Narrative stories and needs of RWA, rather than being the fantasy of getting rich in the currency circle, it is more like the abacus of traditional financial institutions.

Author: Lawyer Liu Honglin

The Currency Circle Needs Faith

The currency circle needs faith, and faith needs to be recharged.

It's getting harder and harder for traditional projects to raise money. What can we rely on to sell dreams?

The profits for investors are getting less and less. How to deceive the institutional sickle?

Traditional funds want to go global. How to find a sexy and legitimate reason?

These three naked and direct questions constantly test various project parties and currency circle service providers, making them toss and turn, and ponder.

What to do? Look through historical literature for information. See if there is anything that can be like a DAO organization, sounding grand and concerning the fate of humanity but not specific, something that everyone can get involved in but seems like a large-scale social experiment where everyone's efforts don't seem to add up to one thing.

This is the beauty of social science, it can only confirm and not disprove. You can say I'm not doing well, but you can't say I'm doing it wrong, firmly grasping the moral high ground of the industry.

Human history is not good at repetition, but good at reenactment. Hard work pays off. From the pile of old papers, everyone found a new narrative logic: RWA (Real World Asset).

I also tried to seriously study RWA.

But a friend in the circle told me, don't waste your time. You lawyers don't understand what Web3.0 and RWA are.

I said, friend, we have no grudges, why do you say that?

He said, in the ideal of the currency circle, RWA is pointing at an unsellable real estate or a bad debt, saying: put it on the chain.

So, the assets are put on the blockchain, forming an immutable Token.

So, netizens scattered around the world, under the decentralized concept, based on a high degree of recognition of the project party's actions, can't stop themselves from giving their USDT or BTC to you.

You start to feel uncertain with the raised virtual currency, wondering if you should have a party in Singapore or become a digital nomad in Bali.

If the project makes money, you say, follow me and we'll have a big feast next time; if the project loses money, you say, we are all adults and we should bear the losses ourselves.

I said: I'm not sure if what you're talking about is RWA, but it sounds like illegal fundraising.

He said: I told you lawyers don't understand RWA, this is called consensus.

Not understanding the currency circle's consensus, but it doesn't hurt to learn common sense. Let's talk about three common sense points related to RWA:

First point: What is RWA?

Second point: How to make RWA successful?

Third point: Is it reliable to do RWA in China?

Once again, this article is from a very unprofessional Web3.0 lawyer, representing only the personal views of Lawyer Honglin and does not constitute legal advice or recommendations on specific matters. Some statements and content in this article may make the native Web3.0 experts uncomfortable.

What is RWA?

RWA (Real World Asset) refers to assets that exist in the real world, rather than on the blockchain network, such as real estate, stocks, bonds, art, etc., which are mapped to the blockchain network in a certain way, enabling interaction with DeFi protocols and providing users with more asset choices and sources of income.

For example, USDT is one of the earliest RWAs, where real-world US dollars are tokenized, creating the USDT token on the blockchain.

For example, users can use their real estate as collateral to borrow stablecoins through a DeFi platform, or tokenize their stocks to trade and invest through a DeFi platform.

Why tokenize real-world assets into RWAs?

Because it's beneficial. Tokenization can provide real-world assets with higher liquidity, transparency, and efficiency, while also bringing more value and diversity to the blockchain ecosystem. For example:

- Reducing transaction costs and time, improving transaction efficiency and convenience. For example, through blockchain technology, real estate can be fractionally traded, allowing more people to participate in real estate investment without paying high intermediary and transaction fees.

- Increasing asset liquidity and accessibility, expanding the audience and market size of assets. For example, through blockchain technology, art can be traded in fractions, allowing more people to appreciate and collect art without worrying about the authenticity and preservation of the art.

- Enhancing asset transparency and traceability, increasing the trust and value of assets. For example, through blockchain technology, gold can be traced in transactions, allowing more people to know the source and quality of gold without relying on centralized institutions and standards.

In the pursuit of RWA, humans have always been persistent. In January 2017, RealT was established on the Ethereum platform, allowing users to purchase partial ownership and tokenized asset ownership of U.S. real estate. In June 2017, Centrifuge was established on Ethereum, allowing enterprises to tokenize their commercial invoices, accounts receivable, and finance through DeFi platforms. In October 2017, MakerDAO launched the DAI stablecoin, allowing users to generate DAI by collateralizing different types of assets.

Next, let's take MakerDAO as an example to see its narrative story.

How does Maker DAO work?

The Maker DAO project was established in 2014 and is one of the earliest decentralized autonomous organizations on Ethereum. Maker DAO can be understood as a decentralized financial system based on the Ethereum blockchain, providing a stablecoin Dai (a cryptocurrency pegged to the U.S. dollar), a governance token MKR, and a collateralized loan platform Maker Vault.

The assets of Maker DAO have the following characteristics:

- Diversification: Maker DAO supports various types of collateral, including cryptocurrencies (such as ETH, WBTC, BAT, etc.), physical assets (such as real estate, art, etc.), and fiat currencies (such as USDC, TUSD, etc.). This can reduce the risk of single collateral and increase the liquidity and credibility of DAI.

- Flexibility: Maker DAO allows users to freely choose the type and ratio of collateral, as long as they meet the minimum collateralization ratio and stability fee requirements. Users can adjust their asset allocation based on their risk preferences and expected returns.

- Transparency: Maker DAO's asset allocation is completely open and verifiable, and anyone can view the current collateral types and ratios, as well as the parameter settings for each collateral (such as minimum collateralization ratio, stability fee, liquidation penalty, etc.) through a blockchain browser or third-party tools. This can increase the trust and traceability of DAI.

- Governance: Maker DAO's asset allocation is determined by MKR holders through voting, allowing them to adjust the parameters of each collateral or add new collateral types. This allows DAI to better adapt to market changes and demand, and allows MKR holders to participate in the governance of the system.

In the development history of Maker DAO, important events include the following, and the parts related to RWA are highlighted:

- In 2014, the Maker DAO project was established, making it one of the earliest decentralized autonomous organizations on Ethereum.

- In 2015, Maker DAO released the first version of the whitepaper, introducing a system for pledging Ether to generate Dai through smart contracts.

- In December 2017, Single Collateral Dai (Sai) was officially launched, the first soft-pegged asset-backed cryptocurrency.

- In January 2018, the MKR token began trading on exchanges, serving as the governance token of Maker DAO, used for risk management and parameter setting in the Maker protocol.

- In March 2020, market turmoil caused by the COVID-19 pandemic and Ethereum network congestion led to a malfunction in Maker Vault's liquidation mechanism, resulting in significant losses for some users. The Maker DAO community voted to initiate an MKR minting plan to compensate affected users and restore the system's capital adequacy.

- In May 2021, Maker DAO announced a partnership with Paxos to include Paxos stablecoins in the collateral list of the Multi-Collateral Dai system, and planned to introduce real-world assets (such as gold, real estate, etc.) into the system.

- In July 2021, Maker DAO announced a partnership with Centrifuge to include Centrifuge's Tinlake assets in the collateral list of the Multi-Collateral Dai system, marking the first time real-world assets were tokenized and used to generate Dai.

- On August 4, 2021, Maker DAO announced a partnership with Centrifuge to include Centrifuge's Real World Assets in its collateral system, increasing the supply of DAI by approximately $5 million and providing more support for DAI with real-world assets.

- In May 2022, Maker DAO released a new governance model, MIPs (Maker Improvement Proposals), dividing the governance process into three stages: proposal, approval, and execution, increasing community participation and transparency.

- In July 2022, Maker DAO became the first project to achieve fully decentralized stablecoin, with all key decisions made by MKR holders through decentralized autonomous organization (DAO) voting.

- In November 2022, Maker DAO completed support for Real World Assets (RWA), allowing users to collateralize physical assets such as real estate, cars, art, etc., to generate Dai, increasing the types and value of Dai collateral.

- In January 2023, Maker DAO introduced a new risk parameter adjustment mechanism, RWAU (Real World Asset Units), delegating the risk assessment and management of RWA to professional asset management institutions, reducing the risk exposure of the Maker protocol.

- In May 2023, Maker DAO successfully integrated Central Bank Digital Currencies (CBDC), allowing users to generate or exchange Dai using digital currencies issued by central banks, increasing the compliance and credibility of Dai.

- In July 2023, Maker DAO announced partnerships with global mainstream payment platforms such as Visa, Mastercard, PayPal, enabling users to use Dai for cross-border payments, e-commerce, peer-to-peer transfers, and various financial activities, enhancing the convenience and accessibility of Dai.

According to data from makerburn.com, as of June 29, 2023, Maker is expected to generate an annual profit of $73.67 million, making it one of the most profitable decentralized applications apart from stablecoins and exchanges. Currently, the market value of MKR is approximately $820 million.

With fame comes controversy, and Maker DAO's development has naturally faced scrutiny, mainly in the following three aspects:

For example, whether Maker DAO's governance is truly decentralized? Some question whether the governance process of Maker DAO is influenced by a minority of large holders or the core team, and whether it fully reflects the will and interests of the community members.

For example, whether Maker DAO's stability mechanism is reliable? Some point out that Maker DAO's stability mechanism overly relies on market mechanisms and liquidation penalties, which could lead to system collapse or token devaluation in extreme situations.

For example, whether Maker DAO's collateral selection is reasonable? Some believe that Maker DAO's collateral selection is either too conservative or too aggressive, failing to fully utilize the diversity and innovation of blockchain and effectively control risk exposure and leverage.

Is RWA Feasible in China?

According to a statistical data from BCG Boston Consulting, the RWA track is expected to reach an overall scale of $16 trillion by 2030.

The future looks promising, but I often see a painful expression on the faces of some blockchain practitioners in China, as if they feel that their ambitions to change the world and get rich are not matched by the land they are in.

So they often wander in different countries, holding Chinese passports, wanting to be global nomads. Their social circle focuses on the global market, discussing the Fed's interest rate cuts, the latest speeches of a minister in Dubai, but they don't consider one question: Where is the biggest market dividend and opportunity for Web3.0 or blockchain? How can it be properly implemented?

Before answering this question, we may need to digress and discuss a basic legal logic.

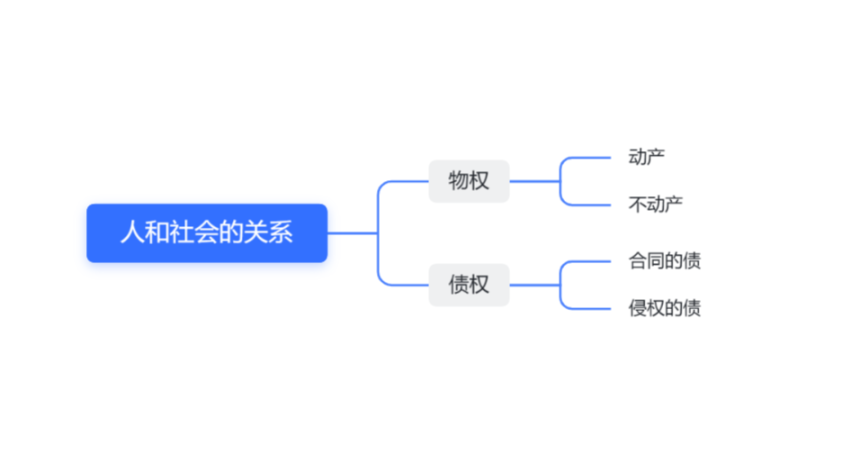

Humans are a sum of social relationships, which can be roughly classified into two categories from a legal perspective: property rights and creditor's rights.

Property rights can be understood as the mobile items you hold in your hand or the monitor you are currently looking at. If it can move, it's called movable property (such as a phone, car); if it cannot move, it's called immovable property (such as a house).

Creditor's rights can be understood as the right to demand something from others, whether it's because someone borrowed money from you or someone caused you harm and owes you compensation. The former arises from a loan relationship, so it's called contractual debt; the latter arises from personal injury, so it's called tort debt.

In the world, everything can be simplified, and so can social relationships. It can be expressed in a mind map as:

The biggest difference between property rights and creditor's rights is that property rights are determined by you, while creditor's rights depend on whether you calculate them or not.

For example, if you can't stand to read this article, you can throw your phone on the ground, and no one can stop you, because the phone is yours, you are the owner, and you have that right.

But creditor's rights are different. If someone owes you money and refuses to pay, no matter how much you try to make them pay through mental efforts, drawing circles to curse them, ultimately it still depends on them to pay.

So the question is, is RWA a matter of property rights or creditor's rights?

To solve the problem of encrypted assets based on blockchain technology, the core issue is for users to have control and dominion over their digital assets without relying on any third party. However, according to the narrative logic of RWA, the process of tokenizing traditional assets, such as unfinished real estate assets or long-overdue debts owed by one company to another, essentially unifies property rights/creditor's rights and then further divides them into creditor's rights.

And the exercise of creditor's rights requires the trust and execution of a third party. As a consumer and holder of RWA, from a legal perspective, when you buy RWA assets, you cannot directly exercise your rights; you need a centralized institution offline.

After all, in the process of putting real-world assets on the chain, no matter how compliant it is, it's just a matter of making lawyers work extra days and adding various legal structures in the due diligence process, having the project party sign more pledge or guarantee agreements from a legal perspective. It proves compliance and progress, but it won't make a qualitative difference.

In addition to deviating from the decentralized thinking of blockchain and departing from the original trustless mechanism, RWA also faces some legal difficulties and obstacles. From my non-professional and superficial understanding, there may be several issues that need to be addressed by talented individuals in the industry.

Issues of RWA's Confirmation and Registration.

RWA is real-world assets that usually need to be registered with relevant ownership registration institutions to prove their ownership and value. For example, when you buy a house in China, you need to register it at the real estate center and obtain a certificate to prove that the house belongs to you; if you want to sell the house to someone else, both parties need to register again. From a legal perspective, this is called the registration of property rights. Everything oral is useless, only what is registered with the real estate bureau matters.

If a salesperson tells you that you have reached an agreement with them and you can transfer the house to them based on a verbal promise, your whole family probably wouldn't agree.

On the blockchain network, RWA exists in a digital or tokenized form, and transactions are very easy. If RWA undergoes transfer or changes on the blockchain network, will it affect its ownership and value in the real world? For example, if a user tokenizes real estate they own and sells it to someone else on the blockchain network, do they still own that real estate in the real world? If disputes or controversies arise, which legal system should be used to resolve them?

Issues of RWA's Evaluation and Audit.

Real-world assets undergo professional evaluation and auditing by third-party institutions to determine their authenticity and value before being tokenized and exist in a tokenized form on the blockchain. At this point, an interesting question arises: how to ensure that the value of RWA on the blockchain network is consistent or close to the value in the real world? How to prevent excessive fluctuations or manipulation of RWA on the blockchain network? How to ensure the authenticity and credibility of RWA on the blockchain network?

Regulatory and Compliance Issues of RWA.

RWA is real-world assets that are usually subject to regulation and legal requirements by relevant regulatory agencies to ensure their legality and security. If they exist in a tokenized form, they often transcend existing regulatory boundaries and categories, leading to a question: how to comply with relevant regulatory requirements and compliance standards while maintaining the innovation and flexibility of blockchain technology? How to effectively regulate and manage RWA on the blockchain network without compromising user interests and privacy? How to intervene and deal with risks or crises in a timely manner?

These issues not only relate to the feasibility and sustainability of combining RWA with DeFi but also to the development and application of blockchain technology in the financial field in China. To address these issues, it requires collaborative efforts from regulatory agencies, legal experts, evaluation institutions, blockchain companies, DeFi platforms, and users to establish a comprehensive legal and compliance system. Only by doing so can RWA be combined with DeFi, providing more possibilities and opportunities for financial innovation and development in China.

Conclusion

RWA is an idealistic concept that is popular in the cryptocurrency community, much like DAO organizations are the ideal business for many project teams. However, the current narrative logic and demands of RWA are contrary to the original intention of cryptocurrencies. People hope that asset transactions are decentralized, freely flowing globally, and can lead to wealth through speculation, but they also want asset tokenization to be centralized, compliant, and reliable for asset appreciation. This kind of operation has left non-Web3.0 people a bit confused.

The narrative and demand for RWA are more like the abacus rattling of traditional financial institutions. Traditional asset management companies and fund groups have already harvested the big players, so how can they tell an attractive story to investors? The story of RWA seems to be a good show where the county magistrate and Huang Silang join forces to fight bandits in the movie "Let the Bullets Fly" - the name doesn't matter, fundraising is the key. Once the money is in hand, everything else is secondary.

RWA's legal compliance involves aspects such as confirmation, registration, evaluation, auditing, and regulation, and currently faces issues such as unclear regulation, incomplete laws, lack of liquidity, and bad debt risks. While RWA is feasible in China, the road ahead is long, and those looking for long-term financial stability should not rush. It might be best to let the bullets fly a little longer.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。