「每周编辑精选」是Odaily星球日报的一档“功能性”栏目。星球日报在每周覆盖大量即时资讯的基础上,也会发布许多优质的深度分析内容,但它们也许会藏在信息流和热点新闻中,与你擦肩而过。

因此,我们编辑部将于每周六从过去\u0026nbsp;7\u0026nbsp;天发布的内容中,摘选一些值得花费时间品读、收藏的优质文章,从数据分析、行业判断、观点输出等角度,给身处加密世界的你带来新的启发。

下面,来和我们一起阅读吧:

投资与创业

1920 年代的投资信托狂热,为理解建立在杠杆、反身性以及溢价/资产净值增长魔力之上的金融泡沫,提供了一个概括性的蓝图。最初的金融创新,很快演变成了投机工具,承诺通过金融炼金术轻松致富。当音乐停止时,那些曾将价格推向欣快高度的反身性机制,加速了其灾难性的下跌。

这与当今的比特币财库公司有着惊人的相似之处——从新实体公司的激增,到对资产净值溢价的依赖,再到利用长期债务来放大回报。

解构HYPE估值全景:Hyperliquid凭什么撑起百亿市值?

基于 7 天数据计算出的市盈率(P/E)如下: 按流通量计算的市盈率约为 12.3 倍,按调整后的完全稀释供应量计算的市盈率约为 21.9 倍。最合理的估值基准应介于这两者之间,可以称之为混合市盈率(Blended P/E Multiple),约为 17.1 倍。

永续合约(perpetuals)是仅次于稳定币的加密领域最大市场之一。目前,Hyperliquid 大约占永续合约市场的 10%。而在现货 CLOB(集中限价订单簿) 市场中占比还更低。

HYPE 在传统金融圈尚未被广泛发现,仅仅是因为团队没有做任何市场营销。华尔街迟早会发现 HYPE。

Hyperliquid 的数据表现亮眼。

下一轮会推动 HYPE 增长的关键因素包括: 前端分发,法币入口的建设,HIP-3,SONN,更多现货资产上线。

政策

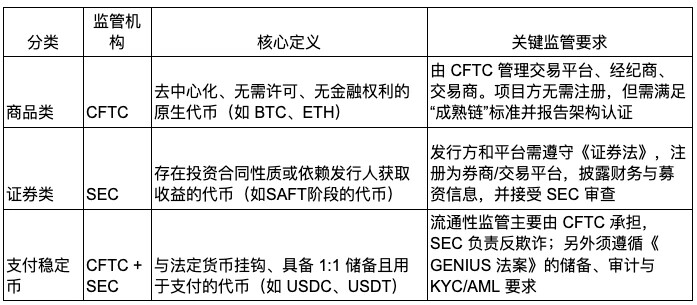

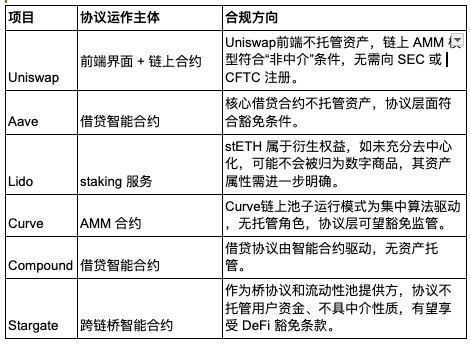

CLARITY 法案与《GENIUS 法案》共同构建了对数字资产的上下游监管体系,前者聚焦区块链基础设施与资产属性划分,后者则专责稳定币监管规范。

对 DeFi 项目而言,新法规明确豁免机制,保护协议开发者;引入自主托管权,保 DeFi 用户财产权利。

加密货币从“无政府主义货币”到“机构资产类别”演变,“抗审查货币”同时具备强制审查功能。

《GENIUS 法案》是最精妙的外交政策操作,却伪装成了国内金融监管。那些本应被加密货币颠覆的机构,如今成了加密监管合法化的最大受益者。

香港RWA沉默金矿:2.1万亿跨境基金代币化,无人听见财富破冰声

标准化金融资产——债券、基金、REITs——才是 RWA 的终极战场。

香港的“监管 - 技术 - 生态”架构已为行业提供了一套可参考的信任框架。

B端企业需通过四重合规验证: 资产筛查,沙盒预演,牌照核验,流动性沙盘。

另推荐:《香港稳定币政策落地直击:核心要点全掌握》《解码香港金管局文件:稳定币监管背后的「严」与「活」》。

空投机会和交互指南

融资4600万美元的Towns上线在即,空投大概率为“小毛”?

本周精选交互项目:0G新Galxe任务;Superp领测试币交易;circle候补名单

比特币生态

主网倒计时,BRC 2.0升级引爆BTC生态,龙头NFT月涨百倍|BTC生态

以太坊与扩容

内部基本面与外部环境在共振:核心指标向好、技术升级不断、团队治理优化,使以太坊网络更加强健;同时稳定币和 RWA 新兴叙事以及 ETF 带来的增量资金,又为 ETH 注入了源源不断的上涨动力。

正因如此,越来越多资管机构和分析师对以太坊中长期前景持乐观态度,认为其有望在未来几年内挑战新的高度。

以太坊财库的风险管理比 Strategy 模式更复杂。以太坊财库通过质押获取收益,但这一过程伴随着流动性受限与智能合约安全等风险,企业需在资金部署的局限性中寻找平衡。

另推荐:《以太坊十周年:重温 ETH 换庄之旅,筹码中心化回潮》《揭秘 ETH 本轮暴涨背后的两大话事人:Tom Lee VS Joseph Rubin》《OKX 研究院 | 以太坊创世块十周年:世界计算机神话进行时》《以太坊十年之痒:世界计算机的理想、困境与破局之路》。

CeFi \u0026amp; DeFi

代币化股票市场目前规模为 5 亿美元,但如果全球股票中能够有 1% 的市场实现代币化,到 2030 年市场规模可能达到 1.34 万亿美元。这意味着 2,680 倍潜在增长,主要驱动力是 2025 年监管明确性和成熟的基础设施的双重推动。

代币化股票支持全天候全球交易,并允许代币化股票所有权。其关键差异化在于与DeFi的整合,使投资者能够在不抛售股票的情况下,将其作为抵押品用于借贷和获取收益。

与其他需要从零创造需求的RWA不同,代币化股票直接切入规模达 134 万亿美元的全球股票市场,并针对明确的痛点。现有需求与可解决的痛点相结合,使其成为最具大规模采用潜力的 RWA 类别。

RWA 代币化浪潮下的企业融资新选择:xStocks 与 Robinhood 模式深度解析

xStocks 由瑞士 Backed Finance 发行,严格遵循瑞士 DLT 法案。其创新在于通过列支敦士登 SPV 持有底层股票,确保即使交易平台遭遇黑客攻击,资产仍安全隔离。

Robinhood 则展现监管套利智慧:由立陶宛注册的 Robinhood Europe UAB 发行,将代币纳入欧盟 MiFID II 框架归类为衍生品,巧妙规避证券发行合规成本。

二者最根本的区别,正是股权凭证与价格追踪合约的法律属性差异。

xStocks 是为流动性与生态赋能的透明引擎,为上市企业提供流动性升级方案;Robinhood 则是控制权保留者的战略跳板,适合珍视控制权的成长型企业快速融资。

ENA的“信心游戏”:2.6亿美元回购稳价,3.6亿美元输血StablecoinX冲刺上市

7 月 21 日,Ethena Labs 宣布与稳定币发行商 StablecoinX 达成 3.6 亿美元的 PIPE(私募股权投资)交易,StablecoinX 计划在纳斯达克上市,股票代码为“USDE”(与 Ethena 的稳定币 USDe 同名)。与此同时,Ethena 基金会高调启动 2.6 亿美元的 ENA 代币回购计划,试图以资本力量稳住币价、提振市场信心。

Ethena 正通过 ENA 代币回购、飞轮模式的增长引擎、USDtb 的合规战略、费用开关的潜在收益以及 Converge 在 RWA 赛道的布局,展现其成为稳定币赛道新星的雄心,或可成为本轮周期下一个兼具创新与稳健的优质标的。

另推荐:《监管会谈、收购牌照、组建联盟:RWA之光Ondo近期动作一览》。

Web3 \u0026amp; AI

AI Agent 周报 | Cookie DAO 上线 ACM 活动下首个项目 Almanak;HUSTLE 周涨幅超 1100%(7.21-7.27)

一周热点恶补

过去的一周内,美 SEC 主席宣布 Project Crypto(5 大要点总结);白宫发布数字资产报告(五大定论与两个悬念):美财政部将管理美国 BTC 储备;美 SEC 批准比特币和以太坊 ETF 的实物赎回机制(解读);香港《稳定币条例草案》正式生效;BNB 突破 860 美元续创历史新高(解读);

此外,政策与宏观市场方面,外媒:白宫正极力游说反对一项涉及总统的股票交易禁令;CBOE 提交新提案,拟简化加密 ETF 上市流程;香港金管局:《稳定币条例》生效后将设 6 个月过渡安排,可申请一揽子法币挂钩稳定币,首个牌照或于明年初发出,稳定币发行方需“识别并阻止”客户使用 VPN,初期香港合规稳定币持有人身份需实名;韩国央行设立虚拟资产部门,负责领导有关韩元稳定币的内部讨论;分析称“找换店”业务暂未受影响;瓦努阿图在香港举行国家资源推介会推动其政府控股公司申请稳定币牌照;Telegram 创始人Pavel Durov再度在法国接受讯问,涉嫌平台存在非法内容;

观点与发声方面,Ray Dalio:投资组合中至少 15%应分配给比特币和黄金;伯恩斯坦:看好 ETH,但以太坊财库策略公司需妥善处理流动性和风险;易理华:市场彻底进入长牛,或将告别传统 4 年周期规律;Vitalik 转推:以太坊 10 年零暂停、零维护;以太坊基金会发文“lean Ethereum”,概述未来十年发展愿景;Tyler Winklevoss:因“惹怒”摩根大通导致 Gemini 用户访问该行数据受限(解读);Solana 联创 Anatoly Yakovenko将 Meme 币和 NFT 斥为“数字垃圾”;Pudgy Penguins 辟谣:未收购 OpenSea;OpenSea 团队成员:代币空投会根据用户画像综合评估;OpenSea 历史成交量 Top 1 用户 Pranksy:不指望 OpenSea 的空投能成功;证券时报:中行、渣打等发钞行有望率先获批香港稳定币牌照;

机构、大公司与头部项目方面,嘉楠科技宣布将 BTC 作为企业长期储备资产;美股上市公司 BTCS 拟融资 20 亿美元,用于扩大 ETH 储备;SharpLink Gaming 于上周末共买入约 3 亿美元 ETH 并全部质押;美股上市公司 CEA Industries Inc.(NASDAQ:VAPE)与 10 X Capital 联合宣布建立 BNB 为核心的加密资产储备财库(解读);以太坊十周年火炬纪念 NFT开放免费铸造;ARK Invest 与 SOL Strategies 合作提供质押服务;PayPal 推出“Pay with Crypto”,支持 Coinbase 和 MetaMask 等钱包交易;MetaMask 推出“稳定币生息”功能,用户可在钱包前端直接存入稳定币赚取收益;Linea 公布代币经济模型(详解)及原生 ETH 收益和销毁机制;Mill City Ventures III 募资 4.5 亿美元启动 SUI 财库战略(解读);pump.fun疑似仅用 1 天的 100%收入回购代币,相关模式或难以持续;7 月 29 日,USD 1 短时脱锚,最低报 0.9934 USDT(解读);京东旗下京东链已注册 JCOIN 及 JOYCOIN,或为旗下稳定币名称;OKX 成为首家在阿联酋提供合规加密衍生品交易的全球平台;TRON Inc.拟募资 10 亿美元;

数据上,Coinbase 上比特币溢价消失,或预示美国机构买盘放缓;嘉信理财发布 Q 3 交易员情绪调查结果:43%对加密货币看涨;调查:14%的美国成年人拥有加密货币,64%的投资者认为其风险极高……嗯,又是跌宕起伏的一周。

附《每周编辑精选》系列传送门。

下期再会~

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。