In the previous two articles, I introduced the existing cryptocurrency stocks and ETFs in the current financial market. Researching these financial assets helps to judge the market trends and sentiments of cryptocurrencies. However, due to the complexity of the types, market value, and varieties, I will further filter and establish a list to help analyze the sentiment of the TradFi market, ultimately reflected in my daily updated "Crypto Tea Time" newsletter.

Watchlist

First, I will filter the 11 cryptocurrency-related ETFs I am interested in, including 2 mutual funds and 9 ETFs from Grayscale. The main monitoring logic is the degree of correlation. I believe that due to Grayscale's dominant position in the crypto market, both GBTC and ETHE should be included in the monitoring, as Grayscale has an astonishing Crypto spot position.

GBTC

GBTC represents the Grayscale Bitcoin Trust, which has been in existence for an incredible 10 years. It is a closed-end fund provided by the digital asset management company Grayscale Investments on September 25, 2013.

As of July 31, 2023, the net asset total is $18.21 billion. GBTC aims to provide investors with the opportunity to invest in Bitcoin (BTC) through traditional investment tools similar to closed-end funds. GBTC operates by holding a certain amount of Bitcoin and issuing shares to investors. Each share represents a specific amount of Bitcoin held by the trust.

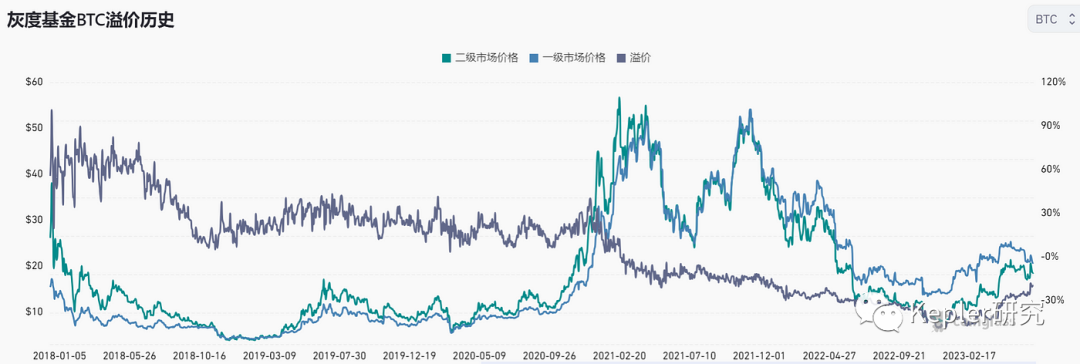

Investors can buy and sell GBTC shares on the OTCQX market, allowing them to gain Bitcoin exposure without directly owning or managing cryptocurrencies. Since 2021, GBTC has started to show a negative premium, implying a decrease in demand or confidence in GBTC from the TradFi market.

GBTC Premium

ETHE

ETHE is the Grayscale Ethereum Trust issued by Grayscale Investments on December 14, 2017. As of July 31, 2023, the net asset total for ETHE is $5.56 billion. It is an investment product that allows investors to invest in Ethereum in a manner similar to buying stocks.

The structure of the Grayscale Ethereum Trust allows investors to gain exposure to Ethereum assets without directly purchasing, storing, and securing Ethereum. ETHE is highly correlated with the trend of Ethereum, but in the early stages, it exhibited a trend consistent with BTC.

ETHE & ETH, D

BITO

BITO is the first Bitcoin futures-linked ETF in the market, listed on the NYSE in October 2021, and is considered a significant breakthrough in the development of cryptocurrencies and ETFs. BITO is issued by the fund management company ProShares, with assets under management close to $1.41 billion.

The fund advisor primarily seeks to provide capital appreciation by managing Bitcoin futures contracts. The fund does not directly invest in Bitcoin, which is a significant difference from GBTC. The fund typically suggests that during periods of stable or declining Bitcoin or Bitcoin futures values, investors usually hold Bitcoin futures contracts.

To maintain exposure to Bitcoin futures contracts, it must sell its futures contracts close to expiration and replace them with new futures contracts with later expiration dates. It is non-diversified, and BITO is linked to BTC futures on the CME, so its price trend closely aligns with BTC.

BITO & BTC, D

BITQ

This is an ETF that I have to monitor. The index was designed by Bitwise Index Services, LLC in April 2021 to measure the performance of companies participating in the cryptocurrency market, including cryptocurrency mining companies, cryptocurrency mining equipment suppliers, cryptocurrency financial service companies, or other financial institutions primarily serving cryptocurrency-related clients (i.e., the cryptocurrency ecosystem).

Typically, the fund will invest at least 80% of its net assets in securities of Crypto Innovators. The asset management scale is $79.82 million.

BITQ is an ETF that I have to monitor, as it covers almost all areas of the cryptocurrency in the TradFi market. Its performance represents the condition of the cryptocurrency industry.

BITQ & BTC, D

BTF

BTF (Valkyrie Bitcoin Strategy ETF) is an actively managed ETF listed on Nasdaq in October 2021, primarily investing in Bitcoin futures contracts.

The fund is an actively managed exchange-traded fund designed to achieve its investment objective by investing all or substantially all of its assets in Bitcoin exchange-traded futures contracts and "collateral investments." The fund does not directly invest in Bitcoin.

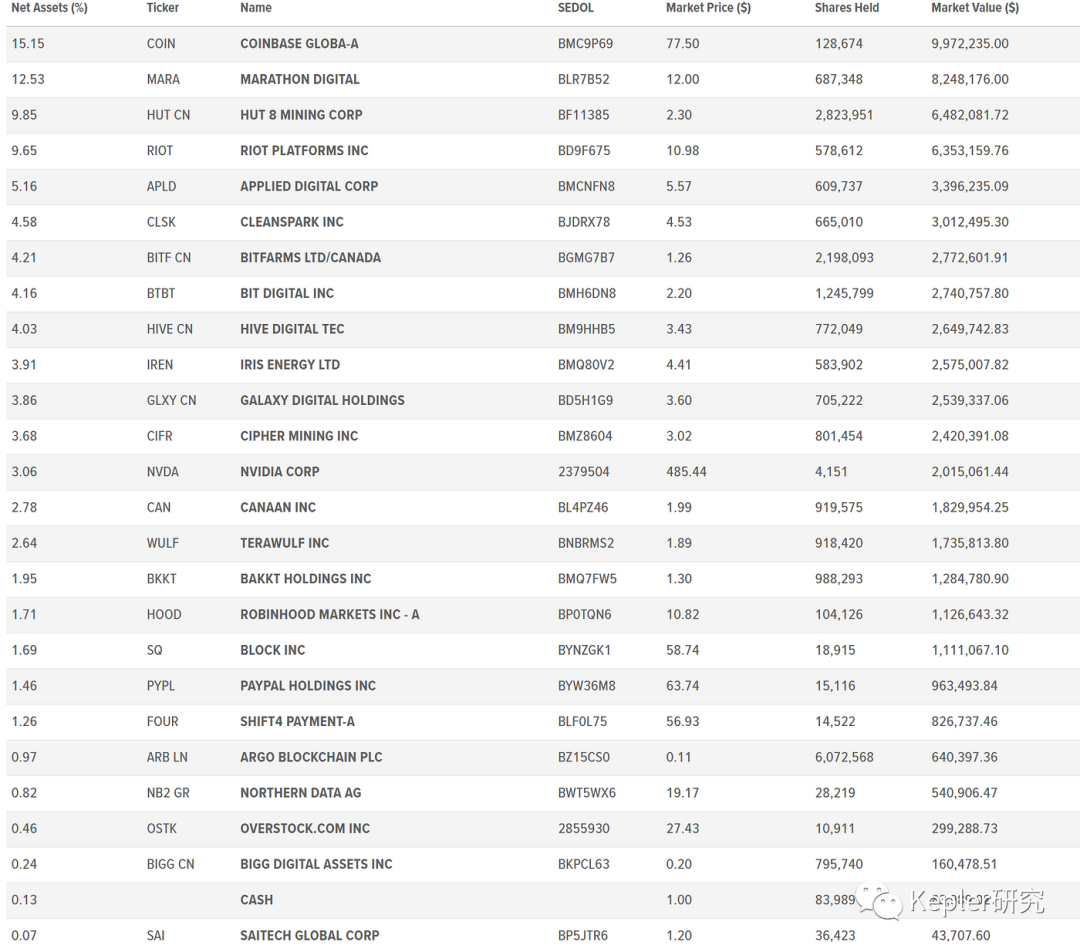

In general, it seeks to purchase a certain number of Bitcoin futures contracts to make the total nominal value of Bitcoin futures contracts held by the fund (i.e., the total value of Bitcoin futures contracts held by the fund) as close as possible to 100% of the net asset value of the fund. The current holdings are as follows:

WGMI

The Valkyrie Bitcoin Miners ETF is an actively managed exchange-traded fund that, as of February 2022, invests at least 80% of its net assets (plus borrowings for investment purposes) in securities of companies from which at least 50% of the income or profits come from Bitcoin mining operations and/or providing specialized chips, hardware, and software or other services to companies engaged in Bitcoin mining. The fund does not directly invest in Bitcoin, nor does it indirectly invest through the use of derivatives or by investing in funds or trusts that hold Bitcoin.

WGMI and BITQ are quite similar. Both have over 75% of their holdings in financial services stocks, but there are two differences: WGMI's net asset total is $24.09 million, while BITQ is five times that amount. Additionally, WGMI's investment categories also include the upstream industry of crypto mining, such as chips, hardware, and software.

This includes stocks of giant companies like NVIDIA and Samsung, but other categories have a relatively small holding, and the holdings of financial services companies are almost the same, so the trends of these two ETFs are almost identical.

WGMI & BITQ, D

XBTF

The Bitcoin Strategy ETF, trading under the symbol XBTF, was listed for trading on the Chicago Options Exchange in mid-November 2021 and is issued by VanEck. The VanEck Bitcoin Strategy ETF (XBTF) seeks capital appreciation through investments in Bitcoin futures contracts.

The fund is actively managed and provides Bitcoin-related investments through easily accessible exchange-traded tools. Similar to BITO, the fund does not directly invest in Bitcoin or other digital assets.

BKCH

The Global X Blockchain ETF (BKCH) seeks to invest in companies that can benefit from the increasing popularity of blockchain technology, including digital asset mining, blockchain and digital asset trading, blockchain applications, and companies in the hardware and digital asset fields. The current net assets of this ETF are $65.82 million, and the trend and holdings of BKCH are consistent with BITQ.

Holdings of BKCH

BITW

This investment aims to track a portfolio that follows the Bitwise 10 Large Cap Crypto Index and seeks to minimize investment analysis-related and management costs for each investor.

It provides a secure way to diversify investments in Bitcoin and leading cryptocurrencies. The fund aims to track an index composed of the top 10 cryptocurrencies by value, screen and monitor for certain risks, and is market-cap weighted, with monthly rebalancing.

Composition of Holdings

The Bitwise 10 Crypto Index Fund aims to reflect the overall performance of the cryptocurrency market. The fund's investment strategy is to track specific cryptocurrency indices, and its price is also influenced by the overall performance of the cryptocurrency market. If the cryptocurrency market rises overall, the price of BITW may rise; if the market falls, the price of BITW may fall.

BITW & BTC, D

BLCN

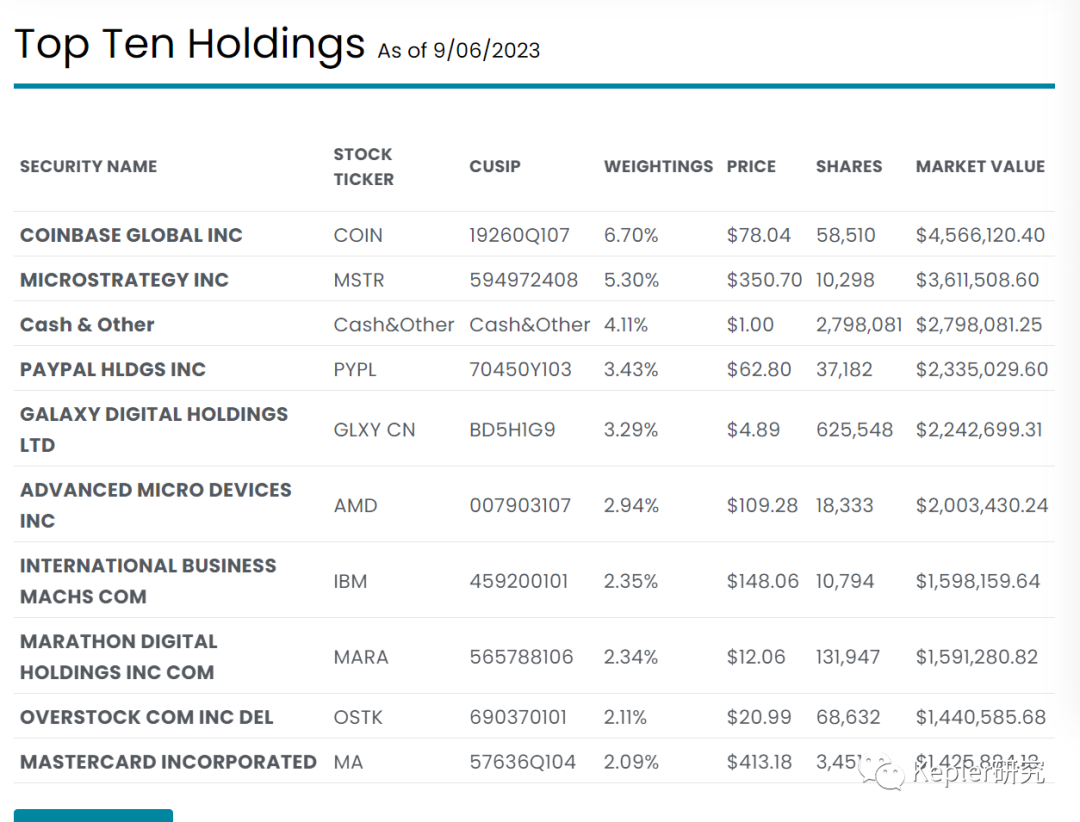

The Siren Nasdaq NexGen Economy ETF was established on January 17, 2018, with current net assets of $68,117,947. The top 10 holdings account for over 30% of the total assets.

The top three investment sectors are technology, finance, and communication. BLCN is also a global fund with assets in the United States, Japan, and China. Its largest holding is COIN, but the top ten holdings include stocks such as PYPL and ADM, making it more comprehensive. I believe it is more similar to WGMI.

From a price perspective, BLCN's overall trend is consistent with BTC, but the correlation is low. I believe this is because BLCN's holdings are more diversified, with financial services investments accounting for only 37.61% of net assets, while technology accounts for 44.19%, indicating that BTC has a stronger financial attribute.

BLCN & BTC, D

BLOK

The BLOK fund is an actively managed ETF established in January 2018, aiming to provide total returns that correspond to the performance of companies involved in the development and utilization of "transformative data sharing technology," by actively investing at least 80% of its net assets in company equity securities.

BLOK & BTC, D

FDIG

This investment aims to provide investment returns that correspond to the performance of the Fidelity Crypto Industry and Digital Payments IndexSM before fees and expenses. The fund typically invests at least 80% of its assets in equity securities included in the index and assets in depositary receipts representing securities included in the index.

The index aims to reflect the performance of companies globally engaged in cryptocurrency, related blockchain technology, and digital payment processing activities.

===

Summary:

Currently, the main types of ETFs in the market can be divided into two categories: those directly anchored to cryptocurrency spot or CME futures, and those holding stocks of companies related to cryptocurrencies, blockchain technology, and digital payment processing activities.

Futures and Spot Class

Overall, the ETFs BITW and ETHE show significant deviations from the trend of BTC spot. The main reason is that BITW tracks a cryptocurrency index of 10, reflecting the overall trend of the crypto market, while ETHE tracks the price trend of ETH futures. The correlation between these two and BTC is relatively low.

Therefore, investing in these ETFs is no different from investing in spot, but it is more compliant with regulations.

Futures and Spot Class & BTC

Stock Class

In the past year, ETFs in this category have shown a lackluster trend, with BLCN underperforming. As mentioned earlier, this is due to its overly diversified holdings, with financial services investments accounting for only 37.61% of net assets. Even if there is a difference in market value, the trends of several ETFs tend to be consistent, indicating that the overall trend of these ETFs also determines the trend of BTC.

Note: All content represents the author's personal views and is not investment advice. It should not be interpreted in any way as tax, accounting, legal, business, financial, or regulatory advice. Before making any investment decisions, you should seek independent legal and financial advice, including advice on tax consequences.

For more content, follow: Public Account KeplerResearch Twitter @kepler008

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。