Title: Analysis of Discord's Potential as a Traffic Entry and Reasons for Its Lack of Success, as well as the Possibility of PWA as a Traffic Entry

Author: Turbo Guo

Reviewers: Mandy, Joshua

TLDR

Telegram, which has the potential to become a traffic entry point for Crypto, has garnered a lot of attention. This article will summarize the Crypto-related applications in Telegram, analyze their strengths and areas for improvement. Additionally, the article will analyze why Discord has the opportunity to become a traffic entry point and the reasons for its lack of success, as well as the possibility of browsers (PWA) as a traffic entry point. The main contents include:

Telegram has a rich variety of Crypto-related applications with a good user experience, making it a good platform for Crypto applications. However, the downside is that the application center and various bots are mixed with chat channels, which may lead to user inconvenience.

Telegram is not limited to the TON ecosystem; it allows for convenient integration of various chains and protocols. Examples include trading bots in the EVM ecosystem and multi-chain wallet tracking applications.

Discord has the opportunity to take on the current role of Telegram, and its bot system has a wide range of capabilities. However, due to reasons such as potential user backlash from primarily gaming users, excessive Crypto fraud affecting user security, and unclear regulation, Discord has not fully embraced Crypto.

Browser applications are well compatible with the existing Crypto ecosystem, but on mobile traffic entry, it may no longer be Metamask but specific applications. Friend Tech is a good example.

The determination of the traffic entry point largely depends on two factors: user experience and regulation. In terms of user experience, applications like Telegram and Friend Tech, which have built-in Crypto features (built-in wallets), are very attractive. In terms of regulation, traditional social media giants face significant pressure, which provides many opportunities for less regulated applications or native applications.

Telegram as a Traffic Entry

Telegram has hosted many Crypto applications. First, we will discuss the form of application existence and entry methods.

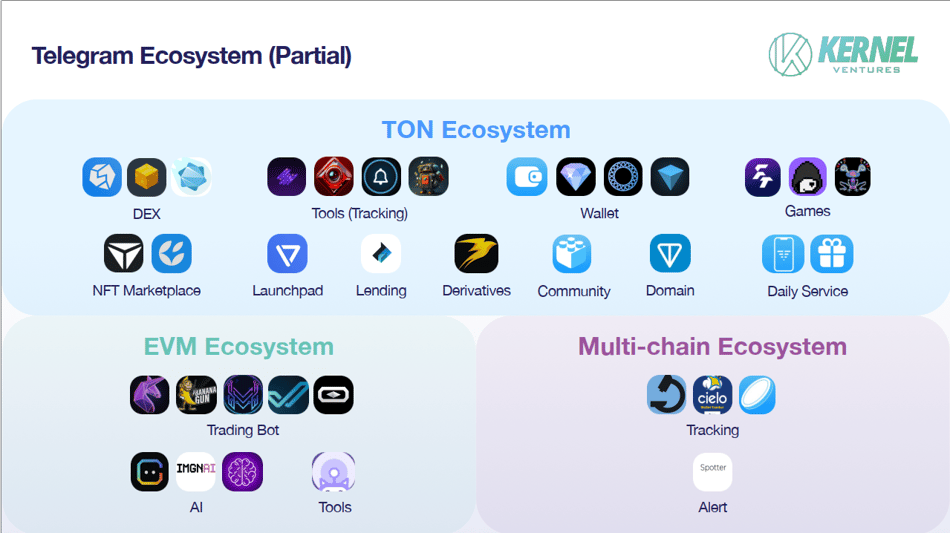

Image Source: Kernel Ventures

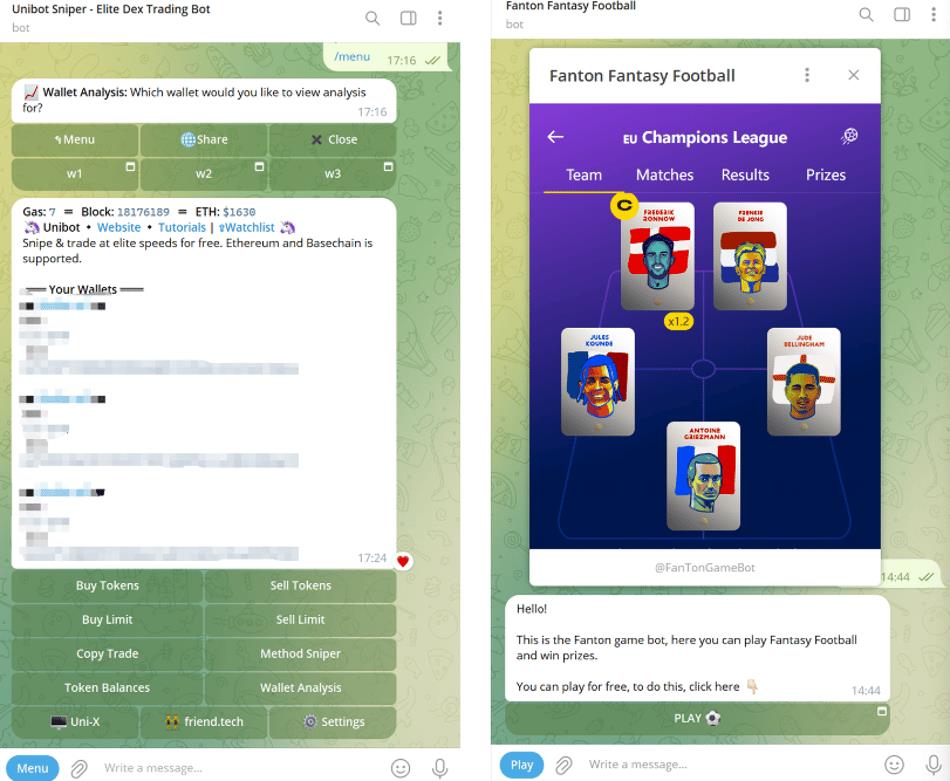

In Telegram, there are two types of "apps": one is Telegram bots that interact through chat boxes, and the other is the Telegram Web App (TWA) that calls a small web window. In the image below, Unibot on the left is a typical bot, while the football game on the right, and many chain games in Telegram, are TWAs. In terms of implementation, TWAs use JavaScript, HTML, and CSS to implement various functions in Telegram through a small web browser.

There are three ways to access applications in Telegram: through links, searching for the application's name, and entering from the Telegram apps center. The ways of using links and searching for names are no different from joining a channel as usual, and entering the apps center is also the same, by using a link or searching for @tapps_bot.

Image Source: Unibot and Fanton Fantasy Football Interface

Telegram not only has TON chain ecosystem projects but also applications based on other public chains, which will be introduced separately.

TON Ecosystem Applications

First, there are wallets. Telegram has had many wallets in the past, such as Tonkeeper, MyTonWallet, and Tonhub. However, with the official hosted wallet Wallet and the built-in non-custodial wallet Ton Space now available, the previous wallets will face significant challenges.

Wallet is a hosted wallet that supports payments using USDT, TON, and BTC. Wallet has the testing TON Space non-custodial wallet. In the future, users will be able to access DeFi applications in TON Space, such as DEX, staking, and lending protocols, and can also directly access third-party dapps on the TON blockchain. In addition, TON Space allows wallet recovery via email, which is very user-friendly and comfortable in practical experience, although it may pose security risks.

In terms of DeFi, the TON ecosystem is still in a very early stage. There are DEXs like Megaton Finance, STON.fi, DeDust.io, and cross-chain attempts like STON, lending protocols like Evaa, and derivatives like Storm Trade. Additionally, the TON ecosystem has launchpad-Tonstarter and TON DNS for domains.

The NFT ecosystem in TON also has some form. The NFT market includes projects like Fragment and Getgems, where users can buy Telegram Usernames and Anonymous Numbers on Fragment, and not only buy and sell usernames and anonymous phone numbers on Getgems, but also buy and sell other NFT projects on the TON chain. However, currently, Fragment's trading volume is greater than Getgems. Overall, as of September 25th, the NFT market in TON has shown good growth, with project content similar to the Ethereum ecosystem, including projects like TON Diamonds and TON Punks.

Image Source: nftscan, 2023/09/25

There is also a large category of games integrated with TON, such as Fanton Fantasy Football, a P2E idle football card game seamlessly connected to the TON ecosystem; punkcity, a turn-based combat game where players earn tokens when they win; Tongochi Game, a P2E MMORPG game that is currently in the demo stage.

Additionally, there are many auxiliary tools, such as TON Wallet Tracker and TON Notify Bot for tracking the flow of tokens and NFTs for a specific address in the TON ecosystem; NFT TONificator for tracking orders and sales of a specific NFT series; community for onboarding bounty tools; Ton Gifts Bot for sending gifts to friends. There is also a comprehensive auxiliary bot, Friends All-in-One BOT, many of its functions are not yet online, and the team hopes to deliver translations, new NFT mint reminders, and NFT floor price reminders, which will also be provided by three independent bots.

An interesting project is mobile, a lifestyle service tool for purchasing esim cards, making it more convenient to use the internet while traveling internationally. More importantly, it can be paid for not only with a credit card but also with a TON wallet.

Ethereum Ecosystem Applications

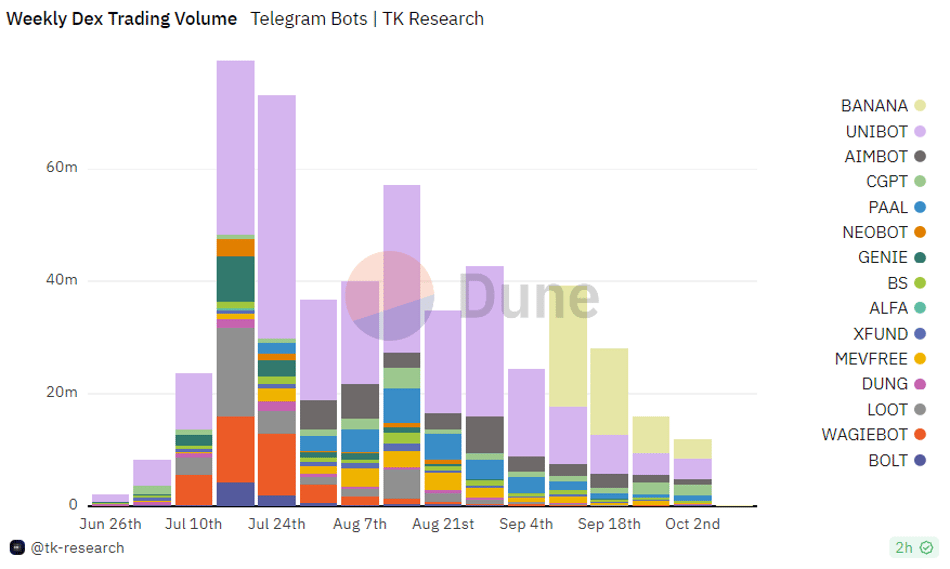

Image Source: DUNE @tk-research

For this type, we will introduce the previously very popular trading bot. If we abstract away the details behind it, we see that the trading bot is essentially an agent commission business. From the weekly trading volume perspective, after experiencing a surge in popularity, TG bot is now in a stage of declining heat.

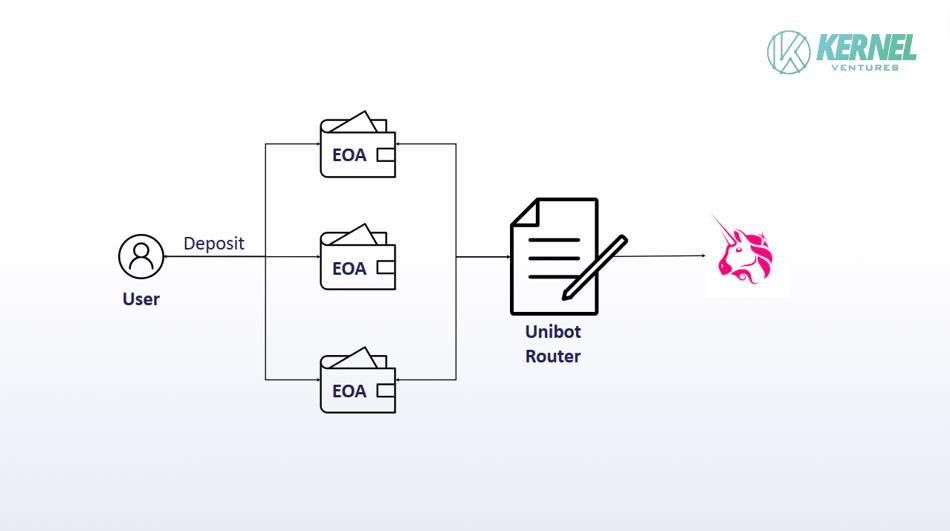

Unibot is essentially a scientific agent that requires users to deposit coins into the official wallet and then trigger limit orders, automatic copying, and automatic coin purchase commands through the Telegram chat window. In principle, Unibot first helps users open an EOA, and then users deposit money into it. When a user initiates a trade (such as selling coins on Uniswap), theoretically, the user's EOA can directly interact with Uniswap, but currently, it goes through the Unibot router contract first, and the Unibot contract calls the Uniswap contract to sell. By going through Unibot's official contract, many things can be done, such as collecting fees. Each time Unibot switches to its own contract, it may be updating features, and currently, the contract is not open source.

Unibot Transaction Flow Image Source: Kernel Ventures

Similar trading bots to Unibot include Banana Gun, Maestro, and DexCheck. Banana Gun requires users to input private keys or generate new addresses through the official bot. Its advantageous features include canceling transactions when sandwiched risk is detected and optimizing block bribes. Maestro, also a trading bot, provides whale tracking, token trading, and more. DexCheck also does wallet tracking, sniper attacks on new token contracts, and token trading.

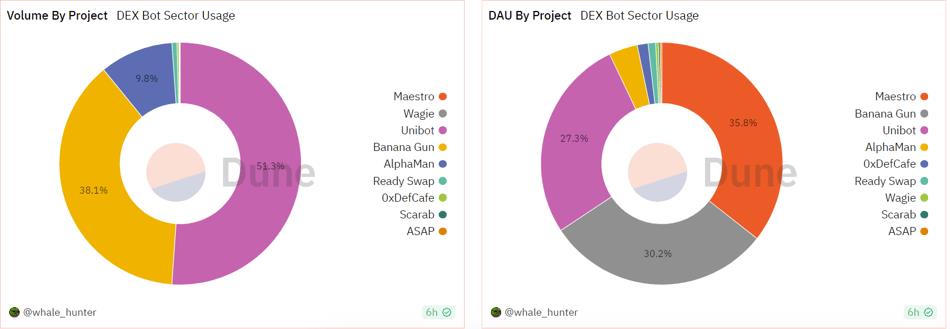

In terms of trading volume, Unibot is the highest, followed by Banana Gun. In terms of DAU, Maestro has the highest, but only slightly higher than Banana Gun and Unibot.

Image Source: DUNE @whale_hunter, 2023/09/25 1:10

Additionally, there are service projects based on the Ethereum ecosystem for token issuance. For example, LootBot can automatically participate in airdrops for users, and holding $LOOT tokens allows participation in profit distribution. There is also IMGNAI, which has a bot that allows users to generate images by sending messages in channels, and the project promises that holding tokens will have future rights, and the tokens are on the Ethereum network. ChainGPT has many business operations, and its developed tele bot can be used as a general LLM to generate smart contract code and perform contract verification. $CGPT is mainly used to purchase services within ChainGPT, and the official also provides token services for staking and earning rewards, and the tokens are also on the Ethereum network. This also involves issuing tokens on Ethereum, and the tokens will be used to purchase services, with a relatively wider range of uses.

Multi-Chain Ecosystem Applications

On Telegram, we can also see applications that support multiple chains, mainly data services or auxiliary tools, with the following four being representative:

Cielo is a relatively comprehensive wallet tracking bot that performs well in terms of multi-chain support. It can track various operations of a single wallet on dozens of chains, including swaps, lending, NFT minting, and can also track large transactions of individual tokens. It is worth mentioning that Cielo has good user experience.

Pessimistic Spotter can detect whether a contract has been attacked, supporting contracts on Ethereum and BSC, such as Uniswap, and others.

CoinCrackerBot can track coin prices, send price alert notifications, and more. This product has a good user experience because receiving information push notifications on chat software is obviously more convenient.

Crypton research is used to track project progress. Users can subscribe to projects like 1inch, Aave, and then choose to receive all news or focus news, and the bot will push messages to the user once selected.

Advantages and Areas for Improvement of Telegram as an Entry Point

The smooth user experience of Telegram is a huge advantage. Every time a transfer is made, an application is opened, or interaction with a bot occurs, it is very smooth, better than the experience of most web3 products, and even surpasses web2 products like Discord.

The downside is that the way to launch the Telegram apps center is somewhat complex. It cannot be directly found in the original Telegram interface and needs to be accessed through an external link or actively searched for, similar to joining a new Telegram channel. Additionally, the apps center and all apps are mixed with the original channels, making it easy to not find them. If users want to pin them themselves, they will also be mixed with important chats. Furthermore, many applications in Telegram create a new bot for each function, which can be relatively chaotic for users to manage. It may be necessary to establish a separate interface for apps and make it easy for users to find commonly used apps.

Currently, TG effectively meets the needs of ordinary users for transfers, and TG bots based on EVM meet the needs of retail investors for grabbing new coin sales, and so on. In the future, how TON will build large-scale DeFi applications is worth further exploration.

The trading bot provides us with a new idea, that is, Telegram can serve as the frontend for various applications on various chains. Not only can DeFi protocols have a common frontend, but people can also integrate various protocols on Telegram. If a project helps users manage, users may not even need to know about the existence of various chains, which is very promising to achieve on Telegram. This will greatly reduce the threshold for using Crypto. Of course, there are issues with directly using Ethereum on Telegram, such as how to easily trigger signatures in Telegram.

Currently, the official is vigorously promoting the development of the TON ecosystem, and Unibot and other bots based on non-TON ecosystems have also made many advances, and the future will need to be tested by time.

Opportunity for Discord as a Traffic Entry

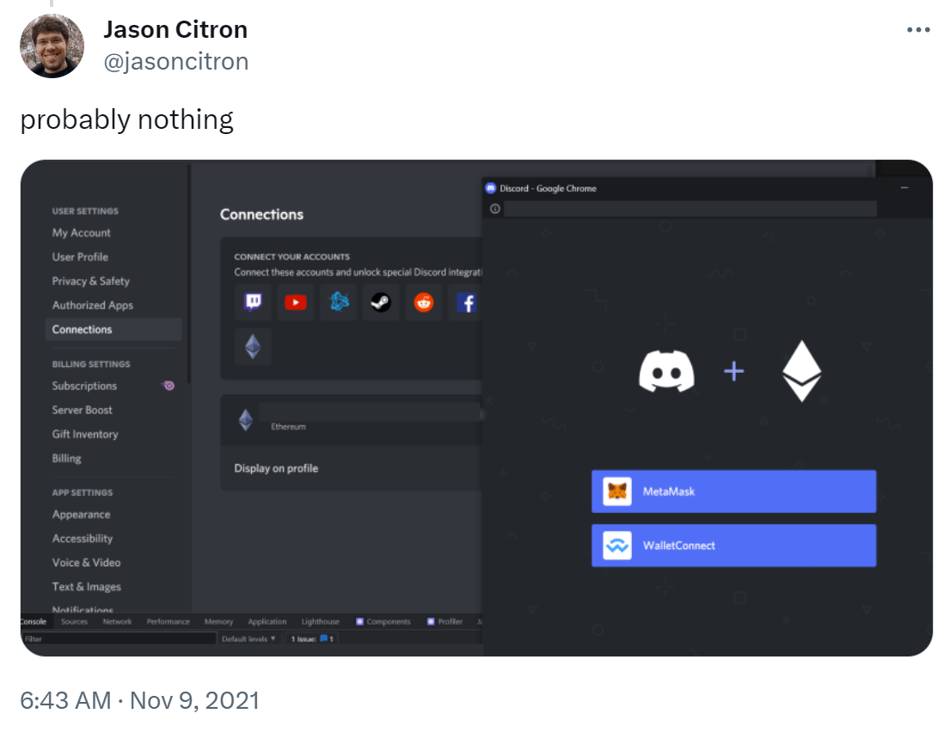

Image Source: A tweet from the Discord CEO

Discord (hereinafter referred to as DC) attempted to integrate Metamask as early as 2021. If promoted, we can imagine people making transfers and payments in DC. Even various dapps can develop their own channels or bots to allow users to swap, borrow, and more in DC, turning DC into the frontend for the entire Crypto.

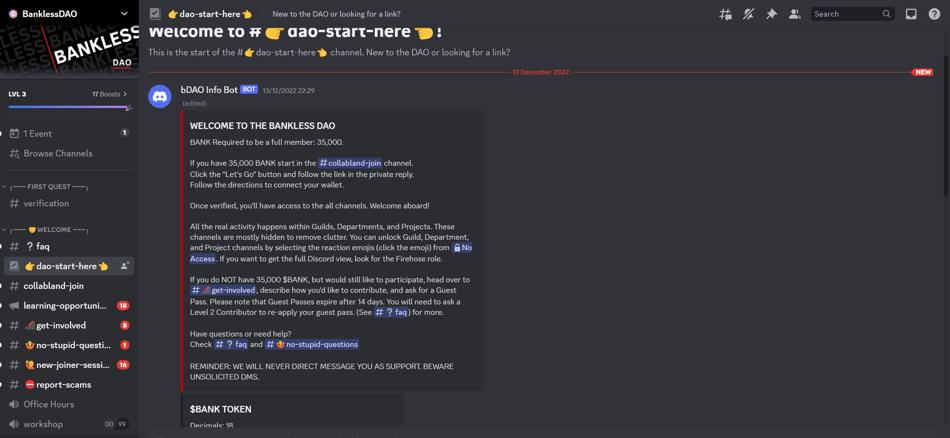

In fact, Discord already has many use cases for Crypto. Bankless DAO uses Discord as a governance tool and has developed governance bots and processes, such as verifying NFTs to obtain identity and granting specific channel permissions based on token holdings. Especially during the NFT summer period, DC became the most important community tool for NFT projects, where people obtained roles, whitelist access, and participated in AMMs, resulting in a large community presence. The DC official also once solicited feedback from users on NFT-related matters, indicating that the team is seriously considering adjusting the product for the NFT community. In theory, DC bots can also achieve many functions, and currently, there are bots available for wallet tracking, tracking NFT transactions, managing whitelists, and more.

Image Source: Bankless DAO Discord

But why didn't Discord continue to advance in this direction? Three reasons can be speculated:

Antagonism from the main user base of gamers;

Excessive fraud affecting user security;

Unclear regulation.

Discord's original vision was "Chat for Gamers," and it was originally built to serve gamers. According to a CNBC report in 2021, 70% of users use DC for gaming or other purposes. Although the company's vision later changed to "Chat for Communities and Friends," expanding the user base, it can be speculated that serving gamers has always been the core of Discord. When DC attempted to support the NFT community, many users protested, canceling Nitro subscriptions and expressing great aversion to NFTs. In fact, the gaming community has always had negative sentiments towards the Crypto community. During the era of proof of work (POW), mining caused graphics card prices to soar, leading to increased costs for players to build their gaming rigs. After the mining craze cooled down, players were able to easily purchase second-hand mining cards (which were used for mining for a long time, and some players believed they were overused and not good second-hand graphics cards). It can be speculated that some gamers extended their dissatisfaction with Crypto from the mining era to the present.

Additionally, the founder tweeted that Crypto has a lot of spam and fraud, and DC is committed to protecting users, so there is no intention to fully integrate Crypto. As a compliant platform, it is reasonable for DC to try to reduce fraud. At the time, government regulation was also unclear, and if haphazardly integrating Crypto caused a large number of users to suffer losses, this would not be a cost that DC could bear.

This also reflects the core differences between DC and TG: the different user profiles and platform positioning. DC's main users are compliant users, and many are gamers, but TG has many users in gray areas, so TG vigorously promoting Crypto will not cause antagonism among its main user group. DC is more of a community tool, while TG has a gray attribute, and the impact of spam and regulation on TG is smaller than on DC, which is advantageous for TG to freely engage in Crypto.

Browser (PWA) as an "Entry Point"

In some scenarios, browsers/web pages replacing local applications is a direction worth paying attention to. Friend.tech uses PWA; Photoshop offers a web version that uses cloud storage, allowing users to switch work across multiple devices; and many people are exploring cloud gaming. On the one hand, with the development of cloud computing power, web applications implemented through the cloud can support more functions, and on the other hand, PWAs indeed have many benefits.

For example, PWAs can operate offline, support dynamic content updates, push notifications, achieve compatibility across different platforms, and can also access phone hardware like a local application, such as using the camera or GPS. In terms of convenience, there is debate over whether web pages or local applications are more convenient. Some people believe that web pages can be opened through links, making them more convenient than installing applications, but others feel that after installing an application, opening it directly from the desktop is more convenient than entering a web address in a browser. Of course, with PWA, it's the same for both. On the web PC side, the current wallet plugin system is relatively complete, and it is even imaginable to use wallet plugins while playing games on the web, or to access other web-based DeFi applications. Additionally, PWAs can bypass platform fees, such as those imposed by Apple, which is significant for Crypto applications.

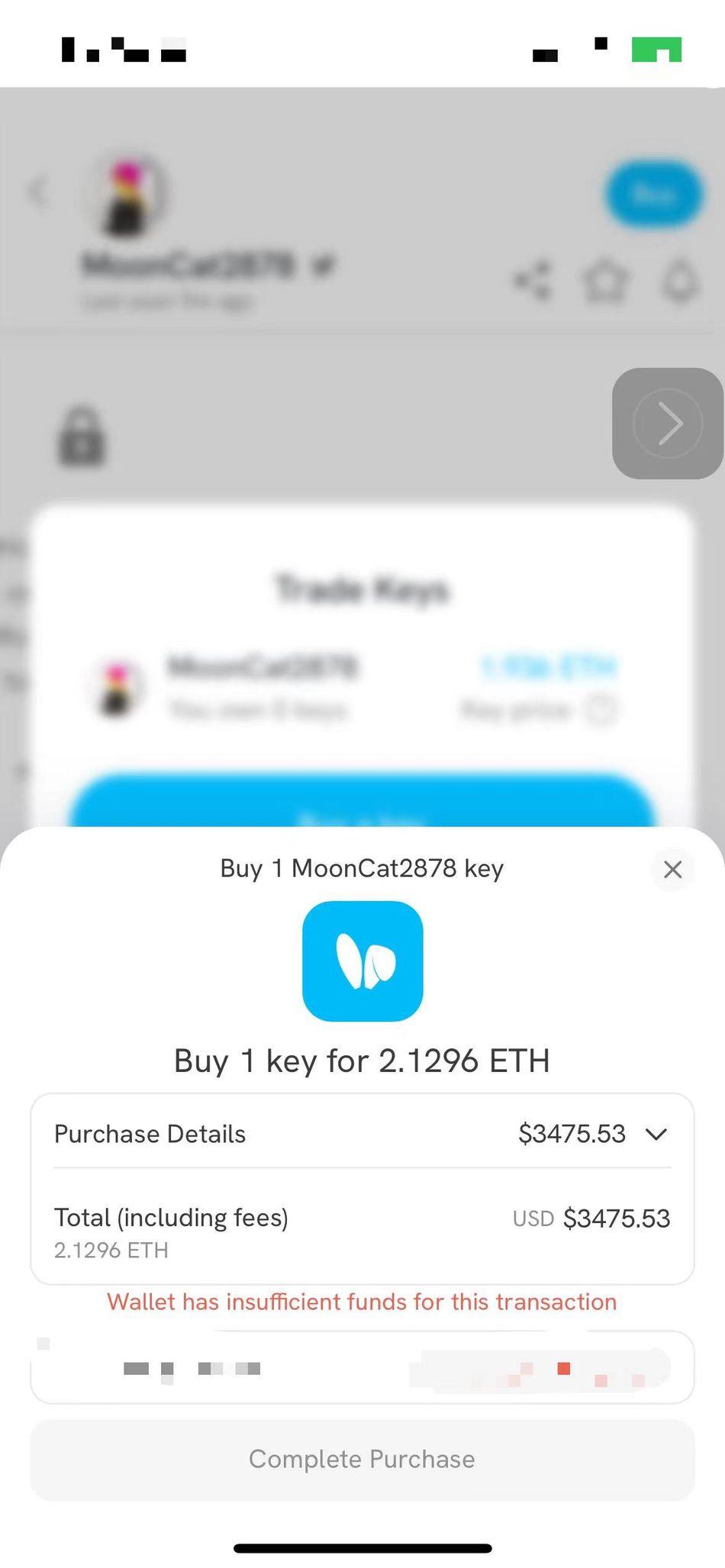

But will wallets continue to serve as the "entry point" in browsers? On mobile, friend.tech tells us that they will not, because users can accept built-in wallets. For users, putting money into an app (essentially L2, or even handing it over to the project) and then operating assets within the app is acceptable, as users don't care about which wallet they use, and using Metamask separately on mobile is not a good experience. Therefore, specific social applications can replace MetaMask to attract traffic and achieve the core of the closed-loop economic model, which is not in the wallet but in other services, and the service provider can embed a wallet like friend.tech.

Image Source: friend.tech's Buy Key interface

Conclusion

Comparing Telegram, Discord, and web pages (PWA) reveals that to some extent, who will become the traffic entry point depends on user experience and regulation. In terms of user experience, TG's smoothness surpasses that of many native Crypto applications, which is its huge advantage. Additionally, the presence of built-in wallets in mobile applications like FT will reduce the competitiveness of Metamask as an "entry point." In terms of regulation, traditional social media giants integrating Crypto will face significant pressure, which provides many opportunities for applications like TG or FT, which are less regulated.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。