Author: Daniel Li, CoinVoice

In the wave of digitization, traditional finance and cryptocurrencies have become the focus of attention. However, there seems to be an invisible gap between these two fields, making their connection appear vague and distant. Now, a new stablecoin called PYUSD is rapidly bridging this gap, becoming a solid bridge connecting traditional finance and cryptocurrencies. As the first compliant stablecoin issued by a "non-crypto" company, the emergence of PYUSD is of great symbolic significance. It represents the further exploration of the traditional financial industry into cryptocurrencies, and also signifies a significant shift in the attitude of enterprises towards stablecoins, indicating an increasing acceptance of regulatory policies. In the future, this change will further drive the integration of Web3, traditional finance, and the real world. PYUSD, as the bridge connecting them, will play an important role in this process.

PYUSD May Become the "Digital Dollar" of the United States

Recently, the U.S. version of "Alipay" PayPal announced the launch of PYUSD, a stablecoin pegged to the U.S. dollar, making it the first mainstream financial services company to adopt cryptocurrency for payments and transfers. The value of PYUSD will be pegged to the dollar at a 1:1 ratio, backed by cash deposits, U.S. short-term government bonds, and other equivalent cash reserves.

The goal of PYUSD is to achieve instant conversion to the dollar, while also being able to be exchanged for other cryptocurrencies offered on the PayPal network. To achieve this goal, PayPal plans to introduce PYUSD into its payment application Venmo, allowing users to freely send and receive tokens between PayPal and Venmo wallets. In addition, as an ERC-20 token based on the Ethereum blockchain, PYUSD can also be transferred to third-party wallets compatible with PayPal, providing users with a wider choice and flexibility.

To ensure the stability and functionality of PYUSD, PayPal will first conduct payment tests between institutions and then quickly open it to eligible U.S. PayPal users. In the future, eligible U.S. PayPal customers will have the following rights:

- Transfer PYUSD between PayPal and compatible external wallets.

- Use PYUSD for peer-to-peer payments.

- Choose to use PYUSD for purchases at checkout.

- Convert any cryptocurrency supported by PayPal to PYUSD and vice versa.

- Buy, sell, hold PYUSD, or transfer PYUSD to eligible U.S. PayPal balance accounts without any fees.

In addition, to increase transparency and trust, PayPal announced that starting in September, Paxos plans to release a public monthly reserve report for PYUSD, detailing the assets that make up its reserves. Furthermore, Paxos will also commission an independent third-party accounting firm to publicly certify the value of PYUSD reserve assets in accordance with the auditing standards established by the American Institute of Certified Public Accountants (AICPA) to ensure their accuracy and reliability.

It is also worth noting that PYUSD and its reserve assets will be subject to strict supervision by the New York Department of Financial Services (NYDFS), which means that even in the event of Paxos Trust's bankruptcy, customer assets will not be used to repay Paxos's debts. In this respect, PYUSD is already ahead of the vast majority of stablecoins.

According to PayPal's future plans, PYUSD will first be launched on its payment application Venmo. This strategic move is significant, as PayPal has 430 million active users globally, and the launch of PYUSD on Venmo can rapidly expand its user base in a short period of time. Additionally, PayPal's global leading advantage in online payments can bring PYUSD into more application scenarios through its extensive business cooperation network, potentially making PYUSD a globally used "digital dollar" widely applied in daily consumption through the PayPal payment network.

PayPal Launches PYUSD Stablecoin: Building the Future of Web3 Business Scenarios

PayPal's stablecoin plan has been in preparation for a long time, but progress has been slow due to the impact of regulatory policies. According to the contract address published by Paxos, PYUSD was minted as early as November 2022, with 1.1 million coins minted, and multiple small transfer tests conducted. Then, on February 1, 2023, 26.4 million coins were minted. However, on February 23, Paxos, the issuer of PYUSD, burned 25.5 million PYUSD.

The cause of this event was Paxos's collaboration with Binance to issue the stablecoin BUSD, which was under investigation by the U.S. Securities and Exchange Commission (SEC). The SEC alleged that Paxos was suspected of issuing securities without registration. Subsequently, the New York State Department of Financial Services (NYDFS) supervised Paxos and demanded that it stop minting BUSD. This not only affected Binance and Paxos but also temporarily shelved PayPal's plans to discuss the issuance of PYUSD with Paxos. It was not until August 7 that PayPal announced the launch of the stablecoin PYUSD.

The timing of PayPal's decision to release PYUSD stablecoin is quite clever. After actively embracing Web3 and reaping many benefits in places like Singapore and Hong Kong, the attitude of the U.S. political sphere also shows signs of change, indicating a willingness to embrace digital assets. This trend can be seen from events such as BlackRock's application for a Bitcoin ETF and the court ruling that XRP is not a security. Changes in the regulatory environment often determine the fate of an industry, and the compliance path of PYUSD also highlights the shift in U.S. regulatory policies towards stablecoins.

It is worth mentioning that issuing stablecoins is not PayPal's first foray into the crypto space. As early as 2014, PayPal opened up Bitcoin payment functionality through a partnership with cryptocurrency exchanges. Over the years, PayPal has been continuously exploring the crypto industry. As of now, PayPal has fully implemented support for the purchase, holding, selling, and transfer of mainstream cryptocurrencies. In addition to creating products and services that increase the utility of digital currencies, PayPal is also committed to increasing consumer and merchant understanding of cryptocurrencies, stablecoins, and central bank digital currencies (CBDCs), and helping users understand related knowledge and risks by providing educational content.

It is clear that PayPal's purpose in doing this is not just to issue stablecoins; stablecoins are just the foundation for achieving a larger goal. As a compliant U.S. dollar stablecoin, PYUSD has the dual advantages of network payments and on-chain support. Combined with PayPal's large user base, market influence, and business cooperation network, the use of PYUSD will surpass the scope of traditional stablecoins and have a wider range of application scenarios. PayPal can move some traditional online payment scenarios to the chain, such as cross-border transactions and transfers. At the same time, leveraging the advantages of on-chain payments with PYUSD, it can rebuild the business scenarios of the Web2 world on Web3 and bring new advantages. It can be said that PYUSD will become an important tool for PayPal to build Web3 business scenarios in the future.

What Changes Will PYUSD Bring to the Crypto Industry

The launch of PYUSD not only plays an important role in PayPal's Web3 strategy but also has a profound impact on the entire crypto industry, mainly reflected in the following aspects:

Reigniting the Stablecoin Battle

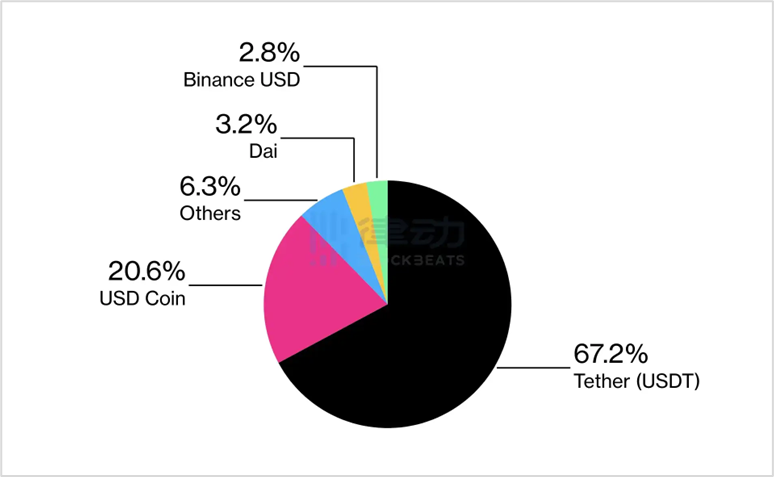

In the stablecoin market, USDT and USDC have always dominated. According to DefiLlama's data, USDT currently ranks first with a market share of 67.2%, followed closely by USDC with a market share of 20.6%. The market share of BUSD, jointly issued by Paxos and Binance, is only 2.8%, ranking fourth. However, with the strong entry of PYUSD, the stablecoin market may usher in a new competition.

Currently, BUSD faces the greatest challenge, as regulatory authorities have required it to suspend the minting of new coins. Since PYUSD and BUSD are issued by the same issuer, once PYUSD is successfully launched, it may quickly replace BUSD in the market. The next most affected stablecoin is USDC, as PYUSD and USDC have similar customer bases, and these customers are more inclined to use regulated stablecoins rather than offshore stablecoins. Relatively speaking, USDT is currently the least affected. According to The Block, Tether's CTO Paolo Ardoino stated that the launch of PayPal's stablecoin will not affect Tether, as PYUSD only serves in the United States, while Tether does not serve in the United States.

However, for PYUSD to be competitive in the stablecoin market, the primary condition is that PYUSD must be listed for trading on exchanges to leverage its advantages. There is already confirmation that Huobi has announced that it will be the first exchange to list the PYUSD stablecoin. Once the liquidity and other conditions are mature, Huobi will immediately start trading and notify users through announcements. Users need to be patient and closely monitor relevant announcements.

Triggering Traditional Industries to Enter the Stablecoin Craze

PayPal's entry into the stablecoin market may have higher strategic goals, but making money is undoubtedly its primary consideration. So, is stablecoin profitable? The answer is yes, and in fact, very profitable. Stablecoin issuers have large cash reserves and do not need to pay interest to customers, so issuing stablecoins alone can make them very profitable. It is reported that the top-ranked stablecoin company Tether achieved a net profit of $1.48 billion in the first quarter of this year, with a staff size of only over 50 people.

In the past, issuing stablecoins may have faced pressure from regulatory policies. However, the successful issuance of the PYUSD stablecoin undoubtedly allows more traditional financial institutions to see opportunities. The model of PayPal collaborating with Paxos to issue stablecoins represents an important step taken by the mainstream financial sector towards cryptocurrencies and blockchain technology. It is reported that institutions such as Visa, Mastercard, and Square are actively exploring the possibility of incorporating stablecoins into their product lines. If there is no significant opposition in the market, they will quickly enter this field, which will undoubtedly trigger a new wave of stablecoin craze.

Accelerating the Popularization of Cryptocurrencies

PayPal's move has played an important role in promoting the popularization of cryptocurrencies. By launching PYUSD on Venmo, PayPal has opened up the possibility of using stablecoins for daily transactions. This means that PayPal's 430 million users all have the opportunity to choose PYUSD as their daily settlement currency. They can enjoy the convenience of cross-border settlements and zero transaction fees. This is very beneficial for PayPal users and also helps promote the development of cryptocurrencies as a legitimate payment method and facilitate their wider acceptance.

In the past, the only way to obtain stablecoins was through crypto companies such as Tether, Coinbase, or Gemini. However, with the introduction of PYUSD into the market, millions of users can enter the crypto world by using one of the widely used payment platforms globally, namely PayPal. This will provide ordinary users with a more convenient and secure way to participate in the application and development of crypto technology.

PayPal's move not only opens a door for traditional financial institutions to enter the crypto field but also provides a more user-friendly and accessible entry path for ordinary users. By launching the PYUSD stablecoin and integrating it into the payment platform, PayPal provides strong support for the popularization and application of cryptocurrencies. This initiative not only helps promote the development of crypto technology but also further advances the global acceptance of cryptocurrencies.

Advancing Regulatory Policy Development

At the end of July 2023, the U.S. House Financial Services Committee approved the "Payment Stablecoin Clarity (Transparency) Act." The purpose of this act is to provide a clear regulatory framework for stablecoins and to protect American investors and consumers by establishing uniform standards. However, the act has been opposed by the Federal Reserve and the U.S. Treasury Department. Democrat Maxine Waters believes that the act has serious issues and is not in the best interest of the United States. As of now, Congress has not passed the stablecoin act, and various institutions are still in negotiations.

In this context, the launch of PYUSD and the stablecoin craze it has sparked may help push Congress to pass the stablecoin act as soon as possible. The launch of PYUSD has brought a sense of urgency to regulatory policies. As the largest payment platform in the U.S., the launch of PYUSD on PayPal means that potentially hundreds of millions of users may enter the crypto market through PayPal in the future. The large number of users may bring risks of money laundering and capital flight. In this situation, the government and regulatory agencies will have to pay more attention to the stablecoin industry and quickly enact corresponding regulatory policies to balance innovation and risk.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。