Cryptocurrency is essentially a social technology. To further refine, cryptocurrency is super social, it is a form of tribalism.

Written by: Thomas Issa

Translated by: DeepTech TechFlow

Obtaining users in the cryptocurrency field is like early humans hunting in the depths of the ice age, spanning thousands of years: their tools are primitive, and the prey is dormant. Early humans wandered on the tundra, knowing little about their prey, and ultimately there were only two outcomes: successful capture or starvation and death from frostbite.

For consumer-grade cryptocurrency products, the story of acquiring customers is similar: either acquire users or perish.

The years 2021 and 2022 mark a period where startups can combine fundraising announcements with subsequent NFT or token airdrops to attract and retain early users; this strategy has been successfully executed by many markets, analytics tools, games, and Web 3 infrastructure, enabling them to gain early momentum based solely on the performance of token projects in the market. Whether it's the NFT pass for digital and physical market Americana, which soared to 0.25eth after its release, or the once promising NFT market Looksrare, which distributed 12% of its total token supply to attract customers from OpenSea. Both attracted consumer attention in the short term, but in the long run, their user base has been volatile.

The failures of these two projects are by no means the biggest mistakes in the cryptocurrency field, but the core issue of these dynamics lies in over-reliance on token and NFT issuance as long-term customer acquisition and retention mechanisms, especially in unfavorable macro environments, further suppressing the value-extracting nature of these designs.

To address the shortcomings of acquiring many consumers, cryptocurrency companies and funds have invested heavily in the "best loyalty" products. Projects are rushing towards "earn as you participate" platforms, where market leaders like Galxe, Layer3, and Zealy have become methods for acquiring, retaining, and instilling customer "loyalty."

These platforms are interesting in terms of top-of-funnel growth metrics, but they are only temporary solutions and marketing support, with almost no impact on the long-term growth and sustained customer acquisition of protocols or projects. Most of these platforms focus on social vanity metrics, encouraging users to follow or join communities on social media. The reward mechanisms are insignificant (with minimal economic benefits and almost no social or reputational benefits). The disconnect between pursuit and consumption exacerbates the inability to track future on-chain transactions, meaning that customers cannot calculate the lifetime value of their potential customers.

Now, there is no doubt that we are rapidly moving towards a future where everything is tokenized. Network participants are inherently greedy and obsessed with financialization, a dynamic driven by blockchain technology.

Just as we tokenize, we will "community-ize." This means that for every commonality among humans, we have the opportunity to share this commonality in digital native communities through the exchange of programmable assets.

Whether it's the music we listen to, the items we purchase, or the schools we attend, we can make these experiences immutable on the chain and share them in the spirit of online communities. We are seeing this trend flourishing in the luxury goods market, as NFTs as companions to physical products bring buyers closer together. LV recently solidified this future through their soul-bound NFT release, which will provide physical products, but more importantly, unparalleled community access for like-minded consumers. Shifting the focus from tradability to consumption fundamentally redefines the community, creating a unique group that is "inseparable" from its consumers.

As Shayon Sengupta put it, cryptocurrency is essentially a social technology, and to further refine, cryptocurrency is super social, it is a form of tribalism. As participants in cryptocurrency, we are all tribes, each tribe originating from commonalities among its members. As a community, we heed the warnings and advice of our peers. In most cases, we do not take action without the consent or recommendation of the group.

Ignoring the group is ignoring the spirit of cryptocurrency consumption behavior.

Native use cases of cryptocurrencies, such as Mirror's Subscribe to Mint, POAP's Attend to Mint, and IYK's Interact to Mint, bring us closer to forming NFT communities through actions, preferences, dislikes, and desires. Digital fashion startups and luxury fashion have already established exchange-based minting as the future of their industry. Thanks to platforms like Medallion, we will be able to join the communities of our favorite artists or collect experiences with future stars on Mercury. All of this lays a crucial foundation for the popularization of digital native communities in our lives.

With the progress attributed to Web 3, it will be possible to extract information about users' purchases and endorsements of products and brands, the places they have visited, the blogs they have read, and even the sports teams they support. Web 3 allows for value capture, which is impossible in the current distribution monopoly system. In the new media model, a user's value is measured based on the absolute value they bring, and they are rewarded through mechanisms such as revenue sharing rebates.

These elements are consistent with a future led by a new model, a concept known as "Community as a Service" (CaaS). Simply put, CaaS can be understood as the value of accessing specific communities being high enough to be considered a marketable product. By understanding the concept of communities, their trends, and their unique role in cryptocurrency, we can realize a future where increasing organic visibility, providing low-cost feedback and insights, enhancing brand credibility, and conducting targeted advertising campaigns will become more affordable.

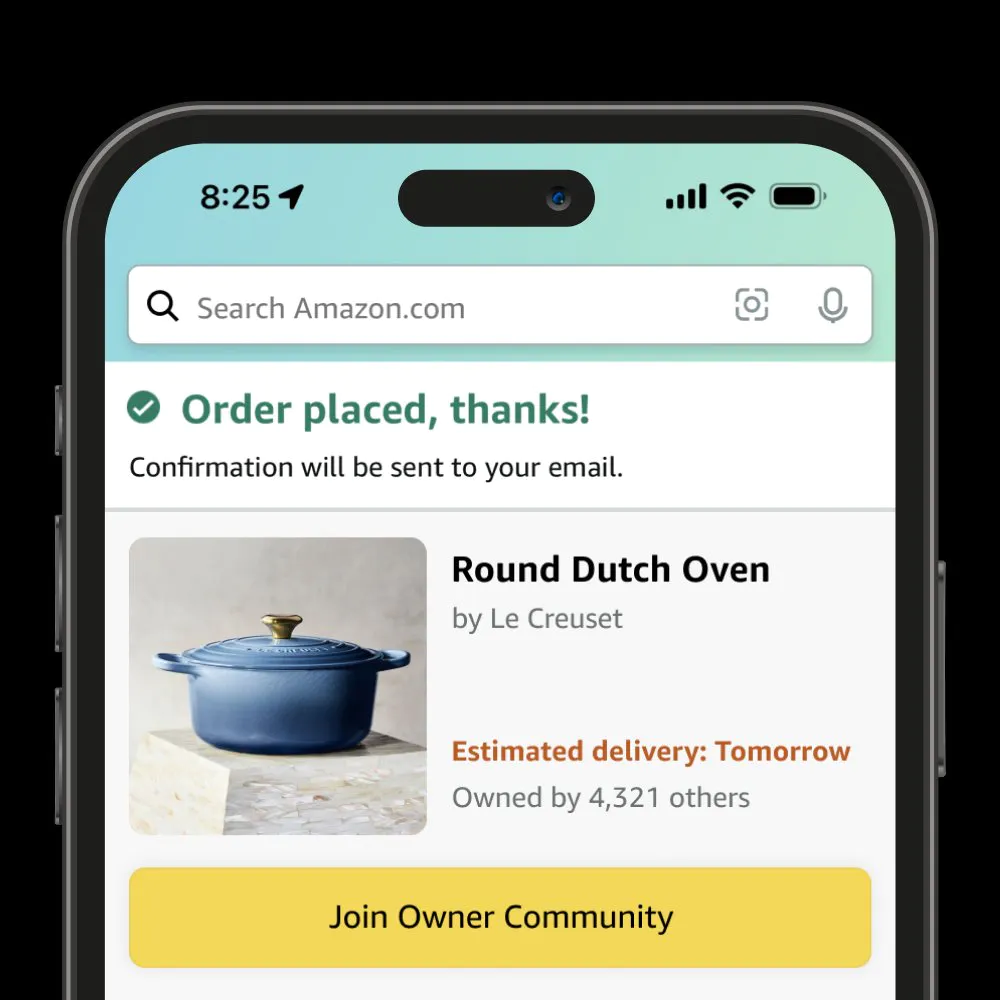

The future of customer acquisition revolves around monetizing communities through cryptocurrency, providing incentives for consumers through simplified and enhanced value creation. In Web 2 social consumption, the community entry process is simple and often disconnected from the brand itself. Through Web 3, the consumer experience shifts from a simple "buy now" to a more inclusive "gain access," representing the most basic form of CaaS principles, and the most powerful distribution platforms come from these communities that support NFTs. Cryptocurrency has established a value capture mechanism that allows communities to own, control, and track their influence. These dynamics will ultimately have a strong impact on brands, projects, and protocols, establishing CaaS dynamics as the future of customer acquisition in every vertical field directly facing consumers.

Transition of CaaS

The striking argument is that Web 3.0 and blockchain technology will usher in an era of enhanced advertiser control, fairness, and decentralization. However, without a system to promote value creation and fair distribution among all value contributors, we cannot maximize this fundamental premise. The CaaS monetization model is the first step in building NFT-supported community infrastructure, which has expanded the field.

Once consensus is established, this trend will be driven by platforms that can aggregate communities, infer data based on chain activities, and determine areas of value addition that communities need to be rewarded for. Builders will be inspired by community aggregation tools (such as De.ID), contribution tracking platforms (such as OrangeDAO's Grove), or efficient advertising networks that connect brands with Discord communities (such as Wildfire).

While this concept is novel and has not yet been directly applied to product or protocol design, builders will productize these trend products that have already supported customer acquisition dynamics, and we will see communities monetize their social and technical influence, ultimately enhancing customer acquisition and validating CaaS business cases.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。