The MakerDAO protocol has earned a significant profit from Real-World Assets (RWA) interest-bearing assets, and then used these profits to pay an 8% interest rate. But why do this?

Today, MakerDAO officially adjusted the DAI deposit interest rate of its lending protocol, Spark Protocol, to 8%. This is higher than the stablecoin "risk-free rate" of the current US Treasury bond yield, which inevitably raises suspicions about whether the high returns are backed by a Ponzi scheme. Let's discuss where this 8% "risk-free" return comes from. Is there a Ponzi scheme behind it? Is this return sustainable? Why is MakerDAO doing this?

Limited to personal knowledge, any errors are welcome to be pointed out, and this does not constitute any investment advice. Where does the 8% "risk-free" return come from? RWAs have been a hot topic in the industry recently, and MakerDAO has become a highly anticipated RWA concept project due to the introduction of a large number of RWA assets. The logic behind why MakerDAO introduced RWA assets can be found in this article.

In simple terms, the purpose of introducing RWA assets into MakerDAO is to leverage external credit to diversify the assets it supports, and the long-term additional returns brought by US Treasury bonds can help stabilize the DAI exchange rate, increase the flexibility of the issuance, and reduce the reliance on USDC in the balance sheet, thereby reducing single-point risk.

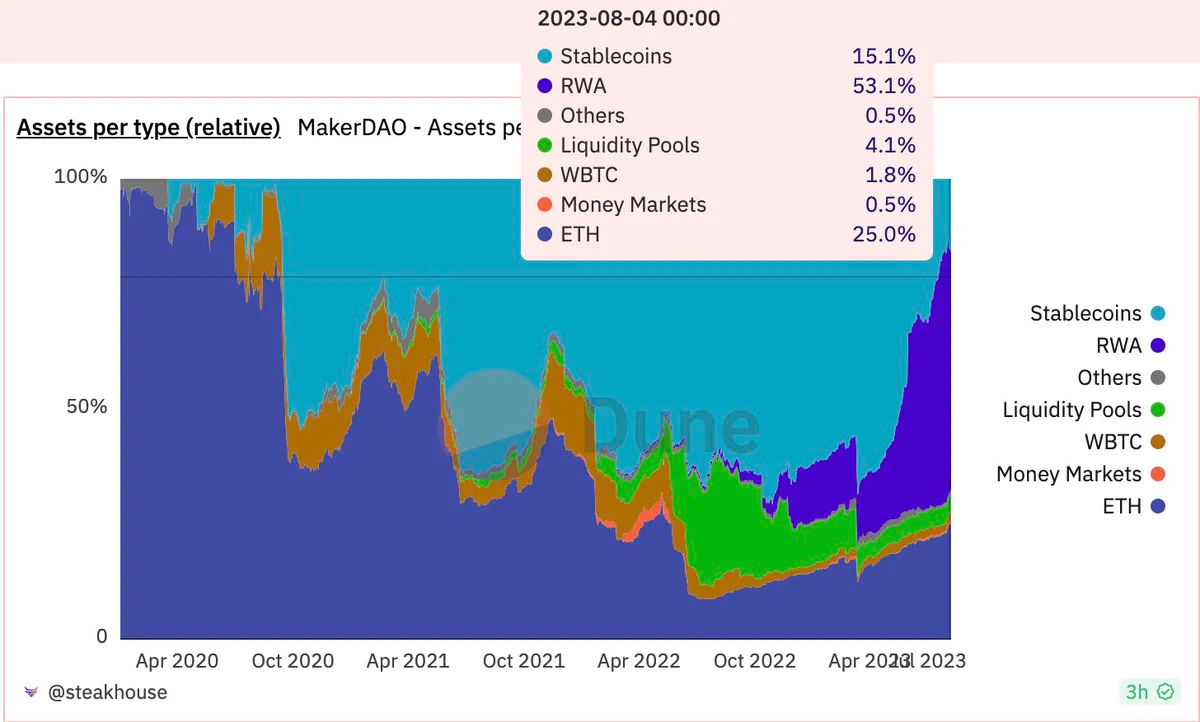

The introduction of a large number of RWA assets has also brought MakerDAO a significant amount of additional income. We can see from Dune that the proportion of RWA assets has exceeded half of the entire MakerDAO protocol's balance sheet.

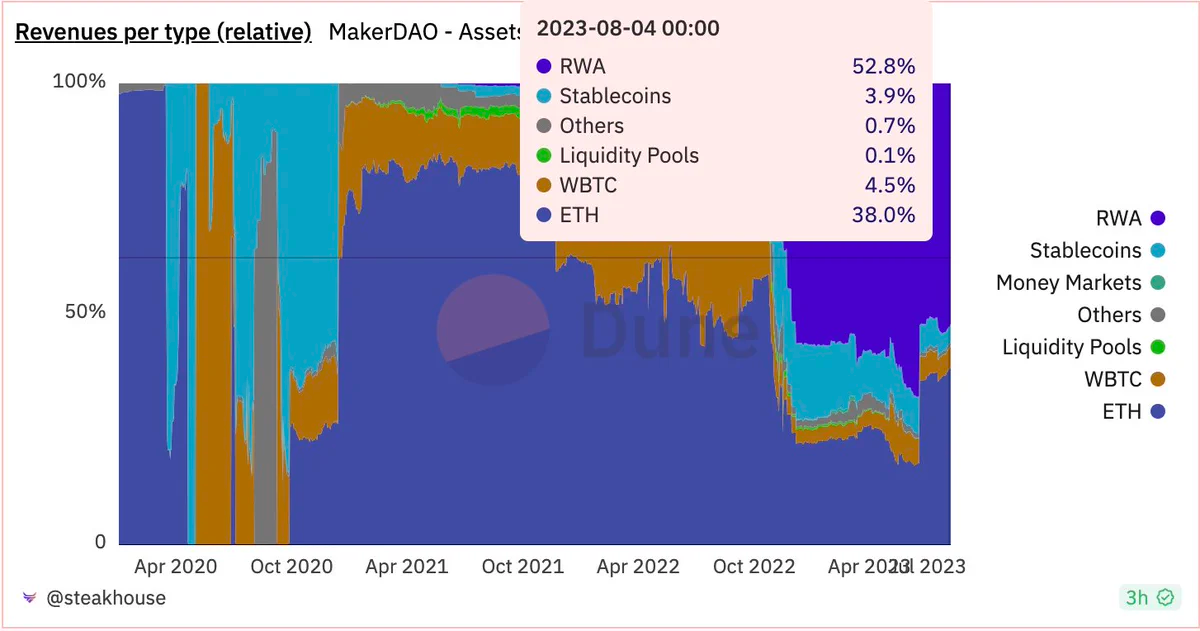

The large amount of interest-bearing RWA assets has brought MakerDAO more income. Currently, over half of MakerDAO's income is generated by interest-bearing RWA assets, with the majority of RWA assets being US Treasury bonds, which have a nearly 5% risk-free interest rate. These profits will ultimately go to MakerDAO's pocket rather than DAI holders.

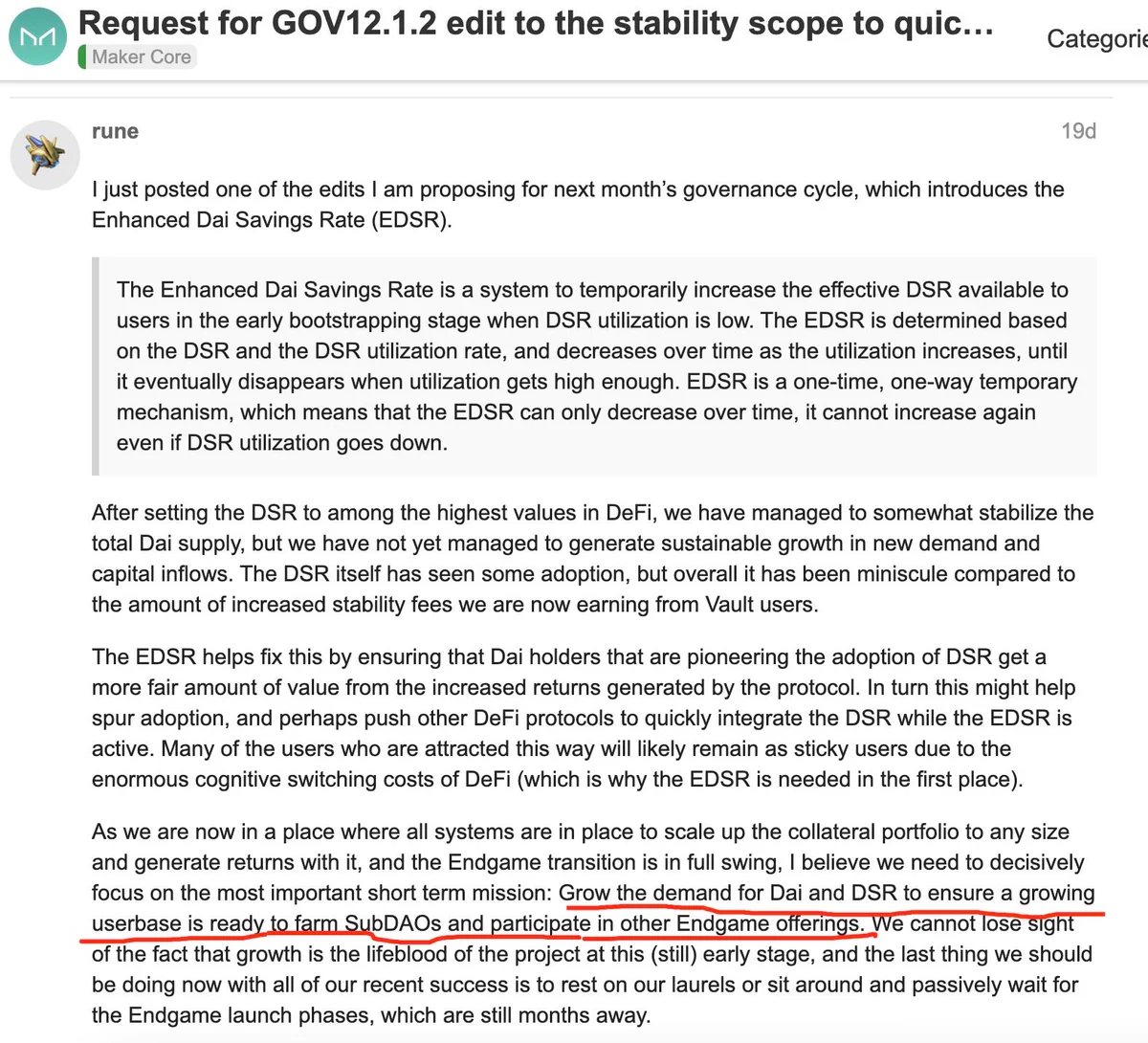

So, the source of the 8% return is very clear. The MakerDAO protocol has earned a significant profit from interest-bearing RWA assets and then used these profits to pay an 8% interest rate. But why do this? According to MakerDAO founder Rune, the purpose of setting the interest rate at 8% is to increase the demand for DAI and DSR, to ensure a continuously growing user base participating in SubDAO and other parts of the Endgame.

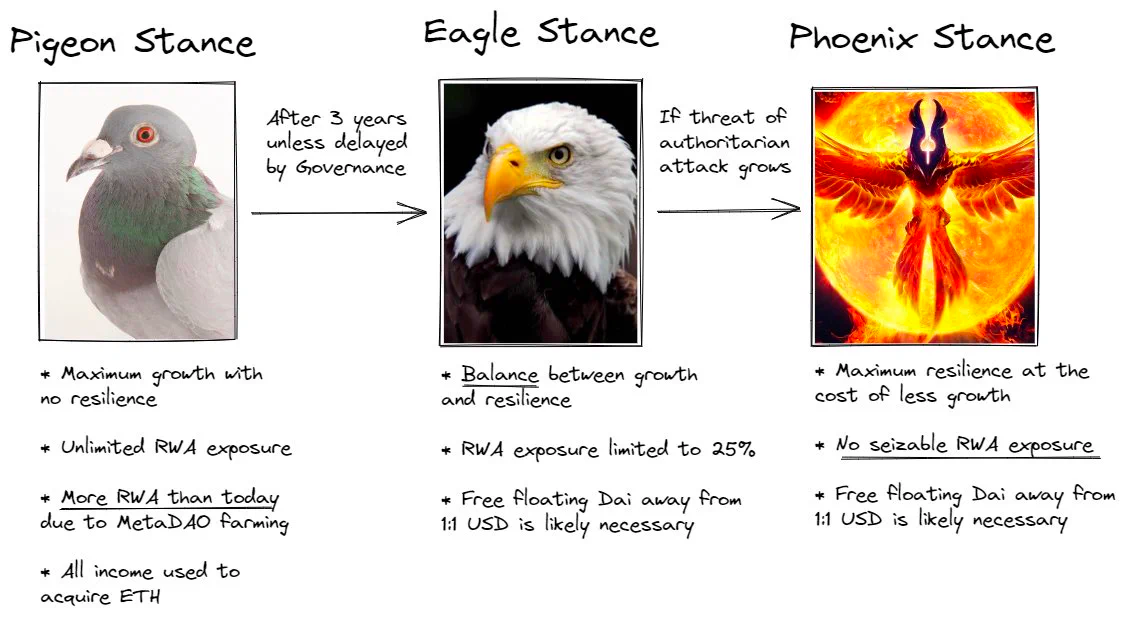

In simple terms, it is to increase the demand for DAI. More DAI = more collateral = more money to buy interest-bearing RWA assets = more income. On the other hand, it also advances the progress of the Endgame plan, which is MakerDAO's vision for achieving complete decentralization.

So, is this 8% interest rate sustainable?

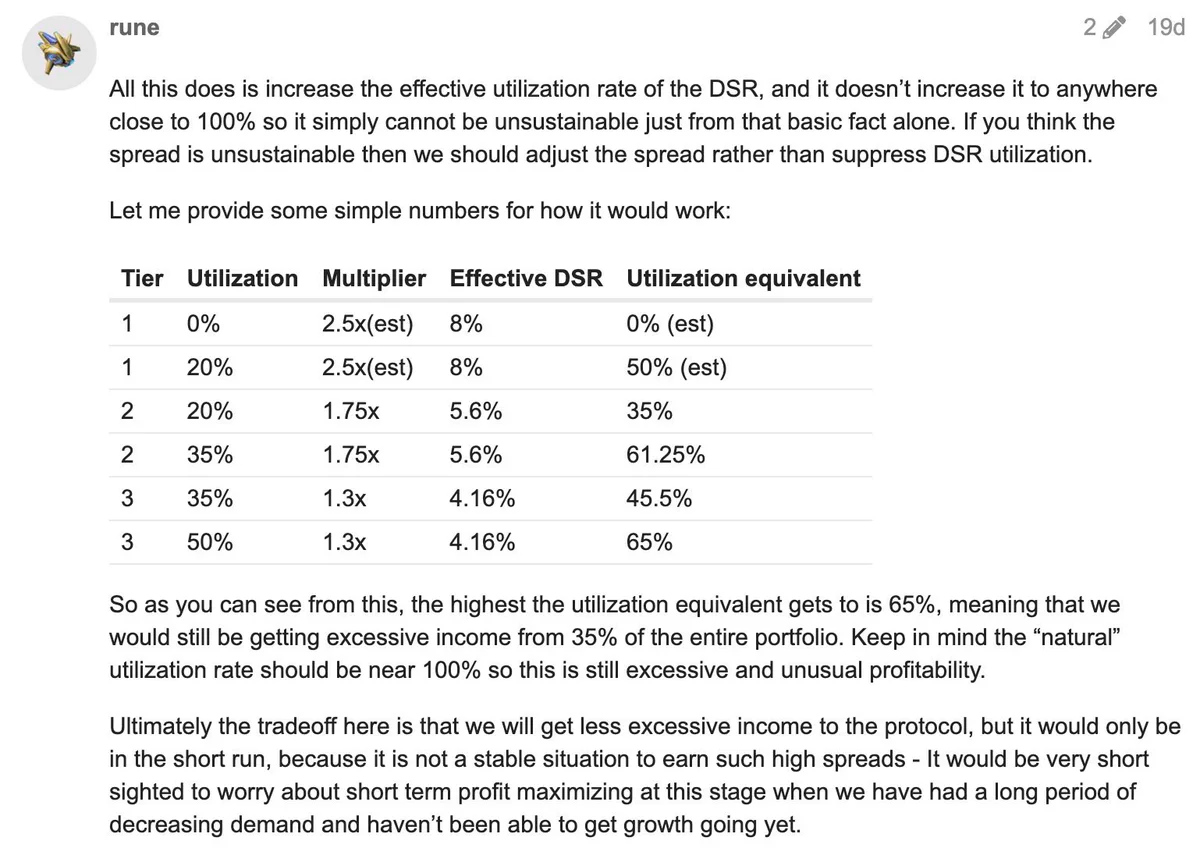

In short, no, it is not sustainable, because this 8% interest rate is actually a one-time "promotion." We can see in the discussion of increasing the DSR interest rate, Rune mentioned the introduction of a new mechanism: Enhanced Dai Savings Rate (EDSR), which is a temporary mechanism to temporarily increase the effective DSR available to users in the early stages of low DSR utilization.

In plain language, it is a one-time high interest rate to attract users when there are few people earning interest in the early DSR. EDSR will be determined based on the DSR and DSR utilization rate and will gradually decrease as the utilization rate increases, eventually disappearing when the utilization rate is high enough. EDSR is a one-time, one-way temporary mechanism, which means that EDSR can only decrease over time and cannot increase again, even if the DSR utilization rate decreases.

In other words, this 8% interest rate is a one-time, one-way "promotion." When the amount of DAI deposited in the DSR reaches a certain threshold, this interest rate will decrease unilaterally and cannot increase again. According to Rune, when the DSR utilization rate reaches 50%, this excess interest rate will disappear, and MakerDAO will never lose. In simple terms, MakerDAO is sharing some of its protocol income with DAI holders.

In summary, MakerDAO has spent a lot of money to buy a lot of RWA, earned a lot of money, and then adjusted the interest rate to 8% to distribute some of the profits to DAI holders to increase the demand and user base for DAI. Once more people start earning interest, this interest rate will decrease until it returns to a normal level.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。