Original Title: "Do Cryptocurrencies as Legal Property Need to be Taxed in Mainland China?"

Written by: TaxDAO

The People's Court Daily published an article on September 1st titled "Identification of the Property Nature of Virtual Currency and Issues Related to the Disposal of Involved Property," which analyzes the criminal nature of cryptocurrencies such as Bitcoin and concludes that cryptocurrencies like Bitcoin have economic attributes and can be classified as property. Current relevant regulations clearly define Bitcoin and other cryptocurrencies as virtual commodities, and administrative and legal policies do not completely prohibit cryptocurrency transactions. Under the current legal and policy framework, the virtual currencies held by relevant entities in China still constitute legal property and are protected by law.

Do individuals need to pay taxes on the transfer income from their cryptocurrency holdings?

Regarding the tax issues related to cryptocurrencies such as Bitcoin, major countries or regions internationally have issued relevant tax regulations that stipulate matters concerning the holding and transfer of cryptocurrencies like Bitcoin. For example, the U.S. tax law stipulates that individuals' capital gains from the transfer of Bitcoin are subject to personal income tax, and the tax rate varies based on the duration of holding. In Japan, individuals' income from the transfer of Bitcoin and other cryptocurrencies is subject to miscellaneous income tax.

In China, on one hand, due to the current policy stipulating that cryptocurrency-related business activities are considered illegal financial activities, there are legal risks for any legal entities, non-legal entities, and individuals participating in cryptocurrency investment and trading activities. On the other hand, there are currently no specific regulations regarding the tax issues related to the transfer income of Bitcoin and other cryptocurrencies. This has led to many practitioners misunderstanding that the transfer income from Bitcoin and other cryptocurrencies is not subject to tax and does not need to be paid.

However, firstly, the current regulations in China do not prohibit individuals from holding cryptocurrencies such as Bitcoin. Just as mentioned in the article from the People's Court Daily at the beginning, according to the existing legal framework, the virtual currencies held by individuals constitute legal property and are protected by law. Secondly, the current tax laws in China do not specifically address Bitcoin and other cryptocurrencies, which does not mean that the transfer income from Bitcoin and other cryptocurrencies is not subject to tax. On the contrary, the existing tax laws in China already cover matters related to the transfer income from cryptocurrencies such as Bitcoin.

Through what channels can the tax authorities obtain information on the transfer of individuals' cryptocurrency assets?

Currently, the tax authorities in mainland China may obtain information on the transfer of individuals' cryptocurrency assets through centralized cryptocurrency exchanges and service providers, information exchanged through the Common Reporting Standard (CRS), information provided by blockchain transaction tracking technology teams, and information provided by public security departments, among other channels.

What tax items might be involved in the transfer of individuals' cryptocurrency?

According to the current tax laws in China, the income generated from the transfer of cryptocurrencies such as Bitcoin by individuals may be subject to payment of personal income tax, among other tax items.

Currently, the existing regulations in China define Bitcoin and other cryptocurrencies as specific virtual commodities, and the virtual currencies held by individuals constitute their personal property. When transfer income occurs, it falls under the category of taxable personal income and should be subject to the calculation and payment of personal income tax based on property transfer income.

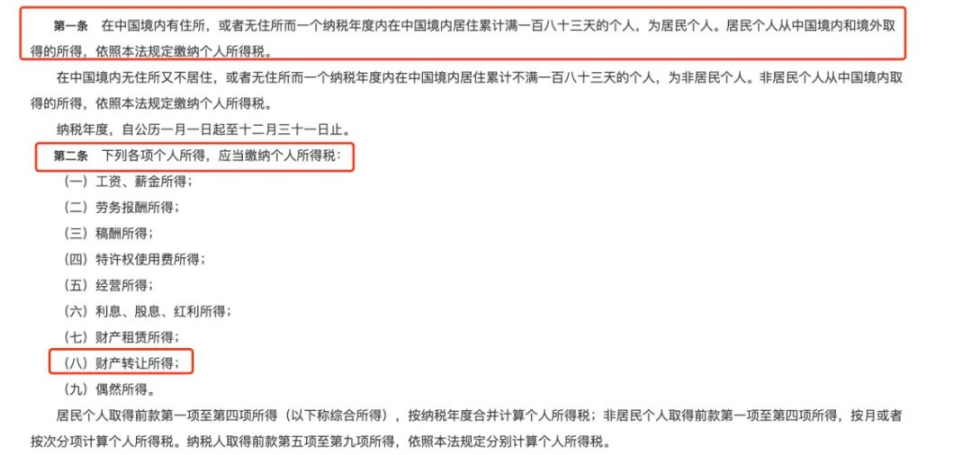

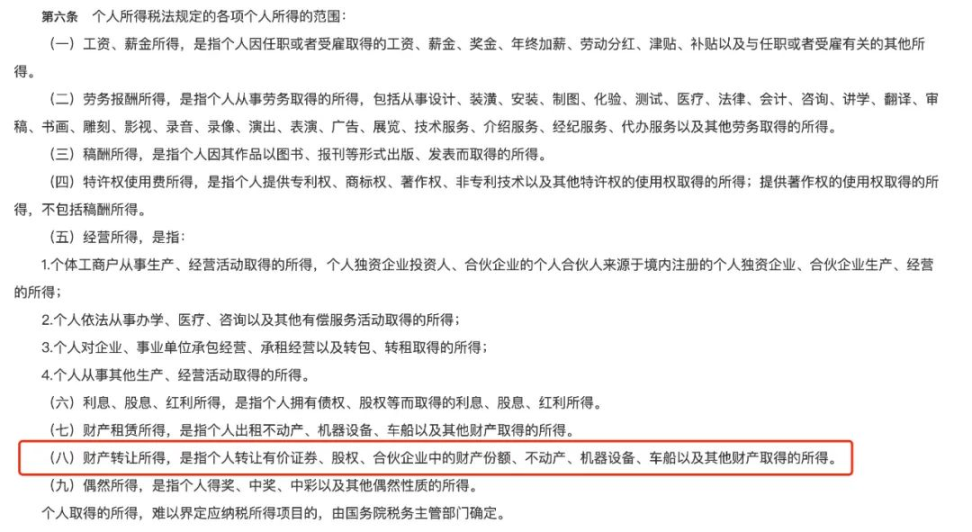

According to the "Individual Income Tax Law of the People's Republic of China," "Article 1, … residents' personal income obtained from within and outside China shall be subject to personal income tax as stipulated in this Law," and "Article 2, the following personal income items shall be subject to personal income tax: …; (8) income from property transfer, etc.," and the "Implementation Regulations of the Individual Income Tax Law of the People's Republic of China," "Article 6, the scope of various personal income items stipulated in the Individual Income Tax Law: …; (8) income from property transfer refers to income obtained from the transfer of securities, equity interests, property shares in partnership enterprises, real estate, machinery and equipment, vehicles and ships, and other property."

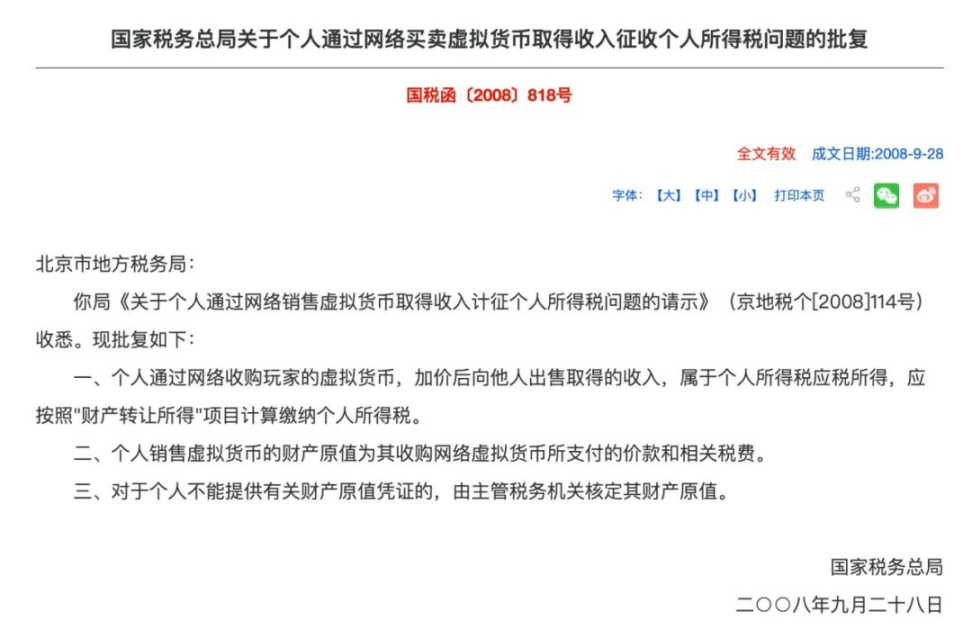

Previously, the State Administration of Taxation issued a specific reply regarding the collection of individual income tax on virtual currency transactions. According to the provisions of Document No. 818 of the State Taxation Letter [2008]: When individuals acquire income by purchasing virtual currency from players through the internet and then sell it to others at a higher price, it constitutes taxable personal income and should be subject to the calculation and payment of personal income tax under the "income from property transfer" category.

Although this provision mainly targets game currency, Q coins, and other virtual currencies, which are different from blockchain-based cryptocurrencies like Bitcoin, according to the existing laws in China, both types of virtual currencies are considered virtual commodities. Therefore, this provision has a certain reference value for the personal income tax related to the transfer of cryptocurrencies like Bitcoin.

What happens if taxes are not paid on the income from cryptocurrency transfers?

The tax should be paid at the time the income is obtained. If the tax is not declared and paid on time, when verified by the tax authorities, not only will the tax that should have been paid need to be paid, but also late payment interest at a daily rate of 0.05% and related fines will need to be paid. If tax evasion occurs, it may also involve corresponding criminal liability. The subsequent costs are extremely high.

How should individuals consider tax-related matters when they have income from the transfer of cryptocurrency assets?

If individuals have income from the transfer of cryptocurrency assets, they can consider tax-related matters from the perspective of their personal tax resident status, the types of taxes involved, the amount of tax payable, and potential tax incentives.

However, the content of tax-related regulations is relatively complex, and tax matters themselves are quite professional. In addition, the calculation of income from the transfer of cryptocurrencies like Bitcoin is complex, leading to even more complexity and uncertainty in tax-related matters concerning cryptocurrency transfers. Therefore, if individuals are involved in income from the transfer of cryptocurrencies like Bitcoin, it is recommended to communicate in advance with tax professionals or institutions to understand whether there are any relevant tax matters involved and how to declare and pay taxes if there are any. Advance planning is necessary to avoid the risk of not timely reporting tax matters or incurring tax obligations in multiple locations, which could lead to unnecessary tax risks or tax costs.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。