Today's Headlines:

- OneCoin co-founder sentenced to 20 years in prison and fined $300 million

- Hong Kong SFC warns: JPEX is an unregulated virtual trading platform

- Binance.US lays off one-third of its staff, CEO Brian Shroder resigns and is temporarily replaced by CLO

- MetaMask launches Snaps feature, will be compatible with non-EVM blockchains

- TON Foundation launches self-hosted encrypted wallet TON Space for Telegram users

- Kasikornbank of Thailand launches $100 million flagship fund KXVC, to invest in Web3, AI, and other fields

- opBNB mainnet officially launched, Enjin Blockchain also officially launched

- Beosin: Current loss amount of CoinEx exchange is at least $53 million

Regulatory News

OneCoin co-founder sentenced to 20 years in prison and fined $300 million

According to The Block, the U.S. Southern District of New York Attorney's Office announced in a statement that OneCoin co-founder Karl Sebastian Greenwood has been sentenced to 20 years in prison and fined $300 million for defrauding 3.5 million investors and using the proceeds to purchase five-star resorts, private jets, and yachts.

U.S. Attorney Damian Williams stated, "As the founder and leader of OneCoin, Karl Sebastian Greenwood carried out one of the largest fraud schemes in history. Greenwood and his co-conspirators, including fugitive Ruja Ignatova, deceived unsuspecting victims, causing them to lose billions of dollars. They promised to achieve a 'financial revolution' and claimed that OneCoin would be a 'Bitcoin killer,' while OneCoin was worthless."

OneCoin, founded by Ruja Ignatova in 2014, has been under investigation in the U.S. and the UK since 2016, and several countries have been attempting to arrest the fraudsters. Last June, OneCoin founder Ruja Ignatova was placed on the FBI's top 10 most wanted list.

According to Reuters, the U.S. Securities and Exchange Commission (SEC) filed a lawsuit in federal court in Manhattan on Tuesday against high-frequency trading market maker Virtu Financial, accusing it of making material false and misleading statements and omissions about information barriers to prevent the misuse of sensitive client information.

The SEC stated in the complaint that Virtu Financial repeatedly falsely informed clients that the company used "information barriers" and "systemic isolation between business groups" to protect their significant non-public information, when in fact, from January 2018 to April 2019, "anyone" could access sensitive client information and trading information at its subsidiary Virtu Americas using a common username and password. The leaked information included clients' detailed personal information and the names, prices, and quantities of securities they bought and sold. The lawsuit seeks civil penalties against Virtu Financial, recovery of ill-gotten gains, and an injunction against further violations.

It is reported that Virtu Financial has stated that it makes markets on major cryptocurrency exchanges, and has participated in a $50 million Series A financing for digital asset and forex brokerage firm Hidden Road Partners; in September last year, Virtu Financial, along with giants such as JPMorgan and Fidelity, launched the cryptocurrency exchange EDX Markets (EDXM).

Hong Kong SFC warns: JPEX is an unregulated virtual trading platform

The Hong Kong Securities and Futures Commission (SFC) announced on its official website that it has noticed a virtual asset trading platform named "JPEX," which actively promotes its services and products to the Hong Kong public through social media influencers and over-the-counter virtual asset currency exchange merchants. The SFC clarified that none of the entities under the JPEX Group have been licensed by the SFC, and they have not applied to the SFC for a license to operate a virtual asset trading platform in Hong Kong.

NFT

A statement was released by the co-founder, manager, and administrator of Milady's parent company Remilia using the @Milady_Sonoro X account, claiming, "Co-founder Charlotte Fang is spreading false narratives unrelated to reality, attempting to preemptively disclose his own misconduct and misappropriation of collective funds before legal review and public disclosure. Three weeks ago, we wrote to Charles (X account is Charlotte Fang), attempting to have him acknowledge that we are co-founders, provide us with the equity we deserve in the collective, and demand that he return all the funds withdrawn from the treasury. In response to our letter, Charles, at the request of his lawyer, wrongly sued us, incorrectly referring to us as 'independent contractors' and 'terrorists.' Charles's claims did not include a contract, nor did they include the numerous pieces of information we received from him, contradicting his own claims. We welcome the opportunity to resolve this dispute in court."

The statement clarified, "1. Remilia has always been a collective. The limited liability company created unilaterally by Krishna in Delaware does not own the collective's assets and was established without the knowledge or support of other co-founders. 2. We are co-founders, executives, board members, and equity holders, with signed contracts, text messages, phone calls, and other evidence to prove it. 3. Bonkler's treasury has not been stolen, and the funds have always (and will continue to be) securely held by the auction contract controlled by Ccccaa, which was approved by the co-founders of Remilia. 4. Upon discovering that Charles had unauthorizedly removed other funds from the collective treasury, we demanded that Charles return the $600,000 in assets from the collective treasury multi-signature to his personal account, but he removed all other co-founders from the multi-signature of the treasury, and after his public posts and lawsuit were filed, he withdrew a total of $2.6 million worth of digital assets."

In response, Charlotte Fang stated, "Remilia has no co-founders, Remilia has no co-founders, from the beginning, I have had sole control over the funds and operations. Before the establishment of the limited liability company, I independently controlled the assets used to fund Remilia's operations, and they directly reached agreements with me and received compensation from funds under my control. The core team working on Milady and Remilio received income shares and joined the company in regular positions, and these individuals never negotiated for equity at that time or at any time. This lawsuit is due to the freezing of company assets before transferring the entire stablecoin and NFT treasury of Remilia to an entity controlled by 5 parties. They threatened to disclose publicly first and refused to comply with the injunction or participate in private arbitration. I took action to freeze Bonkler to protect the community's interests. The developer has no right to retain ownership of the Bonkler contract. Jimbo did receive a letter of intent from a co-founder, but he refused at the time."

Yesterday's news stated that Milady founder Charlotte Fang claimed that a Milady developer seized the codebase and misappropriated $1 million from the Bonkler treasury.

Project Updates

According to Bloomberg, a Binance.US spokesperson stated that the company's CEO, Brian Shroder, has resigned and has been temporarily replaced by Chief Legal Officer Norman Reed. The company is laying off about one-third of its staff, over 100 positions, due to a series of increasingly serious legal and operational challenges.

The Binance.US spokesperson said, "The actions we are taking today provide Binance.US with over seven years of financial business development opportunities, allowing us to continue to serve our customers while operating as a purely crypto exchange. The U.S. Securities and Exchange Commission is attempting to weaken our industry and has had an impact on our business, which has real implications for U.S. employment and innovation. This is an unfortunate example."

Coinbase to list VeChain (VET) and VeThor (VTHO)

According to an official tweet, Coinbase has announced the listing of VeChain (VET) and VeThor (VTHO). Trading will begin after 12:30 AM on September 14th, Beijing time, if liquidity conditions are met. If sufficient supply of the assets is established, trading pairs for VET-USD and VTHO-USD will be phased in.

Note: Coinbase only supports the two mentioned crypto assets on the VeChain network. Do not send these assets through other networks, as funds may be lost. Coinbase does not support providing VTHO network payments to VET holders on the platform. Users wishing to receive these network payments should hold VET in a wallet that supports VTHO payments.

MetaMask launches Snaps feature, will be compatible with non-EVM blockchains

MetaMask has announced the launch of the new Snaps feature, aimed at expanding its usage on blockchain networks that are incompatible with the Ethereum Virtual Machine (EVM) itself. Snap is a software module that can be integrated with MetaMask, allowing the wallet to be used across different blockchains, including Cosmos, Solana, and Starknet, among others. MetaMask has collaborated with over 150 developers to expand the development of Snap.

Later news, MetaMask Snap's public beta already includes 34 applications.

Hashdex has submitted an application for a spot Ethereum ETF

Bloomberg analyst James Seyffart tweeted that crypto asset management company Hashdex has applied for a spot Ethereum ETF called "Hashdex Nasdaq Ethereum ETF."

Celsius to pause claims lawsuit against former CEO and other former executives

The official committee of unsecured creditors of Celsius tweeted that this morning, an agreement was reached between Celsius debtors, the official committee of unsecured creditors, and the U.S. Attorney's Office, pausing the claims lawsuit against former Celsius CEO Alex Mashinsky and other former Celsius executives, while continuing with Mashinsky's criminal trial. The federal prosecutor requested the official committee of unsecured creditors to agree to pause the lawsuit to avoid any potential interference with Mashinsky's criminal trial. The U.S. Attorney agreed to coordinate with the litigation trustee on the distribution of recovered assets in the criminal case. The official committee of unsecured creditors supports swift enforcement and will return any recovered funds to account holders.

Vesta Finance token surges 150% as two co-founders initiate "angry exit" proposal

According to DL News, DeFi lending protocol Vesta Finance is in a leadership crisis, with two of the project's three co-founders—James "Atum" Peterson and Midnight—posting an "angry exit" proposal on the governance forum to exit the project. "Angry exit" refers to the practice of liquidating project funds (in whole or in part) and distributing the funds to investors. In the proposal, they expressed disappointment with the lack of progress in the project and requested $1.68 million in compensation as a settlement. They believe that by disassociating from the current parties and receiving compensation, friction caused by conflicting opinions and ideas can be eliminated, and the removed founders can be fully compensated for their significant contributions.

Another co-founder and CEO, Mikey Milken, opposed their exit and proposed an alternative settlement of "acquiring Atum and Midnight's shares," stating that this would not jeopardize the protocol's upgrade plans. Milken stated that any forward-moving proposal needs to consider the interests of all stakeholders who are still interested in the project's future progress, while allowing disinterested parties to leave. Milken also raised concerns about the regulatory aspects associated with a complete exit. He stated that VSTA is a utility token and does not grant holders the right to claim from the project treasury. Not everyone shares this view. Some investors, including early supporters of the project, have called for an "angry exit." Vesta's major investor, Ogle, believes that "an 'angry exit' is the best outcome for investors at the moment. It's hard to recover from all of this." Several DAO members are also strongly demanding an "angry exit," which is seen as the "best solution" for all parties involved.

Vesta Finance is a DeFi lending protocol on the Arbitrum blockchain, with a total locked value of $11.61 million. The project's treasury holds $10 million in crypto assets. Despite the conflict causing a division in the Vesta community, opportunistic investors are pouring into the project's native token VSTA to obtain a share of the treasury funds. Since the dispute began, the price of VSTA has risen by over 150% (the token's market value is currently around $6.97 million).

Pantera Capital shifts investment strategy to evaluate mid-stage crypto companies

According to Bloomberg, Paul Veradttakit, managing partner at crypto venture firm Pantera Capital, stated in an interview in Singapore, "The biggest change in the company's investment strategy is a greater willingness to evaluate mid-stage crypto companies, with the valuation declines in Series B and C financing rounds being greater than in early-stage investments. Currently, a significant portion of our investable universe is outside the U.S." Veradttakit expects the flow of funds outside the seed stage projects to remain slow for about the next year.

The company's website states that Pantera Capital manages $3.3 billion in assets and about 100 venture investments, with 47% of investment capital outside the U.S. Veradttakit stated that about 40% of portfolio companies are not U.S. companies, and the number of such companies may increase. Over time, and with the establishment of the infrastructure required for cryptocurrencies and blockchain technology, he expects a significant increase in the number of entrepreneurs and applications from Asia.

Binance to delist 20 BUSD-related cross-margin and isolated-margin trading pairs

According to an official announcement, Binance will remove the ALICE/BUSD, ANKR/BUSD, AVA/BUSD, BICO/BUSD, CLV/BUSD, COTI/BUSD, DAR/BUSD, DEGO/BUSD, GLM/BUSD, IMX/BUSD, KP3R/BUSD, KSM/BUSD, LRC/BUSD, MDX/BUSD, MKR/BUSD, POLYX/BUSD, SLP/BUSD, WAXP/BUSD, XTZ/BUSD, and ZIL/BUSD cross-margin and isolated-margin trading pairs at 14:00 on September 21st.

Additionally, Binance will also delist trading pairs such as AMB/BUSD and ASTR/BUSD on September 15th.

Specifically: September 15th, 2023, 11:00 (Beijing time): AMB/BUSD, ASTR/BUSD, BAT/ETH, DASH/BUSD, GMX/BUSD, HOT/BUSD; September 15th, 2023, 13:00 (Beijing time): IMX/BNB, KNC/BNB, MC/BUSD, MDT/BUSD, NULS/BUSD, RAD/BUSD, RAY/BUSD, REQ/BUSD; September 15th, 2023, 15:00 (Beijing time): SSV/BUSD, STMX/BUSD, TROY/BUSD, WOO/BUSD.

Coinbase CEO reiterates decision to integrate Lightning Network, but it will take some time

Coinbase CEO Brian Armstrong responded to a user on the X platform, stating, "The decision to integrate the Lightning Network has been made. Bitcoin is the most important asset in crypto, and we are excited to do our part to enable faster/cheaper Bitcoin transactions. Integration will take some time, so please be patient."

Block.one's crypto exchange Bullish plans to apply for a license in Hong Kong

According to Bloomberg, Tom Farley, CEO of the crypto exchange Bullish, stated that as part of its international expansion efforts, the exchange plans to apply for a license in Hong Kong. Farley revealed that the company has 260 employees globally, with 110 in Hong Kong, about 75 in the U.S., 40 in Singapore, and several dozen in Gibraltar. Farley said, "We are applying for a license in Hong Kong. We have had an exchange there for four years, and it's our largest office."

According to the company's website, the Bullish exchange is registered in Gibraltar and currently does not offer services in the U.S., Canada, mainland China, Japan, Israel, and Russia.

According to the official blog, the crypto exchange BitMEX has announced the launch of prediction markets, a type of cryptocurrency derivative that allows traders to predict the outcomes of various real-life themes, industries, and events and take positions. The first batch of contracts available for trading includes predictions on FTX bankruptcy application (product P_FTXZ26), the future of Bitcoin ETF (product P_XBTETF), and the fate of FTX founder Sam Bankman-Fried (product P_SBFJAILZ26).

According to Fortune magazine, Scott Purcell, founder and CEO of the crypto trust company Fortress Trust, stated that the company lost $12 to $15 million in cryptocurrency in a recent hack, most of which was Bitcoin, but a small amount of two stablecoins, USDC and USDT, was also stolen. The company immediately compensated for this loss, stating, "Out of 225,000 customers, only 4 were truly affected." Purcell emphasized repeatedly that the fault for the security vulnerability lies with a third-party supplier, not with Fortress Trust or its custodial partners, Fireblocks or BitGo.

A Ripple spokesperson declined to comment on the severity of the security vulnerability but stated that "the amount used to pay customer funds has been included in the transaction." The Block previously reported that as part of an acquisition deal, Ripple has fully compensated Fortress customers affected by the security incident. The Ripple spokesperson stated that the acquisition process accelerated after this security incident occurred. As of the announcement of the acquisition deal, Ripple and Fortress Trust had not disclosed that Ripple had agreed to include customers as part of the transaction.

TON Foundation launches self-custody crypto wallet TON Space for Telegram users

According to Decrypt, the TON Foundation announced a partnership with Telegram to launch the self-custody crypto wallet TON Space, now available for approximately 800 million users of the messaging platform. Additionally, the foundation stated that projects built on TON will have priority access to the messaging app's advertising platform, Telegram Ads.

A TON spokesperson stated that the wallet functionality is currently available in Telegram's settings and will be rolled out globally in November, "excluding the U.S. and some other countries."

According to CoinDesk, the crypto exchange FTX has modified its proposal to sell billions of dollars in crypto assets to alleviate concerns raised by the U.S. Department of Justice's bankruptcy trustee in a filing on Tuesday. According to the proposal, despite the potential significant market impact of cryptocurrency trades, FTX still does not need to provide advance trade notice.

The U.S. bankruptcy trustee initially opposed FTX's plan, stating that any intent to sell Bitcoin or Ethereum should be publicly disclosed as widely as possible to allow others the opportunity to object. In a compromise, FTX agreed to allow the U.S. bankruptcy trustee to participate privately and to work with the committee representing creditors. Judge John Dorsey will consider the proposal at a hearing later on Wednesday.

Earlier news, a judge has denied SBF's motion for pretrial release; Bullish and Tribe Capital have made competing bids for FTX.

According to Tech in Asia, the Thai digital bank Kasikorn Bank (KBank) has launched a $100 million flagship fund, KXVC, to invest in AI, Web3, and deep tech startups focused on financial services. In addition to investments, KXVC will provide founders with access to KBank's corporate resources, SME and consumer networks, and partner assistance.

The fund, established by KBank's innovation arm Kasikorn X, plans to focus on investing in over 30 startups and funds in the Asia-Pacific, Israel, the U.S., and the EU.

According to The Hacker News, the internet giant Mozilla, behind the Firefox browser, released a security update on Tuesday to address a critical zero-day vulnerability in Firefox and Thunderbird that has been actively exploited in the wild. The issue has been resolved in Firefox 117.0.1, Firefox ESR 115.2.1, Firefox ESR 102.15.1, Thunderbird 102.15.1, and Thunderbird 115.2.2. Users are advised to upgrade promptly.

The vulnerability, identified as CVE-2023-4863, is a heap buffer overflow in the WebP image format that could lead to arbitrary code execution when processing specially crafted images. Mozilla stated in an advisory report, "Opening a malicious WebP image could lead to a heap buffer overflow in the content process, and we are aware of this issue being actively exploited in the wild in other products." According to the description in the U.S. National Vulnerability Database, the vulnerability may allow remote attackers to execute arbitrary code via a specially crafted HTML page.

According to Financial News, the Hong Kong-listed company BlueFocus Interactive (08267.HK) announced that based on its announcements published on June 15, 2023, July 7, 2023, August 8, 2023, and August 17, 2023, the group purchased a total of 92.4712 units of Bitcoin in open market transactions, with a total cash price of approximately $2.66 million. In the 12 months prior to the announcement, the company purchased a total of 93.85 units of Bitcoin in open market transactions, with a total cash price of approximately $2.7 million. The board proposes seeking shareholder approval to grant purchase authorization to allow directors to conduct potential cryptocurrency purchases during the authorization period, with a total amount not exceeding $5 million. The group also noted that cryptocurrency prices may fluctuate significantly, and the board intends to invest in the largest cryptocurrencies by market value (such as Bitcoin and Ethereum).

Astar Network to launch Astar zkEVM, a Layer 2 solution supported by Polygon Labs

According to The Block, Astar Network is collaborating with Ethereum scaling developer Polygon Labs to launch its Layer 2 solution, Astar zkEVM. According to a statement, Astar Network will use the Polygon CDK (an open-source codebase for launching zero-knowledge-driven Layer 2 chains for Ethereum) to build Astar zkEVM. The Astar zkEVM testnet is planned to launch in the fourth quarter of this year, with sETH serving as the gas token on the testnet.

The perpetual contract trading pairs for several cryptocurrencies, including TRB, PERP, WLD, and YGG, on the OKX platform experienced abnormal price spikes, with TRB briefly fluctuating over 90%, PERP over 13%, and WLD and YGG also briefly fluctuating over 20%.

OKX responded on the X platform that from 15:38 to 15:43 (HKT), there was a short-term abnormality in the platform's limit price calculation system, causing abnormal prices for some contract targets on the OKX platform. The issue has been resolved, and they are currently verifying the specific scope of the impact and user losses, and will provide a compensation plan as soon as possible.

Enjin Blockchain Officially Launched

The blockchain gaming development platform Enjin announced that the Enjin Blockchain has officially launched, and the Enjin Wallet, NFT.io, and other Enjin applications are also set to resume.

According to the official X account, Huobi has been renamed to HTX. The official website logo has also been changed to HTX. They stated, "H" represents the "H" in Huobi, "T" represents TRON, symbolizing the determination to go all in on TRON, and "X" represents the exchange business.

opBNB Mainnet Officially Launched

The opBNB mainnet, based on OP Stack, has officially launched and will focus on enhancing the network's resilience and decentralization through Proof Enhancement, account abstraction, BNB Greenfield data availability, interoperability with BNB Greenfield, and decentralized sorters.

Funding News

Electric Capital Plans to Raise $300 Million for New Fund

According to The Block, Web3 venture capital firm Electric Capital plans to raise $300 million for its new fund, Electric Capital Venture Fund III, as per documents submitted to the U.S. Securities and Exchange Commission (SEC). The fund has not yet begun its initial sale, and Electric plans to limit the issuance time to within one year. Electric Capital, located in Palo Alto, California, was founded by Curtis Spencer and Avichal Garg in 2018. The company raised $110 million for its second venture fund in 2020. In March 2022, Electric Capital raised $1 billion for investing in early-stage crypto startups.

Web3 Collaborative Entertainment Protocol Mythic Raises $6.5 Million, Led by Shima Capital Founder

According to Finsmes, the Web3 collaborative entertainment protocol Mythic Protocol has raised $6.5 million in seed funding, with Shima Capital founder Yida Gao leading the investment. Alpha JWC, Saison Capital, GDV Venture, Planetarium Labs, Arcane Group, Presto Labs, MARBLEX, EMURGO Ventures, HYPERITHM, and some angel investors also participated. The funds will be used to develop and launch the initial core product.

Cross-Border Payment Platform Parallax Completes $4.5 Million Seed Round, Led by Dragonfly Capital

According to the official blog, the cross-border payment platform Parallax has announced the completion of a $4.5 million seed round, led by Dragonfly Capital, with participation from Circle Ventures, General Catalyst, gumi Cryptos Capital, Palm Drive Capital, Comma Capital, Firsthand Alliance, as well as angel investors Balaji, Zach Abrams, and others. The new funds will be used to continue expanding the team and business.

L2 Network Layer N Completes $5 Million Seed Round, Led by Founders Fund and dao5

The Ethereum Layer 2 network Layer N has announced the completion of a $5 million seed round, with Founders Fund and dao5 co-leading the round, and participation from Kraken Ventures and Spencer Noon, among others. Founders Fund's investment in this round amounts to $1.8 million.

Key Data

Report: Liquidity Providers Have Executed Wash Trades Worth Over $2 Billion on Ethereum-Based DEXs

A report by Solidus Labs states that since September 2020, token deployers and liquidity providers have executed wash trades worth over $2 billion in cryptocurrency on Ethereum-based DEXs, manipulating the prices and trading volumes of over 20,000 tokens.

Researchers conducted an investigation into wash trades on three DEXs and found that 67% of liquidity providers executed wash trades, accounting for 13% of the total pool trading volume. Solidus researcher Will Kueshner stated, "In terms of quantity, we are looking at 1% of all liquidity pools, and the actual scale of wash trading on DEXs may be much larger than this."

According to Solidus, wash trades on Ethereum are not cheap, with transaction costs ranging from $1 to $5 per trade. However, the profits can make up for it. For example, the deployer of Shibafarm earned approximately $2 million in profit within two hours in May 2021 by extracting bidirectional liquidity from the pool.

Beosin: CoinEx's Losses Estimated to be at Least $53 Million

According to Beosin's virtual asset anti-money laundering compliance and analysis platform Beosin KYT, as of the time of writing, the exchange CoinEx has estimated losses of at least $53 million across multiple blockchains, including approximately $18 million on the ETH chain, $6.3 million on the BNB chain, $11.1 million on the TRON chain, $6 million on the XRP chain, $5.97 million on the BTC chain, $286,000 on the Polygon chain, $2.65 million on the Solana chain, $448,000 on the BCH chain, $1.7 million on the XDAG chain, and $1.12 million on the KDA chain.

Curve Founder's OTC Buyer Transfers 609,057 CRV to Binance

Lookonchain has updated the situation of the address starting with 0xb0b transferring CRV to Binance, with the address having deposited a total of 609,057 CRV (worth $240,000) into Binance today.

It was previously reported that the address purchased 2.5 million CRV over-the-counter, and earlier today, the address transferred 548,700 CRV to Binance.

PANews APP Points Mall Officially Launched

Free exchange of hardcore prizes: imKeyPro hardware wallet, First Class Cabin Research Report monthly card, Ballet REAL series wallet, AICoin membership, various peripherals, and hundreds of selected research report collections. First come, first served, experience now!

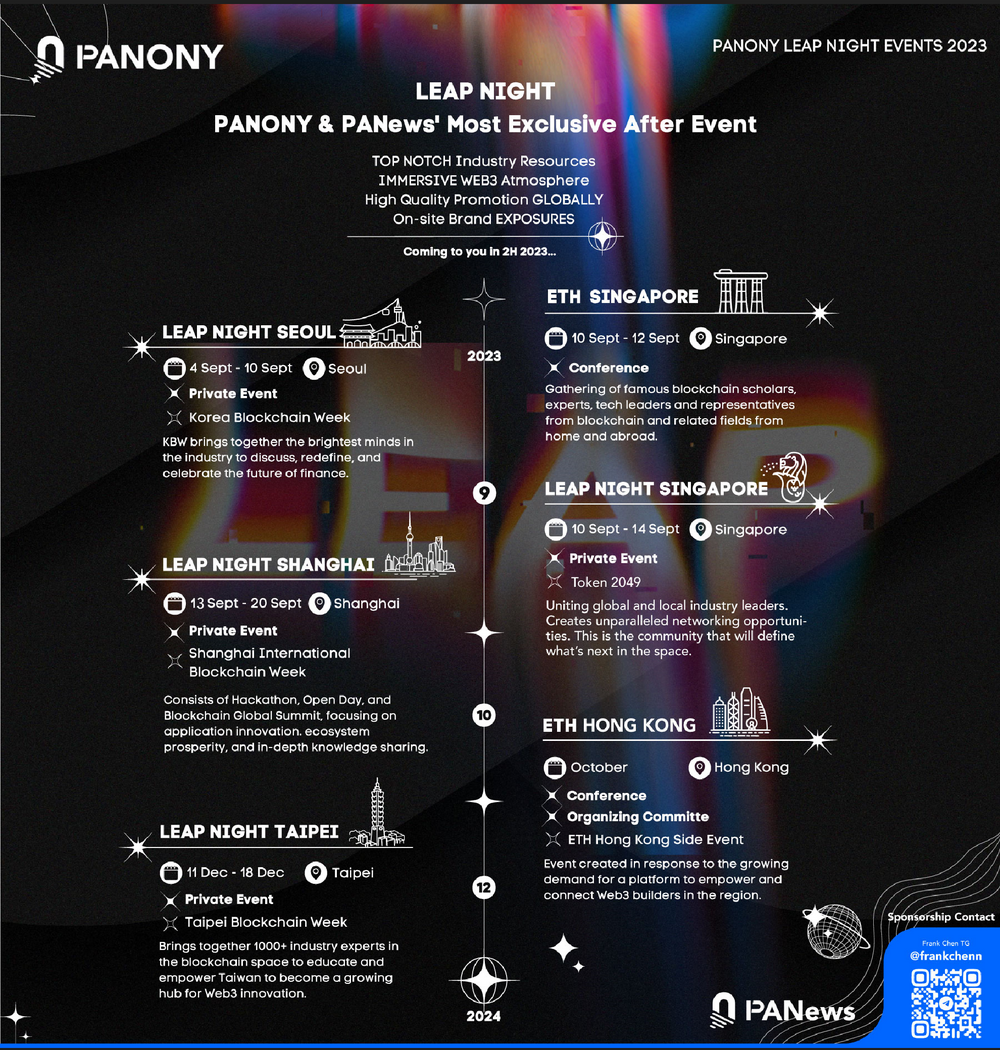

PANews Launches Global LEAP Tour!

South Korea, Singapore, Shanghai, Taipei, multiple locations will come together from September to December to witness a new chapter in globalization!

?Events in multiple locations are being planned, welcome to communicate!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。