Authors: Mustafa Bedawala, Arjuna Wijeyekoon

Compiled by: Babywhale, Foresight News

The blockchain network has long been considered as an innovative payment infrastructure. Over the years, they have been striving to scale to support the secure, high throughput, and low-cost transactions required by payment companies and expected by consumers. Over the past year, the Visa team has closely monitored the technological innovations behind blockchain scalability and is pleased with the significant progress made on Layer 2 networks built on Ethereum and alternative blockchain networks. Our goal is to deeply understand the technical characteristics of blockchain networks and attempt to leverage them to enhance our existing network and build new products for commercial and fund flows.

While we believe that there may be multiple blockchain networks in the payment ecosystem, we see Solana as having the potential to become one of the networks driving mainstream payment flows. With its high speed, scalability, and low transaction costs, Solana has a broad outlook in payments, making it a prime candidate for an efficient blockchain settlement network using stablecoins such as USDC. Solana incorporates many key features and novel innovations that are worth exploring for anyone interested in payment technology.

Visa-scale Transaction Throughput

As a global payment network, Visa can process over 65,000 transactions per second. While Solana has not yet reached Visa's processing efficiency, it can handle an average of 400 user-generated transactions per second (TPS), which can surge to 2,000 TPS during peak demand, allowing it to test and pilot payment use cases. In comparison, Ethereum's average TPS is 12, and Bitcoin's is 7.

Parallel Transaction Processing: Solana's high throughput design allows it to process transactions in parallel, significantly improving network efficiency. Transactions from different independent accounts can be executed simultaneously, enabling Solana to effectively support payment and settlement scenarios where transactions primarily occur between two different parties or involve payments from one party to multiple parties.

Smart contracts can also be executed in parallel on Solana. Transactions specify the states or accounts they interact with, allowing validators to run non-conflicting transactions simultaneously. Unlike other chains using a single-threaded model like Ethereum, Solana employs a multi-threaded approach for parallel transaction execution. In short, Solana's architecture allows for simultaneous processing of multiple transactions, helping to prevent congestion in one part of the network from affecting overall network performance.

Low and Predictable Transaction Costs Enhance Payment Efficiency

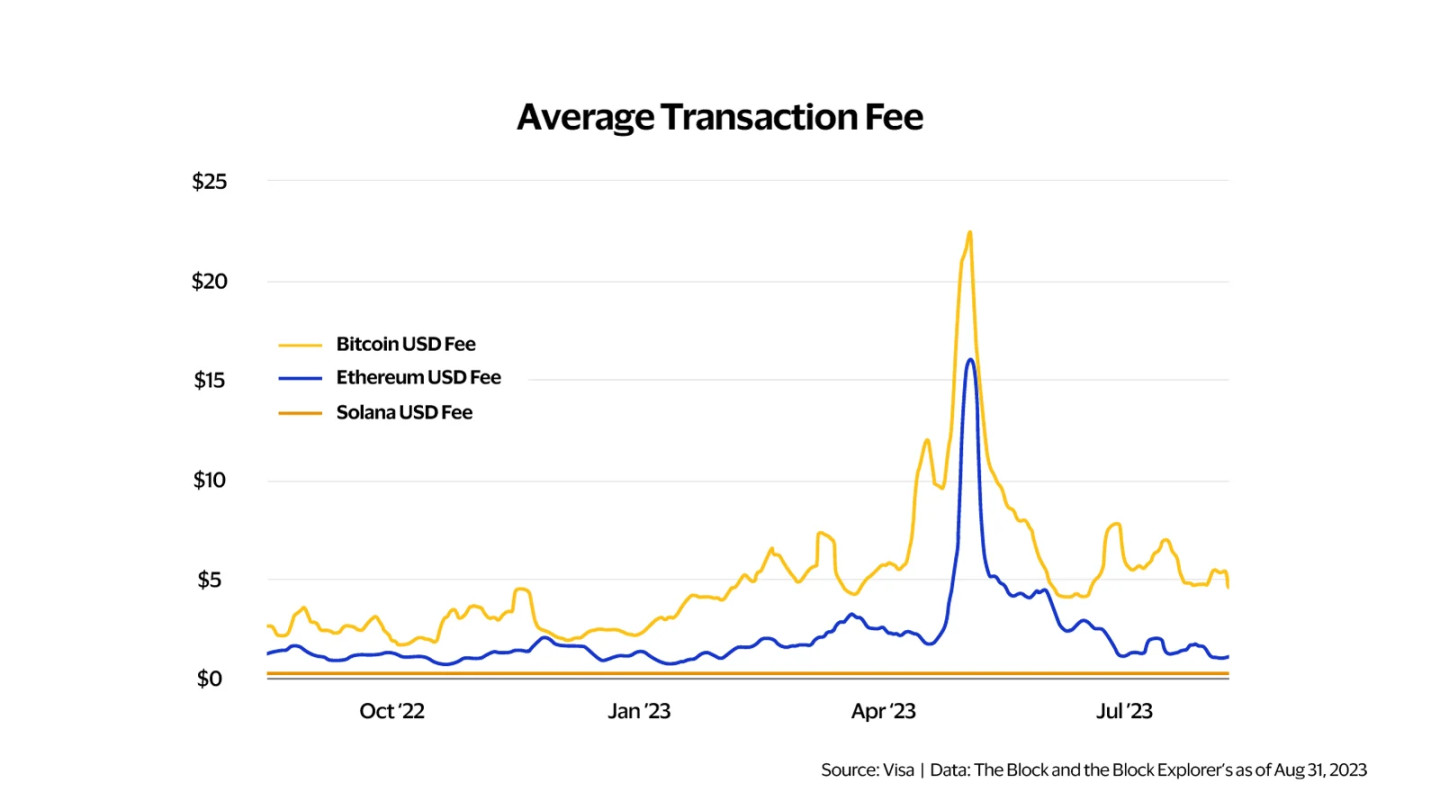

In terms of costs, Solana's transaction fees are not only low (typically less than $0.001), but also predictable. This predictable low cost makes it a network worth exploring for efficiency and cost savings in existing payment businesses. In Figure 1 below, Solana's cost advantage over Bitcoin and Ethereum is evident, as the fees for the latter may fluctuate unpredictably based on transaction demand on the network. For payment companies, a network with unpredictable transaction costs may make it difficult to manage costs in their products and could lead to a poor consumer experience.

Figure 1: Transaction fees denominated in USD

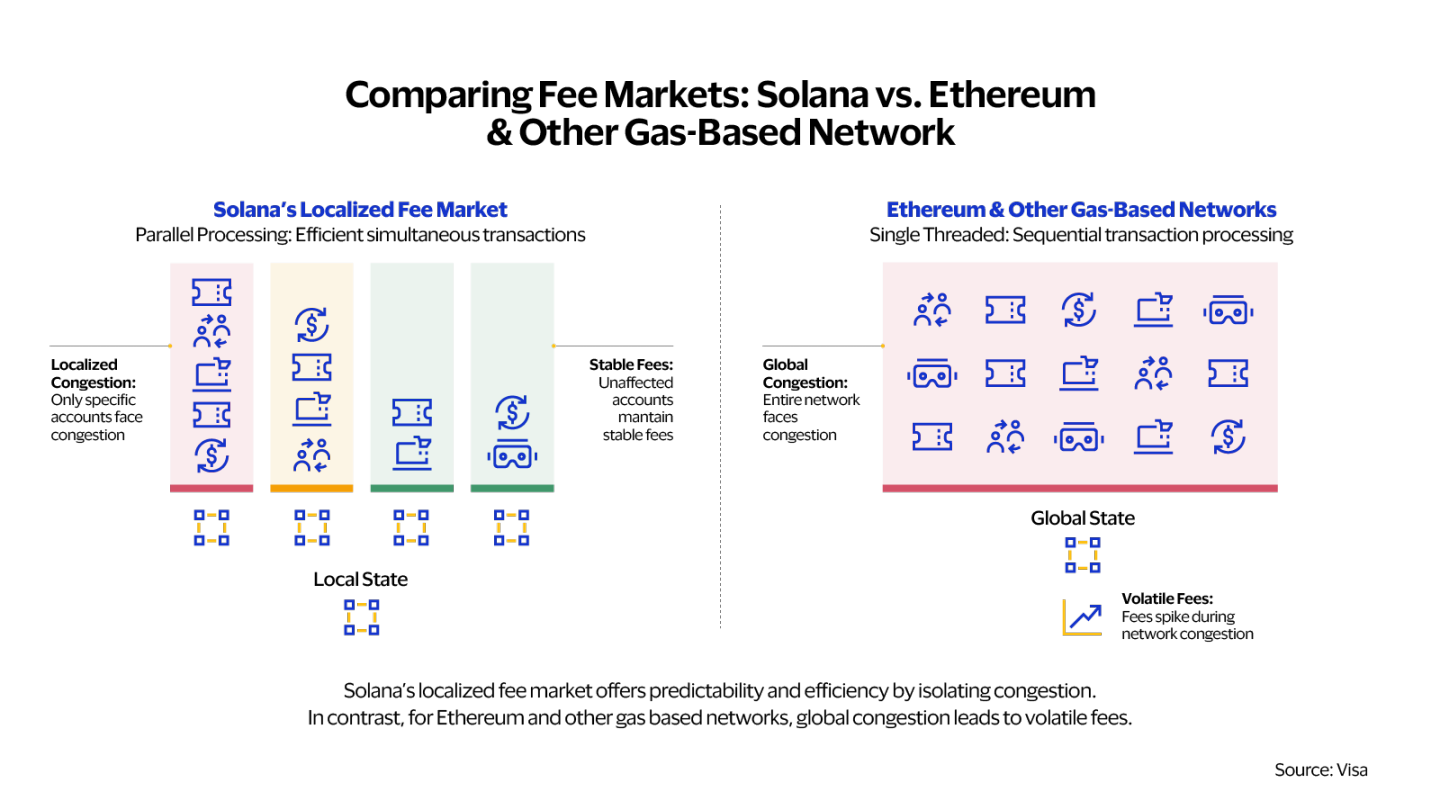

Achieving Cost Predictability through Localized Fee Market: Solana's localized fee market is unique in the blockchain space. This innovation is closely related to Solana's parallel processing capability, where non-overlapping transactions are executed on separate threads, similar to vehicles traveling on separate roads. Network congestion is a significant reason for fee increases in other blockchain networks and can have adverse effects on the entire system. The popularity of NFTs may lead to network congestion, making consumer P2P transactions that could occur simultaneously more expensive and potentially uneconomical.

Figure 2: Comparison of Solana's fee mechanism with Ethereum and other blockchain networks

Solana's mechanism ensures that congestion of transactions from one account does not affect transactions from other accounts. If an account experiences high demand for a specific asset (e.g., NFTs), only the fees for that specific account will increase, while the fees for other accounts remain unaffected. This creates a fee market based on use case demand, where transaction costs temporarily rise when demand for specific assets surges, but the fees for other transactions on the chain remain unaffected. By allowing parallel execution of computations with different states, Solana can create a fee market based on "state competition," rather than having a single global fee market.

Meeting Consumer Expectations for Transaction Finality

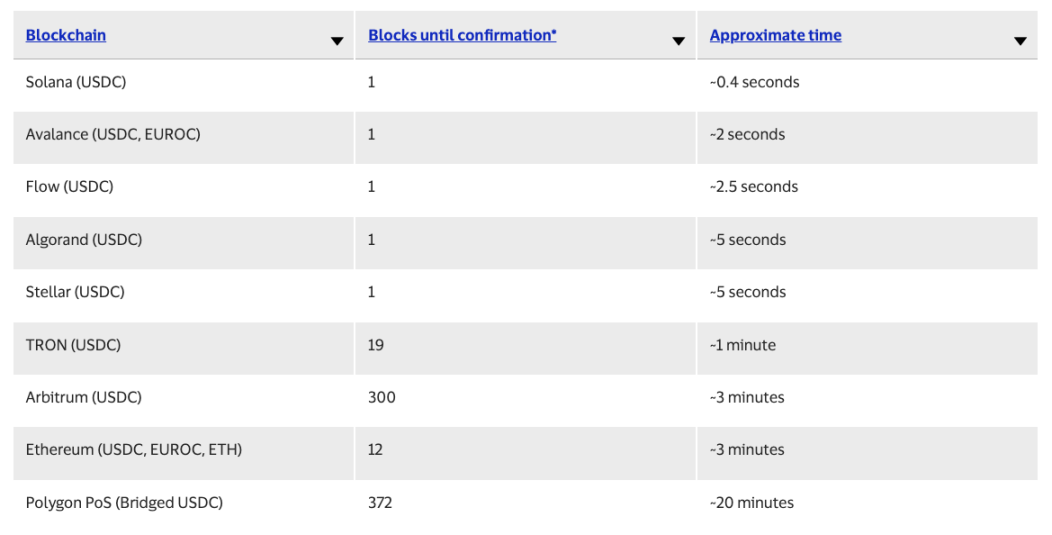

Transaction finality measures the speed at which users expect their actions to be confirmed on the blockchain network. For payments, transaction confirmation time is equally important as network throughput. For example, while Ethereum's average TPS is around 12, during congestion periods, gas limits and smart contract requirements may lead to several minutes of waiting time before transaction confirmation. Solana targets a slot time of 400 milliseconds, but the actual range can be 500 to 600 milliseconds.

The majority of applications on Solana use "optimistic confirmation" to determine their final outcomes. This is a mechanism used by Solana that achieves finality without waiting for all validators to vote on a block. In this scenario, if over two-thirds of the stake-weighted validators have voted on a block and no optimistic confirmation block has been rolled back or failed to finalize, the block can be considered finalized. This mechanism allows Solana to achieve final confirmation in a much shorter time than many other blockchains. Fast transaction finality can lead to a better payment experience. In comparison, Bitcoin transactions require waiting for 6 block confirmations, which can take up to an hour.

Table 1: Number of block confirmations and time required for transaction confirmation on different blockchains

Availability: Large Number of Nodes and Multiple Validator Clients

A payment network can only be effective if transactions can be initiated and executed consistently when users need to make payments. For a blockchain network, availability is best measured by the number of independent participants or nodes supporting the network for users to initiate transactions. As of July 2023, the Solana network boasts an impressive 1893 active validators, entities responsible for block production and voting. Additionally, there are 925 RPC nodes, which maintain local transaction records but may not create blocks themselves. The large number of nodes in the blockchain network enhances its resilience and redundancy. As long as a sufficient number of nodes remain operational, the network can continue to function without data loss even if some nodes encounter issues or go offline. The Solana community also pays attention to the geographical distribution of nodes and the diversity of infrastructure providers to make the network more robust in the face of events such as natural disasters or changes in service provider access policies. The Solana network has nodes in over 40 different countries/regions, with hundreds of independent hosts and diverse geographical locations. This helps ensure smooth and reliable operation even in the face of technical challenges.

Validator clients are software tools that enable node operators to act as validators on a PoS blockchain. The diversity of validator clients enhances the network's resilience. While one client may have errors or vulnerabilities, another client may not, reducing the likelihood of a single software flaw causing network paralysis. Initially, Solana relied on the validator client introduced by Solana Labs. In August 2022, Jito Labs launched the second validator client, Jito-Solana. Shortly after, Jump Crypto also introduced Firedancer (in the testing phase), an independent C++ validator client.

Firedancer stands out for its potential to bring significant performance enhancements, as demonstrated by achieving 600k TPS in a live demo. The purpose of having different validator clients is to maintain network stability. Outside of Ethereum, Solana is one of the few blockchains with multiple completely independent validator clients.

Meeting the Needs of the Times

Solana's unique technical advantages, including high throughput parallel processing, localized fee market low costs, and high resilience with a large number of nodes and multiple validator clients, collectively create a scalable blockchain platform with a credible payment value proposition. These are some of the reasons why we decided to expand the pilot scope of stablecoin settlements to include transactions on the Solana network. As we pilot stablecoin settlement functionality on Solana, we plan to test Solana's ability to meet the needs of modern enterprise financial operations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。