Author: BitpushNews Mary Liu

On August 7th, payment giant PayPal announced the launch of the PayPal USD (PYUSD), a stablecoin backed by the US dollar, making it the first mainstream financial services company to adopt cryptocurrency for payments and transfers.

According to the introduction, PayPal USD (PYUSD) is backed by US dollar deposits and short-term US government bonds, issued by Paxos Trust Co, and will gradually be made available to PayPal customers in the US. Similar to Tether and Circle, the reserves will be held in the form of US Treasury securities. The interest earned on these securities will be shared by PayPal and Paxos.

This move may be a new attempt by the payment company to seek diversified income. In the post-pandemic era, with the weakening momentum of online payments in North America, PayPal's stock price has fallen by 33% in the past 12 months. The company's adjusted operating profit margin for the second quarter was 21.4%, lower than the expected 22%, and its financial performance was lackluster. Disappointed by the quarterly operating profit margin, PayPal's stock price fell by 7% in after-hours trading last Wednesday.

Dan Schulman, President and CEO of PayPal, stated in the announcement that he hopes to consolidate PayPal's leading position in the digital payment field by relying on technology that enables instant and low-cost transfers without the need for a central intermediary through PYUSD. He said, "Over time, our vision is to become part of the entire payment infrastructure."

The announcement from PayPal pushed its stock price up by 3% in Monday's intraday trading.

PayPal's Journey into Cryptocurrency

With over 431 million active accounts worldwide, PayPal first introduced cryptocurrency services in 2020. It allows users to buy, sell, and make payments with a few tokens such as Bitcoin through its platform. Then, in 2021, PayPal announced the launch of Checkout with Crypto, a feature that allows consumers to check out using cryptocurrency at millions of online businesses. Last year, the company enabled users to transfer cryptocurrency from their accounts to other wallets and exchanges.

Argus Research Corp analyst Stephen Biggar stated that the company has been involved with cryptocurrency for a long time, so the launch of a stablecoin is not surprising. The PayPal brand name also gives significant meaning to the cryptocurrency industry.

PYUSD is designed to be exchangeable for US dollars at any time, and can also be exchanged for other cryptocurrencies offered on the PayPal network. It can be used to fund purchases and will soon be available on PayPal's popular payment app Venmo. Users will eventually be able to send their held tokens between PayPal and Venmo wallets. The token can also be transferred to compatible third-party wallets outside the PayPal network.

The PayPal stablecoin is issued by Paxos, a veteran participant in the stablecoin field and a brokerage partner for PayPal's cryptocurrency trading services. Paxos is regulated by the NYDFS, and PYUSD will be a regulated product in the state of New York. In June of last year, PayPal obtained a local cryptocurrency license from regulatory authorities. Paxos had previously issued the Binance-branded stablecoin BUSD, which was ordered to cease operations by the New York State Department of Financial Services in February of this year.

PayPal expects PYUSD to initially be used primarily in the cryptocurrency and web3 fields, such as for the inflow and outflow trading of other digital tokens and in-game payments, and then gradually adopted in areas such as remittances and small payments.

Schulman stated that PayPal had extensive discussions with US regulatory agencies and policymakers in preparation for the launch of PYUSD. He said, "We are now in a position in these conversations where people are comfortable with a respected, well-regulated US financial entity entering the stablecoin space, and see this as an important initial step."

PayPal stated that starting in September, Paxos will release monthly reports detailing the assets supporting PYUSD, and Paxos will also release third-party verification of the reserve assets for PYUSD by an accounting firm.

Challenges Faced by Stablecoins

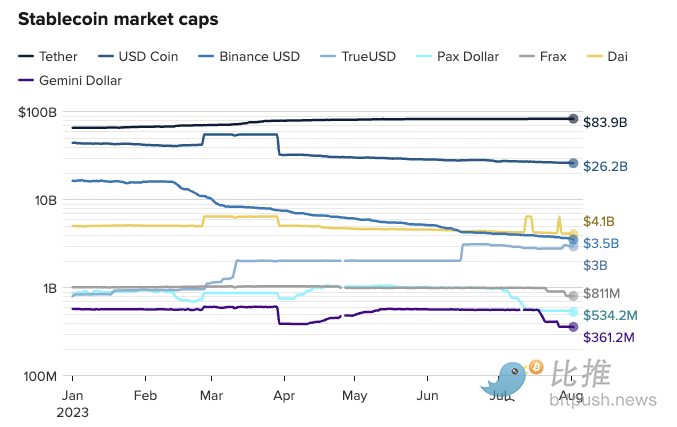

Although stablecoins have been around for years, they have not successfully entered the mainstream consumer payment ecosystem. The cryptocurrency industry has been struggling with regulatory resistance over the past 12 months, and a series of collapses have exacerbated regulatory resistance, leading to an overall decline in the market value of stablecoins.

According to data from CryptoQuant, the market value of the largest US dollar stablecoin, USD Coin (USDC), issued by US companies, has fallen by about 41% since January 1st. USDC is managed by the Centre consortium, founded by Circle, which includes cryptocurrency exchange Coinbase.

Attempts by some tech giants to launch stablecoins have been strongly opposed by financial regulatory agencies and policymakers. Meta (then Facebook) had planned to launch the stablecoin Libra in 2019, but it was thwarted due to concerns from regulatory agencies that it could disrupt global financial stability.

From the UK to the EU, a series of major economies have successively established rules for managing stablecoins, with the EU's policy set to take effect in June 2024.

Last month, the US House Financial Services Committee proposed a bill to establish a federal regulatory framework for stablecoins, focusing on registration and approval process rules for stablecoin issuers.

Jose Fernandez da Ponte, head of PayPal's blockchain and digital currency team, told Bloomberg that the company now believes that the regulatory environment is "moving in a more clear direction," and that due to market concentration, the demand for alternative stablecoins is growing.

Walter Hessert, strategic director at Paxos, told Coindesk that there are clear differences between PYUSD and other competitors, thanks to Paxos' status as a trust company regulated by the New York Department of Financial Services (NYDFS). This means that if Paxos were to go bankrupt, its regulatory agency NYDFS would intervene, and PYUSD would be exempt from bankruptcy. This way, customers would not unknowingly become creditors in the event of bankruptcy, and funds would be returned to each token holder.

Tether's Chief Technology Officer Paolo Ardoino commented, "As another stablecoin in the US, PYUSD may lead to a significant impact on the payment revenue driven by major players such as Mastercard and Visa, and it will further help the industry develop and promote reasonable regulation."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。