How will the court rule on disputes arising from entrusted investment in virtual currency?

By Liu Honglin

With the popularity of cryptocurrencies, the trend of speculation has risen. Some cryptocurrency projects have experienced significant value growth, and some people have made huge profits, becoming the "myth of getting rich" in the industry. However, the cryptocurrency world is deep, and the interaction on wallet chains, exchange security identification, and risk control have certain thresholds, which make some novice users hesitate. Some users make random operations, resulting in huge losses in investment transactions.

Some experienced individuals in the cryptocurrency world have extended a helping hand. Novice users hope to make a profit in the cryptocurrency world and entrust their digital assets to professionals to manage, thus reaching an entrusted trading agreement.

The cryptocurrency world is unpredictable, and making money naturally leads to peace. Losses are also common. There have been many disputes arising from this. Since our country does not have specific legislation for virtual currency, in judicial practice, courts in different regions have different standards for recognition. This article mainly discusses how the court will rule on disputes arising from entrusted investment in virtual currency.

China's Attitude towards the Regulation of Virtual Currency

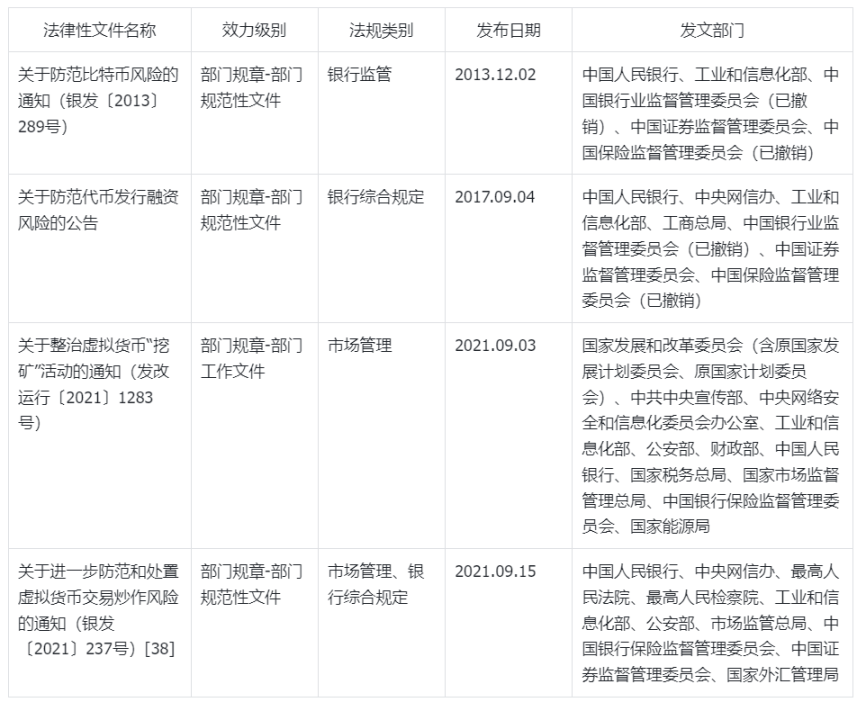

China's regulatory policy on virtual currency is mainly based on departmental normative documents issued by the People's Bank of China and other departments. Namely:

China's regulation of financial activities related to virtual currencies such as Bitcoin has gradually extended from denying its monetary attributes to controlling institutions, and gradually delving into virtual currency financing and investment activities.

The attitude towards business activities related to virtual currency has evolved from "should not" to "must not" and then to "strictly prohibited."

The behavior of investing in virtual currency has shifted from "risk warning" to "self-bear risk," and then directly invokes the principle of public order and good customs to clearly deny the effectiveness of related civil legal acts, that is, contracts.

It can be seen that China's financial regulation of virtual currency is gradually strengthening, with regulatory measures being strengthened in terms of content, subjects, and consequences. Although the effectiveness level of the above documents is only departmental norms, it reflects the conservative regulatory attitude of the current regulatory authorities in China towards Bitcoin and other virtual currencies.

A Showcase of Entrusted Trading Cases of Virtual Currency

Under the current strict regulatory attitude in China, the courts tend to consider contracts related to virtual currency as invalid due to violation of China's regulatory requirements and financial order. However, in the process of searching, we also found some interesting cases.

1. Entrusted investment in spot trading, but secretly opened a contract? Court: Ruled for compensation

Zhang, a senior player in the cryptocurrency world, recommended Bitcoin to his friend Wang, who, seeing Zhang's substantial profits from trading, also developed an interest in trading. However, as a novice in the cryptocurrency world, Wang did not understand the intricacies and entrusted Zhang with RMB to purchase Bitcoin and manage it. Three months later, Zhang showed Wang the balance of his personal bank account and claimed that it was the money earned from buying Bitcoin. It seemed that the cryptocurrency world could indeed make money.

However, the good times did not last long. Over a month later, while chatting with Wang on WeChat, Zhang informed Wang that he had purchased Bitcoin futures and mentioned the risk of the margin being zero. As both parties did not pay the full margin, Wang suffered losses. What was intended to be a pleasant surprise for a friend, leveraging a small amount of capital for a large return, turned into a shock.

After trial, the court found that the two parties had formed a gratuitous entrusted financial management relationship. The risk of investing in Bitcoin spot and Bitcoin futures was far apart. As the trustee, Zhang should have been diligent, but in reality, without Wang's consent, he changed the use of the investment funds privately, which constituted a significant fault. Therefore, Zhang should bear the compensation responsibility to Wang.

This case was approved by two levels of courts, recognizing the entrusted financial management relationship between the two parties. Based on the difference between Bitcoin spot trading and futures trading, the trustee was found to have a significant fault. The court not only supported the lawsuit for compensation of the investment funds but also supported the amount of related interest losses, achieving a complete victory. [Case No. (2020) Min 0205 Civil Final 4592]

2. Invalid contract, but the money still needs to be returned

Huang and Zhang signed a "Digital Currency Quantitative Entrustment Agreement," which stipulated that Huang entrusted USDT coins (equivalent to RMB 200,000) to Zhang for custody in his personal capacity and fully entrusted Zhang to carry out digital currency investment quantitative trading operations, etc. Zhang failed to return the full amount to Huang at the end of the agreement, only returning 95,760 yuan, leaving 104,240 yuan unpaid.

After trial, the court found that the subject matter of this case itself was not legal, so the entrustment custody behavior of both parties regarding the trading object was not legally protected. The "Digital Currency Quantitative Entrustment Agreement" was an invalid contract. Zhang, the defendant, should return the investment funds. As Huang knew that entrusting the investment in virtual currency violated national regulations, he was at fault, and the claim for interest compensation was not supported. [Case No. (2021) Zhe 1003 Civil Initial 2034] (Similar case: [Case No. (2022) Shan 04 Civil Final 1225])

3. Entrusted Bitcoin investment, ruled to return Bitcoin

Xiao Lu and Da Lu signed a "Financial Advisor Agreement," which stipulated that Xiao Lu fully entrusted Da Lu to manage his digital currency account (small and medium-sized client digital assets were held by the second party's account), and Da Lu did not charge any management fees other than profit sharing. Da Lu bore the losses incurred during the trading process of Xiao Lu's account. On December 25, 2019, Da Lu issued an IOU, stating that during the financial management for Xiao Lu, he caused significant losses and was willing to compensate with 60 BTC of digital currency. If not repaid by the due date, it would be repaid in RMB according to the agreed exchange rate.

After trial, the court found that although the "Financial Advisor Agreement" signed by both parties was invalid due to violation of regulations, the resulting IOU had relative independence and was a settlement compensation agreement recognized by both parties. Therefore, it should be enforced according to the IOU. The court ruled for Da Lu to return 60 Bitcoins. [Case No. (2021) Hu 01 Civil Final 16047] (Similar cases: (2021) Yue 0307 Civil Initial 8199, (2021) Hu 0114 Civil Initial 22216, (2022) Hu 0105 Civil Initial 4886, (2023) Liao 0202 Civil Initial 773)

Opinions of Lawyers on Disputes Related to Virtual Currency Investment

Although in practice, disputes related to virtual currency involve various issues such as new types of disputes, lack of legal basis, and inconsistent judicial rulings. Some courts have mentioned in their reasoning that although Bitcoin is not recognized as having monetary attributes in many countries, including China, holders still have property rights in it. This viewpoint undoubtedly protects the property of cryptocurrency holders.

In April of this year, the Supreme People's Court issued the "Summary of the National Court Financial Trial Work Conference (Draft for Soliciting Opinions)," responding to the past phenomenon of not supporting disputes related to virtual currency investment and inconsistent judgments in various places, and clearly stated that for disputes arising from entrusted investment in virtual currency, factors such as the time of entrustment, the reasons for the entrusted matters, and the degree of fault of both parties should be comprehensively considered. (For those interested, you can check out Lawyer Honglin's previous article on this topic, "How do Chinese courts rule on cases related to virtual currency? (In plain language)")

It can be seen that the judicial rulings are constantly changing with the development of practice. Actively advocating for rights not only helps to safeguard one's legitimate rights and interests but also promotes the continuous deepening of theoretical research and legal practice. In the future, it is hoped that through the joint efforts of the cryptocurrency community, ways and means of expanding the protection of digital assets can be continuously explored.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。