Authors: Christophe J Waerzeggers, Irving Aw, & Jess Cheng

Introduction

Neutrality is widely considered a fundamental principle of good tax design. In short, the tax system should remain neutral to ensure that economic decisions are based on economic interests and other non-tax factors, rather than being influenced by tax considerations.

While the tax system can be an effective tool for achieving policy objectives beyond taxation, most jurisdictions have based their taxation of transactions involving crypto assets on neutrality.

Under this approach to taxing transactions involving crypto assets, jurisdictions rely on the primary principles in their domestic tax legislation to maintain a level of neutrality comparable to regular transactions or activities. This approach requires a case-by-case understanding of the facts, but due to the nature and diversity of crypto assets and the unique operations of the crypto industry, this is not an easy task. The rapid development of underlying technology and its inherent global impact transcends any single jurisdiction, making it even more complex. Similar challenges exist in other legal and regulatory areas, including those aimed at designing sound regulatory and supervisory approaches for crypto assets and their processing.

Stablecoins are a type of crypto asset designed to maintain a stable value relative to specific assets or asset pools (IMF, 2021, 41; FSA, 2020, 5). In this way, they aim to address the problem of price volatility in crypto assets; price volatility often makes these assets unsuitable as a store of value and is a major obstacle to their wider use as a means of payment. Given the prospects for wider adoption of stablecoins, it is necessary to conduct a more in-depth study of their tax treatment and related challenges.

This article argues that even though stablecoins have proven to have a more stable value compared to other forms of crypto assets, stablecoins cannot serve as a means of payment and be widely adopted without greater tax certainty and neutrality than currently exists. In addition, the mismatch in tax treatment between jurisdictions also creates opportunities for arbitrage and abuse, thus requiring more comprehensive international cooperation and coordination to address these issues. Finally, regardless of whether the value of a specific stablecoin appreciates or depreciates, clear tax treatment is needed, as taxpayers and tax authorities need to determine the appropriate tax treatment of gains and losses.

The article is divided into four parts. The first part mainly introduces an overview of stablecoins, including the classification of known circulating stablecoin types; the second part discusses the relevant issues of value-added tax (VAT) specific to stablecoins; the third part deals with the main income tax and capital gains tax issues related to stablecoin transactions. The discussion refers to the practices of representative countries, but does not provide a detailed summary of current national practices or methods, nor does it cover all VAT or income tax issues that stablecoin transactions may generate, as this would exceed the scope of this article.

I. Overview and Classification of Stablecoins

Crypto assets have many advantages, including security through encryption technology, which may make them suitable for payment purposes. However, the volatility of crypto asset prices significantly reduces their potential application value as a medium of exchange and means of payment (IMF, 2020). To address this issue, stablecoins have emerged as a subcategory of crypto assets, linking their value to another more stable asset (such as the US dollar, precious metals, or even another crypto asset) or other asset pools (such as a basket of commodities) through a mechanism known as "pegging." Almost all currently circulating stablecoins attempt to mitigate price volatility through some form of pegging mechanism.

It is crucial to distinguish between the concepts of "pegging" and "backing," which also depends on the nature of the claim of the holder of the stablecoin against the issuer (Nature of claim). The former only requires the value of the stablecoin to be pegged to the value of the underlying asset or asset pool (e.g., requiring the issuer to redeem at face value in US dollars), while the latter also involves the setting aside of assets by the stablecoin issuer (or a third party representing the issuer) and includes an understanding of the stablecoin holder's claim against these underlying assets (e.g., pledging or using a pool of short-term government securities) as a means of support for this peg. This distinction is important because some stablecoins may be explicitly pegged to the value of a specific asset, but the holder lacks any clear, legally meaningful right to use the specific asset itself.

Stablecoins can be further distinguished based on the type of reference asset to which they are pegged, either on-chain (i.e., another crypto asset) or off-chain (such as traditional currencies or commodities), and a stablecoin may be supported by more than one type of asset. For example, Tether (issued by Tether Limited, initially claimed to be backed by one US dollar per token), TrueUSD (TrustToken platform), USDCoin (Centre consortium, a collaboration between Circle and Coinbase), and Gemini Dollar (Gemini exchange) are all pegged to the US dollar, at least purportedly corresponding in value to various underlying assets one-to-one. PAX Gold (issued by Paxos Trust Company) is another example of a stablecoin with off-chain reference assets (precious metals). Each token is described as "redeemable" and "backed" by a London Good Delivery gold ounce stored in a professional vault facility in London. This off-chain backing inevitably requires a certain degree of centralization, such as custody of the underlying assets by a custodian, which can be said to diminish the decentralized advantages of crypto assets based on distributed ledgers. In the technical realm, there are also stablecoins that claim to be pegged to or backed by various crypto assets, some of which claim to be fully decentralized, meaning the underlying crypto assets are managed by a smart contract system rather than a central entity. For example, Dai operates on the decentralized Maker protocol and seeks to maintain a stable value using Ether. However, the precise operational mode of different stablecoins (including the legal nature of the support mechanism) may vary significantly.

In theory, stablecoins can exist without the support of underlying assets and achieve a certain degree of price stability. Kowala's kUSD is an example of such a stablecoin, claiming to adjust its supply based on algorithmic and informational interfaces between the blockchain and relevant market data, known as market-based "oracles," to maintain its peg to the US dollar. This stablecoin relies on a fully algorithmic "monetary" policy that adjusts the supply based on the value of its pegged currency, meaning that when the supply is too low, the algorithmic protocol issues new stablecoins, but when the demand is too low, the algorithmic protocol reduces its supply ("burns"), ensuring that the stablecoin's price remains within an acceptable range of its pegged value. There are even more complex situations, such as stablecoins generally referred to as "hybrid stablecoins," which combine support mechanisms and algorithmic protocols to reduce volatility.

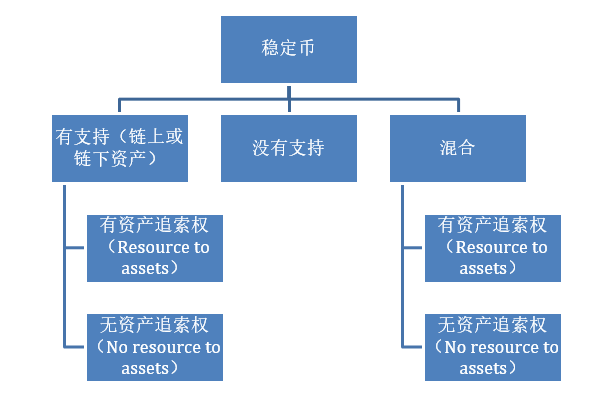

As mentioned earlier, it must be recognized that holders of stablecoins pegged to a particular asset do not necessarily have ownership of that specific asset. Instead, stablecoins can be pegged to the value of one asset but backed by another. For example, the value of the SGA (Saga) stablecoin is pegged to a basket of currencies based on the value of Special Drawing Rights (SDRs) of the International Monetary Fund, but the stablecoin is backed by reserves of different currencies and assets (including cryptocurrencies). Therefore, those choosing to redeem the stablecoin can receive the economic equivalent of the pegged asset but not necessarily the asset itself. Narrowly speaking, stablecoins can be further divided into two types: those with recourse to the underlying asset and those without recourse.

Figure 1: Classification of Stablecoins

Figure 1: Classification of Stablecoins

If stablecoin issuers can make their stablecoins have the characteristics of price stability and a broad user network, and are driven by the reputation and market influence of the association supporting the stablecoin arrangement—such as Facebook's Diem (formerly Libra) project—then such stablecoins will be very suitable as a means of exchange and a store of value to achieve economic purposes. They can serve as a more efficient method of retail payment settlement, especially in jurisdictions with significant currency volatility, or can reduce the cost of cross-border payments, or enable payments between jurisdictions that currently lack efficient interbank payment infrastructure (IMF, 2020, 14). However, at the same time, these stablecoins may also be used by investors as speculative financial instruments, and some investors may be willing to take risks and attempt to profit from the price fluctuations of stablecoins. Therefore, the current challenge is to determine the position of stablecoins within existing legal frameworks, including from a tax perspective (Cheng, 2020). With the rise of stablecoins, regulatory responses from supervisory authorities are diverse, and existing multiple regulatory frameworks may apply to specific types of coins (for example, the Swiss Financial Market Supervisory Authority's guidelines on stablecoins formulated under Swiss regulatory law point out that anti-money laundering, securities trading, banking, fund management, and financial infrastructure regulations may be relevant to specific types of coins). For these regulatory purposes, the regulatory scope of stablecoins may overlap. Specific stablecoin arrangements may be subject to different regulatory regimes simultaneously, but tax law requires that the treatment of stablecoins be placed under a single or primary classification—put another way, the treatment of stablecoins can only be placed under one tax classification and regime.

II. Value-Added Tax Treatment of Stablecoins

Value-Added Tax and Currency

The vast majority of value-added tax systems do not specifically tax the currency used to pay for goods or services provided, generally achieving this by treating the supply of such currency as "out of scope" or explicitly excluding it from the definition of "supply." Conceptually, currency itself does not belong to the consumption category; it is merely a measure of consumption expenditure, and the tax treatment related to goods or services supplied (excluding currency) is determined based on it. Therefore, for value-added tax purposes, providing currency as a medium of exchange and means of payment to obtain goods and services does not constitute a separate taxable transaction. This approach, in practice, also has the benefit of reducing tax complexity and avoiding the actual difficulty of determining the taxable amount and deductible amount for each transaction.

On the other hand, exchanging one currency for another, i.e., currency exchange, is generally considered a supply for the purposes of value-added tax, but even so, it is usually exempt from value-added tax. Excluding such transactions from the tax base is reasonable because there is no consumption in currency exchange transactions; it is merely an exchange of one medium of exchange for another, or a purely financial investment. These exempt measures are important for facilitating unhindered payments, as they bypass the actual difficulties of determining the taxable amount and deductible amount for each transaction.

Treating the supply of currency as an exempt supply rather than a non-supply (or out-of-scope supply) is not without consequences. Although no tax is due in both cases, in the case of an exempt supply, the right of the taxpayer to deduct input tax depends on the quantity of currency supplied, while in the case of treating the supply of currency as out of scope, they are generally not affected in this way. From a compliance perspective, jurisdictions generally require separately reporting exempt supplies in the value-added tax return, while out-of-scope supplies generally do not need to be reported at all.

Finally, it should be noted that value-added tax is only not levied when currency is used as a medium of exchange or acquired as an investment. For example, if the provided currency is coins or collectibles, it should be subject to tax because coins themselves have intrinsic value and should therefore be subject to value-added tax as a supply of goods.

Trends in the Value-Added Tax Treatment of Non-Traditional Digital Payment Methods

Jurisdictions levying value-added tax seem increasingly willing to treat certain non-traditional digital payment methods as currency for the purposes of value-added tax, even though they are not legal tender and do not have the status of legal currency (IMF 2020, 11-12).

In the case of Skatterverket v David Hedqvist C-264/14 (Hedqvist), the Court of Justice of the European Union, through an interpretative approach to the purpose of Article 135(1)(e) of the EU VAT Directive, concluded that, for the purposes of EU value-added tax, the exchange of traditional currency for non-traditional "currency" units (i.e., excluding currency that is legal tender in one or more countries) for the purpose of making a profit (or vice versa) constitutes a financial transaction exempt from value-added tax. However, the court explicitly stated that this exemption should only apply to the following non-traditional "currency": (1) where both parties accept it as an alternative to legal tender; (2) where it has no purpose other than as a means of payment.

The Court of Justice of the European Union considered that the difficulties faced in levying value-added tax on such exchange transactions (in this case, the exchange of traditional currency for Bitcoin) are the same as those faced in (traditional) currency exchange, i.e., how to determine the taxable amount and deductible amount for each transaction. Therefore, not exempting exchange transactions involving non-traditional currencies such as Bitcoin from value-added tax would undermine the effectiveness of the exemption. For value-added tax purposes, EU member states consider such non-traditional currencies as currency as long as they are subjectively accepted by all parties as an alternative to legal tender and objectively have no purpose other than as a means of payment. Although Hedqvist involved the exchange of Bitcoin for traditional currency, the ruling also implies that in the EU, the supply of goods and services using non-traditional currencies such as Bitcoin does not need to be subject to value-added tax as it would be when using traditional currency.

In 2017, Australia amended the Goods and Services Tax (GST) Act to provide that when digital currency is used to pay for other goods and services, its supply is treated the same as the supply of currency and is not considered a supply for the purposes of goods and services tax. The purpose of the legislative amendment was to ensure that the definition of "digital currency" "roughly equates to the characteristics of the national legal tender." Among other things, digital currency must not (1) be denominated in any country's currency; (2) have value that is dependent on or derived from the value of anything else; or (3) confer a right to receive or direct the supply of particular goods, unless that right is purely incidental to the holding or using of the currency. This approach contrasts sharply with the ruling in the Hedqvist case by the Court of Justice of the European Union, which did not explicitly prohibit digital payment methods from being denominated in the national currency or having their value derived from or dependent on something else, but did require that digital payment methods have no objective function other than as a means of payment. Therefore, under Australian tax law, if a digital payment method does not meet the definition of "digital currency" because its value is derived from or dependent on something else, it will be treated as a "financial supply" for input tax purposes (i.e., exempt from output tax and generally not eligible for input tax credit).

Similarly, as of January 1, 2020, Singapore has effectively treated digital payment tokens as currency for goods and services tax purposes; that is, payment using digital payment tokens does not constitute a supply, and the exchange of digital payment tokens for traditional currency or other virtual currencies is exempt from goods and services tax. The proposed definition of "digital payment token" in the new section 2A of the Goods and Services Tax Act in Singapore is broadly similar to the definition of "digital currency" in Australia, but with two significant differences. First, the definition excludes tokens that (1) confer a right to receive or direct the supply of goods or services; (2) no longer have the function of a medium of exchange after the right is exercised. This is more lenient than the approach of the Goods and Services Tax in Australia, which prohibits digital currency from conferring any non-incidental right to receive or direct the supply of any goods. Second, tokens cannot be denominated in any currency or pegged to any currency by their issuer, while the Australian approach does not allow tokens to be denominated in any currency or have their value derived from or dependent on anything else. However, despite the clear legislative wording, the Inland Revenue Authority of Singapore (IRAS) stated in a recent e-tax guide that tokens "pegged to or backed by any legal tender, a basket of currencies, commodities or other assets" should be treated as derivatives, meaning their supply also constitutes a financial supply exempt from goods and services tax (IRAS 2022, para. 5.7).

Value-Added Tax and Stablecoins

As mentioned earlier, the volatility of crypto asset prices often makes them unsuitable as a store of value and hinders their widespread use as a means of payment and medium of exchange. The birth of stablecoins aims to address this issue by pegging their value to other relatively stable currencies or assets. However, the pegging mechanism means that, according to the approaches of Australia and Singapore, stablecoins will always be considered derivatives rather than currency, and therefore their supply will be exempt rather than completely ignored, resulting in substantive and administrative or compliance value-added tax implications for the parties to the transactions. Although the Australian approach is more lenient than the approach of the Court of Justice of the European Union in the Hedqvist case regarding tokens that have purposes other than as a means of payment, this does not change the fact that stablecoins can only be treated as a category and cannot be considered as currency, as they are inevitably pegged to other assets or currencies to maintain stability.

In contrast, according to the approach of the Court of Justice of the European Union, the pegging mechanism—whether to a currency or other asset—does not in itself preclude the possibility of subjecting stablecoins to value-added tax as currency, provided that the parties subjectively consider stablecoins as an alternative to currency and objectively have no purpose other than as a means of payment. As for the former requirement, the stability of coins or tokens can to some extent support the presumption that the parties are more likely to use them as an alternative to currency. On the other hand, since the lack of stability itself does not prevent traditional currency from being considered as currency for value-added tax, its relative stability itself should not be decisive. The strictness of the latter requirement—the objective absence of any purpose other than as a means of payment for the tokens—may exclude hybrid tokens, including hybrid stablecoins, which may have purposes other than as a means of payment.

Pegging and/or Recourse?

In the explanatory memorandum to the Australian amending legislation, it is considered that the value of digital currency "must come from the market's assessment of the currency's value, to achieve the purpose of exchange, even though it has no intrinsic value." Therefore, pegging the value of digital payment tokens to the value of another asset or currency, for the purposes of goods and services tax, excludes these units from qualifying as digital currency and treats them as derivatives whose price is directly dependent on the value of their underlying asset or currency.

However, given that many traditional currencies are effectively or legally anchored to one or more major currencies, it is unclear why pegging to a traditional currency or a basket of traditional currencies automatically deprives non-traditional digital payment tokens of their qualification as digital currency for the purposes of goods and services tax. In addition, comparing stablecoins to derivatives is not entirely accurate. Most derivatives are financial contracts that create rights and obligations between the parties based on the value of the underlying asset or currency at a predetermined date or event in the future. In contrast, stablecoin holders have open-ended rights or claims against their issuer or others, without involving a fixed date or event in the future, and for algorithmic stablecoins or seigniorage stablecoins, since there is no asset backing, they cannot be redeemed for any other assets, and their holders can only make unsecured claims against the issuer. Similarly, stablecoins with asset backing but unclear or non-existent recourse to the underlying assets—including due to a lack of consumer protection regulations—do not provide their holders with any claim to the assets, even if those assets are used in some way to maintain the value of the stablecoin, regardless of the mechanism.

On the other hand, stablecoins pegged to sovereign currencies are more similar to negotiable promissory notes, banknotes, or traveler's checks, where the holder can present the note for payment, similar to a substitute for currency, but it is issued by a private entity rather than a sovereign state and does not have legal tender status (i.e., the law does not require the creditor to accept the stablecoin as payment for a monetary debt unless otherwise agreed in the contract). The fact that stablecoins are not issued by a sovereign state (through a central bank) should not determine whether they should be considered as currency for value-added tax purposes. For example, bank deposits representing claims against commercial banks are issued by private entities but are still considered as currency. Nevertheless, for value-added tax or consumption tax purposes, the fact that certain types of privately issued non-traditional digital currencies are considered as currency implies that legal tender status is not a necessary condition for being primarily used as a medium of exchange and means of payment. In fact, value-added tax laws generally do not require items considered as currency to have legal tender status.

However, stablecoins pegged to assets other than sovereign currencies may raise concerns about value-added tax leakage or avoidance, as the supply of the underlying commodity may be a taxable supply. If the parties do not intend to use stablecoins as a medium of exchange but as a supply or substitute for the underlying asset, there is a risk of leakage as long as the supply of the underlying asset does not exceed the scope or is exempt. The low barrier to entry for token creation and issuance complicates this issue, which may allow individuals to avoid the value-added tax that would otherwise be due on the taxable supply of goods by repackaging transactions as token issuance and transfer. Financial technology regulatory frameworks are still in the early stages of development, and many jurisdictions have expressed the need to avoid hindering innovation and entrepreneurship in designing regulatory systems. However, the lack of or inconsistency in regulation may also make it more difficult for tax authorities to monitor any transactions involving the underlying assets, even the existence of the underlying assets.

Therefore, according to the approaches of Australia and Singapore, the requirement that the value of digital payment units must not be pegged to the value of any other goods can be reasonably interpreted as a means to address this potential leakage and avoidance. The approach of the Court of Justice of the European Union does not provide for this requirement, but instead focuses on the subjective intent of the parties to the transaction and whether the tokens are used as an alternative to currency. Although the subjective intent test allows for the consideration of different relevant factors as a whole and does not exclude tokens pegged to the value of other assets, in practice it may be more difficult to determine, thereby reducing the tax certainty for taxpayers and tax authorities.

Hybridity

Tokens may have more than one functional characteristic, which presents more challenges for the classification for tax and other purposes. The objective test in the Hedqvist case by the Court of Justice of the European Union addresses the issues of leakage and avoidance, i.e., for tokens that have purposes other than as a means of payment (i.e., pure payment tokens), they are refused treatment similar to currency for value-added tax purposes. According to this approach, any other type of token will not be considered as currency for value-added tax purposes, and its supply will generally be subject to tax, unless it is sufficiently similar to financial transactions that are currently exempt.

However, many tokens with other built-in functionalities may be widely accepted as a medium of exchange and means of payment. In this regard, Australia's incidental benefits test seems to be less stringent than the EU's approach, allowing tokens primarily designed as payment tokens to be considered as digital currency as long as their non-payment functions are incidental to their primary purpose as a medium of exchange. As explained in the explanatory memorandum to the Australian amending legislation, the purpose is to ensure that "many common incidental functions in the operation of digital currencies, such as updating distributed ledgers to confirm transactions, do not affect the status of these currencies as digital currency."

The payment token test in the Singapore Goods and Services Tax legislation is the most lenient of the three approaches, with no restrictions on the primary or incidental extent of the non-payment benefits of hybrid tokens. Instead, the ability of the token to be used as a medium of exchange and means of payment after the non-payment benefits or rights are exhausted. However, this approach presents challenges in delineating between currency supply and voucher supply, as vouchers can continue to function as a means of payment even after the benefits or rights have been fully utilized. This can be illustrated by Example 2 in the IRAS e-tax guide:

Example - Digital payment token used to receive specified services and can be used as a medium of exchange

StoreX is a digital token designed to be the exclusive payment method for X Company's distributed file storage network. According to its initial token issuance terms, StoreX grants holders a permanent right to a specified amount of file storage space. The token can also be used to pay for goods and services from other merchants on the X Company platform, even after exercising the specific amount of file storage rights. If it meets all other conditions of a digital payment token, StoreX would qualify as a digital payment token.

In this example, despite StoreX also having file storage rights, the StoreX issued by X Company is considered a currency supply because it is not within the scope of consumption tax. Assuming the token only has file storage rights, it would be considered a product voucher and subject to goods and services tax at the time of voucher issuance. Because StoreX has payment functionality, it is treated as currency rather than a voucher, and the provision of file storage services is not taxed.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。