The intent is still in the early stages of discovery and implementation, but the rise of the new company and the evolution of categories are exciting.

Written by: BRIDGET HARRIS

Translated by: MarsBit, MK

The impact of Intents on account abstraction, storage proofs, rollups, etc., is creating interesting new dynamics for cryptocurrencies. With the emergence of these key components, they are uniquely reshaping user experience (UX), transaction efficiency and design, as well as the balance between centralization and decentralization.

Interpreting Intents

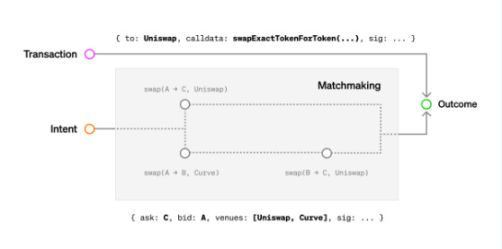

A transaction is a highly specific operation that a user wishes to execute, while an intent specifies the goals a user wishes to achieve within certain parameters. Typically, intents outsource tasks to users and have access to multiple environments, so users do not have to manually operate disparate protocols. By not encoding every aspect of each transaction, more expressive and efficient transactions can be achieved, improving UX.

As Paradigm puts it: "By signing and sharing intents, users effectively authorize recipients to compute paths on their behalf."

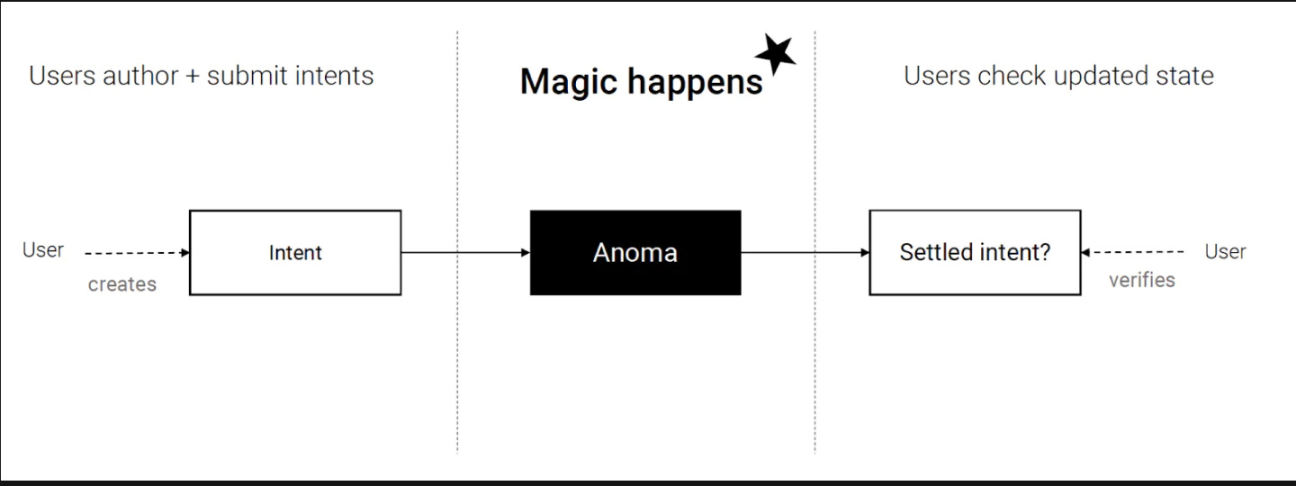

Users simply want to transact at the best price, and they often do not care which platforms are involved (the success of 1inch and the launch of 1inch Fusion as an early example of intent are reasons for success). Additionally, intents can often be fulfilled through many different paths, while transactions have a highly specific execution path. The following diagram illustrates this:

Data Source: Paradigm

In the design of certain intent infrastructures, once a user specifies an intent, it is broadcast to gossip nodes in the p2p network layer. Then, we delegate the computation responsibility to entities called solvers (also known as searchers/matchers), which are also builders in a protocol that is entirely intent-centric (PBS required). Solvers operate to execute the user's intent specification and generate valid transactions. They compete with each other to fulfill intents most efficiently, and then relayers verify, and finally validators on the intent network commit to execution. The process here is: user sends intent to intent pool → gossip nodes broadcast in intent pool → solvers compete to execute transactions in the memory pool.

Intent is an open problem space, and we are not yet fully certain what the UX will look like, but the general goal is to make crypto applications easier, more flexible, and efficient for users. A recent episode of Bankless with Dan Robinson emphasized how new designs will be constructed from a high-level user flow perspective. Users will see a similar interface on the web app, but instead of signing an eth transaction, they sign an offline message, which is then routed to the MEV "black box," ultimately transforming the intent into a complete transaction, and then included on-chain. Intents are a more general format for users than eth transactions, as they only specify the start and end points, rather than specifying through gas, slippage, using only one DEX/AMM, leading to a better user experience. Once an intent is expressed, it is offloaded to a system that finds the best price; users simply broadcast a message, rather than creating the transaction themselves. From there, any solver is free to fulfill the intent, as long as they can prove they have solved it in the most competitive way (e.g., highest satisfaction gradient), allowing users to get the best "price" for anything they are trying to do. In this sense, intents are more attractive and flexible for end users than traditional on-chain transactions, as they can be resolved in various ways, often resulting in faster, cheaper processes, reducing manual steps.

An application example of intent can be seen in UniswapX. In UniswapX, a Dutch auction is used for intent, where the price is set high and gradually decreases, and once someone finds it profitable, they fill the order. As Dan pointed out, the benefit in a competitive market is to reduce slippage, providing a better foundation for order flow auctions.

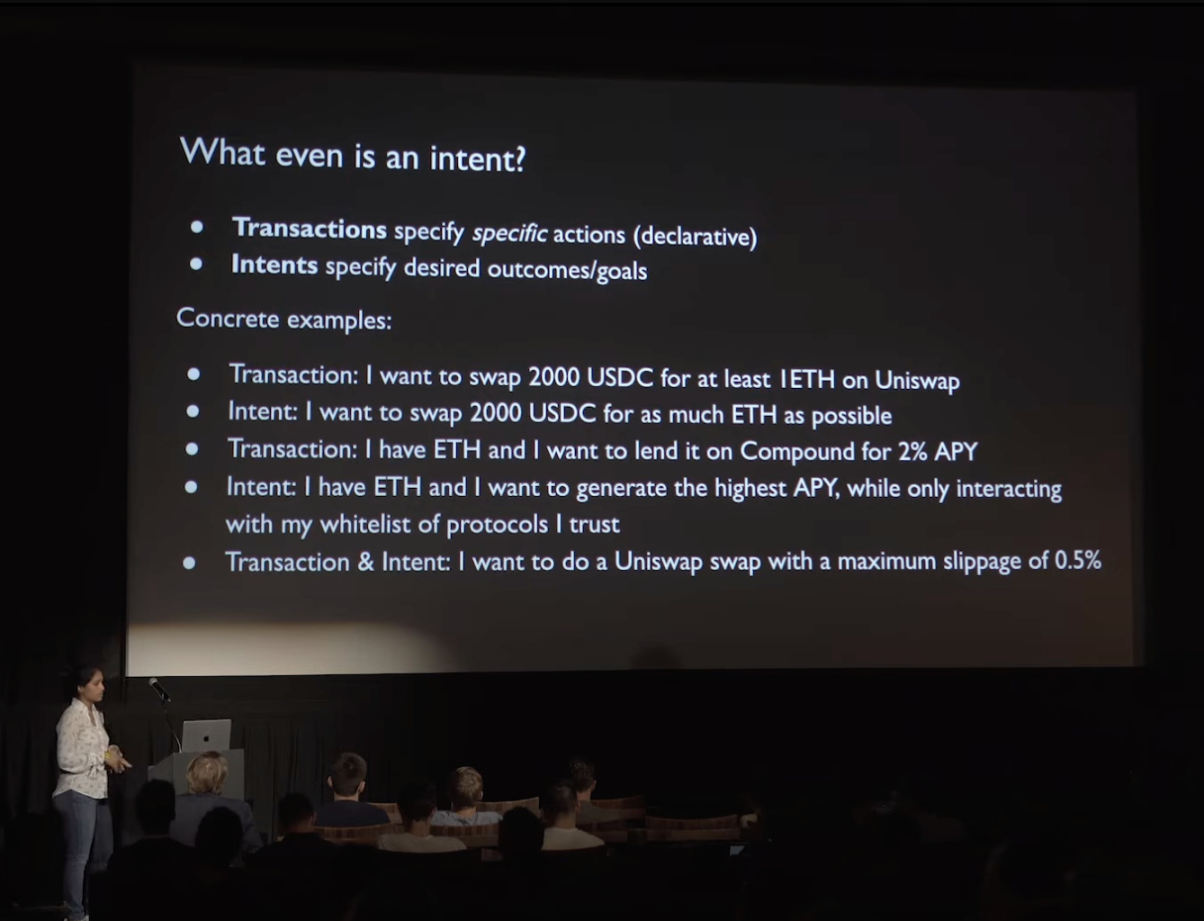

Succinct's Uma Roy provided a great specific example of transactions and intents in her presentation on intents, SUAVE, AA, and cross-chain bridging:

Data Source: Uma Roy

Intents in Practice and Their Implications for Cross-Categories

Intents may have a broad impact on the following categories:

Bridges and rollups: Dan discussed this issue in more detail in a recent Bankless episode, but how UniswapX might handle intents that need to be bridged is as follows: users can simply express intent, for example, having USDC on Arbitrum instead of ETH on Ethereum. Then the fulfillment proof of the intent can be passed to the destination chain through message passing bridges.

- Another element mentioned by Dan is that future market makers may find it more profitable to fulfill intents (e.g., because market makers are rebalancing and trying to exit).

- In many classic cross-chain bridge designs, funds are often held in bridge contracts (e.g., bridges custody funds on rollups), which are often highly susceptible to hacking threats. However, with the emergence of UniswapX, as Dan outlined, the only funds at risk are the "active swaps" or swaps in transit. For example, a swapper expresses intent to transfer funds cross-chain → relayer on-chain commits to fulfill the order [bridge risk] → relayer fulfills the order on the destination chain. This is a huge advancement for the entire cross-chain space, as the exposure time is limited to the moment the swap is in transit, significantly reducing the amount of at-risk funds in a hacking event.

- The intent mechanism can reduce cross-chain complexity, as users do not need to manually bridge assets (a lengthy and expensive process). Instead, they only need to specify the token types they want to hold and where they want to hold them on a rollup/chain. Everything else is abstracted, constituting a huge user experience improvement for swappers. Ultimately, if we use intents to alleviate the massive user experience problem in crypto, users need to be able to access cross-domain environments more effectively by leveraging more liquidity and different tech stacks to fulfill their intents.

Zero-knowledge (storage) proofs: Zero-knowledge storage proofs are a new mechanism for transferring blockchain state between L1s/L2s/L3s in a trustless manner. With the emergence of L2 and L3 ecosystems, the issue of transferring state information becomes increasingly urgent, and the work of storage proofs is to solve this problem quickly and lightweight.

- Storage proofs may work in interesting ways with intents. As mentioned above, when a user specifies an intent to acquire assets on a rollup, a bridge occurs, and the state of the destination chain is sent back through storage proofs to verify if the intent is correctly fulfilled/the chain is in the expected state. Thus, storage proofs can generate trustless asset bridging on supported infrastructures.

- Perhaps in the future, we will see fulfilled intents aggregated into verifiable storage proofs, or conversely, different states' aggregated storage proofs as part of a computation flow to fulfill intents.

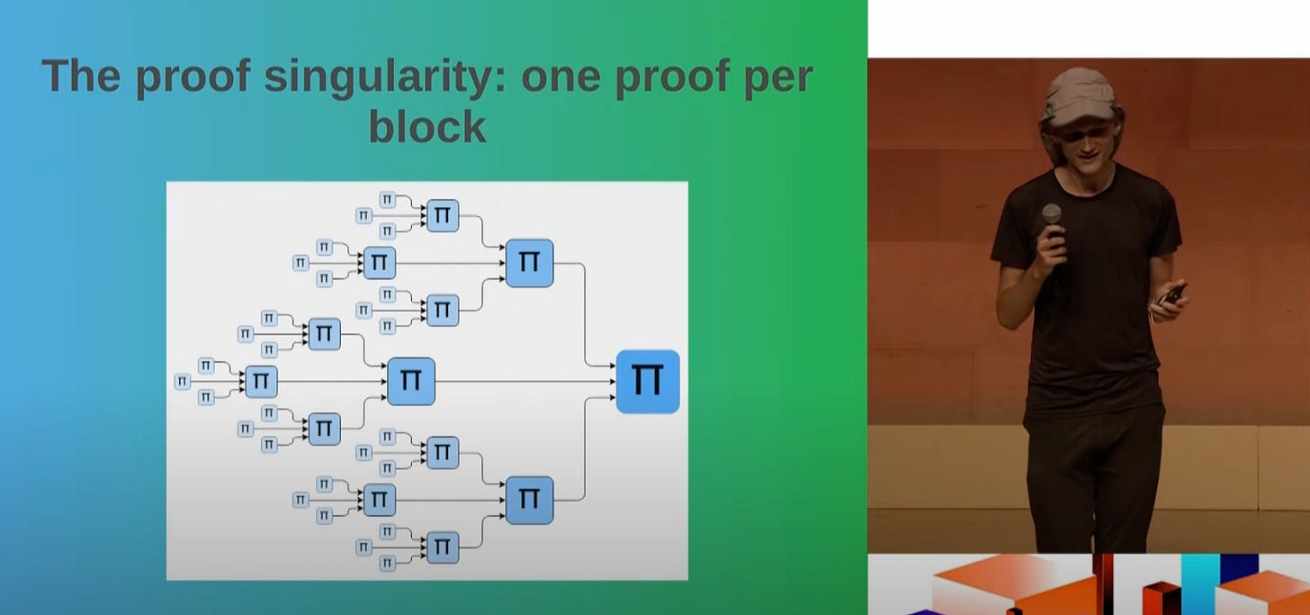

At the EthCC Modular Summit, Vitalik discussed proof aggregation in L2 environments. In the design below, the end proof is just a signature/privacy protocol, the middle proof is an aggregated proof, and then the second-layer proof aggregates the aggregated proof, and finally, there is an overall master proof transmitted to L1. Through proof aggregation, we can significantly reduce costs and optimize the proof process.

Source: Builders and Higher-Level Forms of Aggregation - Vitalik Buterin

Recursive proofs have also been explored through zkTree, initially introduced by the Polymer Labs team, and may help in achieving zkEVMs, zkRollups, zkBridges, and zk storage proofs in the future.

Account abstraction: Essentially, account abstraction acts on upgrading EOAs (externally owned accounts, currently used for standard transaction generation), allowing them to be managed by smart contract wallets, or alternatively, allowing smart contracts to directly initiate transactions. For intents, this new paradigm means that the intent layer may shift from dapps directly to the user's smart contract wallet as intents become more mature and complex. Stanley He has proposed this argument, pointing out that to make AA work with intents, there may be an intent → userOp → bundler flow (intents first flow through the wallet frontend):

Source: Stanley He

Despite AA greatly improving the user experience, users still have to manually discover the best/most efficient platforms for exchanging/bridging/LP'ing, etc. The goal of intents is to further eliminate this discovery layer, allowing users to only specify the starting state and the expected end state.

ERC-4337 has proposed some designs to maintain decentralization, such as a unified ERC-4337 memory pool. This section emphasizes that fragmented/smaller pools (with different bundler strategies) are naturally more susceptible to scrutiny and attacks. Reducing this surface area can be achieved by implementing a standard on each bundler, ensuring their compatibility.

Great projects like Zerodev, Fun, Stackup, and Rhinestone are building in this space.

Some express concerns about centralization issues with intents. David Ma from the Alliance: "The key is that intents are difficult to decentralize, and therefore are increasingly isolated in centralized servers with permissioned read/write."

Efficiency and decentralization are classic issues in this field. Given that cryptocurrencies are hindered by poor user experience, centralized solutions seem tempting. Additionally, as some elements of intents rely on off-chain participants/infrastructure, the computational cost is extremely low, especially lower than conventional transactions. The computational cost for settling orders does not need to run on-chain (which would manifest as gas fees), but rather on the servers of market makers. Naturally, moving certain parts of the transaction flow off-chain will increase centralization, and there are concerns about centralization around solvers (used to coordinate the volume of intents).

Compliance considerations have also been discussed in the context of intents, where users can choose the most "compliant" path to fulfill their intents. The trade-off here will be cost and speed/efficiency, but ultimately it will shift more regulatory burden onto users/liquidity providers rather than the protocol.

Projects

Many interesting projects are leveraging components of AA, bridging, and multi-chain infrastructure in unique ways to strive for access to various deployments and ecosystems, diving deeper into larger liquidity, and providing more efficient and convenient experiences for end users.

Here are some interesting projects:

Essential

Essential is building a comprehensive intent architecture. They have three main projects: a constraint-based programming language for expressing intents (more on DSL), an EIP for account abstracted intents on Ethereum, and a reimagining of the transaction lifecycle from the ground up with an intent-based protocol. The difference between Essential and SUAVE is as follows:

- Essential uses a specially built DSL in Rust for expressing intents. SUAVE uses mEVM (Solidity), which has built-in syntax for preference expression, block construction, etc. Additionally, Essential's architecture never executes intents. Instead, they are resolved and then generate an execution trace of the resolved intent, which is executed on-chain. This contrasts with SUAVE, which generates EVM opcodes as part of the intent.

- SUAVE is dealing with cryptographic execution space, while Essential's protocol does not use cryptographic execution to achieve intent privacy. The underlying intent is included on-chain before decryption and execution.

Essential's consensus mechanism forces solvers to compete on objectively satisfying intents (0-1 satisfaction gradient), competitively encouraging high satisfaction for end users. Essential is currently researching intents in the Ethereum ecosystem and building its own intent-based protocol.

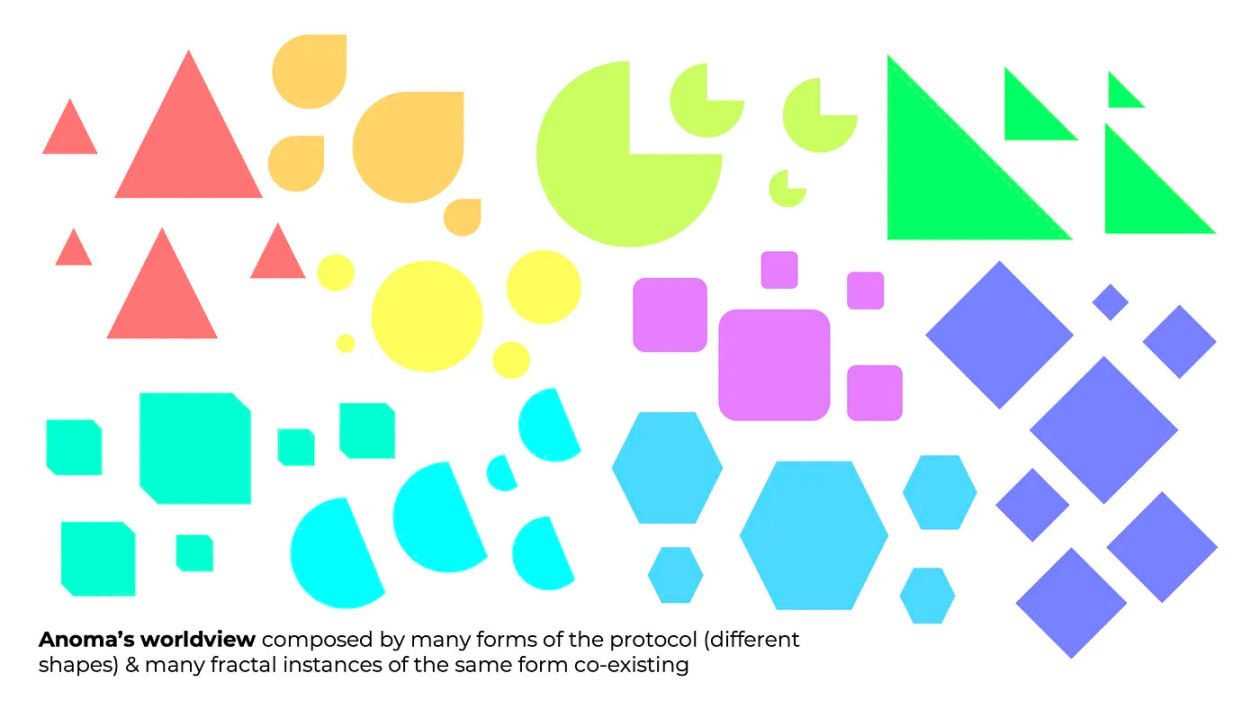

Anoma

Anoma is creating a "intent-centric architecture" where anyone can implement fractal instances of the protocol, which collectively make up the Anoma ecosystem. For intents themselves, Anoma creates partial transactions for users to sign, expressing the expected final state. As Jon Charbonneau pointed out, Anoma's market makers can even update their intents regularly: "For example, 'I am willing to buy X at price Y, but this order is only valid for block height Z.'"

Source: Anoma

Like SUAVE, Anoma also differs from the base. SUAVE is agnostic to the chain and serves intents as an independent middle layer in the stack, while Anoma identifies itself as an architecture that "can be deployed as L1, L1.5, or L2" rather than a feature/layer in the stack.

Source: Anoma

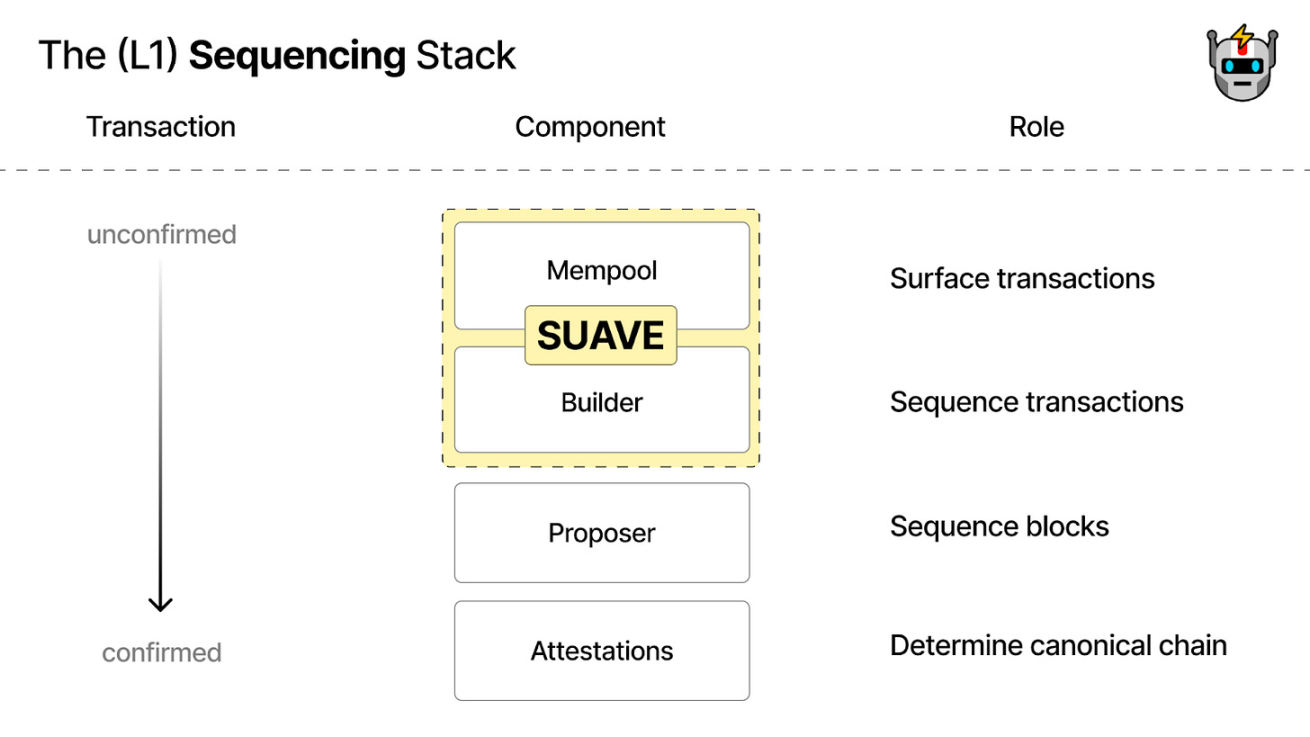

SUAVE

Flashbots' SUAVE is a blockchain itself that can "serve as a plug-and-play mempool and decentralized block builder for any blockchain." It is tailored to facilitate preference expression and execution (similar to intents at a high level). The SUAVE stack is as follows: users can specify a preferred mempool, solvers compete to execute the user's preferred execution network, and solvers actually create blocks in the block building environment—then it can be accepted by other networks.

SUAVE aims to be the mempool and block builder for all blockchains. Source: Flashbots

PropellerHeads

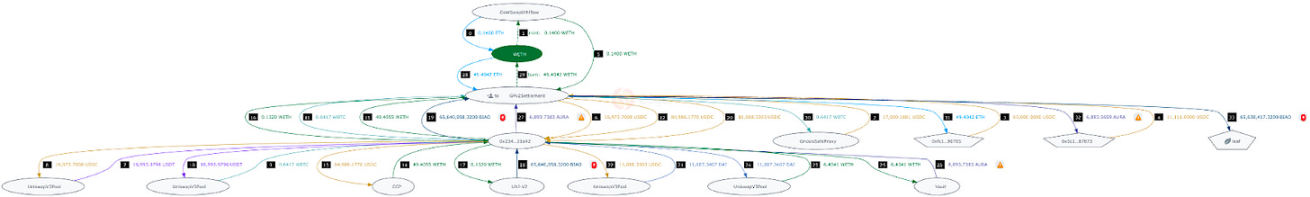

PropellerHeads is refining a specific element of the intent architecture - solvers. By using the PropellerSDK, especially their Solver API and Private RPC, users are more protected from MEV and get better prices in transactions. The Solver API returns the best route for getting the best price by inserting many liquidity sources and running optimization algorithms. An example of a routing combination where four orders from solvers enter one route:

Source: PropellerHeads

OKcontract

OKcontract focuses on specifying smart contract interactions through creating a standard, generating transaction interfaces from specifications, and allowing developers to embed automated interfaces into any webpage with the concept of "low-level intents." This architecture is similar to Uniswap widgets that can be embedded in other sites - OKcontract hopes to do the same for every contract, and in an automated way.

CoW Swap

CoW Swap has built early examples of intents, enabling p2p settlement orders on a CoW protocol-based trading interface. Currently, CoW Swap can settle orders on Uniswap, Sushiswap, 1inch, and Paraswap, and achieve user transactions through signed messages (a process without gas fees). CoW Swap can tap into existing on-chain liquidity instead of owning LP on the platform, and when there is not enough CoWs (coincidence of intent) on the platform, it can leverage liquidity from other AMMs.

Batch auctions where multiple users' orders are matched to settle transactions. Source: Etherscan

Skip

In the IBC ecosystem, the Skip protocol is not typically seen as fulfilling intents, but can be understood in this context as fulfilling intents. Skip operates in Cosmos and reserves block space futures to help stakeholders earn more income and protect users from harmful MEV. Skip's API routing solution finds the most efficient path for cross-chain experiences for end users, ultimately creating a user flow based on intents.

Future Directions

In the crypto space, the future is coming fast. Intents are still in the early stages of discovery and implementation, but watching the rise of new companies and the evolution of categories is exciting. In this space, technological iterations are rapid, so we will undoubtedly see interesting new designs and implementations of these types of architectures in the near future. Abstracting as much as possible from users while maintaining decentralization and driving transaction efficiency and expressiveness is a primary consideration in the intent space. Hopefully, it will ultimately drive adoption of cryptocurrencies and improve efficiency. The dynamics between intents, AA, storage proofs, and bridging are still being explored, and how these parts work together will be crucial for the maturity of the crypto ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。