Author | Callum@Web3CN.Pro

In January 2023, Bitcoin Ordinals (Ordinal Numbers) was launched, allowing information to be added to individual satoshis through "inscriptions" to create Bitcoin NFTs. This protocol allows text, images, and videos to be placed on the Bitcoin blockchain, something that previously only occurred on blockchains with smart contracts can now be achieved on the Bitcoin network.

Subsequently, Domo created the BRC-20 token standard based on the Ordinals protocol, which is a new experiment for creating and transferring tokens by publishing text on Satoshi. The standard gained momentum in April, and with the increasing number of BRC-20 tokens, transaction fees on the Bitcoin chain rose. At its peak, the Bitcoin network even experienced over 500,000 pending transactions.

As BRC-20 tokens became more popular, their value also increased. ORDI was the first token in the BRC-20 standard, with an initial price of $0.1, reaching a peak of 310 times to $31, with a market valuation of approximately $650 million. The establishment of the BRC-20 standard rekindled people's interest in Bitcoin, and with the explosion of the BRC-20 concept, various token standards emerged one after another. Two of the more noteworthy ones are ORC-20 and SRC-20. During the Token2049 event in Singapore in 2023, discussions on these experiments were specifically held at the Ordinals summit hosted by Birthday Research.

Why have these innovative experiments appeared on the Bitcoin network, and what potential do the development of these token standards bring to the future development of the Bitcoin network? In the article "Targeting the Next Bull Market Opportunity: Ordinals Ecosystem," we have already discussed in detail the concepts related to the Ordinals protocol and the development history of the BRC-20 token standard, as well as introduced related projects, tokens, and token platforms. In this article, we will discuss the development of token standards after BRC-20, and the impact of these "X"RC-20 token standards on the future development of the Bitcoin blockchain.

ORC-20

ORC-20, like BRC-20, is a token standard that operates on the Bitcoin blockchain. It is encoded as a JSON (JavaScript Object Notation) file and recorded on Satoshi as a serial number. ORC-20 is an upgraded version of the BRC-20 standard, addressing some of its shortcomings.

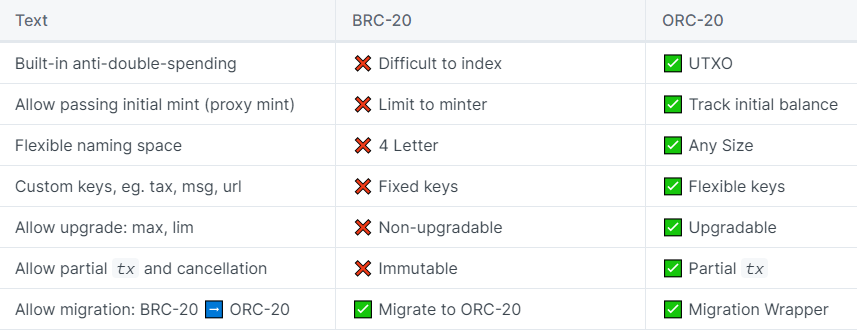

Although BRC-20 can create tokens on the Bitcoin network using the Ordinals protocol, as a very early project, BRC-20 still has many shortcomings: firstly, the BRC-20 standard sets the token supply and maximum minting amount as unchangeable, resulting in poor model flexibility and limiting the development of tokens; secondly, token naming is limited to four digits; finally, the transfer and accounting of BRC-20 tokens rely entirely on external centralized indexers. Since the inscription process itself only writes random data into Sat, the consensus-level Bitcoin network cannot prevent inscriptions that violate the BRC-20 standard. In other words, additional minting of non-BRC-20 standards will also be recorded, leading to hackers conducting double-spending attacks on BRC-20 tokens, resulting in economic losses.

To address these issues, the ORC20 standard emerged. ORC-20 is also an open standard introduced by OrcDAO, aimed at enhancing the functionality of Ordinals tokens on the Bitcoin network to improve the existing BRC-20. ORC-20 removes the token naming restrictions, adds token upgrade capabilities, allowing project parties to empower tokens further. It also adds advanced features such as setting royalties, setting whitelists, and more. ORC-20 is backward compatible with BRC-20 and improves adaptability, scalability, and security, eliminating the possibility of double spending.

Ensure no double spending during transactions through the UTXO model of ORC-20, addressing the double spending issue of BRC-20 (when a transaction is sent, the balance is also sent to the change address).

Can change the initial supply and maximum minting amount, making the coin issuance more flexible.

Resolves the four-letter naming limitation of BRC-20; ORC-20 can use names of any size.

Customizable, such as transaction taxes, royalties, special minting addresses, token images, token IDs, and token information URLs.

Allows deployers to upgrade ORC-20.

Allows cancellation of transactions using "op": "cancel" to cancel nonce transactions.

Allows previously deployed BRC-20 coins to be transferred to ORC-20. Only deployers of BRC-20 can operate transfer commands.

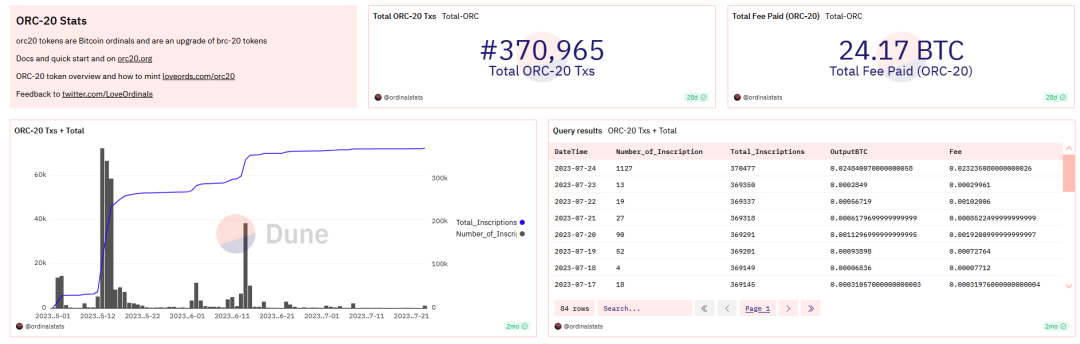

However, due to the incomplete development of the infrastructure for ORC20 and the concentration of wealth still on BRC20, ORC20 currently receives very limited attention. Since its launch in May, the total transaction volume involving ORC-20 is approximately 370,000 transactions, with fees totaling about 24.17 BTC.

It is also important to note that, according to the official description, ORC-20, like BRC-20, is an experimental project and cannot guarantee that tokens created using this standard will have any value or utility. Currently, only the first deployed project ORC is worth paying attention to.

Summary of Common Tools for ORC-20:

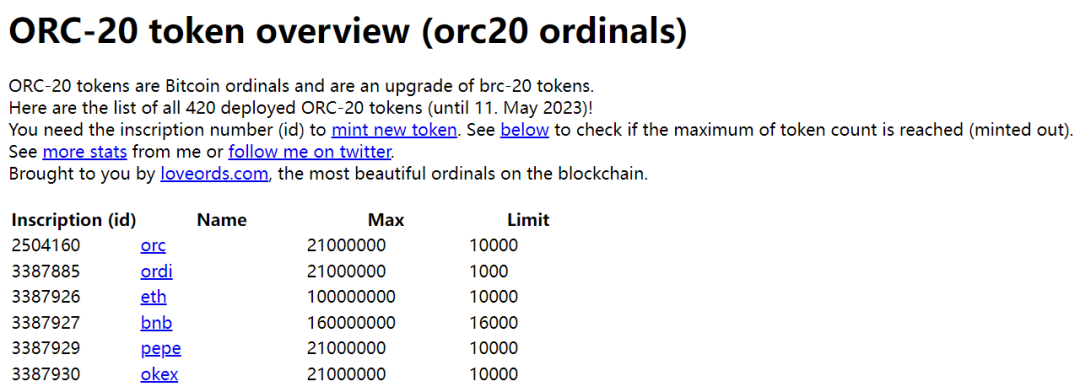

ORC-20 Token List: https://loveords.com/orc20

Minting Tool: http://unisat.io/inscribe

Statistics: http://https://dune.com/ordinalstats/orc-20

SRC20

While ORC-20 addresses some of the shortcomings of BRC-20, it still uses JSON files and does not solve the centralization issue of BRC-20. Moreover, the appearance of ORC-20 has made the token issuance process of BRC-20 more complicated, making it less convenient for widespread use. At the same time, the emergence of ORC-20 seems more like an emotional product of BRC-20 and has not brought particularly outstanding technological iterations, leading to the appearance of similar competitors such as SRC-20 at the same time.

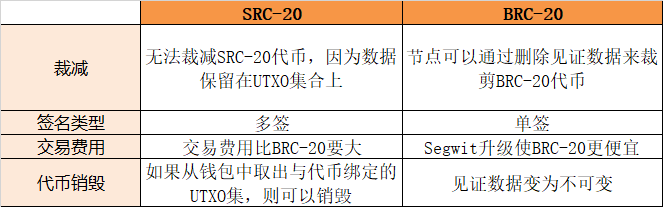

Unlike BRC-20 and ORC-20, which are based on the Ordinals theory, SRC-20 uses Bitcoin Stamps to inscribe text. Bitcoin Stamps are similar to ERC-1155 semi-fungible tokens or digital collectibles, and they are directly stored on the unspent transaction outputs (UTXO) of Bitcoin—records of bitcoins that have not been used in transactions between two addresses—rather than being stored in the witness data as in Ordinals. This difference results in an important feature of Stamps, which can exist on the Bitcoin chain forever, and full nodes must synchronize this data, enhancing data immutability. Similar to BRC-20, the text used for deploying, minting, and transferring SRC-20 tokens is also in JSON format.

The minting of Bitcoin Stamps is based on the Counterparty protocol, an open-source P2P protocol established on the Bitcoin blockchain in 2014. Users burn BTC to obtain the Counterparty (XCP) native tokens they pay when executing smart contracts.

To store up to 80 bytes of data, the protocol uses the "OP_Return" function. If the file is larger than 80 bytes, the data will be stored across multiple outputs in a multi-signature.

To mint Bitcoin tokens, Counterparty converts images into text and encodes them as Base64 files, attaching "Stamp:" before the text. Then, the protocol broadcasts the encoded file to the Bitcoin network, where the file is isolated, verified, and recompiled to restore the original image.

The main controversies in the market regarding Bitcoin Stamps include discussions on immutability and the bloated UTXO set. When comparing Bitcoin Stamps with Ordinals, because image data is stored in Bitcoin's UTXO rather than its witness data, the trimmability of Bitcoin Stamps is poor. Discussions about the inflation of the UTXO set mainly revolve around the uncertainty of increasing hardware requirements for users running Bitcoin nodes.

In addition, there is a general disagreement among members of the Bitcoin community about using block space for digital artwork. The debate about how increasing block sizes and increasing settlement transactions on the chain could put the network in trouble, leading to increased transaction fees, has always existed. Some community members propose increasing block sizes, but many believe that this would make the network more vulnerable to attacks and increase the cost of miners due to increased data storage requirements.

For investors, the most important factor is whether the project has investment value. As cryptocurrencies gradually integrate with traditional finance, the profitability of a project depends on two key factors: hot money and cash flow. Hot money determines whether a project has enough funds for development, and cash flow determines whether the project can be profitable. Hot money is the primary factor because it generates FOMO and attracts a large number of retail investors to invest excessive funds in the project, resulting in an increase in the project's book value and token price.

Currently, the largest token on the BRC-20 platform is Ordi, with a market value of $65 million as of September 13, 2023. The BRC-20 trading platform Unisat is valued at $1 billion. The main source of hot money is OKX's acquisition of Unisat, giving them a significant first-mover advantage. Since there is currently no market support for SRC20, the only way to trade is through OTC trading, indicating that SRC-20 still needs significant support. Therefore, the project mainly attracts retail investors who missed the opportunity of the BRC-20 Ordi token. Due to the limited influx of hot money, cautious observation is still necessary. Although Binance has investigated SRC-20, it has not taken substantial financial measures like OKX did with BRC-20, and the market still leans towards BRC-20.

Summary of Common Tools for SRC-20:

BitcoinStamps Information: https://stampchain.io/

SRC-20 Token Information: https://stampsrc.github.io/

Minting, Deployment, and Transfer of SRC-20 Tokens: https://stampchain.io/src20/

Note: Due to the high latency of SRC-20 and the inundation of non-digital assets with the Counterparty protocol, the Stampchain team has temporarily suspended new minting.

Impact of “X”RC-20 Experiment on the Bitcoin Network

As we have seen before, the development of BRC-20 tokens has already had a significant impact on the Bitcoin network. While these tokens have attracted most of the Bitcoin community, they have caused the Bitcoin blockchain to stall multiple times. For a long time, there were over 500,000 transactions waiting to be processed on the network, with transaction fees exceeding $30. Although the mining and validating community has benefited greatly, such events have raised concerns among Bitcoin community members, who generally believe that BRC-20 tokens have had a negative impact on Bitcoin:

BRC-20 tokens have congested the Bitcoin network: With the addition of BRC-20 tokens, the transaction data for these tokens must now be stored on all Bitcoin blocks.

BRC-20 tokens have undermined the credibility of Bitcoin: Many other cryptocurrencies have lost credibility due to a large number of scams on their blockchains, and Bitcoin does not have to deal with negative news about fraudulent projects on its blockchain. Although Bitcoin is currently not associated with any BRC-20 projects, it may be affected by this in the future.

BRC-20 tokens lack utility: The biggest problem with BRC-20 tokens is that they lack utility. ERC-20 tokens and ERC-721 tokens at least have some functionality because they are compatible with smart contracts. BRC-20 tokens do not have smart contract compatibility, so they have little use beyond creating tokens on the Bitcoin network.

BRC-20-like tokens have become very popular in a short period of time. This growth is largely due to the high gas fees on Ethereum, which have made it difficult for many investors to buy meme coins on Ethereum, leading them to flock to the Bitcoin chain. It is difficult to say whether BRC-20-like tokens are a fad or true game-changers in the cryptocurrency space. The biggest obstacle they must overcome is the lack of smart contract functionality. BRC-20-like tokens currently have something more important than smart contracts—memes. In other words, BRC-20 tokens have broad support because they are based on a blockchain with widespread recognition, and considering this, BRC-20 tokens are likely to become part of Bitcoin.

In the long run, the rapid rise of BRC-20 tokens may attract a large number of investors who have not previously interacted with cryptocurrencies to turn to Bitcoin, which could have a positive impact on Bitcoin. We have seen the progress of BRC-20 token development in the months following its launch. As token standards have the functionality needed to promote emerging ecosystems (deployment, minting, and transfer) and interoperability with other blockchain systems and digital assets, future developments may also allow these experimental tokens to interact with Ethereum smart contracts, be used as collateral for DeFi platforms, or be incorporated into dApps.

Perhaps we just need some time to enter the next phase. For crypto enthusiasts with faith, this is an opportunity to explore the emerging field of Web3, which may become an important part of the future decentralized economy.

References

https://blog.ordzaar.com/token-standards-uncovered-unraveling-brc-20-src-20-drc-20-and-orc-20-c8024868c61

https://medium.com/fourpillars/orc-20-src-20-the-experiment-continues-f9dba00cc6b6

https://cointelegraph.com/learn/what-is-the-src-20-token-standard

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。