What is the cornerstone of productivity SaaS in the face of large models?

Author: Cheng Tianyi

Editor: Cheng Tianyi, penny

Layout: Scout

GPT is a productivity model, and OpenAI is revolutionizing productivity.

Obviously, this makes productivity SaaS companies very anxious. Clickup AI's promotional video inadvertently pointed out the AI strategies of these "old" companies, which are currently competing to launch similar use cases in their product scenarios.

Although these use cases themselves are basically homogeneous, we still observe some unique value propositions—such as focusing on "data." SaaS companies that truly serve enterprise clients do not "use the data stored in their own software to train LLM" as one might initially think, but instead emphasize cloud-delivered trust, copyright-free and legal risk-free datasets, and better help clients make use of data for models.

Therefore, although we still cannot identify which SaaS companies will benefit in the long term and which ones will suffer, we can already see which companies have truly differentiated response strategies. Along this line of thinking, this article selects the 3 most impressive ways and multiple cases at the secondary and primary levels. However, even with these strategies in place, productivity SaaS companies still have to face a series of challenges in pricing, competition with ChatGPT, and long-term product roadmap. The battle for productivity entry is in the midst of a fierce elimination round.

It should be noted that productivity SaaS has two definitions, broad and narrow. The narrow definition usually refers only to production collaboration SaaS around core scenarios such as documents (e.g. Notion), tasks (e.g. ClickUp), videos (e.g. Zoom), and spreadsheets (e.g. Airtable), while the broad definition includes most SaaS that can improve company operational efficiency, from large CRMs to nimble automation tools like Zapier. The productivity SaaS discussed in this article leans more towards the broader range.

As pointed out in our article on Kick, we have observed that the proportion of investors who are so-called "All in AI" in Silicon Valley is not as high as we expected. A common view is that Generative AI has not brought in new user groups and corresponding customer acquisition channels like mobile internet and cloud did, so the old players with Go-To-Market advantage are in the lead. Another mainstream perception is that "it's too early to invest in AI Native applications, it's more cost-effective to make good use of GenAI in one's existing portfolio."

From the perspective of "old" companies' operations, everyone has fully experienced the three waves of PC, mobile internet, and cloud, and almost every professional manager and outstanding entrepreneur has learned about various cases of falling behind, so they will definitely not miss out on something big. With GenAI coming on strong and a consensus in place, no company should feel that this wave of opportunity is too small, so they are all particularly FOMO and clearly entering the market.

However, the actual use cases of GenAI launched by various companies at this stage are almost the same, involving various combinations of "understanding," "generation," and "reasoning" in different scenarios, which can easily lead to aesthetic fatigue when seen too much. Setting aside these specific use cases that have been discussed enough, and combining our experiences from visiting and researching in Silicon Valley, we will pick out 3 interesting value propositions and strategies from secondary giants and unicorns in the primary market.

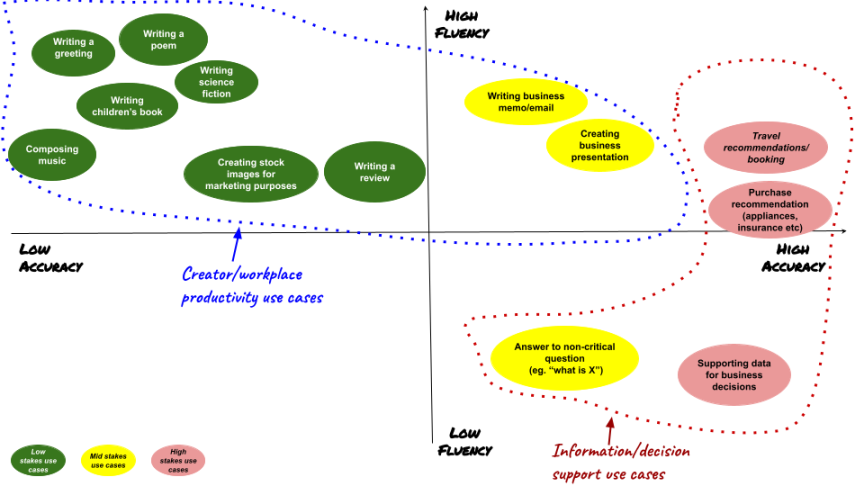

Source - Frameworks of GenAI use cases

by Alana Smith

01. Value propositions and business strategies of secondary giants

Playing with "data" from multiple angles

First angle: Not touching customer data

"Data" can be a very powerful value proposition, but it is not as straightforward as "Salesforce has a large amount of CRM data stored, and Zoom has a large number of potential meeting records, which can be used to train a powerful model." On the contrary, ensuring not to use customer data for model training or task automation without authorization is one of the most important value propositions for these companies, and it is the first angle to play with data—building trust.

For large enterprise clients, GenAI could indeed become a productivity tool, but at the same time, it is a new technology that is difficult to be trusted, and it requires SaaS providers who are good at providing privacy and security guarantees to large enterprise clients to help GenAI bridge this gap.

Recently, when it comes to trust and privacy, "open source + local deployment" has become an obvious answer. On top of this obvious approach, delivering privacy and security in the cloud is a basic skill that SaaS companies serving large enterprise clients have accumulated over the past 10 years. As an example, Slack spent a lot of money to customize the standard data encryption scheme to be more complex in order to expand its customer base from SMB and Mid-Market to large enterprises, integrating with AWS's Key Management Service to allow customers to control keys, and then using service calls to encrypt user data with the keys set by customers. This level of "security and control" is also very common in Microsoft's productivity tools.

"Not touching customer data" is the baseline for building trust. In the case of homogeneous use cases, privacy and data security solutions customized for GenAI have the opportunity to become a differentiated value proposition. Although Microsoft has deep expertise in this area, it has not aggressively promoted this selling point externally. On the other hand, Salesforce's Einstein GPT uses this value proposition more, and after announcing Einstein GPT in March, its most recent major development is the launch of the Trust Layer, attempting to establish itself as the "most trustworthy" GenAI offering.

Second angle: Not touching copyrighted data

Adobe Firefly was ridiculed when it was first released 4 months ago, with the generated Pikachu and Hello Kitty being unbearable. But now Firefly has helped Adobe's users generate over 1 billion assets in the web version and Photoshop, and has been evaluated by the company as "the two most successful beta products in Adobe's history."

The outside world has gradually understood Firefly's unique value proposition over the past few months: to maintain respect for unauthorized copyrighted content and help users of their products avoid legal risks in commercial use of these generated assets. The core of this value proposition is to build a dataset that is completely free of copyright issues. Stability AI and Midjourney continue to maintain a slight lead over Firefly in terms of effectiveness, but inevitably face collective lawsuits because the LAION dataset they use contains 5.6 billion images scraped from the public web without permission.

Third angle: Helping customers connect the data

There are countless startups in this race, so we won't go into the most typical data connection use cases. In addition, the ability to integrate data across on-premises and cloud is a basic skill that needs to be accumulated over the long term, and existing SaaS giants have some differentiated advantages—they have experienced the embarrassment of transitioning from on-premises to cloud for processing legacy data, and have rich experience. Additionally, Salesforce acquired Mulesoft, Google has Apigee, and Microsoft has Power Platform, all of which have various powerful connectors to help customers collect data across organizations and across on-premises and cloud.

By vertically integrating their own cloud, data connectors, and product scenarios, and then combining them with partner LLM, old-school SaaS companies can provide customers with a truly end-to-end stack—first collect the data, then coordinate the data and create related data pipelines, making the data available in different models and scenarios. The sales effects driven by this value proposition are still unknown, but at least it sounds wonderful.

The above introduces three ways to play with data, but the goal is not to make GenAI more powerful, but to truly make it Business Class and Enterprise Ready.

Seizing the opportunity to revitalize the product brand

GenAI can both have a practical impact and be a perfect marketing tool:

EinsteinGPT has brought attention back to Salesforce's Einstein character logo. Before this, Salesforce's Einstein AI brand was not very successful, and it never had a product that was absolutely leading in the market. Instead, startups like Gong.io rose to become the leading players in Conversation Intelligence.

Microsoft's Bing and process mining products are similar. Bing and Google still have significant differences in search experience, and the Power Automate Processing Mining that came from Microsoft's acquisition of Minit also has a gap compared to independent leading players like Celonis. However, through Bing Chat and Copilot, they have garnered a wave of attention from potential customers.

Zoom IQ started late in the Conversation Intelligence race, but with integration with GenAI, it quickly and accurately launched collaboration with other Zoom productivity scenarios, gaining more exposure and attention in front of customers.

Companies like UiPath and Five9, which are considered to have long-term potential damage, are also actively integrating GenAI to make their product lines appear more intelligent.

Although these strategies help products that lack breakthroughs to regain attention, this window of opportunity may be closing. As Copilot in various Microsoft products and other companies' GenAI integrations move from Private Beta to formal version delivery to customers, the role of GenAI Offering will shift from "increasing sales leads" to "improving win rate."

Expanding TAM to protect gross margin

When the uncertain economic environment and macro situation meet the consensus-filled GenAI, we see companies in the secondary market trying to adopt an "All in AI" posture, constantly emphasizing that this is a new industrial revolution or the moment when PCs appeared. However, in actual business strategies, they still try to use GenAI to expand TAM while protecting gross margin as much as possible.

A few companies, such as Microsoft and Google, which delve into the model layer, are slightly exceptional, as they are prepared to increase CapEx investment while protecting gross margin.

In the vast SaaS companies, the thinking and strategy of companies like Zoom are currently standard—GenAI Offering cannot lose money, it must make customers pay directly or upgrade their subscription plans:

AI has a minimal impact on gross margin. For more advanced and higher-end use cases, we hope to charge customers through our platform's consumption model or by having them upgrade their subscription plans. So overall, we are working hard to offset any potential (impact on gross margin). We are very confident in improving long-term gross margin.

Eric Yuan - Zoom

In terms of pricing models, in addition to M365 Copilot, Zoom IQ for Sales, and a series of AI products from Salesforce being separately charged based on seats and usage, bundling with paid subscriptions has become a very popular pricing method.

Exploring a pricing model that is widely accepted while protecting gross margin is a very challenging task, and many products are still in the Private Beta stage, exploring pricing methods. The rise of the pay-as-you-go model for cloud credits in the cloud era, and whether GenAI can drive the emergence of a new type of pricing strategy, is also very much anticipated.

02. "Overseas Unicorns" seeking their foothold

Strong execution as an intermediary bridge

There are two views on the future fate of productivity SaaS companies:

GUI will be worthless, and these SaaS companies will ultimately only provide database value.

GenAI is a Ferrari-level engine, but you still need a complete car.

From a realistic perspective, the first view is still difficult to achieve in the short term, and many people even think that LUI may be the worst UI, which has brought us back to the command-line era. Of course, no unicorn SaaS company is willing to embrace the first fate, so everyone is still trying to provide users with a more complete car.

At this point, the attempts of companies like Notion, ClickUp, and Miro and M365, Google Workspace are essentially no different. However, in the first quarter, when Bing and M365 almost dominated market attention, Notion was one of the first non-AI Native productivity SaaS companies to pay attention to OpenAI's movements at the end of 22, and became the first player among non-AI Native productivity SaaS companies to launch a complete AI product, receiving decent market feedback and quickly generating millions of dollars in ARR.

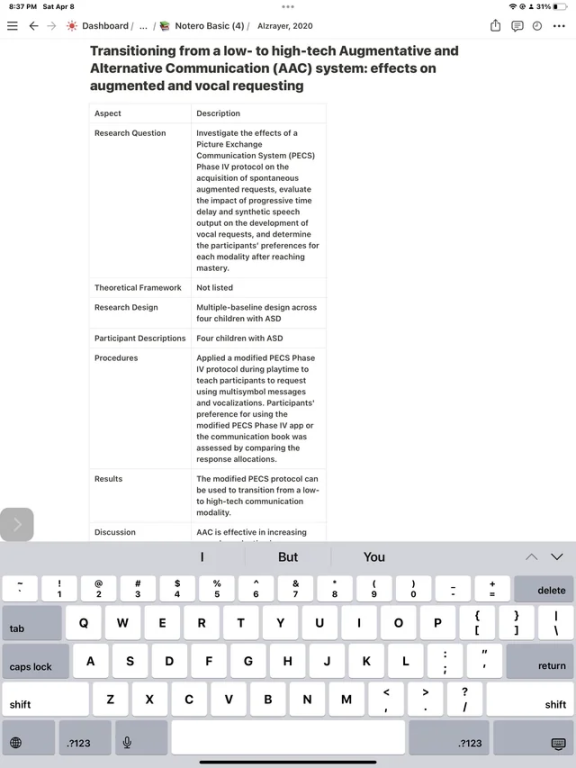

Summarizing a research paper using Notion AI

Some Notion employees we spoke with positioned Notion AI as a two-way bridge—Notion AI's encapsulated instructions help users reduce the threshold for collecting and assembling prompts, while GenAI itself reduces the threshold for users to use various complex components of Notion.

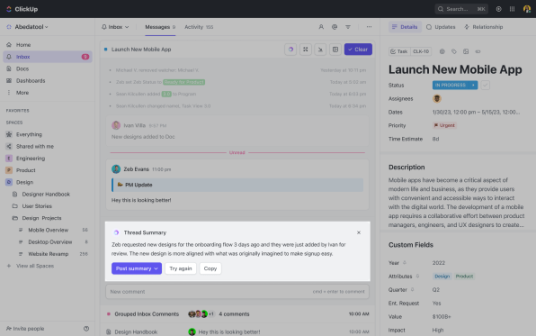

Another heavyweight in the productivity race, ClickUp, has a similar approach to Notion. Its product is even more complex than Notion, embedding whiteboards, videos, and other scenarios. While competitors in the secondary market like Atlassian, Asana, and Monday.com had not yet introduced GenAI Offering, ClickUp launched its own AI product and adopted a pricing strategy similar to Notion's, quickly generating substantial ARR.

Task management using ClickUp's AI features

Arming oneself with open source

For some productivity SaaS companies, being a middle bridge may not be enough, as their survival technology is directly challenged by LLM—two typical examples are Gong.io's conversation analysis and Sourcegraph's code search. They have built a technical moat through traditional ML models, but now these moats have been torn open by LLM.

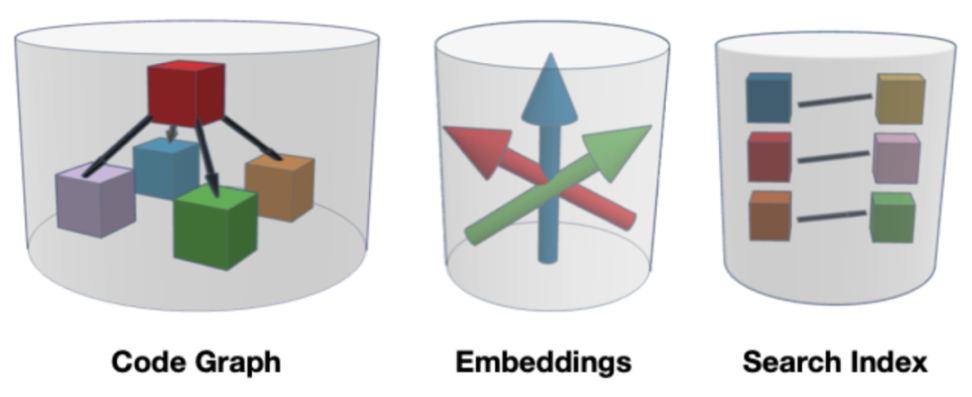

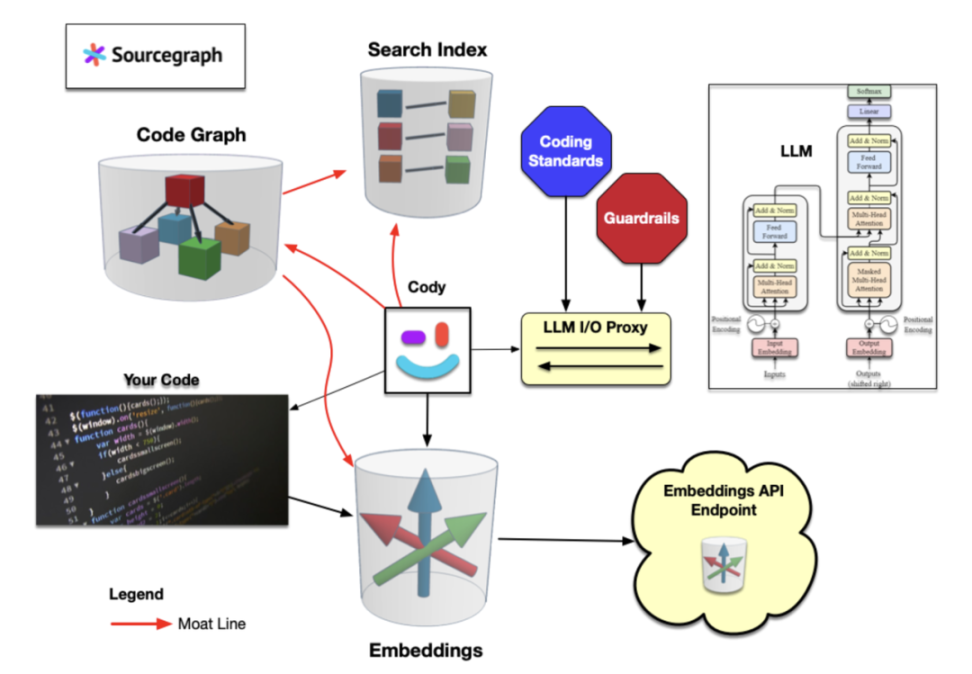

The 3 major technologies behind Sourcegraph

Gong's response was relatively moderate, with no reaction in the first quarter. According to our conversations with early investors, part of the reason may be that the team believes that model capability is not the decisive factor, and the ability to obtain and process customer meeting and conversation data is a dirty and time-consuming job that needs to be accumulated over time. It wasn't until early June that Gong announced the launch of Call Spotlight and Proprietary Generative AI Models.

Perhaps due to the amazing capabilities of ChatGPT and Github Copilot in handling code, Sourcegraph has been a very impressive company in responding to the impact of GenAI over the past two quarters. Although Sourcegraph realized early on that LLM's Context Window still has flaws in handling large-scale code across multiple libraries, it did not stop product innovation. At the end of March, it directly faced the competition and launched Cody, a model-driven code editing assistant by Anthropic, and made its code implementation open source.

The technical solution behind Cody

Due to Cody's advantage in long-context embeddings and Sourcegraph's unique Code Graph, it quickly gained widespread discussion on Hacker News and Twitter. The open-source nature of Cody allows it to be used as a flexible IDE extension, not limited to internal use within Sourcegraph, and quickly became one of the most likely alternative options to Github Copilot, alongside old companies and AI Native products like Cursor.

Expanding value by capitalizing on success

In our article on the ChatGPT Plugin, we described the short-term benefits enjoyed by Zapier.

Current challenges faced by SaaS AI features

Although we have found 6 positive examples trying to illustrate that some productivity SaaS companies are doing well, they inevitably still face some specific challenges. Here are the most typical 5:

Challenge 1: Disappointment caused by PR leading to users

Due to the sudden surge in user interest sparked by ChatGPT, many companies only began preparing their AI Offering in early 23 and crash-released the Private Beta version in mid to late March. This has led to a long waitlist, with many customers knowing that their SaaS provider has launched AI capabilities but have been unable to purchase and use them, having to wait patiently.

For example, many Salesforce customers were very interested in Einstein GPT and repeatedly asked for pricing from their sales team, but received no sales feedback throughout April and May, making many customers view this supposedly serious product launch as a meaningless PR move.

Challenge 2: Conflict between AI and product roadmap

Investors hope that AI will disrupt SaaS, but many SaaS users actually just want to quietly use their document, task management, and video conferencing tools. ClickUp users are eagerly awaiting the official launch of ClickUp 3.0, but are waiting for ClickUp AI first, leading to some very pointed user complaints.

ClickUp's core is to act as a project management tool and database, but the core functionality is full of bugs, some dashboards take minutes to refresh, and reliability, which has claimed 70% of resources in the past 18 months, has seen almost no new features. The delay of 3.0, the basic capabilities of ClickUp Docs are far from Google Docs, and AI itself is of no use.

ClickUp's attempt to make AI look like a sub-item in the product upgrade, but it was found that their top priority was AI rather than 3.0.

ClickUp's decision to release AI instead of 3.0 feels deceptive, 3.0 is no longer "just around the corner," and I would rather take another look at Asana or Wrike.

Other products have similar issues to a greater or lesser extent, for example, the demand for Notion's offline mode may be much stronger than Notion AI, so that users can avoid the embarrassment of being unable to use Notion without WiFi, but Notion AI was launched first and seems to occupy more attention in the product roadmap.

Challenge 3: Pricing model borne by users

This complements Challenge 2: if AI capabilities are given away for free, users have no reason to resent these capabilities. But due to the "expand TAM and maintain gross margin" strategy, users often need to pay extra.

Whether it's $5/month/user for ClickUp, $10/month/user for Notion, or $30/month/user for M365, letting each user pay for themselves is not a large amount, but it is not a small amount for bulk purchases by operators—Notion's Business plan itself is only $15/month/user, so purchasing AI for employees would increase the bill by 60-70%.

Challenge 4: Competing with ChatGPT for entry

These challenges are interconnected!

Due to the existence of Challenge 1, the workflow of many users accustomed to ChatGPT is to paste text into ChatGPT Q&A, and then copy the desired results back into their own SaaS.

Due to the existence of Challenges 2-3, although the specific proportion is difficult to measure, many users have already subscribed to ChatGPT Plus, bearing a bill of $20/month/user. Although this subscription is slightly expensive, it is quite universal, and the total amount subscribed separately for the AI Offering of each SaaS may far exceed $20.

Therefore, the entry logic that our team often discusses is actually happening—productivity SaaS companies are competing with ChatGPT Plus for the budget of each employee, and the outcome of this battle is still undecided.

Challenge 5: Lack of a "genius" CEO

Before going to the United States, we thought that Salesforce's Data Cloud strategy provided top-down guidance for its GenAI roadmap, but talking to internal employees, we found that this was just a very high-level guiding idea, and ultimately returned to the various business teams such as Marketing Cloud, Service Cloud, and Industrial Cloud to propose various GenAI product features from the bottom up.

In fact, from large companies to unicorn companies in the primary market, the way everyone innovates in AI is more or less the same, and there is no situation where the CEO comes up with a genius direction and then just implements it head down. One of the core differences between different players is how much the CEO is willing to allocate total resources for this part. Given the existence of Challenge 2 and the uncertainty brought by AGI, this may be difficult to balance and become one of the most important issues that all SaaS CEOs need to consider in the next 5 years.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。