Original Author: Scarlett Wu

It has been over a year since the last review of the Yuga ecosystem (see "APE 质押临近、监管施压,关键时点重新审视 Yuga Labs 生态价值"). Yuga Labs, which was once worshipped a year ago, continues to deliver products that often meet or occasionally exceed expectations. However, the prices of ecosystem tokens and NFTs have already shattered the market's high expectations for the metaverse/crypto IP. With AK's Twitter pinned post and the fundamental aspects and delivery of the Yuga ecosystem having refreshed the conclusions of previous research, as a long-term follower and participant in the primary and secondary markets of the gaming and metaverse sectors, Mint Ventures will re-evaluate Yuga Labs and its related ecosystem.

https://twitter.com/Rewkang/status/1679643703751876609

This study attempts to answer the following questions:

Over the past year, has the product delivery of Yuga Labs and ApeCoin DAO been worthy of the community's trust? (This will be elaborated on in the following sections in relation to the support for NFT and $APE prices)

What are the potential upsides and downsides of the subsequent ecosystem? Is AK's inference reasonable?

1. Yuga Labs Ecosystem Annual Review

The previous Yuga Labs ecosystem review was published in October 22. In the nine months since then, the fundamental changes of Yuga Labs can be summarized in the following aspects:

1.1 Yuga Labs Mainline: MDvMM Comes Late

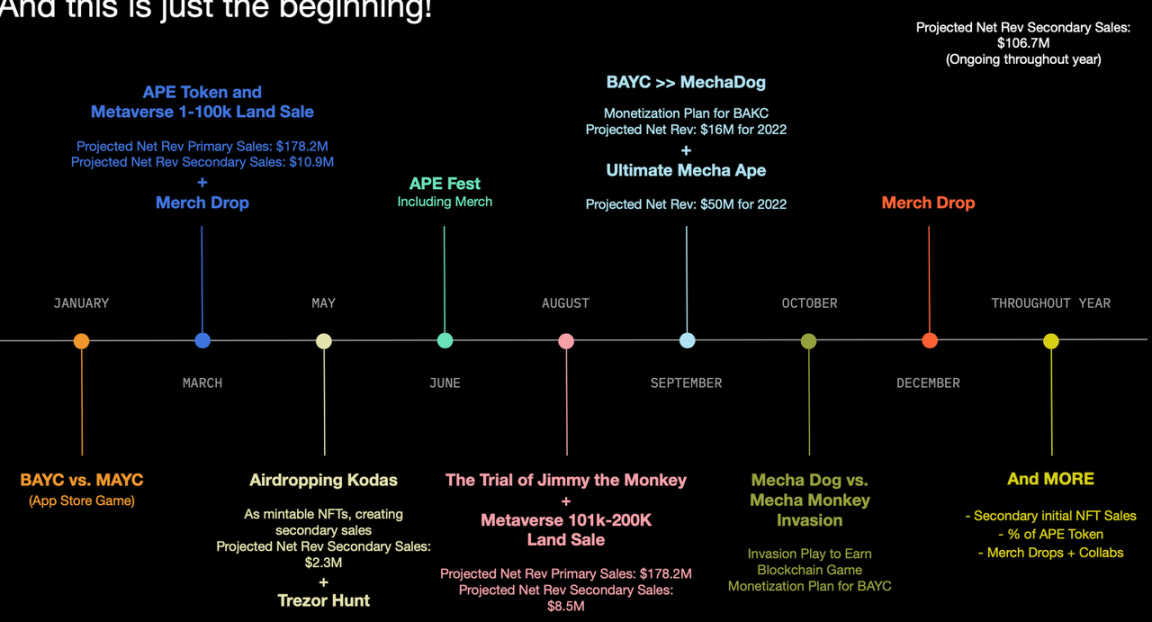

In the seed round pitch deck circulated by Yuga Labs, the storyline of MDvMM (Mech Dog vs. Mech Monkey) was supposed to be a 3-month-long event from August 2022 to October 2022.

Screenshot of Yuga Labs' Pitch Deck

However, perhaps due to significant internal personnel changes, MDvMM only released the first message of this storyline on November 25, 2022: The Trail begins this Christmas.

https://twitter.com/BoredApeYC/status/1595864347355537408?s=20

This also marked the starting point of the NFT price surge in the Yuga series. For example, in the subsequent release of key narratives and game rules, they were all crucial points for the price changes of BAKC.

Parsec, Charted by Mint Ventures

MDvMM Timeline

In the narrative of MDvMM, there are many key points worth discussing. This is not only highly related to the NFT/FT prices of Yuga itself, but also involves the creation of the entire NFT community narrative—Yuga Labs once pioneered the narrative universe of NFTs, so can it still bear the heavy responsibility of saving the NFT market with a new narrative?

1.1.1 Common Issues with Incentivized Games—Criticism of web2.5 Anti-cheating Measures

Since the first phase of Dookey Dash, due to the widespread expectation in the market that "Sewer Passes at the top of the rankings can be upgraded to NFTs with higher value in the later stage," black market and boosting may yield hundreds or even thousands of USDT in single transactions. (In fact, this speculation is valid—when this article was written, the floor price of higher-level HV-MTL HOLO was 6.5E, while the floor price of the most common HV-MTL was 0.6E.) The market's expectations for Yuga Labs games and trust in the fairness of the games have fostered such a profitable trading market.

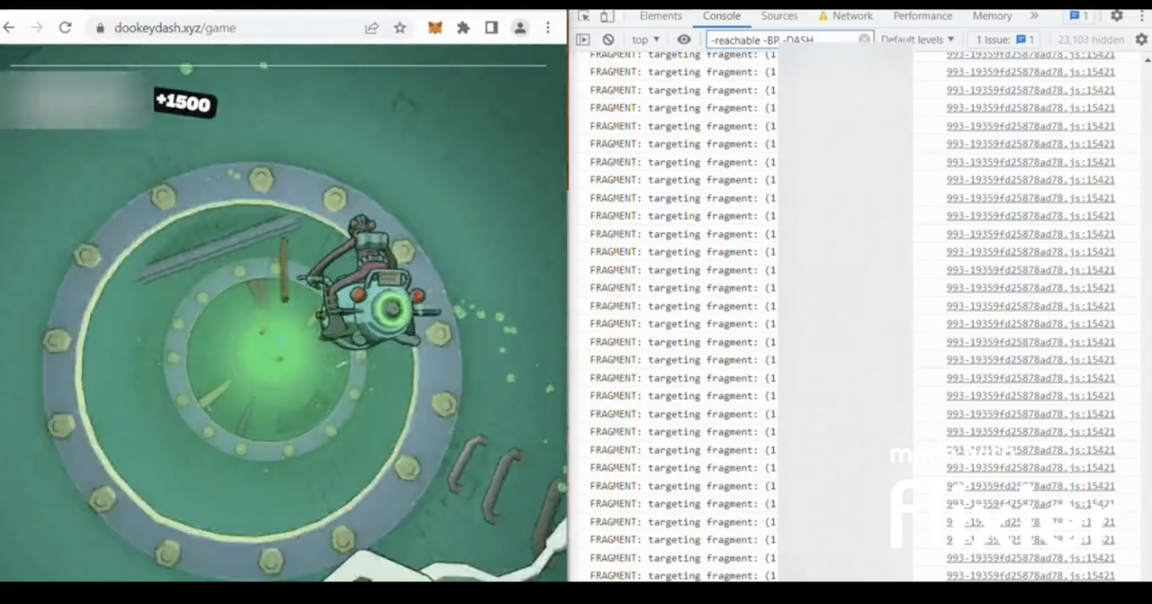

Unfortunately, despite the "suspicious" detection during the game process, there are still simple ways to bypass the anti-cheating system:

@xClearHat

The core logic is: Although Dookey Dash appears to be random and cyclical, the selected process is actually limited. This process depends on a "process seed," and by inserting the same seed locally multiple times, the exact same game process can be generated, from rewards to obstacles. The anti-cheating logic set by Yuga Labs itself is that as long as the "game process corresponding to the local process seed" matches the "player's actual operation input data sent to the server," the player is considered genuine. With a determined process map, cheaters can design a rule-based bot or use an optimal path algorithm to efficiently pass through these obstacles while collecting fragments. Since the bot can simulate mouse movement and clicks, it is difficult to determine cheating based on the bot—players can even livestream themselves playing the game on Twitch, simply moving the locked mouse randomly, while the on-screen monkey skillfully dodges obstacles and collects enough fragments, pretending to be deeply engrossed, and receiving cheers and applause.

Unfortunately, the author @xClearHat believes that Yuga could have avoided/delayed the complete invasion of the game by cheaters through the following methods:

Provide process maps and data on the server side, rather than locally: This would mean higher costs, as low latency requires bandwidth, and bandwidth means dense deployment of servers, while Dookey Dash players are spread all over the world.

Encrypt game rules: Two days before the end of the first round of Dookey Dash, the game was shut down for maintenance, and the JavaScript files were recompiled into new files that partially obfuscated cheaters—previously, the files used by the game were almost plaintext, making the aforementioned reverse engineering exceptionally simple. Since Dookey Dash is a time-limited game, as long as the cracking process is complex and time-consuming, it would actually maintain the fairness of the game.

Establish a dynamic system to provide process seeds at random intervals: Players would no longer be able to generate game processes corresponding to a certain process seed at any time and would need to find the right time—this would greatly increase the difficulty of cheating.

Although this thread has been widely circulated, it was unable to prevent the final announcement of the game results by Yuga Labs— the first-place esports player was not actually in first place, but after kicking out the cheater based on the game video, he received a valuable key. But how many cheaters who were not greedy enough to compete for first place with the esports player, but only wanted to maintain a high ranking, have not been discovered? We do not know. The gaming world of blockchain is not always absolutely fair and just— at least web2.5 games are not.

Example of cheating system gameplay in Dookey Dash created by @xClearHat

Perhaps the wide circulation of this thread was enough to attract attention, or Yuga Labs had already arranged to change strategies in the next phase. HV-MTL's Forge used a clever way to weaken the impact of bots and cheats on the competitive experience: voting. In the six stages, the AMP level of each stage is determined by rankings, which are decided by voting, and users can choose to upvote and downvote— even if a bot is used to push one's own HV-MTL to the highest rank, as long as the base's visual name does not match reality, or other players collectively believe that the increase in votes is unreasonable, it could be downvoted to a very low rank.

https://forge.hv-mtl.com/preview/1

Community self-supervision is certainly a good solution, shifting the cost of review from purely the project side to the hands of game players. Reaching the top rankings not only requires advanced computer skills (operations that require occasional mouse clicks can still be completed through cheating, although there is a risk of being banned), but also requires extensive social connections (group chats for mutual voting) and sufficient capital (using more mech tickets to make up for insufficient heads, or buying tickets OTC at a price of around 1 USDT). But the question is, why spend so much time and effort on a game with average gameplay and a focus on ranking? Currently, the main ways of canvassing are still "mutual voting" and "having more mechs to vote for oneself," although Yuga has set up Twitter account binding for non-holders to vote, it is actually used to differentiate the ranking scores under the same holder's voting, and is not the main focus of ranking differentiation (from the results, there are indeed many cases of the same score range, so it is necessary to pay attention to Twitter binding voting).

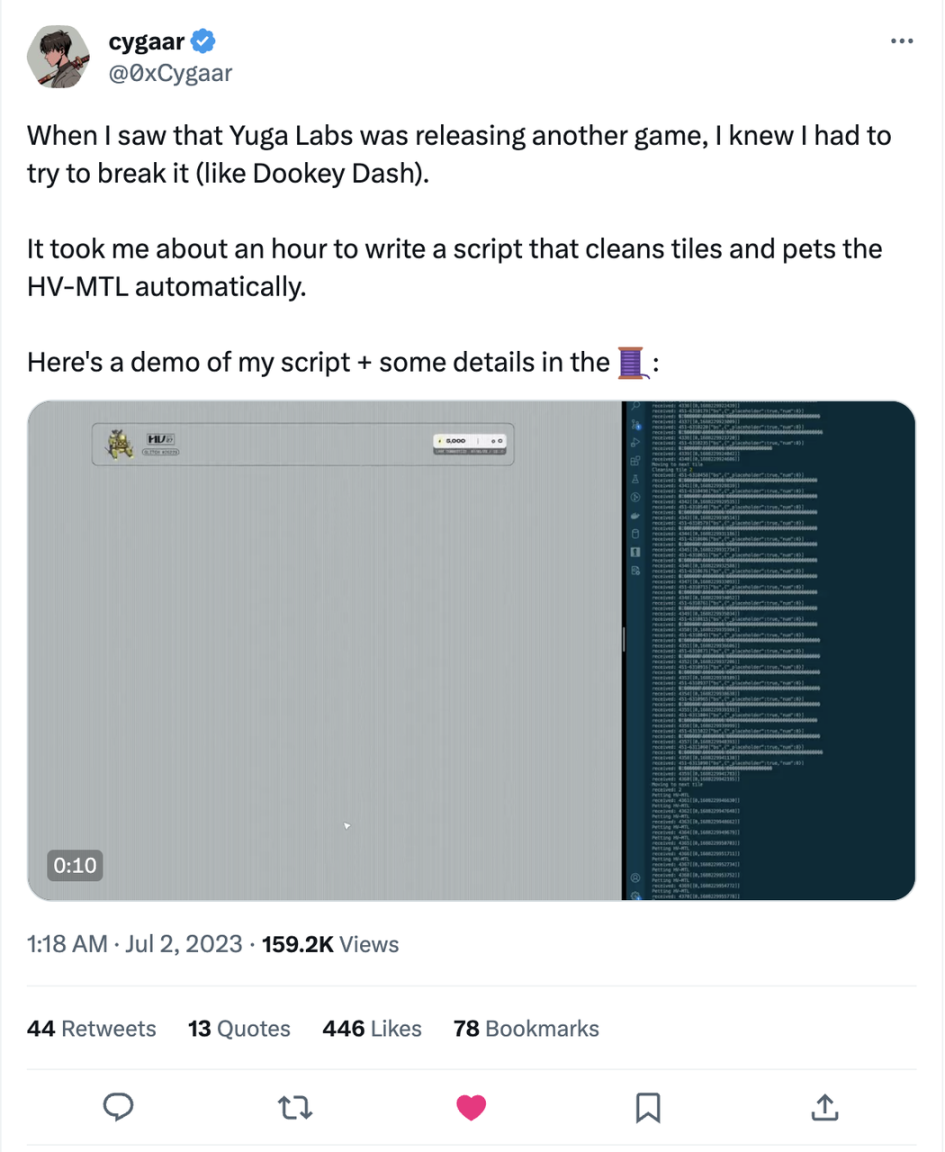

@0xCygaar

The end of the first season at the end of July has given some clues. With over 20,000 HV-MTLs, only 133 obtained the highest level of AMP. The first season's AMP corresponds to the mech's head, and the ongoing second season corresponds to the mech's weapon. If Yuga Labs achieves or even exceeds expectations, the six AMPs should form a quite cool mech. But will there still be myths of buying thousands of ETH for the golden monkey, or the keys?

AMP Concept Image

Cheating is a key element of disrupting the Magic Loop in the traditional gaming industry, and Web3 games need to pay more attention to the large-scale bot and cheating. Community self-supervision is likely a good solution, and being bot-friendly may be another—auto-chess mode has been increasingly introduced by traditional game developers into their existing game mechanisms. When auto-chess simplifies most of the player's interactions in the game, what we need to consider is, what kind of experience do players want to have? Is it the result of play & earn account balance growth, the exhilarating experience of another story, the thrill of skillfully defeating bosses, or the social status symbol that can be flaunted among friends?

From Dookey Dash and HV-MTL, the core goal of players may be quite simple—obtaining scarcity, which means NFTs with potentially higher value. There may be some social value and cultivation experience, but not much.

1.1.2 Token Release and Economic System Consumption—Capturing Value in a Drop in the Bucket

When discussing the consumption and value capture of $APE, it is necessary to first clarify a concept—where do the consumed tokens go?

Since players directly use $APE, it is not a buyback; $APE will not be minted on the total supply of 1 billion nor will it be burned, so it is not deflationary—actually, the income from $APE all goes into Yuga Labs' wallet. For Yuga Labs, this is their game revenue.

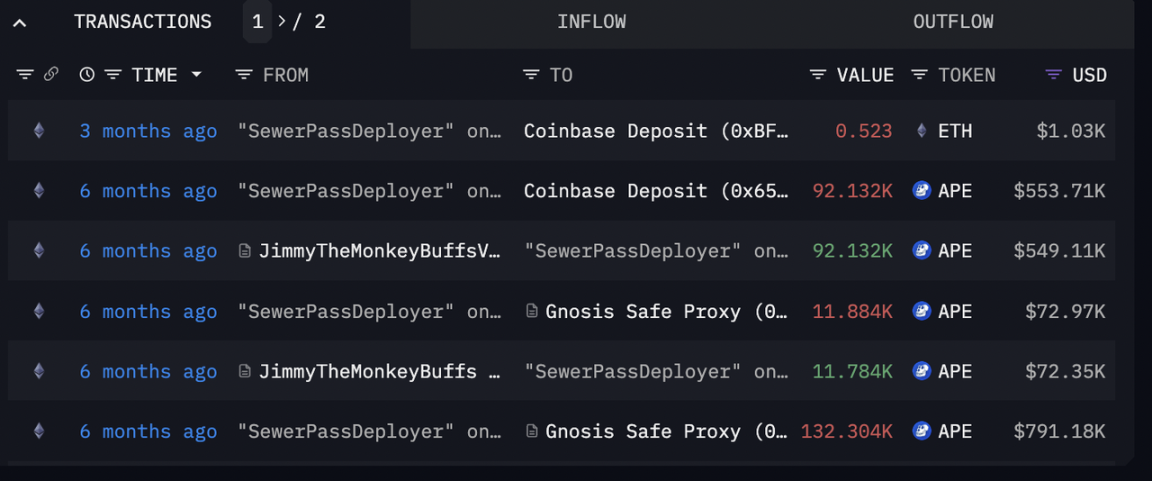

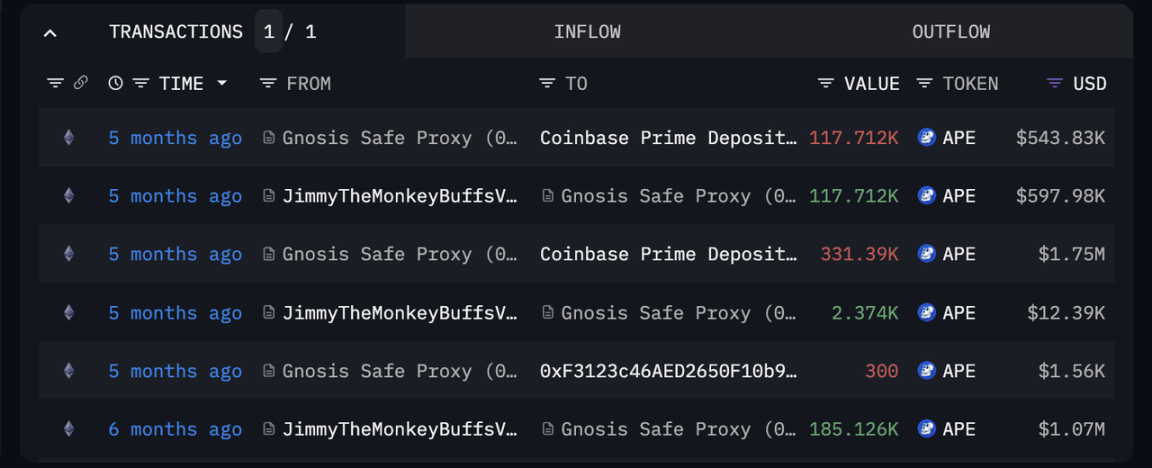

According to Arkham's analysis, the revenue from the Dookey Dash mini-game, shortly after the game ended, partly went to Coinbase, and another part briefly stayed in another multi-signature wallet before also going to Coinbase.

https://platform.arkhamintelligence.com/explorer/address/0x9223abD716FF22C62Db2c6760eB6A59a33AF729E

https://platform.arkhamintelligence.com/explorer/address/0xDa7a4a45cE9c5b42102fcb456AE2532beD252a24

In other words, the consumption of $APE does not lead to a long-term decrease in circulation, but rather brings a certain degree of buying pressure in the short term, as well as a short-term lock-up of circulation—how long this period is depends on Yuga Labs' mood. Additionally, if Yuga Labs holds a large amount of $APE, it may also lead to the problem of concentrated selling pressure.

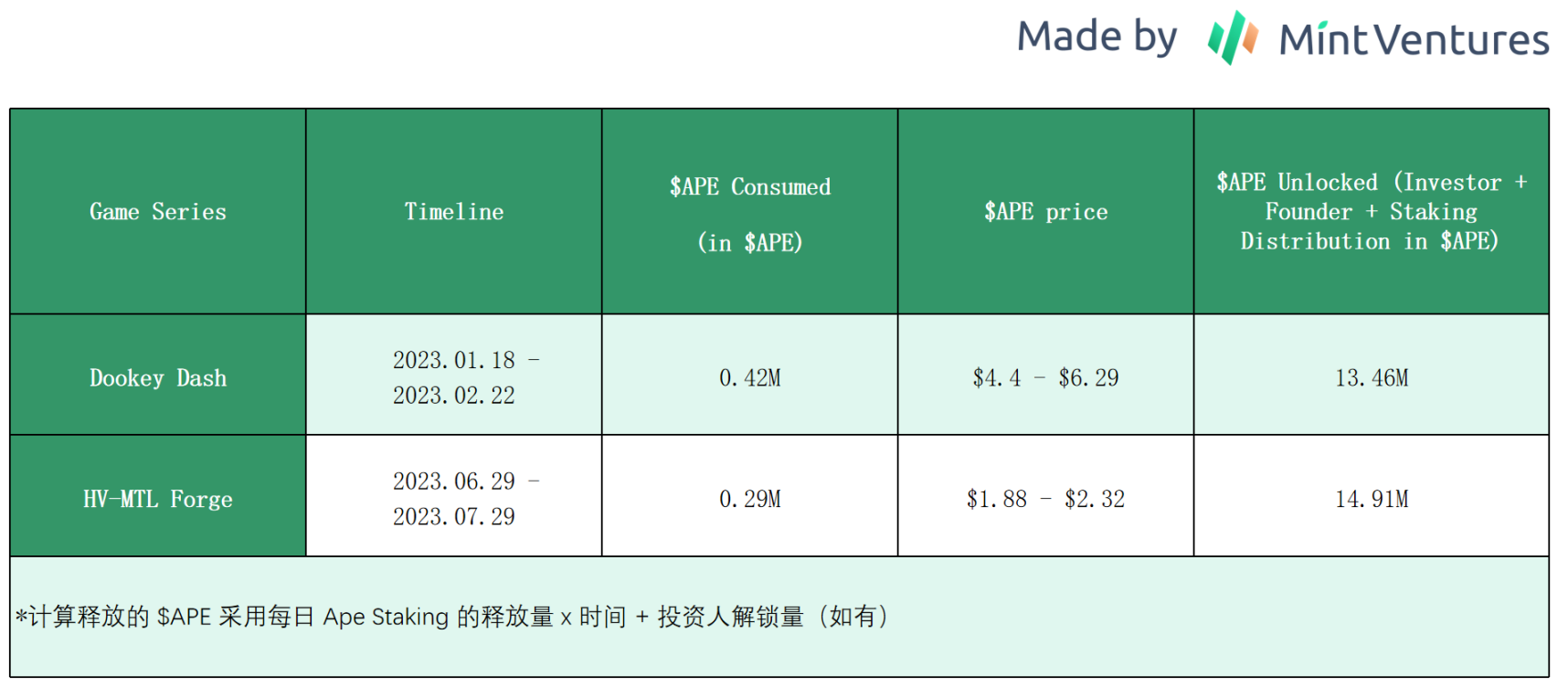

Under this premise, we can analyze the consumption of $APE by Dookey Dash and HV-MTL separately:

Regardless of whether Yuga Labs receives tokens that are readily available for sale, even if the project side does not sell this portion of tokens with high integrity, it is only a small fraction of the token rewards allocated by the staking system at the same time, and the tokens unlocked by investors and the project side.

1.1.3 NFT Utility vs. Narrative—Why Has BAYC's Price Lost Its Former Glory?

Since BAYC's price fell from the "floor stabilizing around 50E," the market has always been puzzled: why has BAYC's price and consensus lost its former glory?

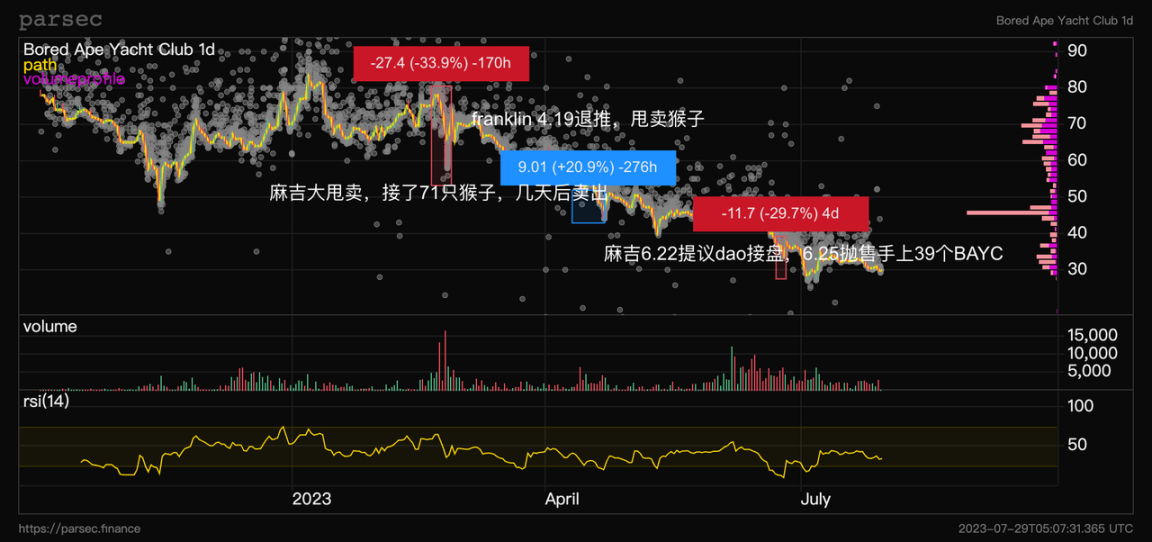

The answer may be very simple: the past glory was the result of retail investors riding the wealth creators' train—once the big players who hoarded BAYC left the market, the liquidity consensus for BAYC disappeared, and so did the value consensus. Among them, machibigbrother.eth and Franklin are the most prominent.

The former became the core holder and preacher of the BAYC NFT series early on, holding dozens to hundreds of BAYC, and the latter once used "Franklin has 61 Apes" as his Twitter name to show his identity in the BAYC community. He also staged several dramatic sell-offs using BendDAO, earning the nickname "monkey market maker" (for more details, refer to Jessica's analysis in "[BAYC Price Decline Reappears: A Comprehensive Analysis of the NFT Lending Leader BendDAO's 'Crisis' and 'Opportunities'").)

In the market downturn of the past six months, machibigbrother.eth was forced to accept 71 BAYC in February due to trusting Blur's bidding wall, and then suffered a large loss and sold them all at once, causing a waterfall in BAYC's price. On April 19, Franklin announced a temporary retreat from Twitter and sold all the remaining BAYC in his hands, reducing the number of big players willing and able to catch a large number of BAYC sell-offs.

On June 22, after machibigbrother.eth began accumulating BAYC, he proposed a draft for ApeCoin DAO, suggesting that the DAO use its treasury to repurchase NFTs to maintain NFT prices. After the information spread in the market, on June 25, he sold 39 BAYC in one go—clearly, the faith and narrative in the eyes of small holders are just tools for creating momentum and profits in the hands of big players. (In fact, there is still a considerable distance from the draft to the vote for ApeCoin DAO, and machibigbrother.eth's previous proposal has never been recognized by the DAO and pushed into the voting stage, but the news itself was enough to scare and gain some market feedback from the public who do not understand this ecosystem.)

This reminds me of the conversation I had with Shim before: the narrative consensus at the beginning of an NFT project is most intuitively manifested in the price consensus—not only in the NFT market, but also in the traditional luxury goods industry. Looking back at the changes over the past year, it is clear to see that Yuga Labs' price consensus is declining, while the consensus on the product's capabilities is rising. In other words, its NFTs are transitioning from luxury items that were once priced out of thin air overnight to consumer goods that can be priced in line with their peers.

As BAYC transitions from a consensus of being priced out of thin air to a tool for calculating airdrop prices and discounting cash flows, and then becomes a part of the game's items and functional bonuses, it is moving from pure narrative to increasing utility. Utility raises the baseline price, but also limits the price ceiling. At the same time, holders have transitioned from being collectors who "HODL and show my status" to speculators who "ambush before the airdrop and sell after the airdrop." Even if Yuga Labs tries to differentiate BAYC from MAYC, BAKC, HV-MTL, and $APE in terms of psychological positioning, it still cannot change the result of their mutual influence and BAYC being dethroned from the luxury item pedestal.

1.2 Otherside Subplot: Low Prices, but Promising Game Quality

In March 2023, Otherside 2nd trip went live, dividing players into four teams led by esports streamers and KOLs from the gaming and NFT communities to compete in scoring. Unlike last year's 1st trip, this experience truly achieved 1) interactive and data upload with thousands of people on the same screen and 2) gameplay trials with thousands of people on the same screen.

https://youtu.be/_RmFWo9Htwg

Although the author was limited to watching the live stream due to the game being overloaded (despite having over 50,000 Otherside holders, only about 8,000 people were able to enter the game), they still experienced the stunning visuals of UE5 and the excitement of battling alongside thousands of people. From single-player games to MMOs, and from MMOs with dozens of players to thousands of players on the same screen, technological advancements have made new gameplay possibilities, and Otherside is likely a pioneer in the gameplay of thousands of people on the same screen.

The delivery of this experience by Otherside was undoubtedly beyond expectations, but this kind of exceeding expectations did not lead to an increase in the price of Otherdeed. The prize for the winners of the 2nd Trip was a helmet, Otherside Relics, totaling 2220, airdropped by Otherside to the wallets of the winning team's corresponding Otherside holders. On the day of the airdrop, the price of Otherside Relics reached as high as 0.7 ETH, but it still has a floor price of 0.2 ETH.

However, the price of Otherdeed was not as fortunate. The market seemed to interpret the airdrop expectations brought by Otherside as bearish—each new NFT airdrop means that holders of Otherdeed will receive fewer NFTs in the future, reducing their future cash flow and lowering the valuation of the NFT.

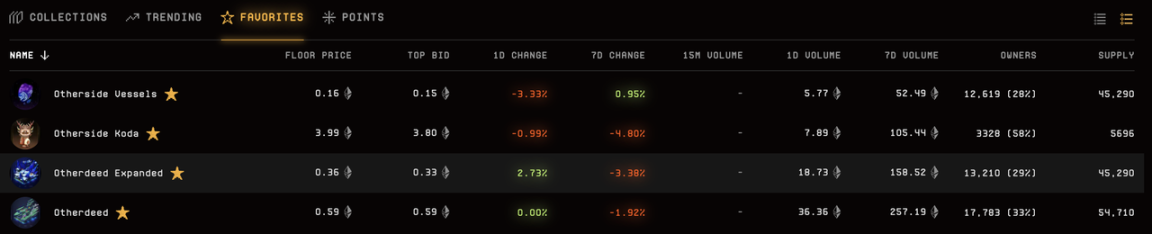

The subsequent separation of Otherdeed further exacerbated the decline in its price,

- Otherdeed (without Koda): Separated into Otherdeed Expanded and Otherside Vessels, with Vessels evolving into Mara in the subsequent Mara mini-game and being able to combine with Koda to become Kodamara

- Otherdeed (with Koda): Separated into Otherdeed Expanded, Otherside Vessels, and Otherside Koda

Clearly, Otherside hopes to maximize the gaming attributes of NFTs, but from the perspective of NFT series investment, overly complex series nesting may confuse most non-hardcore players, and the dispersion of liquidity makes it difficult to support the NFTs returning to their original prices—hence the continuous decline in the floor price of the Otherside series.

On July 28, 2023, Otherside's official account released a teaser video of the offline Playtest, indicating that the game experience is no longer limited to exploring limited scenes with colored robots, but is a true exploration of jungles, mountains, lakes, and bars with Avatars. It seems that the official launch of the Otherside game is no longer just a pipe dream and may achieve the experience expected of the first Web3 game.

https://twitter.com/OthersideMeta/status/1684756832265621504?s=20

1.3 ApeCoin DAO Subplot: Lackluster Ecosystem, Astonishing Inflation

In the past six months, ApeCoin DAO has only passed over twenty proposals, with a large part related to governance processes and efficiency improvements in Ape Staking (which seems quite absurd—it's hard to imagine a company established in a traditional way spending a lot of time improving departmental configurations and management processes over a year after operation). Some are related to rewards for $APE contributors (which align with the interests of voters), and the remaining are mainly related to BD and narratives, creating movies, games, and comics with Ape's philosophy as the core narrative. The only proposal that seems promising is the establishment of an Ape ecosystem project incubator led by Forj—although it is still too early to see substantial output.

From the initial ApeCoin DAO Council composed of investors to the transfer of power to council members elected by the community, we have seen less and less innovation and courage, and the actual participants in DAO activities are few. With billions in circulation, the total votes for each vote are around 10 million, indicating that $APE holders are not interested in governance content, and for them, the greatest utility of $APE is just staking.

Looking back at the introduction of $APE use cases by ApeCoin DAO:

- Ecosystem token: Yuga Labs' products all use $APE for payment, but the actual demand does not match the circulation (see 1.3), and the DAO ecosystem has not shown significant growth, making it difficult to see the possibility of matching ecosystem value and monetary value.

- Payment method: Although some NFTs from Gucci/Times/OpenSea do accept $APE as payment, this seems more like a gimmick than an actual use case. Few people are willing to hold a token with fluctuating prices as a payment tool for the long term.

- Staking profits: The price of $APE has dropped from $5 at the start of staking to less than $2, meaning that without hedging, significant losses are likely. But if all stakers are hedging—do stakers really believe in the future of $APE?

It seems that in the inaction or incompetence of ApeCoin DAO (or the entire Yuga Labs token/NFT holder community), only staking profits have been realized—purely mining with coins. Even if users have made some profits, does it really benefit the Yuga Labs brand? Staking + rewards is just a means of buying time for ecosystem development, and if the ecosystem cannot thrive during this time and inflation is quite terrifying, it will be a huge blow to the token price, and we can only wait for the reality of the token being halved again and again.

2. Potential Upside and Downside Scenarios

2.1 Potential Upside

Otherside's launch and fun gameplay

- It is currently the 2nd trip, but there are rumors of an offline Playtest. Yuga Labs' previous level of game delivery has not disappointed.

Breaking out of the crowd

- Deep brand collaborations (such as previous collaborations with adidas/Gucci, which not only depend on the team's BD capabilities but also need to align with the trend of joint branding in the larger environment)

- Derivative games/movies, etc.

Securities narrative reversal

- Yuga Labs was investigated by the SEC last October, but in June of this year, $APE was not included in the SEC's list of lawsuits.

APE consumption

- Mech game value capture (in previous activities, consumption is quite limited compared to inflation)

- Ape Fest (the next offline gathering in HK may drive high-net-worth individuals in Hong Kong to purchase NFTs)

2.2 Potential Downside

Price anchoring and narrative no longer + lack of liquidity

- Lack of market makers (such as the previous machibigbrother and Franklin) and high community dependence on Yuga Labs will continue to cause price fluctuations based on the effects of Yuga Labs' new activities. However, in the current low liquidity market, the price does not fluctuate much with positive news, but it drops significantly with negative news. Unlike the decentralized art collection logic of Punk, most collectors do not care about short-term prices, and without the desire to sell, there is no end to being dethroned due to liquidity shortages.

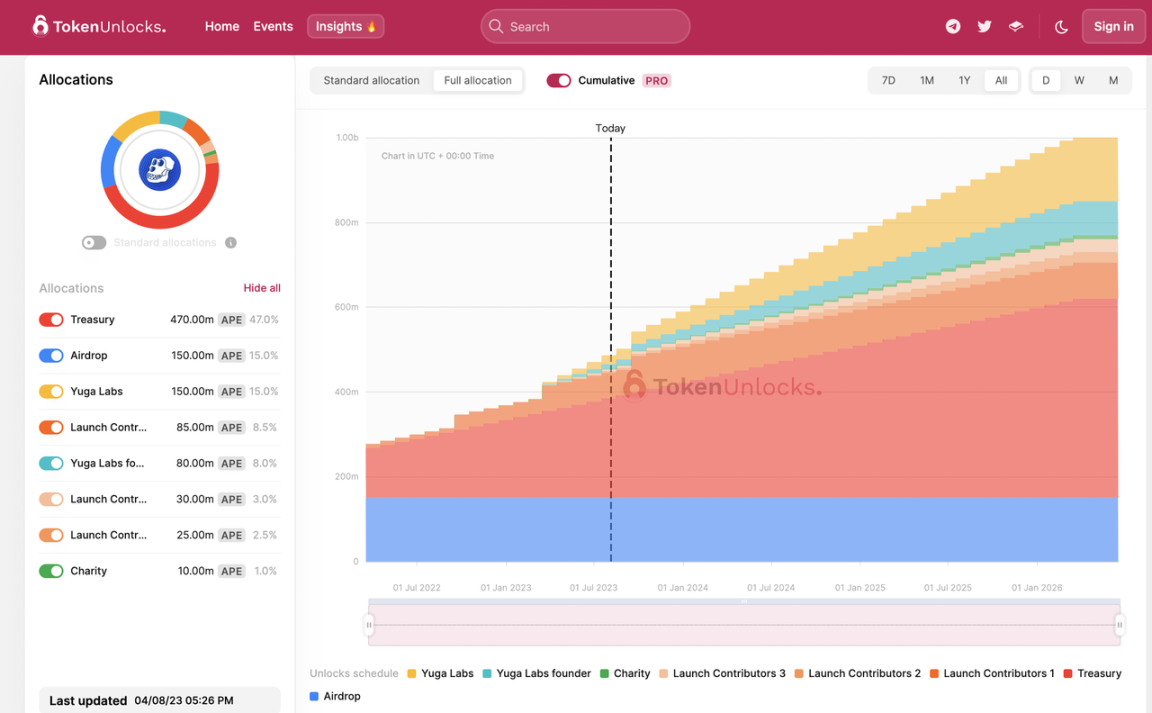

Token inflation

- $APE still has significant inflation, and investors may further sell off (the current price is already lower than the previous primary market valuation of $20 billion FDV, which is less than the $40 billion given by VCs at the time, although the VCs do not only hold the token mapping but also the Yuga Labs equity corresponding to the IP)

Source: Token Unlock

Token use cases are almost non-existent.

Payment use case - Few people use $APE for transactions on OpenSea, it's just a gimmick.

Ecosystem development - In the past six months, ApeCoin DAO has been very inefficient, with low organizational efficiency and lack of incentives, which has instead dragged down Yuga's level.

Staking - The only real use case at present. However, the APR (Annual Profit Rate) has dropped from over 300% at the beginning to 50% (pure $APE) / 140% (paired with NFT). Hedging miners may profit, while naked stakers suffer heavy losses.

It currently appears that the downside force is still greater than the upside. Of course, Yuga Labs' level of delivery may mean that they will still stand tall in the industry (not dying but possibly being surpassed), but perhaps for a very long time to come, "deflating the bubble" will still be the major trend for Yuga Labs' assets.

Reference and Acknowledgments: The writing of this article would not have been possible without the discussions with @Noahnftn@Z57831357 on the topic of cheating in Dookey Dash, as well as @CryptoScottETH's detailed data tracking of HV-MTL. Special thanks to @anymose96 for the detailed breakdown and sharing of the current status of HV-MTL rules, and to @0xbobo@alpacacheeze for brainstorming and discussions at every critical juncture._

References:

https://www.panewslab.com/zh/articledetails/w23ypcwje9p9.html

https://snapshot.org/#/apecoin.eth

Official websites of Yuga Labs, MDvMM, and Otherside.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。