Hotairballoon Weekly Report on the Cryptocurrency Market (10.2–10.8)

Hotairballoon has selected important information and investment situations in the cryptocurrency market from last week, as well as on-chain data from popular tracks such as LSD and RWA. Additionally, it has also compiled a list of projects with significant recent unlock amounts for reference.

I. Important Information in the Cryptocurrency Industry Last Week

A quick overview of important industry information for the week.

(I) Policies/Regulations

- Head of BIS Innovation Center: Central Banks Need to Be Prepared Regardless of Their Preference for Cryptocurrencies

On October 2, Cecilia Skingsley, the head of the BIS Innovation Center, stated at the New York Fed FinTech Conference on AI and digital assets that the BIS knows it needs to stay ahead and practice what it preaches, regardless of whether central banks like cryptocurrencies or not.

The center's mission is to research and investigate how new technologies, including cryptocurrencies, are changing the operations of central banks. Skingsley stated that the BIS knows it cannot ignore the field of digital assets. "The experience of Libra in 2019 and everything that followed made everyone aware that too much is happening in the tech field that we cannot ignore. Regardless, central banks need to be prepared."

- IMF Proposes a National Cryptocurrency Risk Assessment Matrix

On October 2, the International Monetary Fund released a working paper titled "Assessing the Macroeconomic Financial Risks of Cryptocurrencies." In the paper, authors Burcu Hacibedel and Hector Perez-Saiz proposed a cryptocurrency risk assessment matrix (C-RAM) for countries to identify indicators and triggering factors of potential risks in the industry. The matrix also aims to summarize potential responses of regulatory agencies to the risks they may identify.

- US SEC and Five Other Regulatory Agencies Issue Warnings on Cryptocurrency Investments

On October 3, the US Securities and Exchange Commission (SEC) and other regulatory agencies, including FINRA, CFTC, NFA, SIPC, and NASAA, jointly issued multiple warnings regarding cryptocurrency investments, stating that cryptocurrency investments may have abnormal volatility and speculation. They also cautioned that platforms for buying, selling, borrowing, or lending these assets may lack protection.

Regulatory agencies warned that those offering cryptocurrency investments or services may not be complying with applicable laws, including federal securities laws. Additionally, the announcement detailed the many risks faced by cryptocurrency investors, including unregistered issuance, lack of protection from the Securities Investor Protection Corporation (SIPC), and fraud.

- LayerZero Partners with Conflux to Enable Chinese Telecom's BSIM Cards to Use Other Blockchains

On October 3, according to official sources, the LayerZero Labs development team announced a strategic partnership with Conflux Network, enabling users of China Telecom's blockchain-based SIM cards (BSIM) to access full-chain functionality on LayerZero-supported blockchain networks. Through this partnership, users will be able to transfer digital assets and data stored on BSIM cards from the Conflux mainnet to other blockchain networks using LayerZero's full-chain data communication platform. The new BSIM functionality will initially be used to transfer cryptocurrencies from the Conflux mainnet (eSpace and Core space) to Ethereum, with more chains and functionalities to be added in the coming months.

- Payment Giant Visa Launches a $100 Million Generative AI Special Investment Fund

On October 3, Visa announced the launch of a $100 million generative AI new fund, which will be invested in companies focusing on developing generative AI technologies and applications related to commerce and payments. This investment will be managed by Visa's global corporate investment department, Visa Ventures.

- Macau Judiciary Police: Virtual Currencies Are Not Legal Tender in Macau, Caution Against Scams

On October 3, the Macau Judiciary Police reminded the public that virtual currencies are not legal tender in Macau, but rather virtual commodities, and transactions involving them are speculative and highly risky. They advised the public to fully understand and be aware of such commodities before blindly following and to be cautious against being deceived or potentially being used for illegal activities such as money laundering. The Macau Judiciary Police stated that investment scams involving virtual currencies have been frequent in recent months, often involving luring victims through social media influencers and persuading them to participate in virtual currency investment plans claiming high returns.

- Judge Rejects SEC's Motion to Appeal Ripple Case Ruling

On October 4, DB NEWSWIRE tweeted that District Judge Analisa Torres rejected the SEC's motion to appeal the ruling in the Ripple case. In a brief ruling, Torres stated that the SEC failed to fulfill its legal obligations, neither proving the existence of legal control issues nor providing sufficient reasons for the existence of disagreements. Following the announcement, XRP rose by approximately 5%.

- Ripple Obtains Major Payment Institution License in Singapore

On October 4, according to CoinDesk, Ripple's Singapore subsidiary has obtained a major payment institution (MPI) license from the Monetary Authority of Singapore (MAS), enabling it to provide digital payment token services in Singapore. Earlier reports indicated that Ripple received preliminary approval from the Monetary Authority of Singapore in June this year. Additionally, Coinbase Singapore has also obtained an MPI license in Singapore.

- BIS Collaborates with Several European Central Banks to Develop Data Platform to Track Cryptocurrency and DeFi Fund Flows

On October 4, according to Cointelegraph, the Bank for International Settlements (BIS) has collaborated with the Deutsche Bundesbank, the Dutch central bank, the European Central Bank, and the Bank of France to develop a proof-of-concept (PoC) platform called ProjectAtlas. This platform is designed to track on-chain and off-chain transactions of cryptocurrency exchanges and public blockchains, aiming to measure the macroeconomic relevance of the cryptocurrency market and DeFi protocols to provide insights, information, and economic impacts on the industry, while pointing out the lack of transparency and potential risks, as well as significant failure cases unique to the crypto field.

- El Salvador Launches First Bitcoin Mining Pool, to Utilize Geothermal Energy for Mining

On October 6, according to The Block, renewable energy and mining company Volcano Energy and Bitcoin mining software provider Luxor Technology jointly launched "Lava Pool" in El Salvador. This is the first Bitcoin mining pool in El Salvador, aiming to use the country's abundant geothermal energy to mine Bitcoin. According to a statement, Volcano Energy will exclusively mine through the pool and donate 23% of its net income to the Salvadoran government as part of a public-private partnership program.

- Basel Banking Supervisory Committee to Propose Disclosure Requirements for Bank Cryptocurrency Exposure

On October 7, according to CoinDesk, the Basel Banking Supervisory Committee released a report on banking sector turmoil in 2023, agreeing to consult on climate and cryptocurrency exposure disclosures. It stated that banks must disclose their holdings of cryptocurrencies. The committee also indicated that an upcoming consultation paper will propose "a series of disclosure requirements related to bank cryptocurrency exposure risks" to supplement existing capital requirements for digital assets established in December last year. It has already stated that banks should hold potential prohibitive capital for unsecured cryptocurrencies such as Bitcoin or Ethereum.

- Singapore to Establish Inter-Agency Committee to Review Anti-Money Laundering System

According to official sources, Singapore will establish an inter-agency committee to review the anti-money laundering system in light of the recent largest money laundering case in Singapore. The Monetary Authority of Singapore and other institutions will appoint relevant individuals to participate in the committee, with the Second Minister for Finance and National Development serving as the committee's chairman. Singapore will subsequently review the anti-money laundering system from the perspectives of foreign individuals purchasing and holding local real estate, as well as the registration and operation of corporate entities.

- Hong Kong Financial Secretary: Retail Buying and Selling of Stablecoins Not Allowed Until Official Regulation

On October 6, according to Ming Pao News, Hong Kong Financial Secretary Paul Chan Mo-po stated on an investment committee visit program that until stablecoins are officially regulated in Hong Kong, retail buying and selling will not be allowed. He mentioned that related currencies in the market are supported by the US dollar or gold to stabilize their value, but there have been instances of stablecoins experiencing price fluctuations or even collapsing in the past. The reserve management of stablecoin issuers will affect price stability and investors' rights to redeem fiat currency. Considering these factors, retail buying and selling will not be allowed in Hong Kong until stablecoins are officially regulated.

- US Non-Farm Payrolls Increase by 336,000 in September, Unemployment Rate at 3.8%

On October 6, according to Jin10 data, the US non-farm payrolls increased by 336,000 in September, exceeding the expected 170,000 and the previous value of 187,000. The US unemployment rate in September was 3.8%, slightly higher than the expected 3.7% and the previous value of 3.8%.

- Deputy Director of Hong Kong Security Bureau: Hong Kong Customs Has No Authority to Regulate Virtual Currencies

On October 4, according to Sing Tao Daily, the Hong Kong Legislative Council Security Affairs Committee discussed the latest developments in customs participation in international activities, including the JPEX case and the regulation of virtual currencies. Deputy Director of the Hong Kong Security Bureau, Sonny Au, stated that under the Anti-Money Laundering and Counter-Terrorist Financing Ordinance, anyone operating a currency exchange must apply for a license from customs, which is responsible for regulating licensed currency service operators. As virtual currencies are not legal tender, customs has no authority to regulate them. The government and relevant regulatory agencies are continuously reviewing the development of the situation and improving regulatory mechanisms for the future regulation of virtual currencies and assets.

- Hong Kong Financial Secretary: NFTs Must Obtain SFC Approval for Sale if They Constitute "Collective Investment" or "Securities"

On October 7, according to Oriental Daily News, Hong Kong Financial Secretary Paul Chan Mo-po revealed during an appearance on the Hong Kong Investment Committee program that the Hong Kong Monetary Authority is preparing for a public consultation on stablecoin regulation. Additionally, non-fungible tokens (NFTs) that exist only in digital form and are considered collectibles are not regulated by the Securities and Futures Commission (SFC). However, if they constitute "collective investment" or have the nature of "securities," they must obtain SFC approval before being sold in the market.

(II) Project Information

- dYdX Community Votes to Approve $20 Million v4 Incentive Plan

On October 2, the dYdX community voted to approve the "dYdX v4 Launch Incentive Proposal" temperature check vote. The proposal suggests allocating $20 million in DYDX from the dYdX Chain community treasury for a six-month launch incentive program on v4 to incentivize early adopters.

- Coinbase Obtains Major Payment License in Singapore

On October 2, according to official sources, Coinbase Singapore has obtained a major payment institution (MPI) license from the Monetary Authority of Singapore. Coinbase will develop and release products tailored for Singapore and conduct training and recruitment programs at its technical center in Singapore. Earlier reports indicated that Coinbase is committed to expanding its services for Singaporean customers. In March of this year, Coinbase opened local bank transfer services for Singaporean users free of charge.

- OpenSea Launches All-in-One Store OpenSea Studio, Supporting NFT Project Publishing and Management

On October 4, according to official sources, OpenSea announced the launch of OpenSea Studio, an all-in-one store for creators to publish and manage projects. It supports minting NFTs in their own wallets, building on most OpenSea-compatible blockchains, and allows collectors to mint NFTs using credit/debit cards. OpenSea also announced plans to add new features in the coming months.

- Oasis Network to Launch Synthetic Version of Its Native ROSE Token, syROSE, in Q4

On October 4, according to CoinDesk, the privacy computing network Oasis Network will launch syROSE, a synthetic version of its native ROSE token, in the fourth quarter of 2023. Oasis will work with SYNTHR to introduce ROSE to six blockchain networks, including Ethereum, Arbitrum, Avalanche, Polygon, and BNB Chain. By seamlessly enabling exchanges, staking, and lending on various Web3 blockchain platforms, syROSE will allow Oasis users to quickly and easily transfer their tokens to ecosystems outside of Oasis.

- MakerDAO Adds $169 Million in RWA Assets in the Past Week, Protocol's RWA Total Assets Approximately $3.278 Billion

On October 4, data from makerburn.com shows that MakerDAO has added $169 million in RWA assets since September 28. This includes an increase of over $127 million in RWA assets through BlockTower Andromeda, an increase of $38 million in RWA assets through Monetalis Clydesdale, and an increase of $3.61 million in RWA assets through BlockTower S3. Additionally, the current total RWA assets of the protocol are approximately $3.278 billion.

- Immutable Releases Immutable zkEVM Roadmap, Mainnet Launch Scheduled for December to January Next Year

On October 5, Immutable released the mainnet launch roadmap. In November, the plan is to rebuild the Immutable zkEVM testnet, upgrading its first EVM client from Polygon Edge to Geth to ensure that Immutable zKEVM is as close to Ethereum as possible and fully compatible with the entire Ethereum tool ecosystem. From December to January next year, the zkEVM mainnet will be launched, with developer invitations before opening to the public. In 2024, Immutable will provide a dedicated application chain with the same technical stack and features as Immutable zkEVM but with a unique level of customization. Finally, zk-prover will be introduced, providing a trustless Ethereum-to-Immutable zkEVM cross-chain bridge.

- Latest Ethereum Meeting: Devnet-9 Current Network Participation Rate Approaching 90%, a Positive Indicator of Testnet Health

On October 7, Christine Kim, Vice President of Research at Galaxy, summarized the 119th Ethereum Core Developers Consensus Meeting (ACDC). The meeting mainly discussed the current progress of Devnet-9 (the current network participation rate approaching 90%, a positive indicator of testnet health, testing of MEV-related tools, etc.), the launch time of Devnet-10 (if known issues are fixed, the earliest attempt to launch could be next week. This is likely the final developer testnet, and it will then enter the public testnet phase, mainly for testing EIP-7514, which sets the maximum epoch churn limit for validator activation queues to 8, slowing down the growth of ETH staking rate to buy time for a better validator reward scheme), and the timeline for Dencun testing (it was agreed at the last meeting to test Dencun on Goerli before Holesky, and many developers also supported the release of Dencun on the public testnet before the Istanbul Ethereum Developers Conference Devconnect in mid-November this year, but developers are currently unsure if this timeline can be achieved).

- Chainlink Officially Releases All-in-One Data Solution Chainlink Data Streams

On October 6, Chainlink officially announced the release of Chainlink Data Streams, an all-in-one data solution developed for the DeFi industry. This solution combines low-latency data transmission and automated trade execution to improve response speed and user experience.

- Optimism: 230 Million OP Tokens to be Transferred to Institutional Custodian for Security Purposes

On October 6, Optimism tweeted that approximately 230 million OP tokens are expected to be transferred on October 5. These tokens belong to core contributors and are being transferred to an institutional custodian for security purposes.

- StarkWare Delays First Token Unlock to April 2024

(III) Other

- CertiK: 184 Security Incidents Occurred in Q3, Resulting in Nearly $700 Million in Losses

On October 2, according to a report from blockchain security company CertiK, a total of 184 security incidents occurred in the third quarter of this year, resulting in nearly $700 million in losses of cryptocurrency assets. This exceeds the $320 million in the first quarter and $313 million in the second quarter, making it the "most financially damaging" quarter of the year.

Among the various types of attacks, private key leaks were the most destructive, with 14 security incidents resulting in losses of over $204 million. Additionally, exit scams and oracle manipulation were also prevalent in this quarter. There were a total of 93 exit scam incidents, resulting in losses of over $55 million in digital assets, and 38 oracle manipulation incidents, resulting in losses of over $16 million in cryptocurrencies.

- Data: Ethereum Futures ETF Had Initial Trading Volume of Less Than $2 Million in the First Few Hours

On October 3, Bloomberg ETF analyst Eric Balchunas tweeted that the initial trading volume of the Ethereum Futures ETF was quite subdued, at less than $2 million in the first few hours. This figure is significantly lower compared to the trading volume of up to $200 million in the first 15 minutes for the ProShares Bitcoin Futures ETF. Earlier reports indicated that ProShares, VanEck, and Bitwise launched Ethereum Futures ETFs on Monday. Investors can purchase ProShares ETFs through brokerage accounts without the need for cryptocurrency custodians, exchange accounts, or wallets.

- Grayscale September Market Report: Bitcoin Shows Strong Performance Amid Global Market Volatility

On October 5, according to the September market report released by Grayscale, Bitcoin showed strong performance in the global market volatility of September 2023, with a 4.1% increase. Meanwhile, most traditional assets suffered significant losses, especially in the context of rising US bond yields, demonstrating Bitcoin's characteristics as a "store of value" and a "safe haven" in times of crisis. The report further indicated that the next price catalyst for Bitcoin may come from the approval of a Bitcoin spot ETF. In particular, the SEC must seek a rehearing of the recent court ruling against Grayscale by October 13. If the SEC drops the appeal, it will reconsider Grayscale's application to convert GBTC to a spot ETF and other related Bitcoin spot ETF applications.

- Federal Reserve Data: Bitcoin Shows Better Inflation Resistance Than the US Dollar

On October 5, according to a report by Cointelegraph, the Federal Reserve Bank of St. Louis compared the inflation resistance of Bitcoin (BTC) and the US dollar (USD) in purchasing eggs, showing that Bitcoin performs better than the US dollar in resisting inflation. The author of the article used data from January 2021 to measure the price of a dozen eggs in both Bitcoin and US dollars. Despite significant price fluctuations in Bitcoin, the amount of sats required to purchase the same quantity of eggs with Bitcoin has decreased more than with the US dollar since the peak in December 2022. As of August 2023, the amount of Bitcoin required to purchase eggs has decreased by 70%, while the US dollar has decreased by 58%.

- Data: Total Investment in Crypto Companies in 2023 Reduced to Approximately $7.3 Billion, Recent Employment Rate Decline Exceeds 5%

On October 6, according to Bloomberg, data from PitchBook shows that as of September 19, the total transaction value for investments in cryptocurrency and blockchain projects in 2023 has been reduced to approximately $7.3 billion, about a quarter of the total transaction value for the entire year in 2021 and 2022. Meanwhile, employment in the crypto industry is decreasing. Based on data from 35 large companies, labor intelligence company Revelio Labs found that despite a growth rate of over 18% in the crypto industry workforce at the beginning of 2022, the employment rate has been declining throughout the year, with the most recent decline exceeding 5%.

- Over the Past Year, North Korean Hacker Group Lazarus Group Laundered Over $900 Million Through Cross-Chain Bridges

On October 7, according to Yonhap News Agency, the North Korean hacker group Lazarus Group laundered over $900 million (approximately 1.2 trillion Korean won) in cryptocurrency through cross-chain bridges from July last year to July this year, accounting for about one-seventh of the total amount laundered through cross-chain bridges in the past year, which was $7 billion.

- Vitalik's Post: Protocol and Staking Pool Changes Can Improve Decentralization and Reduce Consensus Costs

On October 7, Ethereum co-founder Vitalik Buterin published a blog post titled "Protocol and Staking Pool Changes Can Improve Decentralization and Reduce Consensus Costs." The article discusses the two emerging layers of staking models and their two types of participants (node operators and delegators), the two main flaws in the current state (centralization risk of node operators and unnecessary consensus layer burden), and the operation of the two-tier staking. The article also analyzes the importance of having delegators from a protocol perspective. It proposes three ways to expand voting rights: better voting tools within the pool, more competitive and sealed delegations between pools, and specific consensus participation.

(II) Last Week's Investment and Financing Situation

(I) DeFi

- On-chain credit risk management company Cicada Partners completes a $9.7 million Pre-Seed round of financing, led by Choppa Capital

On-chain credit risk management company Cicada Partners announced the completion of a $9.7 million Pre-Seed round of financing, led by Choppa Capital, with participation from Bitscale, Bodhi Ventures, and Shiliang Tang.

- Cryptocurrency startup Ostium Labs raises $3.5 million in funding for the development of perpetual contract trading for digitalized commodities

Cryptocurrency startup Ostium Labs raised $3.5 million in funding for the development of a digitalized commodities perpetual swap protocol. Diverse investors including General Catalyst, LocalGlobe, SIG, and Balaji Srinivasan provided support.

- Solana ecosystem DEX Convergence RFQ completes a $2.5 million pre-seed round of financing, led by C² Ventures

Solana ecosystem DEX Convergence RFQ completed a $2.5 million pre-seed round of financing at a valuation of $30 million, with C² Ventures leading the round and participation from Big Brain Holdings, Israel Blockchain Association, Auros Global, and others.

- Real-world asset (RWA) tokenization platform DigiShares completes a $2 million funding round, plans to raise an additional $1.2 million

Real-world asset (RWA) tokenization platform DigiShares announced the completion of a $2 million funding round, with specific investor information yet to be disclosed. DigiShares is raising an additional $1.2 million through the crowdfunding platform Republic.

- L1 Advisors completes a $1.6 million seed round of financing, including a $1 million strategic investment from VanEck

(III) Other

On-chain wealth and asset management protocol L1 Advisors completes a $1.6 million seed round of financing. This includes a $1 million strategic investment from VanEck, with participation from Ironclad Financial, Ismail Jai Hokimi, and others.

Liquidity staking platform Accumulated Finance V2 completes financing, with participation from Curve and De Facto Capital. The amount of financing has not been disclosed.

(II) Gaming on the Chain

- GameFi platform NexGami completes a $2 million seed round of financing, with Polygon Ventures, Fundamental Labs, and Ledger Capital participating, resulting in a post-investment valuation of $20 million.

(III) Infrastructure & Tools

Blockchain product development company Trinetix completes a $10 million strategic financing round from investment fund Hypra. The new funds will enable Trinetix to further expand into Latin America, enhance its operations for North American clients, and expand its presence in the Latin American market.

The Open Network (TON) receives a multi-million dollar investment from MEXC Ventures. The specific amount has not been disclosed. Additionally, MEXC and the TON Foundation have established a strategic partnership aimed at promoting global Web3 accessibility by lowering entry barriers.

AirDAO announces a $7.5 million investment from DWF Labs, with a one-year lock-up period and a 36-month unlocking period, to promote wider adoption of the AirDAO ecosystem. This extends and expands the partnership following the $2 million investment from DWF Labs in September 2022.

Privacy protocol provider Fairblock completes a $2.5 million pre-seed round of financing, led by Galileo, with participation from Lemniscap, Dilectic, Robot Ventures, GSR, Chorus One, Dorahacks, and Reverie.

(IV) Venture Capital Institutions

- CMCC Global's new fund completes a $100 million fundraising round and will invest in blockchain companies in Hong Kong. The Hong Kong-based cryptocurrency-focused venture capital firm CMCC Global announced that its newly established "Titan Fund" has completed its first round of fundraising, raising $100 million from over thirty investors, including Block.one, IDG Capital, Winklevoss Capital, Jebsen Capital, and Yat Siu, founder of Animoca Brands.

(V) Others

Web3 restaurant loyalty application Blackbird announces the completion of a $24 million Series A financing round, led by a16z Crypto, with participation from QED, Union Square Ventures, Shine, Variant, and several restaurant groups. This round of financing brings Blackbird's total funding to $35 million, and the company plans to use the funds to expand its business.

Web3 social app Phaver has completed a $7 million seed round of financing, with participation from Polygon Ventures, Nomad Capital, Symbolic Capital, dao5, Foresight Ventures, Alphanonce, f.actor, Superhero Capital, and SwissBorg.

Online art brokerage company Fountain announces the completion of financing, with participation from Flamingo DAO, Collab+Currency, Sfermion, VonMises, Cozomo de’ Medici, 6529 Capital, and others. The amount of financing has not been disclosed.

### (III) Last Week's Major Track Data

(I) RWA

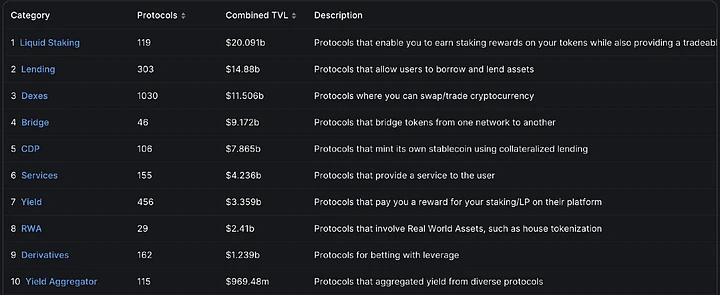

According to data from defillama, the total TVL of the RWA track has reached $2.41 billion, slightly increasing from last week. The total locked value (TVL) ranks 8th, and defillama has recorded a total of 29 RWA protocols, an increase of 1 from last week.

These RWA (Real World Asset) tokenization projects include tokenization of US Treasury bonds and real estate, among others.

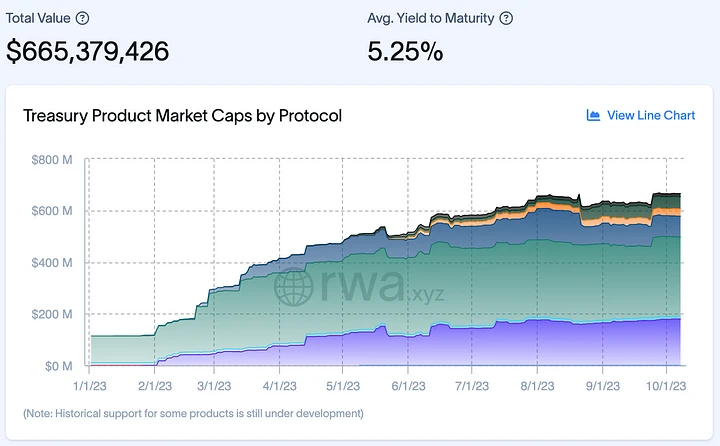

According to data from rwa.xyz, the scale of tokenized US Treasury bonds has reached $665 million, slightly increasing from last week, with an average yield of over 5%.

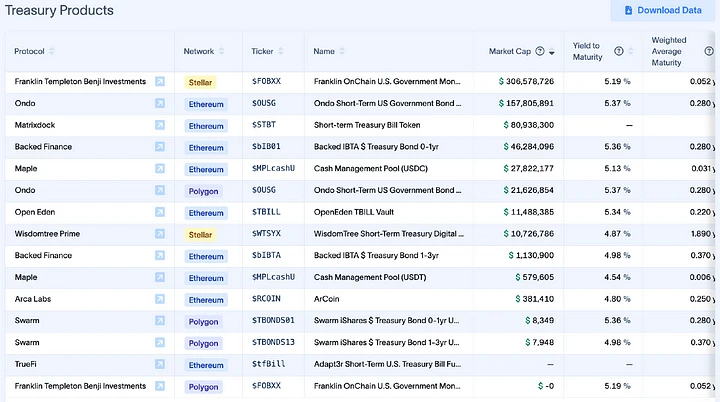

Among these tokenized US Treasury bond projects, the Franklin Templeton Benji Investments Market Cap on Stellar has the highest market cap, reaching $306 million, with a yield of 5.19%.

MakerDAO

At the time of writing, the Dai scale in DSR has increased by 283 million, reaching 1.67 billion, and the total Dai supply has increased to 5.56 billion, slightly increasing from last week, with a DSR deposit rate of 5%.

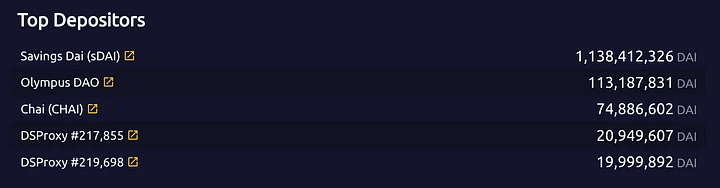

sDAI is at 1.138 billion, slightly increasing from last week.

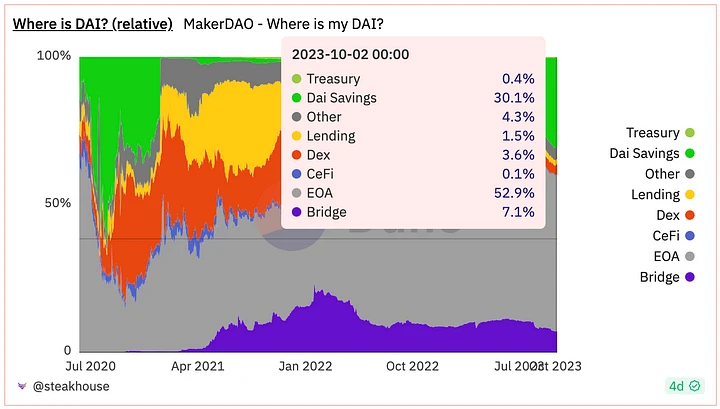

Let's take a look at the distribution of DAI.

The share of DAI in DEX and Lending has been declining since October 2022, while the holding rate of DAI in EOA accounts has been increasing, reaching 52.9%, slightly down from last week. The share of DAI Savings has been increasing since the adjustment of DSR interest rates, and has now reached 30.1%.

Currently, the highest proportions are EOA, DAI Savings, and Bridge.

Maker's own lending protocol Spark has reached a TVL of $693 million, an increase of nearly $700 million from last week.

According to data from the dune platform, RWA's share of MakerDAO's revenue has reached 66.6%, an increase of two percentage points from last week, which is related to MakerDAO's strong layout in the RWA track.

(II) LSD

Currently, the staked amount of ETH in the beacon chain has reached 27.36 million ETH, slightly increasing from last week, accounting for 22.78% of the total ETH supply, with 850,000 nodes.

The current ETH staking yield is approximately 3.44%, which is decreasing as the staked amount increases.

Among the three major protocols, in terms of ETH staking amount, Lido has grown by 3.78% in the past week, Rocket Pool by 1.90%, and Frax by 5.12%. In terms of price performance, LDO has decreased by 4.6% in the past week, RPL has increased by 8%, and FXS has decreased by 5.36%.

(III) Ethereum L2

According to data from the l2beat platform, the TVL of Ethereum Layer2 has decreased by 3.26% in the past week, with the current TVL at $10.71 billion.

In Ethereum Layer2, Arbitrum still has the highest TVL, reaching 54.53%, and Base has seen the fastest recent growth, with a TVL increase of 25.16% in the past week, reaching $557 million.

(IV) DEX

- TVL

According to data from defillama, the total locked value (TVL) in the DEX track is $11.495 billion, slightly decreasing from last week.

Uniswap has the highest TVL, followed by Curve, PancakeSwap, Balancer, SUN, and Thorchain, with most DEXs experiencing a decrease in TVL compared to last week.

Among DEXs on the Ethereum mainnet, Uniswap, Curve, Balancer, Sushi, and Loopring have the highest TVL.

The top 6 DEXs on Arbitrum, OP Mainnet, zkSync Era, Starknet, and Base in terms of TVL.

The top 6 DEXs on other Layer1 chains in terms of TVL.

- Trading Volume

The decentralized exchange (DEX) trading volume in the past 24 hours is nearly $1.31 billion, a decrease from last week, while the total global cryptocurrency exchange trading volume in the past 24 hours is $34.5 billion, with DEX trading volume accounting for only 3.8%.

(V) Derivatives DEX

- TVL

According to data from defillama, the TVL of most derivatives DEXs has increased recently, mainly due to the rise in token prices.

In the derivatives track, GMX has the highest TVL, followed by dYdX, Gains Network, MUX Protocol, and ApolloX, among others.

- Trading Volume

According to data from coingecko, the decentralized derivatives trading platform with the highest trading volume in the past 24 hours is dYdX, with a trading volume of $275 million, significantly higher than other decentralized derivatives platforms.

IV. Recent Token Unlocks

There are 6 projects with noteworthy token unlocks recently, with APT and SWEAT having relatively large unlock amounts.

Follow Hotairballoon@HorairballoonCN on Twitter for more industry news: https://twitter.com/HotairballoonCN

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。