SEDA has created a unified data layer that allows information, liquidity, and message transmission to flow not only from the real world, but also between blockchains.

Written by: Sunny & David

SEDA: Peter and Jasper

Preface

Oracle is an essential element for maintaining and enhancing the "trust machine" of blockchain.

In June, Vitalik mentioned the need for an ultimate oracle in the crypto ecosystem as infrastructure. Apart from the well-known Chainlink, there are many important projects persistently building in this field, such as SEDA.

SEDA aims to be the HTTP of Web3, building a data transmission layer that allows querying data from any layer 1. Compared to other products, SEDA is more egalitarian and down-to-earth, attempting to create a true 'people's Oracle' in line with the spirit of web3. For example, it supports data from any source, has a more user-friendly pricing design, and is more cost-effective for simple data requests.

In the following interview, we will learn about the experiences and thoughts of the co-founders of SEDA, understand why they wanted to build such an Oracle, and how they managed to achieve such great success during two difficult years when everyone was questioning them. We hope this interview can help everyone to understand SEDA and Oracle more, and also provide some warmth and encouragement for those in the entrepreneurial winter.

International Entrepreneurship, Meeting at ETH Berlin

TechFlow: Can you briefly introduce your backgrounds and the reasons for entering the cryptocurrency field?

Peter Mitchell:

I am the co-founder and CEO of SEDA. When we were developing the first application, I was responsible for Jasper's part of the work. I got in touch with cryptocurrency through EveryDapp, the first platform to plan and rank dApps.

My goal was to build a user-friendly platform that allows Web3 newcomers to understand various smart contracts. We reviewed and verified the code, and provided beginners with entry guides.

This project marked my first appearance in the cryptocurrency field. In 2018, I found Jasper and sought a technical co-founder to start a new venture with him.

Jasper:

I am the co-founder and CTO of SEDA. Before getting into cryptocurrency, I focused on Facebook data analysis, creating dashboards for large publishers using the Facebook API. I left my previous startup because Facebook frequently changed their API, making it difficult to maintain viable software. We were constantly patching software vulnerabilities instead of innovating.

I was attracted by the charm of cryptocurrency and transitioned to the cryptocurrency field, taking on contract development work. A notable task at this stage was working on the plasma client at Finality Labs, funded by the Ethereum Foundation, focusing on Ethereum's scalability.

TechFlow: Peter is from the United States, and Jasper is from the Netherlands. How did you meet and decide to establish SEDA with this international background?

Peter:

- We actually met at ETH Berlin. In 2018, I found Jasper on GitHub, where he was developing a hackathon project for ETH Berlin 2018. At that time, I was looking for a co-founder and CTO, so I messaged him, saying, "Hey, we should meet." We basically spent the entire weekend hacking together, and then we continued to build and collaborate.

Jasper:

I showcased my first project at ETH Berlin, where I met Peter. We collaborated on multiple projects and eventually developed an application specifically for derivative trading based on startup milestones and funding rounds.

However, we realized that platforms like Augur and 0x, built on Ethereum, were costly and unlikely to achieve widespread adoption.

Therefore, we shifted our focus to open market infrastructure. At this stage, we discovered a huge opportunity in the Oracle field. So, we delved into research and started developing Oracle. So far, we have developed two Oracle products, one of which received over $3.7 billion in support during the recent bull market.

However, seeing potential improvements in our products, we revisited our initial concept. We are currently improving our infrastructure with the goal of becoming the foundational data layer of Web3. This will support data queries from any layer 1 and support computation within our network.

Three Questions about SEDA: What? Why? How?

TechFlow: Can you explain in detail what SEDA is now and what problems SEDA is solving?

Jasper:

When you deploy a smart contract on platforms like Ethereum, all the data in that contract is, by definition, public, but sometimes partially hidden. This means that anyone can read it, including other smart contracts, which can also use this data. Essentially, this is similar to open, permissionless APIs that can communicate with each other, emphasizing interoperability.

However, this approach is limited because smart contracts can only access data on Layer 1. What we are building is a bridge connecting Layer 1 and all other data in the world. This allows smart contracts not only to query data from other smart contracts but also to make internet requests to obtain any desired data, thus achieving seamless connection of on-chain and off-chain information.

Peter:

You can think of SEDA as the foundational transport layer of Web3, similar to HTTP in traditional networks. The problem we are currently facing is fragmentation. With the emergence of each new Layer 1 ecosystem or Layer 2 roll-up, including superchains, subnets, and various other choices for building unique ecosystems with unique use cases, everything becomes decentralized. As a result, resources (such as users, liquidity, and adoption) are dispersed across a complex, diverse, and unique ecosystem network.

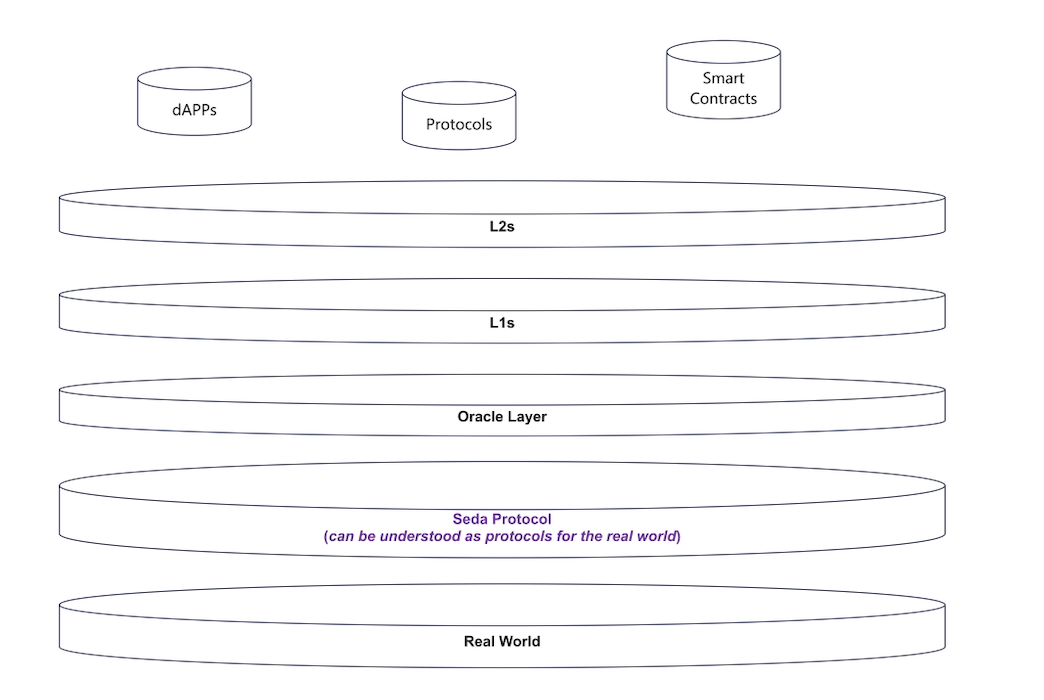

SEDA has created a unified data layer that allows information, liquidity, and message transmission to flow not only from the real world, but also between blockchains. You can think of SEDA as a foundational layer below Layer 1 and Layer 2, connecting them in a coherent manner. This is what we are launching in the market today.

TechFlow: Will the SEDA protocol disrupt the existing oracle market?

Jasper:

Consider the trend driving the system, where you can view cryptocurrencies as having secure, decentralized, and permissionless immutable Layer 1, such as Ethereum.

On top of this system, you can build mutable code, such as Compound. Here, you have a decentralized contract that is immutable and permissionless, allowing anyone to review the code and understand exactly how the protocol operates under specific conditions. Everything becomes clear: how much USDC is borrowed, how much ETH is collateralized, and we know the exact borrowed APY, and so on.

However, there is still an opaque middle layer, like building a very tall skyscraper on sand. This middleware layer represents centralized failure points in crypto. If the Oracle fails or provides incorrect data, serious consequences may arise.

Many existing oracles are not very decentralized; they have a whitelist validator set where only 10 or 20 companies can push data, or they provide access to data equivalent to Web 2.0 style. This may require signing contracts or exclusive agreements, making data access very permissioned and opaque, similar to unstable middleware.

Peter:

In the DeFi application scenario of oracles, we believe that to truly scale decentralized finance (DeFi), especially if you want to see $1 trillion in value in DeFi, you cannot rely on a small, opaque, centralized group of companies.

Doing so is as bad as handing over the entire infrastructure to traditional banks. In this case, you ultimately place your trust in relatively small software companies that may have opaque business practices.

Our vision is to ensure fully permissionless systems from the bottom of the Layer 1 stack to the top of the protocol layer.

TechFlow: How does the SEDA protocol establish this close data layer for L1/L2 blockchains and real-world data?

Peter:

You can think of the Oracle in the SEDA framework as something like a module. For example, you can build a module on our network for Oracle data (such as price data).

Visualize the structure as a stack, with SEDA serving as the foundational layer of data. Above that, you have the network layer, composed of Layer 1 or Layer 2. Then, protocols and smart contracts are built on top that can query data or perform cross-chain computation or message passing.

In this case, Oracles can be seen as a function or module specifically designed to operate on top of our data standards.

Jasper:

Eight weeks after the launch of our first Oracle product, we had three active networks securing a total of $37 billion in crypto assets, making SEDA the second-largest Oracle in the cryptocurrency space. This rapid growth highlights the adoption, liquidity, and usage demand of these networks. However, the evolving cryptocurrency space faces an integration challenge: the lack of reliable data and bridging capabilities will isolate new networks.

Each L1 and L2 operates as an independent entity, similar to Web 2 data silos. SEDA aims to connect these entities. The rapid growth of our initial product highlighted the complexity of Oracle deployment. Typically, Oracles are smart contracts on L1 or L2, supported by infrastructure components such as data providers. Each new integration requires redeveloping and redeploying Oracles.

For example, redeployment on Ethereum or EVM L2 is straightforward, but on Solana, it requires rebuilding in Rust, introducing new security challenges.

SEDA's solution is to aggregate data on our Cosmos SDK main chain, where our security and consensus processes reside. Then, the data is relayed to each L1 or L2 through relay smart contracts. This simplified approach allows us to scale without constantly reassessing trust assumptions.

Cosmos-Based Full-Chain Oracle

TechFlow: Why use the Cosmos SDK?

Jasper:

We build using the Cosmos SDK. To query our data, you only need a smart contract that can parse our encrypted proofs from our network, allowing access to our data. While our infrastructure is built on Cosmos, we do not rely on Inter-Blockchain Communication (IBC). We have implemented our own fully trust-minimized bridging mechanism.

We chose Cosmos because it is the most mature and plug-and-play infrastructure for creating custom networks. Our goal is to act as a data hub, aggregating and distributing data on our main network to all connected networks.

Cosmos, as a dedicated application-specific blockchain, seamlessly achieves this goal. It is battle-tested, supported by an active community, and adopts a reliable Tendermint proof-of-stake system.

We settle and checkpoint using Cosmos. However, we also have an overlay network consisting of custom nodes responsible for data queries. These nodes are randomly selected by the Cosmos chain through its built-in randomness feature in its validator set.

Cosmos selects random overlay nodes to execute specific computations. Once these computations are completed, the results are returned to the Cosmos chain and subsequently distributed. Essentially, Cosmos provides the preferred SDK for developers looking to develop application-specific blockchains that are chain-agnostic.

TechFlow: How is decentralization achieved in the protocol?

Jasper: The system runs on the Cosmos SDK. While I may not be the best person to delve into its technical details, I can guide you on how data is collected and then returned to users. Here's how it works:

Users make price feed requests, such as the price of ETH-USDC on Ethereum.

Our network identifies the data request, and our validator set randomly selects a specific number of overlay network nodes to fetch this data.

In the price feed request, users can specify which data sources to use, providing API endpoints. Additionally, the request includes a binary file defining how the data should be computed.

The request is sent to the selected overlay network nodes.

These overlay network nodes operate as a secret committee, meaning they do not know which other nodes are processing the same request. They retrieve the necessary data and perform the specified computation.

Using a commit-reveal scheme, each node first commits its result and then reveals it in sequence.

Individual results are aggregated as predetermined.

The aggregated result is then passed back to the individual or entity requesting the price feed.

Subsequently, the protocol can access and use this data.

Peter:

In Cosmos, there are multiple validator sets, each with a subset. The system is robust, utilizing randomness to determine which validators are chosen to query data. Instead of specifying specific companies or entities as data query nodes, any validator in the network may be selected. One challenge of Cosmos is its limited validator set. In our network, there are approximately 100 validators responsible for the data chain, which is a relatively small number. To further decentralize the execution of data requests, we have implemented an overlay network design. The primary role of these 100 validators is to use a verifiable random function to select nodes from the overlay network.

Our goal is to have the overlay network consist of thousands of nodes, ensuring a broader selection pool than the core chain.

Public Goods and Revenue Model

TechFlow: As a data layer protocol, what is SEDA's revenue model?

Peter:

- Essentially, when making a data request, you attach a payment, which can be made in various currencies, depending on what the relayer supporting our network accepts. The relayer then uses this payment at their discretion. However, to perform computations through our network, the relayer needs to burn a certain amount of network tokens. Our goal is to ensure easy access to our data. Therefore, while relayers can accept various currencies, they ultimately burn our tokens to pay for computation fees. As these tokens are burned, our network experiences deflation, similar to EIP 1559.

TechFlow: How does the concept of public goods intertwine with SEDA's protocol compared to Ethereum?

Jasper:

Ethereum is a public good. It is non-excludable and non-rivalrous, meaning anyone can use it without limiting others' use. Ethereum's funding primarily comes from gas and issuance. A specific percentage is minted annually and distributed to validators, as well as their base income.

Ethereum has become the foundation for decentralized computing and numerous financial applications, including lending protocols, perpetual contracts, real-world assets, and NFT minting randomness. These applications often require oracles.

Currently, oracles are primarily funded by private companies, and the economic model is not sustainable. We believe in the importance of building a decentralized, permissionless, self-sustaining ecosystem through the use of funds. This is crucial for long-term reliability. Relying on private companies for data poses a risk; if the company goes bankrupt, the dependent systems may collapse.

Therefore, viewing data infrastructure as a public good is crucial. We focus on computations related to requests, which have many similarities with smart contracts.

TechFlow: How does SEDA, as a public good, generate revenue?

Jasper:

- The network and infrastructure remain open and permissionless. There are built-in parameters, such as burning data to request information. If a protocol uses our service, they compensate relayers with their chosen currency (such as USC or ETH), which is then converted and burned in our core network.

Peter:

While our team builds the protocol, we operate as a non-profit association in Switzerland. Our goal is not to levy additional fees on our network or embed it in our consensus. However, we can design revenue tools.

For example, we may create data modules that allow institutions like Nasdaq to privately link their API with our network. Any revenue tools would be supplementary, enhancing the user experience. However, the main network remains open, transparent, and free, and we do not have any financial incentives.

Jasper:

It is important to emphasize that network participants need incentives. This is not a charity. Validators in the network are not operating out of pure goodwill. Therefore, built-in mechanisms to support these decentralized network members are crucial.

One approach we take is to become an oracle that is aware of MEV. When prices update on Ethereum and transactions are visible in the mempool, MEV searchers predict the updated network state. They assess potential opportunities and strategically position specific oracle updates through frequent flashbots auctions based on the value they can extract.

Currently, this auction revenue goes to Ethereum validators. We believe this is not the only way. We are innovating, internally auctioning the right to position our oracle updates, channeling this potential revenue to our network validators.

Two Years, Enduring the Capital Winter

TechFlow: Major capital markets in European countries may not be as mature as in the United States. Can you share your experience in raising funds for the project and achieving growth?

Peter:

Our journey began in the bear market of 2018. Over two years, we attempted to raise funds but could only secure enough to sustain our project. Many venture capitalists we approached were very hesitant, explaining that they were not investing due to the market downturn.

European venture capital firms we approached were particularly cautious, waiting for us to have a large team and significant traction before considering investment.

For startups like ours, with only Jasper and me having a concept at the time, finding investors willing to take a risk was indeed challenging. Most of our fundraising was completed between late 2020 and early 2021, right at the onset of the Covid pandemic.

I remember going to cities like San Francisco and New York to meet investors, and despite the economic strain, we still paid nearly $4000 for a brief hotel stay at the time. Fundraising was truly a tough struggle.

Jasper: A notable point is that while we dealt with investors for two years, we were also building the product. Investors recognized this resilience. They saw that we were not just pursuing quick profits but were committed to continuous construction. Demonstrating steadfast determination in the bear market significantly enhanced our reputation. This perseverance earned tremendous trust from our investors.

Peter:

Today, we have raised over $22 million, with investors including Distributed Global, Coinbase Ventures, Coin Fund, Reciprocal, and many other institutions. Fortunately, in this bear market, we have ample funding and a solid track record. This not only allows us to survive but also to thrive. Even in these challenging times, we are expanding, hiring, and accelerating growth, and we are deeply grateful for this.

Learning from the previous bear market, we remember the challenges of 2018 and 2019, when capital was not as readily available as it is now. We have ensured financial responsibility and secured enough resources to grow and maintain an offensive posture in any subsequent bear market.

Peter: When Jasper and I started working together, we lived in Hamburg, just a short five-minute walk apart. Becoming founders brought an emotional rollercoaster; it was like riding a roller coaster. At times, everything seemed hopeful, while at other times, the challenges were immense. Jasper and I have always been a strong support system for each other.

The mutual understanding between us has been crucial. The foundation of this understanding is how we built our team. We took the time to hire team members, ensuring a strong, talented core. As our growth continues, the consistent feedback from our team is an appreciation for the culture, which emphasizes hard work and mutual understanding.

Afterword: Reflections on the ETHcc Conference

This interview took place in the interview room at ETHcc 2023, generously provided by the YAP team. In this concentrated conference room atmosphere, the main themes driving Web3 developers were evident: infrastructure, real-world assets, and account abstraction.

While Jasper and Peter chose to stay in Europe to further develop SEDA, they pointed out that the startup environment in Europe is often more cautious compared to North America. SEDA's early venture capital came from North America, and European investors followed suit after receiving certain market signals.

Surrounded by charming cafes, bakeries, and picturesque scenery, one can't help but imagine what it would be like if Europe had a startup atmosphere like that of San Francisco.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。