Author: PSE Trading Trader @Christine

Market Reaction: Shocked???

Last week, the market was like being hit by a heavy hammer when it heard Powell's hawkish remarks, instantly dropping by 2%. This plot twist was actually within expectations. Powell talked extensively on stage about lowering inflation, strong growth, and his firm commitment to maintaining high interest rates to control inflation risk. Of course, in the short term, the dialogue on high interest rates may make the stock character feel panicked, but the script adjustment in the Summary of Economic Projections (SEP) may bring a mid-term surprise to the stock market. The market's initial reaction, like the audience's gasp, was an increase in interest rates and a drop in stocks.

Powell's View: "Soft Landing" Should Not Be the Baseline Expectation

Powell: "I have always thought that a soft landing is a possible outcome… Ultimately, this may be determined by factors beyond our control, but I think it is possible."

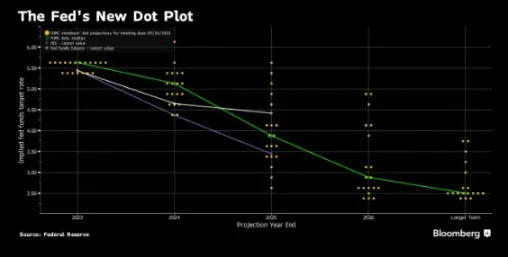

Dot Plot Trends and Economic Forecasts

The Federal Open Market Committee (FOMC) maintained its 2024 core PCE forecast at 2.6%, revised 2023 to 3.78%, and raised its actual GDP expectation from 1.1% to 1.5%. This combination of a "soft landing" basically aligns with investors' expectations and is seen as a mid-term positive for stocks. The FOMC has left open the possibility of a rate hike for the remainder of 2023 and raised the 2024 median point to 5.1%, while keeping the long-term point at 2.5%. The upward movement of the dot plot has formed a slight balance for positive growth revisions.

Powell's Press Conference and the Federal Funds Rate

The federal funds rate remains rock solid, but the odds of a rate hike in November have jumped from 25% before the meeting to 35%. The market's mood is like being on a roller coaster, worried about the prospects for long-term interest rates. At the press conference, Chairman Powell seemed to be performing a high-wire balancing act, emphasizing the importance of data on one hand and maintaining policy flexibility on the other, undoubtedly pouring cold water on the hawkish information brought by the dot plot. Nevertheless, the basic expectation remains moderately optimistic, with long-term investments in growth/technology still being the market's favorite.

Good Luck Closing: The Battle Between Risks and the Market

If Congress does not pull itself together, the U.S. government may face a "good luck closing" crisis on September 30. Recent dynamics, such as the House's failure to vote on a continuing resolution (CR) and the rejection of the motion to advance the defense spending bill, have made the shadow of this crisis even heavier. Although from a macro perspective, a government shutdown may pose limited risks to the overall economy in the short term, stocks highly dependent on government spending may feel a chill.

BTC: Still Bullish Despite the Bear Market?

Despite the hawkish information flying everywhere, I still have a positive view of the market. After the market recovers from the "shock," investors will surely bounce back and focus on positive economic data:

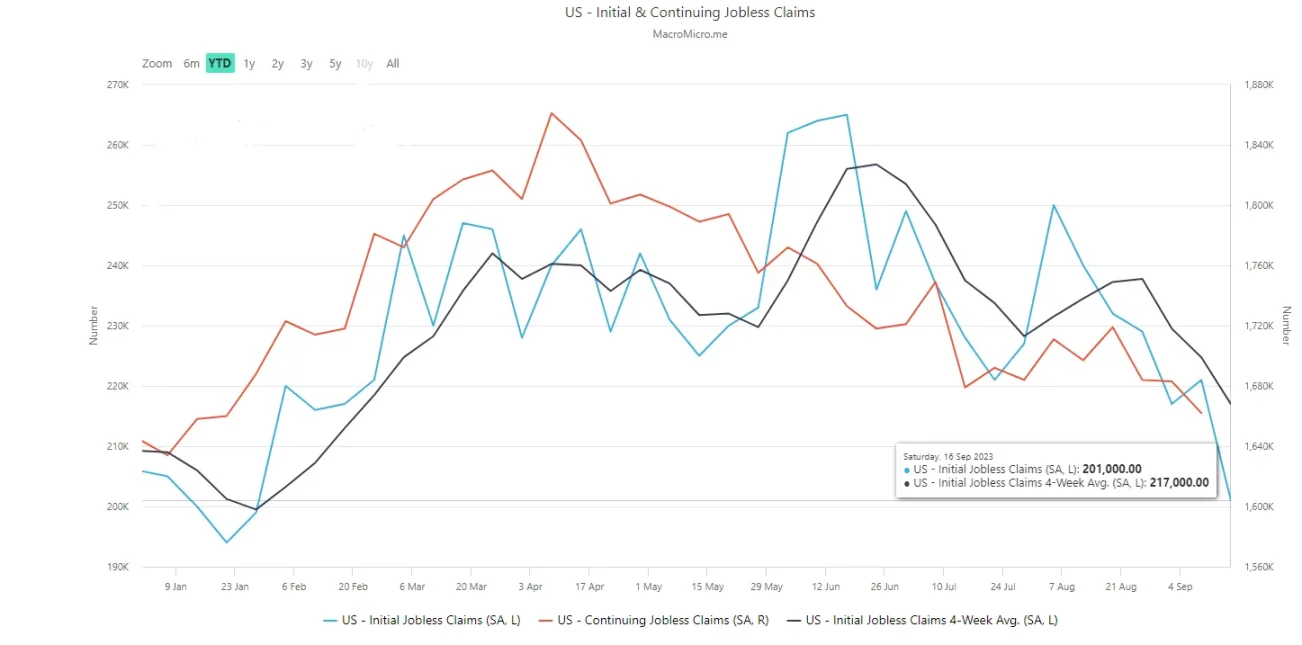

U.S. Initial Jobless Claims Drop to 201K, Lowest Level Since January

Surprisingly, the number of initial jobless claims for the week ending September 16 actually decreased, rather than the slight increase expected by everyone. They dropped from 221k to 201k. The four-week average also declined. Even more encouraging, the number of continuing claims for unemployment benefits dropped from 1683k to 1662k for the week ending September 9. When looking at the data for each state, it is found that only 14 states had an increase in seasonally adjusted initial claims. This decrease in initial claims is the lowest level we have seen since the beginning of the year, truly highlighting the strength and tightness of the current job market. This indicates that we may see robust job growth, which may further push down the unemployment rate.

Economic Activity: Still Strong

Last week's economic data shows that actual economic activity remains strong. Retail sales data exceeded expectations, the Purchasing Managers' Index (PMI) report was robust, and weekly jobless claims remained low, indicating a healthy economy and no increase in layoffs. In terms of inflation, there are no signs of economic weakness, although inflation is slightly higher than expected, it is not high enough to prompt the Federal Reserve to raise rates at the recent Federal Open Market Committee (FOMC) meeting.

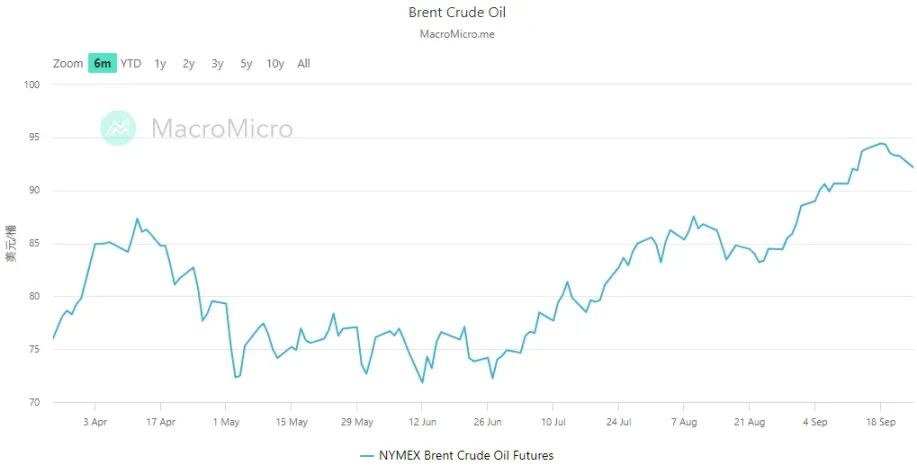

Oil Prices and Inflation: Impact on the Economy

The surge in oil prices is causing gasoline prices to rise, which will undoubtedly hit consumption. However, since the U.S. is now a major oil-producing country and is basically energy independent, there are winners to balance out the losers. Economic bears are focusing on these price increases and see higher oil prices pushing the total inflation rate in August to +0.6%, while the core inflation rate is only +0.2%. Despite concerns about the Fed and inflation, the market's direction and narrative are more focused on the strong economic and corporate profit outlook for the next six months.

Some Risks: Strikes, Shutdowns, and Market Volatility

The strike by the United Auto Workers may last longer than expected, and the upcoming government shutdown in October may moderately impact the economy.

However, the market is ignoring the chaos and political posturing from Washington and maintaining its positive momentum, which may tend to rise before the end of the year. The performance of tech stocks remains strong until their earnings disappoint, and the successful IPO of Arm Holdings last week shows a healthy restart of the IPO market and continued demand for risk.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。