The cryptocurrency market has entered a new phase, with Bitcoin experiencing a slight rebound but still overall in a state of fluctuation. It has been reported that 83% of G20 member countries and major financial centers have made progress in the transparency of cryptocurrency regulation, and there is a changing attitude towards cryptocurrencies, from rejection to acceptance, and now to regularized regulation, reaching a consensus. JPMorgan is researching deposit tokens based on blockchain for payments and settlements, further accelerating the application of blockchain technology in the financial sector.

Although Bitcoin is currently in a state of fluctuation in the short term, with a resistance point at $26,800 and a support point at $25,300, short-term high-short and low-long operations can be carried out. However, from a medium to long-term perspective, we believe that after each rebound, Bitcoin is likely to show a downward trend, indicating a bearish view.

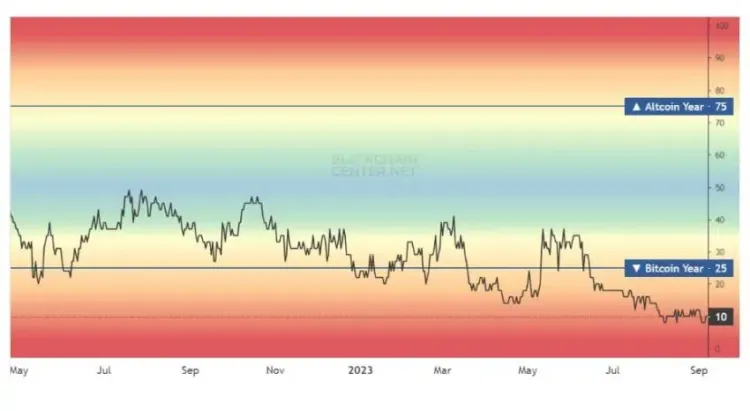

"Altcoin Season" Index Drops to Near Record Lows

Recent data shows that the "Altcoin Season" index has dropped to near record lows. This index is used to determine whether it is the season for Bitcoin or altcoins. Currently, the index is at 10 within the annual range, indicating that Bitcoin's performance is better than most altcoins. This is the first time it has reached such a low level since 2020. In the months following the previous crash, the cryptocurrency market entered an altcoin season driven by decentralized finance (DeFi).

Based on historical observations, when the price of Bitcoin reaches its lowest point, a rebound often occurs. Although Bitcoin prices are expected to rise in 2023, some altcoins are still hitting new lows due to the U.S. Securities and Exchange Commission's (SEC) crackdown and intense selling by Robinhood. However, based on historical experience, most altcoins may have already hit bottom. Therefore, the index may rise in the coming months.

Both Bitcoin and altcoins touched new lows during the FTX crash, leading traditional media to discuss the collapse of the cryptocurrency market. FTX was once the second largest cryptocurrency exchange, and its collapse had a significant impact on most of the cryptocurrency market. However, the U.S. Securities and Exchange Commission has begun to label the largest altcoin projects as securities, leading to many stock prices hitting new lows. Shortly after, there were reports that Robinhood began selling these altcoins designated by the SEC, further causing a market collapse. After XRP's victory, the prices of all these cryptocurrencies rose significantly, but still did not reach new lows, indicating that most altcoins may have reached a true bottom.

Opportunities Still Exist for Altcoins

Since reaching its peak in June 2023, Bitcoin's dominance has been steadily declining, which is a positive development for the altcoin market. The decline in Bitcoin's dominance indicates that the new funds entering the cryptocurrency market are less affected by Bitcoin. Despite news about Grayscale, Bitcoin's dominance has not significantly increased.

The only factor that could increase Bitcoin's dominance is FTX's announcement a few weeks ago of its plan to sell its holdings. FTX holds a large amount of top cryptocurrencies such as SOL and ETH. Considering that the overall cryptocurrency market trading volume is at near record lows, this sell-off could cause significant damage to the altcoin space.

How should the current situation be addressed? Many factors indicate that these altcoins are going through an adjustment period, and we may have witnessed a relatively poor phase. This does not mean that altcoin projects will rise tomorrow or next month, but it does indicate that many altcoins have reached price levels where long-term holders may consider adopting dollar-cost averaging (DCA).

It is important to remember that there are still many unknown factors, such as the upcoming economic recession or other unpredictable black swan events that cannot be predicted by charts. Therefore, when formulating an investment plan, be sure to consider these factors. Stay cautious and make wise decisions based on your risk tolerance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。