Original | Odaily Planet Daily

Author | Qin Xiaofeng

In recent days, as the BNB cross-chain bridge hacker Venus account position began to be liquidated, external crypto KOLs have begun to focus on discussing the future trend of BNB. Pessimists believe that BNB may repeat the same mistakes as FTT, leading to a collapse. They even compared the historical trends of the two, causing community panic. As shown below:

(KOL comparing BNB with FTT prices)

The question is, how much selling pressure will the recent liquidation of BNB have on the market? In conclusion, it will not have a major impact. The liquidation of BNB positions on Venus is entirely taken over by the BNB Chain team and will not be sold on the market, nor will there be large-scale chain liquidation.

The incident dates back to October last year, when a hacker used a loophole in the BNB cross-chain bridge "BSC Token Hub" to steal about 2 million BNB—when the price of BNB was $280, with a total value of about $560 million. Subsequently, the hacker deposited 924,821 BNB into the lending protocol Venus, borrowed about $152 million in stablecoins (including $116 million USDT and $36 million USDC), and transferred them to other chains.

After the incident, BNB Chain immediately released a new version, BSC v1.1.15, which can prevent activities related to the hacker account, and the BNB Chain node program blocked the flow and potential attacks of the stolen funds through blacklisting and suspension functions. In simple terms, the assets in the hacker's wallet address (the remaining 1.02 million BNB and other stablecoin assets) were restricted from being transferred—essentially, the wallet assets were permanently frozen, and the hacker only truly stole just over 900,000 BNB.

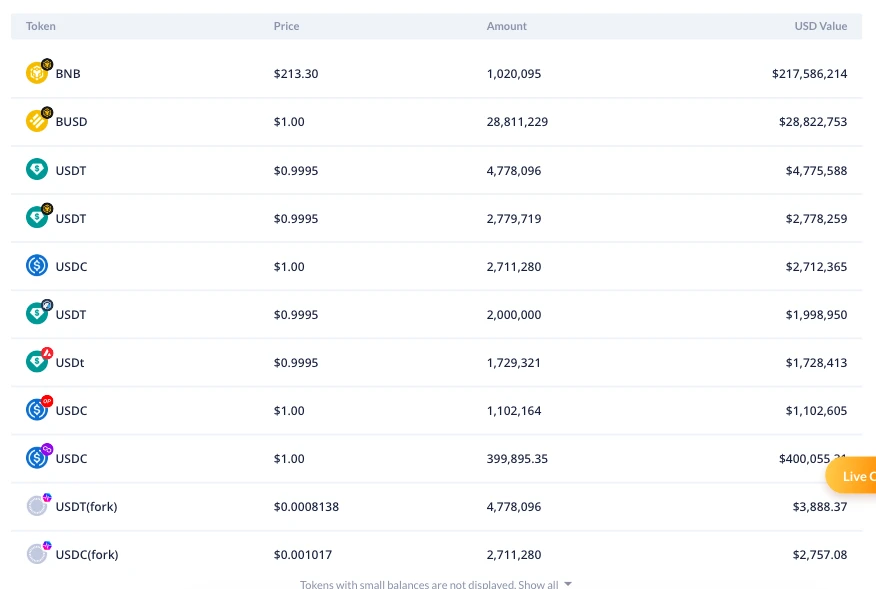

(Hacker wallet address assets)

At this point, the only headache for all parties was how to handle the BNB assets that had already been used as collateral in Venus. Directly reclaiming and destroying them at zero cost would mean a huge deficit of $150 million for Venus, which the depositors clearly would not agree to. Allowing the Venus protocol to operate on its own and automatically sell at the liquidation price would lead to a massive chain liquidation, further depressing the price of BNB, which is also not in the best interest of Binance.

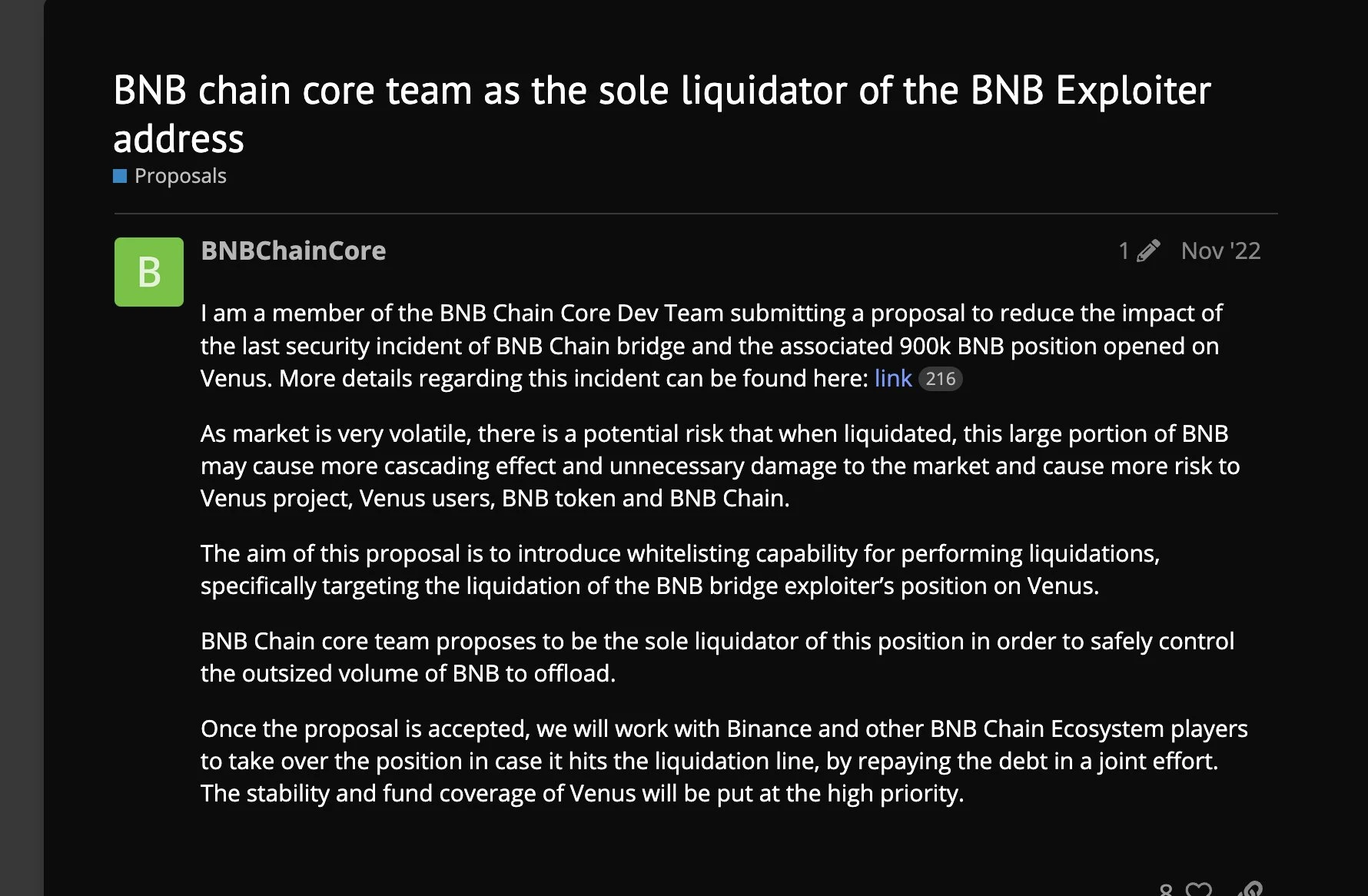

(BNB Chain community proposal)

In the end, Binance decided to bear the loss and proposed a proposal in the Venus community called VIP-79, which was approved. The specific content is: the whitelist address controlled by the BNB Chain core team is the only liquidator of the position, to safely control this extremely large supply of BNB and avoid direct chain liquidation. Furthermore, Binance promised that the liquidated BNB would not be sold on the market, but would be destroyed after being reclaimed.

At the time, the liquidation price of the BNB position in the Venus hacker address was about $220 USDT, and the spot price of BNB once approached this level. Therefore, the BNB Chain transferred $30 million USDT to the whitelist address as standby liquidation funds to prevent short-term price crashes. Interestingly, in the following weeks, the price of BNB began to rise, reaching as high as $400 USDT at one point, and the liquidation pressure discussion gradually decreased as the distance from the liquidation threshold increased.

Until June 12th of this year, as the price of BNB continued to decline and once again approached $220, attracting attention from the crypto community, BNB Chain once again supplemented with $30 million in stablecoins to address the challenge. This time, the price of BNB remained strong near $220 and began to rebound, once again avoiding liquidation.

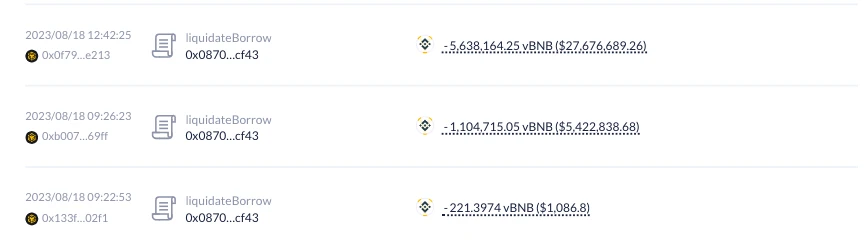

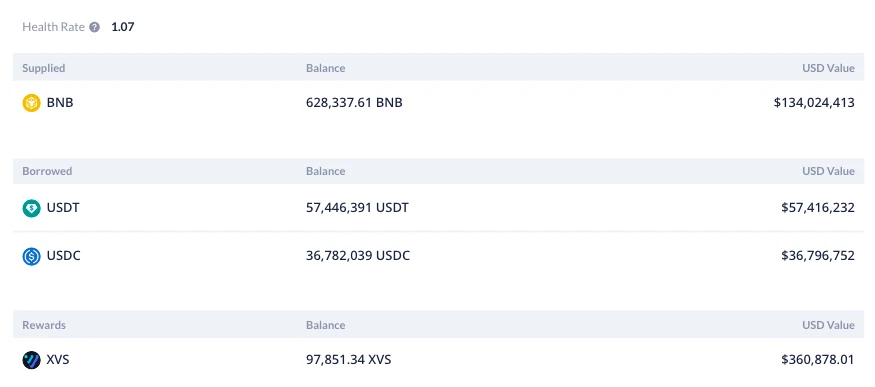

Finally, on August 18th, with a significant retracement in BTC price, the price of BNB finally broke through $220, and the BNB position in the Venus hacker address began to be liquidated (health factor below 1). On that day, a total of 6.7431 million vBNB (Venus BNB) was liquidated, and the BNB Chain address paid over $30 million to reclaim about 140,000 BNB. At this point, the liquidation price of BNB dropped to around $211, with the remaining 784,615 BNB in the hacker address. As shown below:

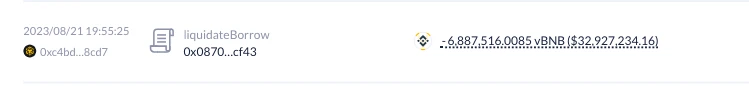

On the evening of August 21st, the price of BNB fell below $211, triggering another liquidation, with approximately $6.88 million vBNB being liquidated, and the BNB Chain address once again paying over $30 million to reclaim about 156,200 BNB. As shown below:

As of now, the remaining position in the hacker account is 628,337 BNB, and the health factor of the Venus account has returned to 1.07. According to estimates, the next liquidation price is about $199, with the current price of BNB at $213, requiring a 6.5% drop. The borrowing amount for this account is approximately $94.21 million, and the breakeven point for debt and collateral is about $150; in other words, as long as BNB remains above this price, Venus will not incur financial losses.

(Venus hacker account)

Overall, over the past few days, the BNB Chain has paid $60 million to reclaim 296,400 BNB, with minimal impact on the market. The price of BNB dropped from a low of $220 to $203, a maximum decrease of 7.7%; currently, the price of BNB is only down 3.1% from the $220 on the 18th, while BTC has dropped 2.3% during the same period.

However, with the agitation of certain individuals, BNB seems to have become a doomsday scenario, even the second FTT. In reality, the situation faced by Binance this time is not at all comparable to FTX: FTX misappropriated assets, causing a deficit of over $10 billion, while Binance is only liquidating $150 million of hacker debt, and the process is completely transparent and open.

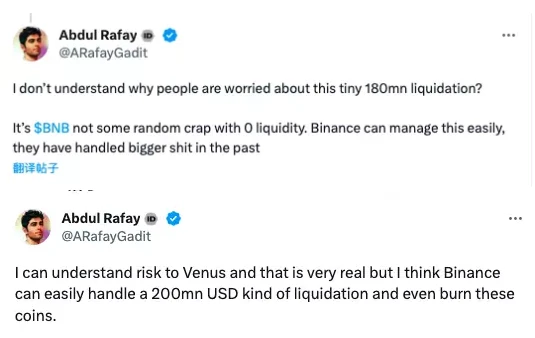

"I don't understand why people are worried about this small $180 million liquidation. BNB is not some random garbage with zero liquidity, Binance can easily handle this issue, they have dealt with bigger things in the past. I can understand the risks faced by Venus, but I think Binance can easily handle the liquidation of nearly $200 million, or even destroy these tokens." Abdul Rafay, co-founder of the cryptocurrency investment platform Zignaly, commented. Abdul Rafay

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。