Despite the bear market, there are still real sources of income in the industry such as market-making and LSD. However, most retail investors have not only failed to increase their wealth but have also suffered losses.

Taking market-making as an example, as one of the earliest real sources of income in DeFi, the early market-making strategies and operations were quite simple. Even though there were certain impermanent losses accompanying the rise in the market, the overall income was still very considerable. However, today, old-school DEXs represented by Uniswap have undergone several iterations, and emerging protocols like GMX, as one of the highest income sources in the industry, have provided LPs with more flexible functions and strategic space. DeFi participation requires more flexible and efficient strategies, as well as a certain risk management capability. The survival space for ordinary retail investors in the DeFi market is getting smaller, and it is becoming increasingly difficult for them to achieve higher returns.

On the other hand, the crypto market is not lacking in entities that can bring value-added income. Professional DeFi market-making teams have emerged in such industry trends. They use professional quantitative trading tools to formulate trading strategies supplemented by rigorous risk management, earning considerable income, while retail investors can only envy. Retail investors need to leverage the wisdom of professional teams in order to get a piece of the pie. The key issue is how to connect and match the strategies of professional teams with the funds of retail investors. Professional strategy teams find it difficult to establish trust and prove their innocence, and they also have no way to create financial instruments to expand financing channels. Trust issues and the lack of financial instruments make it difficult for professional strategies to scale up.

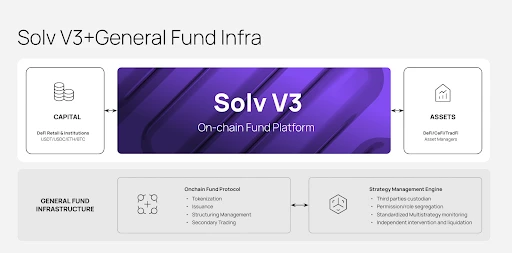

Since its establishment in August 2020, Solv Protocol has been committed to lowering the threshold for creating and using on-chain financial tools, successively launching the industry's first 1.5-level market liquidity solution, Vesting Voucher, and the first on-chain bond market, achieving over $100 million in bond issuance and trading. The officially launched Solv V3 in March 2023 positions itself as an on-chain fund platform, realizing the full-process standard of on-chain fund issuance, trading, and clearing. Behind Solv V3 is a universal fund infrastructure consisting of two key modules:

1) On-chain fund protocol, supporting fund creation, issuance, and trading;

2) Multi-link on-chain risk control system, protecting funds at multiple stages from asset selection, fund permissions, to clearing.

On July 31, Solv V3 officially launched its first flexible subscription and redemption open-end fund—Blockin GMX Delta Neutral Pool, which not only has a longer duration but also supports investors to subscribe or redeem more flexibly. On August 1, Solv Protocol announced the completion of a $6 million financing round, with investments from Japanese banking giant Nomura Securities' investment arm Laser Digital, Dahua Bank, and We Capital, among others. Prior to this, Solv had also received endorsements from institutions such as Binance Labs and Blockchain Capital.

Solv V3: One-stop on-chain fund issuance and investment

Solv V3 is an industry-oriented decentralized infrastructure that provides a unified, secure, and transparent platform for creating, issuing, managing, and settling on-chain funds, supporting the efficient flow of funds through the issuance and purchase of on-chain funds for both fund demand and supply.

Next, we will demonstrate the strength of Solv V3 through two market-making fund strategies launched by Solv: iZUMi 202301 and Blockin GMX Delta Neutral Pool.

(1) iZUMi 202301 Closed-end Fund

iZUMi 202301 is a closed-end fund issued by multi-chain one-stop liquidity provider iZUMi Finance on the Solv V3 platform, raising funds to provide liquidity for iZiSwap.

To meet the income expectations and risk preferences of different investors, the fund's investment shares are designed in two parts—Senior Tranche (priority fund) and Junior Tranche (subordinated fund). The former receives priority income but only earns a fixed income of 7%; the latter is designed for investors seeking higher risk and higher returns, taking on risk priority but can receive the portion of income beyond 7% based on share allocation. In actual settlement, high-risk users who purchase the Junior Tranche received an extremely high yield of up to 31.6%.

The fund manager's ability to efficiently create layered funds on Solv V3 is due to the original ERC-3525 standard developed by the Solv team, which has flexible splitting characteristics designed specifically for advanced financial assets and supports various complex fund structures. In addition to layered funds, Solv also supports other security cushion models such as First Loss Capital, providing investors with more diversified asset choices.

Following the completion of "202301," iZUMi Finance successively issued multiple fund products on Solv V3, focusing on the zkSync Era network market-making, raising a value of $22 million in ETH, stETH, USDC, USDT, etc., and gaining support from funds and individual investors such as Unicode Digital, NextGen Digital Venture, Bella Protocol, and Incuba Alpha. Without exception, all fund products were fully redeemed on time, demonstrating a good credit record.

(2) Blockin GMX Delta Neutral Pool Open-end Fund

GMX is one of the hottest projects in the crypto market this year. As the largest decentralized derivatives platform on Arbitrum, GMX is also a representative project generating real income, becoming one of the hottest sources of income in DeFi. Users can earn income by providing liquidity to mint GLP, part of which comes from the transaction fees and protocol rewards generated by GMX's daily activities, and part comes from the profit and loss of the counterparty's trades.

However, since GLP is anchored by a basket of assets such as BTC, ETH, stablecoins, holders also need to bear the risk of uncompensated losses caused by the price fluctuations of BTC and ETH. Moreover, as traders continue to profit, GLP may also suffer losses in extreme one-sided markets. According to DeFiLlama's GLP dashboard, the highest yield can reach 54.42%, and the lowest can reach 5.43%, with extremely high volatility.

In January of this year, the professional market-making team Blockin Capital issued a closed-end fund called GMX Delta Neutral Fund on Solv, which not only provides liquidity on GMX but also monitors trader positions and changes in GLP component currencies in real time, and hedges the corresponding exposure through perpetual contracts on Binance, transforming GLP into a low-risk, high-yield stablecoin mining pool. Real trading data shows that this strategy only experienced a slight 1.1% drawdown during the USDC decoupling period, achieving an annualized return of 20.02%.

On July 31, Blockin Capital once again issued the first open-end fund—Blockin GMX Delta Neutral Pool based on Solv V3, adopting the same trading strategy as the previous GMX market-making fund, while allowing subscription and redemption at any time.

To mitigate market risks, Solv also worked with Blockin Capital to establish a very strict suspension and liquidation mechanism for this open-end fund. Whenever the redemption net asset value falls below 3% of the 30-day average net asset value, the fund is forcibly suspended, and all funds are converted back to the USDC investment currency. Solv, Blockin Capital, and the risk manager jointly initiate a community vote to decide whether to restart or liquidate the fund. The risk manager only has the authority to suspend funds during the fund's co-management process, monitoring the net asset value of the fund in real time and initiating interventions or suspensions in a timely manner.

Solv V3 continues to bring more diverse sources of income to the crypto market

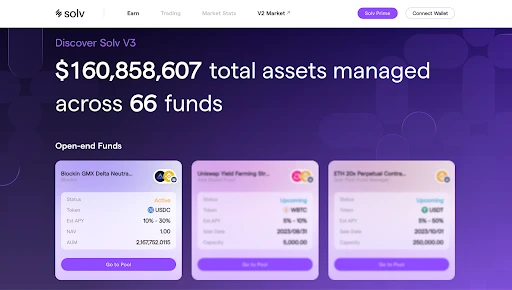

According to official data, since the launch of V3, over $150 million in funds have been sold. Currently, on Ethereum, BNB Chain, and Arbitrum, Solv V3 has attracted more than 10 fund managers and issued over 40 funds.

However, market-making fund strategies are just an important part of Solv V3's asset categories. Solv will also leverage its advantages in asset screening and creation to continue bringing more diverse sources of income to the market.

Thanks to the powerful asset expression capability of ERC-3525, Solv V3 allows fund managers to highly customize their fund products. Like customizing NFTs, they can visually customize the subscription rules, fee structures, and income strategies managed by smart contracts for their funds. This is mainly reflected in three aspects:

Diverse underlying assets: In the DeFi direction, build more diversified management strategies on DEXs, derivatives markets, liquidity staking, and NFTFi, providing diversified sources of income; in the CeFi direction, gradually launch quantitative funds, arbitrage strategy funds, and CeFi market-making funds; in the TradFi direction, package more real-world assets, match corresponding income strategies, and continue to bring sufficient and stable sources of income to the crypto market.

Diverse income strategies: Solv V3 supports various fund management strategies such as active management, income enhancement, copy trading, and structured products.

Diverse product structures: Solv also supports various product structures such as layered funds and First Loss Capital protection funds, serving investors with different risk preferences and building stronger confidence for investors.

Earlier this month, Solv also announced that it will integrate NFT collateral lending platforms such as Pine Protocol within August and launch a secondary trading market for fund shares in the first quarter of next year, unlocking more DeFi Lego gameplay and providing more liquidity solutions and income opportunities.

Solv V3 brings more mature risk management mechanisms

While creating high-quality asset products for the market, Solv has also established a comprehensive on-chain risk control mechanism.

On the one hand, it has implemented fund co-management and hierarchical permission based on smart contracts. Regardless of whether DeFi or CeFi strategies are used, the funds raised on the Solv platform will be transferred to a designated MPC solution through Solv V3 smart contracts, and corresponding rights will be granted based on roles, achieving full isolation of fund transfer rights, liquidation rights, and operation rights, eliminating single points of failure and ensuring dedicated use of funds. With full on-chain monitoring, if the fund creator is found to violate the fund strategy and misappropriate assets, Solv will immediately freeze the funds to avoid greater losses. For investors, they can also monitor the use of funds and fund returns in real time through the UI page, with automated visualization of profits and losses, truly achieving transparency of processes and traceability on-chain.

On the other hand, it has also implemented an efficient response liquidation mechanism. Solv organizes a trusted institutional network to set reasonable liquidation thresholds for each fund, elects and appoints professional Risk Managers to maintain fund security, to address potential extreme situations. Risk Managers will monitor positions and margins in real time, issue risk alerts, provide risk reports, and in the event of a liquidation, close positions in an orderly manner and conduct reasonable settlements. For example, in the case of the GMX open-end fund, investors can expect a return of 10%-30% while enjoying a protection mechanism that suspends the fund if the 30-day average drawdown reaches 3%.

Solv V3 has built a highly collaborative decentralized institutional network, providing reliable services and risk management for funds, and laying a trustworthy foundation for on-chain investments.

Conclusion

Ryan Chow, the founder of Solv Protocol, also stated in an interview with CoinDesk, "The fund market is one of the most valuable capture directions in the DeFi world. With the development of new narratives such as RWA and LSD, DeFi assets will inevitably experience a more diversified outbreak. Solv V3 already has a relatively mature infrastructure and is in a leading position in the market. We will continue to bridge high-quality assets and industry liquidity through decentralized fund platforms to prepare for the large-scale adoption of DeFi in the next stage."

In the official documentation, Solv introduces that most of the $SOLV tokens will be used for community incentives, and users participating in the purchase and holding of open-end funds will also have the opportunity to receive airdrop incentives.

In a more detailed Roadmap, Solv states that it will integrate an NFT collateral lending platform in August this year and launch an ETH benchmark strategy fund on the LSD protocol. In the fourth quarter of this year, Solv will launch RWA (real-world assets) related strategy funds. In the first quarter of 2024, it will launch an open-end parent fund and token rewards; in the second quarter of 2024, it will launch a secondary trading market for fund shares.

The emergence of Solv V3 has lowered the threshold for creating and investing in crypto funds, allowing those with income-generating capabilities to quickly create funds to generate cash flow, and also allowing more ordinary crypto players and incremental investors to access more high-quality fund income products and provide liquidity with confidence. We look forward to Solv creating more new asset products for the crypto market, driving more incremental assets into the market, and pushing the development of the crypto market to a new level.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。