The crisis at Curve is still fermenting.

Affected by security incidents and potential liquidation risks, CRV continued to decline today, reaching a low of $0.482 at one point, rebounding to $0.58 as of the time of writing, with a 24-hour decline of 8.13%.

At the same time, governance tokens of major Curve ecosystem projects have also suffered heavy losses, with Convex (CVX) hitting a low of $2.884 and currently trading at $3.034, with a 24-hour decline of 11%.

Due to the potential threat of liquidation defaults, several lending projects including Aave and Frax are also declining simultaneously, with AAVE trading at $64.61, down 8.87% in the past 24 hours, and FXS trading at $5.69, down 5.03% in the past 24 hours.

The continuing spread of the impact has even led to the entire DeFi sector turning to a pessimistic sentiment.

What are the main dangers facing Curve right now?

Although only a day has passed, the main source of Curve's current crisis has changed.

If yesterday's main risk for Curve came from the contract security threat caused by the Vyper vulnerability, today the main risk comes from the potential liquidation threat of CRV in the major lending platforms, with the health of Curve founder Michael Egorov's personal debt position being crucial.

It needs to be clear that these two threats are fundamentally not the same thing. Even without the Vyper vulnerability, if the market continues to decline, Egorov's debt position liquidation risk will eventually be exposed, but this time Vyper acted as a catalyst to bring this "hidden danger" to the forefront.

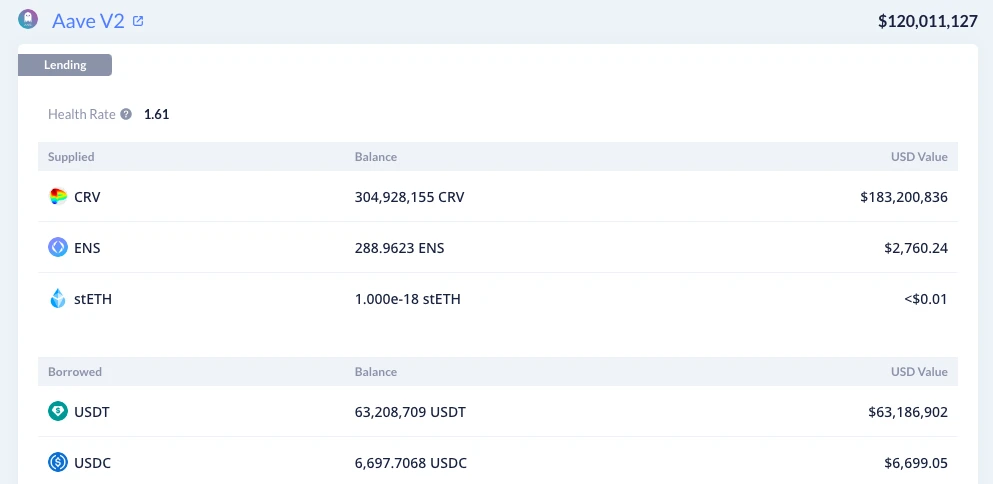

On-chain data shows that as of 3:00 PM today, Egorov has collateralized approximately 450 million CRV on Aave, Fraxlend, Abracadabr, and Inverse, borrowing approximately $105 million. The overall liquidation price of this debt position is approximately $0.38 to $0.4.

Since 450 million CRV accounts for half of the token's circulating supply, it is certain that if these debt positions are liquidated, a large amount of CRV will be dumped directly into the market in a short period of time, which will inevitably deal a heavy blow to the already fragile CRV price.

Will it be liquidated?

Since the security incident yesterday, Egorov has been trying various measures to avoid potential liquidation, such as adding CRV collateral, gradually repaying part of the debt, or using Curve to indirectly influence the debt position interest rates.

So, can these measures prevent potential liquidation?

First, it needs to be clear that Egorov's personal debt positions are spread across multiple lending platforms such as Aave, Fraxlend, Abracadabr, and Inverse, each with different sizes and risk conditions. Among them, the debt position on FRAXlend is the largest and the most dangerous.

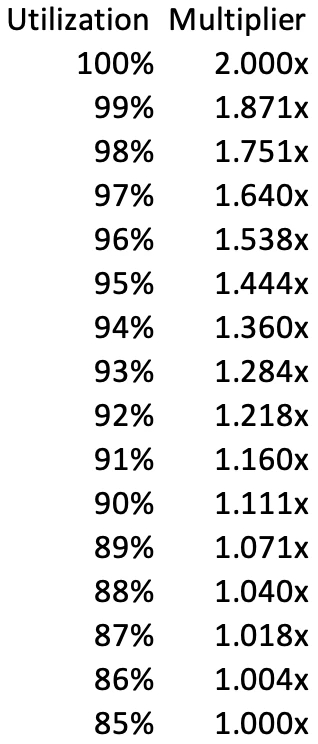

The reason for this is that FRAXlend uses a special interest rate adjustment mechanism. When the overall funds in a pool reach 85%, the interest rate will increase by a certain multiplier every 12 hours (doubling when it reaches 100%), with the interest rate potentially reaching up to 10,000%.

Odaily Planet Daily Note: Multiplier for interest rates when the utilization rate of FRAXlend's various liquidity exceeds 85%.

Due to the utilization rate of the CRV/FRAX market within FRAXlend being consistently above 85% for a considerable period from yesterday to today, even reaching close to 100%, the pool's loan interest rate has continued to rise (according to some users, the interest rate has even reached 132%) and has the potential to continue rising.

This also means that if the overall utilization rate of the CRV/FRAX market does not decrease, Egorov will face increasingly high loan interest rates, leading to a continuous expansion of his debt position and subsequently raising the liquidation threshold, exacerbating the overall liquidation risk of the debt position.

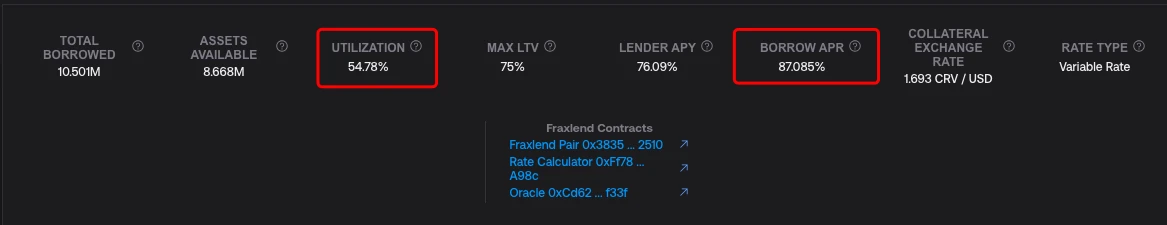

Fortunately, Egorov has realized the special situation of this debt position within FRAXlend. In order to reduce the utilization rate of this pool, Egorov has taken various measures. With Egorov gradually repaying $7.13 million to FRAXlend this afternoon, the size of this debt position has been reduced to approximately $10 million, the overall utilization rate of the CRV/FRAX market has decreased to 54.78%, and the loan interest rate has decreased to 87.085%, temporarily containing the danger.

It is worth mentioning that during this period, Curve also launched a liquidity pool crvUSD/fFRAX for the CRV/FRAX market within FRAXlend. Users who want to participate in this pool to earn CRV incentives need to deposit in the CRV/FRAX pool within FRAXlend to reduce the overall utilization rate of the pool. Some users have criticized this measure as Egorov exercising centralized power and using Curve to solve his own crisis.

In conclusion, it seems that Egorov has gained some breathing room for this debt position within FRAXlend for the time being, which has also led to a certain rebound in the price of CRV, indirectly alleviating the liquidation risk of his debt positions on other platforms such as Aave, Fraxlend, and Abracadabr.

What would happen if a full liquidation occurred?

First, let's confirm two points.

First, apart from the pools affected by the Vyper vulnerability yesterday, Curve's other smart contracts are still operating normally. As a leading project that has emerged from the fiercely competitive DeFi sector, Curve's contract quality should not be subject to too much questioning—it's difficult to detect underlying language bugs even with extensive audits.

Second, the operation of the Curve protocol at the functional level and the price of CRV are related (mainly affecting incentives), but it does not depend on the latter. In other words, CRV can plummet, but Curve will still exist.

As for the price trend of CRV, I personally lean towards the possibility of a full liquidation not being very likely. This is because based on the on-chain records of Egorov repaying FRAXlend this afternoon, it seems that he is selling CRV off-chain at a price of $0.4 (Frog Nation's former CFO 0xSifu revealed that the buyer will have a 6-month lock-up period), which is basically equivalent to the potential liquidation price of Egorov's debt positions.

This means that some large funds in the market still have a relatively reasonable estimate of the value of CRV. Even in the face of short-term liquidation risk, they are willing to hold it for the long term at a discounted price.

Therefore, even if a liquidation occurs, CRV may experience a short-term sharp decline due to the sudden large sell-off, but if a lower price than the market's estimate appears, potential buying pressure may help CRV gradually recover. After all, the Curve protocol is still operating solidly, and the reputation it has built over the past two years will not completely dissipate.

In the end, compared to the industry benchmark Curve of two days ago, today's Curve has only experienced one security incident (and Vyper has to bear the brunt), and although the actual losses are not insignificant, they can likely be covered by Curve's financial reserves.

What lessons can be learned afterwards?

As time passes, the event will eventually come to a conclusion.

The storyline I envision is that regardless of whether this liquidation occurs, Curve will continue to exist, and CRV will gradually return to normal after experiencing various fluctuations, eventually bringing the event to a close.

At this current point in time, I would like to focus more on some simple reflections on the roles of the three parties (Curve, Egorov, lending protocols) in this crisis.

First, regarding Curve, it seems difficult to demand too much, as it is challenging to detect underlying language bugs even with extensive audits at the protocol level. Next, the focus for Curve may be to jointly discuss a reasonable compensation plan with other affected protocols (Alchemix, JPEG'd, Metronome).

Next, for Egorov, as an individual user, there seems to be no problem with leveraging the rules of lending protocols to maximize the efficiency of his funds. However, as a key figure in Curve, Egorov's actions of using lending protocols to offload his financial risks and transfer them to the entire community have raised suspicions (some community users doubt that Egorov never considered closing positions).

As for lending protocols, the discussion about the debt position size limit for altcoins has long been a topic in the DeFi industry. One of the tangible manifestations of the bull-bear transition is the reduction in the liquidity of altcoins, making the once lucrative altcoin pools a source of risk. After this event, it is likely that major lending protocols will pay more attention to this issue.

In terms of specific projects, FRAXlend has demonstrated better resilience in this liquidation crisis through its dynamic interest rate design, "forcing" Egorov to prioritize addressing the debt position issue on this platform, thereby reducing the risk exposure first and indirectly achieving a "head start" without adjusting the rules.

After this event, some voices lament that DeFi is cooling down, but I don't think so. Over the years, DeFi has experienced many ups and downs, and the impact of various negative events during bear markets is always magnified. However, looking back in the future, this may just be a particularly special hack attack, coupled with an unhealthy lending debt position.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。