Author: Go2Mars, HKUST Crypto-Fintech Lab

Dear readers,

I am honored to introduce to you this "2023 Global Decentralized Finance Lending Track - Insight Analysis Report". As the director of the Hong Kong University of Science and Technology Digital Finance Lab (HKUST Crypto-Fintech Lab), I have been committed to promoting the development of cryptographic financial technology and exploring innovative possibilities in this field. This report is a carefully crafted result of the combined academic research and industry practice shared wisdom by our team and Go2Mars Capital.

In the past few years, the rise of Web3 technology has brought about tremendous changes in the financial industry. Web3, with its core features of decentralization, security, transparency, and programmability, has brought unprecedented opportunities and challenges to the lending field. With the use of technologies such as blockchain, smart contracts, and cryptocurrencies, the financial market is undergoing a transition from traditional centralized models to decentralized models.

This report aims to delve into the development trends, key challenges, and prospects of the Web3 lending track. Researchers from Go2Mars Capital and our lab's research team have conducted extensive research and analysis in this field, and engaged in in-depth discussions with experts and practitioners in the industry. We will provide a comprehensive overview of key topics such as Web3 lending protocols, decentralized lending markets, asset collateralization, and risk management. In addition, this report will also introduce some of the latest lending innovation cases, with Prestare Finance being an innovative project from our lab, exploring how Web3 technology promotes the development and innovation of the financial market. We will explore emerging areas such as blockchain-based lending protocols, decentralized lending platforms, and lending derivatives, and discuss their potential impact on the traditional financial system.

Through this report, we hope to provide readers with a comprehensive understanding of the Web3 lending track and valuable references for practitioners in the industry, academic researchers, and policymakers. We believe that with the development of Web3 technology, the lending market will become more open, efficient, and inclusive, contributing to the sustainable development of the global financial system.

Finally, I would like to sincerely thank the hard work and support of our lab team members and partners from Go2Mars Capital, as well as the attention and support of our readers. I hope this white paper can bring you inspiration and guidance.

Wishing that our joint efforts can promote a better development of the financial world and pave the way for the future of financial technology. Let's work together!

Kani CHENHKUST, Department of Mathematics(Director).Fellow of Institute of Mathematical Statistics.Director of HKUST Crypto-Fintech Lab.

Preface

Lending is the beginning of everything in the financial market, it is the source.

Whether it is "The Wealth of Nations" or Mankiw's economics textbooks, we can easily understand that the core of financial activities is based on trust between people, which allows people to lend funds or assets to each other, thus optimizing resource allocation.

Lending is a credit activity, referring to the lender (bank or other financial institution) lending monetary funds to the borrower (enterprise, individual, or other organization) according to certain interest rates and conditions to meet their production or consumption needs. In lending activities, the borrower can increase their income by leveraging their capital, which is the role of leverage. However, leverage also amplifies the borrower's risk, and if the borrower fails to repay on time, it can lead to losses or even bankruptcy. In order to avoid or transfer this risk, people have invented various financial derivatives, such as futures, options, and swaps, which can be used to hedge or speculate on market fluctuations. It is no exaggeration to say that finance and financial derivatives are built on the underlying proposition of "lending".

Due to the inconvenience of centralized finance, people have turned their attention to blockchain, hoping to achieve more efficient, fair, and secure financial services through decentralization. Decentralized lending is one of the important application scenarios, using smart contracts to match lenders and borrowers, lock assets, calculate interest, and execute repayments, without relying on any third-party institutions or individuals.

As of now, the on-chain DeFi lending track has become one of the most important tracks in the blockchain market, with a TVL of $14.79 billion. However, there is a lack of innovation in the current DeFi lending protocols, and the market focus is gradually shifting. How to innovate on the existing models and integrate the latest technologies has become a problem facing innovators.

The DeFi lending track needs a new narrative.

Part 1: DeFi Lending Principle Deconstruction - How Decentralization is Changing the Development of Financial Lending

The Distributed Revolution at the Financial Underlying Level: From Traditional Finance to "Decentralized Finance"

"Lending can promote the flow and accumulation of capital. Capitalists can lend idle capital to those in need of financial support, thereby promoting economic development and capital accumulation."

- Adam Smith, "The Wealth of Nations"

One of the core functions of the financial sector is to channel savings into productive investment opportunities. Traditionally, ignorant depositors put their money in banks to earn interest; banks then lend funds to borrowers, including businesses and households. The key is that as lenders, banks screen borrowers to assess their creditworthiness, ensuring that scarce capital is allocated to the best use.

In the screening process, banks combine hard and soft information, the former including the borrower's credit score, income, or educational background, and the latter usually obtained through extensive relationships with the borrower. From this perspective, the history of financial intermediaries is an exploration of improving information processing. For borrowers who are difficult to screen, lenders may require collateral to secure the loan, thereby mitigating information asymmetry and aligning incentives. For example, entrepreneurs often have to pledge the net value of their homes when applying for a loan. If there is a default, the lender can seize the collateral and sell it to recover the loss.

For centuries, collateral has played a widespread role in lending, with loans secured by real estate dating back to ancient Rome. Over time, market carriers and forms have changed, and DeFi lending platforms also bring depositors and potential borrowers together, without a central intermediary like a bank. Specifically, lending activities take place on the platform - or a series of smart contracts that manage loans according to predetermined rules. One party is the individual depositor (also known as the lender), who deposits their encrypted assets into the so-called liquidity pool to earn deposit interest. The other party is the borrower, who obtains encrypted assets and pays loan interest. These two interest rates vary based on the encrypted assets and the demand for loans, and are also influenced by the size of the liquidity pool (representing the money supply). The platform usually charges a service fee to the borrower. Since the process is automated, loan issuance is almost instantaneous, and the associated costs are low.

A key difference between DeFi lending and traditional lending is the limited ability of DeFi lending to screen borrowers. The identities of borrowers and lenders are hidden by encrypted digital signatures. Lenders therefore cannot access information such as the borrower's credit score or income statement. Therefore, DeFi platforms rely on collateral to align the incentives of borrowers and lenders. Only assets recorded on the blockchain can be borrowed or pledged, making the system largely self-referential.

Typical DeFi loans are issued in stablecoins, while collateral consists of high-risk unsecured encrypted assets. Smart contracts assign a haircut or margin for each type of collateral, determining how much minimum collateral the borrower must provide to obtain a given amount of loan. Due to the high price volatility of encrypted assets, over-collateralization occurs - the required collateral is often much higher than the loan size, and the minimum collateral ratio on major lending platforms is usually between 120% and 150%, depending on expected price appreciation and volatility.

- The exploratory period (2017-2018) was the initial stage of the DeFi ecosystem, during which a batch of decentralized financial protocols based on smart contracts emerged on the Ethereum platform, providing users with different types of encrypted asset lending services. Among them, MakerDAO was the earliest stablecoin issuance protocol, allowing users to generate DAI stablecoins by collateralizing encrypted assets; Compound was the earliest interest rate market protocol, allowing users to deposit or borrow encrypted assets and dynamically adjust interest rates based on market supply and demand; Dharma was the earliest bond issuance protocol, allowing users to create, purchase, or sell fixed-rate bonds based on encrypted assets. These protocols laid the foundation for the DeFi ecosystem and provided inspiration and reference for later innovators.

- The explosive period (2019-2020) was a phase of rapid growth in the DeFi ecosystem, during which the on-chain lending market exhibited characteristics of diversification and innovation. Not only did more DeFi projects enter the market competition, but more lending protocols also underwent innovation and optimization to adapt to different user needs and market environments. These lending protocols involved various encrypted assets, including stablecoins, native tokens, synthetic assets, NFTs; or used different risk management methods, including collateralization ratio, liquidation penalty, insurance pool, credit scoring; or designed different interest rate models, including fixed rates, floating rates, algorithmic rates, derivative rates, etc.; or implemented different governance mechanisms, including centralized governance, decentralized governance, community governance, token incentives. These lending protocols also achieved a higher degree of interconnection and synergy, providing users with a richer and more flexible range of financial services and income opportunities through smart contracts and composite strategies. Lending protocols that rose or developed during this period include Aave, dYdX, Euler, Fraxlend, each with its own distinctive advantages, as well as facing challenges and risks.

- The expansion period (2021-present) presents more challenges and opportunities for the on-chain lending track. On the one hand, as the Ethereum network becomes congested and transaction fees rise, lending protocols are seeking cross-chain and multi-chain solutions to improve efficiency and reduce costs. Some lending protocols have been deployed on other public chains or have used cross-chain bridging tools to achieve interoperability of assets and data, such as the cross-chain lending protocol Radiant. On the other hand, with the demand and attention of the real economy and traditional finance, lending protocols are also exploring the possibility of bringing real-world assets (RWA) onto the chain to expand the scale and influence of the lending market. Some lending protocols have attempted to tokenize real assets such as real estate, automobiles, and bills, and provide corresponding lending services. Representative lending protocols include Tinlake, Centrifuge, Credix Finance, among others.

Core Elements of Decentralized Lending

Whether it is blockchain-based decentralized lending or traditional lending based on financial institutions, they have certain similarities in their core components. Regardless of the lending method, there needs to be borrowers, lenders, interest rates, terms, collateral, and other elements. These elements constitute the basic logic and rules of lending, and also determine the risks and returns of lending. In decentralized lending, various parameters are determined by DAO, so the entire financial model also includes a governance module. Specifically, it includes the following elements:

- Borrower: The borrower is the party in need of borrowing funds, typically for investment, consumption, or emergencies. The borrower needs to submit a loan request to the lender or platform and provide necessary information and conditions such as loan amount, term, interest rate, collateral, etc. After obtaining the loan, the borrower needs to repay the principal and interest to the lender or platform according to the agreed terms and schedule.

- Lender: The lender is the party willing to lend funds, typically with idle funds and seeking returns. The lender needs to provide their funds to the borrower or platform and accept necessary information and conditions such as loan amount, term, interest rate, and risk. After lending the funds, the lender needs to recover the principal and interest according to the agreed terms and schedule.

- Platform: The platform acts as an intermediary or coordinator in the lending process. It can be a centralized institution such as a bank, credit union, or online lending platform, or a decentralized system such as blockchain, smart contracts, or DeFi platforms. The main function of the platform is to provide a trusted and efficient lending market for borrowers and lenders, and to facilitate fund matching and flow. The platform usually charges a certain fee or profit as compensation for its services.

- Governance: In decentralized protocols, parameters such as interest rates, collateral assets, and LTV are determined by voting with governance tokens, making governance an important role in protocol decision-making. Governance typically requires holding or staking a certain number of governance tokens to obtain voting rights and governance rewards. Governance can influence the development direction and parameter settings of the protocol by proposing or supporting proposals.

Breakdown and Analysis of the Lending Process

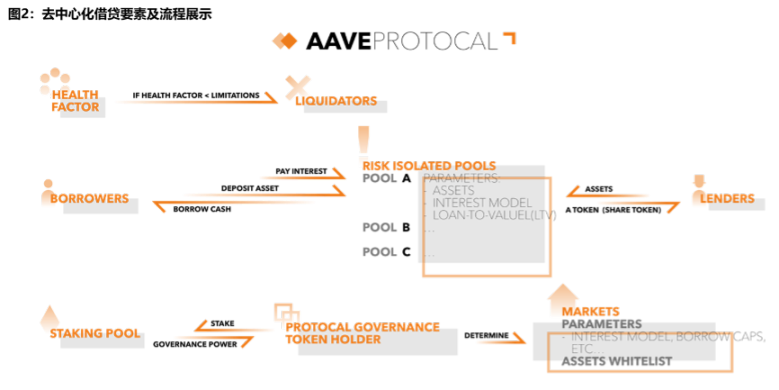

The decentralized lending process is similar to centralized lending, involving similar steps such as initiating and processing loan requests, providing and managing collateral, loan repayment and liquidation. The characteristic of decentralized lending is that it does not require trust in any intermediary institution, but rather automatically executes lending agreements through smart contracts. The decentralized lending process is as follows (refer to Figure 2):

On decentralized platforms, there are usually different collateral pools corresponding to assets of different risk levels, each with different parameters such as lending interest rates, collateralization ratios, liquidation ratios, etc. Borrowers typically need to select a collateral pool based on their collateralized assets, then deposit their collateral into the collateral pool contract to obtain the borrowed assets. Due to the difficulty of verifying credit on-chain, decentralized lending often involves over-collateralized borrowing, where the value of the collateral / loan amount > 100%.

After selecting a collateral pool, borrowers can input the type and amount of assets they want to borrow. The platform will display corresponding loan terms, interest rates, collateralization ratios, etc., based on the current market conditions and collateral pool parameters, for the borrower's reference. Typically, the platform provides a range of cryptocurrencies as collateral options, such as Bitcoin, Ethereum, stablecoins, etc. Different cryptocurrencies have different risk levels, and therefore different parameter settings. Borrowers can choose more stable or more volatile cryptocurrencies as collateral based on their risk preferences and expected returns.

Once the borrower has determined the loan conditions, they can initiate the loan request. The platform will verify the borrower's identity and address, as well as whether the provided collateral meets the requirements. If everything is in order, the platform will transfer the borrower's collateral into the smart contract and transfer the corresponding amount of borrowed assets to the borrower. At the same time, the platform will record the borrower's relevant information, such as loan amount, term, interest rate, collateralization ratio, and generate a unique loan ID in the contract.

Based on the borrower's loan request, the platform will match suitable lenders from the collateral pool and transfer their assets to the borrower. Lenders can be individual or institutional, single or pooled. In addition to providing assets, lenders will also receive corresponding interest income and token rewards.

Lenders can increase or decrease the assets they provide at any time to adjust their returns and risks. The platform dynamically adjusts lending interest rates based on market supply and demand to balance the interests of both borrowers and lenders. During the loan term, borrowers can repay part or all of the loan and interest at any time, and retrieve the corresponding amount of collateral from the smart contract. If the borrower repays the entire loan and interest on time, the platform will end the loan relationship and delete the relevant information.

At the same time, the platform will monitor the value of the collateral in real-time and calculate the collateralization ratio, liquidation ratio, and health factor for each loan. The collateralization ratio is the ratio of the collateral value to the loan amount, the liquidation ratio is the minimum collateralization ratio that triggers liquidation, and the health factor is the ratio of the collateralization ratio to the liquidation ratio, reflecting the borrower's repayment ability and risk level. The platform will provide this information to the borrower in various ways and remind them to be aware of the risks.

If the borrower is unable to repay on time or their collateralization ratio falls below the liquidation ratio (e.g., 150%), the platform will automatically trigger the liquidation process, selling their collateral at a certain discount to a liquidator to repay their debt, and charging a certain penalty.

The liquidator can be the platform itself or a third-party institution, and they can profit by purchasing the collateral. After liquidation, if there is remaining value in the collateral, the platform will return it to the borrower; if the collateral's value is insufficient to repay the debt, the platform will write it off and bear the loss.

Game of Interest Distribution in the Lending Process

For lending protocols, there are three sources of income: interest paid by borrowers, collateral liquidation, and service fees. These income streams are distributed to the protocol itself, LP (Liquity Provider), and secondary market support. The distribution of interests can be seen as a game and an optimization process.

To attract a higher Total Value Locked (TVL) in the early stages, projects may choose to offer incentives. This means they will take various measures to attract LPs and borrowers. For example, they may set higher interest rates to attract LPs to deposit assets into liquidity pools. At the same time, they may also provide convenience for borrowers, such as subsidizing to reduce borrowing costs. In the later stages, projects will pay more attention to the stability of stablecoin prices. To achieve this goal, they may provide liquidity in the secondary market to support the token price. This can be achieved through buying or selling tokens. In addition, projects may also adjust interest rates and subsidy policies to balance supply and demand and maintain market stability.

In summary, the protocol needs to balance the interests of all parties. It needs to attract enough LPs to provide liquidity while also providing competitive interest rates and convenient lending conditions for borrowers. Additionally, the protocol needs to support its token price through the secondary market and maintain operations through service fees. Therefore, the protocol needs to continuously adjust the distribution of interests among all parties to achieve optimal results.

Deconstructing the DeFi Lending Model: How Decentralized Systems Impact Lending Mechanisms

DeFi Lending Mechanism 1: Peer-to-Peer and Pool-based Lending Models

Lending models can be classified into peer-to-peer and pool-based lending based on the matching method of lending behavior. The matching method refers to how borrowers and lenders find each other and reach a lending agreement. Peer-to-peer lending refers to direct transactions between borrowers and lenders, where both parties can freely choose lending conditions, but it takes time and costs to find suitable trading partners. Pool-based lending refers to transactions between borrowers and lenders through a common pool of funds, where both parties do not need to know each other's identity and only need to follow the rules of the pool, which can improve efficiency and liquidity but also face some risks and limitations.

The pool-based method is currently the mainstream approach, with protocols like AAVE and Compound belonging to the pool-based lending model. This model aggregates different assets into their respective liquidity pools through liquidity providers. Borrowers can borrow assets from the liquidity pool by collateralizing token assets. The interest paid by borrowers is the income of the liquidity pool, which is distributed to all liquidity providers in the borrowed asset pool, and the interest is not allocated to specific liquidity providers, hence it is called the pool-based lending method.

The pool-based lending method has some advantages. Firstly, it effectively diversifies risks. Since the bad debt risk is borne by the entire liquidity pool, the risk borne by each liquidity provider is relatively small. Secondly, this method ensures liquidity. Since liquidity providers aggregate different assets into their respective liquidity pools, borrowers can borrow assets from the liquidity pool of the target asset, ensuring that borrowers can obtain the required funds in a timely manner.

However, the pool-based lending method also has some disadvantages. Firstly, the income received by each liquidity provider is distributed. Since the interest is distributed to all liquidity providers in the borrowed asset pool and not allocated to specific liquidity providers, the income received by each liquidity provider is relatively small. Secondly, the low capital utilization rate of liquidity providers. Since most of the funds are idle, the capital utilization rate of liquidity providers is relatively low.

The peer-to-peer (p2p) on-chain lending model was initially proposed by the ETHLend protocol, attempting to achieve 100% capital utilization efficiency through order book matching. With the peer-to-peer lending model, borrowers and lenders can engage in lending activities at negotiated prices and interest rates. Currently, protocols like morpho belong to the peer-to-peer lending model. Secondly, this method ensures that borrowers receive all interest income. Since borrowers can complete lending with 100% capital utilization, they can receive all interest income.

However, the peer-to-peer (p2p) on-chain lending model also has some disadvantages. Firstly, completing transactions on-chain is not easy. Since all prices and transactions need to be recorded on-chain, borrowers and lenders need to spend a lot of gas fees to complete lending, which is not user-friendly for both parties. Secondly, this method requires borrowers to bear all the risks—collateral insufficiency or bad debt risks caused by market price fluctuations will be borne by the borrower.

DeFi Lending Mechanism 2: Over-collateralized and Under-collateralized Lending Models

Based on the degree of credit enhancement between the borrower and lender, lending can be divided into two different models. One model is over-collateralized lending, where the borrower needs to provide collateral worth more than the borrowed assets to ensure that the lender can recover the principal and interest by selling the collateral in the event of market fluctuations or default. This model is suitable for borrowers with lower credit or higher risk, as they need to pay more costs to obtain funds.

The other model is under-collateralized lending, where the borrower only needs to provide collateral worth less than the borrowed assets, allowing them to leverage the potential for higher returns from asset price increases. This model is suitable for borrowers with higher credit or lower risk, as they can amplify returns with lower costs. However, this model also carries greater risks, as lenders may not be able to fully recover losses through selling collateral in the event of market reversals or defaults.

- Over-collateralized lending requires the value of the collateral to be greater than the loan amount. For example, when borrowing $6,400 worth of DAI on AAVE, users need to have at least $10,000 worth of collateral on AAVE. In the DeFi market, the prices of most assets fluctuate significantly. To avoid the risk of bad debts caused by the value of the collateral being lower than the loan amount due to price fluctuations, over-collateralized protocols design a liquidation threshold in advance. When a user's Loan-to-Value (LTV) ratio exceeds the liquidation threshold, the protocol introduces external liquidators to liquidate the user, reducing the LTV back to a safe range. In this process, various reward mechanisms encourage liquidators to initiate liquidation, ensuring the safety of the fund pool. Over-collateralization results in lower capital utilization. Currently, most on-chain assets are considered liquid assets, and the lower capital utilization of over-collateralization does not meet people's needs, limiting the effectiveness of financial tools.

- Under-collateralized: In traditional finance, credit is also an important tool. Credit allows borrowers to advance expenses, stimulating economic activity. However, due to the censorship resistance and anonymity of blockchain, when bad debts occur, individuals cannot be held accountable, and DeFi protocols cannot assess the credit of each address. Therefore, to ensure the safety of funds and protocols, lending protocols prefer to use over-collateralization. However, in the current DeFi market, many protocols are attempting to introduce a combination of on-chain and off-chain methods to provide under-collateralized loans to whitelisted users. One way to combine off-chain methods is to introduce Know Your Customer (KYC). The protocol or protocol token holders will review and evaluate the background and funds of the borrower. After passing the evaluation, they will form a loan agreement with a crypto institution (including amount, term, interest rate, and collateral ratio), and ultimately decide whether to grant the loan to the borrowing institution through proposals or multiple voting methods. Today, protocols like Maple and TrueFi define the role of the borrower as a crypto institution or crypto fund organization.

DeFi Lending Mechanism 3: Floating Rate and Fixed Rate Lending Models

Floating Rate Model: AAVE's predecessor, Ethlend, demonstrated a peer-to-peer lending model based on an order book, with clear maturity dates and fixed interest rates. However, it was phased out of the DeFi market due to insufficient liquidity and low volume of fund matching. AAVE introduced a p2pool model that controls interest rates based on supply and demand. In this model, loans do not have fixed maturity dates, and to maintain the balance of funds in the market, the interest rate is influenced by the utilization rate of funds. When the utilization rate of funds in the market increases, indicating demand exceeding supply, the interest rate rises to suppress market demand and safeguard the safety of the fund pool. When the utilization rate of funds decreases, indicating supply exceeding demand, the interest rate decreases to stimulate market demand. Representative lending protocols using floating rates include AAVE and Compound. They adjust interest rates in real-time in response to market changes. This method has its advantages and disadvantages. The advantage is the ability to respond quickly to market changes and maintain the safety of the fund pool. However, the disadvantage is that floating interest rates bring greater risk exposure and are not conducive to long-term financial activities. In this model, investors need to closely monitor market dynamics and adjust investment strategies based on actual conditions. Risk control should also be considered to avoid over-investment or excessive leverage.

Fixed Rate Model: In traditional finance, fixed-rate lending is the more common method, and predictable interest rates can provide appropriate tools for building stronger investment portfolios. However, in the DeFi field, it is challenging to price assets reasonably and establish corresponding fixed interest rates. Currently, different protocols in the DeFi market use different methods to form fixed interest rates, including zero-coupon bonds and interest rate markets.

Zero-coupon bonds are bonds that do not pay interest, and their trading price is lower than face value. Upon maturity, they are paid at face value to bondholders. Lenders can purchase zero-coupon bonds at a discounted price and receive the face value upon maturity. The difference between the purchase price and the face value is the lender's interest, and the fixed interest rate obtained by the lender is the ratio of interest to the time from purchase to maturity. Borrowers can borrow zero-coupon bonds by collateralizing assets and sell them at a discount to obtain funds. Upon maturity, if they want to redeem the collateral, they need to repay the debt on the zero-coupon bonds. The difference between the face value of the zero-coupon bonds lent out by the system and the funds obtained from the sale is the interest on the loan. Based on market supply and demand, borrowers and lenders can trade zero-coupon bonds at a fixed interest rate, thereby achieving a fixed interest rate.

The representative lending protocol for fixed interest rates is the Yield Protocol. The Yield Protocol is a permissionless market for collateralized fixed-rate lending on Ethereum. It introduces a derivative model for zero-coupon bonds as collateral, making fixed-rate borrowing possible. This means that borrowers can lock in a fixed interest rate to protect themselves from interest rate fluctuations.

The protocol defines yTokens as ERC-20 tokens that settle a fixed amount of the target asset on a specified date. This allows the creation of a market for these tokens, where buyers and sellers can trade at prices reflecting market expectations of future interest rates. These tokens are collateralized and have maintenance collateralization ratio requirements similar to other DeFi platforms. This means that borrowers must deposit collateral to secure their loans, and if the value of the collateral falls below the maintenance requirement, part or all of the collateral can be sold by the custodian to liquidate the position and repay the debt. This provides additional security for lenders, as they can be confident that their funds are backed by collateral.

In addition to zero-coupon bonds, investors can also access fixed-rate income products through other means. One method is to derive a secondary market for trading interest rates based on existing interest sources, such as floating rates or liquidity mining. In this secondary market, investors can purchase and trade various fixed-rate products to obtain stable returns. Additionally, protocols can generate fixed-rate income products through other means to provide more options for investors. Typically, these include the following two types:

- Principal-Interest Separation: This involves tokenizing potential interest returns from DeFi investments as income products, dividing the investment amount into principal and interest portions, pricing them separately, and selling them in token form. Upon maturity, holders of the principal portion tokens receive the initial investment amount, while holders of the interest portion tokens receive all the interest from the investment. For example, if the interest income obtained from depositing 10,000 DAI into the Compound protocol is expected to be around 4%, the principal is priced at 9,600 and the interest is priced at 400. When the product is sold and matures, holders of the principal portion tokens receive 10,000 DAI, and holders of the interest portion tokens receive the remaining interest. This product includes fixed-rate components and a bullish view of the Compound interest market. A representative protocol for this type is Pendle. Pendle is a yield trading protocol that allows users to purchase assets at a discount or gain leveraged exposure without facing liquidation risk. This is achieved by deploying derivative protocols for fixed interest rates on Ethereum and Arbitrum. The protocol tokenizes future returns by separating principal and interest, providing more flexibility and control for investments. Users can deposit income-generating assets into the platform, and smart contracts tokenize the principal and interest. These tokens can then be traded on the platform using an automated market maker (AMM) algorithm. This allows for efficient and transparent trading of these assets, providing users with more options for managing their investments.

- Structured Products: By leveraging the uncertainty of floating interest rates and the different risk tolerances and capital opportunity costs of each investor, protocols can design structured products to reallocate risk based on individual needs. This allows investors to choose suitable structured products for risk management and maximizing returns in uncertain market environments. In structured products, Class A products guarantee priority distribution of fixed returns, while Class B products offer high-risk, high-return opportunities. Using the example of depositing 10,000 DAI into the Compound protocol, Class A investors receive a stable 4% return, while Class B investors can receive the remaining excess returns. If the interest rate is less than 4%, Class B investors also need to make up for the shortfall in interest for Class A investors.

DeFi Lending Model Four: Auction Liquidation and Partial Repayment Liquidation Lending Model

In DeFi lending, the liquidation process involves the health factor of accounts (also known as the health index). The health factor is related to the collateral and loan amount of the account. If the value of the health factor reaches a critical threshold (equal to or less than 1), the loan is under-collateralized. It will be liquidated, and the user will lose all collateral assets:

Due to market fluctuations, the health factor can manifest in two different ways: an increase in the value of deposited assets and a corresponding increase in the value of collateral, resulting in the same (also increased) numerical value of the health factor, which is higher than the critical threshold of 1. A decrease in the value of deposited assets and a corresponding decrease in the value of collateral result in the same (also decreased) numerical value of the health factor, making the loan position riskier as the value approaches the critical threshold of 1. If it falls below the critical threshold, the loan is under-collateralized and will be liquidated. Users can increase the health factor by depositing more assets as collateral to keep the loan position safer. By doing so, they can avoid the risk of being liquidated on one hand and allow for more profitable borrowing on the other.

During the lending process, if a borrower's health factor is less than 1, the borrower will face liquidation. The liquidation process can be divided into partial repayment liquidation and auction liquidation modes. Partial repayment liquidation involves directly selling a portion of the borrower's collateral at a certain discount through a contract order, allowing any user to repay the debt and immediately resell for arbitrage. This method can quickly resolve the borrower's loan issues and also provide arbitrage opportunities for other users. Auction liquidation involves publicly auctioning the collateral from a starting price, gradually increasing the price. This method ensures the maximization of the collateral's value and provides the borrower with more time to resolve the loan issues.

When choosing a liquidation mode, it is necessary to determine based on the actual situation. If the borrower wants to quickly resolve the loan issue and is willing to bear a certain asset loss, the partial repayment liquidation mode can be chosen. If the borrower wants to preserve their assets as much as possible and is willing to spend more time resolving the loan issue, the auction liquidation mode can be chosen.

Comparison of the Advantages and Disadvantages of the Four DeFi Lending Models

- Peer-to-Peer Model vs. Pool Model: In terms of security, the existing peer-to-peer lending model, Morpho Finance, is based on the interest-bearing tokens of Compound and AAVE. Therefore, in addition to potential security risks inherent in the protocol itself, its security also depends on the underlying tokens of the protocol. However, in terms of efficiency and flexibility, Morpho has optimized the interest rate model of traditional p2pool protocols, making the interest rates more favorable for both borrowers and lenders. Undoubtedly, this increases capital utilization efficiency.

- Fully Collateralized vs. Undercollateralized Mode: In terms of transparency and security, fully collateralized protocols perform better and are more resilient to market tests. Most undercollateralized protocols have an additional security assumption, which involves trusting a centralized entity or organization. While undercollateralized mode may be attractive during good market performance, it inevitably carries the risk of defaults when the market turns bearish. In terms of the return rate for borrowers, the undercollateralized mode may perform better, but due to protocol limitations, it may not allow for recursive borrowing, thus limiting the options for users.

- Floating Rate vs. Fixed Rate Model: Generally, floating rates are more flexible, usually changing based on the utilization rate of the lending pool, allowing for better capture of market changes. Additionally, floating rate protocols like AAVE have simpler product logic, larger TVL, and provide a certain level of protocol security. Fixed-rate products are more complex, with more influencing factors, and the yield rate is usually difficult to calculate. Furthermore, there are more protocols at the protocol level that offer fixed income products, leading to highly dispersed TVL and uncertain protocol security. Considering these factors, fixed-rate products have a certain barrier to entry for regular DeFi users.

- Auction Liquidation vs. Partial Repayment Liquidation Mode: In practical applications, both liquidation modes have their pros and cons. The partial repayment liquidation mode can quickly resolve the borrower's loan issue, but since the collateral is sold at a discount, the borrower may incur some asset loss. On the other hand, the auction liquidation mode can maximize the value of the collateral, but the auction process may be lengthy and not conducive to quickly resolving the borrower's loan issue. Therefore, the choice of liquidation mode should be based on the actual situation.

Design of Collateral Ratios: Different lending protocols, such as MakerDAO, AAVE, and Compound, have different collateral ratios for different collateral assets. For example, mainstream assets like ETH and WBTC have relatively low collateral ratios (or relatively high loan-to-value ratios) due to their high consensus, good liquidity, and relatively low volatility, while non-mainstream coins have higher collateral ratios. MakerDAO even offers Vaults with different collateral ratios for the same collateral to encourage high collateral behavior and reduce liquidation risk.

Multi-layered Insurance Liquidation Mechanism: To cope with extreme market conditions, some mainstream lending protocols design multi-level prevention mechanisms. For example, MakerDAO has the Maker Buffer Fund, debt auction mode, and emergency shutdown mechanism; AAVE has designed a safety module and attracts funds to enter the safety module by distributing protocol income. In addition, the auction mechanism is constantly being improved.

Accuracy of Price Feeds: The entire liquidation process heavily relies on the accuracy of price feeds from oracles, making price accuracy crucial. Currently, MakerDAO ensures security by establishing its own oracles, while AAVE uses leading oracle provider Chainlink.

Involvement of Liquidators: The active participation of liquidators is a solid guarantee for the liquidation process. Currently, major protocols incentivize liquidators by offering them incentives.

Summary: Issues and Challenges of On-Chain Lending

On-chain lending provides users with fast, convenient, and low-cost lending services in a decentralized manner. The development of decentralized lending has attracted a large amount of funds and users, forming a large and active market that supports the circulation and investment of crypto assets. However, decentralized lending also faces some common and specific issues and challenges, including:

- Liquidity: On-chain lending platforms rely on users depositing or borrowing crypto assets to form liquidity pools, thereby providing lending services. The amount of liquidity determines whether the platform can meet the borrowing needs of users and the level of lending rates. Insufficient liquidity can lead to the platform's inability to attract and retain users, reducing its competitiveness and revenue. Excess liquidity can depress interest rates, reducing user incentives. Therefore, on-chain lending platforms need to design reasonable mechanisms to balance liquidity supply and demand, such as dynamically adjusting interest rates, providing liquidity mining rewards, and achieving cross-chain interoperability.

- Security: On-chain lending platforms are controlled by smart contracts, which means they may be at risk of programming errors, logic flaws, or malicious attacks. In the event of a security incident, it could lead to theft, freezing, or destruction of user funds, resulting in significant losses. Therefore, on-chain lending platforms need to undergo rigorous code audits, security testing, and risk management, as well as establish emergency mechanisms and governance models to ensure the security of user funds.

- Scalability: On-chain lending platforms are limited by the performance and capacity of the underlying blockchain, such as transaction speed, throughput, and fees. When the blockchain network is congested or fees are high, the user experience and efficiency of on-chain lending platforms are affected. Therefore, on-chain lending platforms need to find more efficient and cost-effective blockchain solutions, such as layer-2 scaling, sidechains, and cross-chain bridges.

- Compliance: Due to their decentralized and anonymous nature, on-chain lending platforms may face legal and regulatory challenges and risks, such as anti-money laundering, counter-terrorism financing, consumer protection, and tax compliance. These issues may affect the legitimacy, sustainability, user trust, and security of on-chain lending platforms. Therefore, on-chain lending platforms need to communicate and coordinate with relevant regulatory authorities and stakeholders, comply with applicable laws and regulations, and ensure their compliance and social responsibility.

Part 2: Exploring the DeFi Lending Track - How Decentralized Track Deeply Integrates with Financial Lending

NFT Collateralized Lending Model: Using DeFi to Play with NFTs in a Decentralized Financial Way

NFT, or Non-Fungible Token, typically refers to tokens that comply with the ERC-721 standard. Since the release of this standard, NFTs have become an indispensable asset in the blockchain world. However, due to the non-fungible and difficult-to-price nature of NFTs, they face issues such as low liquidity, leading to high capital thresholds and underutilization.

NFT holders may have to sell at lower prices when facing capital shortages or may not be able to participate in certain blue-chip projects due to small capital volumes. Additionally, they may incur liquidity losses due to the difficulty in valuation. To address these issues, the market has proposed the concept of NFTFi, attempting to increase the liquidity, pricing, utilization, and compatibility of NFTs in a financial way to create a better NFT player experience.

NFTFi lending and borrowing protocols unlock liquidity for borrowers and provide novel forms of income for lenders. These protocols allow NFT holders to lock their digital assets as collateral to unlock the liquidity of another digital asset. This allows borrowers to obtain the required liquidity without having to sell their valuable NFTs. At the same time, lenders can earn income by providing liquidity.

In addition, NFTFi also provides other financial tools such as leasing, borrowing, and fractionalizing NFTs. These tools allow NFT holders to lease their digital assets for others to use or to fractionalize them for sale or trade. This allows NFT holders to earn income without selling their valuable NFTs. NFT owners lock their NFTs with the protocol. Then, the owner can borrow alternative digital assets over time by paying interest to the lender. If the NFT owner defaults, the NFT serves as collateral.

NFT owners can repay the loan at any time to retrieve their NFT. Through this process, NFT lending and borrowing protocols provide a way for NFT owners to unlock the liquidity of their NFTs without selling them.

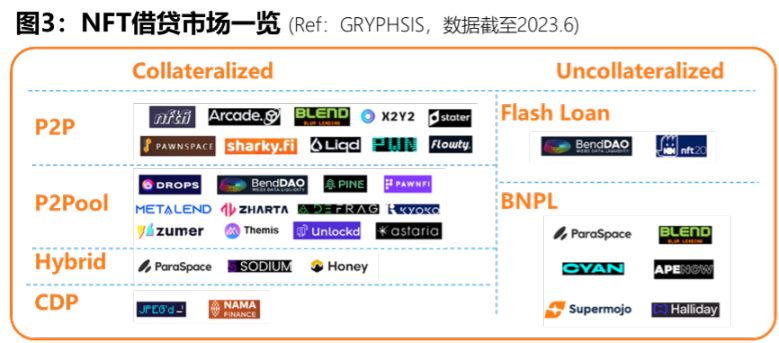

Operation of NFTfi

In 2020, the NFT market experienced explosive growth, attracting numerous creators and collectors. In order to allow NFT owners to better utilize their digital assets, some protocols began offering NFT financial services, such as collateralization, lending, and dividends. NFTfi is one of the protocols focused on NFT lending, allowing NFT owners to use their NFTs as collateral to borrow cryptocurrency from lenders. At the same time, lenders can earn interest by providing cryptocurrency and have the opportunity to take ownership of the collateral if the borrower defaults. This provides NFT owners with a way to unlock the value of their assets without selling them. Since its launch in 2020, NFTfi has become one of the leaders in the NFT finance field. As of July 6, 2023, its total borrowing volume has reached $463 million, with 47,612 loans. However, there are still $26 million in outstanding receivables among these loans. 23 NFT lending protocols have been included in DeFiLlama. At the beginning of the market, the NFTfi protocol maintained a high first-mover advantage, but later entrants represented by BendDAO, ParaSpace, and Blend have occupied a higher market share with their superior mechanisms.

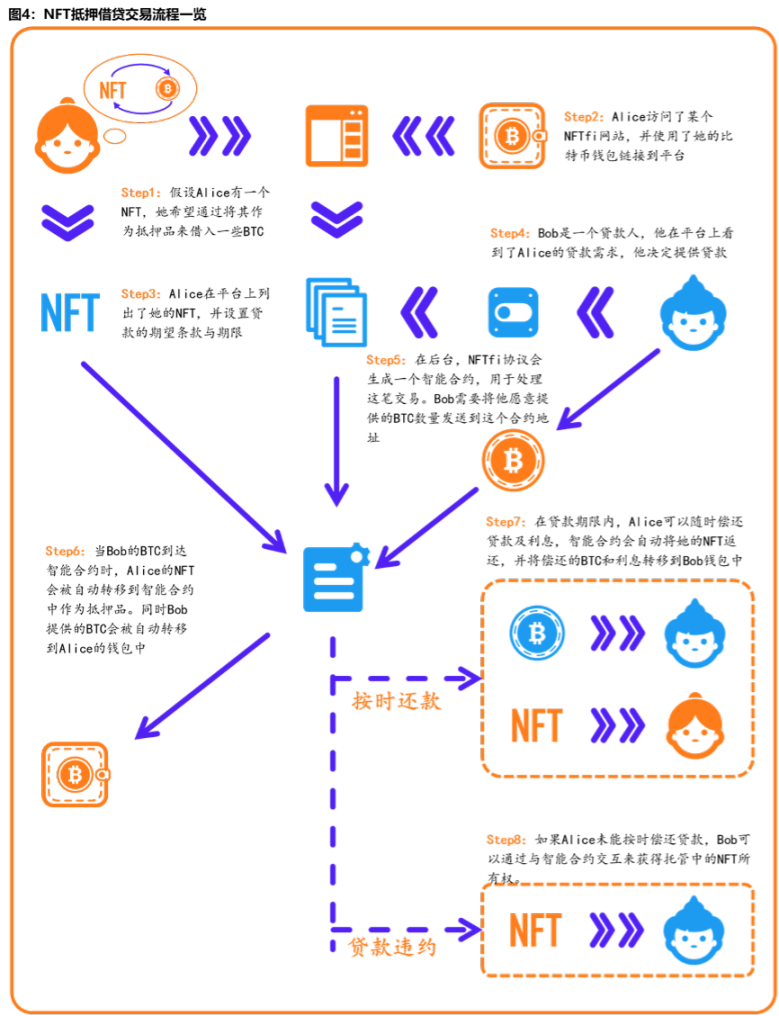

The working principle of the NFTfi platform is to facilitate peer-to-peer lending transactions between NFT owners and lenders. Specifically, NFT owners can use their NFTs as collateral to borrow cryptocurrency from lenders. This process involves the following steps:

First, NFT owners list their NFTs on the NFTfi platform and set the expected terms of the loan. This includes the amount of cryptocurrency they wish to borrow, the interest rate, and the loan term. They can also choose whether to accept partial or full loans. Once the NFT is listed, other users on the platform can view it and provide loan quotes. Loan quotes can be the same or different from the expected terms, and it's up to the NFT owner to decide whether to accept. When a loan quote is accepted, the NFT is transferred to a secure escrow smart contract. This ensures that the NFT is securely held as collateral during the loan. In exchange, the lender directly sends the agreed amount of cryptocurrency (wETH, DAI, or USDC) to the borrower's wallet. This allows the borrower to immediately access liquidity without selling their NFT.

Borrowers can use the borrowed funds as they wish, but they are responsible for repaying the loan and any interest within the agreed-upon time. If they fail to do so, the lender has the right to claim ownership of the NFT held in escrow. This means they can sell or retain the NFT on the platform or in other markets. Therefore, borrowers need to assess the risks and returns of their NFT and borrowed funds. However, if borrowers fully repay the loan on time, they will automatically regain ownership of their NFT in their wallet. This allows them to retain ownership of their valuable assets while still accessing their value through borrowing.

NFTfi Case Study 1: BendDAO

The significance of BendDAO lies in its initiation of the first peer-to-pool lending model. This model provides higher capital efficiency compared to peer-to-peer lending, allowing NFT owners to access liquidity more quickly and conveniently. In this model, users can borrow directly from the protocol after collateralizing their NFTs, without waiting for a suitable borrower to complete a "1-to-1" match.

Similar to FT lending protocols, the loan funds typically come from liquidity providers. These liquidity providers earn lending interest by providing funds to the protocol. This allows NFT owners to quickly access liquidity without selling their NFTs. At the same time, liquidity providers can earn stable returns by providing funds. BendDAO's peer-to-pool lending model brings new opportunities to the NFT market. It provides a new way for NFT owners to utilize their digital assets and offers a new investment channel for investors.

The advantages of BendDAO's peer-to-pool lending model include providing NFT owners with a faster and more convenient financing method. In the traditional peer-to-peer lending model, NFT owners need to wait for a suitable borrower and negotiate with them to obtain a loan. However, in BendDAO's peer-to-pool lending model, NFT owners can directly borrow from the protocol by collateralizing their NFTs.

Secondly, BendDAO's peer-to-pool lending model provides investors with more investment opportunities. In the traditional peer-to-peer lending model, investors need to find suitable borrowers and negotiate with them to invest. However, in BendDAO's peer-to-pool lending model, investors only need to provide funds to the protocol to earn stable returns.

NFTfi Case Study 2: ParaSpace

Similar to BendDAO, ParaSpace also uses a Peer-to-Pool model for its underlying lending business. In this model, users can borrow and lend in real-time as borrowers by collateralizing NFTs, and as lenders by providing funds to earn interest paid by borrowers.

The innovation of ParaSpace lies in its introduction of the first cross-collateral credit system, instead of using the isolated collateral pool design used by existing platforms. This allows users to provide loans with a unified credit limit for all collateral. This design provides users with more flexibility and convenience, allowing them to better manage their assets.

The working principle of the cross-collateral credit system is that users can collateralize multiple types of assets (including NFTs and other cryptocurrencies) together to obtain a unified credit limit. They can then use this credit limit for lending transactions. This means users do not need to set up separate collateral accounts for each type of collateral, but can manage their assets collectively.

Additionally, ParaSpace's cross-collateral credit system provides users with more investment opportunities. Since users can collateralize multiple types of assets together, they can diversify their risks and achieve higher returns. At the same time, this design also provides investors with more investment choices, allowing them to better manage their investment portfolios.

NFTfi Case Study 3: Blur

Blur's NFT lending protocol, Blend, is a P2P perpetual NFT lending protocol that allows users to use NFTs as collateral to obtain ETH loans, or borrow ETH (buy now, pay later) to purchase NFTs on the Blur market. The protocol was launched on May 1, 2023, and currently supports 3 NFT series (Azuki, Cryptopunks, Miladys).

The difference from other lending protocols is that the interest rate for Blend loans is fixed and has no maturity date. Interest accumulates until the loan is repaid. This means that as long as someone is willing to lend against the collateral, Blend will automatically "roll over the loan position," and only requires on-chain transactions when someone decides to exit the position or when the interest rate changes. Borrowers can repay the loan at any time.

If the borrower fails to fully repay the loan by the due date, the lender can initiate a Dutch auction for refinancing options (at any time). New lenders can take over the loan at an attractive interest rate. If there are no bidders interested in the loan, the original lender will take ownership of the collateral NFT. As Blur rewards users providing loans, lenders have an incentive to offer favorable terms.

For borrowers, the risk can be significant; if the lender triggers a 30-hour loan auction, they have 24 hours to repay the loan. If they fail to do so, the loan's interest rate may increase significantly to make it attractive to other potential lenders. Lenders also face the risk of being unable to find a taker for the loan within the 30-hour window. While the lender will receive the NFT as collateral for the loan, its value may not likely cover the loan amount they provided.

In summary, Blur's NFT lending protocol Blend provides users with a novel, flexible, and potentially risky way to access ETH liquidity or purchase NFTs. It brings new vitality to the NFT market and offers users more choices.

One difference between NFT lending and traditional lending is that the collateral itself does not have strong capital attributes, meaning their commercial attributes cannot directly support the TVL aspect of the lending protocol. Therefore, the protocol itself needs to use its token as liquidity incentives to attract a large amount of fund pool deposits that can be lent out to the NFT lending protocol. However, the token price may not be supported in the secondary market. Ultimately, this is due to the fact that the narrative types of NFTs are currently limited to PFP, which have poor financial attributes. Although there are some new types of NFTs, such as The Llamas, which have the ability to generate income, and EIP-6551, which creates Token Bound Accounts for NFTs, the scale of these assets is still relatively small. However, when the NFT ecosystem is not dominated solely by PFP types in the future, there is still room for imagination in the NFT lending market.

Long Tail Asset Collateralization Model: Decentralizing Financial Market Access

"The really amazing thing about the long tail is its scale. Combine enough non-hit products on the tail, and you've got a market bigger than the hits."

— Chris Anderson

The long tail effect, initially described by Chris Anderson, the editor-in-chief of "Wired" magazine, in 2004, is used to describe the business and economic models of websites such as Amazon, Netflix, and Rhapsody. It refers to the phenomenon where the total revenue accumulated from previously overlooked low-selling but diverse products or services surpasses that of mainstream products due to their large quantity. In the internet field, the long tail effect is particularly significant. Long tail assets refer to assets with low liquidity, trading volume, and market value. These assets are often not well-recognized, so their trading volume and market value are relatively low. In the crypto asset field, most assets belong to the long tail. These assets carry relatively high risks because of their low liquidity and potential price fluctuations.

Current mainstream lending protocols like Aave isolate collateral assets based on different risks, assigning different collateralization ratios and interest rates to different assets. This method effectively protects the interests of investors and avoids significant losses due to price fluctuations of a single asset. However, Aave on the Ethereum mainnet currently only supports blue-chip tokens such as DAI, USDT, USDC, ETH, and CRV, which account for only a fraction of the total market value of tokens on Ethereum. This limitation greatly restricts the development of the lending market.

Due to the support of only a few blue-chip tokens, many investors cannot use lending protocols for borrowing operations. This means they cannot utilize their other holdings to access liquidity or invest through borrowing. This is a huge loss for investors. Additionally, the lending market becomes relatively singular. Investors can only choose from a limited number of assets and cannot fully utilize the market. This also limits the development of the lending market.

To address this issue, lending protocols supporting long tail assets have emerged, providing investors with more choices by supporting a wider variety of assets. Investors can use their long tail assets for lending operations and access liquidity. These protocols can awaken untapped liquidity in the market. Many long tail assets are underutilized due to a lack of liquidity, and these protocols provide liquidity for these assets, allowing them to play a role in the market.

Reference to Euler Lending Protocol

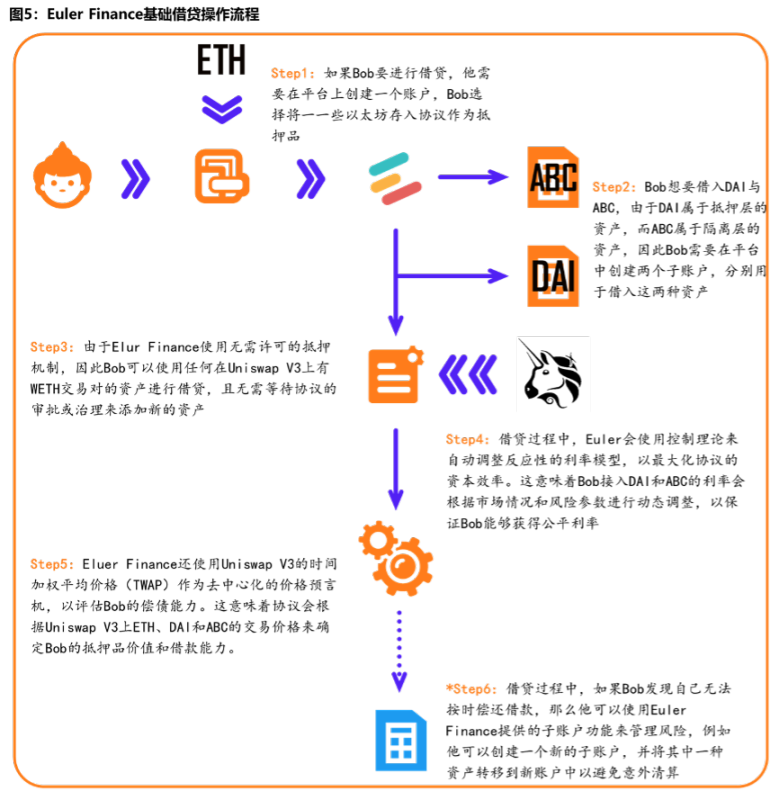

Euler Finance is a permissionless DeFi lending protocol. Anyone can list almost any token for lending on Euler, as long as the token is listed on Uniswap v3 with a WETH trading pair. Listing tokens without permission carries high risk, but Euler has proposed a series of risk management concepts and solutions—

Asset Segmentation Mechanism: Euler Finance uses a risk-stratified asset classification to divide assets into isolation, crossover, and collateral layers to protect the protocol and users from the impact of risk overflow. Isolation layer assets are the highest-risk assets and can only be used for regular borrowing and lending. Users cannot use these assets as collateral to borrow other assets, nor can they borrow multiple isolation layer assets in the same account. Crossover layer assets are of medium risk and can be used for regular borrowing and crossover borrowing. Users cannot use these assets as collateral to borrow other assets, but they can borrow multiple crossover or isolation layer assets in the same account. Collateral layer assets are the lowest-risk assets and can be used for any type of borrowing, collateral, and crossover borrowing. Users can use these assets as collateral to borrow any other type of assets and can borrow multiple collateral, crossover, or isolation layer assets in the same account.

Decentralized Price Oracle: In traditional lending protocols, the protocol needs to use a price oracle to assess the user's debt repayment ability. A price oracle is a service that provides asset price information, helping the protocol determine the collateral value and borrowing capacity of users. However, traditional price oracles are typically centralized, relying on a few trusted data providers to supply price information. The issue with this approach is that if data providers are attacked or fail, the protocol and users may suffer losses. Euler Finance uses Uniswap v3's TWAP as a price oracle, meaning it calculates the average asset price based on the historical data of asset trades on Uniswap v3. TWAP is a commonly used financial metric that determines the average asset price by calculating the weighted average of asset prices over a period of time. By using TWAP as a price oracle, Euler Finance can more accurately assess the user's debt repayment ability and avoid the risks associated with traditional price oracles.

Dynamic Liquidation Ratio: In traditional lending protocols, when a user fails to repay a loan on time, the protocol initiates a liquidation process to sell the user's collateral to repay the loan. Liquidation is typically a painful process as it results in the user losing their collateral and may have adverse effects on the protocol and other users. Additionally, the liquidation process also faces the issue of Miner Extractable Value (MEV). MEV refers to the additional profits miners can gain by reordering transactions. During the liquidation process, miners can prioritize high-value liquidation transactions by reordering transactions to gain additional profits. To address these issues, Euler Finance introduces a dynamic liquidation mechanism using dynamic liquidation discounts and ratios to achieve soft liquidation and reduce MEV. The dynamic liquidation discount adjusts dynamically based on market conditions and risk parameters to ensure users receive a fair price during the liquidation process. The dynamic liquidation ratio adjusts dynamically based on the user's debt repayment ability and risk parameters to prevent users from suffering excessive losses during the liquidation process. Additionally, Euler Finance uses the dynamic liquidation mechanism to reduce MEV. Since the dynamic liquidation discount and ratio are adjusted based on market conditions and risk parameters, miners cannot gain additional profits by reordering transactions.

Adaptive Interest Rates: In traditional lending protocols, interest rate models are typically static, using fixed parameters to adjust the cost of borrowing based on market supply and demand. Static interest rate models have a problem in that they require predetermined parameters to ensure the protocol's capital efficiency. Capital efficiency refers to the protocol's ability to fully utilize the funds provided by depositors while ensuring borrowers receive reasonable interest rates. If the parameters are set unreasonably, the protocol may experience idle funds or excessive borrowing, resulting in losses for the protocol and users. To address this issue, Euler Finance uses control theory to automatically adjust reactive interest rate models to maximize the protocol's capital efficiency. Control theory is a mathematical method that helps the protocol dynamically adjust the parameters of the interest rate model based on market conditions and objectives. Euler Finance uses an algorithm called a PID controller to implement reactive interest rate models. The PID controller is a commonly used control algorithm that adjusts the output signal based on the error signal. In Euler Finance, the error signal refers to the difference between the actual utilization rate and the target utilization rate, and the output signal refers to the borrowing interest rate. Euler Finance uses the PID controller to implement reactive interest rate models, adjusting the borrowing interest rate based on the difference between the actual utilization rate and the target utilization rate. If the actual utilization rate is higher than the target utilization rate, the protocol increases the borrowing interest rate to encourage depositors to provide more funds and suppress excessive borrowing. If the actual utilization rate is lower than the target utilization rate, the protocol lowers the borrowing interest rate to encourage borrowers to use more funds and suppress excessive deposits. The purpose is to allow the protocol to automatically adapt to market changes and maintain efficient capital utilization.

Sub-Account Protection: In traditional lending protocols, users typically can only manage their borrowing positions in one account. The issue with this approach is that if a user wants to simultaneously engage in multiple types of borrowing, they need to manage all their borrowing positions in the same account. This may make it difficult for users to manage their borrowing risks and may have adverse effects on the protocol and other users. To address this issue, Euler Finance introduces a sub-account mechanism to help users manage multiple borrowing positions and provide options for protective collateral. Sub-accounts allow users to create multiple independent accounts within the Euler Finance protocol, each capable of independently managing its borrowing positions. This allows users to more flexibly manage their borrowing risks and better utilize the features provided by the protocol.

For example, if a user wants to engage in two different types of borrowing simultaneously, they can create two sub-accounts in Euler Finance, each used to manage two different types of borrowing positions. This allows users to better control their risks and better utilize the features provided by the protocol. Additionally, Euler Finance provides options for protective collateral, allowing users to set protective collateral in sub-accounts to prevent unexpected liquidation.

Reference to Long Tail Asset Collateralization Case

Currently, in the long tail asset lending field, there is still no dominant application. Previously, Euler Finance had developed well, with a TVL reaching $300 million at one point, but due to vulnerabilities in its business logic code, it suffered a hack and no longer has development prospects. Currently, Silo Finance is gaining momentum, with a TVL reaching $270 million since the protocol went live last year. In addition, there are many emerging protocols attempting to seize this opportunity, such as the dAMM protocol, which supports multiple long tail assets, and the OpenLeverage protocol on Arbitrum, which provides permissionless lending for over 95% of the 300+ protocols on Arbitrum.

dAMM is a decentralized protocol that allows users to deposit any ERC-20 token and borrow any other ERC-20 token from a liquidity provider's pool. This means users can easily access a variety of tokens without the hassle of exchanging one token for another. Instead, they only need to deposit their tokens into the dAMM protocol and borrow the tokens they need. The protocol uses an automated market maker (AMM) to determine interest rates and collateral ratios based on supply and demand. This means that the more people want to borrow a specific token, the higher the interest rate. Conversely, if there is low demand for a specific token, the interest rate will be lower. The AMM also considers the amount of collateral required to borrow a specific token. The greater the volatility of the token, the more collateral is required to borrow it.

OpenLeverage is a permissionless margin trading protocol. Anyone can use this protocol to create margin trading markets for any currency pair on existing DEXs. Token suppliers can then lend out any individual token from the OpenLeverage liquidity pool. OpenLeverage does not require deposits from both sides of the market and does not experience impermanent loss, as no market-making is done to generate revenue. As the liquidity provider, the pool issues "LTokens," representing their contribution to the pool's liquidity, which generates revenue from token borrowers.

There is still significant development potential in the long tail asset lending direction. Currently, mainstream lending protocols have minimal support for long tail assets, making it difficult to utilize them. This means there is a significant demand gap in the market waiting for new lending protocols to fill. With numerous public chains, each chain will have its own native long tail asset lending protocols. This provides developers with significant opportunities to develop lending protocols tailored to long tail assets on different public chains. This allows users to find lending protocols that suit their needs on different public chains.

RWA Collateralized Lending Model: Connecting Virtual and Real with Decentralized Finance

RWA (Real World Asset) refers to real-world assets. In the context of cryptocurrency, it refers to the tokenization of assets from the physical world (such as real estate, commodities, or artwork) and representing them on the blockchain. This allows these assets to be traded and used as collateral in decentralized finance (DeFi) protocols.

Tokenization is the process of converting ownership of assets into digital tokens that can be traded and managed on the blockchain. This enables previously illiquid or difficult-to-trade assets (such as real estate or artwork) to be easily bought and sold in decentralized markets. One of the main benefits of tokenizing real-world assets is that it allows these assets to be used as collateral in DeFi protocols. DeFi is a rapidly growing sector of the cryptocurrency industry aimed at providing financial services such as lending, borrowing, and trading in a decentralized and transparent manner. By using tokenized real-world assets as collateral, users can access these financial services without selling the assets, unlocking the value of previously illiquid assets. Many types of assets (such as artwork or real estate) are typically difficult to liquidate. However, through tokenization and blockchain technology, these assets can now be easily traded and used as collateral, providing asset owners with new opportunities to leverage their assets and generate returns, unlocking the liquidity of such assets. In the past, if cash was needed, assets may have had to be sold. By using tokenized RWA assets, they can be used as collateral on lending protocols supporting these assets, allowing asset ownership to be retained while obtaining the necessary liquidity.

RWA Concept Representation: Centrifuge Protocol

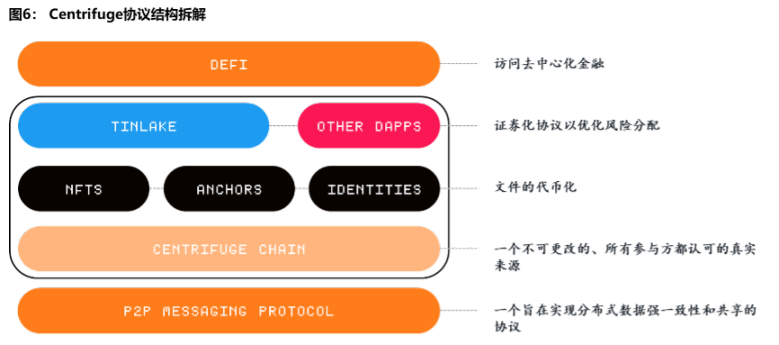

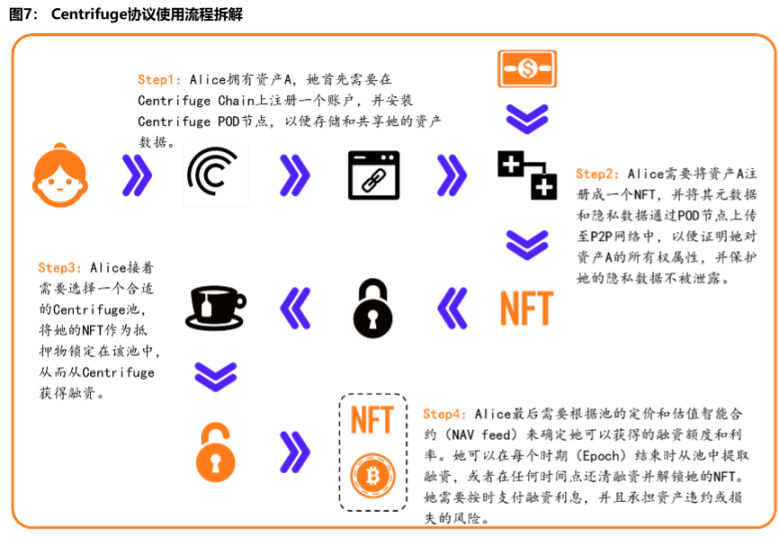

The Centrifuge protocol consists of Centrifuge Chain, Ethereum Smart Contracts, Centrifuge POD, NFTs, and Centrifuge - Ethereum Bridge, enabling the tokenization, financing, and integration of real-world assets (see Figure 6):

- Centrifuge Chain is the underlying blockchain of Centrifuge, responsible for handling the creation, transfer, and collateralization of NFTs, as well as cross-chain communication with Ethereum. Centrifuge Chain is developed using the Substrate framework and supports the Polkadot ecosystem.

- Ethereum Smart Contracts are smart contracts deployed by Centrifuge on Ethereum, responsible for managing Centrifuge pools, layered tokens, pricing and valuation, investment and redemption, CFG rewards, and other functions. Ethereum Smart Contracts synchronize data and trigger events with Centrifuge Chain through the Centrifuge - Ethereum Bridge.

- Centrifuge POD is a peer-to-peer network node of Centrifuge, responsible for storing and sharing metadata and privacy data of real-world assets, as well as verifying the authenticity and integrity of assets. Centrifuge POD communicates using Centrifuge's P2P protocol, ensuring data security and trustworthiness.

- NFTs are non-fungible tokens used by Centrifuge, representing ownership and value of real-world assets, and can be transferred and collateralized between Centrifuge Chain and Ethereum. NFTs follow the ERC-721 standard and can interact with other DeFi protocols on Ethereum.

- Centrifuge - Ethereum Bridge is the cross-chain bridge between Centrifuge and Ethereum, responsible for synchronizing the status and events of NFTs and CFG tokens, as well as providing the exchange function between CFG and wCFG. Centrifuge - Ethereum Bridge is developed using the Snowfork framework and supports bidirectional asset transfer and message delivery.

The Centrifuge protocol provides an innovative solution for the tokenization of real-world assets, allowing asset originators to convert their assets into non-fungible tokens (NFTs). NFTs are unique digital tokens that can prove ownership and attributes of an asset on the blockchain. The Centrifuge protocol uses Centrifuge Chain as its underlying blockchain, responsible for handling the creation, transfer, and collateralization of NFTs. Centrifuge Chain is developed using the Substrate framework and supports the Polkadot ecosystem. On Centrifuge Chain, asset originators can register their assets as NFTs and lock these NFTs as collateral in Centrifuge pools to obtain financing from Centrifuge.

The Centrifuge pool is a "revolving pool" that is a smart contract responsible for managing the financing and investment of real-world assets. The key feature of the revolving pool is that it allows investors to lock and redeem investments at any time without waiting for the assets to mature. This allows investors to flexibly adjust their investment strategies, while asset originators can continuously access liquidity. The Centrifuge pool has different layered tokens representing different risk and return levels. Layered tokens are similar to the common structure of layered bonds in traditional finance, where high-risk, high-return tokens are called Junior tokens, low-risk, low-return tokens are called Senior tokens, and there can also be Mezzanine tokens in between. Investors can choose tokens that suit their risk preferences for investment.

The Centrifuge protocol calculates the Net Asset Value (NAV) of each pool through a pricing and valuation smart contract (NAV feed). NAV reflects the present value of all outstanding financing and the remaining liquidity (Reserve) in the pool. NAV is calculated based on data and algorithms provided by Centrifuge POD, considering factors such as the risk rating, maturity date, and interest rates of the real-world assets behind each NFT. NAV ultimately determines the value and price of each layered token, as well as the amount investors need to pay or receive when investing and redeeming. The Centrifuge protocol executes investment and redemption orders at the end of each period (Epoch). An epoch is a fixed-length time period during which all locked orders are recorded and processed based on priority and risk indicators at the end of the period. This ensures that the fund allocation and risk control in the pool are reasonable and effective.

The Centrifuge protocol not only provides an innovative financing platform for asset originators and investors but also integrates with DeFi protocols. DeFi protocols are decentralized financial applications based on Ethereum, such as MakerDAO, Aave, Compound, etc., which provide services such as stablecoins, lending, and trading. The Centrifuge protocol communicates with Ethereum through the Centrifuge - Ethereum Bridge, enabling the transfer and use of NFTs and CFG tokens in Centrifuge pools between the two blockchains.

The Centrifuge - Ethereum Bridge is developed using the Snowfork framework, supporting bidirectional asset transfer and message delivery. Through integration with DeFi protocols, the Centrifuge protocol can provide more liquidity and value for real-world assets, such as financing or redemption through MakerDAO to create the stablecoin DAI, or using NFTs as collateral to borrow other tokens through Aave or Compound.

The Centrifuge protocol also provides DeFi protocols with more asset types and sources of income, such as earning stable returns and CFG rewards by investing in layered tokens in Centrifuge pools. CFG rewards are a mechanism through which the Centrifuge protocol incentivizes investors to participate, distributing the native token CFG to investors daily at a certain rate. CFG tokens can be used for governance and decision-making in the Centrifuge network or traded on exchanges.

Other High-Quality RWA Project Targets

The concept of RWA has been around for a long time, but due to the complexity of bringing physical assets onto the blockchain, large-scale development has not yet been achieved. In the current market, RWA can be divided into the following categories based on different physical assets: real estate, stocks, Layer1, climate, emerging markets, TradFi, etc. There are numerous RWA protocols in the market, each focusing on different assets, and there is ongoing competition among these protocols based on transaction fees. Some well-developed RWA projects include Ondo Finance, MakerDAO, which has also launched an RWA module and generates revenue from it.

Maple Finance is a decentralized protocol that connects institutional borrowers with a pool of lenders. It allows borrowers to obtain unsecured loans by providing credit reputation and business information. Maple also enables lenders to earn interest by providing liquidity to different pools, each with its own risk and return profile. It has partnered with Centrifuge to introduce RWA collateralized loans to its platform. Maple provides a capital-efficient option for institutional borrowing and fixed-income lending in the decentralized finance space. Unlike most platforms that offer collateralized loans and floating rates, Maple Finance offers unsecured loans to borrowers and transparent fixed-income opportunities to lenders. Lenders can earn sustainable returns by lending to rigorously vetted institutional borrowers, while pools initiate, manage, attract capital, and commit loans to the loan pool after formulating their investment strategies and determining the approval process for creditworthy borrowers.

Ondo Finance is a decentralized investment bank that invests in US-listed money market funds off-chain and conducts stablecoin lending operations in its sub-protocol, Flux Finance, including USDC, USDT, DAI, and FRAX. Its protocol revenue comes from annual management fees, and users need to complete the KYC/AML process to trade fund tokens and use them in permitted DeFi protocols. OndoFinance offers four products to choose from: Ondo Money Market Funds (OMMF): invests in high credit-rated US government bonds, short-term bonds, and other debt instruments; Ondo Short-Term US Government Bond Fund (OUSG): invests in US short-term note ETFs; Ondo Short-Term Investment Grade Bond Fund (OSTB): primarily invests in short-term investment-grade debt securities, with an average portfolio duration usually not exceeding one year; Ondo High Yield Corporate Bond Fund (OHYG): primarily invests in high-yield corporate bonds.