This time, the disgrace was brought to Singapore. Ironically, one of the suspects is the buyer who purchased 20 units at Conning River Bay for a total price of 100 million Singapore dollars in May last year.

Written by: WZ (Wang Zong)

Source: Wang Wang Lai Fu

Born in mainland China, mostly from Fujian.

Made fortune in the Philippines, Myanmar, and Laos.

Entered Singapore with passports from Cyprus, Vanuatu, Turkey, and Cambodia.

Through Singapore's family office 13O (rumors), transformed into a tycoon in the tea-selling industry.

Died in a sudden raid by the Singapore police on Tuesday.

That night, some Fujianese acted upon hearing the news and fled Singapore overnight.

1. The largest money laundering case in Singapore's history

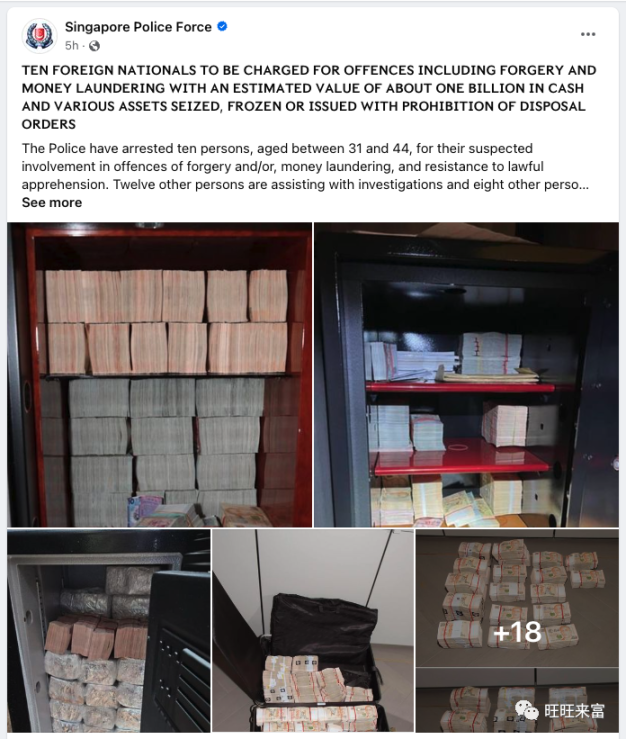

This week, the Singapore Police Force (SPF) and multiple departments conducted a coordinated raid, arresting 10 individuals with a total value of over 1 billion Singapore dollars, approximately 700 million US dollars.

Luxury cars, mansions, and countless luxury watches and handbags were involved in this operation, showcasing the extravagant lifestyle of the wealthy.

For specific details about the arrests, refer to SPF's Facebook page, which includes 18 extravagant on-site photos. The following image is one of the official screenshots.

During a press visit, the police also mentioned that none of the arrested individuals are citizens or permanent residents of Singapore, which carries significant irony. The exact words were:

All the persons involved are neither Singapore citizens nor permanent residents.

2. Mastermind of the money laundering case holds multiple passports

It is believed that all 10 individuals are from Fujian, China. However, most of them hold typical investment immigration passports, mainly from Cyprus, Vanuatu, and Turkey.

If you are unfamiliar with the legal and compliant acquisition of a second nationality passport for a few tens of thousands of US dollars (provided that the source of funds is legal), it is recommended to refer to previous articles from Wang Wang Lai Fu:

- The Vanuatu passport bought in 3 weeks, now banned from entering the EU

- More than 50% of the 6000 Cyprus passports are from illegal sources

Why are these individuals mainly concentrated in Cyprus, Vanuatu, and Turkey?

Because the most significant feature of these three countries is their lax due diligence. Historical data shows that even individuals with a bad or criminal background can still buy a passport with money.

The ultimate result is:

- Cyprus was completely halted 3 years ago, and in recent years, hundreds of passports have been revoked, leaving a bad reputation.

- Although Vanuatu has not been completely halted, the EU has completely stopped visa exemptions, leaving very few countries with visa exemptions.

- Turkey currently seems to have no issues, but it is certain that a fate similar to Cyprus will emerge in the future.

Next, let's analyze the backgrounds of the 10 individuals arrested with "Cyprus" and "Vanuatu" passports.

2.1. Cambodian passport + Cyprus passport

A 40-year-old Cypriot man was arrested in a Good Class Bungalow (GCB) in Ewart Park. He was also found to hold passports from China and Cambodia.

It is certain that he was born in mainland China. Why would he hold a passport from one of the world's least developed countries, Cambodia?

He did business there and incidentally bribed his way to a Cambodian passport.

Using this Cambodian passport as a stepping stone, he then applied for a Cyprus passport, effectively whitewashing his previous dark history.

During the arrest, when the police showed his identity and requested him to open the door outside his bedroom, the man jumped from the balcony on the second floor of the bungalow and was found hiding in a drain by the police.

The police seized over 2.1 million Singapore dollars and other foreign currencies, issued prohibitory disposal orders for 13 properties and 5 vehicles estimated to be worth over 118 million Singapore dollars, and also seized multiple pieces of jewelry, bottled wine, and grape wine.

The police also froze 4 related bank accounts with a total value of over 6.7 million Singapore dollars.

How did he acquire these accounts?

We will analyze this later.

2.2. Turkish passport + Vanuatu passport

A 42-year-old Turkish man was arrested in a villa in Bishopsgate. He was also found to hold passports from China and Vanuatu.

In earlier years, Turkish passports were not thoroughly investigated, and buying a $250,000 house could get you a passport.

Vanuatu is known in the industry as a "runaway passport." Consider who would purchase this passport, and you will understand.

The police seized nearly 720,000 Singapore dollars and other foreign currencies, 1 electronic device, 36 luxury watches and handbags, issued prohibitory disposal orders for 4 properties and 3 vehicles estimated to be worth over 29 million Singapore dollars, and also seized multiple bottles of wine and grape wine. The police also froze 2 related bank accounts with a total value of over 1.18 million Singapore dollars and other foreign currencies.

2.3. Chinese passport + Cambodian passport

A 41-year-old Cambodian man was arrested in a villa on Nassim Road. He was also found to hold a foreign passport issued by China.

The Cambodian passport, like the first man who attempted to escape, was likely obtained through bribery.

The poorer the country, the easier it is to conduct underground business, including passports.

The police seized over 777,000 Singapore dollars and other foreign currencies, 11 electronic devices, 33 luxury handbags and watches, 75 pieces of jewelry, issued prohibitory disposal orders for 7 properties and 6 vehicles estimated to be worth over 76 million Singapore dollars, and also froze 3 related bank accounts with a total value of over 2.4 million Singapore dollars.

According to the charge, he was accused of submitting a forged document to Citibank Singapore two years ago, claiming to be an executive director of an import-export company.

2.4. Chinese passport + Vanuatu passport

A 35-year-old Vanuatu man was arrested in a villa on Third Avenue. He was also found to hold a foreign passport issued by China.

This individual probably had a slightly unfavorable background, hence only holding a Vanuatu passport. Those with a more acceptable background are unlikely to hold only a runaway passport.

The police seized over 1.4 million Singapore dollars and other foreign currencies, 95 pieces of jewelry, 69 luxury handbags and watches, 22 electronic devices, 2 gold bars, issued prohibitory disposal orders for 13 properties and 4 vehicles estimated to be worth over 1.2 billion Singapore dollars, and also froze 6 related bank accounts with a total value of over 20 million Singapore dollars and other foreign currencies.

2.5. Turkish passport + Dominican passport

This involves a couple, a 44-year-old man and a 43-year-old woman, living in a villa on Pearl Island in Sentosa Cove.

The man holds a Chinese passport + Saint Kitts passport.

The woman holds a Chinese passport + Turkish passport + Dominican passport.

This time, the focus is on the 5 Caribbean countries. Overall, the due diligence in the 5 Caribbean countries is much stricter than previously mentioned, but there are still loopholes, leading to the UK revoking Dominica's visa exemption and the EU requiring the 5 Caribbean countries to raise the threshold for naturalization while enhancing due diligence.

The police seized over 7.6 million Singapore dollars and other foreign currencies, issued prohibitory disposal orders for 9 properties and 5 vehicles estimated to be worth over 1.06 billion Singapore dollars, and also froze 1 related bank account with a total value of over 22 million Singapore dollars and other foreign currencies.

The couple was accused of forging an agreement 3 years ago, intending to deceive CIMB Bank into believing that they owned real estate in Macau and received payment for the sale of the property, using this as proof of the source of their assets.

2.6. Cyprus passport + Vanuatu passport

The other individuals are similar to those mentioned above, holding passports from Cyprus, Cambodia, and Vanuatu.

From the time Cyprus opened its applications to the complete halt a few years later, a total of approximately 7,000 sets were approved globally. Officially, it is acknowledged that over 50% were issued to applicants with issues, constituting illegal gains.

Currently, only about 6% of problematic passports have been revoked.

If convicted, according to Singaporean law:

Individuals convicted of money laundering will face a maximum of 10 years' imprisonment, a maximum fine of 500,000 Singapore dollars, or both.

Forgery of documents to deceive will be punished with a maximum of 10 years' imprisonment, and the criminals will also be fined.

The 3.5 billion sweep of Conning River Bay caused a sensation in Bukit County

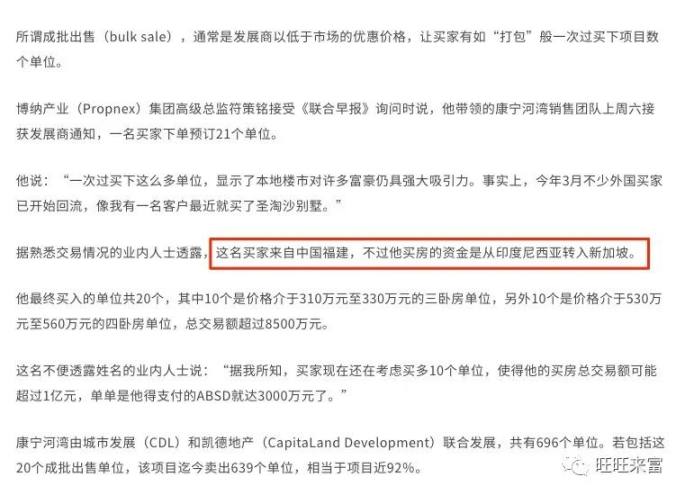

Interestingly, one of the tycoons spent 100 million Singapore dollars (including tax) last year, equivalent to over 70 million US dollars, to purchase 20 large units in the Conning River Bay area of Conning River Bay.

This news made headlines in major Singaporean media, truly opening the eyes of the "down-to-earth" people of Bukit County.

Upon careful observation, it can be noted that many media reports on this matter include a statement: According to industry insiders familiar with the transaction, the buyer is from Fujian, China, and the funds used to purchase the property were transferred from Indonesia to Singapore.

Insiders revealed Fujian, Indonesia.

With these three words appearing together, the truth is now clear.

4. Those who assisted in money laundering are in big trouble

The mastermind of the money laundering case.

Next, let's talk about the accomplices who assisted in money laundering, especially those who knowingly turned a blind eye to the other party's issues and deliberately allowed them to pass through compliant accomplices.

The mastermind does not have Singaporean PR or citizenship, but the accomplices, we believe, are mostly PR or citizens.

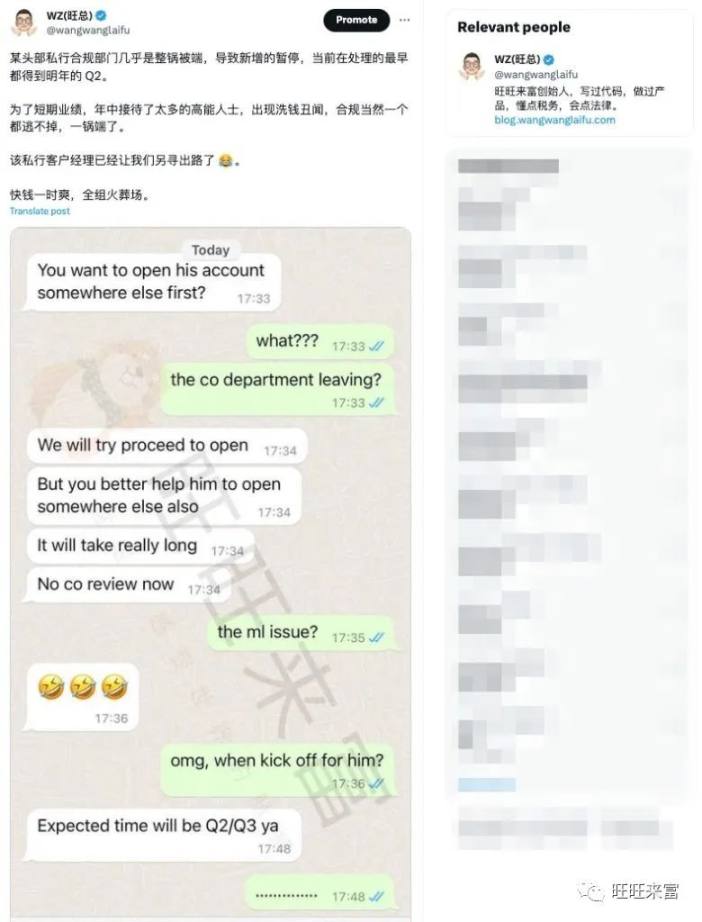

Last year, a certain private bank in Singapore stopped onboarding new clients, and the entire compliance department underwent a complete personnel change, indicating a clue. For specific details, refer to our Twitter link.

Which institutions are involved in this? Let's analyze.

4.1. Retail banks in Singapore

Retail banks are where the funds initially enter. The Singapore police discovered that the vast majority of bank accounts they investigated were likely opened at these retail banks. This includes the entry of funds, which should have flowed into these retail banks from overseas or other places.

Public reports revealed that two men were accused of submitting forged documents to Citibank, and a couple is suspected of submitting forged documents to deceive CIMB Bank.

The above are just public data, and the police disclosed hundreds of accounts. We believe that most mainstream personal bank accounts in Singapore are likely involved.

4.2. Private banks in Singapore

This is the main focus of this article. Insider information indicates that a certain private bank in Singapore has handled 80% of the illicit funds flowing into Singapore in the past 5 years, possibly even more.

Fraud has always existed, and the inflow of funds into Singapore is related to many factors. Starting from 2018, funds began to flow in continuously.

Many tycoons are also knowledgeable, knowing that Singapore has a family office program that not only provides tax exemptions but also offers Singaporean residency. Who wouldn't want to live in a villa in the Garden City all day instead of KK?

For more information about the Singapore family office, refer to:

- Best Practices and Common Issues in the Singapore Family Office 13O

- Analysis of Singapore Tax Residents in the Singapore Family Office 13O

- 9 Common Issues in the Construction of the Singapore Family Office 13O

- Analysis of a One-time 20 Million Singapore Dollar Transaction in the Singapore Family Office 13O

A kitchen knife is originally used for cooking, but using it to harm others was not its original purpose.

To establish a family office, a private bank is naturally required. With a threshold of 20 million Singapore dollars, the source of assets must be explained. Who will explain it? With what justification?

Did you sell enough tea leaves in Fujian to make 20 million Singapore dollars?

This is also why the Monetary Authority of Singapore declared in June that it would strengthen anti-money laundering measures, due diligence, and compliance in private banking for (ultra) high-net-worth individuals.

4.3. Lawyers and intermediary institutions

To establish a family office, lawyers or consulting intermediaries are naturally required.

If a client tells you that they made at least 20 million Singapore dollars selling tea leaves, and you readily accept this explanation and then provide a legal opinion for them.

Do you think there's a problem with this?

Furthermore, insider information indicates that a certain intermediary institution in Singapore systematically helped tycoons apply for 13O with MAS, and the explanations for the source of funds were surprisingly consistent. Working in conjunction with private banks, they deceived the Monetary Authority of Singapore. The entire company was shut down in July.

No deal, no harm.

We believe that aside from the retail banks, private bank compliance, and relationship managers who assisted in money laundering, the intermediary institutions involved are also likely to face imprisonment.

5. Singapore does not like hot money or illicit funds

Any country or region that wants to develop in a legitimate manner has a zero-tolerance policy for fraud and money laundering.

In recent years, too much hot money has flowed into Singapore, and what has been revealed this time is just the tip of the iceberg.

Where those who flew out of Singapore overnight will go, we do not know.

But they probably won't be coming back to Singapore.

Hot money is enjoyable for a moment, but it leads to disaster for the entire family.

Here, we also need to declare to our (potential) clients:

1) As a consulting firm regulated by both Singapore and Hong Kong, we will strictly adhere to relevant anti-money laundering provisions and conduct due diligence on every client.

2) If your funds come from legal and compliant sources, we will spare no effort to build the most suitable offshore company structure, family office, and offshore trust structure for you and your family, to maximize asset protection, inheritance, and tax optimization.

3) If the source of your assets is unclear, we recommend seeking help elsewhere. We are unable to assist in such cases.

6. Further reading

【01】Practical Guide to the Singapore Family Office 13O

【02】Practical Guide to the Singapore Family Office 13D

【03】What is KYC in Bank Due Diligence?

【04】Practical Guide to Opening an Overseas Private Bank Account

【05】Practical Guide to Opening a Private Bank Account in Singapore

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。