate operations to other operators while continuing to validate for Ethereum.

- Trust mode: Choose trusted operators to operate, and if the selected operator does not execute as agreed, the interests of the delegator will be penalized. Additionally, delegators need to consider the fee ratio with the delegator, potentially forming a new market where each EigenLayer operator will establish a delegation contract on Ethereum, specifying how fees will be distributed to the delegators.

3.3. Project Ecosystem Applications

EigenLayer is best suited for use in protocols with a low likelihood of slashing. For example, protocols with liveness guarantees are not suitable for EigenLayer, as the likelihood of server crashes and staking being slashed is always high.

The following services are suitable for using the Eigen protocol:

- Data availability services

- Oracles

- Cross-chain bridges

- Rollup sequencers (e.g., decentralized Optimism and Arbitrum)

- RPC nodes, such as Infura

- MEV management

- Cross-chain bridges

Cross-chain bridges are a great use case for EigenLayer, which is related to their design. For example, if I blacklisted @Hyperlane_xyz bridge, but Hyperlane is very flexible and does not have any liveness requirements for nodes, the likelihood of ETH staked by users being slashed is very low.

Architectures like the one mentioned above are very suitable for running on EigenLayer. Other potentially suitable protocols include @SuccinctLabs, @axelarcore, @0xsquid_, and others.

In addition to asset transfer bridges, ZK messaging protocols such as @HerodotusDev can also use EigenLayer.

Rollup Sequencers

Another important use case is running rollup sequencers on EigenLayer. The centralized sequencers we currently use can review and reorder transactions.

Running rollup sequencers on EigenLayer would make L2 rollup sequencers like Optimism and Arbitrum more decentralized and secure.

Decentralized sequencers will be able to enable MEV auctions like Flashbots, or use fair/random ordering, similar to @project_shutter.

RPC Nodes

EigenLayer will enable truly decentralized RPC nodes, similar to existing solutions like @POKTnetwork, and even some centralized providers like @infura_io can migrate to EigenLayer.

Decentralized RPC is crucial for avoiding client-level censorship!

Appchains

Recently, the topic of appchains has sparked a lot of discussion in Web2. Use cases such as games and applications seem to benefit from running independently for scalability, and they would benefit from modular application chains. Appchain deployment protocols, such as @atlas_zk and @0xStacked, will be able to use Eigenlayer to enhance the security of new appchains while returning value to restakers, achieving a win-win situation.

Oracles

Oracles are well-suited for Eigenlayer because they are secured by the value of tokens (e.g., LINK). By using more collateral to secure the oracle network, the security of oracles will be greatly increased, reducing the likelihood of attacks.

EigenDA and Celestia

One of Eigenlayer's flagship products is its internally built data availability module, EigenDA (Eigen Data Availability). The idea is to separate the execution layer, settlement layer, data, and consensus, allowing for easy operation of execution layers like @fuelabs_.

Compared to Celestia, EigenDA has a clear advantage - it can more easily bootstrap a large validator network by leveraging existing ETH validators and staking. Unlike Celestia, EigenDA is not a consensus layer, so it will be lower cost and higher throughput.

3.3.1. Projects Built on EigenLayer

The following projects are pioneers in using EigenLayer to protect their infrastructure, aggregating, integrating, and extending Ethereum's cryptographic economic security and decentralization through the EigenLayer protocol.

AltLayer

AltLayer is building a rollup-as-a-service tool to scale execution at extremely low cost. AltLayer provides flash rollup by quickly validating state transitions using EigenLayer validators without permission.

Blockless

Blockless is an infrastructure platform for launching and integrating full-stack decentralized applications, enabling them to surpass the limitations of smart contracts. With a globally distributed, trustless node infrastructure (protected and supported by EigenLayer restakers and operators), applications can achieve high-performance trustless computation, automatic horizontal scaling, and advanced load balancing.

In-depth discussions about Blockless's collaboration can be found on the EigenLayer forum.

Celo

Celo is migrating from an EVM-compatible Layer 1 blockchain to Ethereum Layer 2 to achieve trustless liquidity sharing, decentralized sequencing, and promote greater consistency with Ethereum. Celo will leverage the data availability layer supported by EigenLayer and EigenDA, inheriting the architecture of Danksharding to increase throughput, reduce costs, and minimize latency.

More details about EigenLayer's role in this significant event in Celo's ecosystem can be found in the official migration proposal.

Drosera

Drosera is a zero-knowledge automation protocol providing emergency response infrastructure for Ethereum. EigenLayer leverages the native trust network to bootstrap Drosera, making the network more decentralized over time.

Drosera aims to leverage the decentralized nature of Ethereum consensus to create a powerful and responsive collective of first responders. The protocol defines emergency response logic and advanced verification checks for operators to execute. EigenLayer's slashing and reward mechanisms ensure honesty and accountability, extending monitoring and bug bounty programs into a dynamic model.

Espresso

Espresso is creating a shared sequencer solution that supports decentralized rollup, improved interoperability, and a robust, highly scalable data availability layer. Through EigenLayer, restaking optimizes node usage and capital efficiency while ensuring trusted neutrality, security, and fast pre-confirmation in transaction validation.

Restaking can maintain consistency between Layer-1 validators and Layer-2 ecosystems. In centralized sequencers, almost all rollup values (e.g., fees, MEV) can be captured by the sequencer. If the rollup values captured by Layer-1 validators are minimal or non-existent, it could compromise the security of the rollup, as Layer-1 may be tempted by malicious behavior. By using decentralized sequencers and involving Layer-1 validators in their operation, these security issues are greatly mitigated.

More details about this collaboration can be found in Espresso's announcement.

EigenDA

EigenDA is a data availability service providing high throughput and economic security through Ethereum operators and restakers. Based on the principles of danksharding, EigenDA aims to expand the programmable scope of rollup while increasing the throughput limit. Horizontal scaling will eventually allow EigenDA to achieve up to 1TB/s of scaling at minimal cost and technical overhead. Flexible token economics, reserved bandwidth, modifiable signature schemes, elliptic curves, and other features enable EigenDA to support various projects and use cases.

Earlier this year, learn more about EigenDA from Sreeram Kannan's presentation.

Hyperlane

Hyperlane is developing a permissionless interoperability layer supporting composability between chains, including local rollup bridges, inter-rollup communication, and multi-chain application architectures. It brings modular security through EigenLayer restaking, enabling permissionless, chain-agnostic application deployment in any environment.

You can see the scope of our collaboration with Hyperlane in this forum post.

Lagrange

Lagrange is building infrastructure for zk-based cross-chain state and storage proofs. It brings superlinear security derived from restaking through EigenLayer, providing a powerful primitive to dynamically scale the underlying security of state proof generation, overcoming inherent security limitations faced by bridging at scale.

Lagrange State Committees, composed of EigenLayer restaking validators, prove the finality of proposed block state transitions submitted by Optimistic Rollup sequencers to Ethereum. ZK MapReduce proof system of Lagrange is then used to generate zero-knowledge state proofs. Messaging or bridging protocols can use these proofs to create a shared, permissionless secure zone for cross-chain state.

For more details, refer to Langrage's Medium article and their complete announcement on the forum.

Mantle

Mantle is building an Ethereum Layer-2 that achieves fast and cost-effective transactions through innovative rollup architecture and modular data availability. Mantle currently uses MantleDA, a modified version of EigenDA, and will migrate to EigenDA upon release. This allows the Mantle ecosystem to provide high throughput and low gas costs for blockchain games, decentralized social networks, and next-generation applications.

Learn more about the collaboration in this blog post from the Mantle team.

Omni

Omni is creating an interoperability infrastructure as a unified layer for all rollups to achieve data interoperability. It is built on EigenLayer to provide security for future use cases, including cross-rollup stablecoins and primitives that can aggregate liquidity and facilitate fast, inexpensive communication between rollups.

You can see how EigenLayer is integrated into Omni's tech stack in Omni's release blog.

Polyhedra

Polyhedra is developing new infrastructure based on zk-proofs to achieve trustless and efficient cross-chain interoperability through parallel and distributed computing. It leverages EigenLayer's restaking to enhance the security and efficiency of the first and second layer chains using zkBridge, thereby reducing on-chain verification costs for EVM-compatible networks.

You can read more on the Polyhedra team's official blog.

WitnessChain

WitnessChain is building transparent middleware for blockchain. By leveraging Eigenlayer's decentralized network, WitnessChain can create a decentralized monitoring network for verifiable AVS monitoring, which will help provide the first line of defense for optimistic rollup.

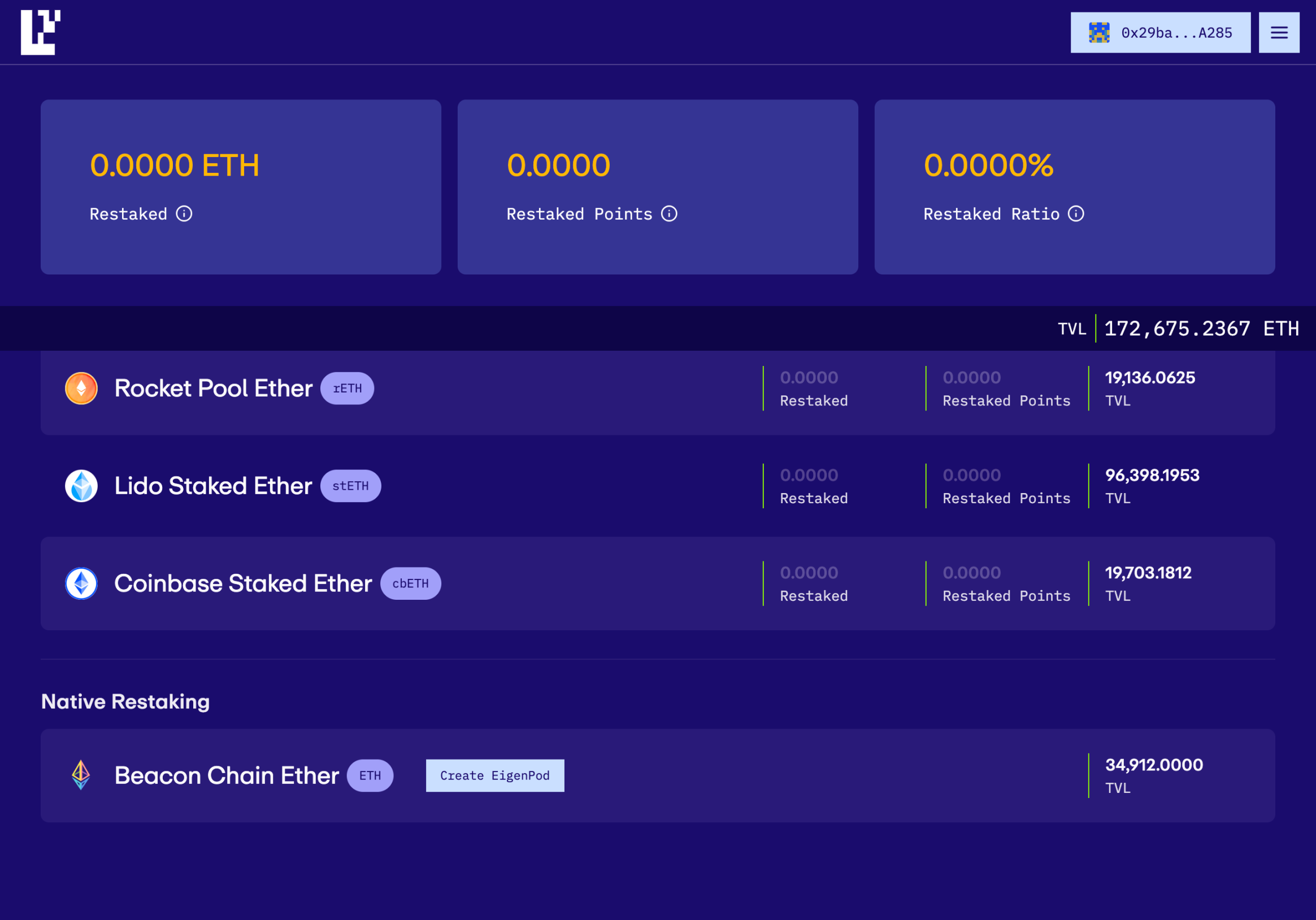

3.4. Project Interface

3.4.1. Homepage

3.4.2. Learn

3.4.3. ReStaking

3.5. Project Data

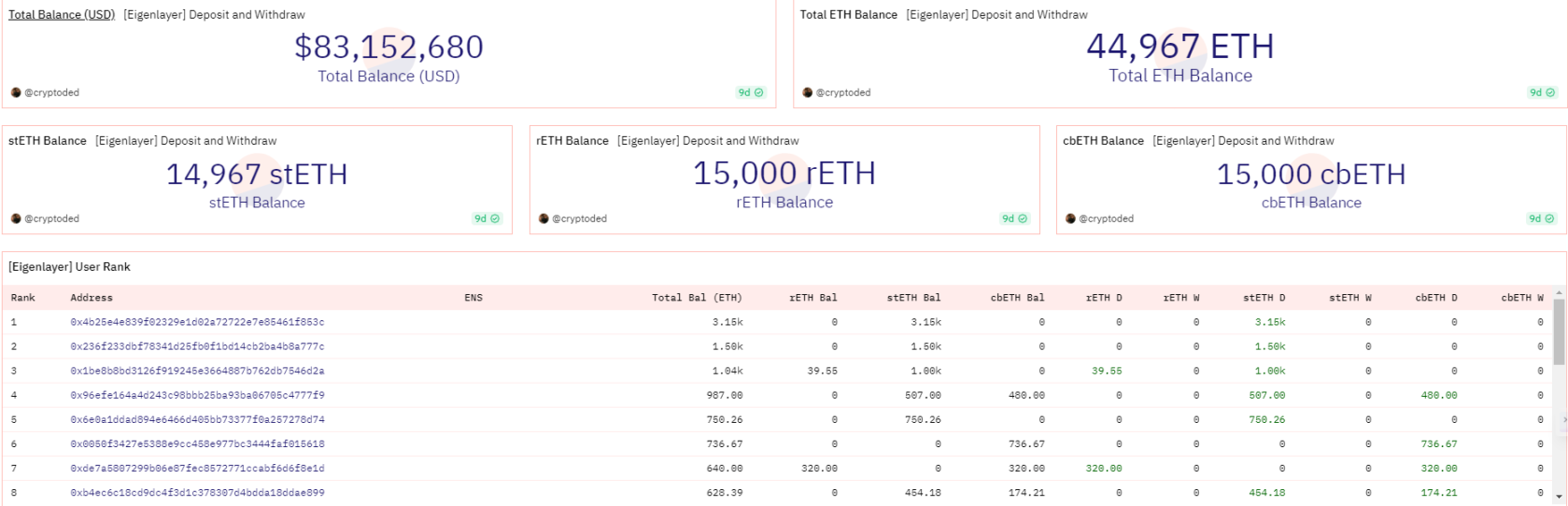

3.5.1. Restaking Data

According to EigenLayer's official website, as of August 1, 2023, EigenLayer has 10 supported modules and 55,670.57 ETH restaked. These modules include EigenDA, The Graph, Chainlink, tBTC, API3, Gravity Bridge, Threshold ECDSA, iExec, and more. These modules cover various types such as data availability layer, oracle networks, bridges, threshold encryption schemes, trusted execution environments, demonstrating EigenLayer's wide applicability and compatibility. These modules are also among the best and most well-known projects in the blockchain field, showcasing EigenLayer's high quality and standards. This data indicates that EigenLayer has achieved a certain level of success and influence, and also shows that EigenLayer still has great potential for development.

3.5.2. Social Media Data

As of August 1, 2023, EigenLayer has performed well on social media platforms, indicating high project popularity. Currently, EigenLayer's Discord account has attracted over 126,000 followers, with over 7,300 daily online users, making it one of the most popular channels. Additionally, there is frequent interaction on Twitter updates.

4. Industry Space and Potential

4.1. Track Analysis

4.1.1. Project Classification

EigenLayer is a blockchain infrastructure platform focused on ETH liquidity staking, falling under the category of ETH restaking track.

4.1.2. Market Size

According to Staking Rewards data, as of August 1, 2023, the total value locked (TVL) in the global staking market is $12.2 trillion, with Ethereum holding the largest share at $403 billion. Other major staking networks include Solana, Cardano, Polkadot, Avalanche, Cosmos, and more.

According to DeFi Llama data, as of August 1, 2023, the total value locked (TVL) in the global staking market is $201.4 billion, with Lido holding the largest share at $147.4 billion. Lido is a liquidity staking protocol that allows users to stake ETH on the Ethereum 2.0 network and receive equivalent stETH tokens for use in the DeFi market or for restaking. Other major restaking protocols include EigenLayer, Tenet, and more.

4.1.3. Core Competitive Factors

1) Staking Scale

Asset scale refers to the total staked amount in the staking pool. We believe that an excellent staking platform should have a high asset scale to demonstrate stability and credibility.

2) Security

Protecting user assets is the most important goal for staking projects. Restaking projects need to ensure that user assets are not at risk due to smart contract vulnerabilities, improper validator behavior, or hacking attacks. Therefore, high-level security measures and risk management mechanisms such as multi-signature, firewalls, insurance, and penalties are necessary.

3) Yield

Restaking projects need to provide higher returns than single staking to attract users. Therefore, optimizing staking strategies, income and reward allocation, and utilizing compounding effects are necessary to increase user capital efficiency and returns.

4) Liquidity

Restaking projects need to address the liquidity of staked assets so that users can join or exit staking at any time, or transfer staked assets to other protocols or platforms. Therefore, providing liquidity staking tokens, liquidity mining, and lending markets are necessary to improve user liquidity and freedom.

5) Ecosystem

Restaking projects need to build a strong ecosystem to support validation services for various PoS networks and protocols, thereby enhancing network security and decentralization. Collaboration and integration with other blockchain platforms, DeFi applications, Layer 2 protocols, and more are necessary to provide users with more choices and opportunities.

4.1.4. Competing Projects

As mentioned earlier, the most common types of staking in blockchain are network node staking for normal secure operation and liquidity staking to increase transaction liquidity.

When looking at restaking platforms like EigenLayer, it's easy to draw comparisons to liquidity bootstrapping protocol Tokemak, as they both have an "intermediary" nature. Tokemak attracts users to stake assets on its platform to create a comprehensive token pool, and then directs the liquidity of the pool to other applications and protocols. While there are some similarities in logic, the difference lies in EigenLayer's focus on ETH restaking for node validation services in other applications, as opposed to Tokemak's goal of attracting stakers through reward token distribution or LP earnings. Additionally, the competition for liquidity rewards in DeFi protocols intensifies, making the secondary staking track a blue ocean at present.

Lido allows users to earn from PoS staking and enables stETH to earn additional income from the DeFi ecosystem. The difference lies in Lido being a single staking platform, while EigenLayer focuses on secondary staking for node validation in different application protocols to earn additional income, creating a competitive relationship.

EigenLayer is a pioneer and innovator in the restaking field, with no clear competitors at present. As an innovative concept, it has not been fully replicated or imitated by other protocols, and the market is still in its early stages with few participants.

However, EigenLayer's restaking track may face potential competition or challenges from:

- Other LSD protocols developing their own restaking functionality, such as Lido Finance, Rocket Pool, etc.

- Other data availability and governance service protocols developing their own LSD functionality, such as The Graph, Aragon, etc.

- Other Layer 2 or cross-chain protocols developing their own security and trust networks, such as Polygon, Cosmos, etc.

- Additionally, LSDFi projects in the market may compete for LSD market share, as EigenLayer primarily uses LSD as collateral. We will consider projects in this track as competitors.

4.2. Token Economic Model Analysis

4.2.1. Token Total Supply and Distribution

EigenLayer currently does not have its own token, but it may issue one in the future. Stay tuned for updates.

4.2.2. Token Value Capture

Based on the analysis of the EigenLayer project, if EigenLayer issues a token, the token value may be captured through the following aspects:

1) Governance: Allowing token holders to participate in protocol parameter and direction decisions within EigenLayer.

2) Earnings: Allowing token holders to share in EigenLayer's protocol income and rewards, such as fees and rewards from restaking protocols or services.

3) Collateral: Allowing token holders to use EigenLayer's token as collateral to participate in the security and trust of other protocols or services.

4.2.3. Core Token Demand

Based on the analysis of the EigenLayer project, the core token demand for EigenLayer may come from the following categories:

- LSD holders: They can restake their LSD through EigenLayer to other protocols or services, gaining dual income and governance rights.

- Protocols or services in need of security and trust: They can utilize ETH's trust layer through EigenLayer to reduce their security costs and risks.

5. Preliminary Valuation

5.1. Core Issues

5.1.1. What stage is the project in? Is it mature or in the early to mid-stage of development?

EigenLayer is a relatively new project, founded in 2021, completed a seed round of financing in May 2022, and completed a Series A round in February 2023. EigenLayer has launched its first phase mainnet, and the next phase will introduce Operators responsible for executing verification tasks for AVS (Active Verification Services) built on the EigenLayer protocol, currently supporting 10 modules. The market size and potential for EigenLayer are significant, but it also faces challenges and risks such as technical difficulty, ecosystem compatibility, and market competition. EigenLayer needs continuous innovation, ecosystem development, and marketing efforts to achieve its project vision and goals. Therefore, EigenLayer is still in the early stages of development with significant potential for growth.

5.1.2. Does the project have reliable competitive advantages? Where do these competitive advantages come from?

- Innovation: EigenLayer introduces the innovative concept of secondary staking, allowing Ethereum consensus layer stakers to choose to validate other modules and gain additional income and influence. This mechanism is unprecedented in the blockchain field and represents a trend and direction for future development.

- Technological advantage: EigenLayer utilizes Ethereum consensus layer stakers as validators, providing high decentralization and security, avoiding the trust risks of centralized service providers or proprietary tokens.

- Scalability: EigenLayer supports various types and levels of blockchain technology, including consensus protocols, data availability layers, virtual machines, guardian networks, oracle networks, bridges, threshold encryption schemes, trusted execution environments, etc. These technologies are among the most important and active in the blockchain field, with significant potential and prospects for future development. EigenLayer can provide foundational services such as security, scalability, and interoperability for these technologies, promoting innovation and diversity in blockchain applications.

- Influence: EigenLayer expands Ethereum's trust network, allowing any system to absorb Ethereum pool security, thereby increasing Ethereum's value and influence. EigenLayer has also attracted some of the most outstanding and well-known projects in the blockchain field as its supported modules, such as The Graph, Chainlink, tBTC, API3, Gravity Bridge, etc. EigenLayer has also gained support and recognition from some of the most authoritative and influential investment institutions and individuals in the blockchain industry, such as Blockchain Capital, Coinbase Ventures, Spencer Bogart, etc.

5.1.3. What are the main variable factors in the project's operations? Are these factors easy to quantify and measure?

Restaking volume: The restaking volume refers to the quantity of ETH or liquidity tokens restaked through EigenLayer, reflecting the trust and participation of stakers in EigenLayer, as well as EigenLayer's market share and income scale. The higher the restaking volume, the more welcome and supported EigenLayer is by stakers, indicating its competitiveness and influence. Restaking volume is an easily quantifiable and measurable factor, obtainable through the EigenLayer official website or other data platforms.

Number of supported modules: The number of supported modules refers to the quantity of software modules that EigenLayer can obtain for validation nodes and interfaces. It reflects the demand and selection level of modules for EigenLayer, as well as the ecosystem compatibility and service scope of EigenLayer. The more supported modules there are, the more EigenLayer can meet the needs and expectations of the modules, indicating greater scalability and diversity. The number of supported modules is an easily quantifiable and measurable factor, obtainable through the EigenLayer official website or other data platforms.

Verification service quality: Verification service quality refers to the effectiveness and level of verification services provided by EigenLayer for modules. It reflects EigenLayer's technical capabilities and user experience, as well as its value capture and creation. Higher verification service quality indicates that EigenLayer can better ensure the security, scalability, and interoperability of modules, as well as provide high-quality services and experiences. Verification service quality is a factor that is not easily quantifiable and measurable, but can be evaluated using indicators or standards such as the number of validators, distribution, stability, response speed, accuracy, fee rates, reward rates, penalty rates, etc.

5.1.4. Project Management and Governance

EigenLayer utilizes a reputation-based committee for governance, consisting of prominent individuals from the Ethereum and EigenLayer communities. The committee is responsible for upgrading EigenLayer contracts, reviewing and vetoing penalty events, and allowing new AVS to enter the penalty review process.

AVS can use this committee to assure restakers in EigenLayer that they will not be subject to malicious or erroneous penalties. Additionally, AVS developers can conduct practical testing of code repositories related to AVS. Once mature and trusted by restakers, AVS can cease using the committee as a backup. When creating AVS on EigenLayer, the committee may be required to conduct security audits and other due diligence, including checking system requirements for validators serving AVS.

5.1.5. Risks and Concerns

Generally, things have two sides, and while EigenLayer provides security and economic benefits, it also brings some risks and concerns.

Vulnerability security risk: Secondary staking increases the risk exposure of staked assets. In addition to the risks of primary staking, it is also subject to the security of the assets in the restaking protocol, including data availability layers, middleware, sidechains, oracles, various bridges, etc. Vulnerabilities in these protocols could lead to losses for secondary stakers.

Diminished native token value: Relying on staking validators provided by EigenLayer may potentially reduce the value of the protocol's native token. This is because a portion of the token's value comes from its governance role in the staking network. Introducing ETH staking may weaken this aspect of the token's role, affecting the protocol's ability to capture value.

High dependency: If a protocol adopts EigenLayer's staking platform, the protocol's independence and security will be influenced by EigenLayer, creating a high dependency on EigenLayer.

Centralization risk: If EigenLayer becomes a major restaking platform, similar concerns to those raised about Lido may arise. For example, staked ETH on Lido already accounts for 32% of the ETH in the Ethereum beacon chain, raising concerns about over-centralization. After all, it is not safe to put all your eggs in one basket.

However, the project team has stated that EigenLayer will not have centralization risks, as it only acts as an intermediary, and the staked assets are essentially at the application layer, not on its protocol. While this may not completely alleviate concerns, it at least shows that the project team is considering how to avoid over-centralization issues.

5.2. Why Re-Staking

5.2.1. For ETH Holders:

EigenLayer can bring additional income to users through restaking, allowing them to earn not only staking rewards on the Ethereum mainnet but also additional income through secondary staking protocols.

ETH holders can engage in three modes of restaking within EigenLayer. The first is directly restaking ETH staked on the PoS chain through EigenLayer; the second is restaking LP tokens containing ETH through EigenLayer; and the third is restaking LP tokens containing stETH through EigenLayer.

5.2.2. For Application Protocols:

Security: EigenLayer provides greater governance security for protocols. In PoS-based blockchains, staking is a core mechanism, and the more assets are staked, the lower the likelihood of governance attacks, as the cost of attacking increases. These protocols can include middleware, sidechains, oracles, and layer 2 networks. For example, in EigenLayer, a block can only be verified if over 50% of the restaked ETH and the protocol's native token are used for validation.

Additionally, the dual-staking model (ETH + protocol native token) can effectively reduce the risk of a death spiral. When the price of the protocol's native token falls, the restaked ETH can effectively provide value support, thereby protecting the protocol's security.

Economics: EigenLayer provides blockchain node validation services for protocols through restaking. By directly using EigenLayer's staking validation platform, protocols no longer need to establish their own validation platform and pool, allowing them to focus more on developing core protocol functions and improving user experience. This is similar to early internet companies needing to build their own server rooms, but with professional cloud services, they can focus primarily on function development, saving costs and improving efficiency.

The modular blockchain concept separates the consensus layer, data availability layer, and transaction execution layer. Specifically for Ethereum, it provides security at the consensus layer, allowing innovative applications at the execution layer.

However, if you want to create a new consensus protocol on Ethereum, such as a data availability protocol, or other middleware, oracles, layer 2 networks, you still need to establish your own node validation service.

6. SWOT Analysis

6.1. Project Strengths

Trinity of income: Through EigenLayer's restaking solution, liquidity tokens can capture income not only within the Ethereum system but also through other cross-chain bridges, oracles, and more. If lsdETH LP staking is introduced in the future, it can achieve a trinity of income: staking Ethereum rewards, rewards from collaborating project nodes, and rewards from staking liquidity tokens in DeFi LP pools.

For users, this presents an additional value-adding opportunity, combining with liquidity staking derivatives to significantly improve the network's capital efficiency.

Increased market efficiency: Unlocking the liquidity of LSD and LP tokens provides more asset choices and combinations for the DeFi industry. By leasing Ethereum security on the open market through EigenLayer, new protocols can save costs on internal guidance and maintenance.

Enhanced network security: Increasing the security of networks using liquidity staking allows more assets to be staked, thereby increasing the network's value and resistance to attacks. This promotes Ethereum's economic security and provides security for application protocols, creating a positive feedback loop.

Lowering the barrier for projects: New blockchain projects need to establish their own trust layer to ensure the security of data and funds. This requires a lot of time, money, and increases the difficulty of launching. If Ethereum's beacon chain staking can be used as a trust layer, it can reduce costs and barriers, improving core functionality and user experience.

6.2. Project Weaknesses

Asset loss risk: If nodes or networks are attacked, forked, or subject to improper behavior, restakers' assets may be penalized, leading to partial or permanent loss.

Asset bubble risk: An excessive number of tokens or stablecoins in the market may lead to inflated asset values or deviation from their true value, increasing market instability and investor confusion.

Value capture risk: If the security and incentives provided by EigenLayer are insufficient to attract protocols and validators, it may lead to loss of protocol sovereignty, reduced value for collaborating projects, or slow ecosystem development.

Unstaking period risk: If restaked ETH requires a waiting period to unlock upon unstaking, users may face liquidity and price fluctuation risks.

Trust leverage risk from restaking: In an open trust trading market, trust layer nodes can provide validation services for different protocols through restaking to earn additional income. When trust layer funds are used to provide validation services for applications/middleware layers with significant value accumulation to earn more income, it may lead to extreme leverage in trust, where the disruption reward exceeds the disruption cost, reducing the economic security of the trust layer.

6.3. Project Opportunities

Leadership and innovation: Restaking is a unique concept with no direct competitors in the race, and has not been completely replicated or imitated by other protocols. Additionally, the market is still in its early stages with few participants.

Market share: Currently, the largest market in the DeFi industry is Staking, with a total value of approximately $20 billion TVL. Especially as many blockchain platforms are still under development, the cryptocurrency market continues to expand. Therefore, the ReStaking market will have numerous growth opportunities.

6.4. Project Threats

Tokenomics issues: If users can earn rewards by restaking ETH without needing to use the native tokens of other protocols, EigenLayer's native token may lack value and demand.

Reward distribution issues: If protocols cannot balance incentives for existing participants and restaking participants when adopting EigenLayer, it may lead to unfair token distribution and low user participation.

Security event risk: If a large portion of staked ETH in the Ethereum network is restaked, any security vulnerabilities in a protocol could lead to a large amount of ETH being penalized, affecting the security of the Ethereum network.

Technical risk: EigenLayer involves various types and levels of blockchain technology, which may have technical flaws or vulnerabilities leading to system crashes or attacks. These technical risks could result in asset or trust losses for restakers and modules, impacting the project's reputation and development. EigenLayer needs to mitigate technical risks through rigorous code audits, testnet deployments, and security rewards.

References

https://www.panewslab.com/zh/articledetails/494x55dz.html

https://www.datawallet.com/crypto/eigenlayer-explained

https://www.panewslab.com/zh/articledetails/5402965u1dvj.html

https://www.163.com/dy/article/I9UML1RM05560MYZ.html

https://www.defidaonews.com/article/6783918

https://foresightnews.pro/article/detail/22729

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。