Original Author: William, Wu said blockchain authorization release

With the development of financial technology and changes in global geopolitical relations, governments around the world are gradually realizing the huge potential of stablecoins. Countries and regions such as the European Union, the United States, Singapore, and Hong Kong, China have successively launched consultations and legislative activities in order to seize the initiative in the future. On August 15, the Monetary Authority of Singapore (MAS) announced the final version of the regulatory framework for stablecoins, becoming one of the first jurisdictions in the world to incorporate stablecoins into its local regulatory system. In the near future, Hong Kong, China, and the United States will also enact stablecoin regulatory laws and regulations. Therefore, the release of the regulatory framework by Singapore this time is of significant value and will to some extent become a template for reference by regulatory agencies in various countries. Therefore, this article will analyze in detail the regulatory framework for stablecoins in Singapore and insight into the future development trends of global stablecoin regulation.

I. Key Points of the Regulatory Framework for Stablecoins in Singapore

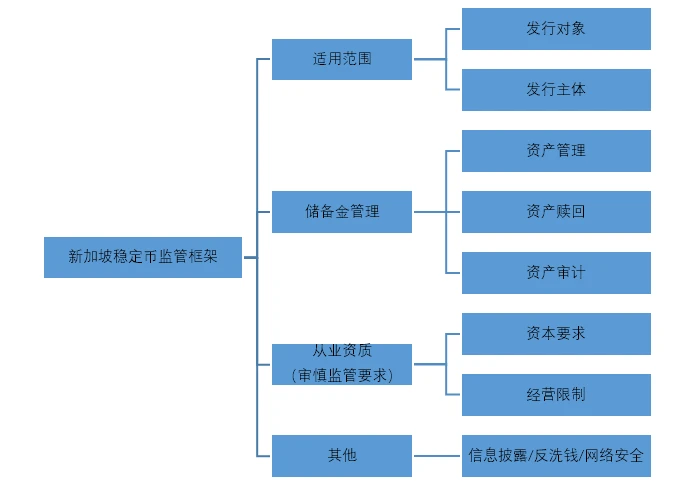

MAS's earliest regulatory attempt regarding stablecoins can be traced back to the PS Act enacted in December 2019, followed by the issuance of a consultation paper in December 2022, seeking public opinions on the proposed stablecoin regulatory framework, and finally completing the final stablecoin regulatory framework on August 15 this year. Therefore, Singapore's complete regulatory framework for stablecoins involves the content of the above three regulatory documents, rather than just one of them. According to the author's analysis, the regulatory framework for stablecoins in Singapore mainly includes the following parts:

Figure 1 Key points of the regulatory framework for stablecoins in Singapore

1. Scope of Application

One point that has attracted market attention in the regulatory framework for stablecoins issued by Singapore this time is the openness of the stablecoin issuance. MAS allows the issuance of single-currency stablecoins (SCS) anchored to the Singapore dollar (SGD) + G10 currencies. Generally speaking, a country's currency is a symbol of its sovereignty, and other countries have no right to manage it. However, MAS allows stablecoins to be anchored to the currencies of other countries, which is a significant breakthrough. This indicates that MAS has a certain degree of openness and innovation, fully considering the national conditions of G10 countries and communicating with various countries.

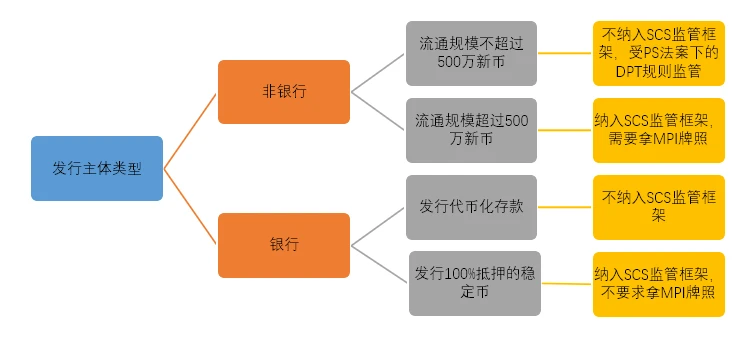

Secondly, in terms of the issuer, MAS has made significant adjustments. MAS divides stablecoin issuers into two categories: banks and non-banks. For non-bank issuers, MAS requires that only stablecoins with a circulation scale of more than 5 million Singapore dollars be included in the stablecoin regulatory framework, and they need to apply for an MPI license under the PS Act; otherwise, they do not fall within the scope of stablecoin regulation and only need to comply with the DPT regulations under the PS Act. For banks, MAS originally planned to include tokenized deposits in the stablecoin category, but the significant difference in the nature of assets between the two (deposits are products under the bank reserve system, not 100% collateralized, and are liabilities of the bank) led to their exclusion. Therefore, banks also need to issue stablecoins with 100% asset collateral, but it is important to note that banks do not need to apply for an MPI license. MAS explained that the Banking Act already requires banks to meet relevant standards.

Figure 2 Issuer scope regulations

2. Reserve Management

In terms of reserve management, MAS has made detailed provisions, mainly in the following areas:

Firstly, in terms of asset composition, MAS requires that reserves can only be invested in cash, cash equivalents, bonds with a remaining maturity of no more than three months, and has made detailed provisions on the qualifications of the asset issuer: either government/central bank-issued currency cash, or international institutions rated AA- or above. It is worth noting that MAS has made restrictive interpretations of cash equivalents: mainly referring to bank deposits, checks, and promissory notes that can be quickly liquidated, but does not include money market funds. Therefore, stablecoins like USDC that invest 90% of their assets in money market funds, or even stablecoins like USDT that invest in some commercial paper, do not meet MAS regulatory requirements.

Secondly, in terms of fund custody, MAS requires the issuer to establish a trust and open a segregated account to distinguish its own assets from reserves; and has made clear provisions on the qualifications of the fund custodian: it must be a financial institution with a custody service license in Singapore, or an overseas institution with a branch in Singapore and a credit rating not lower than A-. Therefore, stablecoin issuers who want to be included in the MAS regulatory framework in the future must find a financial institution in Singapore or with a branch in Singapore to cooperate.

Finally, in terms of daily management, MAS requires that the daily market value of reserves be higher than 100% of the circulation scale of SCS, and that redemptions be made at face value and not exceed 5 days, and that monthly audit reports be published on the official website at redemption.

3. Professional Qualifications

The notable aspect of this regulatory framework is MAS's detailed provisions on the qualifications of stablecoin issuers as part of prudent regulation. MAS has made three main provisions on the qualifications of the issuer:

First is the Base Capital Requirement, which is similar to the Basel Agreement's requirement for banks' own capital. MAS stipulates that the capital of stablecoin issuers must not be less than 1 million Singapore dollars or 50% of annual operating expenses (OPEX).

Secondly, Solvency requires that liquid assets exceed 50% of annual operating expenses or meet the scale required for normal asset withdrawals, and this scale needs to be independently verified. It is important to note that MAS has made clear provisions on the categories of liquid assets, mainly including cash, cash equivalents, government bonds, large certificates of deposit, and money market funds.

Finally, Business Restriction requires that the issuer not engage in lending, staking, trading, asset management, and is not allowed to hold shares of any other entity. However, MAS also explicitly states that stablecoin issuers can engage in stablecoin custody and transfer business to buyers. This actually restricts stablecoin issuers from engaging in mixed operations. Furthermore, MAS explicitly states that stablecoin issuers are not allowed to pay interest to users through lending, staking, asset management, and other activities. However, other companies can provide similar services for stablecoins, including sister companies in which stablecoin issuers do not hold shares.

4. Other Regulatory Requirements

MAS has also made provisions on information disclosure, qualifications and restrictions of stablecoin intermediaries, network security, and anti-money laundering, but there are no noteworthy points, so this article does not go into further analysis. Interested readers can read the relevant documents on their own.

II. The Pros and Cons of Singapore's Stablecoin Regulatory Framework

The introduction of the regulatory framework for stablecoins in Singapore has a significant impact, whether on the compliant development of the global stablecoin industry or on the demonstration and guidance for other countries, so I will not elaborate too much on this. Here we mainly focus on several areas that MAS can continue to improve in the future.

This time, MAS's regulatory framework for stablecoins has shelved or blurred several important issues, which may pose hidden risks in the near future.

First is the issue of the category of reserves. MAS originally planned that the valuation currency of reserves must be consistent with the anchored currency, that is, if a stablecoin is issued in Singapore dollars, its reserve assets must be Singapore dollar assets rather than US dollar assets. However, this will bring a serious problem: users are very concerned about whether stablecoins can be exchanged for major world currencies such as the US dollar. If a Singapore dollar stablecoin can only be exchanged for Singapore dollars, then the stablecoin will not have a competitive advantage and will result in a very small issuance volume; secondly, the types and depth of investable assets for some anchored currencies are very limited, which will be a major challenge for reserve management. MAS should also be aware of these issues, but has not explicitly allowed reserves to be invested in different currency assets, only reiterating that the issuer needs to control risks and meet the 100% reserve requirements.

Second is the issue of cross-jurisdictional regulation. MAS proposed two solutions to address this issue: one is for the issuer to submit a proof document annually to demonstrate that stablecoin issuance in other regions also meets the same standards; the other is to establish cooperation with different jurisdictions. However, both of the above solutions are impractical due to real factors, so MAS can only settle for second best, requiring stablecoin issuers not to allow cross-jurisdictional issuance at the initial stage. However, some stablecoins have already become global stablecoins, issued in different regions and on different public chains. If issuers comply with the above requirements, they may lose market competitiveness.

Finally, the regulatory issue of systemically important stablecoins. In last year's consultation paper, MAS provided a descriptive explanation of what constitutes a systemically important stablecoin and hoped to regulate it based on the standards of financial market infrastructure. However, due to practical factors, MAS has chosen to shelve the controversy for the time being.

Apart from the content of the regulation itself, another important issue of concern to the market is: what are the pros and cons of issuing compliant stablecoins in Singapore?

On the one hand, the advantage of compliant stablecoins lies in their compliance. For example, due to their own compliance and security, compliant stablecoins give users greater confidence, and further, MAS requires compliant stablecoins to be labeled as "MAS-Regulated Stablecoin" to distinguish them from other stablecoins, which is conducive to the promotion of stablecoins; and because of their compliance, they are more recognized by traditional financial institutions and face fewer obstacles from banks when depositing and withdrawing funds.

On the other hand, we should also pay attention to the cost issue of compliant stablecoins. Firstly, MAS has clearly stipulated the qualifications for issuance, with clear provisions on own capital, solvency, and business scope, which existing stablecoin issuers are not subject to; secondly, there is the issue of market fairness, MAS stipulates that banks issuing stablecoins do not need to obtain an MPI license, but non-bank issuers need to apply for an MPI license. Currently, the application period for MPI is approximately 1-2 years, and there are many audit requirements for enterprise qualifications. Since the implementation of the PS Act in 2019, the number of enterprises obtaining MPI licenses has not been large. Therefore, issuing compliant stablecoins in Singapore requires a significant amount of time, manpower, and financial resources.

In summary, under the current MAS stablecoin regulatory framework, the possibility of banks or large companies issuing "MAS-Regulated Stablecoin" is higher; for non-bank small and medium-sized enterprises, the current policy is not friendly.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。