Life is only beautiful when you walk out of it, not when you wait for brilliance to come. Maintain a positive and enterprising attitude, and luck and beauty will come unexpectedly. Good morning!

Morning market analysis: Yesterday, the market showed a U-shaped trend, reaching a high of 26500, but it was manipulated by the market makers. In the end, it only closed up 59 points. Currently, Bitcoin and Ethereum are both at the lower band of the one-hour Bollinger Bands, which can be used to follow the trend and make a profit.

Li Xingguo's suggestions:

Bitcoin can be bought near 25700, with a target of 26300 Ethereum can be bought near 1590, with a target of 1620

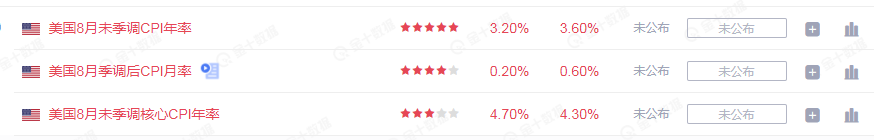

On Wednesday, the US will release the CPI year-on-year for August, with a previous value of 3.2% and a market expectation of 3.6%. Whether it's the change in non-farm payroll data, US retail monthly rate, initial jobless claims, or the release of the service industry PMI manager index, they all provide support for measuring changes in CPI inflation data. The 11 interest rate hikes by the Federal Reserve have reduced inflation from 9.1% to 3.2%, while the Fed's ultimate goal is to keep it within 2%. In addition, according to the latest CME Fed observation, the market generally believes that the Fed will maintain interest rates in September. However, it is worth noting that there is a 40.7% probability of a 25 basis point rate hike in November. This week, the US will release the August CPI data. If CPI effectively falls back, the Fed may end this round of rate hikes. But if inflation rebounds, there is still a possibility of a 25 basis point rate hike in November.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。