Today's Headlines:

- Hong Kong Police: JPEX Case Suspected of Conspiring to Defraud, Involved Amount Reaches 1.2 Billion Hong Kong Dollars

- Qiu Dagen: Hong Kong Parliament Conducting Second Round of Consultation on Stablecoins, Hopes to Announce Regulatory Conditions by Mid Next Year

- Circle's Native USDC Officially Launches on the Polkadot Network

- Citi Group Launches Token Services, Ventures into the Digital Asset Field

- Optimism Begins Third Round of Airdrops, Distributing 19 Million OP Tokens to Over 31,000 Addresses

- Polygon zkEVM Mainnet Test Version to Undergo Dragonfruit Upgrade on September 20

- Cryptocurrency Startup Bastion Completes $25 Million Financing, Led by a16z crypto

- Blockchain Capital Raises $580 Million for Two New Crypto Funds

Regulatory News

Binance.US Again Refuses to Provide Business Operation-Related Documents to SEC

According to CoinDesk, documents submitted to the court on Monday showed that BAM Trading, the entity behind Binance.US, once again refused to provide the SEC with the requested documents related to its business operations. BAM Trading's lawyers stated in the documents that the SEC's requests for documents were "overly broad" or too burdensome, causing too much inconvenience to the exchange. The SEC had previously requested BAM to provide a series of documents, including records of the company's handling of customer assets, proof of reserves, and a statement of overall financial condition, among others. One request related to the exchange's alleged use of a custody service called Ceffu to transfer funds of U.S. customers abroad. The SEC claimed that these requests were intentionally ignored by Binance.US.

According to another court document, the SEC has urged the Washington, D.C. court to approve an investigation into the issue of Binance.US's asset custody. The SEC reiterated its concerns about Binance's use of the custody platform Ceffu, stating that the investigation results so far indicate an "urgent need for examination." The SEC claimed that "Cefu" is an entity of Binance, not just a digital asset wallet provider. The SEC stated that Ceffu, formerly known as Binance Custody earlier this year, may also provide services to Binance.US, and thus be used to transfer funds of U.S. customers out of the country, which violates previous agreements.

At a subsequent hearing, Judge Zia Faruqui of the U.S. District Court for the District of Columbia did not make any rulings on the SEC's request for evidence disclosure or Binance.US's opposition, but encouraged both parties to handle various requests for evidence discovery together. The SEC and BAM agreed to hold a hearing on October 12 and to submit a joint status report by October 10.

Federal Reserve to Announce September Interest Rate Decision Early on September 21 According to First Financial, the Federal Reserve will announce the September interest rate decision at 2:00 a.m. Beijing time on September 21, and Fed Chairman Powell will hold a press conference at 2:30 on the same day.

Qiu Dagen: Hong Kong Parliament Conducting Second Round of Consultation on Stablecoins, Hopes to Announce Regulatory Conditions by Mid Next Year At the 9th Global Blockchain Summit of the 2023 Shanghai Blockchain International Week, Qiu Dagen, a member of the Legislative Council of the Hong Kong Special Administrative Region, delivered a keynote speech titled "Prudently Promoting the Sustainable Development of Web3 in Hong Kong." Qiu Dagen stated that after the issuance of licenses to virtual asset service providers in Hong Kong on June 1, the next step of work will be to discuss what types of products can be bought and sold, develop innovative products, who can buy these products, and who cannot. These will be distinguished according to professional investors and retail investors. The parliament is currently conducting a second round of consultation on stablecoins, hoping that by the middle of next year, Hong Kong's regulatory conditions for stablecoins will be announced, allowing stablecoin participants to issue stablecoins in Hong Kong at that time.

Qiu Dagen mentioned his advice to the Chief Executive of Hong Kong last month at the conference, including tokenization, digital Hong Kong dollars, and stablecoins. He hopes that the policies proposed can make Hong Kong a center for digital assets.

Hong Kong Police: JPEX Case Suspected of Conspiring to Defraud, Involved Amount Reaches 1.2 Billion Hong Kong Dollars At a briefing on the JPEX virtual asset trading platform case, Senior Superintendent Kong Hing-fai of the Commercial Crime Bureau of the Hong Kong Police Force stated that the JPEX case is suspected of conspiring to defraud, using advertisements, social media, and different platforms, actively promoting the platform's services and products to the public, touting "low risk and high returns," thereby attracting investors. The police attach great importance to this case and have set up a hotline urging suspected victims to report as soon as possible. As of midnight last night, the police had received 1,641 reports, involving an amount of 1.2 billion Hong Kong dollars. After the Securities and Futures Commission issued a warning, JPEX still raised the withdrawal limit to 999 USDT, making it impossible for users to withdraw funds. Yesterday, the police arrested 8 people, including the owners and managers of over-the-counter trading exchange shops.

Later in the day, the Hong Kong Securities and Futures Commission stated that JPEX's actions have escalated and therefore issued a warning, stating that the "application for a license list" is not suitable for public disclosure. The Hong Kong police superintendent stated that JPEX almost controls all user assets and its platform token is worthless, and arbitrarily adjusts the withdrawal limit. The acting inspector of Hong Kong stated that more arrests are not ruled out in the JPEX case, and intends to confiscate 67 million Hong Kong dollars of suspicious criminal proceeds.

NFT

According to Cryptoslate, at least three NFT markets have restricted the trading of the NFT series "Stoner Cats." Each market has taken different approaches to restrict Stoner Cats. OpenSea and Blur continue to display items from the series, but they prevent trading by hiding listings and offers on individual NFT pages. An OpenSea spokesperson confirmed that Stoner Cats cannot be bought, sold, or transferred on the platform, but stated that the series has not been delisted or removed.

In addition, Rarible has hidden the entire collection of Stoner Cats. The website stated that the collection has been "removed from public view." Rarible assured users that they still own the related NFTs; like most NFTs, these items can freely circulate on the blockchain or be traded on other compatible markets. In response to this, Rarible stated that, "based on its market monitoring of recent events," the company has blocked access to Stoner Cats.

This project was organized by American actress Mila Kunis, who also voiced a character in the animated web series accompanying the NFT series. Regulatory action may be a direct or indirect factor behind the decline of this series of NFTs. On September 13, the U.S. Securities and Exchange Commission (SEC) charged the parent company of Stoner Cats with violating securities regulations and announced that the company had paid a $1 million settlement.

Project Updates

According to the Circle official blog, Polkadot USDC is now available for developers and users on the Polkadot network. Circle accounts and the Circle API can easily access Polkadot USDC and transfer it to parallel chains in Polkadot through the XCM protocol. It supports 24/7 trading and lending on parallel chains such as Centrifuge, HydraDX, and Moonbeam.

According to Bloomberg, Citi Group has launched token services as part of a broader push to offer digital assets to institutional clients. The new product converts client deposits into digital tokens and is provided by the company's Treasury and Trade Solutions division, which has been focused on using this service to enhance cash management and trade finance capabilities.

The statement mentioned that for Citi Group's new product, the company will rely on a private blockchain owned and managed by the bank. Customers do not need to set up their own digital wallets but can access the service through the bank's existing systems.

According to official information, Optimism announced the start of the third round of airdrops. 19 million OP tokens will be distributed to over 31,000 unique addresses. The airdrop began at 4:10 a.m. Beijing time on September 19, and the tokens will be directly distributed to addresses that delegated their OP voting rights between January 20, 2023, and July 20, 2023. This airdrop does not require claiming and will be sent directly to eligible addresses. The official reminder advises not to interact with any websites claiming to distribute the third round of airdrops.

According to official information, the Polygon zkEVM mainnet test version will undergo the Dragonfruit upgrade at 3:30 p.m. Beijing time on September 20, with an expected duration of about 2 hours. Once the upgrade is completed, the Polygon zkEVM mainnet test version will remain in sync with the latest version of Solidity. During the upgrade, the network will still be available, but a downtime of approximately 2 minutes is expected to facilitate the restart of the sequencer. In addition, the Polygon zkEVM cross-chain bridge will be temporarily unavailable from 3:30 p.m. to 5 p.m.

According to the official X account, the Web3 social app Tip Coin announced the opening of token claiming for TIP and the launch of DEX liquidity early this morning. The TIP token claim page experienced downtime within a few minutes of going live, and the official announcement of the page being fixed was made at 1:49 a.m.

However, as per PANews' observation, the claim page is currently experiencing issues again, displaying "page not found" upon opening, and the official statement regarding this is yet to be released.

According to The Block, the Cosmos ecosystem Layer 1 public chain Canto will migrate to Ethereum and transition to using Ethereum Layer 2 with zero-knowledge proofs. Canto is working with Ethereum scaling development company Polygon to achieve this, using the Polygon Chain Development Kit (CDK) to support the new design, with a focus on RWA assets. Canto stated, "Polygon CDK provides Canto with a powerful suite to offer ZK L2, extending the community's permissionless sovereignty, security, and liquidity as a public good."

At the 9th Global Blockchain Summit of the 2023 Shanghai Blockchain International Week, Joseph Chan, CEO of Cyberport Management Company Limited, delivered a keynote speech titled "Grasping the New Forces of the Web3 Era." Joseph Chan stated that 2023 is not only the 20th anniversary of Cyberport but also the first year of Web3 in Hong Kong. He also mentioned that Cyberport is collaborating with HSBC in September to test the general consumption of digital Hong Kong dollars at Cyberport. Now, in designated Cyberport cafes and Hong Kong-style tea restaurants, digital Hong Kong dollars can be used to purchase coffee and snacks.

In addition, Joseph Chan stated that Cyberport currently has over 190 Web3 companies, and the number is still increasing, covering various fields including foundational blockchain infrastructure companies, fintech, and digital entertainment. Cyberport's Web3 base focuses on talent cultivation, industry development, and public awareness.

Regarding the current situation of Web3 funds in Hong Kong, Joseph Chan stated, "During this period, we have close ties with over 40 funds specializing in Web3, and their assets or funds add up to $4 billion."

According to CoinDesk, the bankrupt cryptocurrency exchange FTX has filed a lawsuit against the parents of founder Sam Bankman-Fried (SBF), Joseph Bankman and Barbara Fried, to "recover tens of millions of dollars of fraudulently transferred and misappropriated funds." The amended complaint seeks court determination for damages from FTX's bankruptcy, the return of any property or payments previously provided to SBF's parents, and punitive damages for "intentional, willful, wanton, and malicious conduct." It is noted that SBF's parents, Joseph Bankman and Barbara Fried, are both professors at Stanford Law School.

The complaint states that "FTX Trading paid Blue Water, owned by Joseph Bankman and Barbara Fried, a total of $18,914,327.82, including taxes, fees, and costs, as well as various expenses related to Blue Water, totaling over $90,000. Joseph Bankman's mastery of tax law and unique understanding of FTX Group's convoluted corporate structure allowed him to conveniently transfer a total of $10 million in cash gifts, composed of funds from Alameda Ltd., to himself and Barbara Fried. Leveraging their decades of experience and legitimacy as law professors, they did not seek to help FTX Group but to plunder it for their own enrichment and for causes they favored. Joseph Bankman helped dissipate FTX Group's funds in donations and helped cover up a whistleblower complaint from September 2019. At the explicit request of Barbara Fried, FTX Group donated tens of millions of dollars to SBF's political donation strategy MTG or causes supported by MTG."

Injective Collaborates with Caldera to Launch inEVM Testnet, Mainnet Deployment Planned for Q4

According to The Block, Injective, a Cosmos-based Layer 1 blockchain, has collaborated with the customizable rollup project Caldera to launch its Layer 2 solution, inEVM, on the testnet. This allows Ethereum applications to run natively within the Injective ecosystem. The inEVM, compatible with the Ethereum Virtual Machine, will enable Ethereum developers to deploy their applications on Injective, such as decentralized exchanges, without the need to change the code. The inEVM testnet was officially launched today, and the mainnet deployment is planned for the fourth quarter.

Binance founder Zhao Changpeng stated in an internal event, "Although many people have been talking about the departure of many senior management personnel from Binance recently, many people have joined Binance, and we have added about six to seven hundred people in the past few months. We hope to attract more talent to join this industry or join Binance. Decentralization may be a very important core in the future. We are under too much pressure now because of centralization."

Aave Community Proposal to "Increase GHO Borrowing Rate to 2.5%" Approved

Funding News

Crypto Startup Bastion Completes $25 Million Funding Round, Led by a16z crypto

According to Bloomberg, cryptocurrency startup Bastion has completed a $25 million seed funding round, led by a16z crypto, with participation from Laser Digital Ventures under the Nomura Group, Robot Ventures, Not Boring Capital, and others. Bastion provides cryptocurrency custody and other services. The company's initial employees include regulatory and compliance executives from cryptocurrency exchanges such as Kraken.

Bastion founders Riyaz Faizullabhoy and Nassim Eddequiouaq (formerly Chief Technology Officer and Chief Security Officer at a16z crypto, respectively) worked in Meta's blockchain security infrastructure department for two years before joining a16z Crypto.

Blockchain Capital Raises $580 Million for Two New Crypto Funds

San Francisco-based venture capital firm Blockchain Capital has raised $580 million for two new cryptocurrency investment funds. Established in 2013, the company announced the launch of its sixth early-stage fund and its first opportunity fund, raising a total of $580 million. Payment giant Visa is one of the funding providers. Visa and PayPal also invested in Blockchain Capital's fifth $300 million fund, which concluded in 2021.

According to today's announcement, the company has a particular focus on investing in cryptocurrency startups in the infrastructure, gaming, DeFi, consumer, and social sectors. The company also noted that the industry's volatility over the past year or two "has exposed the dangers of short-term thinking, leading many to misjudge this emerging technology."

Key Data

Total Market Value of Stablecoins Declines for 18 Consecutive Months, Shrinking by 10% This Year

According to Reuters, research firm CCData stated that while the entire crypto ecosystem has rebounded from its 2022 low, the market value of stablecoins is set to decline for 18 consecutive months (including this month). As of September 14, this figure has shrunk by nearly one-tenth this year, to $124.4 billion (approximately $123.7 billion as of today).

After falling below $80 billion in the first three months of this year, the market value of USDT reached a historic high of $83.8 billion in July, and has since dropped to around $82.9 billion. Paolo Ardoino, Chief Technology Officer of Tether, stated that the value of USDT is supported by its popularity in certain regions, and Tether's stickiness among users is due to the fact that the entire emerging market, most of Central and South America, and Central Asia essentially operate on Tether.

The market value of USDC has declined by over 53% from its historic high in June last year, and currently hovers above $26 billion. Dante Disparte, Chief Strategy Officer and Global Head of Policy at Circle, stated that the collapse of Silicon Valley banks and banks in other regions earlier this year continues to bring uncertainty to the market, although he emphasized that growth is not the only measure of the company's success. He stated, "The U.S. has experienced some temporary de-risking, but this is not the result of regulatory ambiguity. This is more the result of the lingering effects of the banking crisis. I think even so, we will begin to see some adjustments in the market."

PANews APP Points Mall Officially Launched

Free redemption of hardcore prizes: imKeyPro hardware wallet, First Class Cabin Research Report Monthly Card, Ballet REAL series wallet, AICoin membership, various peripherals, and hundreds of selected research report collections, first come, first served, experience now!

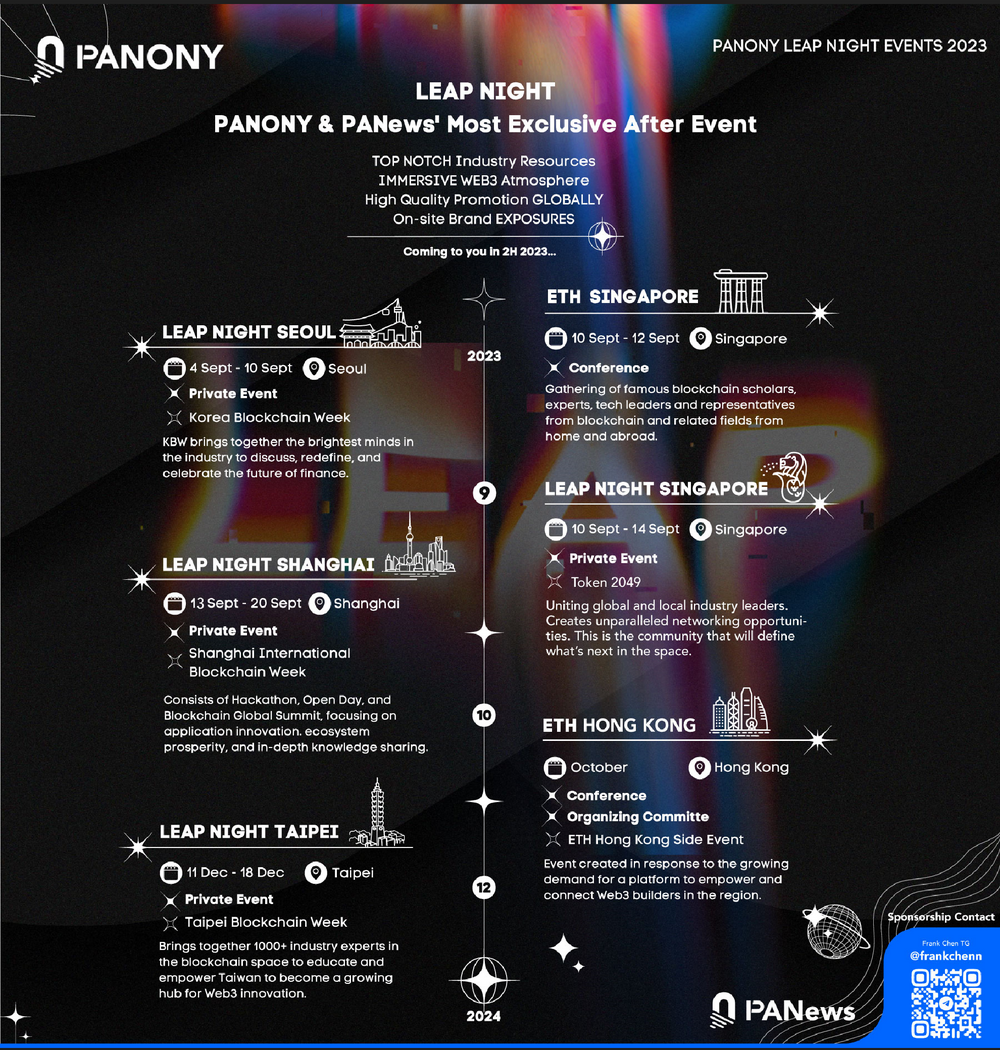

PANews Launches Global LEAP Tour!

Korea, Singapore, Shanghai, Taipei, multiple locations will come together from September to December to witness a new chapter in globalization!

?Events in multiple locations are being jointly organized, welcome to communicate!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。